Rates

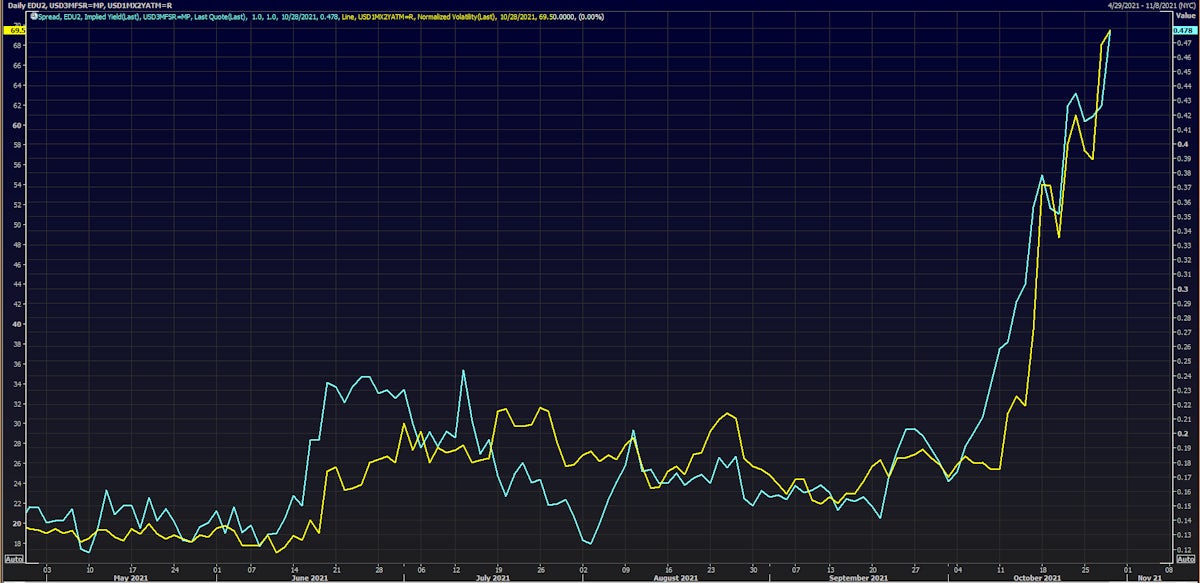

Front-End Surge In Implied Rates And Implied Volatilities A Reflection Of Repositioning Throughout The Rates Complex

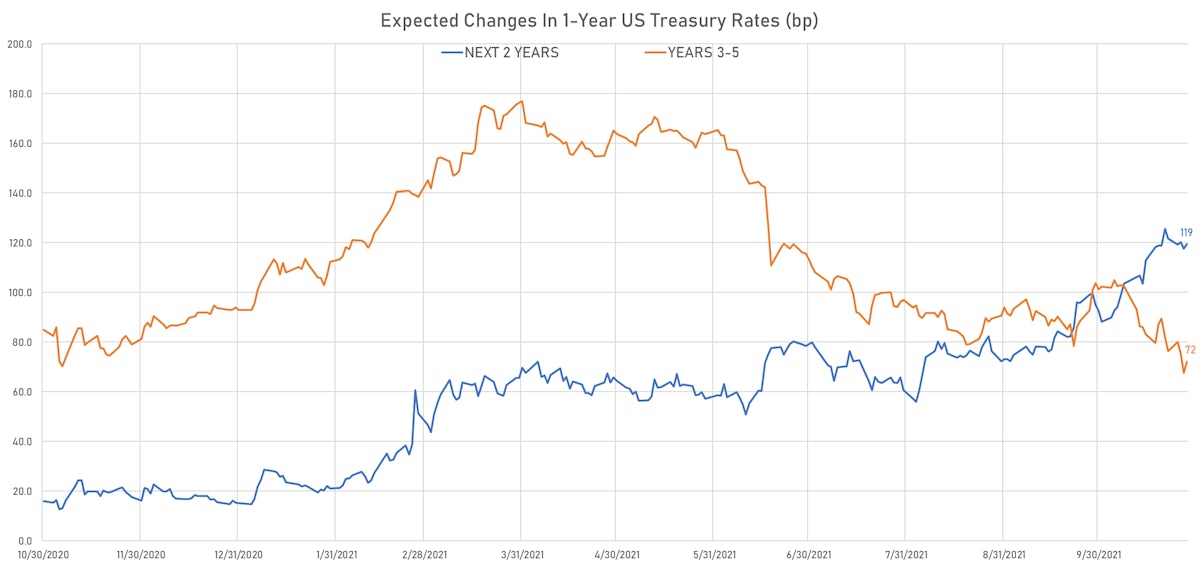

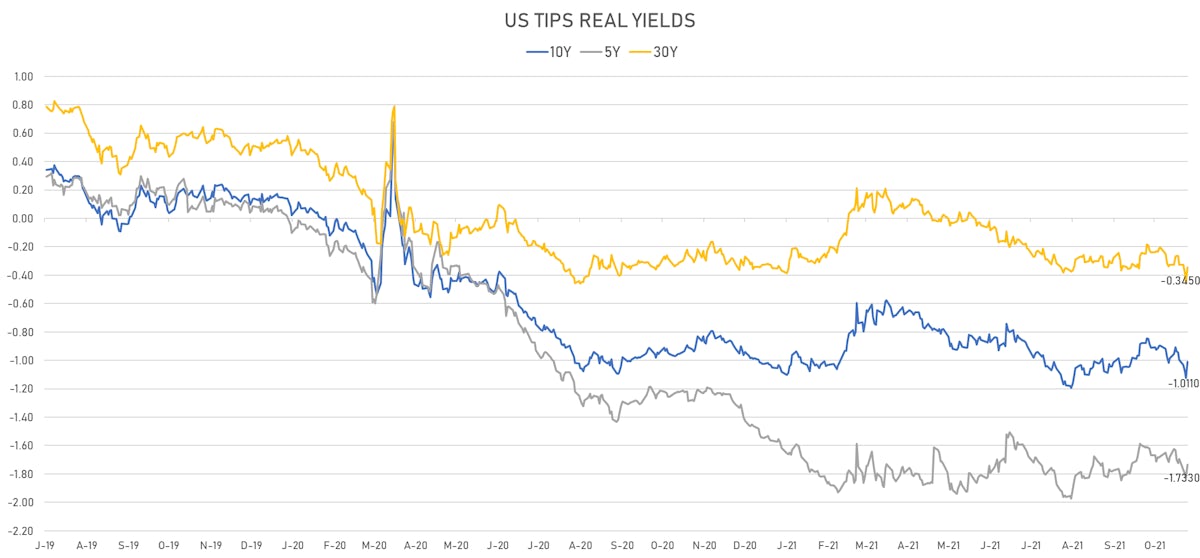

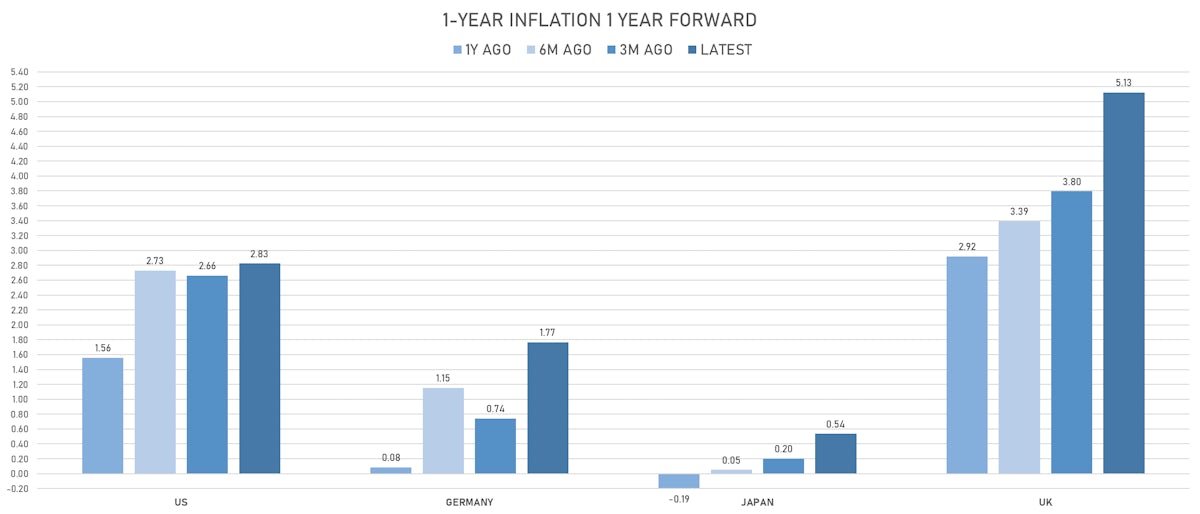

Inflation breakevens dropped and real yields rose sharply today, as the curve steepened around the belly and 1s5s10s butterfly spreads fell again (an indication of how much the belly rose relative to the wings)

Published ET

Implied Fed Hikes Priced Into EDU2 Futures vs 1-month By 2 Year ATM Swaption Normalized Volatility | Source: Refinitiv

QUICK US SUMMARY

- 3-Month USD LIBOR +0.30bp today, now at 0.1316%; 3-Month OIS +0.0bp today, now at 0.0760%

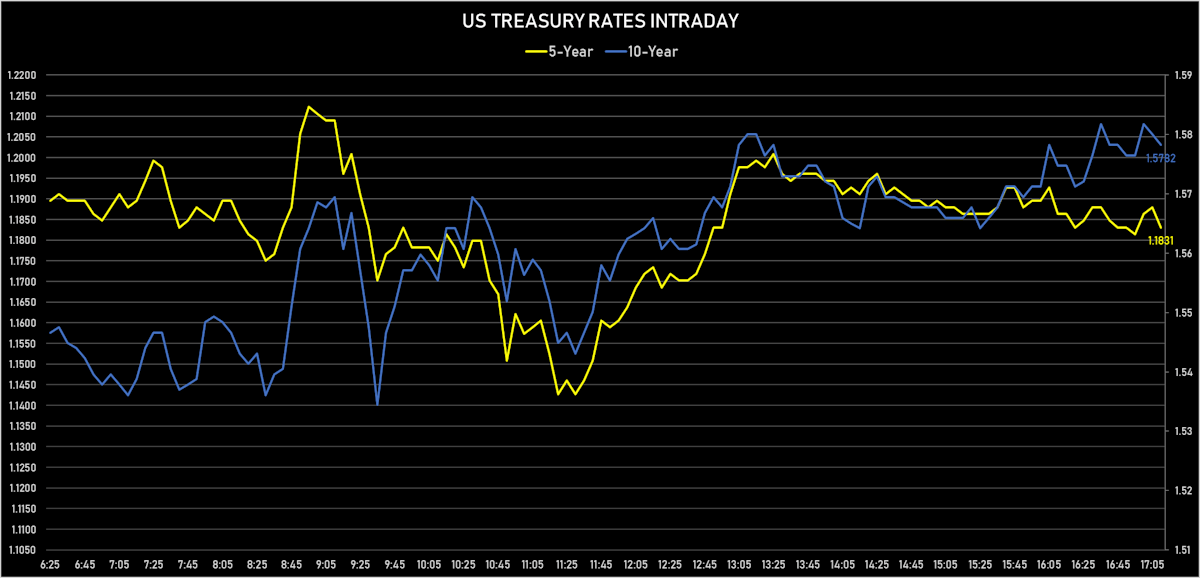

- The treasury yield curve steepened, with the 1s10s spread widening 2.8 bp, now at 145.9 bp (YTD change: +65.5bp)

- 1Y: 0.1190% (unchanged 0.0 bp)

- 2Y: 0.4891% (down 1.4 bp)

- 5Y: 1.1831% (up 3.3 bp)

- 7Y: 1.4500% (up 3.8 bp)

- 10Y: 1.5782% (up 2.8 bp)

- 30Y: 1.9790% (up 1.9 bp)

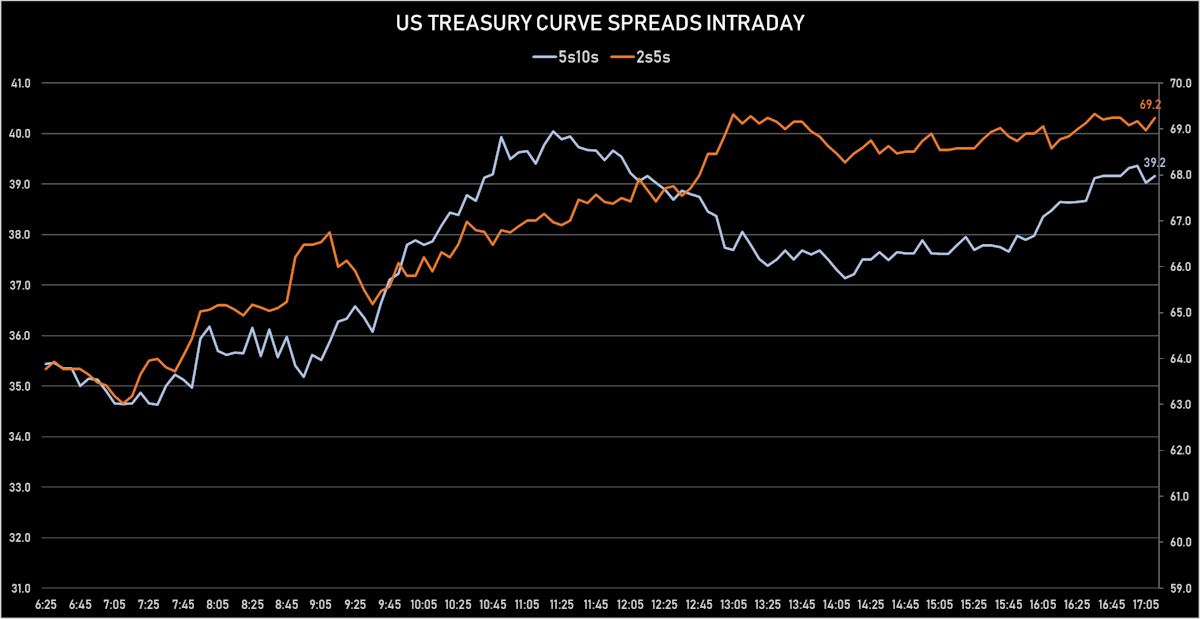

- US treasury curve spreads: 2s5s at 69.5bp (up 4.9bp today), 5s10s at 39.4bp (down -0.8bp), 10s30s at 40.2bp (down -0.9bp)

- Treasuries butterfly spreads: 1s5s10s at -68.2bp (down -3.8bp), 5s10s30s at 0.4bp (down -0.7bp)

- US 5-Year TIPS Real Yield: +9.4 bp at -1.7330%; 10-Year TIPS Real Yield: +11.2 bp at -1.0110%; 30-Year TIPS Real Yield: +10.5 bp at -0.3450%

OUR COMMENTARY

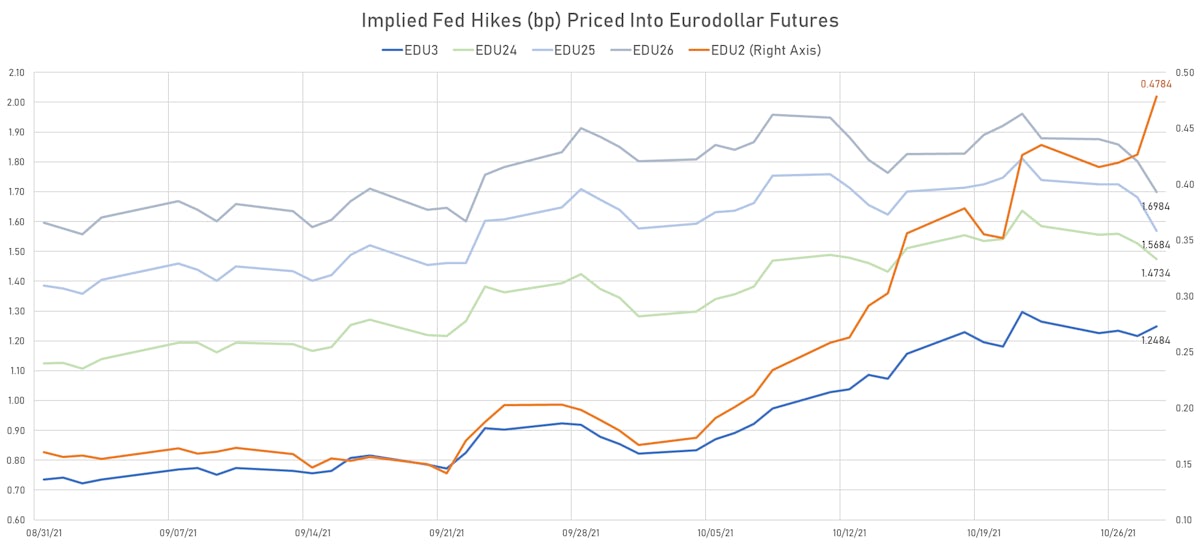

- There is a large discrepancy between the Fed’s own dot plot and market pricing of the interest rate path, which sees the first hike in July 2022, immediately after the end of tapering.

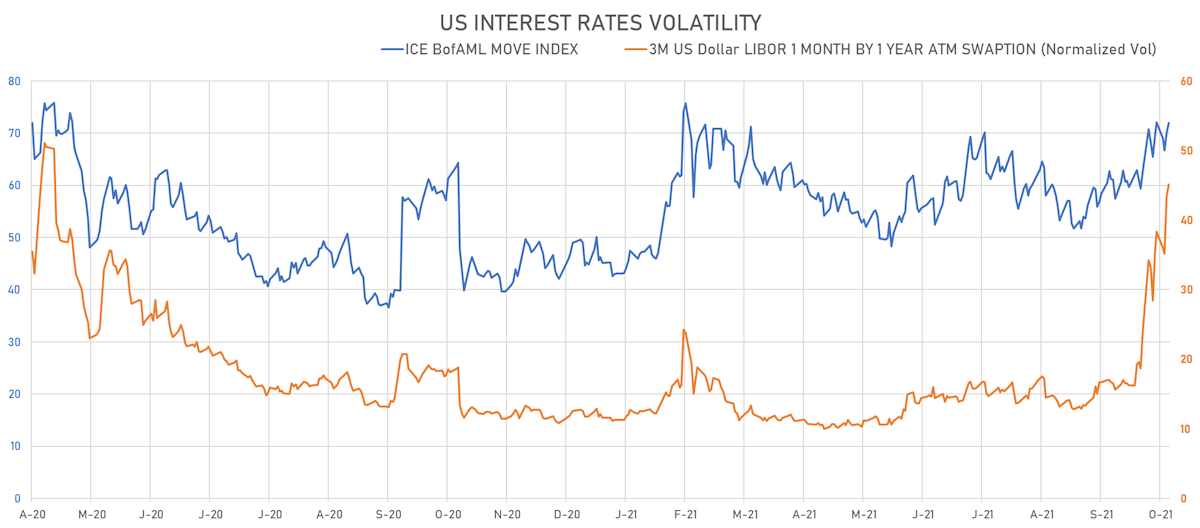

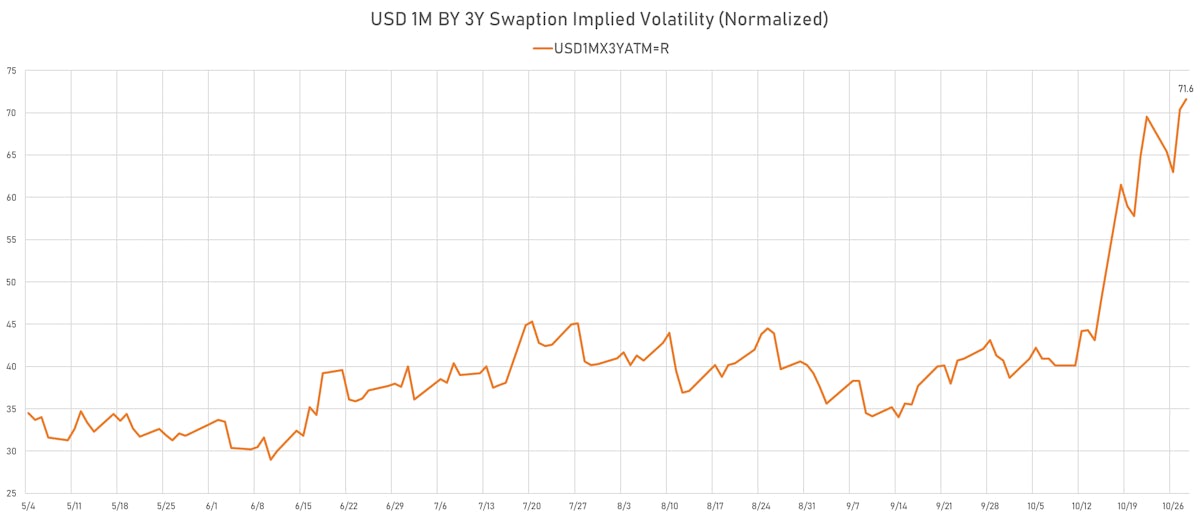

- As we mentioned before, short-term interest rates volatility has surged in the last couple of weeks. That is mostly a reflection of how uncertain the near future is: the Fed is about to announce next week its QE tapering plan, inflation expectations are at the highest levels in years, COVID is still around and winter is ahead of us (prime season for respiratory diseases), and economic data releases have been weakening lately. In that context, markets are trying to gauge what the most likely outcome will be for interest rates and risk premia. No easy task, and we expect continued shifts in expectations until the situation becomes clearer.

- Having said that, the moves in Eurodollar implied rates and volatility spike we've seen are also linked to broad market positioning at the wrong end of the curve: a good number of market participants had shorted the long end and bet on a steepening of the yield curve. And the exact opposite happened, which has naturally led to a mad scramble for cover and a bloodbath.

US$ 68.3 BN 7-Year, 1.375% COUPON US TREASURY NOTE AUCTION (91282CDF5)

- The results were unimpressive but not terrible: bad pricing was counterbalanced by solid end-user demand (at 83.4% vs 81.0% prior and 77.2% average)

- High Yield: 1.461%, a 1.1 bp tail compared to the when issued at the bid deadline (vs. 1.332% in September auction)

- Direct bids: 19.5% (vs 20.9% prior and 18.7% average)

- Indirect bids: 63.9% (vs 60.1% prior and 58.5% average)

- Bid-to-cover: 2.25 (vs 2.24 prior and 2.28 average)

US MACRO RELEASES

- Advance Q3 GDP growth was weaker than expectations at 2.00 % (vs 6.70 % prior), below consensus estimate of 2.70 %. The report showed a slowdown in consumption and business investment growth, but inventories contributed positively. Not incredibly concerning as most sell-side economists are looking for a significant rebound in Q4 GDP growth.

- Implicit Price Deflator, GDP, Total-adv, Change P/P for Q3 2021 (BEA, US Dept. Of Com) at 5.70 % (vs 6.20 % prior), above consensus estimate of 5.50 %

- Personal Consumption Expenditure, Profits after tax total-adv, Change P/P for Q3 2021 (BEA, US Dept. Of Com) at 1.60 % (vs 12.00 % prior)

- Personal Consumption Expenditure, Total-adv, Change P/P for Q3 2021 (BEA, US Dept. Of Com) at 5.30 % (vs 6.50 % prior)

- Personal Consumption Expenditure, Total-adv, Change P/P for Q3 2021 (BEA, US Dept. Of Com) at 4.50 % (vs 6.10 % prior), in line with consensus estimate

- Total-adv, Change P/P for Q3 2021 (BEA, US Dept. Of Com) at -0.10 % (vs 8.10 % prior)

- Jobless Claims, National, Initial, four week moving average for W 23 Oct (U.S. Dept. of Labor) at 299.25 k (vs 319.75 k prior)

- Jobless Claims, National, Initial for W 23 Oct (U.S. Dept. of Labor) at 281.00 k (vs 290.00 k prior), below consensus estimate of 290.00 k

- Jobless Claims, National, Continued for W 16 Oct (U.S. Dept. of Labor) at 2.24 Mln (vs 2.48 Mln prior), below consensus estimate of 2.42 Mln

- Pending Home Sales, United States, Change P/P for Sep 2021 (NAR, United States) at -2.30 % (vs 8.10 % prior), below consensus estimate of 0.00 %

- Pending Home Sales, United States for Sep 2021 (NAR, United States) at 116.70 (vs 119.50 prior)

- Kansas Fed, Current composite index for Oct 2021 (FED, Kansas) at 31.00 (vs 22.00 prior)

- Kansas Fed, Current production index for Oct 2021 (FED, Kansas) at 25.00 (vs 10.00 prior)

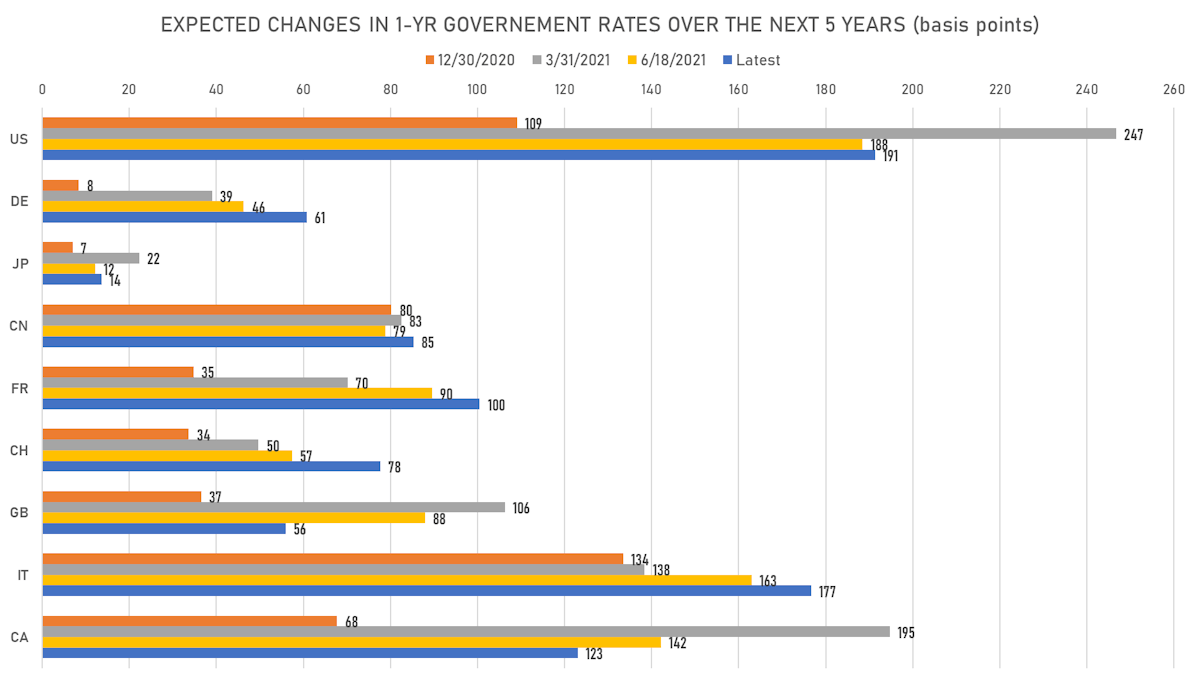

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 47.8 bp by the end of 2022 (equivalent to 1.9 hikes by end of 2022), up 5.2 bp today

- The 3-month USD OIS forward curve prices in 126.2 bp over the next 3 years (equivalent to 5.05 rate hikes)

- The 3-month Eurodollar zero curve prices in 144.8 bp over the next 3 years (equivalent to 5.79 rate hikes)

- 1-year US Treasury rate 5 years forward up 6.9 bp, now at 2.0766%, meaning that the 1-year Treasury rate is now expected to increase by 191.4 bp over the next 5 years (equivalent to 7.7 rate hikes)

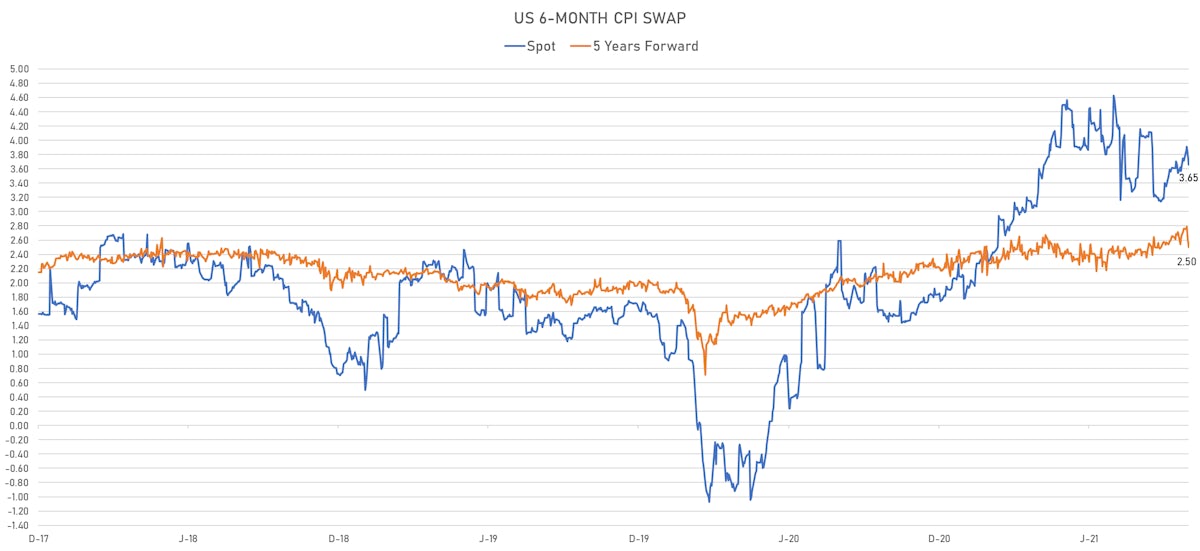

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.90% (down -8.3bp); 2Y at 3.36% (down -11.2bp); 5Y at 2.99% (down -7.4bp); 10Y at 2.57% (down -8.2bp); 30Y at 2.34% (down -8.3bp)

- 6-month spot US CPI swap down -14.7 bp to 3.655%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.7330%, +9.4 bp today; 10Y at -1.0110%, +11.2 bp today; 30Y at -0.3450%, +10.5 bp today

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 1.7% at 45.1%

- 3-Month LIBOR-OIS spread up 0.3 bp at 5.6 bp (12-months range: 2.7-17.5 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.440% (up 3.0 bp); the German 1Y-10Y curve is 0.5 bp flatter at 49.4bp (YTD change: +32.7 bp)

- Japan 5Y: -0.062% (down -1.4 bp); the Japanese 1Y-10Y curve is 0.5 bp flatter at 19.4bp (YTD change: +5.7 bp)

- China 5Y: 2.828% (up 0.1 bp); the Chinese 1Y-10Y curve is 2.5 bp steeper at 72.2bp (YTD change: +25.8 bp)

- Switzerland 5Y: -0.347% (up 5.4 bp); the Swiss 1Y-10Y curve is 2.6 bp steeper at 60.0bp (YTD change: +32.6 bp)