Rates

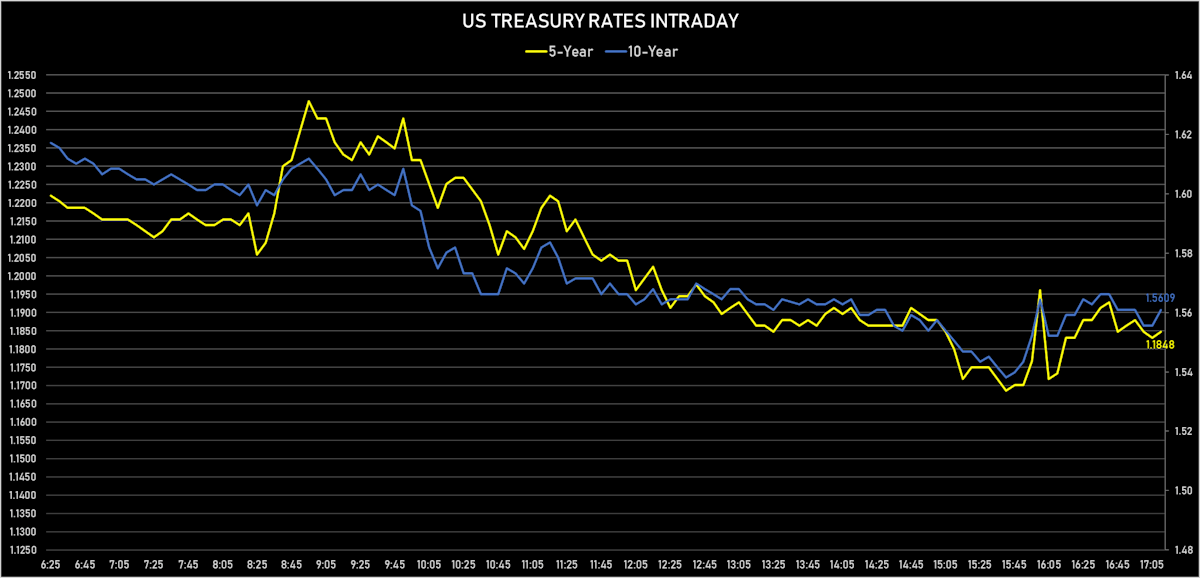

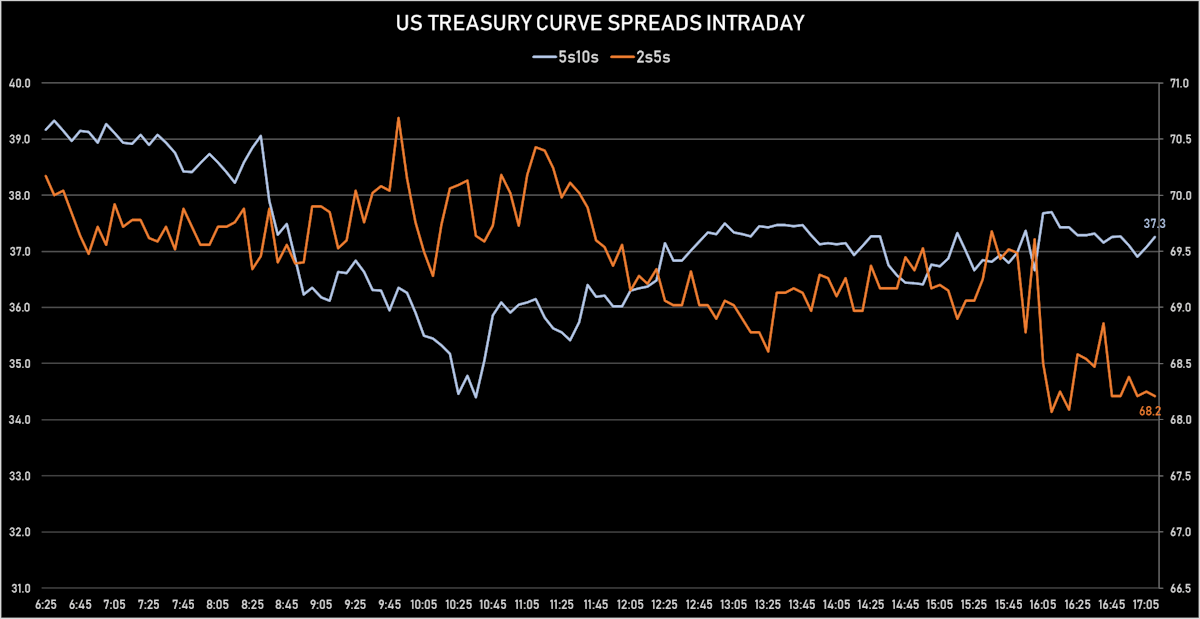

Short Rates Rise, Yield Curve Flattens Again After BLS Reports Faster Than Expected Wage Growth

The weekly CTFC positioning data points to potentially more of the same ahead: with more fast money accounts betting on a steepening of the yield curve, an aggressive flattening of the curve remains the pain trade

Published ET

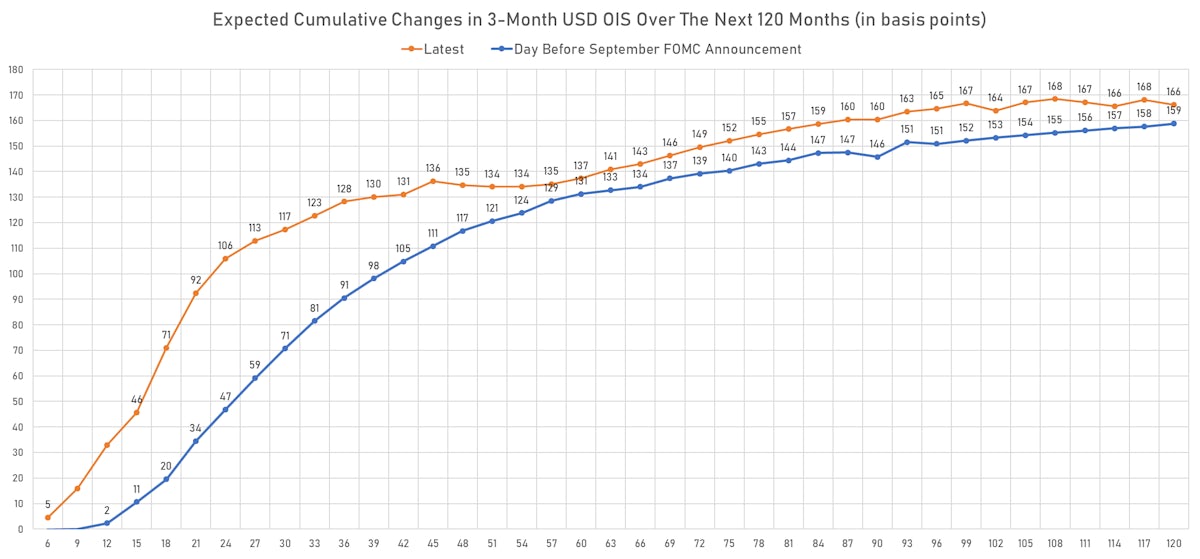

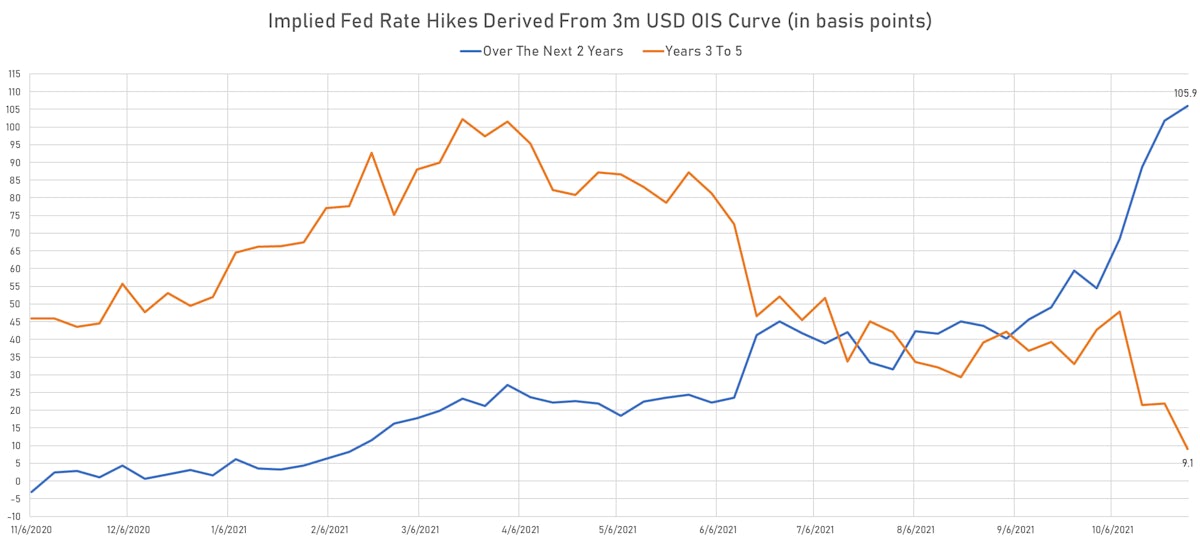

Implied Fed Rate Hikes Priced Into The 3-Month USD OIS Forward Curve (weekly prices) | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.07bp today, now at 0.1323%; 3-Month OIS -0.1bp today, now at 0.0750%

- The treasury yield curve flattened, with the 1s10s spread tightening -2.5 bp, now at 144.2 bp (YTD change: +63.7bp)

- 1Y: 0.1190% (up 0.8 bp)

- 2Y: 0.5010% (up 1.2 bp)

- 5Y: 1.1848% (up 0.2 bp)

- 7Y: 1.4575% (up 0.8 bp)

- 10Y: 1.5609% (down 1.7 bp)

- 30Y: 1.9390% (down 4.0 bp)

- US treasury curve spreads: 2s5s at 68.5bp (down -1.0bp), 5s10s at 37.5bp (down -1.9bp), 10s30s at 37.9bp (down -2.4bp)

- Treasuries butterfly spreads: 1s5s10s at -69.6bp (down -1.3bp), 5s10s30s at 0.4bp (unchanged)

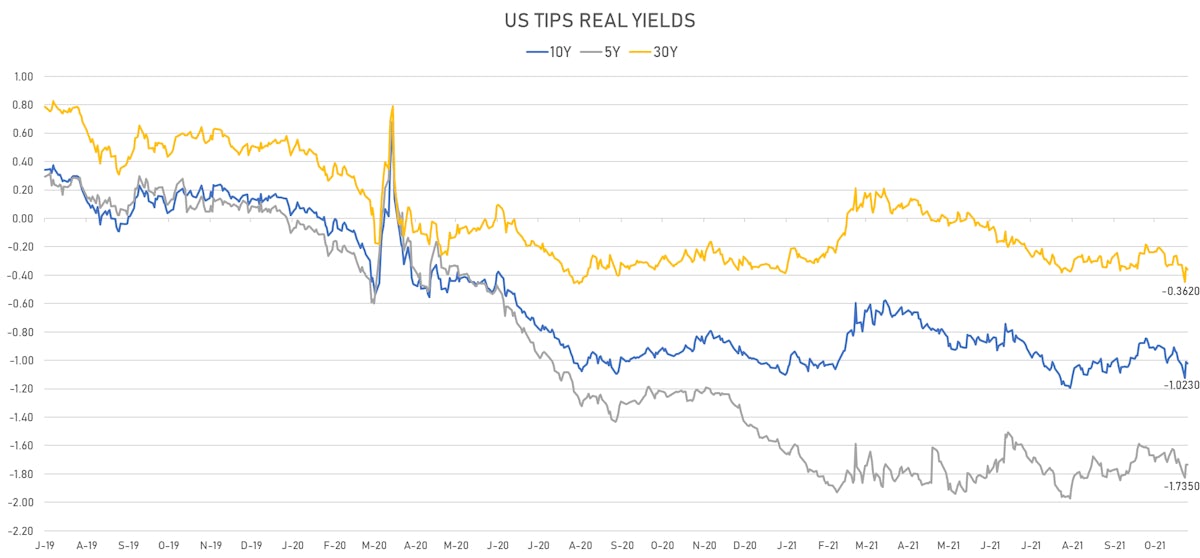

- US 5-Year TIPS Real Yield: -0.2 bp at -1.7350%; 10-Year TIPS Real Yield: -1.2 bp at -1.0230%; 30-Year TIPS Real Yield: -1.7 bp at -0.3620%

US MACRO RELEASES

- Labor Cost, Employment cost index, wages and salaries, Change P/P for Q3 2021 (BLS, U.S Dep. Of Lab) at 1.50 % (vs 0.90 % prior)

- Labor Cost, Employment cost index, total compensation, Change P/P for Q3 2021 (BLS, U.S Dep. Of Lab) at 1.30 % (vs 0.70 % prior), above consensus estimate of 0.90 %

- Labor Cost, Employment cost index, benefit costs, Change P/P for Q3 2021 (BLS, U.S Dep. Of Lab) at 0.90 % (vs 0.40 % prior)

- Personal Consumption Expenditure, Change Y/Y for Sep 2021 (BEA, US Dept. Of Com) at 4.40 % (vs 4.30 % prior)

- Personal Consumption Expenditure, Change P/P for Sep 2021 (BEA, US Dept. Of Com) at 0.30 % (vs 0.40 % prior)

- Personal Consumption Expenditure, Change P/P for Sep 2021 (BEA, US Dept. Of Com) at 0.30 % (vs 0.40 % prior)

- Change P/P for Sep 2021 (BEA, US Dept. Of Com) at -1.00 % (vs 0.20 % prior), below consensus estimate of -0.20 %

- Personal Consumption Expenditure, Change P/P for Sep 2021 (BEA, US Dept. Of Com) at 0.60 % (vs 0.80 % prior), above consensus estimate of 0.50 %

- Personal Consumption Expenditure, Personal consumption expenditures less food and energy, Change Y/Y for Sep 2021 (BEA, US Dept. Of Com) at 3.60 % (vs 3.60 % prior), below consensus estimate of 3.70 %

- Personal Consumption Expenditure, Personal consumption expenditures less food and energy, Change P/P for Sep 2021 (BEA, US Dept. Of Com) at 0.20 % (vs 0.30 % prior), in line with consensus estimate

- Personal Consumption Expenditure, Total, trimmed mean inflation rate (1-month annualized), Change M/M for Sep 2021 (Fed Reserve, Dallas) at 5.10 % (vs 2.80 % prior)

- Chicago PMI, Total Business Barometer for Oct 2021 (MNI Indicators) at 68.40 (vs 64.70 prior), above consensus estimate of 63.50

- 1 Year Inflation Expectations (median) for Oct 2021 (UMICH, Survey) at 4.80 % (vs 4.80 % prior)

- University of Michigan, 5 Year Inflation Expectations (median), Change Y/Y for Oct 2021 (UMICH, Survey) at 2.90 % (vs 2.80 % prior)

- University of Michigan, Consumer Expectations Index, Volume Index for Oct 2021 (UMICH, Survey) at 67.90 (vs 67.20 prior)

- University of Michigan, Consumer Sentiment Index, Volume Index for Oct 2021 (UMICH, Survey) at 71.70 (vs 71.40 prior), above consensus estimate of 71.40

- University of Michigan, Current Conditions Index, Volume Index for Oct 2021 (UMICH, Survey) at 77.70 (vs 77.90 prior)

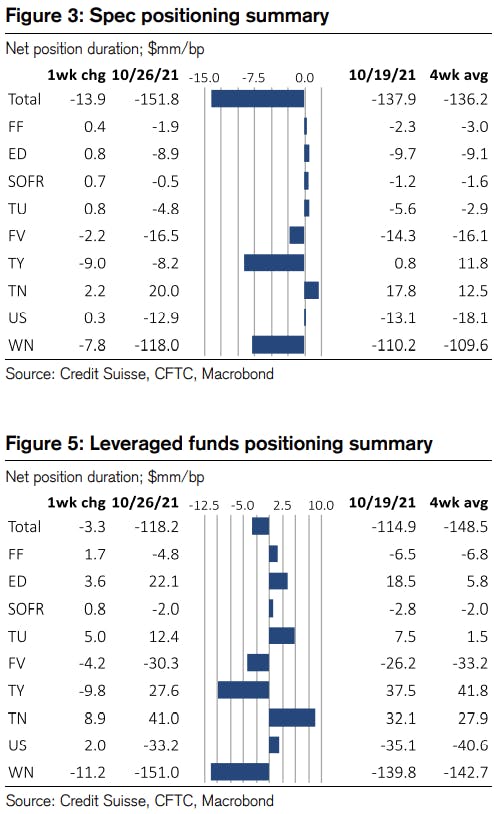

WEEKLY NET DURATION POSITIONING DATA

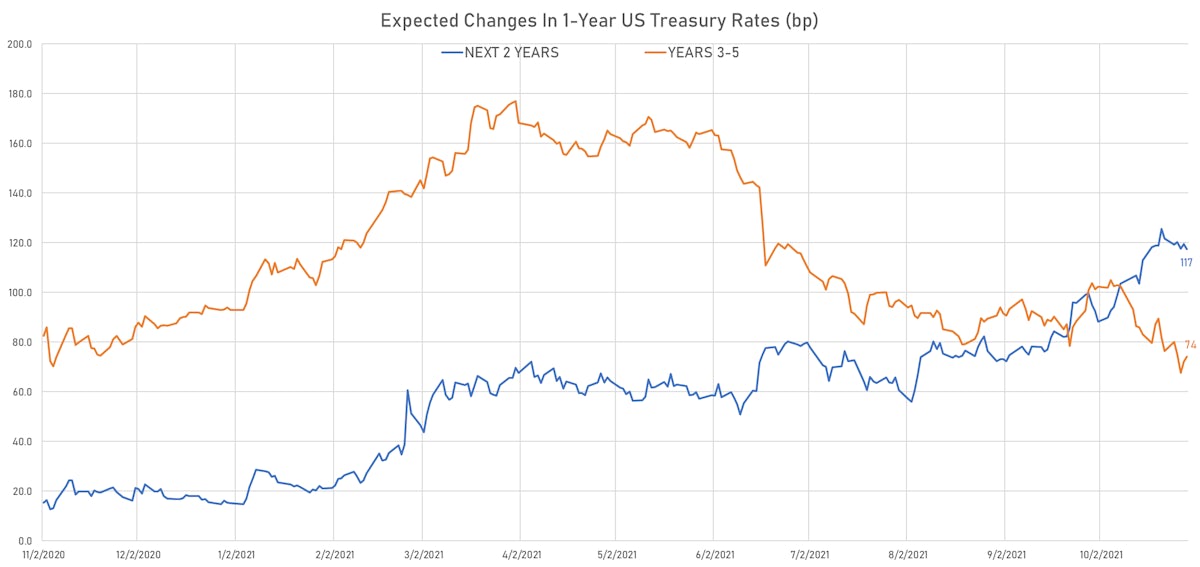

- On a net aggregate level, fast money investors are getting more exposed to violent flattening of the yield curve, seemingly doubling down on a big losing trade

- The reason is that many economists and strategists expect Fed funds rate liftoff in 2023, meaning zero rate hike in 2022, whereas money markets have already priced in more than 2 rate hikes in 2022.

- So the pain trade remains a flattening curve, although looking at fundamentals it's hard to see end of 2022 forward rates going much higher

- Specs have very little positioning at the short end of the curve but added to their shorts from the belly out

- Leveraged funds added to their curve steepening bias, buying Eurodollar and 2-year Treasury futures, selling more 10-year treasury futures

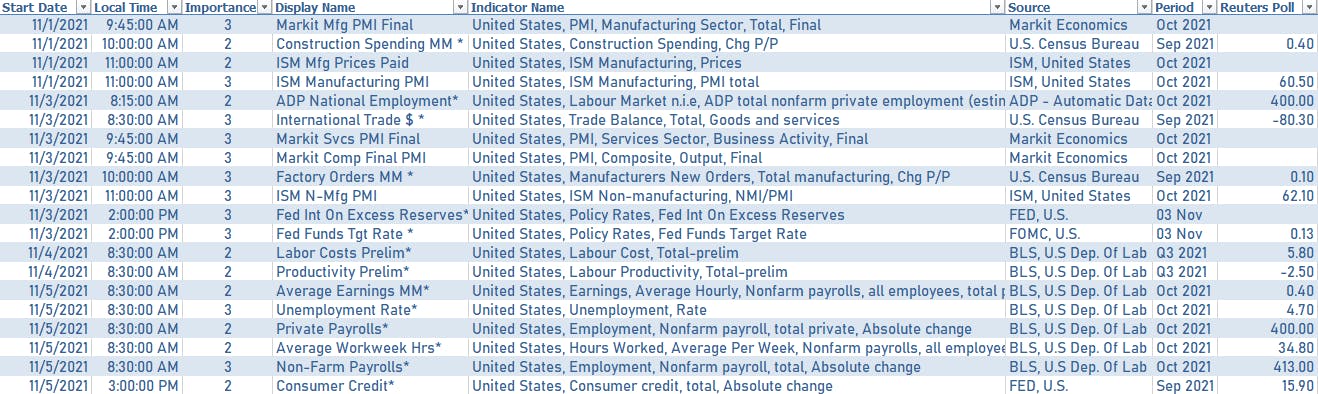

US MACRO WEEK AHEAD

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 51.3 bp by the end of 2022 (equivalent to 2.1 hikes by end of 2022), up 3.4 bp today

- The 3-month USD OIS forward curve prices in 128.2 bp over the next 3 years (equivalent to 5.13 rate hikes)

- The 3-month Eurodollar zero curve prices in 146.8 bp over the next 3 years (equivalent to 5.87 rate hikes)

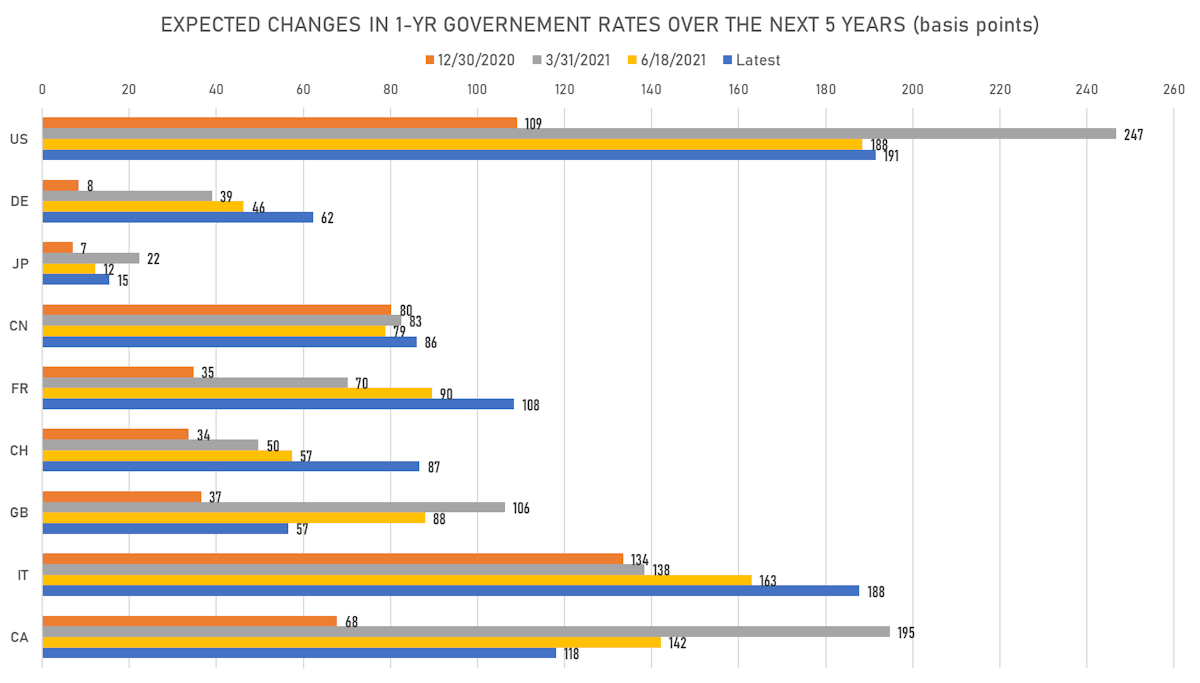

- 1-year US Treasury rate 5 years forward up 0.9 bp, now at 2.0852%, meaning that the 1-year Treasury rate is now expected to increase by 191.5 bp over the next 5 years (equivalent to 7.7 rate hikes)

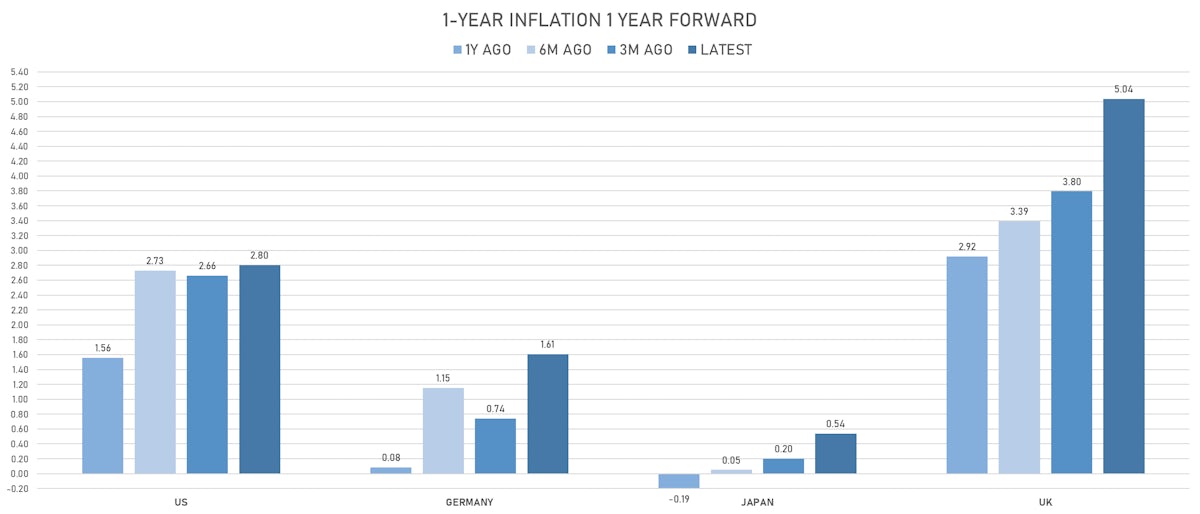

US INFLATION & REAL RATES

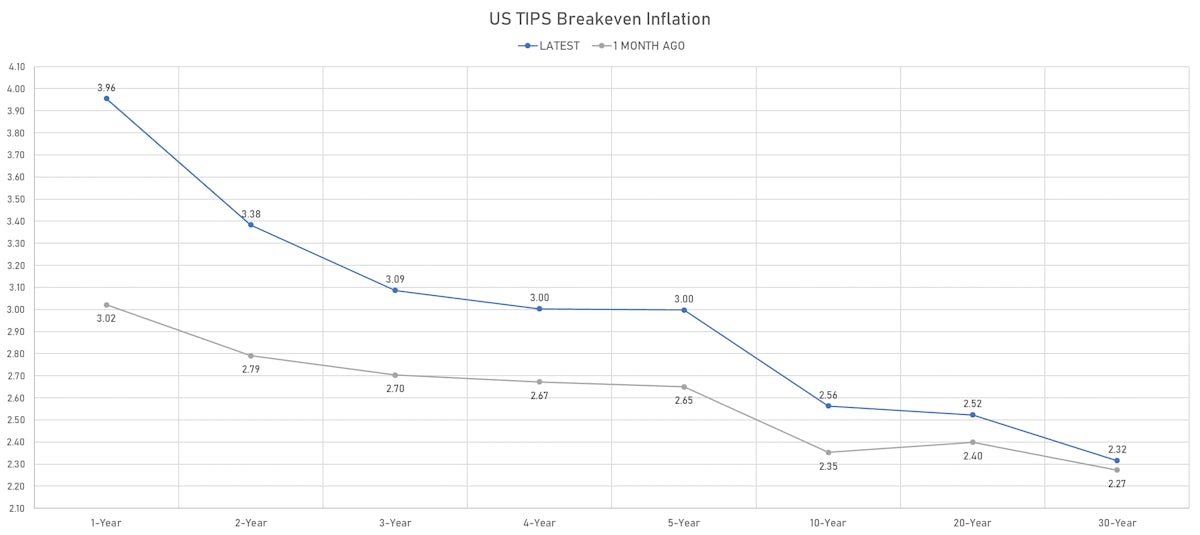

- TIPS 1Y breakeven inflation at 3.96% (up 5.7bp); 2Y at 3.38% (up 1.8bp); 5Y at 3.00% (up 1.0bp); 10Y at 2.56% (down -0.8bp); 30Y at 2.32% (down -2.1bp)

- 6-month spot US CPI swap down -3.2 bp to 3.623%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.7350%, -0.2 bp today; 10Y at -1.0230%, -1.2 bp today; 30Y at -0.3620%, -1.7 bp today

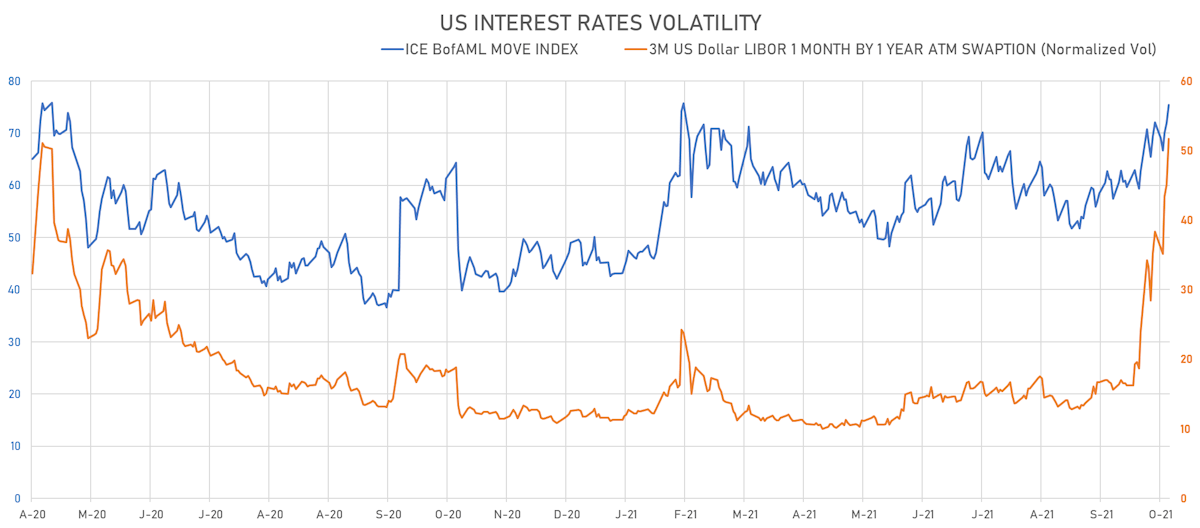

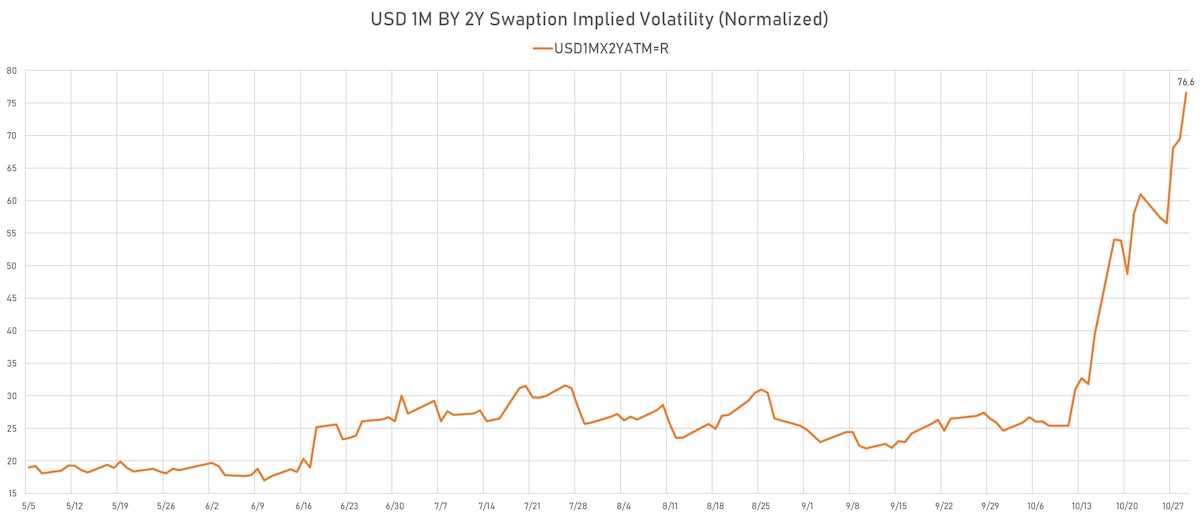

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 6.6% at 51.7%

- 3-Month LIBOR-OIS spread up 0.2 bp at 5.7 bp (12-months range: 2.7-17.5 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.387% (up 7.2 bp); the German 1Y-10Y curve is 0.7 bp steeper at 57.5bp (YTD change: +46.2 bp)

- Japan 5Y: -0.062% (unchanged); the Japanese 1Y-10Y curve is unchanged at 20.7bp (YTD change: +5.7 bp)

- China 5Y: 2.832% (up 0.4 bp); the Chinese 1Y-10Y curve is 1.7 bp steeper at 73.9bp (YTD change: +27.5 bp)

- Switzerland 5Y: -0.261% (up 8.6 bp); the Swiss 1Y-10Y curve is 13.4 bp steeper at 69.4bp (YTD change: +46.0 bp)