Rates

US Yield Curve Steepens, With Higher Breakevens, Lower Real Yields To Kick Off A Relatively Light Week Ahead In Terms Of Macro Data

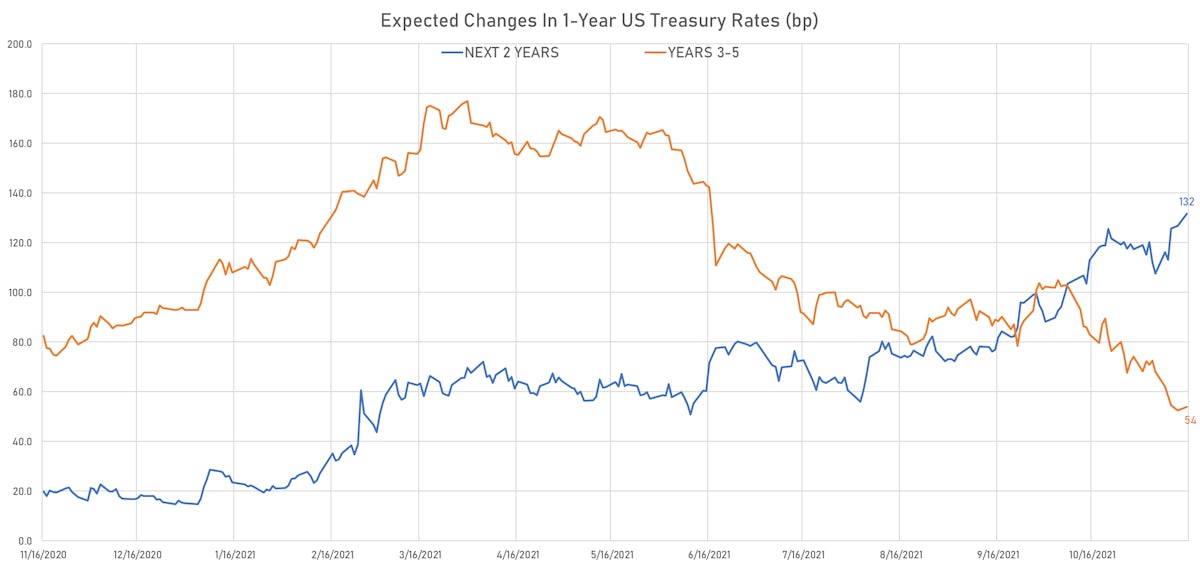

We expect the very front end of the curve to rise further, with even hotter inflation prints this winter pushing the Fed into an acceleration of taper and early liftoff

Published ET

Recent Changes In The 6-Month US CPI Swap Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

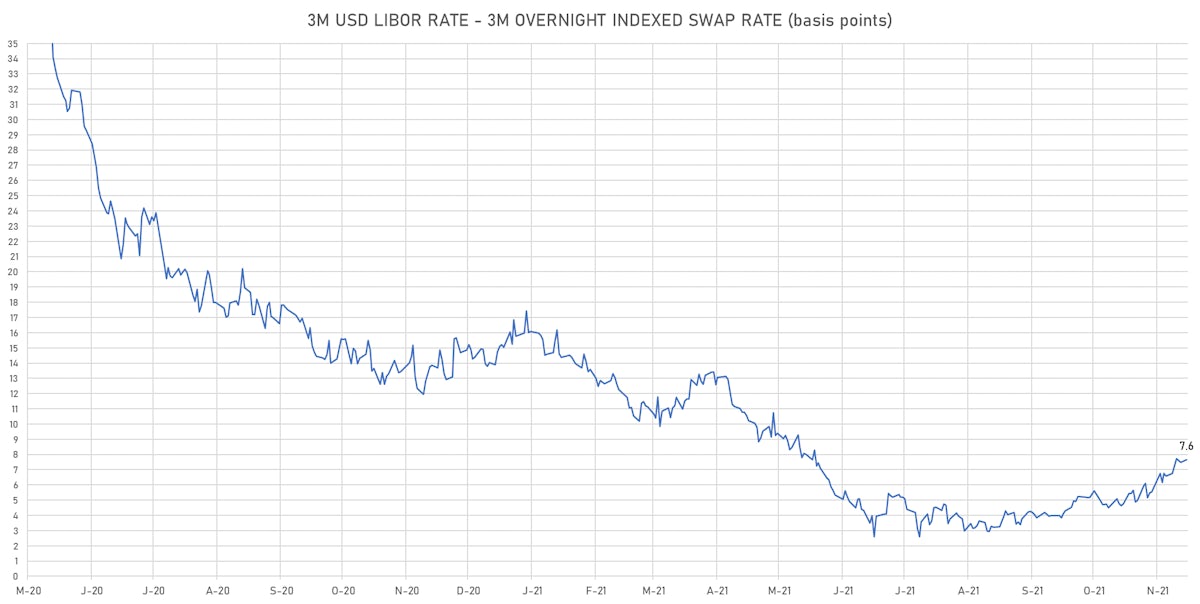

- 3-Month USD LIBOR +0.29bp today, now at 0.1550%; 3-Month OIS +0.2bp at 0.0815%

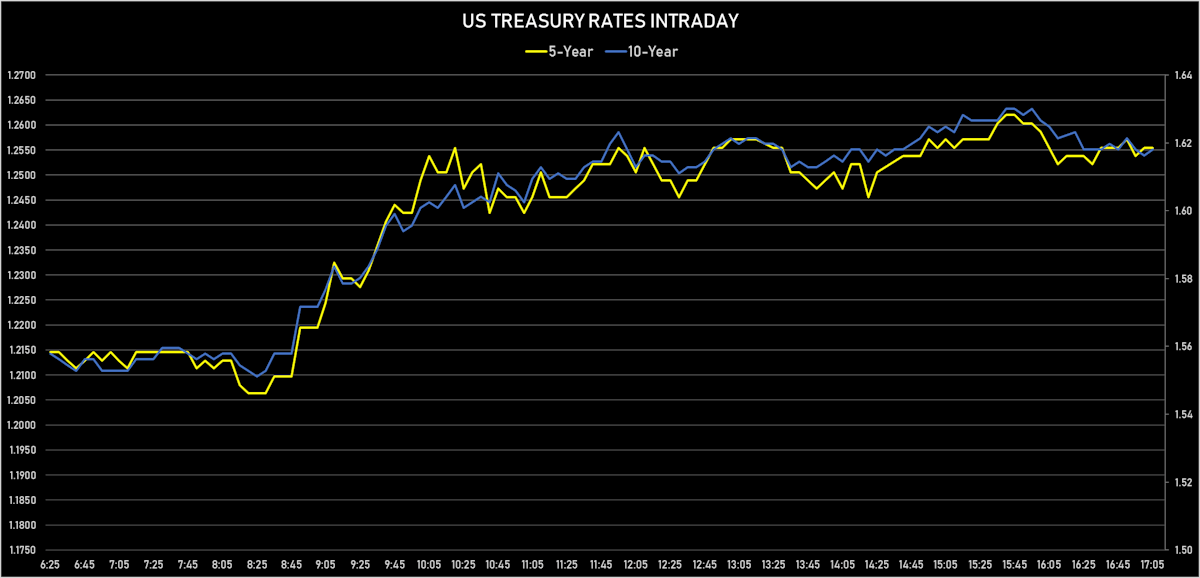

- The treasury yield curve steepened, with the 1s10s spread widening 5.1 bp, now at 140.8 bp (YTD change: +60.3bp)

- 1Y: 0.1620% (down 0.3 bp)

- 2Y: 0.5175% (up 0.2 bp)

- 5Y: 1.2276% (up 2.8 bp)

- 7Y: 1.4615% (up 4.1 bp)

- 10Y: 1.5699% (up 4.8 bp)

- 30Y: 1.9377% (up 5.9 bp)

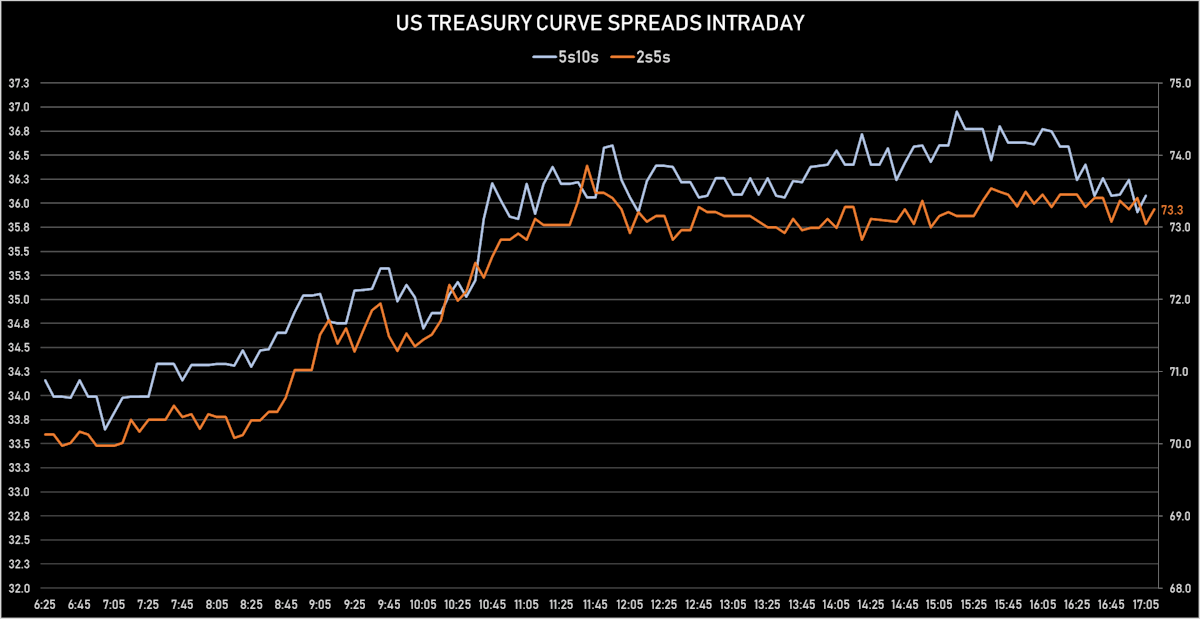

- US treasury curve spreads: 2s5s at 73.5bp (up 2.6bp today), 5s10s at 36.3bp (up 2.1bp today), 10s30s at 37.9bp (up 1.5bp today)

- Treasuries butterfly spreads: 1s5s10s at -74.2bp (down -1.0bp), 5s10s30s at 1.9bp (down -0.5bp)

- US 5-Year TIPS Real Yield: -4.8 bp at -1.9310%; 10-Year TIPS Real Yield: +1.5 bp at -1.1470%; 30-Year TIPS Real Yield: +4.0 bp at -0.4760%

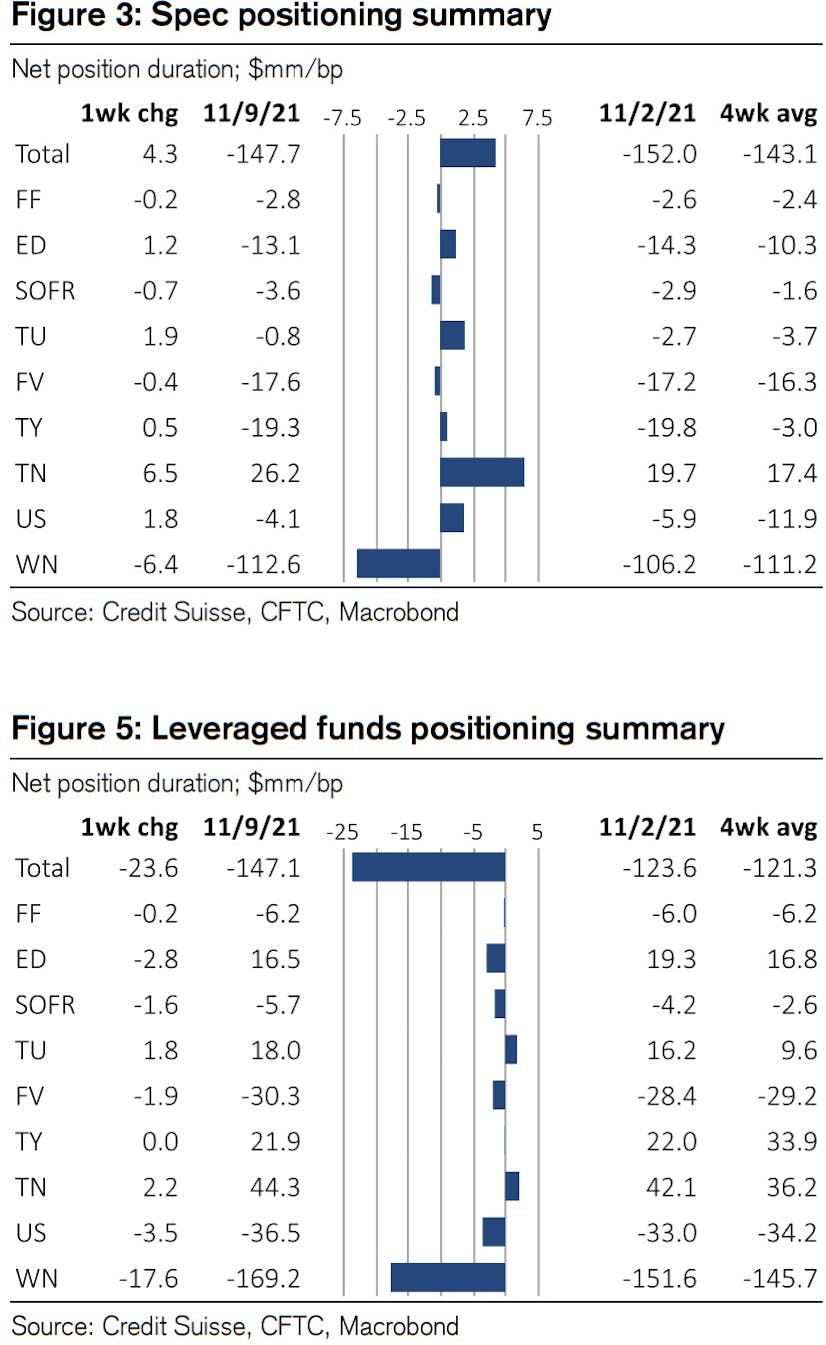

WEEKLY DURATION NET POSITIONING UPDATE

- Some short covering in the past week for specs, though on aggregate they are still short duration all along the curve

- Leveraged funds on the other hand increased markedly their net short duration at the long end of the curve

US MACRO RELEASES

- New York Fed, General Business Condition for Nov 2021 (FED, NY) at 30.90 (vs 19.80 prior), above consensus estimate of 21.20

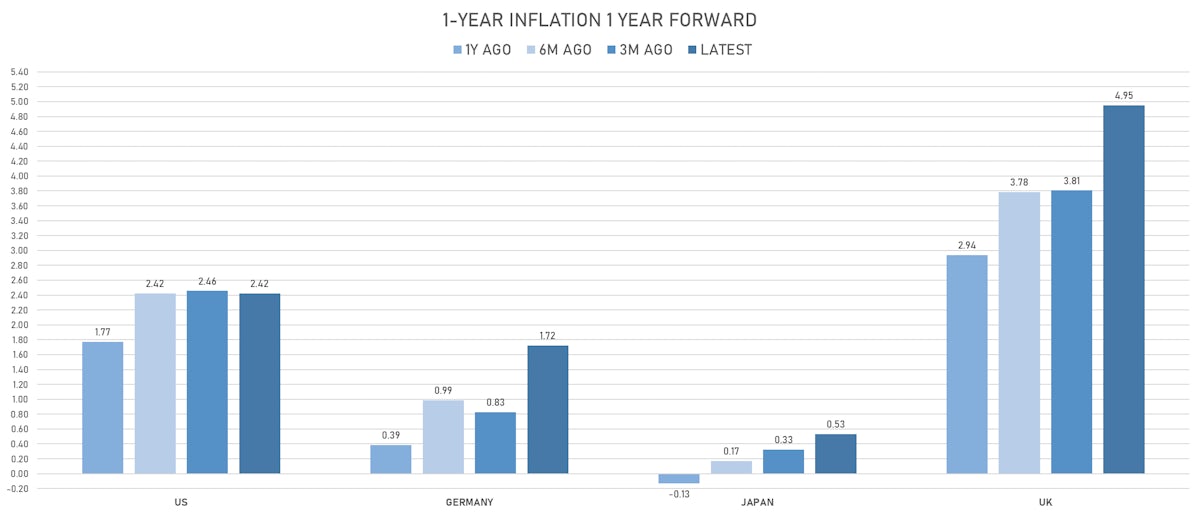

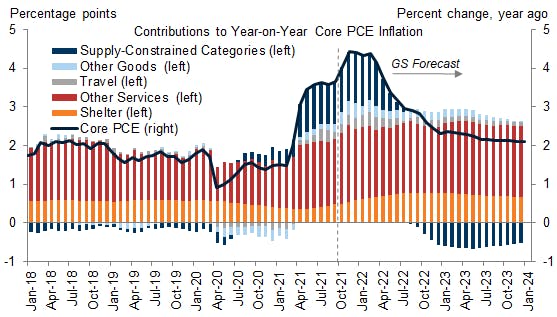

INFLATION FORECASTS

- Latest GS show core PCE inflation should get much worse before it gets better

- That is likely to put significant pressure on the Fed to accelerate taper

US FORWARD RATES

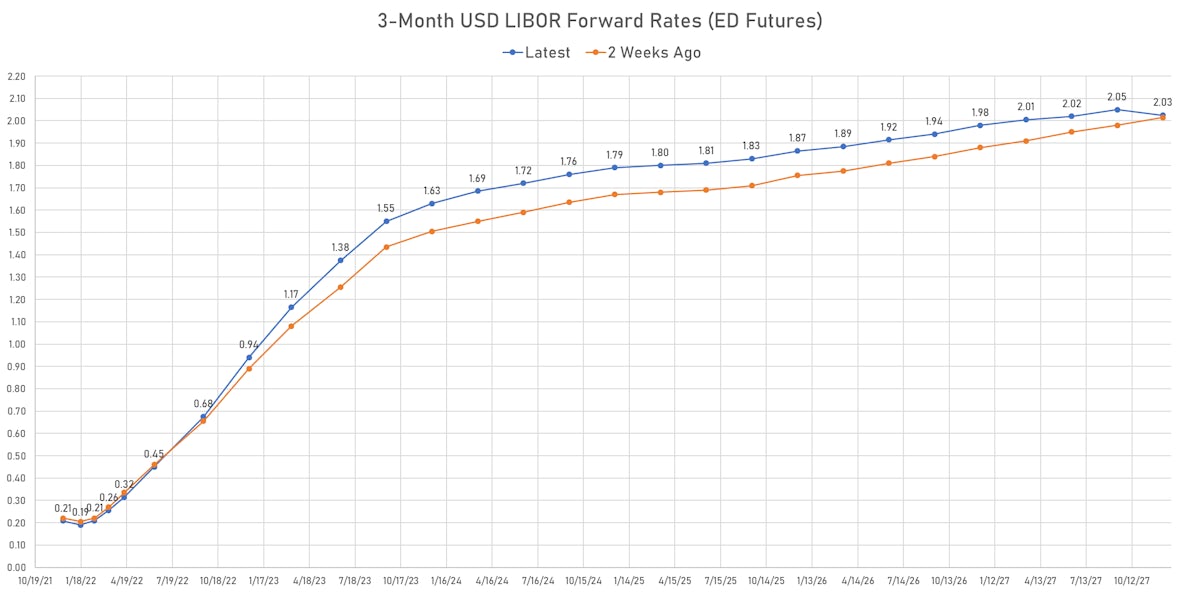

- 3-month Eurodollar future (EDU2) expected hike of 51.7 bp by the end of 2022 (equivalent to 2.1 hikes by end of 2022), up 1.2 bp today

- The 3-month USD OIS forward curve prices in 37.9 bp of rate hikes over the next 12 months (up 1.1 bp today), 81.8 bp of rate hikes over the following year (up 0.5 bp today), and 33.8 bp total rate hikes in years 3 to 5 (up 5.7 bp today)

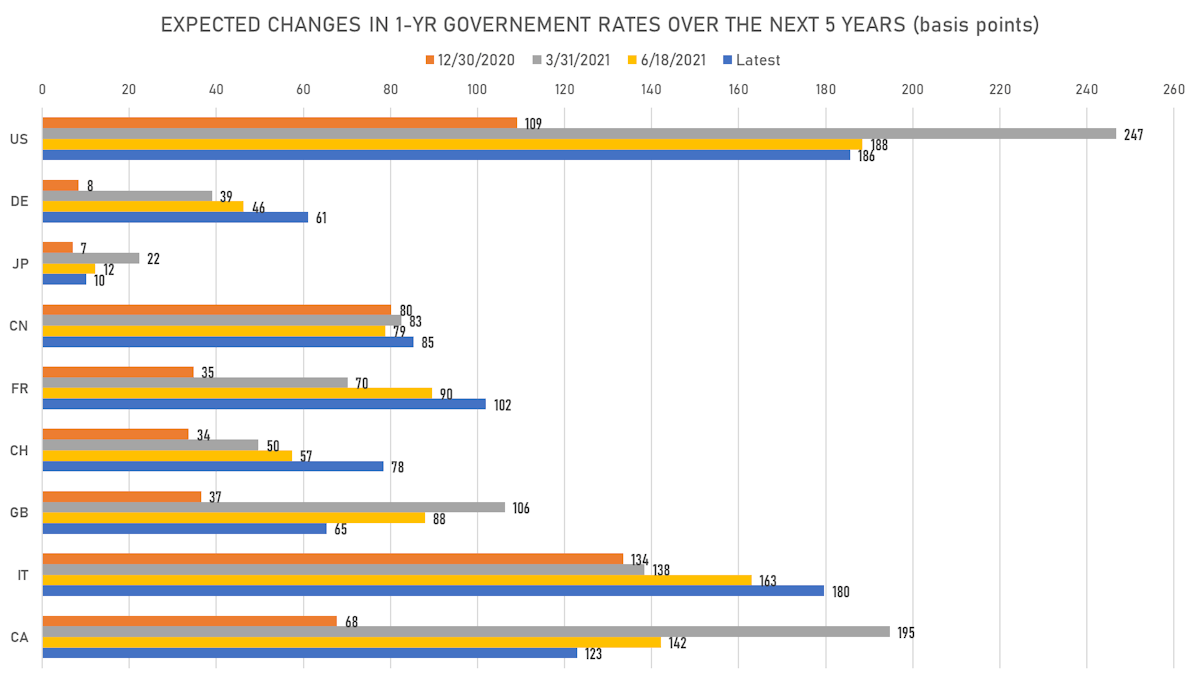

- 1-year US Treasury rate 5 years forward up 6.1 bp, now at 2.0502%, meaning that the 1-year Treasury rate is now expected to increase by 185.6 bp over the next 5 years (equivalent to 7.4 rate hikes)

US INFLATION & REAL RATES

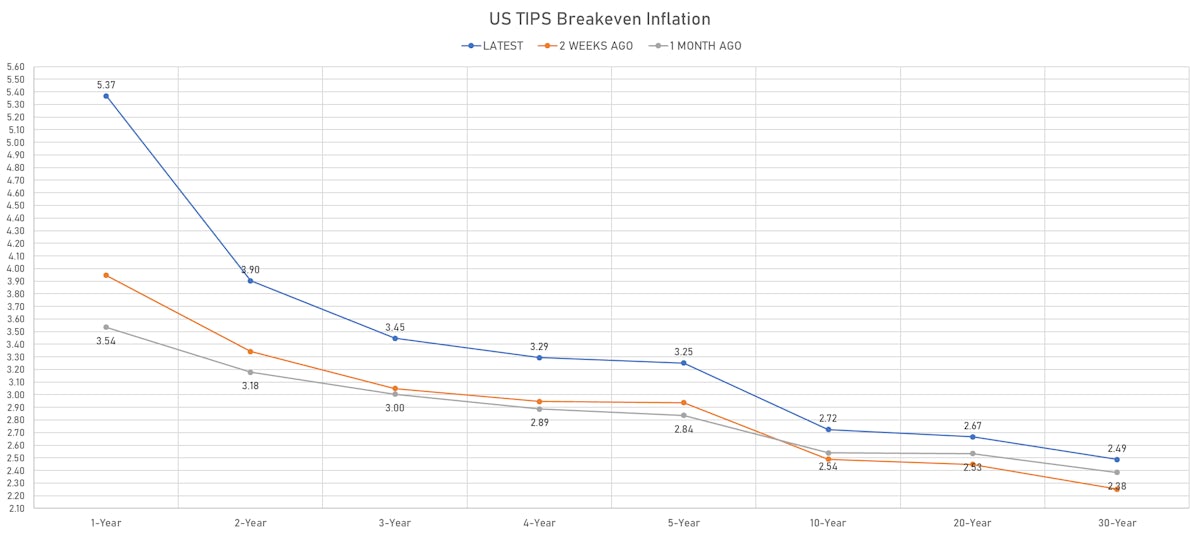

- TIPS 1Y breakeven inflation at 5.37% (up 27.2bp); 2Y at 3.90% (up 15.1bp); 5Y at 3.25% (up 7.3bp); 10Y at 2.72% (up 3.4bp); 30Y at 2.49% (up 1.9bp)

- 6-month spot US CPI swap down -28.2 bp to 4.670%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.9310%, -4.8 bp today; 10Y at -1.1470%, +1.5 bp today; 30Y at -0.4760%, +4.0 bp today

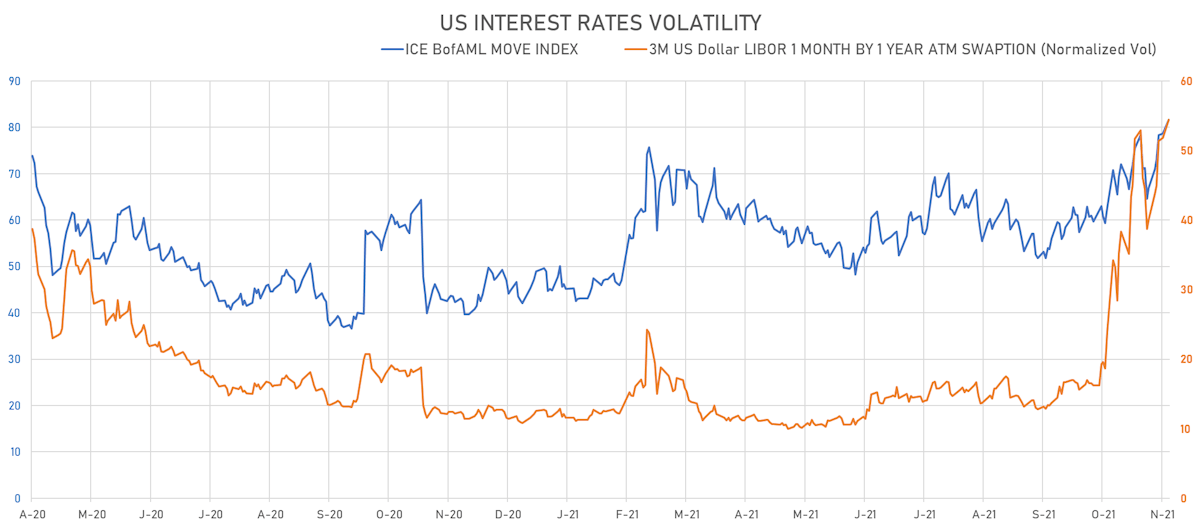

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 2.6% at 54.4%

- 3-Month LIBOR-OIS spread up 0.1 bp at 7.6 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.522% (up 0.8 bp); the German 1Y-10Y curve is 0.8 bp steeper at 52.2bp (YTD change: +34.9 bp)

- Japan 5Y: -0.079% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.3 bp steeper at 19.0bp (YTD change: +4.2 bp)

- China 5Y: 2.740% (down -2.3 bp); the Chinese 1Y-10Y curve is 0.4 bp flatter at 74.0bp (YTD change: +27.6 bp)

- Switzerland 5Y: -0.379% (up 2.2 bp); the Swiss 1Y-10Y curve is 2.7 bp steeper at 59.5bp (YTD change: +32.1 bp)