Rates

Nominal Yields Pretty Stable: Inflation Breakevens Fall While Good Philly Fed Survey Brings Higher 5Y Real Yields

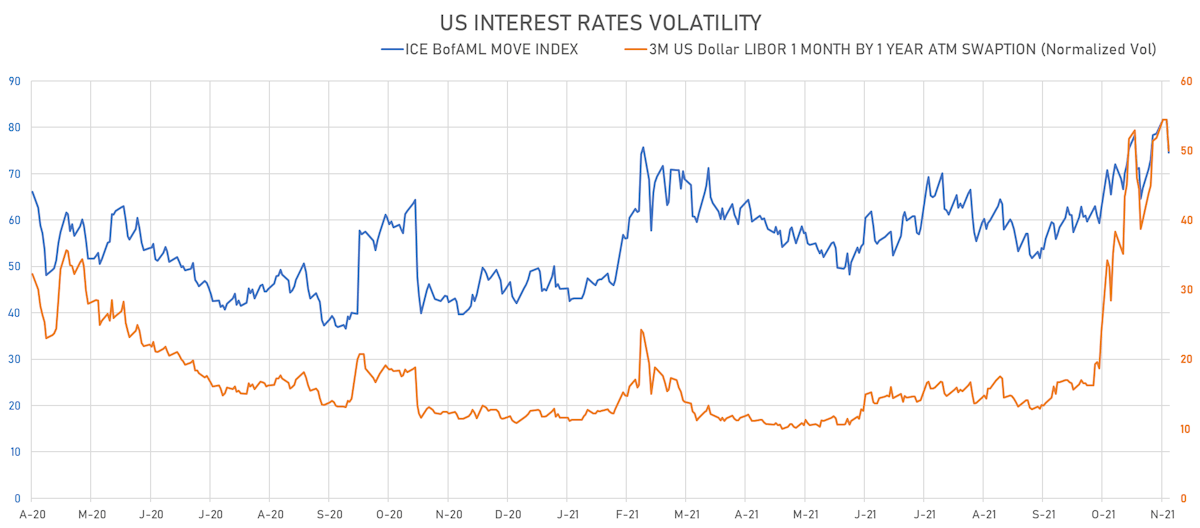

Rates volatility is falling back, we're in a consolidation phase prior to the next inflation print, which is the Core PCE Deflator released next Wednesday along with the FOMC minutes; although it's unlikely to bring as much of a surprise as the latest CPI, look out for firmer front-end rates into the event

Published ET

US Treasury Curve Spreads | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

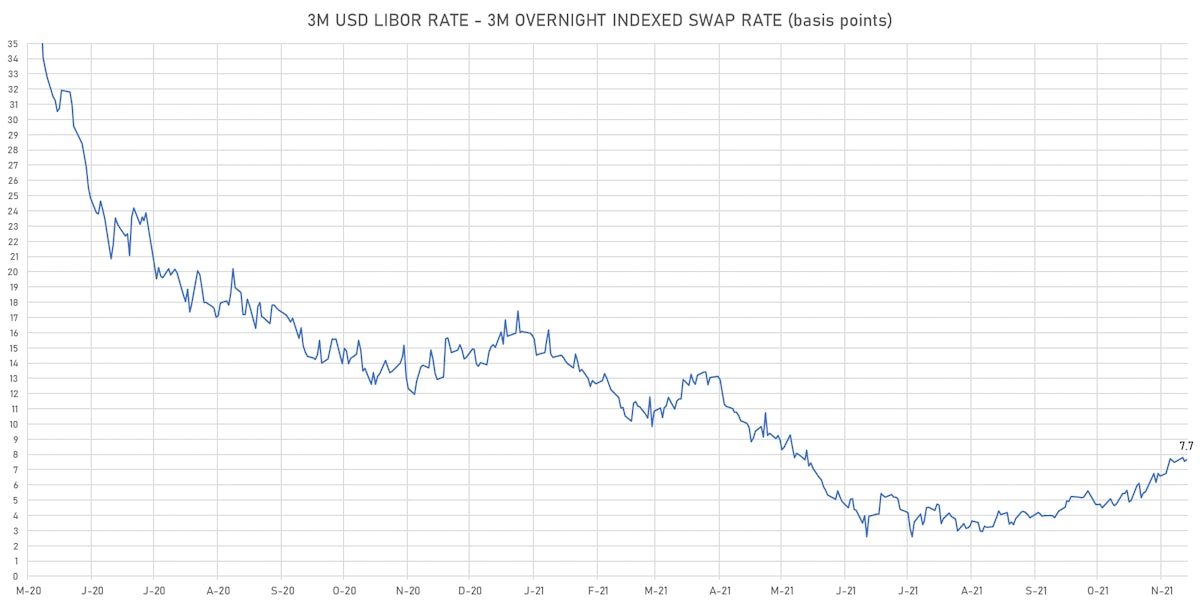

- 3-Month USD LIBOR +0.21bp today, now at 0.1575%; 3-Month OIS +0.1bp at 0.0830%

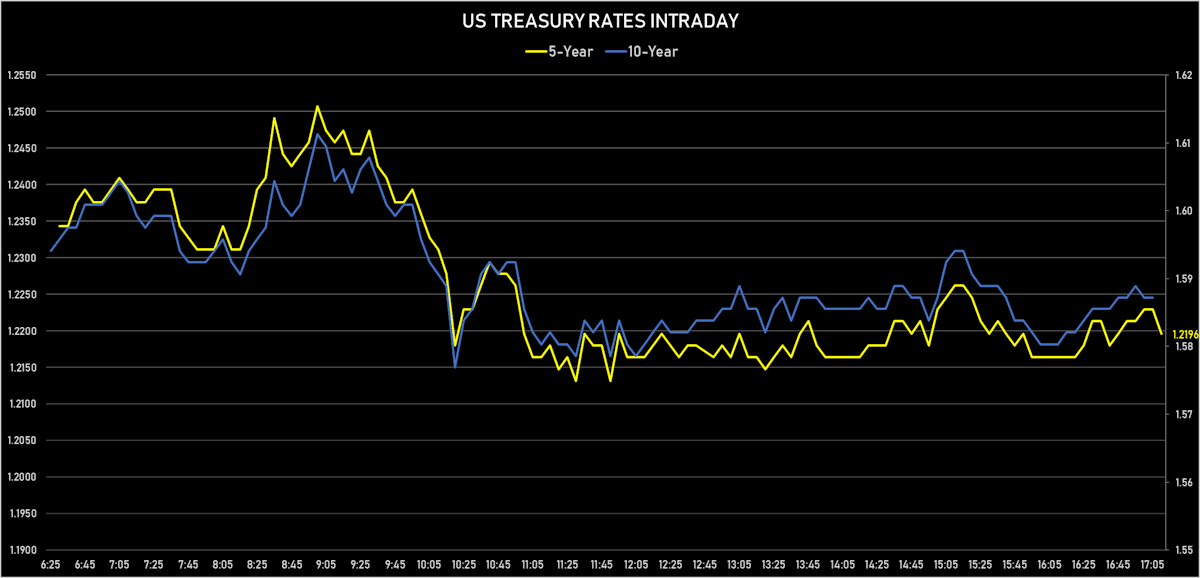

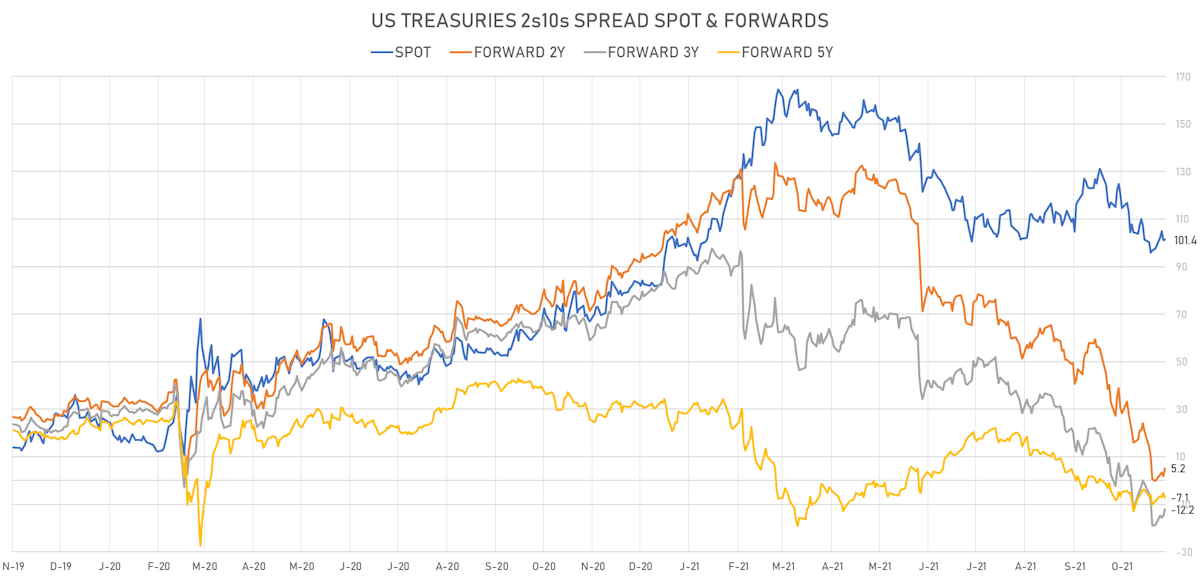

- The treasury yield curve steepened, with the 1s10s spread widening 0.4 bp, now at 142.7 bp (YTD change: +62.3bp)

- 1Y: 0.1600% (down 0.3 bp)

- 2Y: 0.5021% (up 0.4 bp)

- 5Y: 1.2196% (down 1.0 bp)

- 7Y: 1.4699% (down 0.4 bp)

- 10Y: 1.5872% (up 0.2 bp)

- 30Y: 1.9734% (up 0.6 bp)

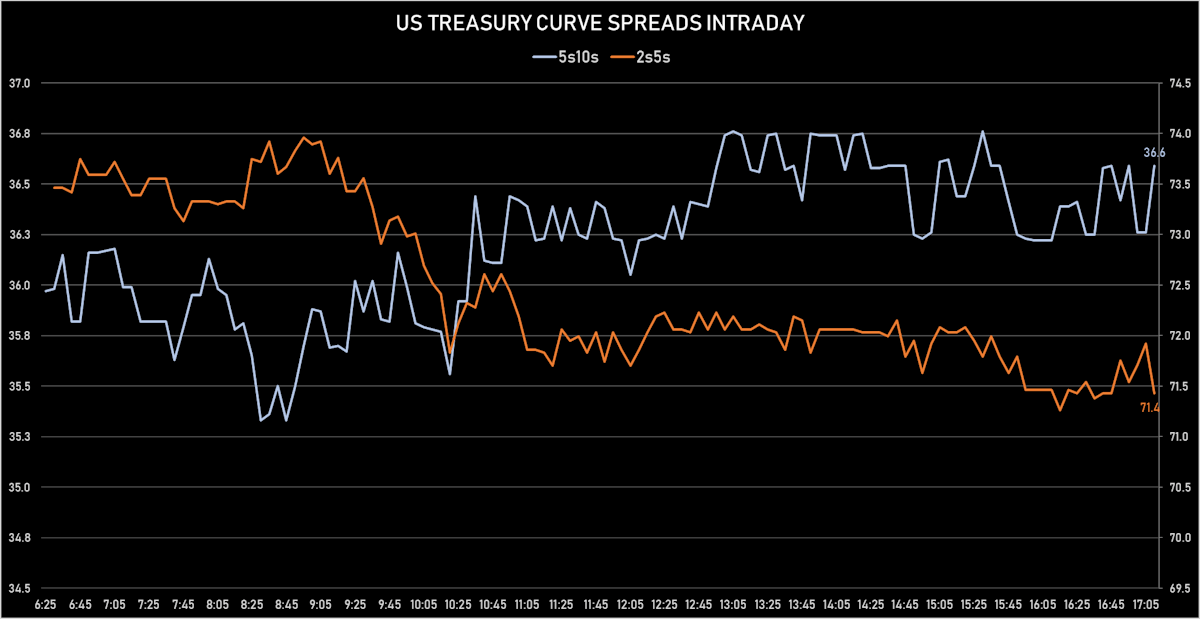

- US treasury curve spreads: 2s5s at 71.7bp (down -1.2bp), 5s10s at 36.8bp (up 0.6bp today), 10s30s at 38.6bp (down -0.3bp)

- Treasuries butterfly spreads: 1s5s10s at -70.9bp (up 1.9bp today), 5s10s30s at 1.6bp (down -0.9bp)

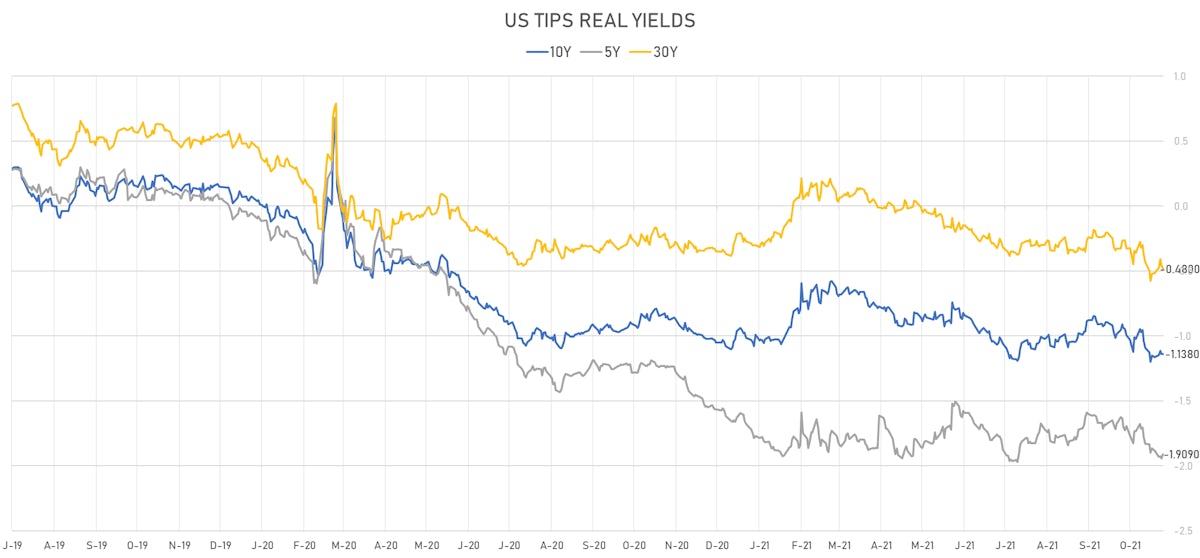

- US 5-Year TIPS Real Yield: +3.3 bp at -1.9090%; 10-Year TIPS Real Yield: +0.1 bp at -1.1380%; 30-Year TIPS Real Yield: -2.2 bp at -0.4800%

$14BN 0.125% COUPON 10-YEAR TIPS AUCTION (91282CCM1)

- Good results with decent pricing and solid non-dealer bidding at 89.8% (vs 87.3% prior and 83.4% average)

- Priced at -1.145% (vs -0.939% in prior auction), a 0.4 bp stop-through vs when-issued at the bid deadline

- Bid-to-cover at 2.43 (vs 2.55 prior and 2.47 average)

- Direct bids at 13.0% (vs 15.8% prior)

- Indirect bids at 76.8% (vs 71.5% prior)

US MACRO RELEASES

- Jobless Claims, National, Continued for W 06 Nov (U.S. Dept. of Labor) at 2.08 Mln (vs 2.16 Mln prior), below consensus estimate of 2.12 Mln

- Jobless Claims, National, Initial for W 13 Nov (U.S. Dept. of Labor) at 268.00 k (vs 267.00 k prior), above consensus estimate of 260.00 k

- Jobless Claims, National, Initial, four week moving average for W 13 Nov (U.S. Dept. of Labor) at 272.75 k (vs 278.00 k prior)

- Kansas Fed, Current composite index for Nov 2021 (FED, Kansas) at 24.00 (vs 31.00 prior)

- Kansas Fed, Current production index for Nov 2021 (FED, Kansas) at 17.00 (vs 25.00 prior)

- Leading Index, Change P/P for Oct 2021 (The Conference Board) at 0.90 % (vs 0.20 % prior), above consensus estimate of 0.80 %

- Philadelphia Fed, Future capital expenditures for Nov 2021 (FED, Philadelphia) at 31.10 (vs 32.40 prior)

- Philadelphia Fed, Future general business activity for Nov 2021 (FED, Philadelphia) at 28.50 (vs 24.20 prior)

- Philadelphia Fed, General business activity for Nov 2021 (FED, Philadelphia) at 39.00 (vs 23.80 prior), above consensus estimate of 24.00

- Philadelphia Fed, New orders for Nov 2021 (FED, Philadelphia) at 47.40 (vs 30.80 prior)

- Philadelphia Fed, Number of employees for Nov 2021 (FED, Philadelphia) at 27.20 (vs 30.70 prior)

- Philadelphia Fed, Prices paid for Nov 2021 (FED, Philadelphia) at 80.00 (vs 70.30 prior)

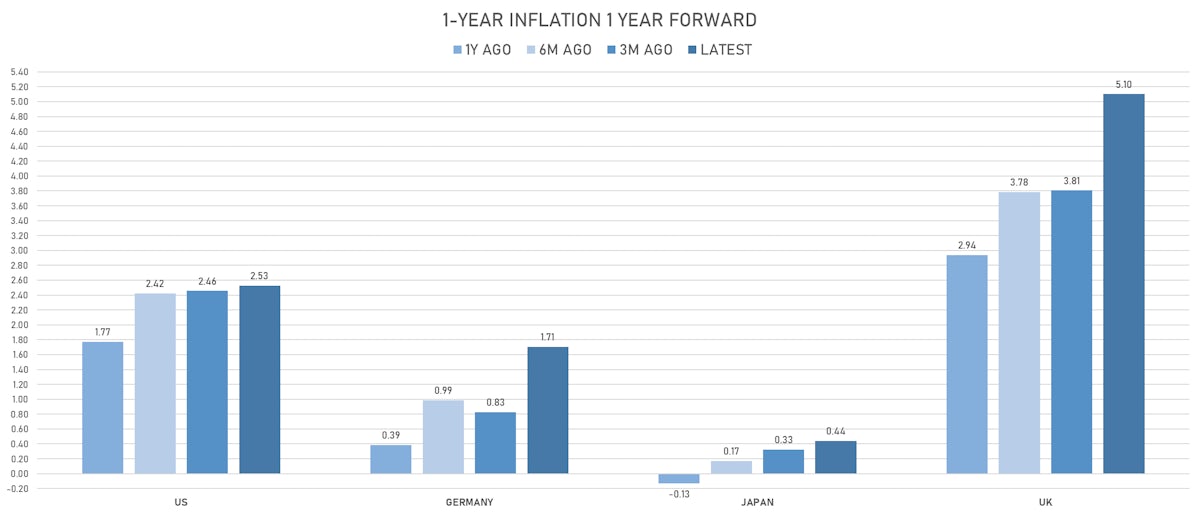

US FORWARD RATES

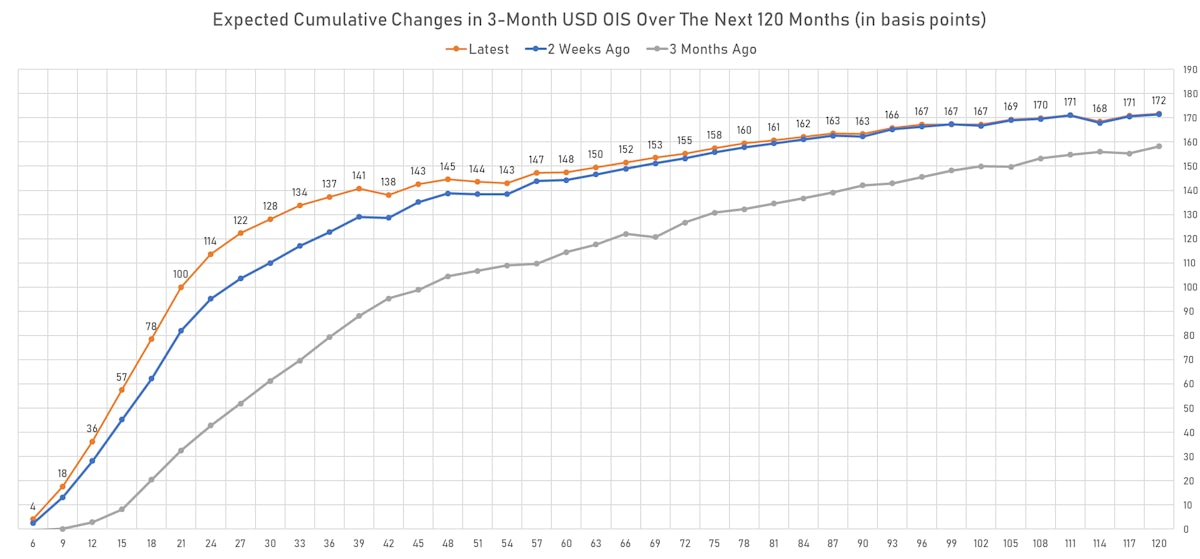

- 3-month Eurodollar future (EDU2) expected hike of 49.0 bp by the end of 2022 (equivalent to 2.0 hikes by end of 2022), down -0.2 bp today

- The 3-month USD OIS forward curve prices in 36.2 bp of rate hikes over the next 12 months (down -0.9 bp today), 77.5 bp of rate hikes over the following year (up 0.6 bp today), and 33.9 bp total rate hikes in years 3 to 5 (down -5.5 bp today)

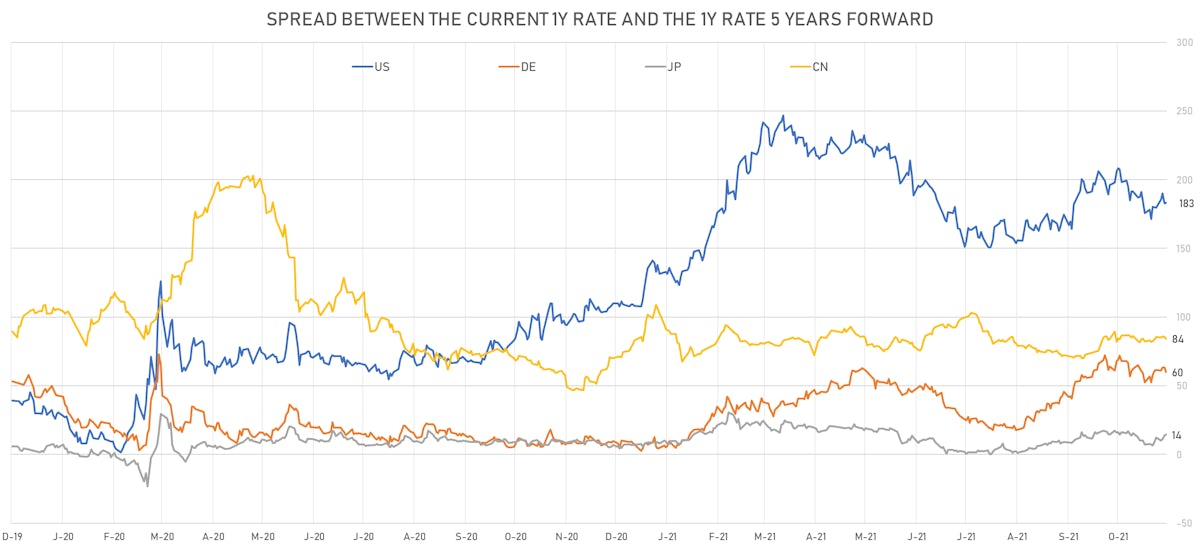

- 1-year US Treasury rate 5 years forward up 0.7 bp, now at 2.0179%, meaning that the 1-year Treasury rate is now expected to increase by 183.2 bp over the next 5 years (equivalent to 7.3 rate hikes)

US INFLATION & REAL RATES

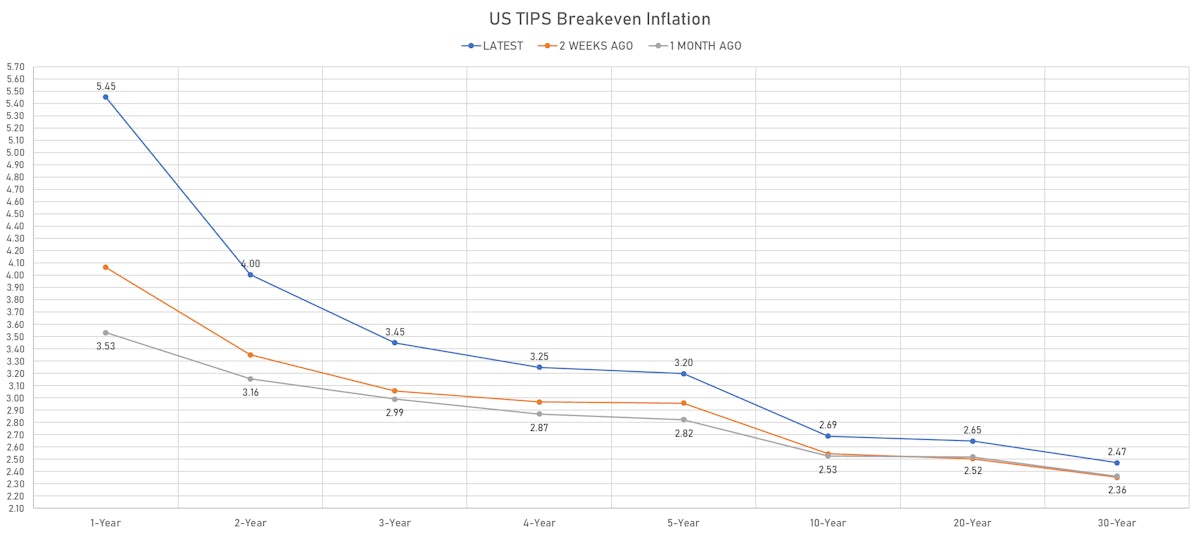

- TIPS 1Y breakeven inflation at 5.45% (down -5.1bp); 2Y at 4.00% (down -2.4bp); 5Y at 3.20% (down -4.3bp); 10Y at 2.69% (up 0.4bp); 30Y at 2.47% (up 3.0bp)

- 6-month spot US CPI swap up 1.2 bp to 4.753%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.9090%, +3.3 bp today; 10Y at -1.1380%, +0.1 bp today; 30Y at -0.4800%, -2.2 bp today

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -4.4% at 50.0%

- 3-Month LIBOR-OIS spread up 0.1 bp at 7.7 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.582% (down -3.0 bp); the German 1Y-10Y curve is 2.0 bp flatter at 51.2bp (YTD change: +35.0 bp)

- Japan 5Y: -0.068% (up 0.9 bp); the Japanese 1Y-10Y curve is 0.4 bp steeper at 19.6bp (YTD change: +5.9 bp)

- China 5Y: 2.735% (down -0.6 bp); the Chinese 1Y-10Y curve is 1.6 bp flatter at 72.9bp (YTD change: +26.5 bp)

- Switzerland 5Y: -0.418% (down -1.0 bp); the Swiss 1Y-10Y curve is 1.3 bp flatter at 62.8bp (YTD change: +36.4 bp)