Rates

Rates Volatility Remains Elevated, As The US Yield Curve Shifts Down, Bull Flattens

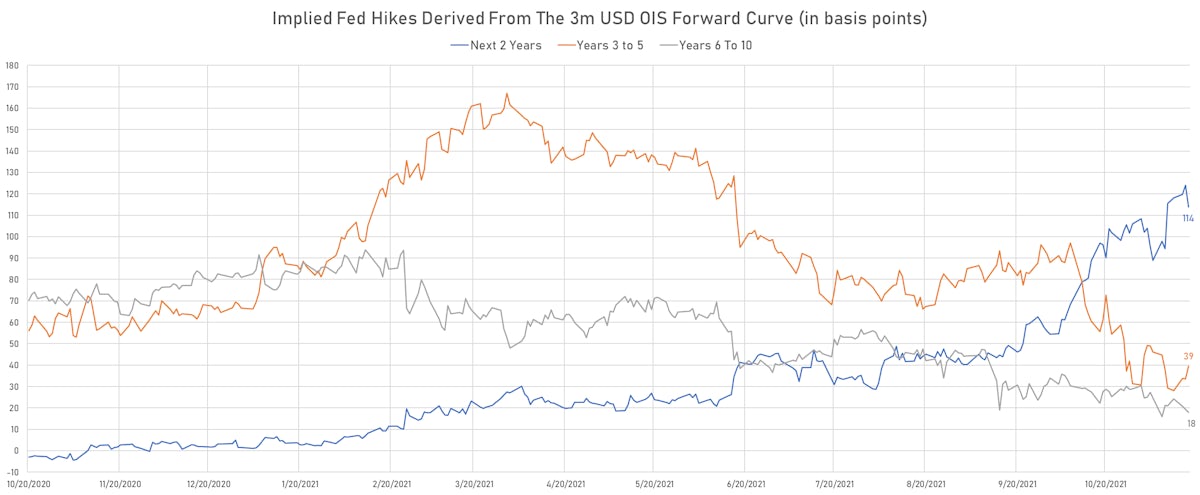

Looking at the spread between the 2025 and 2023 Eurodollar futures implied yields, currently just above 27bp, the market continues to expect a much shorter / shallower than usual hiking cycle, assigning a still significant probability to the 'policy mistake' scenario (though not as high as in the UK, where a policy reversal is expected from 2024)

Published ET

Spread In Implied Yields Between 2025 And 2023 3-Month Interest Rates Futures | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

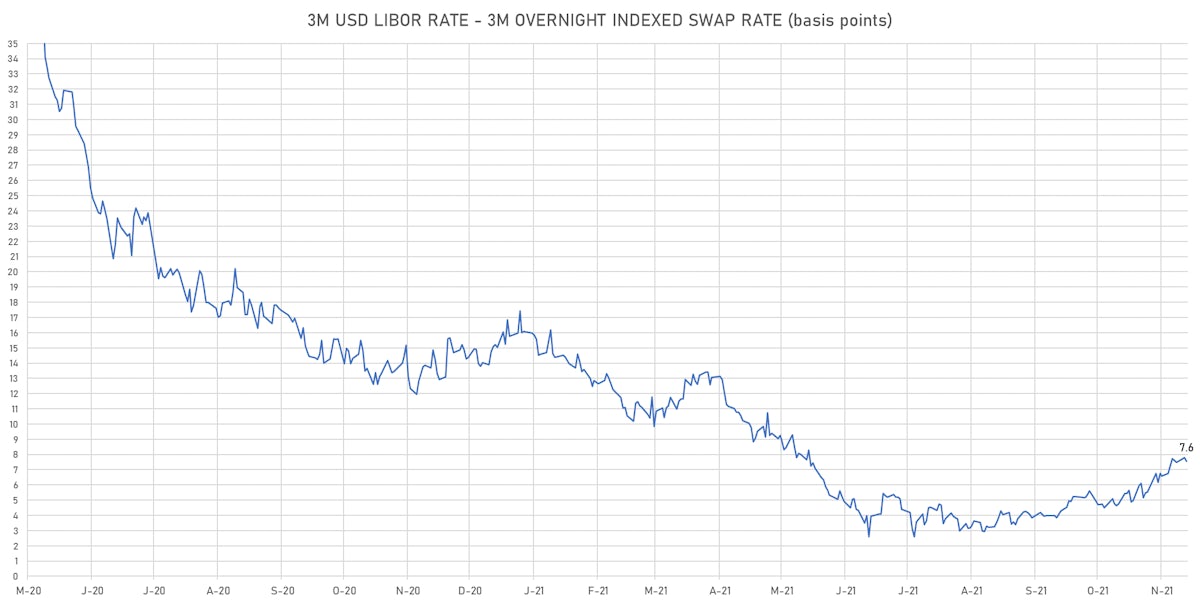

- 3-Month USD LIBOR -0.25bp today, now at 0.1600%; 3-Month OIS 0.0bp at 0.0820%

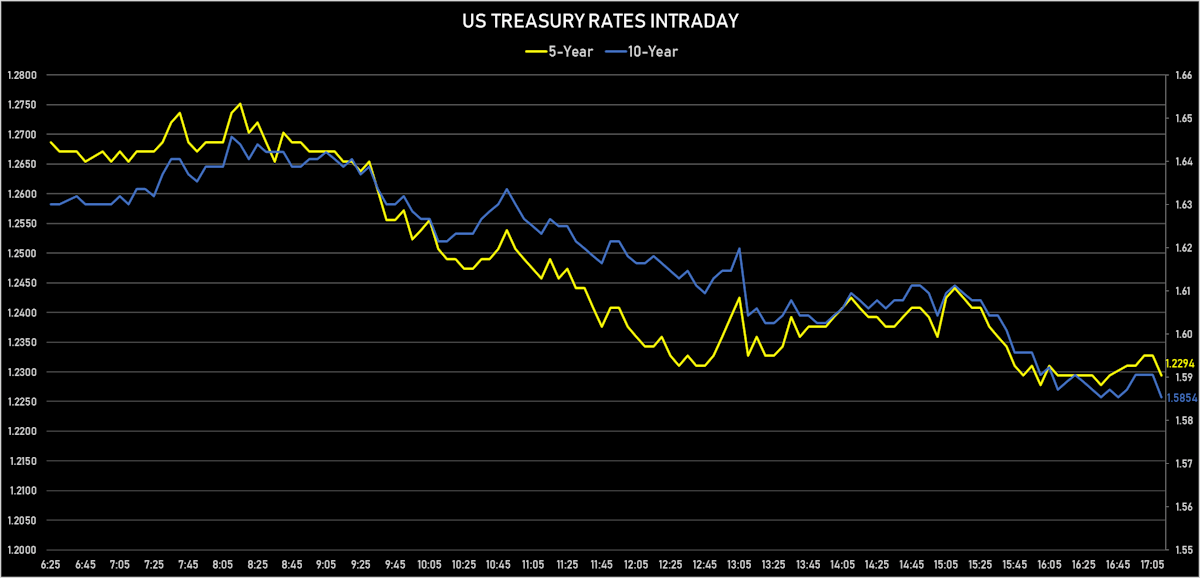

- The treasury yield curve flattened, with the 1s10s spread tightening -4.7 bp, now at 142.0 bp (YTD change: +61.6bp)

- 1Y: 0.1650% (down 0.8 bp)

- 2Y: 0.4979% (down 2.4 bp)

- 5Y: 1.2294% (down 4.1 bp)

- 7Y: 1.4735% (down 5.4 bp)

- 10Y: 1.5854% (down 5.5 bp)

- 30Y: 1.9678% (down 6.5 bp)

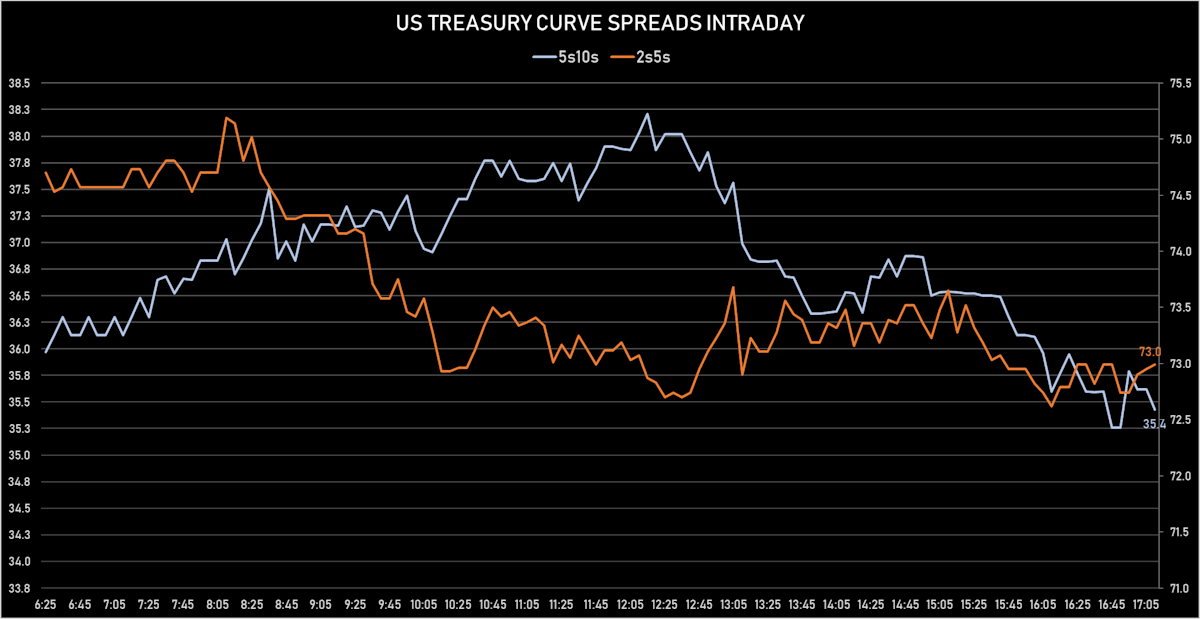

- US treasury curve spreads: 2s5s at 73.2bp (down -1.6bp), 5s10s at 35.6bp (down -1.0bp), 10s30s at 38.2bp (down -0.7bp)

- Treasuries butterfly spreads: 1s5s10s at -72.8bp (up 1.7bp today), 5s10s30s at 2.5bp (up 0.5bp)

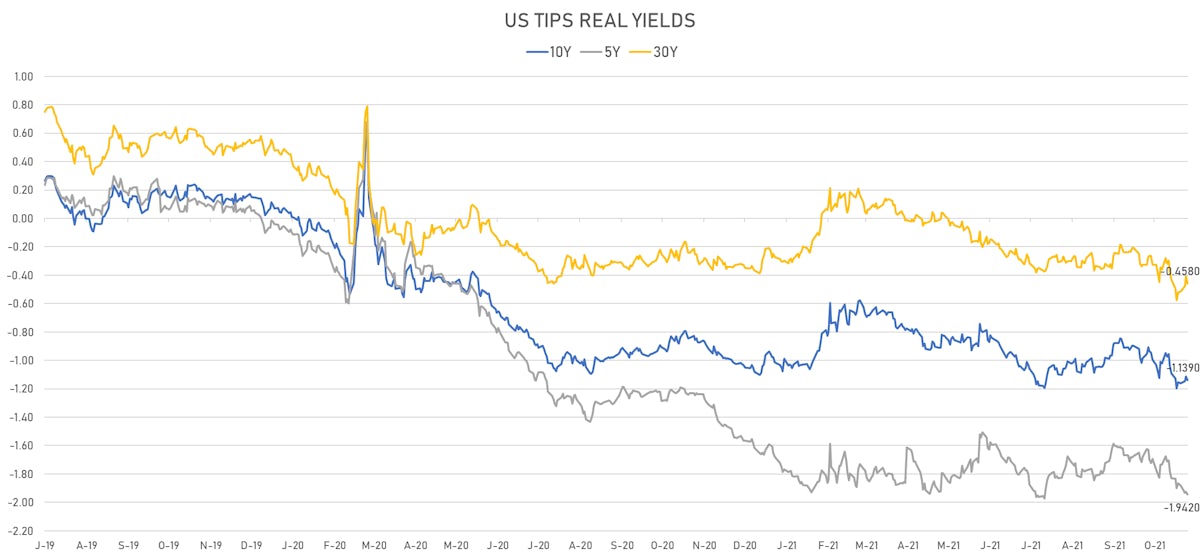

- US 5-Year TIPS Real Yield: -1.5 bp at -1.9420%; 10-Year TIPS Real Yield: -2.4 bp at -1.1390%; 30-Year TIPS Real Yield: -5.1 bp at -0.4580%

$23BN 20Y 2% COUPON TREASURY BOND AUCTION (912810TC2)

- Mixed results with decent demand but poor pricing

- Priced at 2.065%, a 1.3bp tail vs when-issued at the bid deadline

- Bid-to-cover ratio at 2.34 (vs 2.31 average)

- Indirect bids at 60.18% (vs 59.7% average)

- Direct bids at 19.38% (vs. 15.9% average)

US MACRO RELEASES

- Building Permits for Oct 2021 (U.S. Census Bureau) at 1.65 Mln (vs 1.59 Mln prior), above consensus estimate of 1.64 Mln

- Building Permits, Change P/P for Oct 2021 (U.S. Census Bureau) at 4.00 % (vs -7.80 % prior)

- Housing Starts for Oct 2021 (U.S. Census Bureau) at 1.52 Mln (vs 1.56 Mln prior), below consensus estimate of 1.58 Mln

- Housing Starts, Change P/P for Oct 2021 (U.S. Census Bureau) at -0.70 % (vs -1.60 % prior)

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 12 Nov (MBA, USA) at -2.80 % (vs 5.50 % prior)

- Mortgage applications, market composite index for W 12 Nov (MBA, USA) at 639.90 (vs 658.10 prior)

- Mortgage applications, market composite index, purchase for W 12 Nov (MBA, USA) at 282.50 (vs 278.40 prior)

- Mortgage applications, market composite index, refinancing for W 12 Nov (MBA, USA) at 2,695.00 (vs 2,841.00 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 12 Nov (MBA, USA) at 3.20 % (vs 3.16 % prior)

US FORWARD RATES

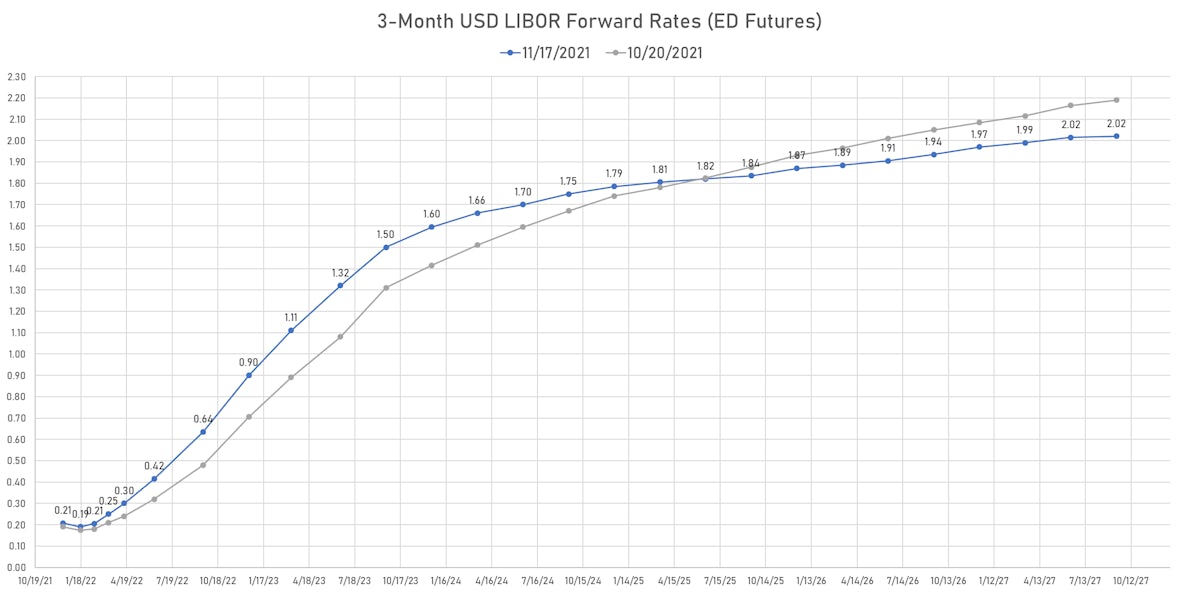

- 3-month Eurodollar future (EDU2) expected hike of 47.8 bp by the end of 2022 (equivalent to 1.9 hikes by end of 2022), down -3.7 bp today

- The 3-month USD OIS forward curve prices in 37.1 bp of rate hikes over the next 12 months (down -0.2 bp today), 76.8 bp of rate hikes over the following year (down -9.8 bp today), and 39.4 bp total rate hikes in years 3 to 5 (up 5.8 bp today)

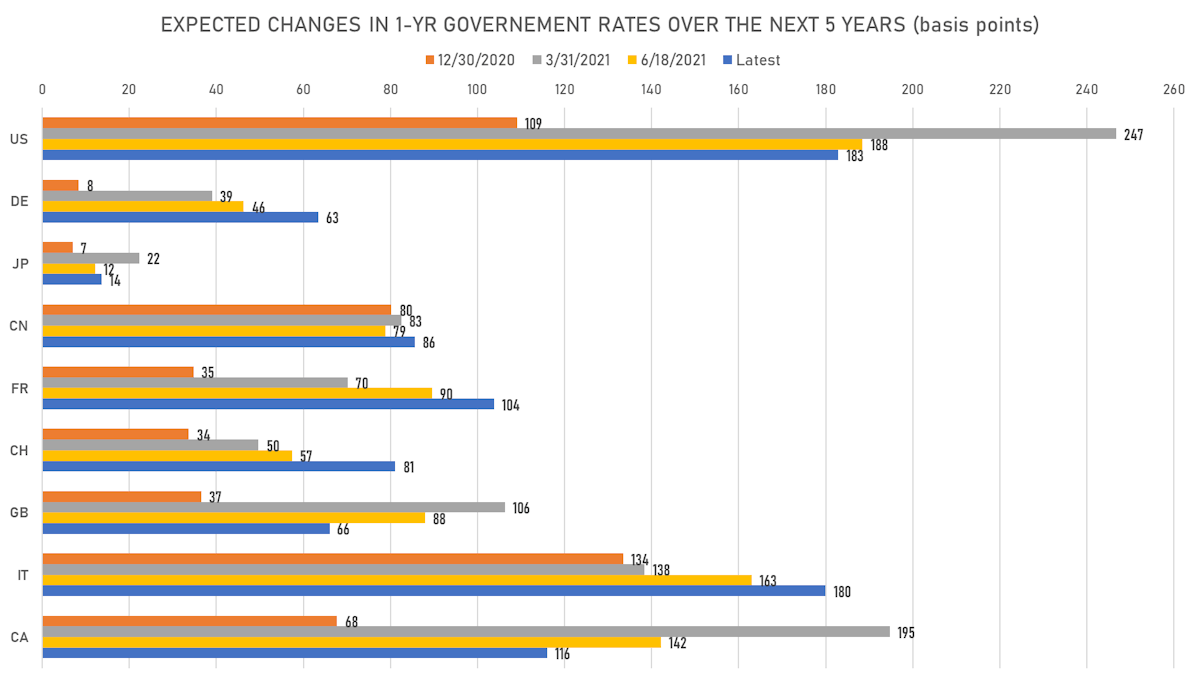

- 1-year US Treasury rate 5 years forward down 8.3 bp, now at 2.0112%, meaning that the 1-year Treasury rate is now expected to increase by 182.8 bp over the next 5 years (equivalent to 7.3 rate hikes)

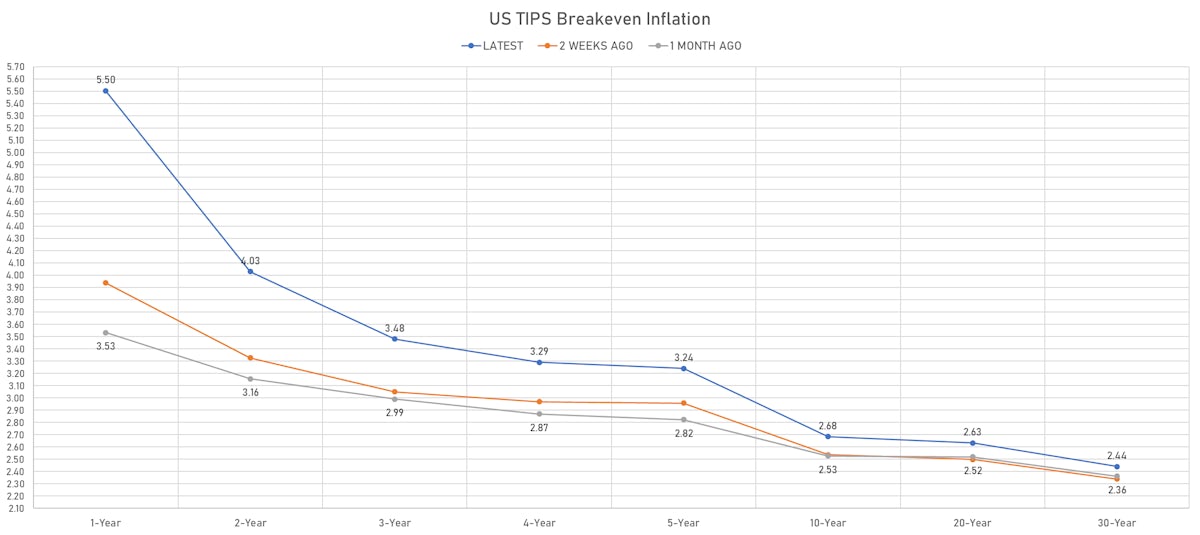

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.50% (up 2.7bp); 2Y at 4.03% (up 8.2bp); 5Y at 3.24% (down -2.6bp); 10Y at 2.68% (down -3.2bp); 30Y at 2.44% (down -1.5bp)

- 6-month spot US CPI swap down -8.4 bp to 4.741%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.9420%, -1.5 bp today; 10Y at -1.1390%, -2.4 bp today; 30Y at -0.4580%, -5.1 bp today

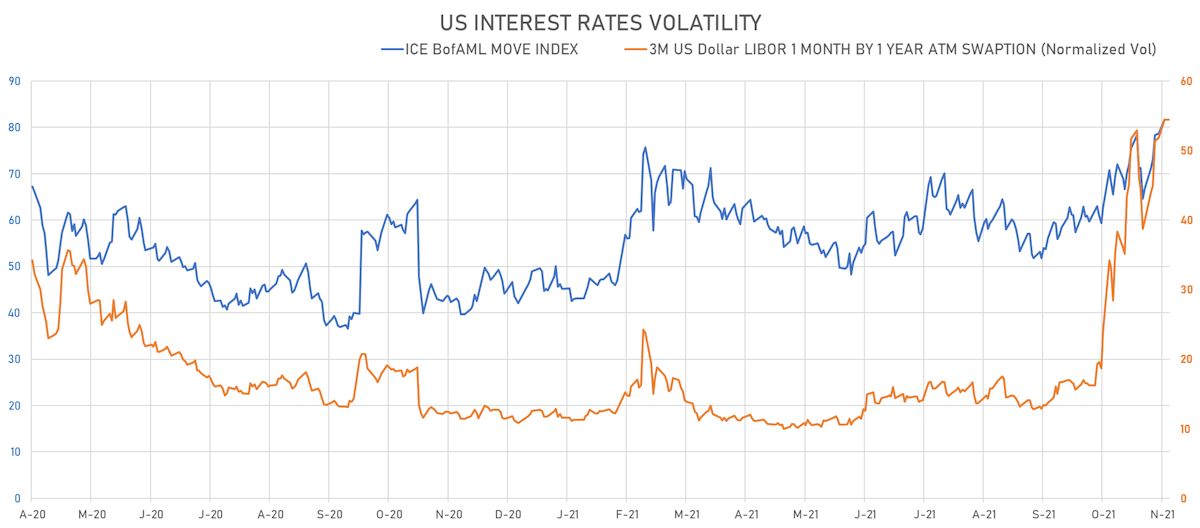

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) unchanged at 54.4%

- 3-Month LIBOR-OIS spread down -0.3 bp at 7.6 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.563% (up 0.2 bp); the German 1Y-10Y curve is 0.7 bp steeper at 51.8bp (YTD change: +37.0 bp)

- Japan 5Y: -0.072% (unchanged); the Japanese 1Y-10Y curve is 0.2 bp steeper at 19.8bp (YTD change: +5.5 bp)

- China 5Y: 2.741% (unchanged); the Chinese 1Y-10Y curve is 0.2 bp flatter at 74.5bp (YTD change: +28.1 bp)

- Switzerland 5Y: -0.396% (down -0.7 bp); the Swiss 1Y-10Y curve is 7.1 bp steeper at 64.9bp (YTD change: +37.7 bp)