Rates

Front End Of The Curve Rises Further On CPI Shocker, With Continued Back-End Flattening In 5s30s

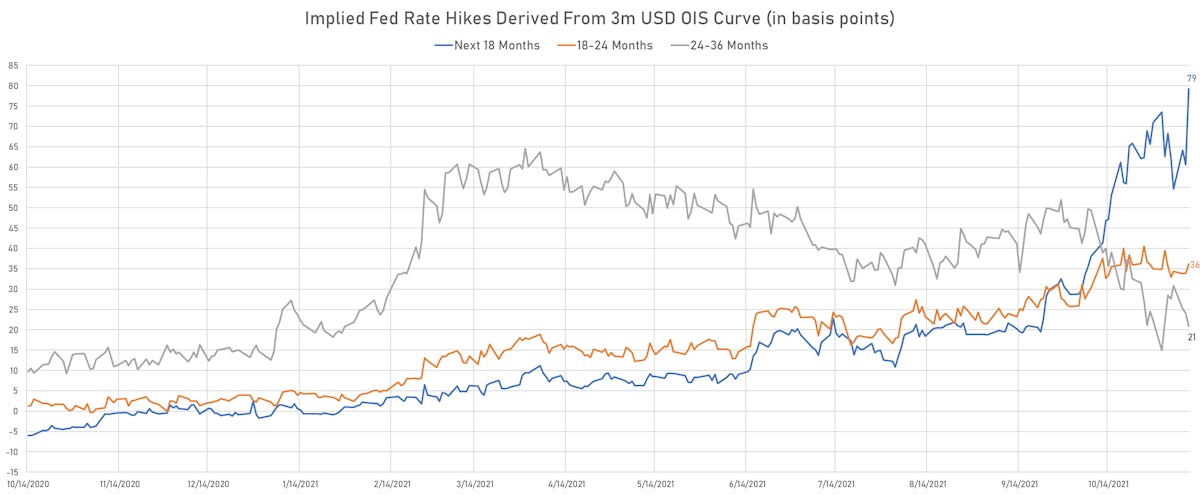

Looking at the Eurodollar curve, there is still room for pricing in hikes in the early part of 2022, with the Fed's stated flexibility to act before the end of taper if needed (with a high threshold for action. in order to avoid looking panicky); the March '22 contract now prices in a 38% probability of a hike before June (up 10% today)

Published ET

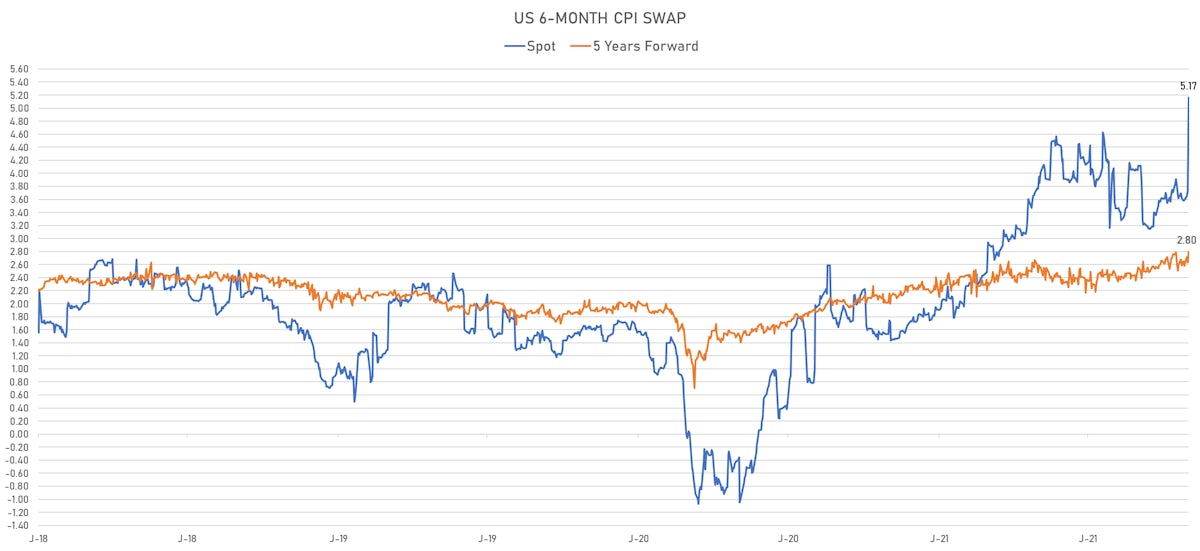

6-Month CPI Swap Spot & 5 Years Forward | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

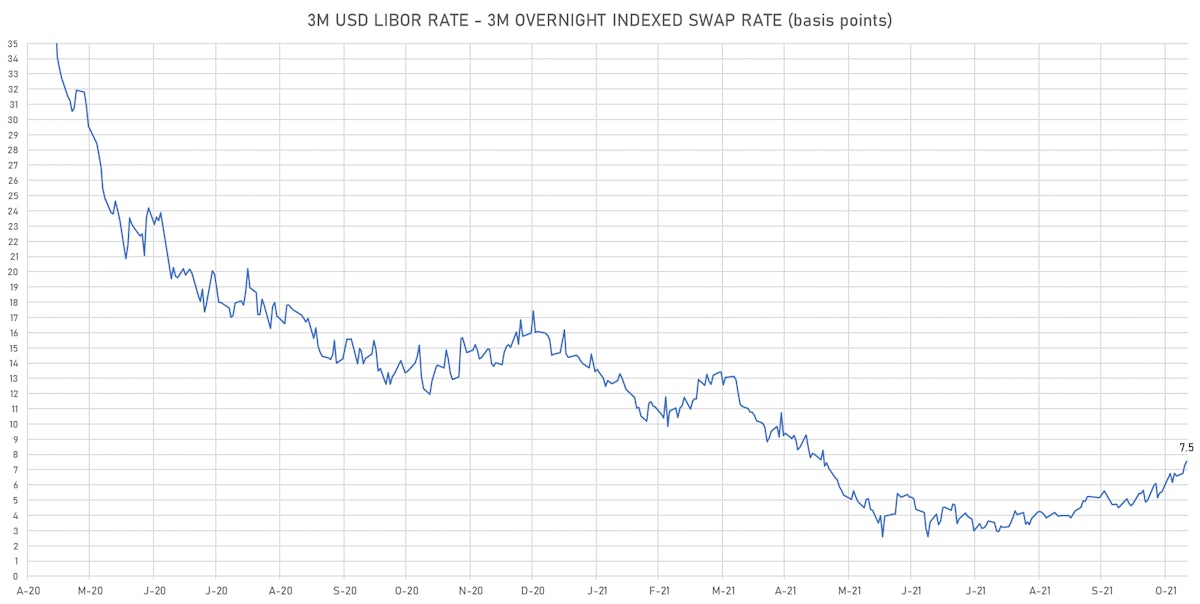

- 3-Month USD LIBOR +0.49bp today, now at 0.1495%; 3-Month OIS +0.2bp at 0.0790%

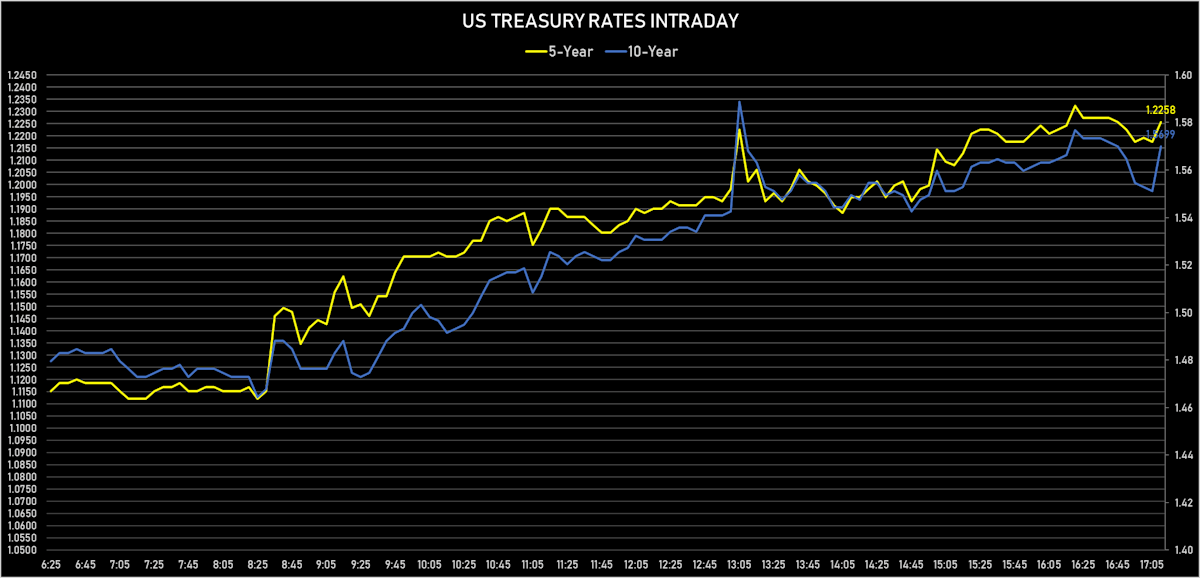

- The treasury yield curve steepened, with the 1s10s spread widening 10.3 bp, now at 143.3 bp (YTD change: +62.8bp)

- 1Y: 0.1370% (up 2.8 bp)

- 2Y: 0.5189% (up 9.6 bp)

- 5Y: 1.2258% (up 14.5 bp)

- 7Y: 1.4602% (up 13.8 bp)

- 10Y: 1.5699% (up 13.1 bp)

- 30Y: 1.9245% (up 10.2 bp)

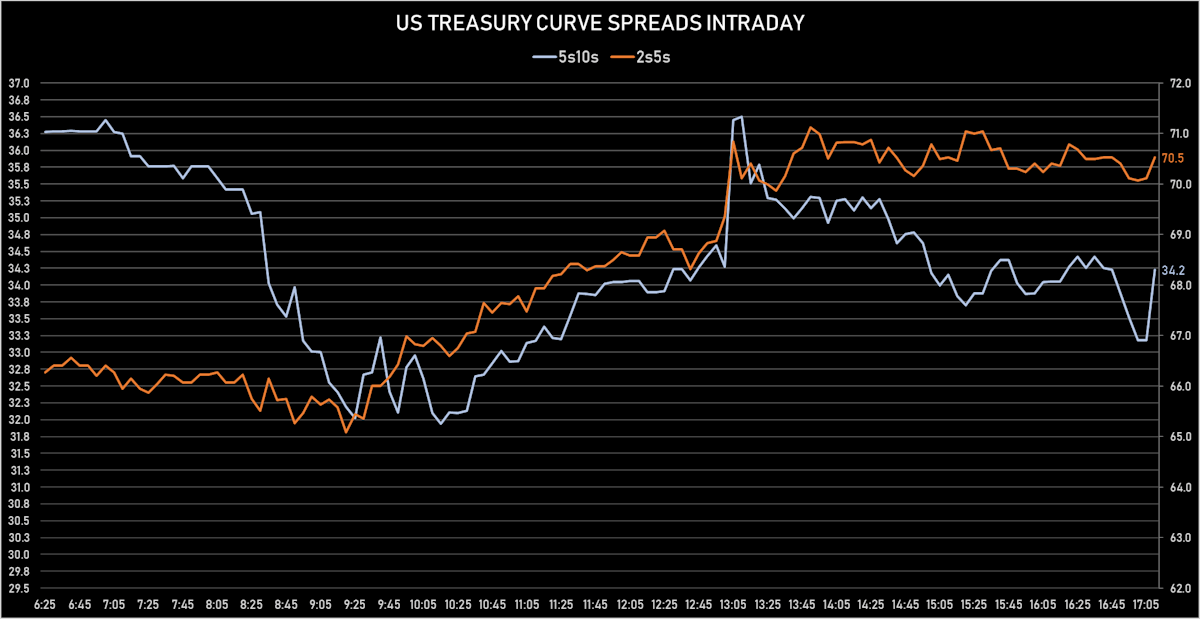

- US treasury curve spreads: 2s5s at 70.7bp (up 4.3bp today), 5s10s at 34.4bp (down -2.1bp), 10s30s at 35.5bp (down -2.9bp)

- Treasuries butterfly spreads: 1s5s10s at -72.9bp (down -13.1bp), 5s10s30s at 1.5bp (down -0.6bp)

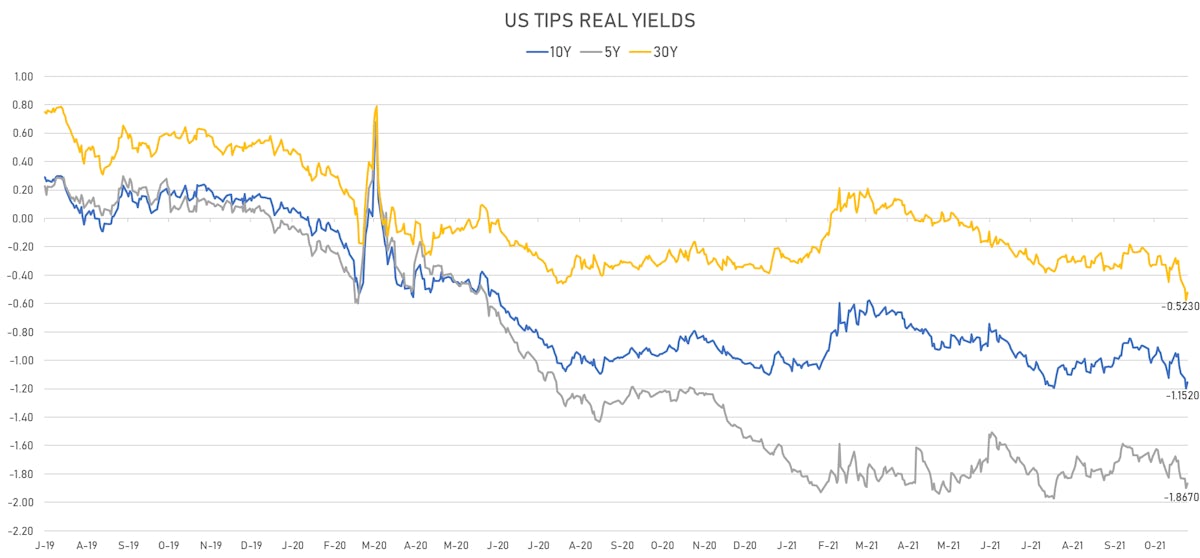

- US 5-Year TIPS Real Yield: +3.2 bp at -1.8670%; 10-Year TIPS Real Yield: +4.7 bp at -1.1520%; 30-Year TIPS Real Yield: +5.5 bp at -0.5230%

$25BN 30-YEAR 1.875% COUPON TREASURY BOND AUCTION (912810TB4)

- Catastrophic results as the auction priced in the midst of a renewed volatility surge, with anemic end-user demand at 74.8% (vs 87.7% in October and 82.0% average)

- High yield at 1.940% (vs 2.049% prior), a huge 5.2 bp tail vs when-issued at the bid deadline

- Bid-to-cover at 2.20 (vs 2.36 prior and 2.33 average)

- Direct bids at 15.8% (vs 17.2% prior and 18.3% average)

- Indirect bids at 59.0% (vs 70.5% prior and 63.7% average)

US MACRO RELEASES

- CPI - All Urban Samples: All Items, Change Y/Y for Oct 2021 (BLS, U.S Dep. Of Lab) at 6.20 % (vs 5.40 % prior), above consensus estimate of 5.80 %

- CPI, All items less food and energy for Oct 2021 (BLS, U.S Dep. Of Lab) at 281.70 (vs 280.02 prior)

- CPI, All items less food and energy, Change P/P for Oct 2021 (BLS, U.S Dep. Of Lab) at 0.60 % (vs 0.20 % prior), above consensus estimate of 0.40 %

- CPI, All items less food and energy, Change Y/Y, Price Index for Oct 2021 (BLS, U.S Dep. Of Lab) at 4.60 % (vs 4.00 % prior), above consensus estimate of 4.30 %

- CPI, All items, Change P/P for Oct 2021 (BLS, U.S Dep. Of Lab) at 0.90 % (vs 0.40 % prior), above consensus estimate of 0.60 %

- CPI, All items, Price Index for Oct 2021 (BLS, U.S Dep. Of Lab) at 276.59 (vs 274.31 prior), above consensus estimate of 275.76

- CPI, FRB Cleveland Median, 1 month, Change M/M for Oct 2021 (Fed Reserve, Cleveland) at 0.60 % (vs 0.50 % prior)

- Earnings, Average Weekly, Total Private, Change P/P for Oct 2021 (BLS, U.S Dep. Of Lab) at -0.90 % (vs 0.80 % prior)

- Federal Budget, Current Prices for Oct 2021 (Fiscal Service, USA) at -165.00 Bln USD (vs -62.00 Bln USD prior), above consensus estimate of -179.00 Bln USD

- Jobless Claims, National, Continued for W 30 Oct (U.S. Dept. of Labor) at 2.16 Mln (vs 2.11 Mln prior), above consensus estimate of 2.10 Mln

- Jobless Claims, National, Initial for W 06 Nov (U.S. Dept. of Labor) at 267.00 k (vs 269.00 k prior), above consensus estimate of 265.00 k

- Jobless Claims, National, Initial, four week moving average for W 06 Nov (U.S. Dept. of Labor) at 278.00 k (vs 284.75 k prior)

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 05 Nov (MBA, USA) at 5.50 % (vs -3.30 % prior)

- Mortgage applications, market composite index for W 05 Nov (MBA, USA) at 658.10 (vs 623.80 prior)

- Mortgage applications, market composite index, purchase for W 05 Nov (MBA, USA) at 278.40 (vs 271.10 prior)

- Mortgage applications, market composite index, refinancing for W 05 Nov (MBA, USA) at 2,841.00 (vs 2,645.00 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 05 Nov (MBA, USA) at 3.16 % (vs 3.24 % prior)

- Refinitiv / Ipsos Primary Consumer Sentiment Index (CSI) for Nov 2021 (Refinitiv/Ipsos) at 53.61 (vs 57.78 prior)

- Wholesale Inventories, Change P/P for Sep 2021 (U.S. Census Bureau) at 1.40 % (vs 1.10 % prior), above consensus estimate of 1.10 %

- Wholesale Trade, Change P/P for Sep 2021 (U.S. Census Bureau) at 1.10 % (vs -1.10 % prior), above consensus estimate of 0.40 %

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 49.6 bp by the end of 2022 (equivalent to 2.0 hikes by end of 2022), up 10.0 bp today

- The 3-month USD OIS forward curve prices in 35.3 bp of rate hikes over the next 12 months (up 8.1 bp today), 80.1 bp of rate hikes over the following year (up 12.9 bp today), and 29.3 bp total rate hikes in years 3 to 5 (down -8.5 bp today)

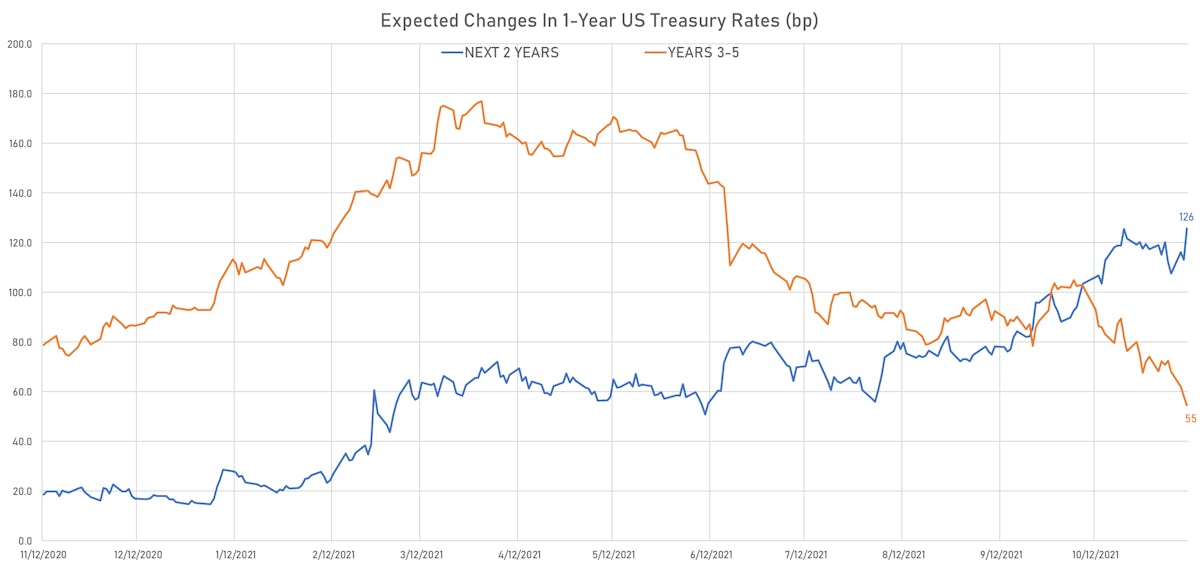

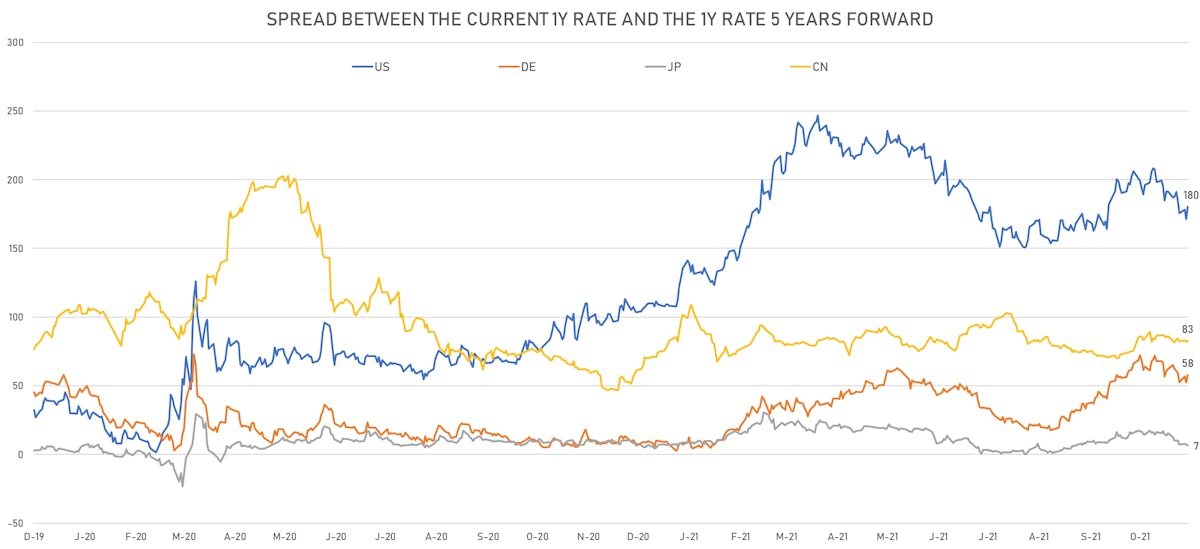

- 1-year US Treasury rate 5 years forward up 13.2 bp, now at 1.9976%, meaning that the 1-year Treasury rate is now expected to increase by 180.2 bp over the next 5 years (equivalent to 7.2 rate hikes)

US INFLATION & REAL RATES

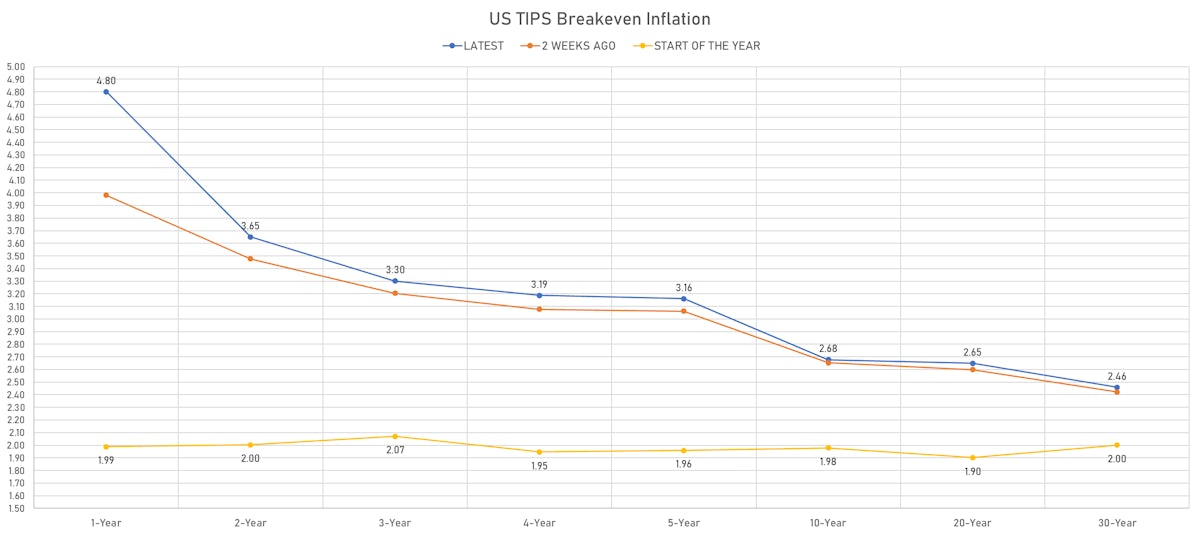

- TIPS 1Y breakeven inflation at 4.80% (up 52.0bp); 2Y at 3.65% (up 18.9bp); 5Y at 3.16% (up 11.3bp); 10Y at 2.68% (up 6.5bp); 30Y at 2.46% (up 4.5bp)

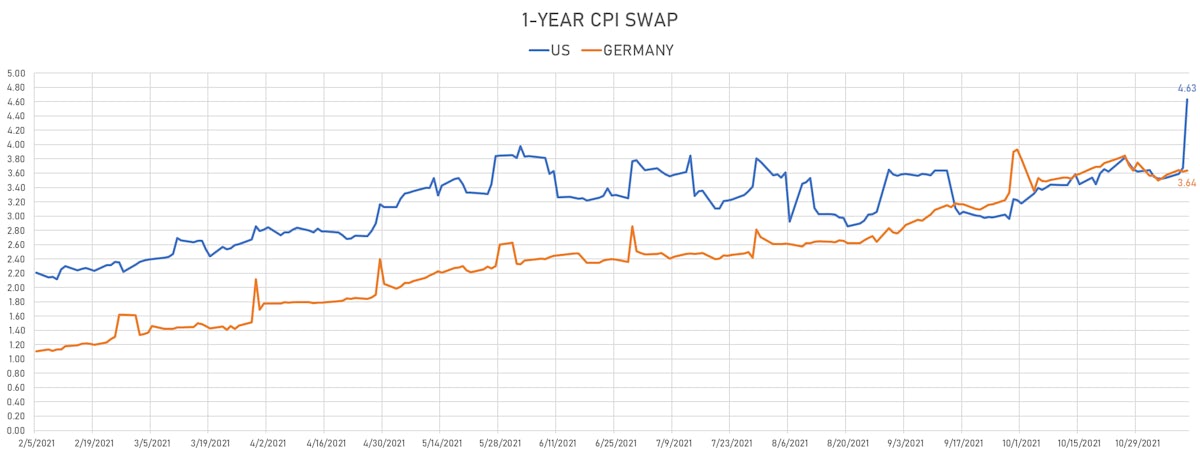

- 6-month spot US CPI swap up 143.8 bp to 5.166%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.8670%, +3.2 bp today; 10Y at -1.1520%, +4.7 bp today; 30Y at -0.5230%, +5.5 bp today

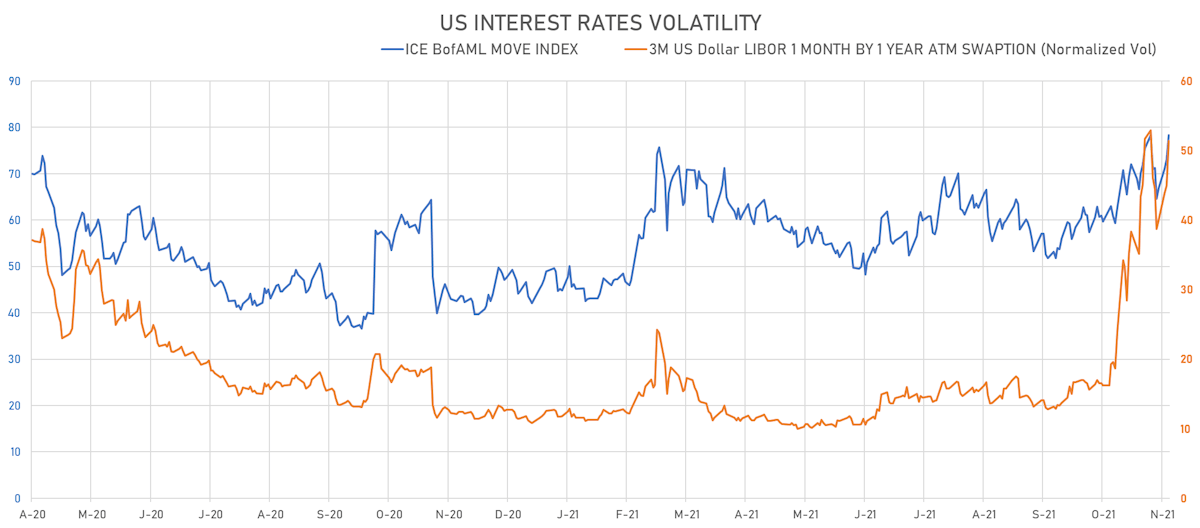

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 6.4% at 51.4%

- 3-Month LIBOR-OIS spread up 0.3 bp at 7.5 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.521% (up 5.1 bp); the German 1Y-10Y curve is 6.0 bp steeper at 50.9bp (YTD change: +35.1 bp)

- Japan 5Y: -0.086% (down -0.4 bp); the Japanese 1Y-10Y curve is 0.2 bp steeper at 17.6bp (YTD change: +2.5 bp)

- China 5Y: 2.740% (up 0.1 bp); the Chinese 1Y-10Y curve is 0.3 bp flatter at 71.8bp (YTD change: +25.4 bp)

- Switzerland 5Y: -0.391% (up 4.1 bp); the Swiss 1Y-10Y curve is 5.1 bp steeper at 61.5bp (YTD change: +31.1 bp)