Rates

Rates Volatility Slightly Higher But Very Little Change In The Yield Curve, As Market Awaits FOMC Start Tomorrow

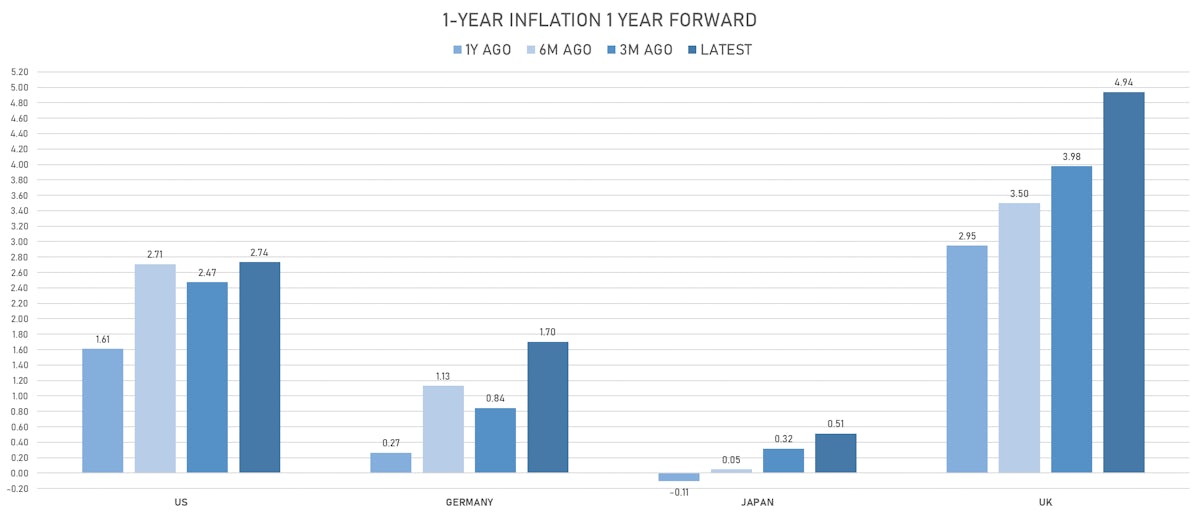

Putting aside the positioning squeeze and volatility over the last week, it feels like a new peak may be in view for short-term inflation expectations and implied short rates: with December 2022 Eurodollar Futures (EDZ2) now pricing in more than 3 hikes, it's hard to see much upside unless the Fed radically changes its views

Published ET

US 1Y CPI Zero Coupon vs 3-month USD LIBOR 10 Months Forward | Source: Refinitiv

QUICK US SUMMARY

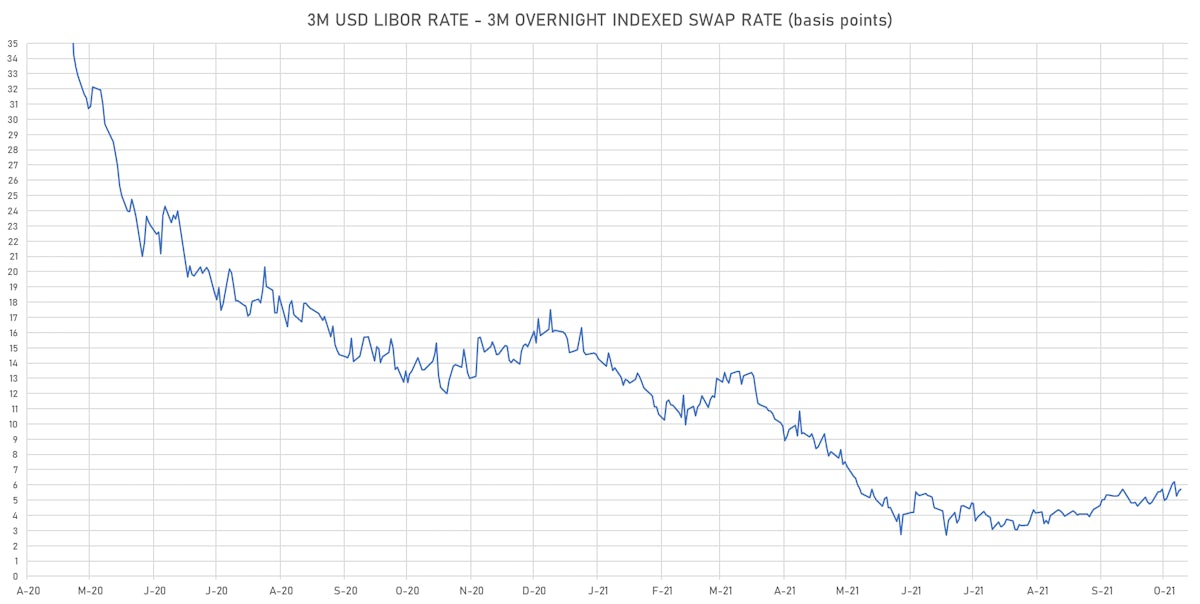

- 3-Month USD LIBOR +0.86bp today, now at 0.1409%; 3-Month OIS unchanged today, now at 0.0750%

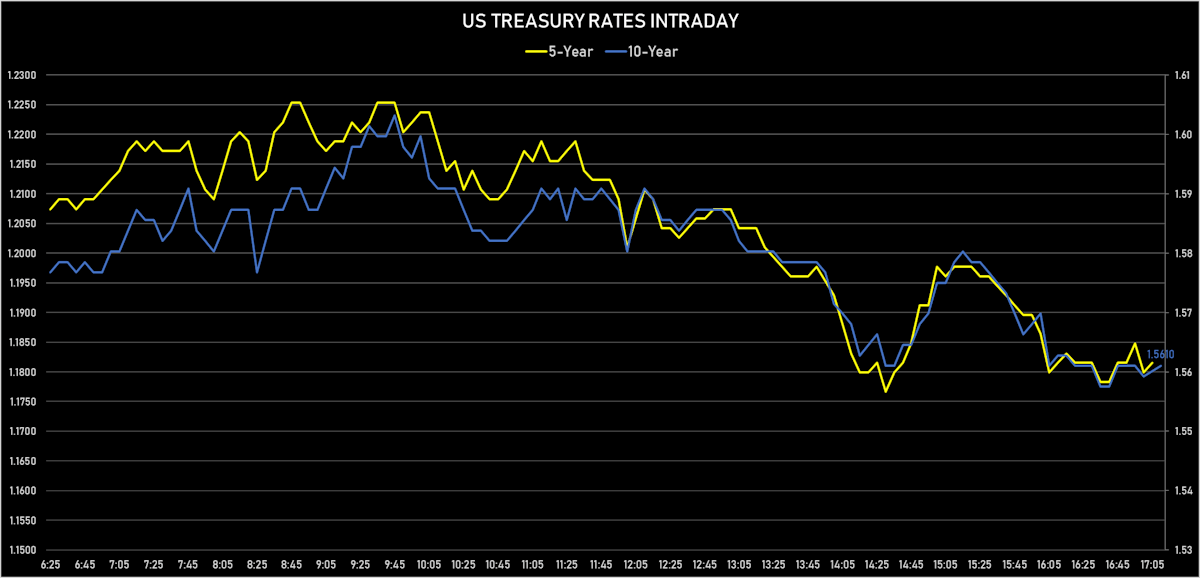

- The treasury yield curve didn't move, with the 1s10s spread unchanged, now at 143.4 bp (YTD change: +63.0bp)

- 1Y: 0.1270% (unchanged)

- 2Y: 0.5011% (unchanged)

- 5Y: 1.1815% (down 0.3 bp)

- 7Y: 1.4457% (down 1.2 bp)

- 10Y: 1.5610% (unchanged)

- 30Y: 1.9610% (up 2.2 bp)

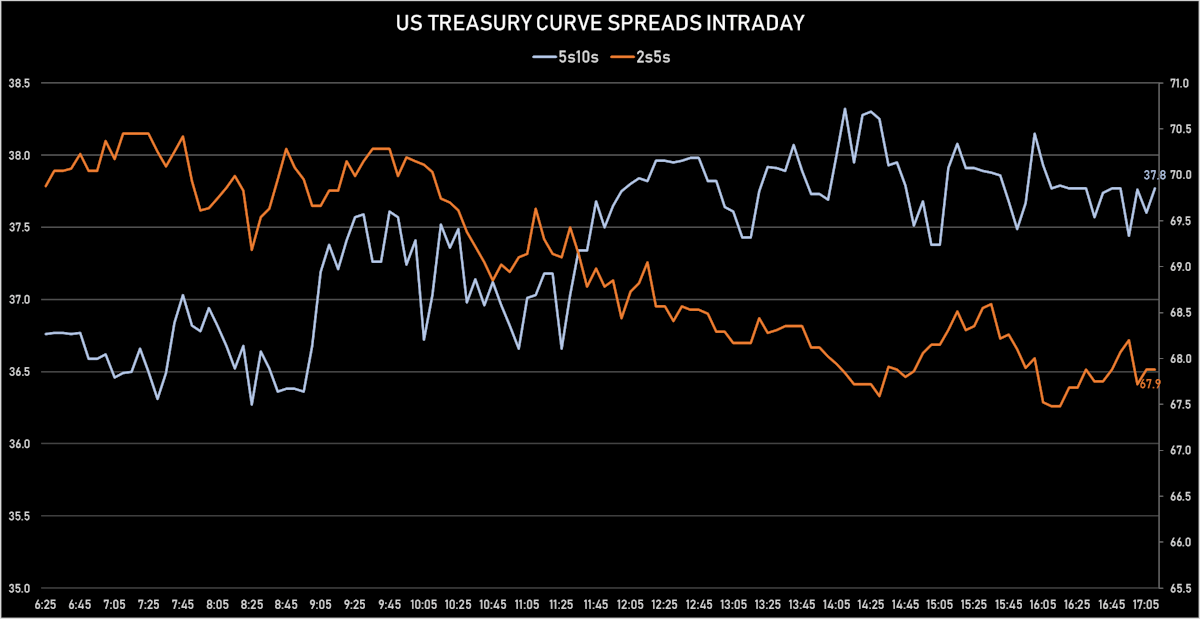

- US treasury curve spreads: 2s5s at 68.2bp (down -0.3bp), 5s10s at 37.9bp (up 0.5bp today), 10s30s at 40.0bp (up 2.2bp today)

- Treasuries butterfly spreads: 1s5s10s at -68.7bp (up 0.8bp today), 5s10s30s at 1.7bp (up 1.3bp)

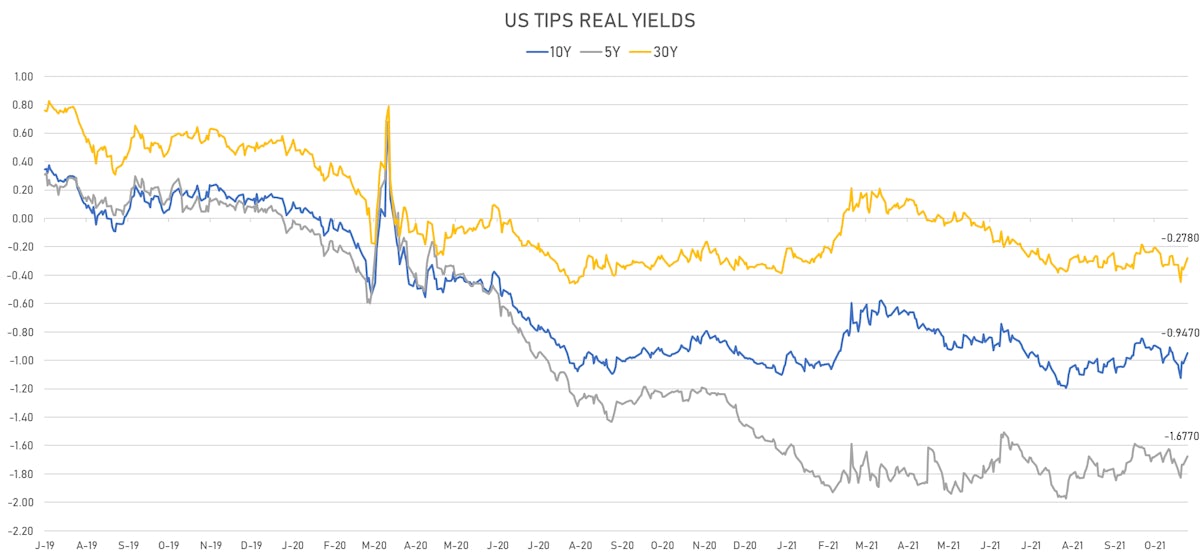

- US 5-Year TIPS Real Yield: +5.8 bp at -1.6770%; 10-Year TIPS Real Yield: +7.6 bp at -0.9470%; 30-Year TIPS Real Yield: +8.4 bp at -0.2780%

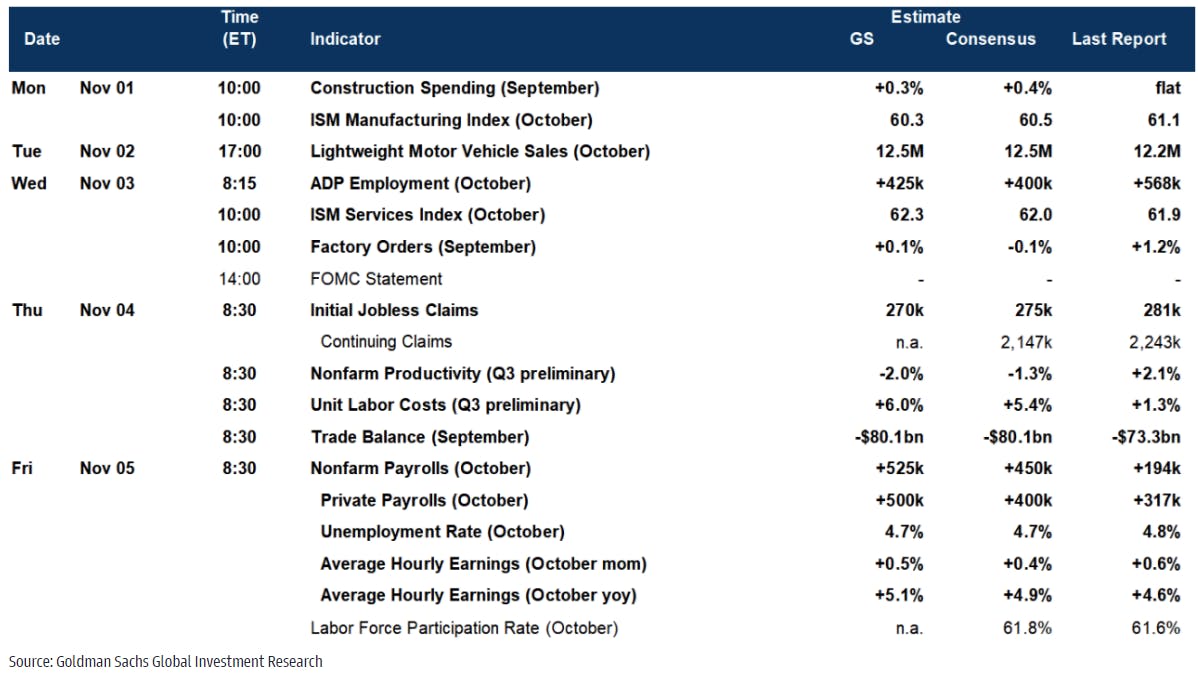

US MACRO RELEASES

- PMI, Manufacturing Sector, Total, Final for Oct 2021 (Markit Economics) at 58.40 (vs 59.20 prior)

- ISM Manufacturing, Employment for Oct 2021 (ISM, United States) at 52.00 (vs 50.20 prior)

- ISM Manufacturing, New orders for Oct 2021 (ISM, United States) at 59.80 (vs 66.70 prior)

- ISM Manufacturing, Prices for Oct 2021 (ISM, United States) at 85.70 (vs 81.20 prior)

- Construction Spending, Change P/P for Sep 2021 (U.S. Census Bureau) at -0.50 % (vs 0.00 % prior), below consensus estimate of 0.40 %

- ISM Manufacturing, PMI total for Oct 2021 (ISM, United States) at 60.80 (vs 61.10 prior), above consensus estimate of 60.50

US WEEKLY ECON ESTIMATES FROM GS AND CS

US INFLATION & REAL RATES

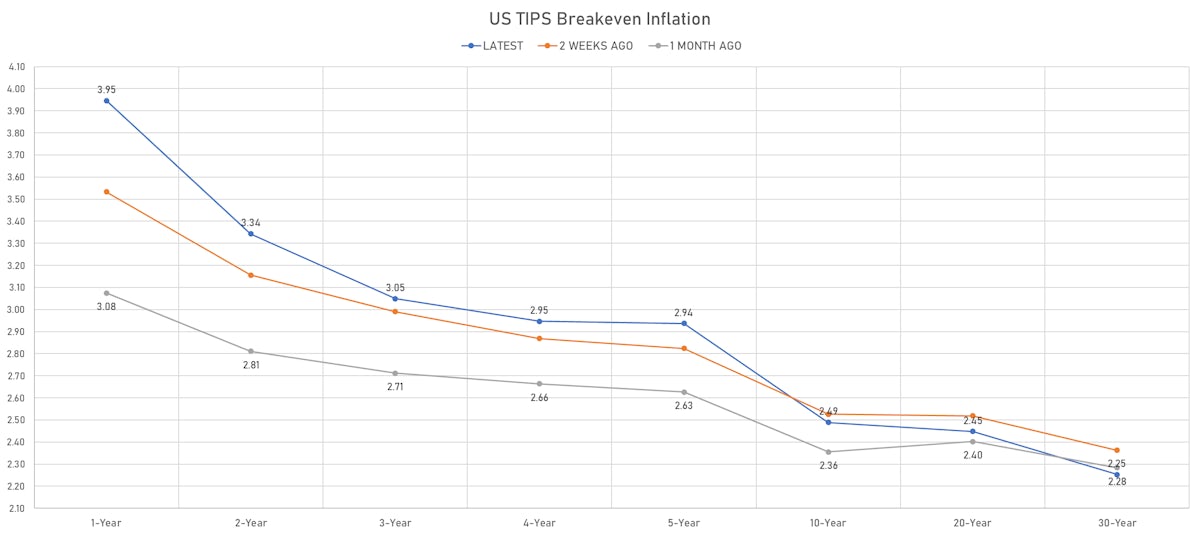

- TIPS 1Y breakeven inflation at 3.95% (down -1.0bp); 2Y at 3.34% (down -4.0bp); 5Y at 2.94% (down -6.2bp); 10Y at 2.49% (down -7.4bp); 30Y at 2.25% (down -6.4bp)

- 6-month spot US CPI swap up 7.0 bp to 3.693%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.6770%, +5.8 bp today; 10Y at -0.9470%, +7.6 bp today; 30Y at -0.2780%, +8.4 bp today

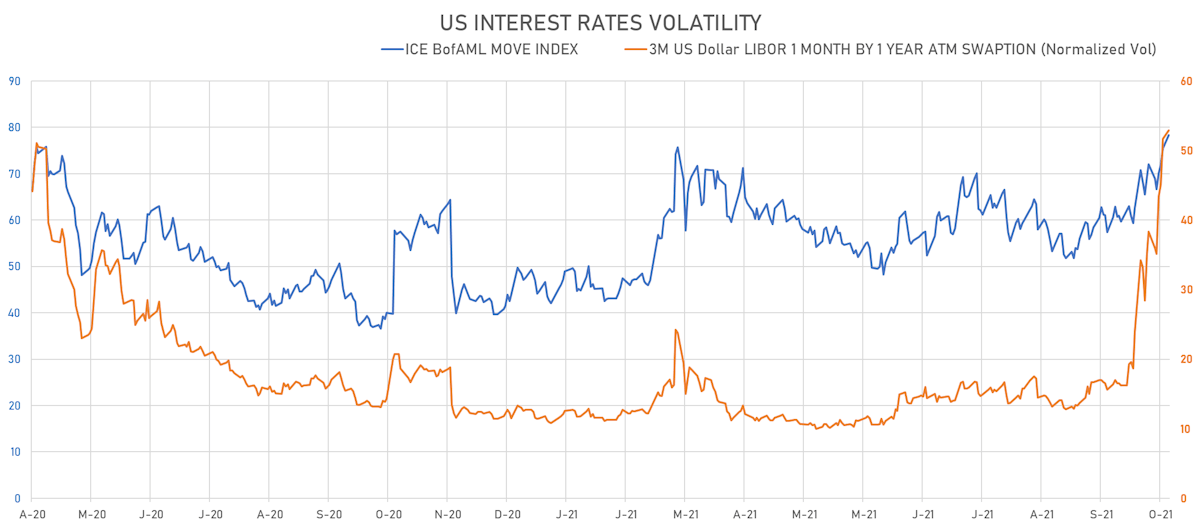

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 1.2% at 52.9%

- 3-Month LIBOR-OIS spread up 0.9 bp at 6.6 bp (12-months range: 2.7-17.5 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.416% (down -2.5 bp); the German 1Y-10Y curve is 1.1 bp flatter at 57.3bp (YTD change: +42.4 bp)

- Japan 5Y: -0.075% (down -0.2 bp); the Japanese 1Y-10Y curve is 0.1 bp flatter at 20.0bp (YTD change: +5.6 bp)

- China 5Y: 2.801% (down -3.1 bp); the Chinese 1Y-10Y curve is 3.6 bp flatter at 70.3bp (YTD change: +23.9 bp)

- Switzerland 5Y: -0.254% (up 0.7 bp); the Swiss 1Y-10Y curve is 1.7 bp flatter at 71.4bp (YTD change: +44.3 bp)