Rates

Short-Term Yields And Rates Volatility Fall Significantly As Recent Front-End Pressures Ease

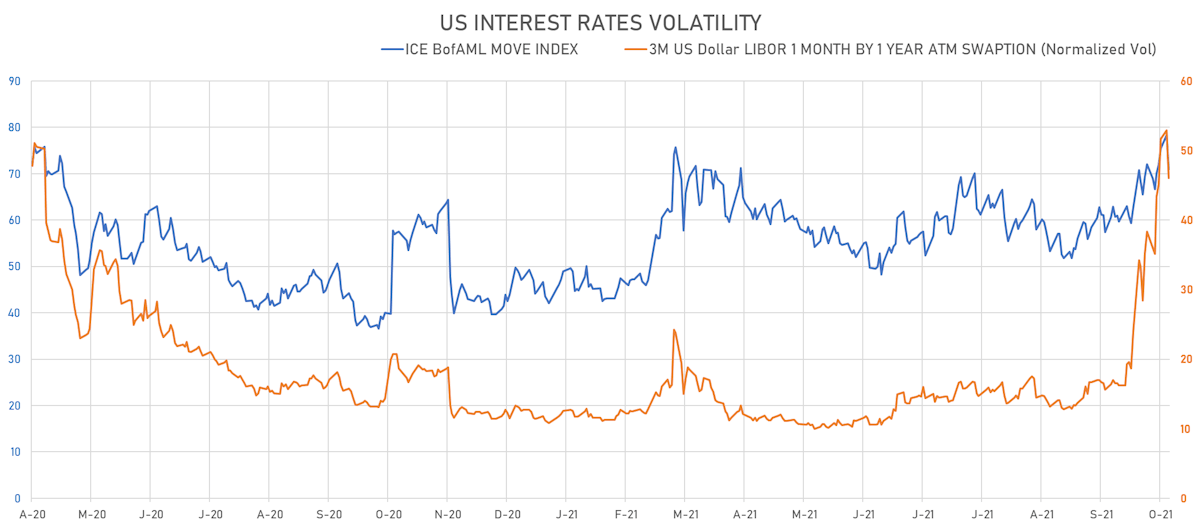

It may be a temporary reprieve though, with the Fed decision and Powell's speech likely to bring renewed volatility later this week as the market digests / prices in the latest FOMC statements

Published ET

September 2022 Eurodollar (EDU2) Implied Yield & 1 month by 2 year ATM Swaption Implied Volatility | Source: Refinitiv

QUICK US SUMMARY

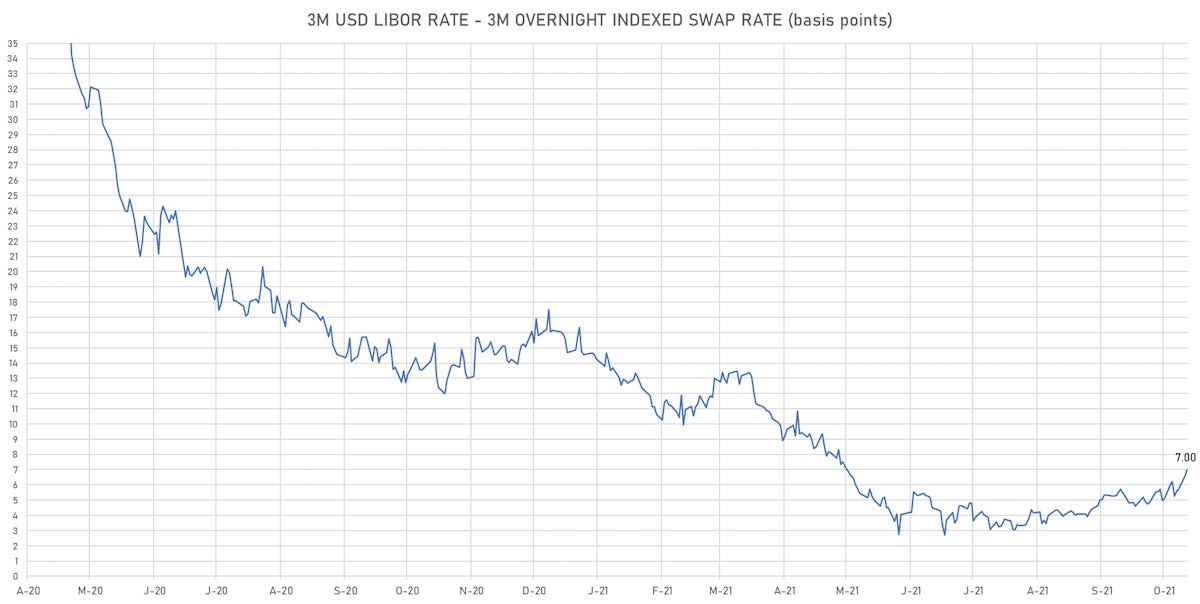

- 3-Month USD LIBOR +0.41bp today, now at 0.1450%; 3-Month OIS unchanged at 0.0750%

- The treasury yield curve flattened, with the 1s10s spread tightening -1.2 bp, now at 142.0 bp (YTD change: +61.6bp)

- 1Y: 0.1270% (down 0.3 bp)

- 2Y: 0.4480% (down 5.3 bp)

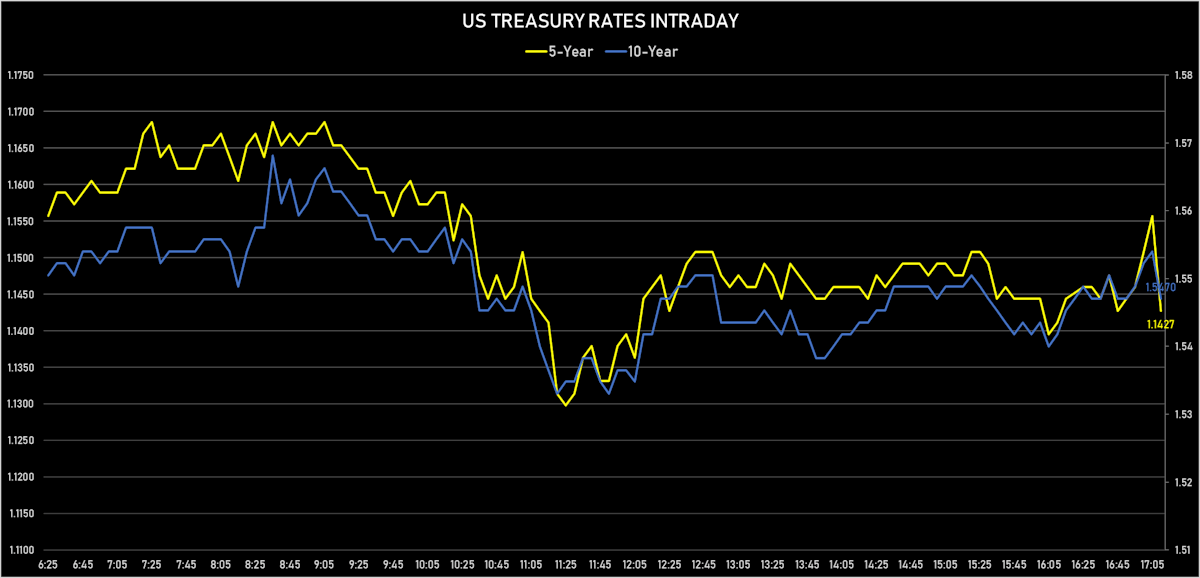

- 5Y: 1.1427% (down 3.9 bp)

- 7Y: 1.4138% (down 3.2 bp)

- 10Y: 1.5470% (down 1.4 bp)

- 30Y: 1.9583% (down 0.3 bp)

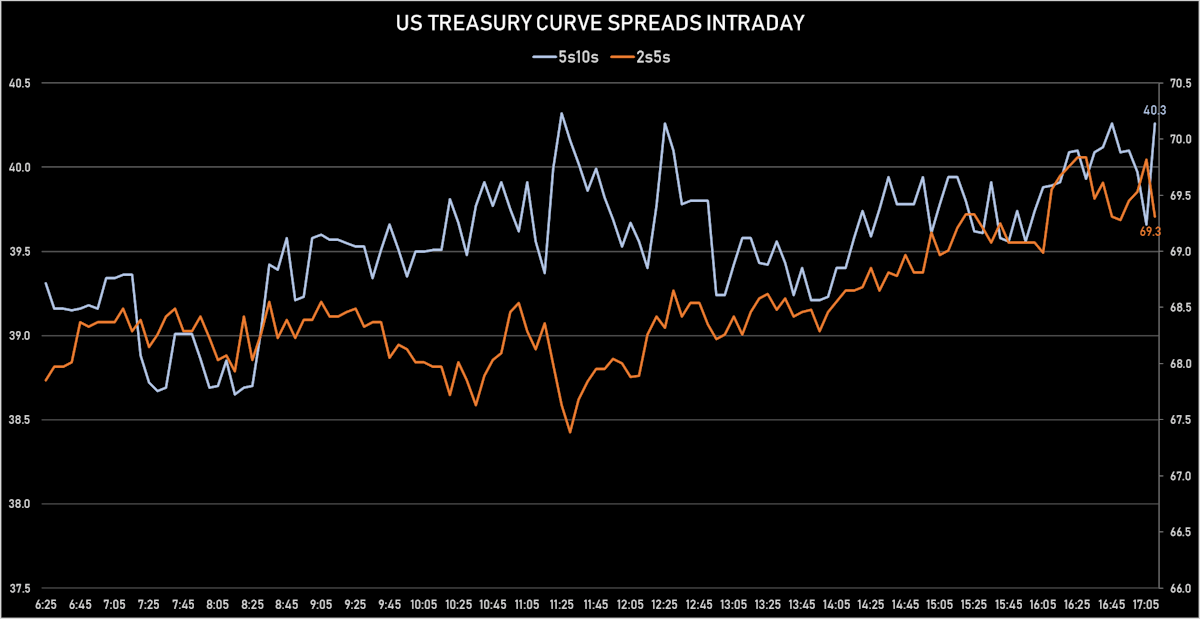

- US treasury curve spreads: 2s5s at 69.5bp (up 1.4bp today), 5s10s at 40.4bp (up 2.5bp today), 10s30s at 41.2bp (up 1.1bp today)

- Treasuries butterfly spreads: 1s5s10s at -62.6bp (up 6.1bp today), 5s10s30s at 0.5bp (down -1.2bp)

- US 5-Year TIPS Real Yield: -3.7 bp at -1.7140%; 10-Year TIPS Real Yield: -2.6 bp at -0.9730%; 30-Year TIPS Real Yield: -4.2 bp at -0.3200%

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 30 Oct (Redbook Research) at 16.90 % (vs 15.60 % prior)

FOMC PREVIEW / POTENTIAL RISKS

ENDING OF QE / TAPER PROCESS

- The consensus for the pace of tapering is $15 bn / month ($10bn in treasuries and $5bn in MBS), with the process ending in June 2022

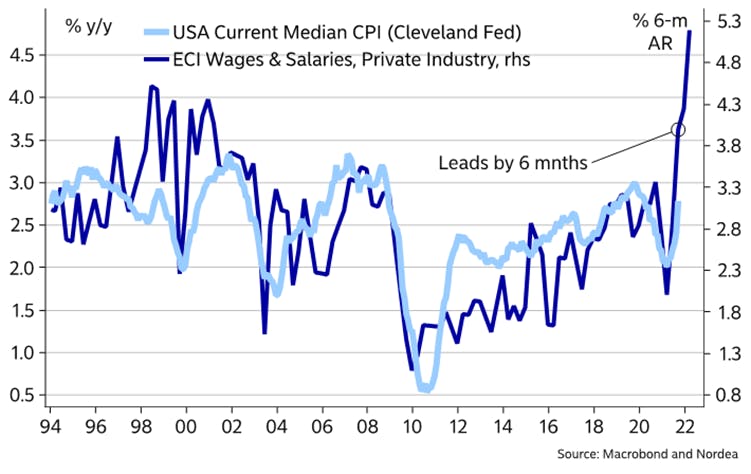

- With wages rising rapidly (albeit at the lower end of the pay scale), the risk of inflation expectations becoming anchored at a higher level is real. Some economists see the possibility of the Fed having to accelerate the pace of tapering to $30bn / month, with the process ending in April/May 2022, in order to be free to hike soon thereafter.

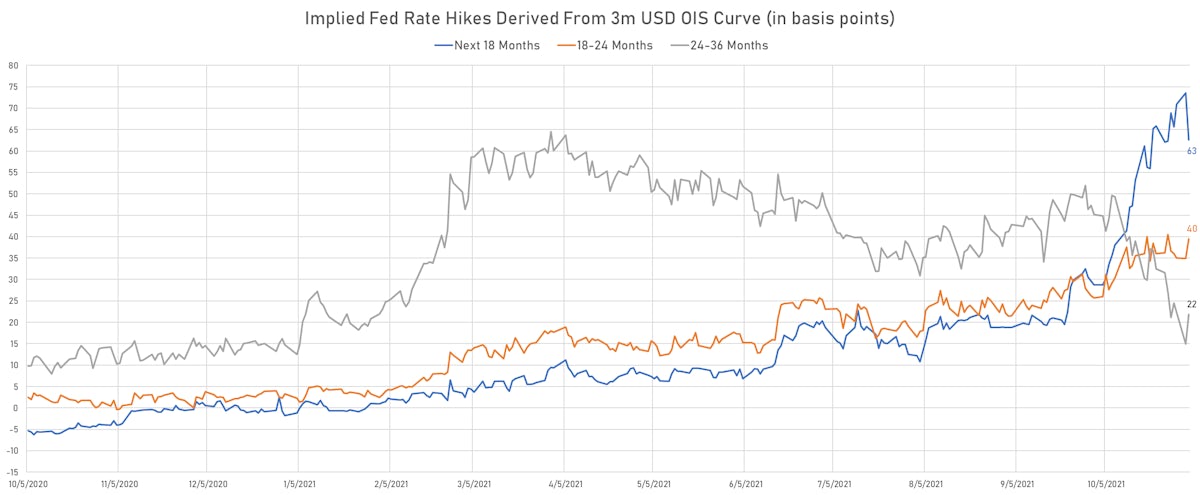

RATES LIFTOFF / TIMING OF HIKES

- When it come to rate hikes, nobody expects Powell to commit to anything, as he has repeatedly emphasized that the tapering process and rates liftoff are completely separate issues

- Further, the Fed has made it clear that QE would need to have ended before any discussion of rate hikes.

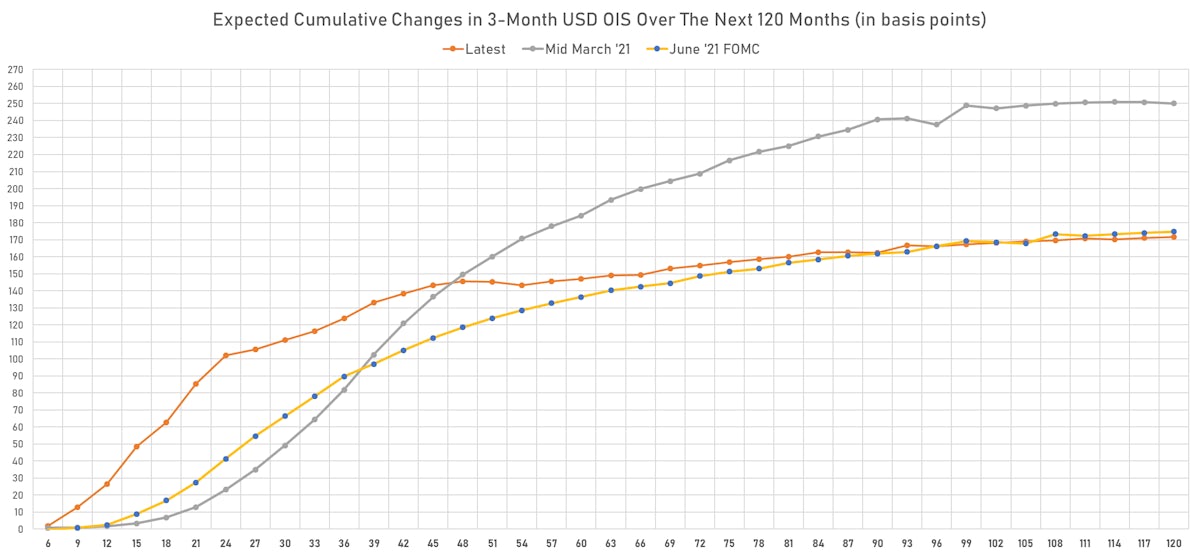

- In this context, there are three main paths ("tri-modal" as David Mericle might call it)

- Short-term inflationary pressure come down quickly and the Fed sees no need for hikes in 2022: this outcome would lead to a downward repricing of front-end rates and a steepening of the curve.

- Inflation is higher than the Fed expects but nothing crazy, and they start hiking at a modest pace of 1 to 2 hikes (25bp each) in 2022. That is pretty close to the current market consensus, and would likely not cause major moves in rates.

- Inflation turns out to be much higher than expected, pushing the Fed to end QE rapidly and start hikes In June 2022, perhaps with a 50bp shocker, followed by two more 25bp hikes in September in December, for a total of 100bp in 2022. That is definitely a non-consensus outcome, which would cause a rise in front-end rates and a violent flattening of the curve.

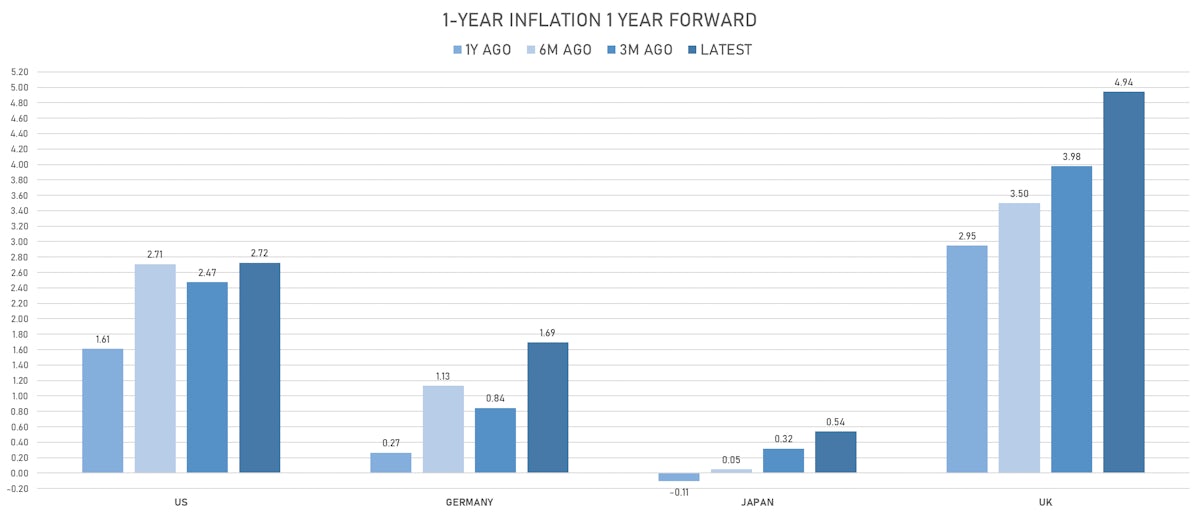

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 43.5 bp by the end of 2022 (equivalent to 1.7 hikes by end of 2022), down -7.9 bp today

- The 3-month USD OIS forward curve prices in 124.0 bp over the next 3 years (equivalent to 4.96 rate hikes)

- The 3-month Eurodollar zero curve prices in 144.7 bp over the next 3 years (equivalent to 5.79 rate hikes)

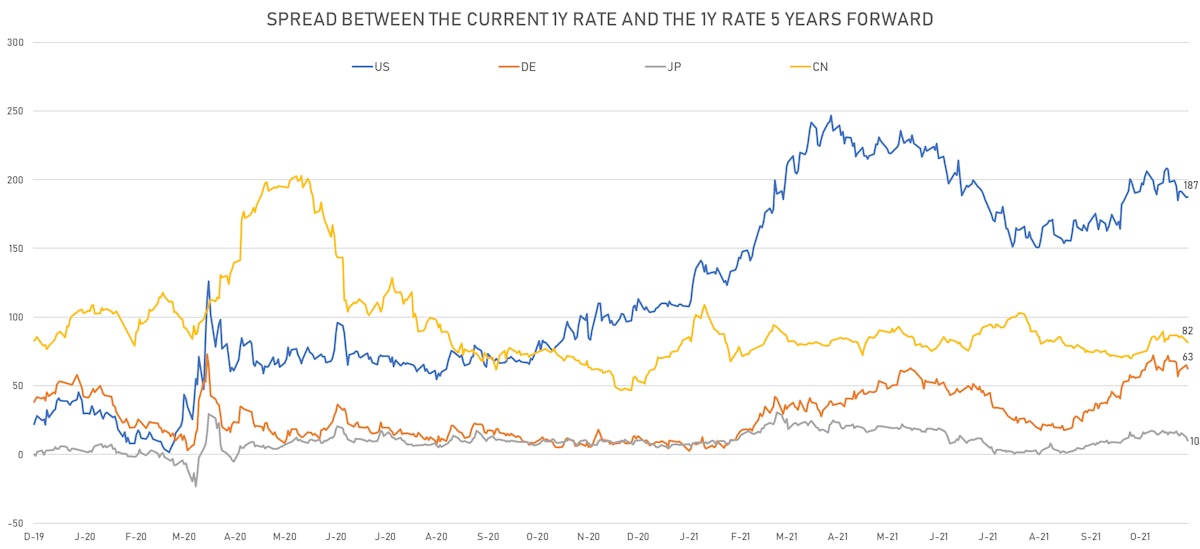

- 1-year US Treasury rate 5 years forward down 1.2 bp, now at 2.0377%, meaning that the 1-year Treasury rate is now expected to increase by 187.4 bp over the next 5 years (equivalent to 7.5 rate hikes)

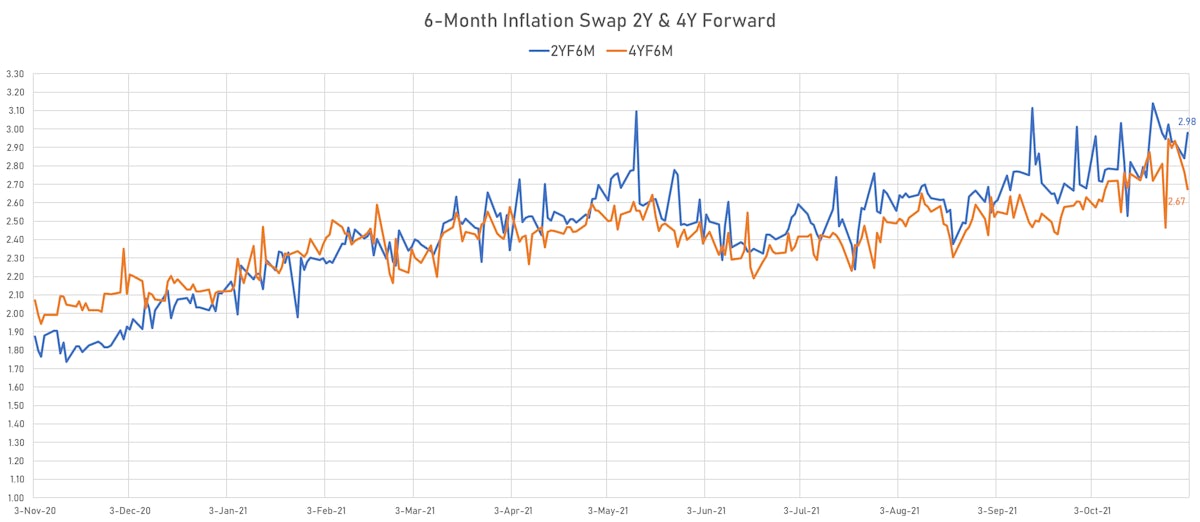

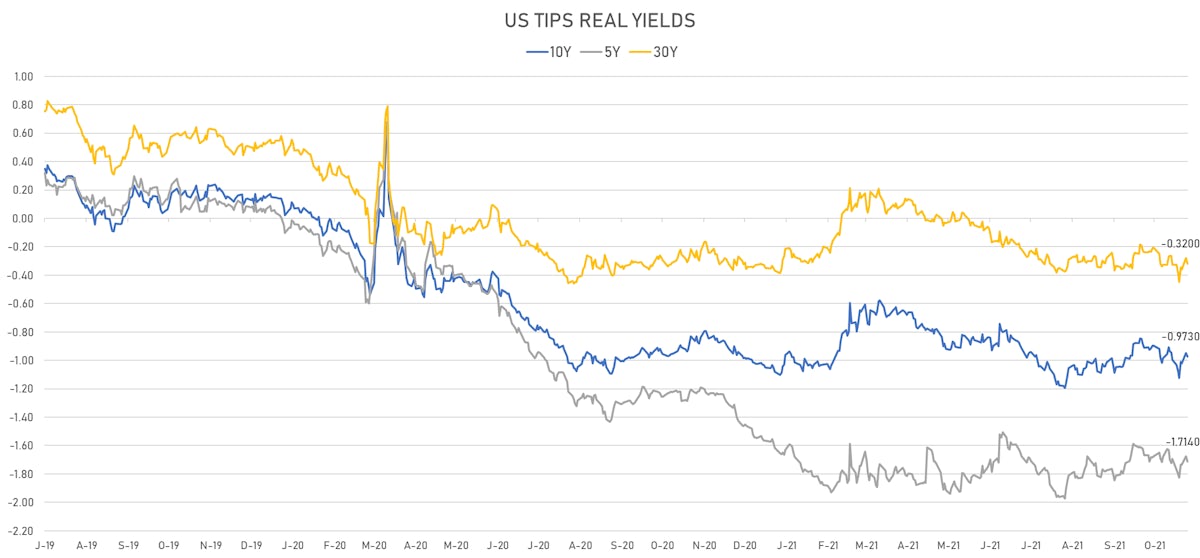

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.94% (down -1.0bp); 2Y at 3.33% (down -1.1bp); 5Y at 2.93% (down -0.6bp); 10Y at 2.50% (up 1.0bp); 30Y at 2.29% (up 3.9bp)

- 6-month spot US CPI swap down -7.1 bp to 3.622%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.7140%, -3.7 bp today; 10Y at -0.9730%, -2.6 bp today; 30Y at -0.3200%, -4.2 bp today

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -6.9% at 46.0%

- 3-Month LIBOR-OIS spread up 0.4 bp at 7.0 bp (12-months range: 2.7-17.5 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.470% (down -6.9 bp); the German 1Y-10Y curve is 4.3 bp flatter at 53.1bp (YTD change: +38.1 bp)

- Japan 5Y: -0.086% (down -0.3 bp); the Japanese 1Y-10Y curve is 1.4 bp flatter at 17.5bp (YTD change: +4.2 bp)

- China 5Y: 2.787% (down -1.4 bp); the Chinese 1Y-10Y curve is 0.9 bp steeper at 71.2bp (YTD change: +24.8 bp)

- Switzerland 5Y: -0.361% (down -11.9 bp); the Swiss 1Y-10Y curve is 0.7 bp flatter at 70.0bp (YTD change: +43.6 bp)