Rates

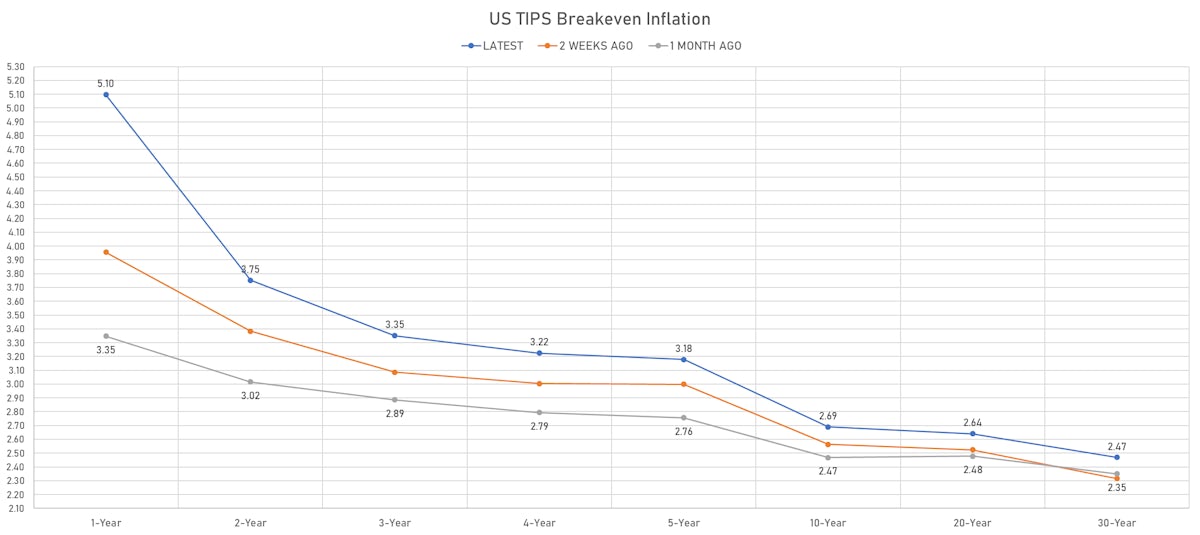

Rates Stable (Higher Breakevens, Lower Real Yields) Despite Much Weaker Than Expected U Mich Sentiment Survey, As Inflation Stays Top Of Mind

The probability (priced into EH2 Eurodollar futures) that the US central bank will start hiking before June '22 rose significantly this week (now at 42%), as pressure is building on the Fed to take control of inflation (though much of it comes from things beyond its control)

Published ET

Probability of a Fed Hike Before June 2022 priced into EDH2 futures | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

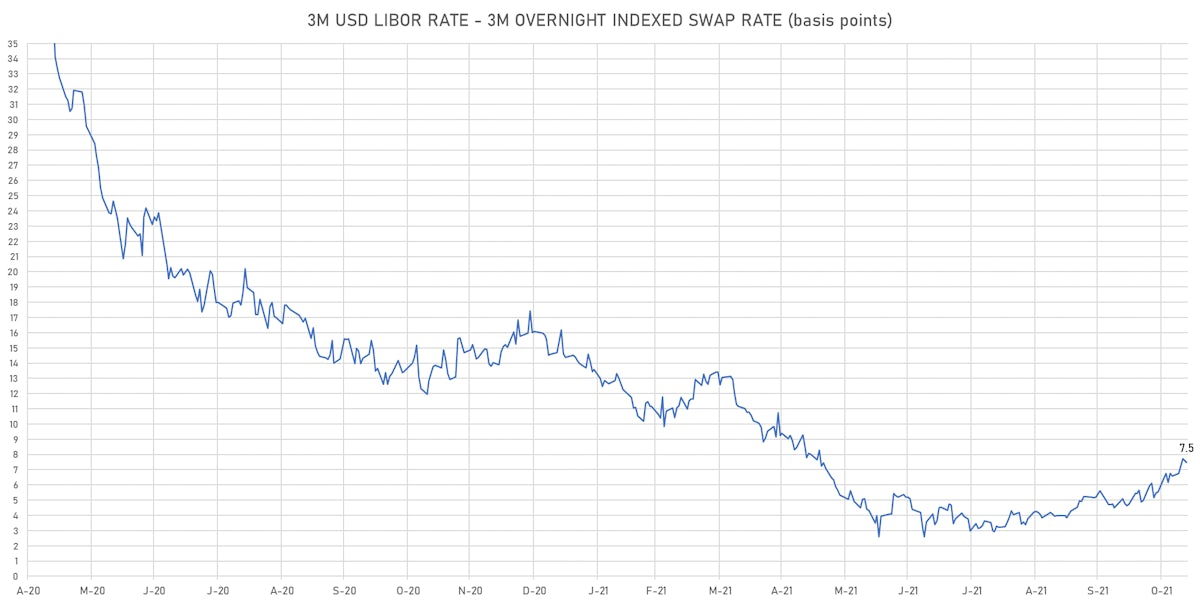

- 3-Month USD LIBOR +0.06bp today, now at 0.1560%; 3-Month OIS +0.3bp at 0.0800%

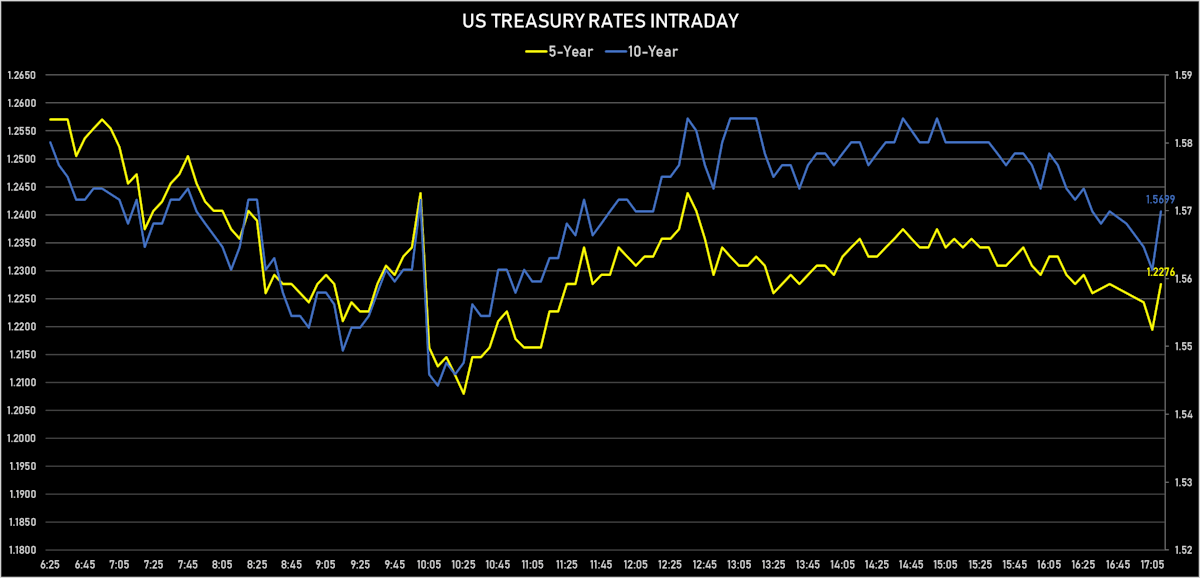

- The treasury yield curve flattened, with the 1s10s spread tightening 0.0 bp, now at 140.8 bp (YTD change: +60.3bp)

- 1Y: 0.1620% (unchanged)

- 2Y: 0.5175% (down 0.1 bp)

- 5Y: 1.2276% (up 0.2 bp)

- 7Y: 1.4615% (up 0.1 bp)

- 10Y: 1.5699% (unchanged)

- 30Y: 1.9377% (up 1.3 bp)

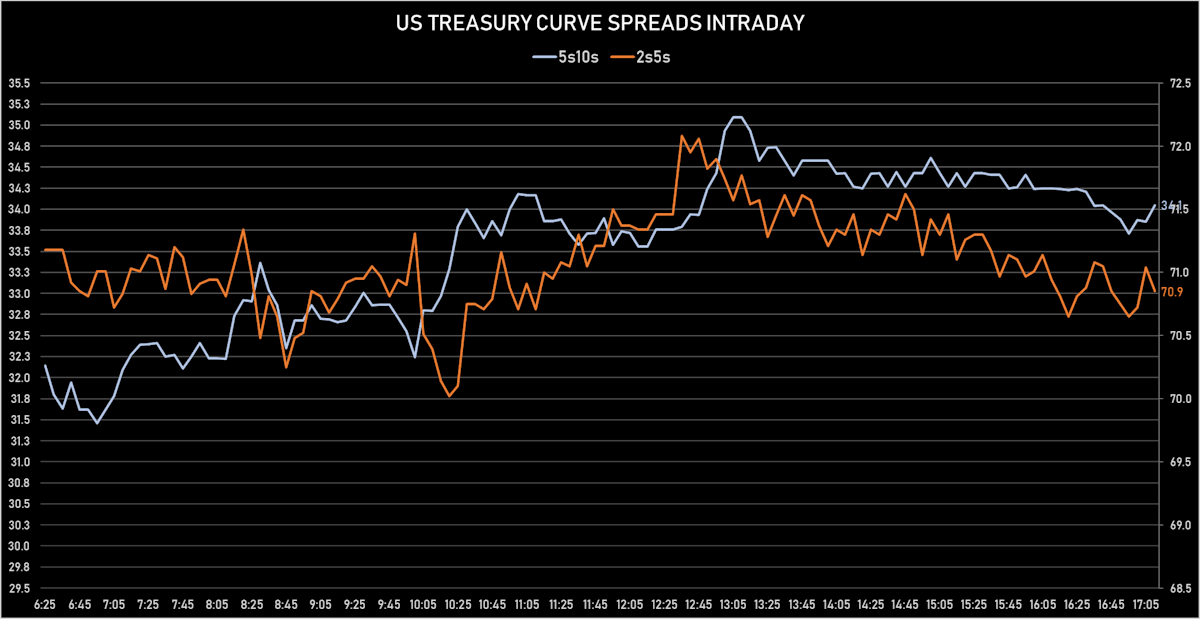

- US treasury curve spreads: 2s5s at 71.0bp (up 0.7bp today), 5s10s at 34.2bp (up 0.7bp today), 10s30s at 36.8bp (up 1.6bp today)

- Treasuries butterfly spreads: 1s5s10s at -73.2bp (down -0.4bp), 5s10s30s at 2.4bp (up 0.9bp)

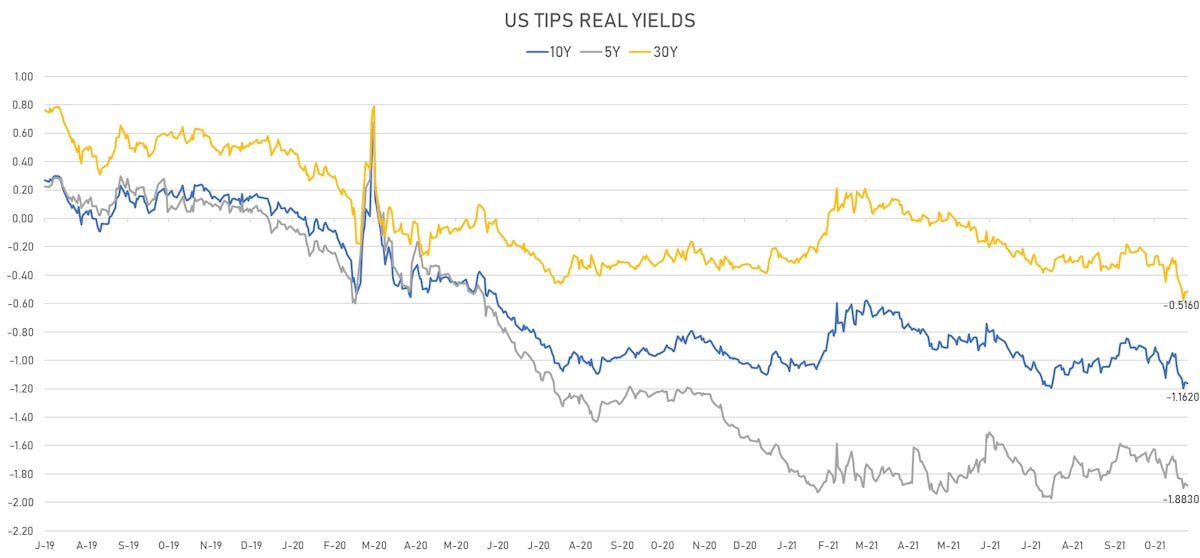

- US 5-Year TIPS Real Yield: -1.6 bp at -1.8830%; 10-Year TIPS Real Yield: -1.0 bp at -1.1620%; 30-Year TIPS Real Yield: +0.7 bp at -0.5160%

US MACRO RELEASES

- JOLTS Job Openings for Sep 2021 (BLS, U.S Dep. Of Lab) at 10.44 Mln (vs 10.44 Mln prior), above consensus estimate of 10.30 Mln

- University of Michigan, Current Conditions Index-prelim, Volume Index for Nov 2021 (UMICH, Survey) at 73.20 (vs 77.70 prior), below consensus estimate of 80.00

- University of Michigan, Total-prelim, Change Y/Y for Nov 2021 (UMICH, Survey) at 2.90 % (vs 2.90 % prior)

- University of Michigan, Total-prelim, Volume Index for Nov 2021 (UMICH, Survey) at 62.80 (vs 67.90 prior), below consensus estimate of 70.00

- University of Michigan, Total-prelim, Volume Index for Nov 2021 (UMICH, Survey) at 66.80 (vs 71.70 prior), below consensus estimate of 72.40

- 1 Year Inflation Expectations (median), preliminary for Nov 2021 (UMICH, Survey) at 4.90 % (vs 4.80 % prior)

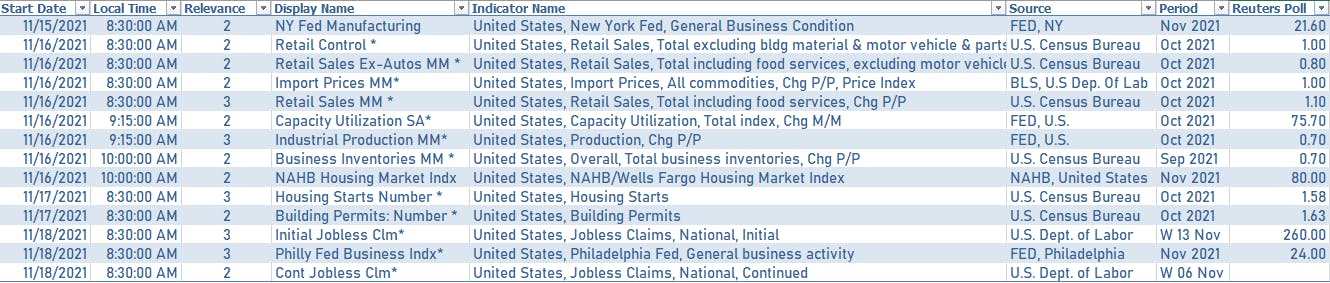

NEXT WEEK IN US MACRO

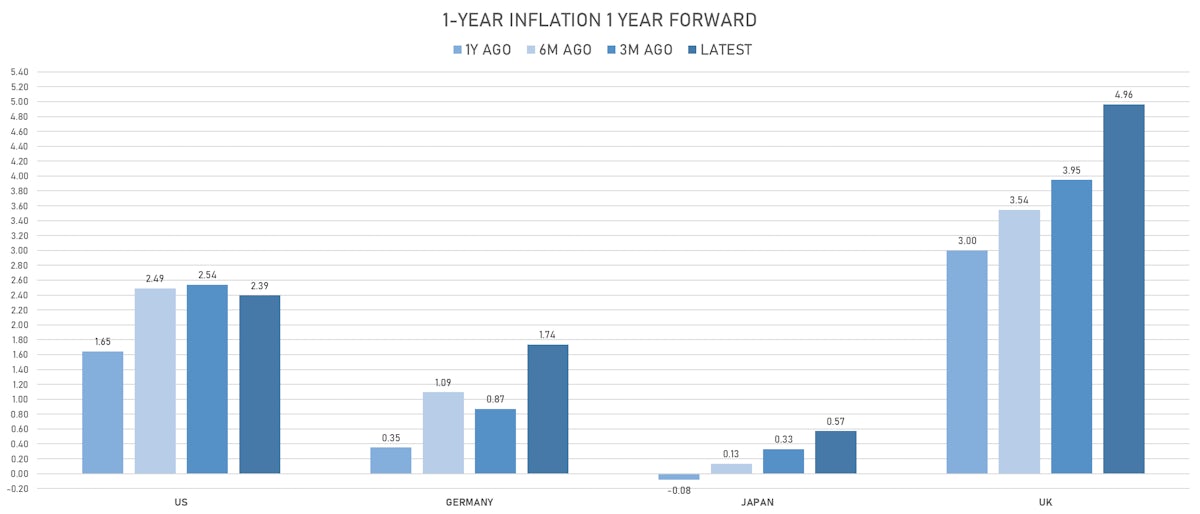

US FORWARD RATES

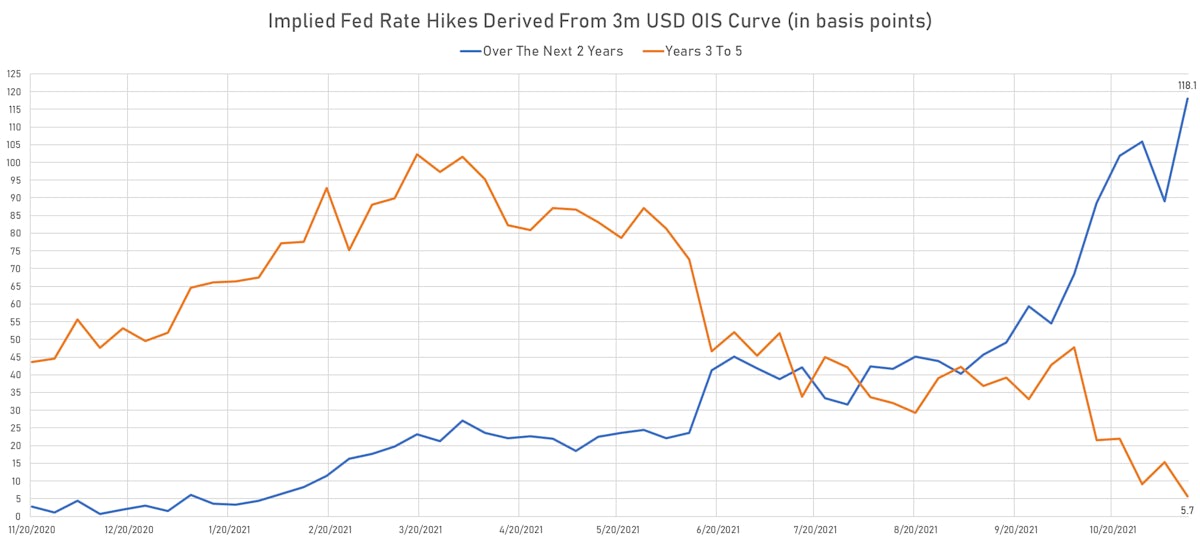

- 3-month Eurodollar future (EDU2) expected hike of 51.5 bp by the end of 2022 (equivalent to 2.1 hikes by end of 2022), down -1.4 bp today

- The 3-month USD OIS forward curve prices in 36.8 bp of rate hikes over the next 12 months (up 1.5 bp today), 81.3 bp of rate hikes over the following year (up 1.2 bp today), and 28.1 bp total rate hikes in years 3 to 5 (down -1.2 bp today)

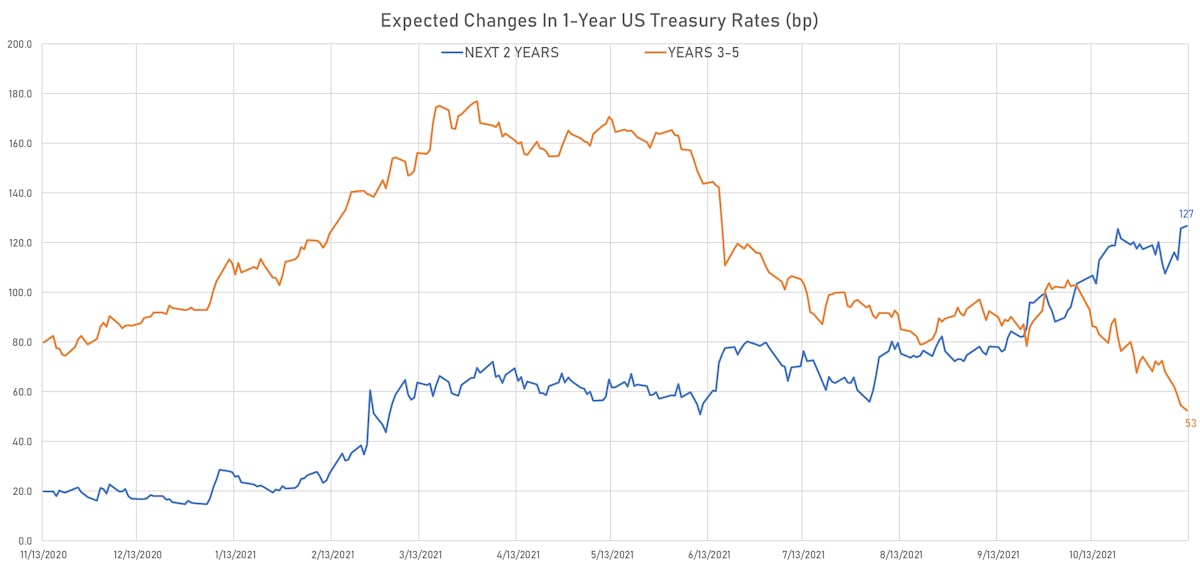

- 1-year US Treasury rate 5 years forward down 0.8 bp, now at 1.9897%, meaning that the 1-year Treasury rate is now expected to increase by 179.4 bp over the next 5 years (equivalent to 7.2 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.10% (up 29.4bp); 2Y at 3.75% (up 10.1bp); 5Y at 3.18% (up 1.8bp); 10Y at 2.69% (up 1.2bp); 30Y at 2.47% (up 0.9bp)

- 6-month spot US CPI swap up 63.9 bp to 4.953%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.8830%, -1.6 bp today; 10Y at -1.1620%, -1.0 bp today; 30Y at -0.5160%, +0.7 bp today

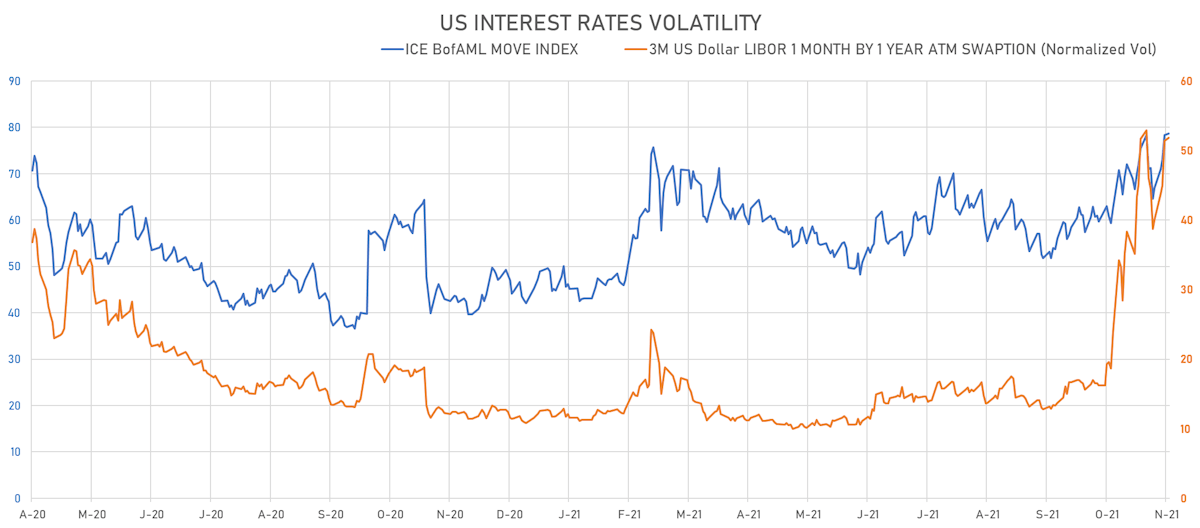

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.4% at 51.8%

- 3-Month LIBOR-OIS spread down -0.2 bp at 7.5 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.568% (down -4.9 bp); the German 1Y-10Y curve is 4.0 bp flatter at 48.8bp (YTD change: +34.1 bp)

- Japan 5Y: -0.067% (up 0.5 bp); the Japanese 1Y-10Y curve is 1.0 bp steeper at 18.8bp (YTD change: +3.9 bp)

- China 5Y: 2.763% (up 0.3 bp); the Chinese 1Y-10Y curve is 1.8 bp steeper at 74.4bp (YTD change: +28.0 bp)

- Switzerland 5Y: -0.401% (down -5.5 bp); the Swiss 1Y-10Y curve is 4.1 bp flatter at 55.8bp (YTD change: +29.4 bp)