Rates

Rates At The Front-End Rise As Fed Governors Waller And Clarida Talk About Accelerating Taper, Yield Curve Flattens (Higher Real Yields, Lower Breakevens)

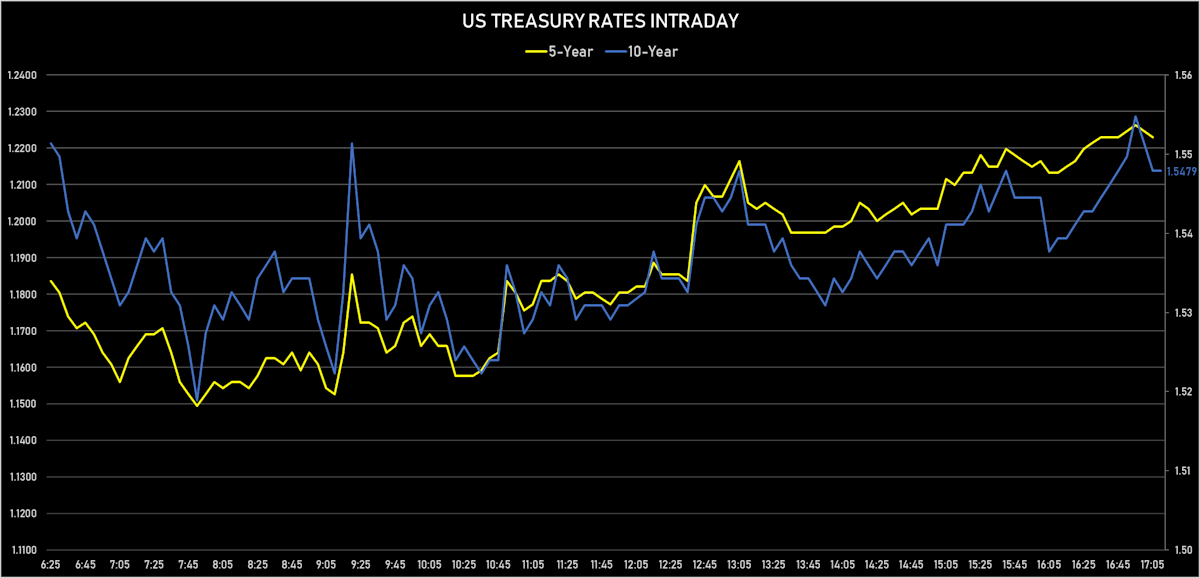

5-Year US Treasury yields dipped 7bp as new lockdowns were announced in Europe, then steadily climbed back to close nearly unchanged, as traders also positioned for macro events in the next few days ahead of Thanksgiving

Published ET

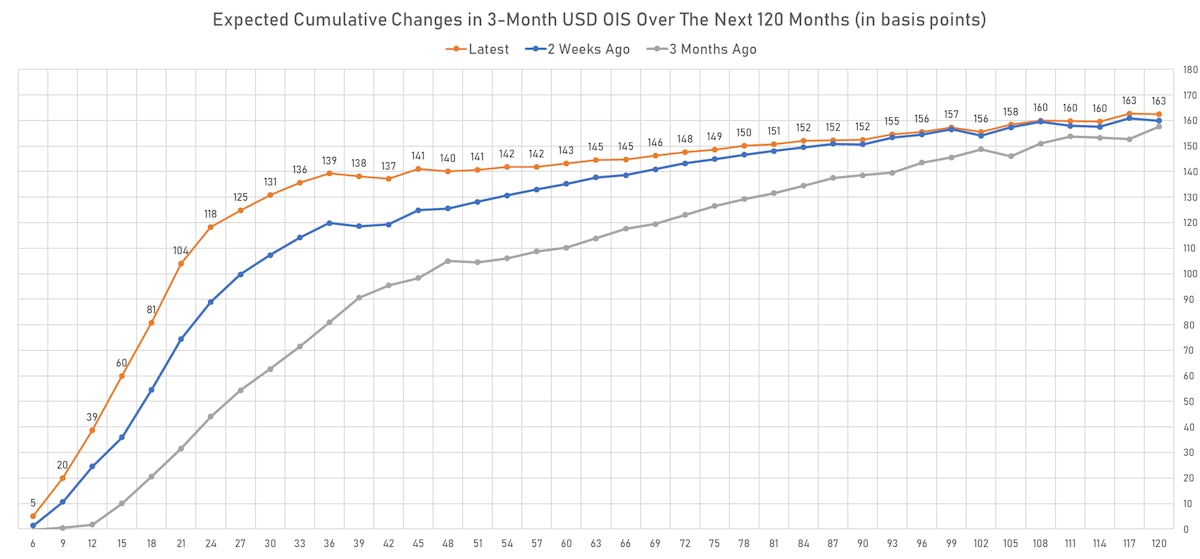

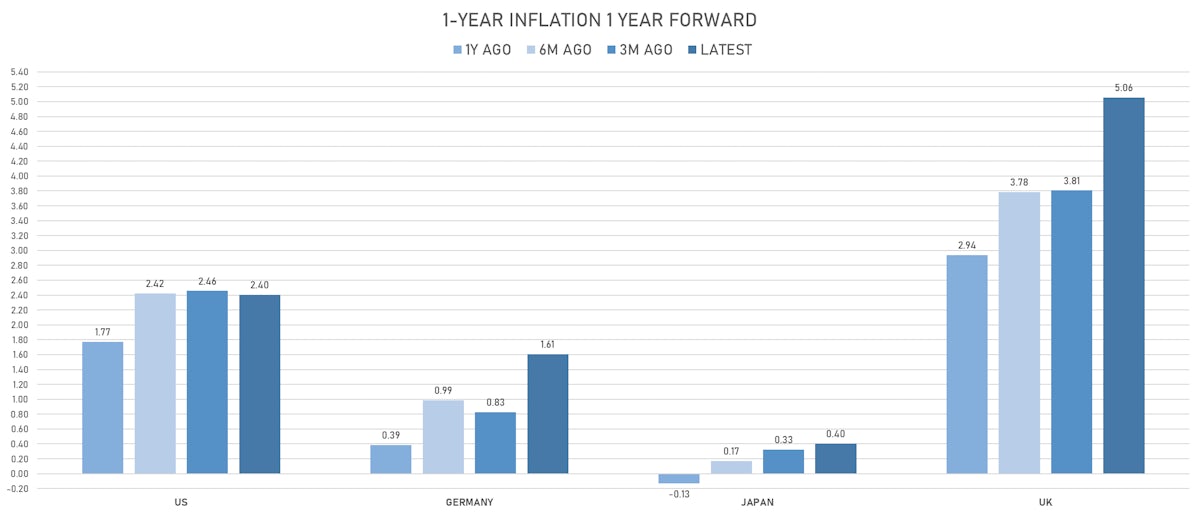

A quarter-by-quarter look at how shallow the Fed hiking cycle is expected to be | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

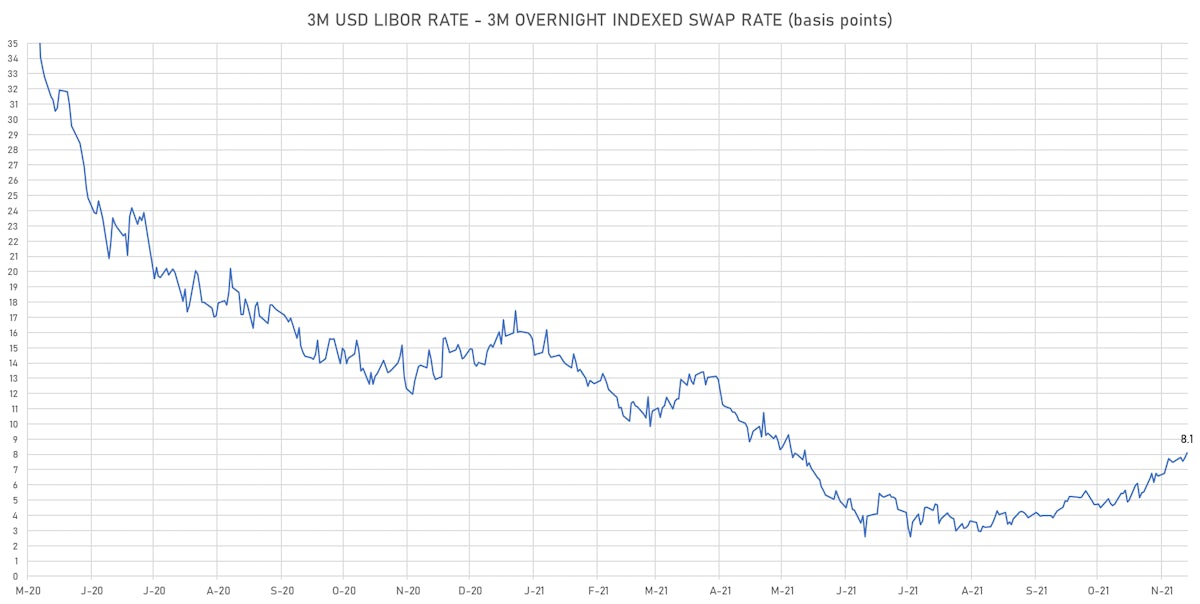

- 3-Month USD LIBOR +0.44bp today, now at 0.1596%; 3-Month OIS +0.2bp at 0.0830%

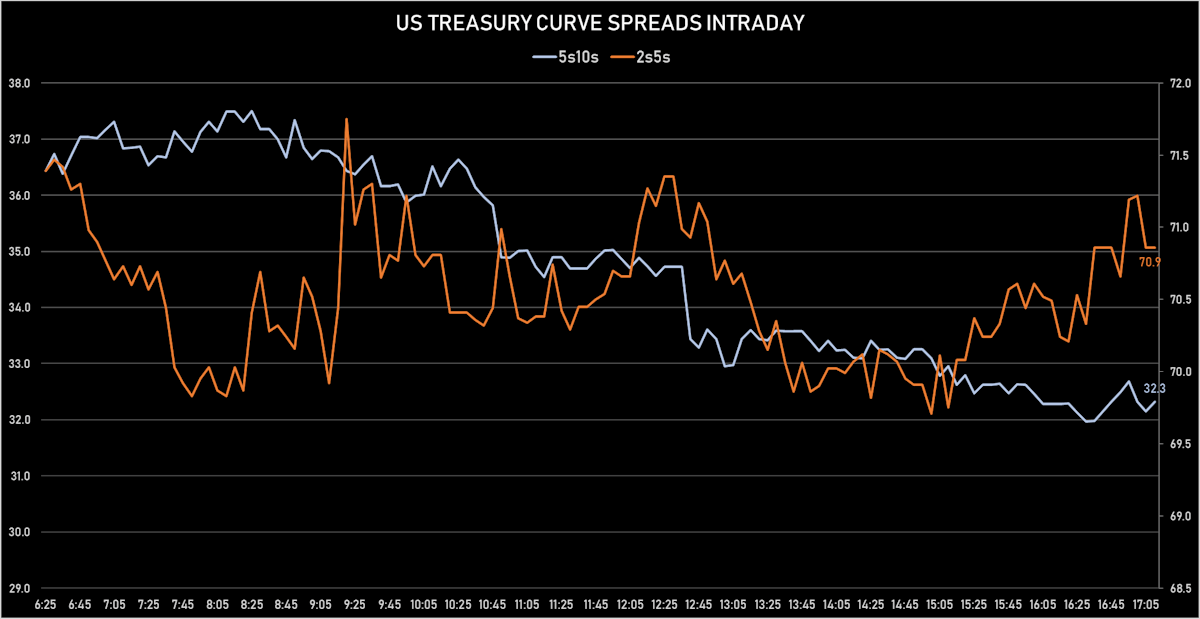

- The treasury yield curve flattened, with the 1s10s spread tightening -4.2 bp, now at 139.1 bp (YTD change: +58.6bp)

- 1Y: 0.1570% (up 0.3 bp)

- 2Y: 0.5128% (up 1.1 bp)

- 5Y: 1.2230% (up 0.3 bp)

- 7Y: 1.4533% (down 1.7 bp)

- 10Y: 1.5479% (down 3.9 bp)

- 30Y: 1.9114% (down 6.2 bp)

- US treasury curve spreads: 2s5s at 71.0bp (down -0.7bp), 5s10s at 32.5bp (down -3.9bp), 10s30s at 36.4bp (down -2.2bp)

- Treasuries butterfly spreads: 1s5s10s at -75.3bp (down -4.4bp), 5s10s30s at 3.2bp (up 1.6bp)

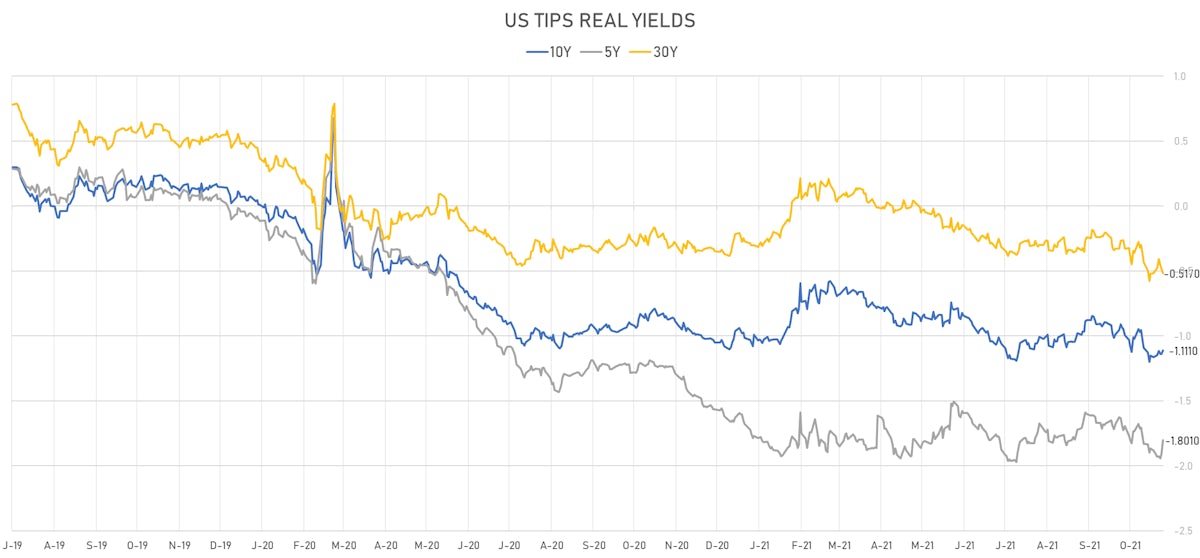

- US 5-Year TIPS Real Yield: +10.8 bp at -1.8010%; 10-Year TIPS Real Yield: +2.7 bp at -1.1110%; 30-Year TIPS Real Yield: -3.7 bp at -0.5170%

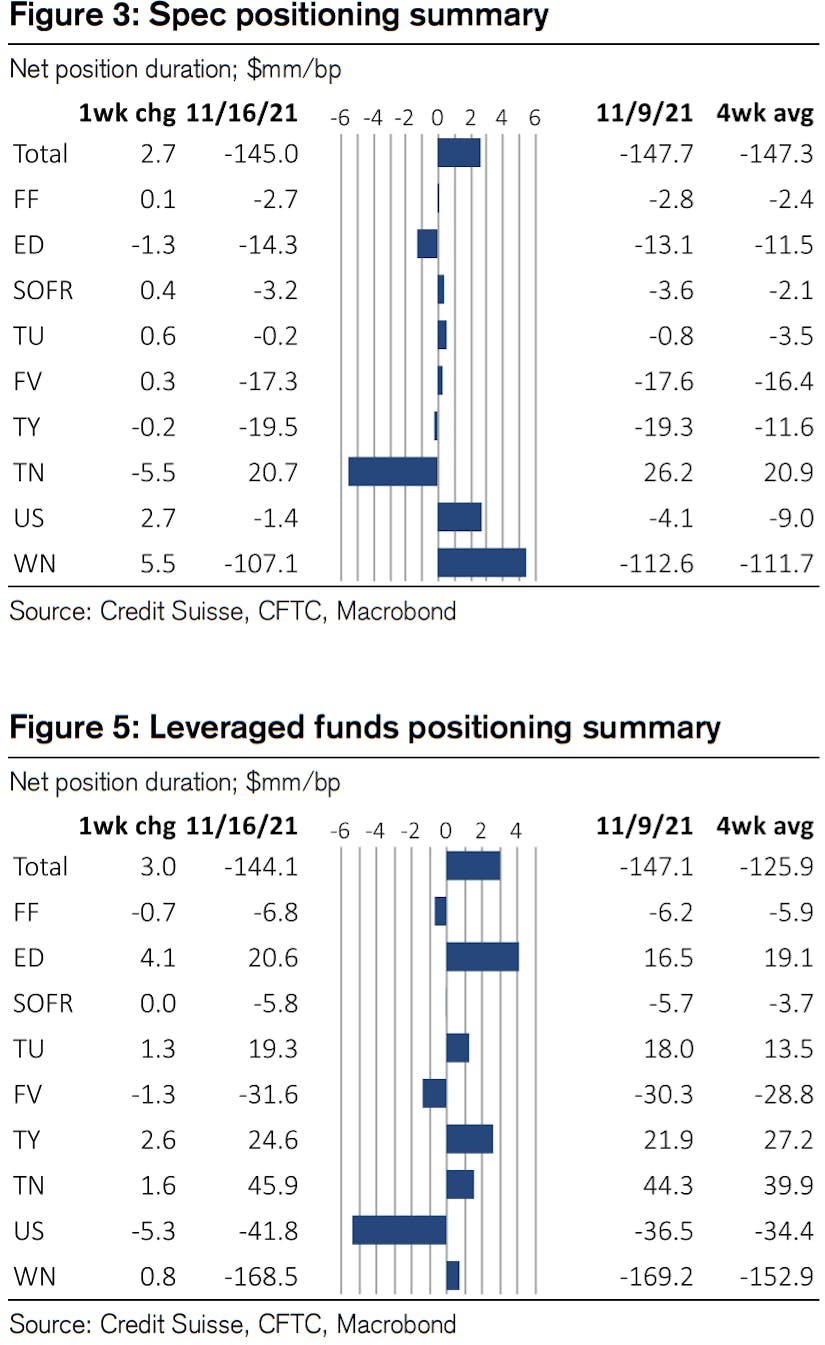

WEEKLY CFTC NET POSITIONING REPORT

- Specs showed a curve flattening bias this week: bought some duration at the long end (still massively net short) and sold some at the front end

- Leveraged funds did the opposite, showing again a steepening bias: increased their net long duration at the front end, sold more duration at the long end

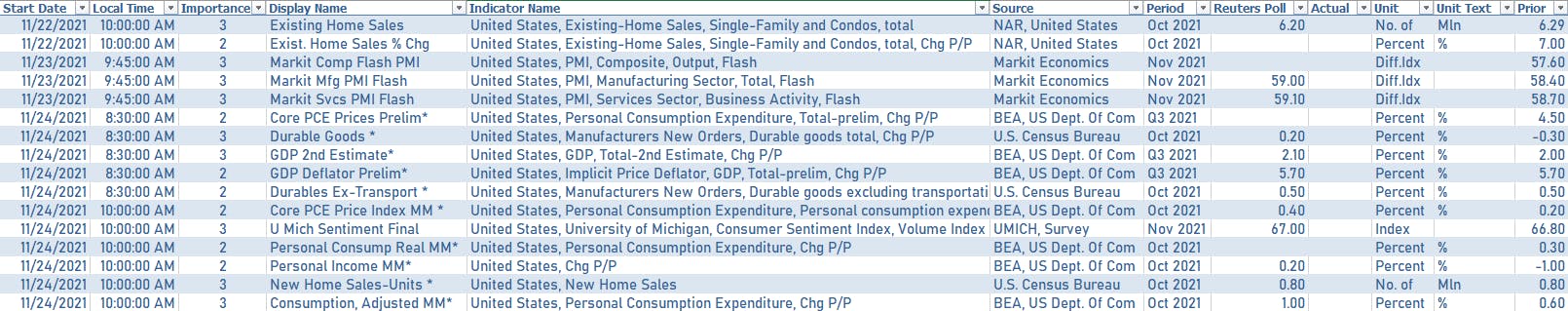

US MACRO WEEK AHEAD

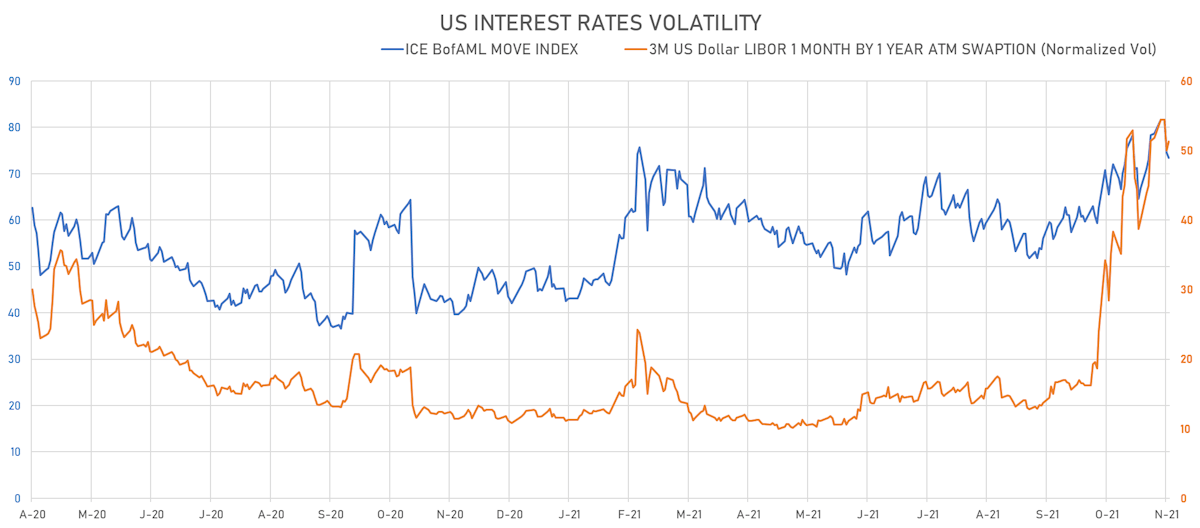

- Biden decision on Powell vs Brainard is important as the latter is seen as more dovish, but the chairman doesn't make policy and the FOMC voters next year will be more hawkish. Changing the top person now would be seen mostly negatively by the market, as it would create more instability at a time when economic uncertainty has already brought rates volatility to very high levels.

- Flash PMIs on Tuesday, expected to show further improvements in services and manufacturing

- PCE Core Deflator data on Wednesday, expected to hit 5.7% M/M and 4.0% Y/Y

- FOMC minutes, also on Wednesday

- Potential for more lockdown announcements around Europe

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 53.1 bp by the end of 2022 (equivalent to 2.1 hikes by end of 2022), up 4.1 bp today

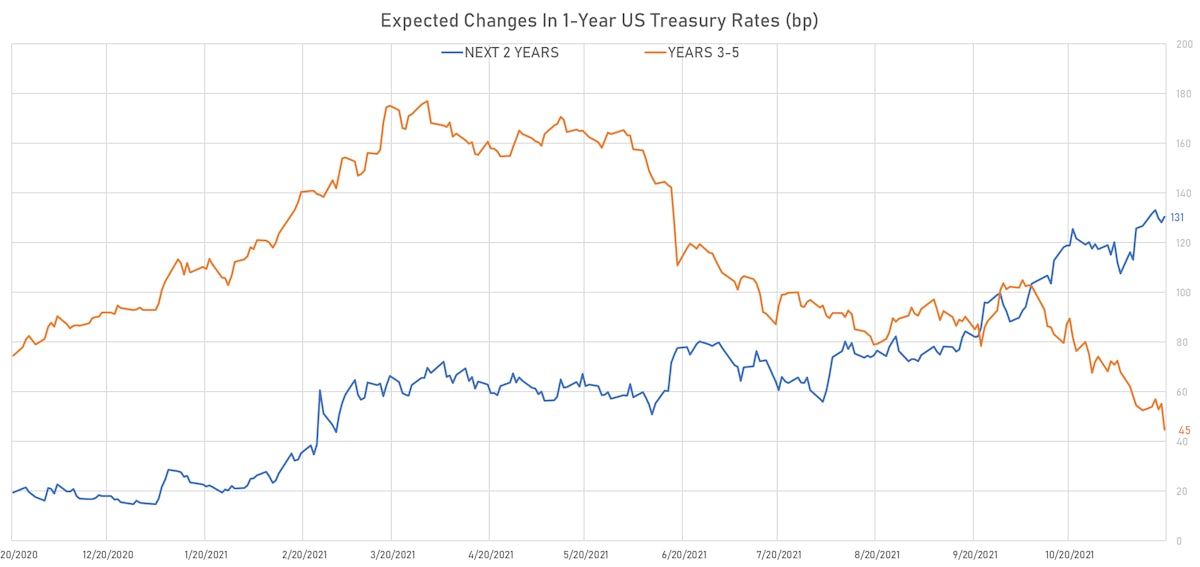

- The 3-month USD OIS forward curve prices in 38.6 bp of rate hikes over the next 12 months (up 2.4 bp today), 79.6 bp of rate hikes over the following year (up 2.1 bp today), and 25.0 bp total rate hikes in years 3 to 5 (down -8.9 bp today)

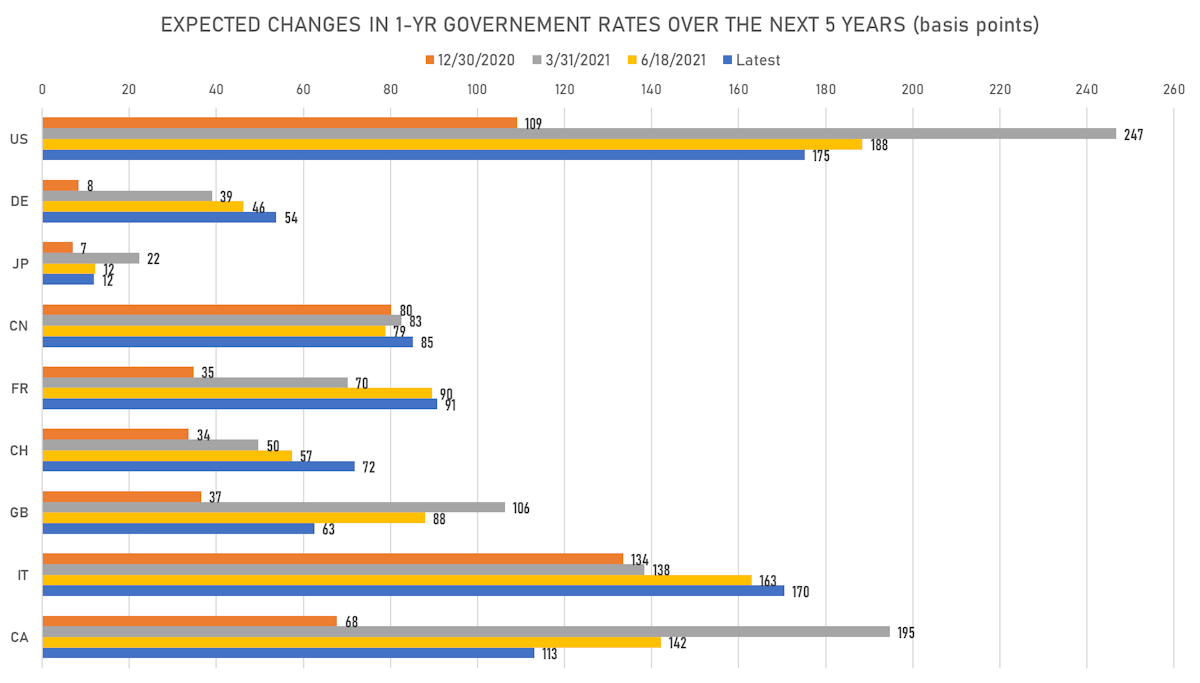

- 1-year US Treasury rate 5 years forward down 7.4 bp, now at 1.9440%, meaning that the 1-year Treasury rate is now expected to increase by 175.2 bp over the next 5 years (equivalent to 7.0 rate hikes)

US INFLATION & REAL RATES

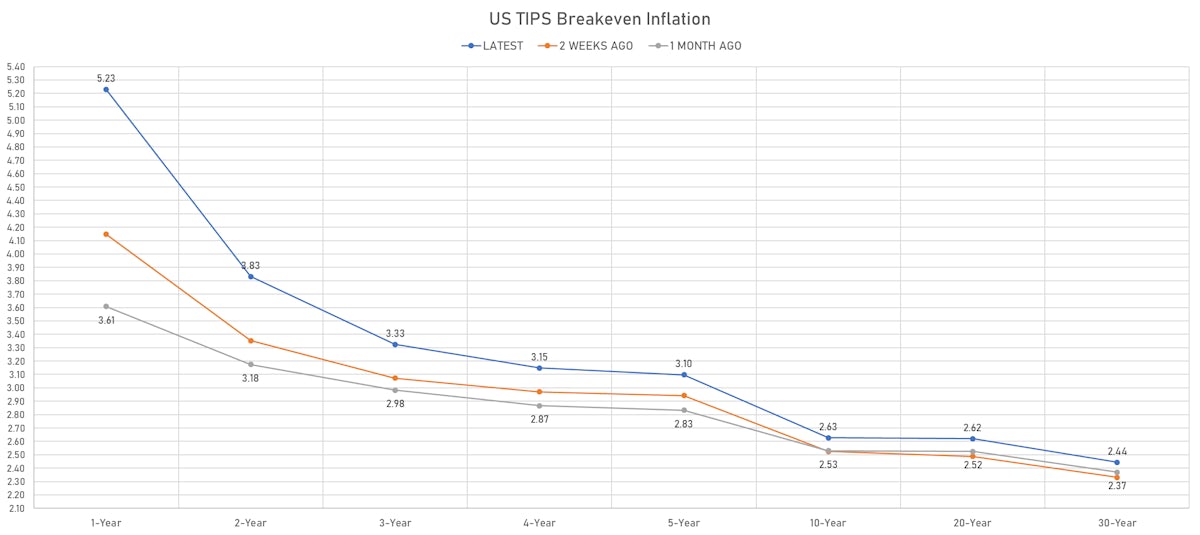

- TIPS 1Y breakeven inflation at 5.23% (down -22.1bp); 2Y at 3.83% (down -17.3bp); 5Y at 3.10% (down -10.0bp); 10Y at 2.63% (down -6.1bp); 30Y at 2.44% (down -2.7bp)

- 6-month spot US CPI swap down -13.8 bp to 4.615%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.8010%, +10.8 bp today; 10Y at -1.1110%, +2.7 bp today; 30Y at -0.5170%, -3.7 bp today

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 1.3% at 51.3%

- 3-Month LIBOR-OIS spread up 0.3 bp at 8.1 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.630% (down -4.6 bp); the German 1Y-10Y curve is 6.4 bp flatter at 44.1bp (YTD change: +28.6 bp)

- Japan 5Y: -0.067% (down -0.9 bp); the Japanese 1Y-10Y curve is 0.1 bp flatter at 20.4bp (YTD change: +5.8 bp)

- China 5Y: 2.736% (up 0.1 bp); the Chinese 1Y-10Y curve is 1.7 bp steeper at 74.6bp (YTD change: +28.2 bp)

- Switzerland 5Y: -0.477% (down -5.9 bp); the Swiss 1Y-10Y curve is 11.9 bp flatter at 56.9bp (YTD change: +24.5 bp)