Rates

US Rates Volatility And Inflation Breakevens Higher; Fed Speakers Suggest More Flexibility If Inflation Rises More Than Expected

The front end of the curve is obviously the most active: looking at current Eurodollar futures pricing, the probability of a rate hike before the June 2022 FOMC is now 30%, with the most likely date for Fed funds rate liftoff being 27 July 2022 (96% probability before September 2022 and there is no FOMC in August)

Published ET

Implied Hikes Priced Into The 3M USD OIS Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.28bp today, now at 0.1428%; 3-Month OIS +0.1bp at 0.0780%

- The treasury yield curve steepened, with the 1s10s spread widening 3.1 bp, now at 131.0 bp (YTD change: +50.5bp)

- 1Y: 0.1450% (up 0.8 bp)

- 2Y: 0.4048% (up 4.2 bp)

- 5Y: 1.0555% (up 6.6 bp)

- 7Y: 1.3186% (up 5.8 bp)

- 10Y: 1.4548% (up 3.8 bp)

- 30Y: 1.8877% (up 0.2 bp)

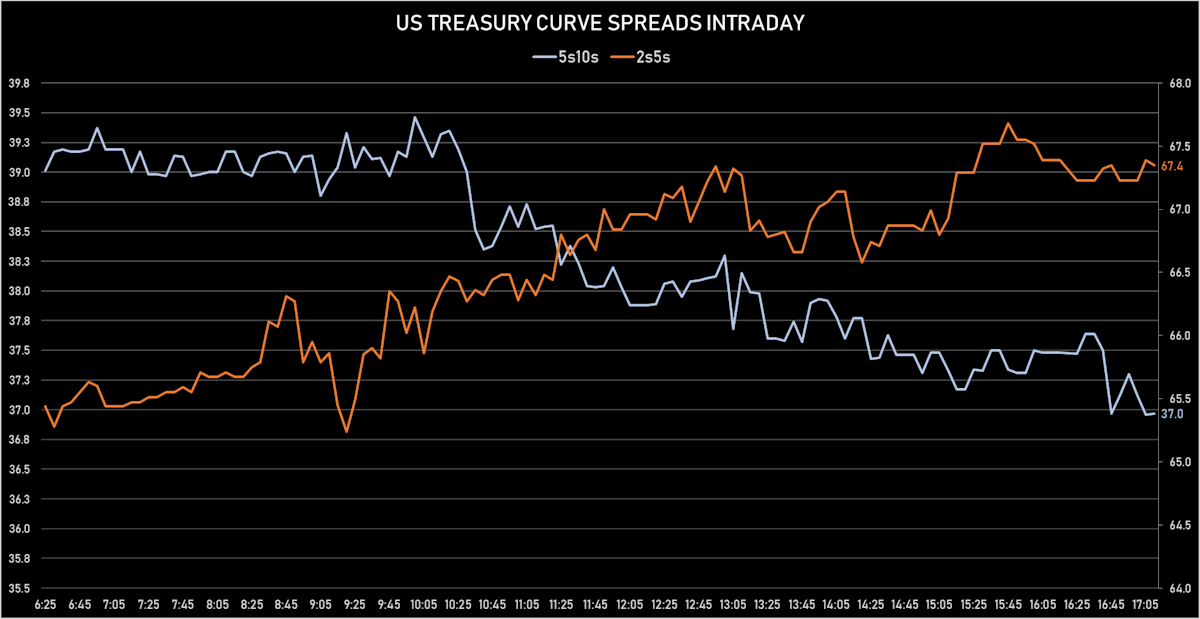

- US treasury curve spreads: 2s5s at 67.4bp (up 2.6bp today), 5s10s at 37.5bp (down -2.4bp), 10s30s at 39.3bp (down -3.9bp)

- Treasuries butterfly spreads: 1s5s10s at -62.0bp (down -9.7bp), 5s10s30s at 1.9bp (down -1.4bp)

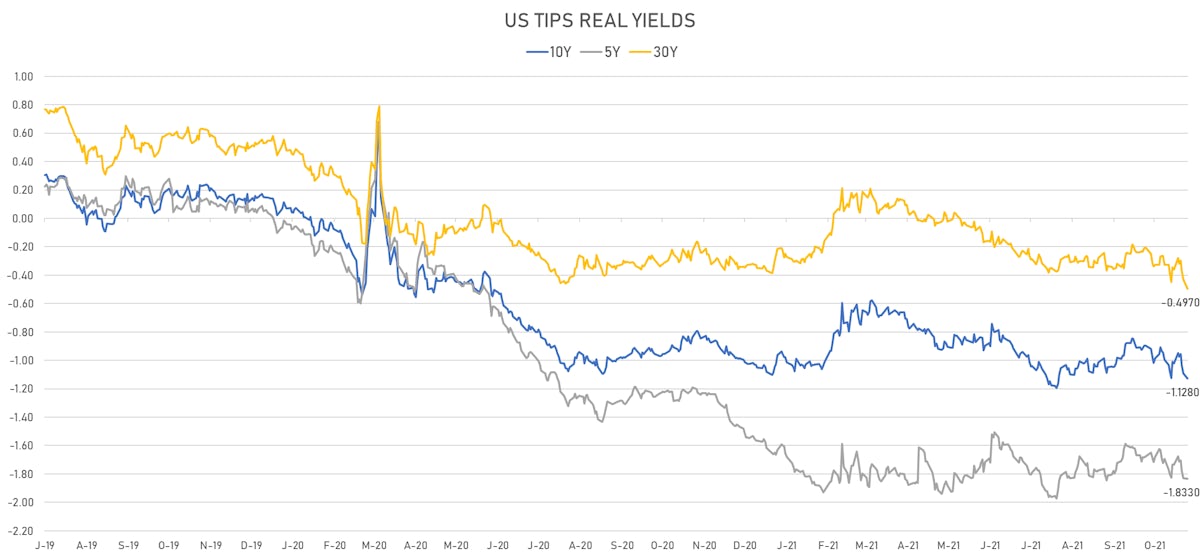

- US 5-Year TIPS Real Yield: -0.4 bp at -1.8330%; 10-Year TIPS Real Yield: -3.5 bp at -1.1280%; 30-Year TIPS Real Yield: -6.6 bp at -0.4970%

FED SPEAKERS TODAY

- Clarida: "The necessary conditions for raising the target range for the federal funds rate will have been met by year-end 2022." Added that current inflation is "much more than a moderate overshoot of our 2% longer-run inflation objective, and I would not consider a repeat performance next year a policy success"

- Bullard: "If inflation is more persistent than we are seeing right now, then I think we may have to take a little sooner action in order to keep inflation under control"

- Harker: "I don’t expect that the federal funds rate will rise before the tapering is complete. But we are monitoring inflation very closely and are prepared to take action, should circumstances warrant it."

- Evans: The bar for changing the pace of Fed's taper is "reasonably high", still sees Fed funds rate liftoff in 2023 though he admits that if inflation expectations increase substantially it would make sense to hike in 2022

$ 55.8 BN 3-YEAR 0.75% COUPON TREASURY NOTE AUCTION (91282CDH1)

- Mixed auction results: bad pricing was understandable considering current levels of rates volatility, while end-user demand was very strong (at 75.6% vs 63.1% prior and 67.6% average)

- High yield at 0.75%, a 1bp tail from the when-issued at the bid deadline (vs 0.635% prior)

- Bid-cover-ratio at 2.33 (vs. 2.36 prior and 2.44 average)

- Direct bidders 18.0% (vs 18.9% prior and 17.1% average)

- Indirect bidders at 57.6% (vs 44.2% prior and 50.4% average)

- Primary dealers at 24.3% (vs 36.9% prior and 32.4% average)

US MACRO RELEASES

- The Conference Board Employment Trends Index (ETI) for Oct 2021 (The Conference Board) at 112.23 (vs 110.35 prior)

US FORWARD RATES

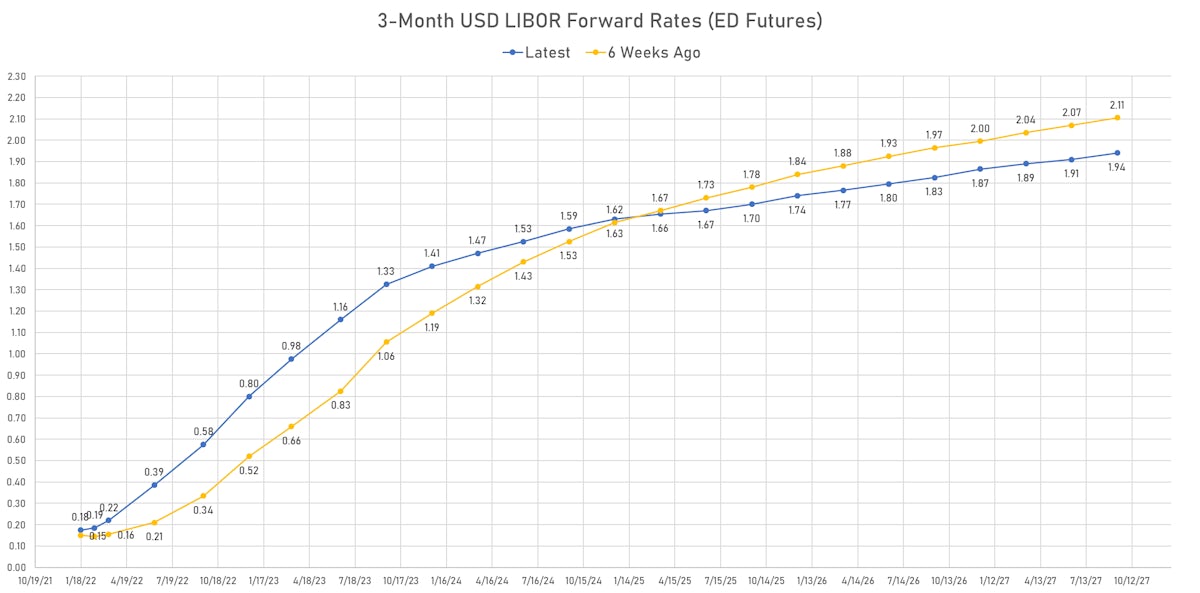

- 3-month Eurodollar future (EDU2) expected hike of 42.9 bp by the end of 2022 (equivalent to 1.7 hikes by end of 2022), up 3.7 bp today

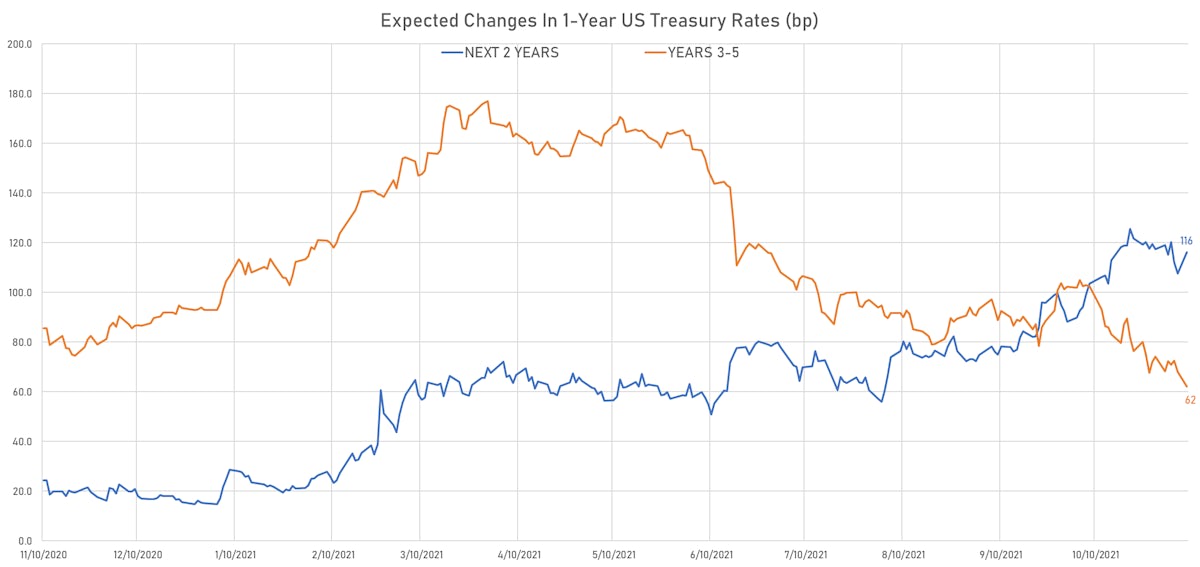

- The 3-month USD OIS forward curve prices in 27.7 bp of rate hikes over the next 12 months (up 3.1 bp today), 70.3 bp of rate hikes over the following year (up 5.8 bp today), and 44.6 bp total rate hikes in years 3 to 5 (down -1.6 bp today)

- 1-year US Treasury rate 5 years forward up 4.0 bp, now at 1.9455%, meaning that the 1-year Treasury rate is now expected to increase by 177.9 bp over the next 5 years (equivalent to 7.1 rate hikes)

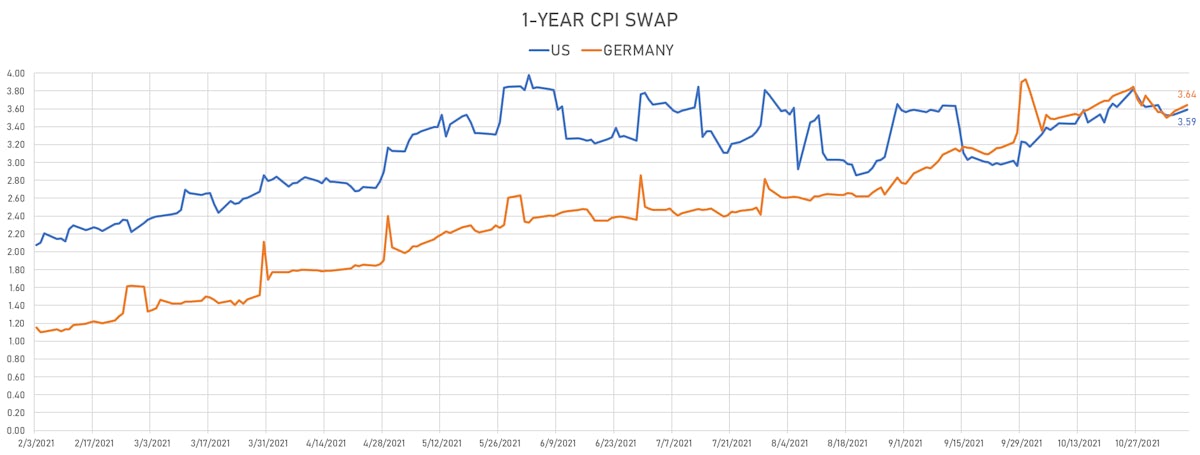

US INFLATION & REAL RATES

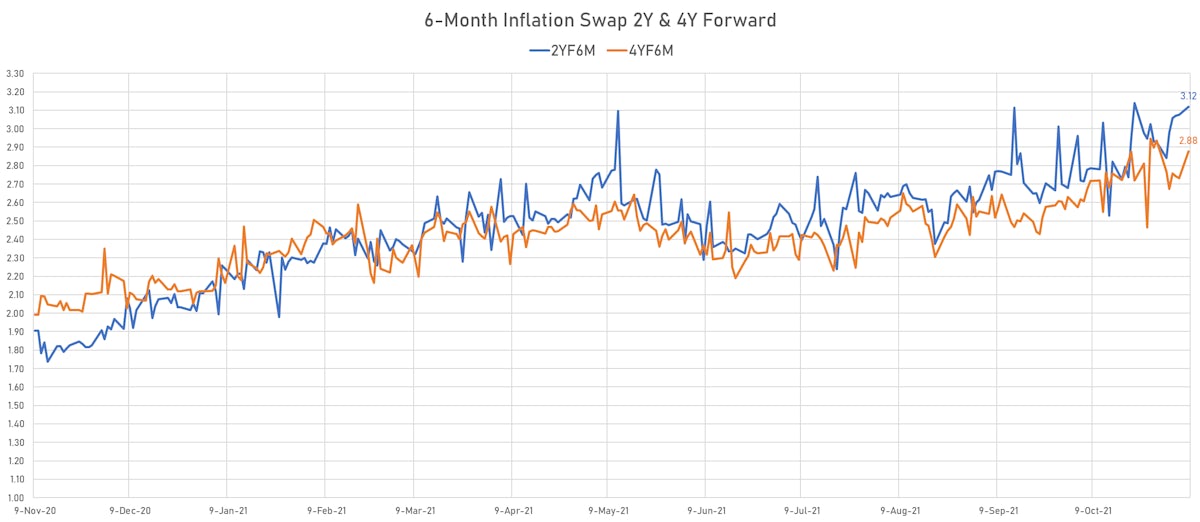

- TIPS 1Y breakeven inflation at 4.21% (up 6.0bp); 2Y at 3.42% (up 6.4bp); 5Y at 3.02% (up 7.4bp); 10Y at 2.59% (up 6.8bp); 30Y at 2.40% (up 6.4bp)

- 6-month spot US CPI swap up 6.2 bp to 3.651%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.8330%, -0.4 bp today; 10Y at -1.1280%, -3.5 bp today; 30Y at -0.4970%, -6.6 bp today

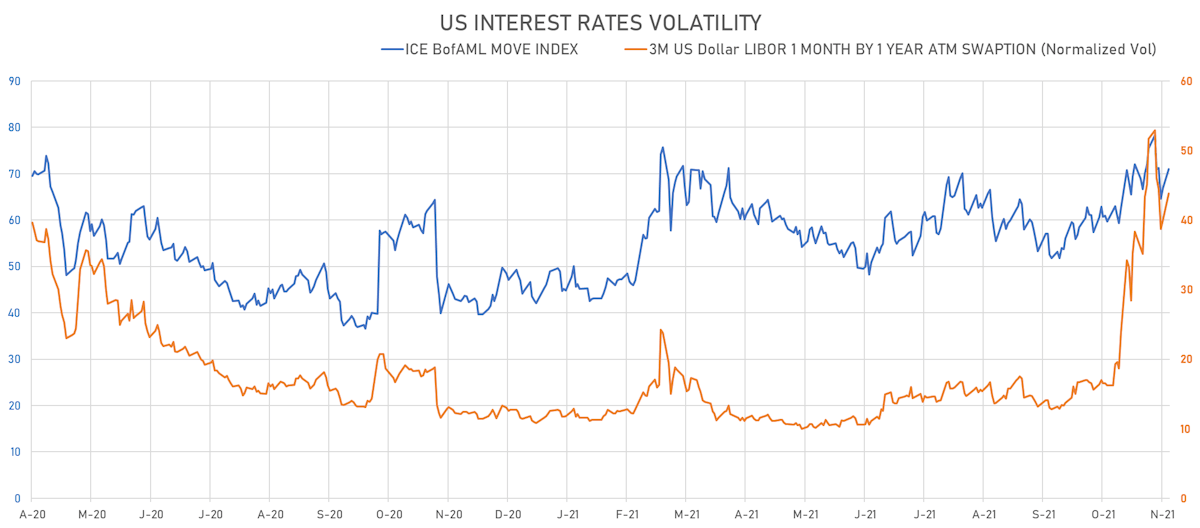

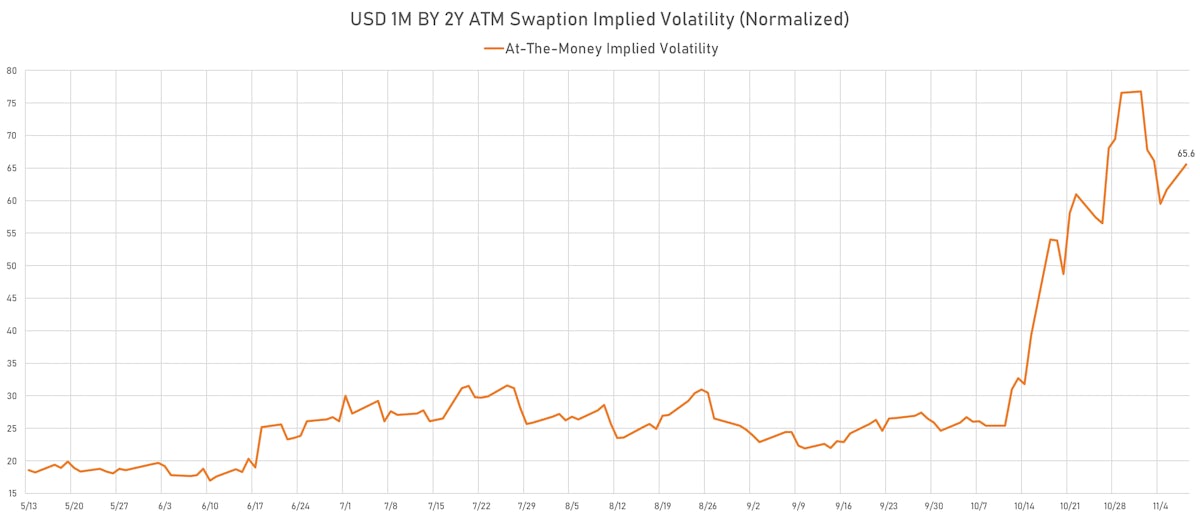

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 3.8% at 43.8%

- 3-Month LIBOR-OIS spread down -0.3 bp at 6.5 bp (12-months range: 2.6-17.4 bp)

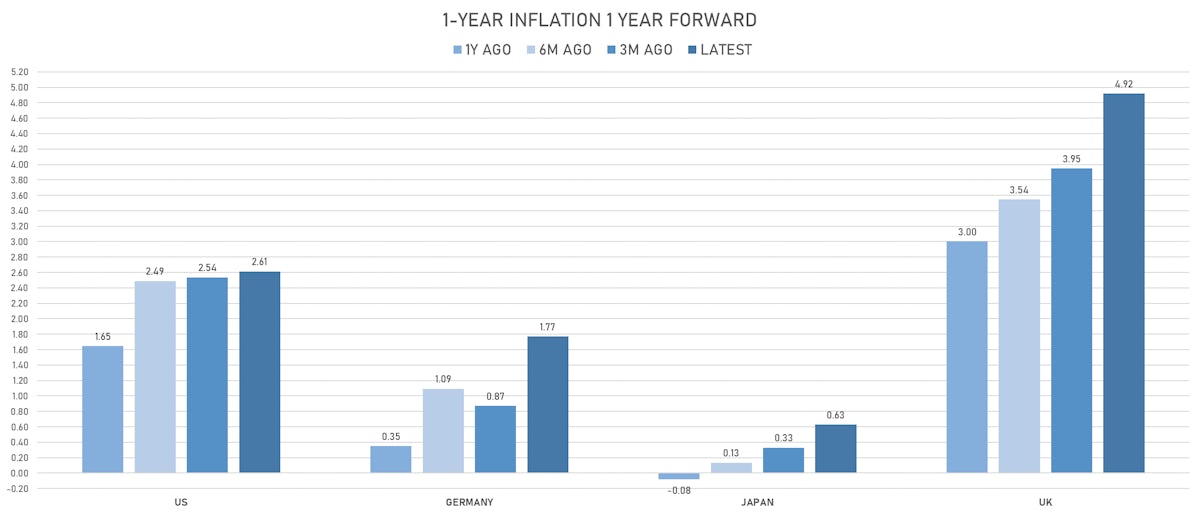

KEY INTERNATIONAL RATES

- Germany 5Y: -0.549% (up 2.1 bp); the German 1Y-10Y curve is 5.3 bp steeper at 48.0bp (YTD change: +32.0 bp)

- Japan 5Y: -0.090% (up 0.1 bp); the Japanese 1Y-10Y curve is 0.1 bp steeper at 17.4bp (YTD change: +2.4 bp)

- China 5Y: 2.728% (up 0.5 bp); the Chinese 1Y-10Y curve is 0.3 bp flatter at 71.2bp (YTD change: +24.8 bp)

- Switzerland 5Y: -0.445% (up 1.8 bp); the Swiss 1Y-10Y curve is 4.8 bp flatter at 57.5bp (YTD change: +23.1 bp)