Rates

Powell's Nomination For A Second Term Drives Rates Higher In A Big Way, Most Significantly From The Front Of The Curve Out To The Belly

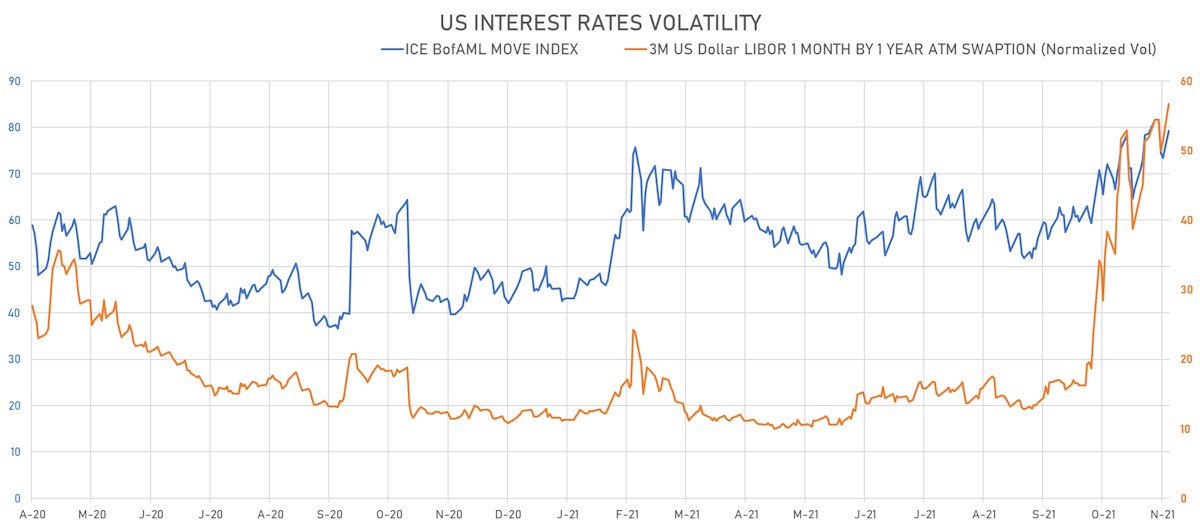

Rates volatility is at the highest level since March 2020 and the forward curve continued to flatten, with 2s10s Treasury spreads now inverted from 2 years out and the tightest TIPS 5s30s spread since the beginning of the year

Published ET

Fed Hikes Implied From Fed Funds Futures | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

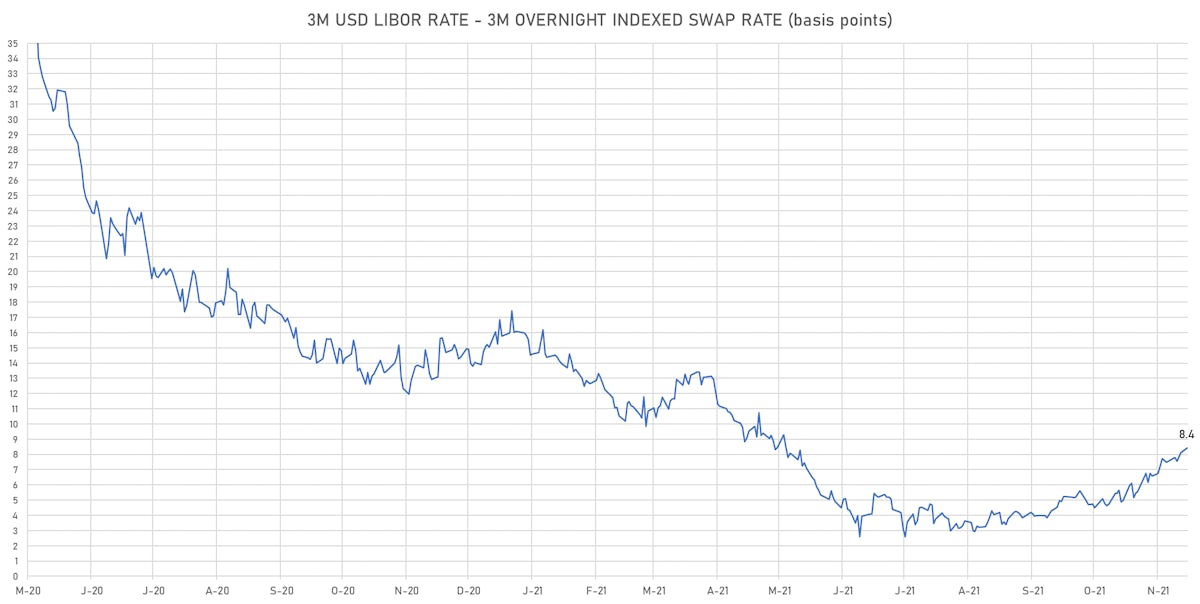

- 3-Month USD LIBOR +0.56bp today, now at 0.1640%; 3-Month OIS +0.3bp at 0.0855%

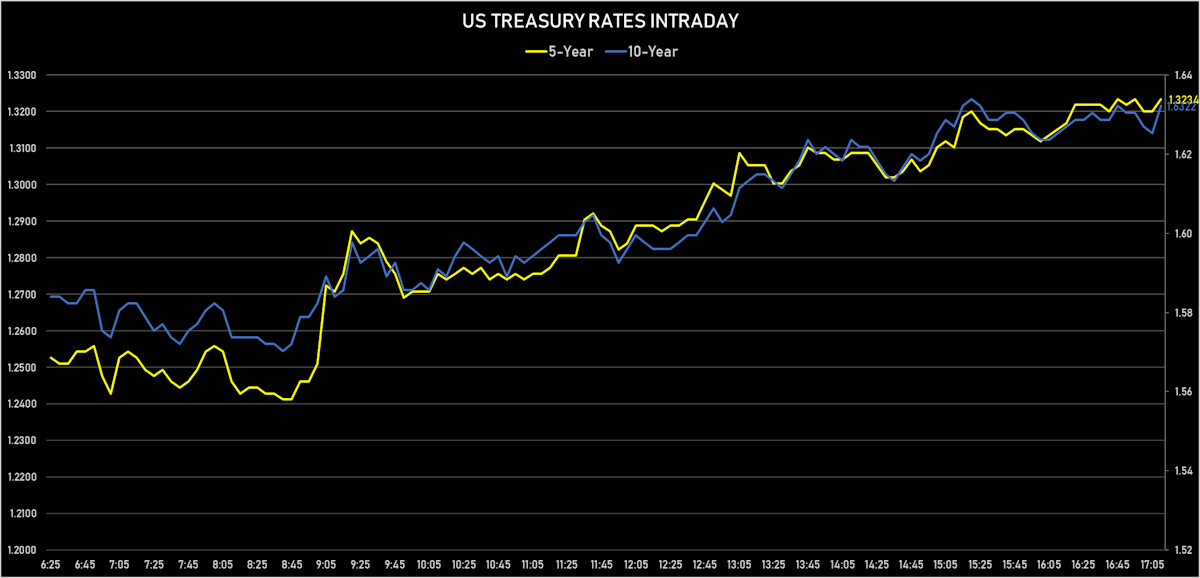

- The treasury yield curve steepened, with the 1s10s spread widening 5.4 bp, now at 147.5 bp (YTD change: +67.1bp)

- 1Y: 0.1570% (up 3.1 bp)

- 2Y: 0.5924% (up 8.0 bp)

- 5Y: 1.3234% (up 10.0 bp)

- 7Y: 1.5586% (up 10.5 bp)

- 10Y: 1.6322% (up 8.4 bp)

- 30Y: 1.9734% (up 6.2 bp)

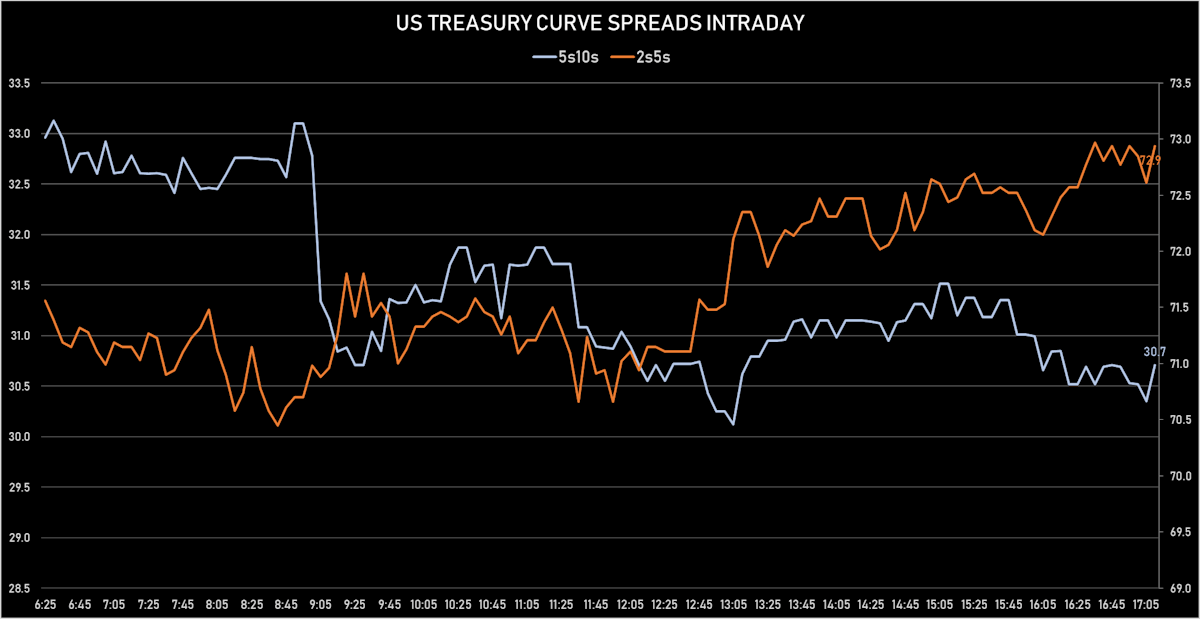

- US treasury curve spreads: 2s5s at 73.1bp (up 1.9bp today), 5s10s at 30.9bp (down -1.8bp), 10s30s at 34.2bp (down -2.5bp)

- Treasuries butterfly spreads: 1s5s10s at -83.9bp (down -8.6bp), 5s10s30s at 2.5bp (down -0.7bp)

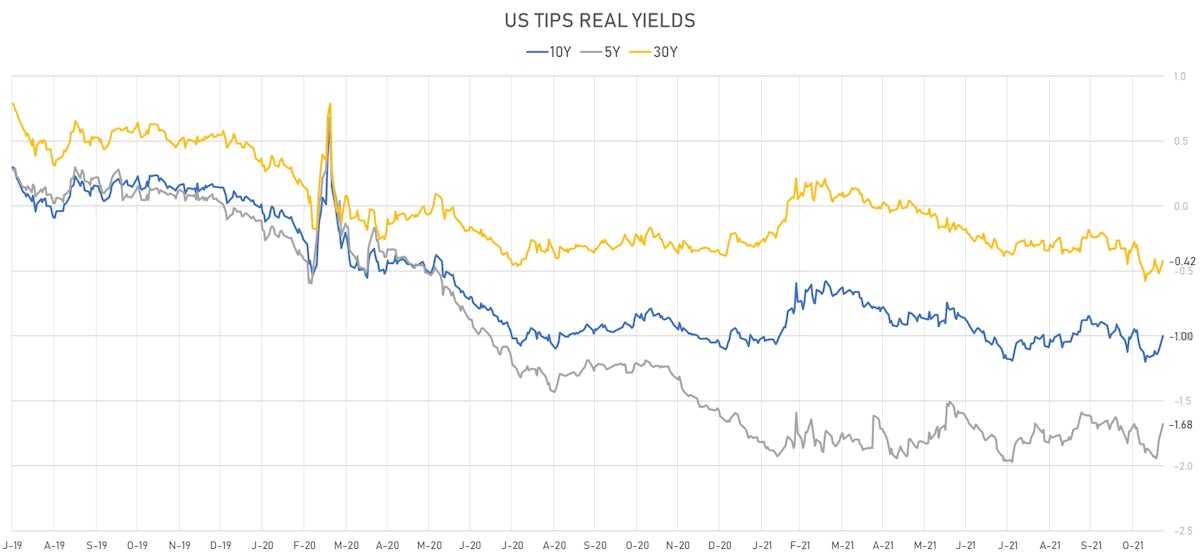

- US 5-Year TIPS Real Yield: +12.2 bp at -1.6790%; 10-Year TIPS Real Yield: +11.0 bp at -1.0010%; 30-Year TIPS Real Yield: +9.4 bp at -0.4230%

$57.8 BN 2-YEAR TREASURY NOTE AUCTION (91282CDM0)

- Terrible stats for this offering, with miserable pricing and anemic end-user demand (at just 62.8% vs 82.1% prior and 75.8% average)

- High yield at 0.623% (vs 0.481% prior), a tail of 1.1bp vs when-issued at the bid deadline

- Direct bids at 17.2% (vs 22.3% prior and 16.7% average)

- Indirect bids at 45.6% (vs 58.1% prior and 52.3% average)

- Bid-to-cover at 2.36 (vs 2.69 prior and 2.54 average)

$58.9 BN 5-YEAR TREASURY NOTE AUCTION (91282CDK4)

- Bad results all around: poor pricing and weak end-user demand (at 73.1% vs 82.1% prior and 75.8% average)

- High yield at 1.319% (vs 1.157% prior), a 1 bp tail from the when-issued at the bid deadline

- Direct bids at 16.2% (vs 17.4% prior and 16.7% average)

- Indirect bids at 56.9% (vs 64.8% prior and 59.1% average)

- Bid-to-cover at 2.34 (vs 2.55 prior and 2.37 average)

US MACRO RELEASES

- Chicago Fed CFMMI, National Activity Index for Oct 2021 (Fed Res, Chicago) at 0.76 (vs -0.13 prior)

- Existing-Home Sales, Single-Family and Condos, total for Oct 2021 (NAR, United States) at 6.34 Mln (vs 6.29 Mln prior), above consensus estimate of 6.20 Mln

- Existing-Home Sales, Single-Family and Condos, total, Change P/P for Oct 2021 (NAR, United States) at 0.80 % (vs 7.00 % prior)

US FORWARD RATES

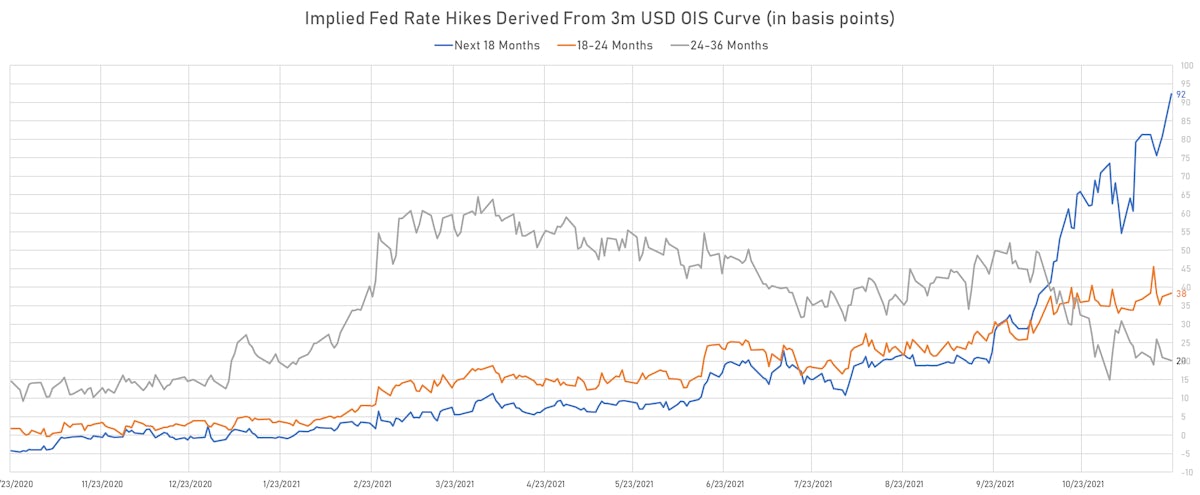

- 3-month Eurodollar future (EDU2) expected hike of 60.0 bp by the end of 2022 (equivalent to 2.4 hikes by end of 2022), up 10.4 bp today

- The 3-month USD OIS forward curve prices in 47.1 bp of rate hikes over the next 12 months (up 8.5 bp today), 83.6 bp of rate hikes over the following year (up 4.0 bp today), and 22.9 bp total rate hikes in years 3 to 5 (down -2.1 bp today)

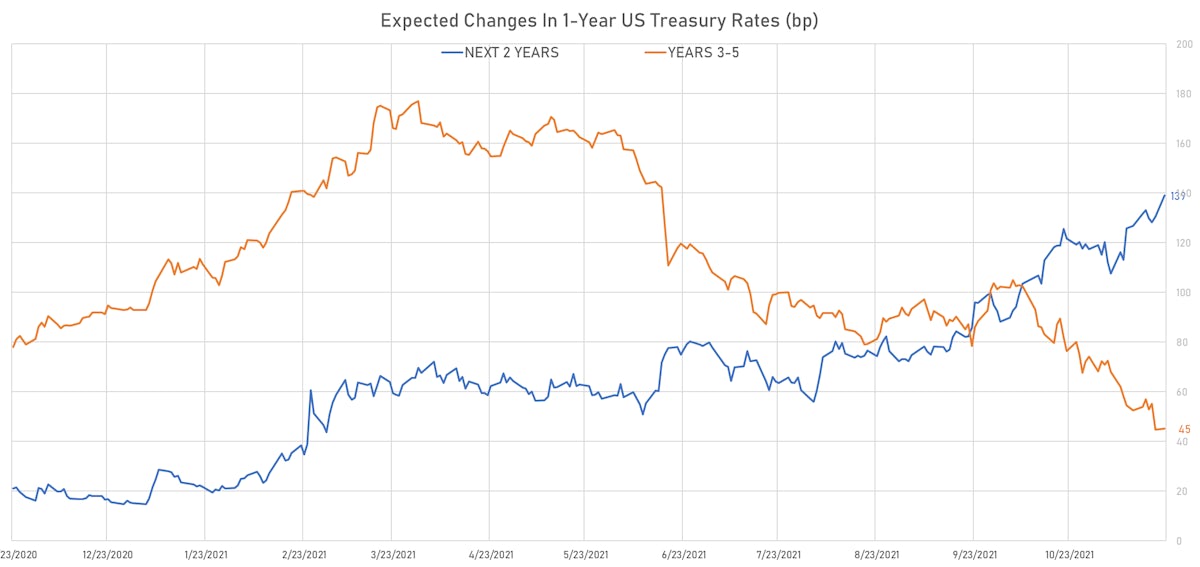

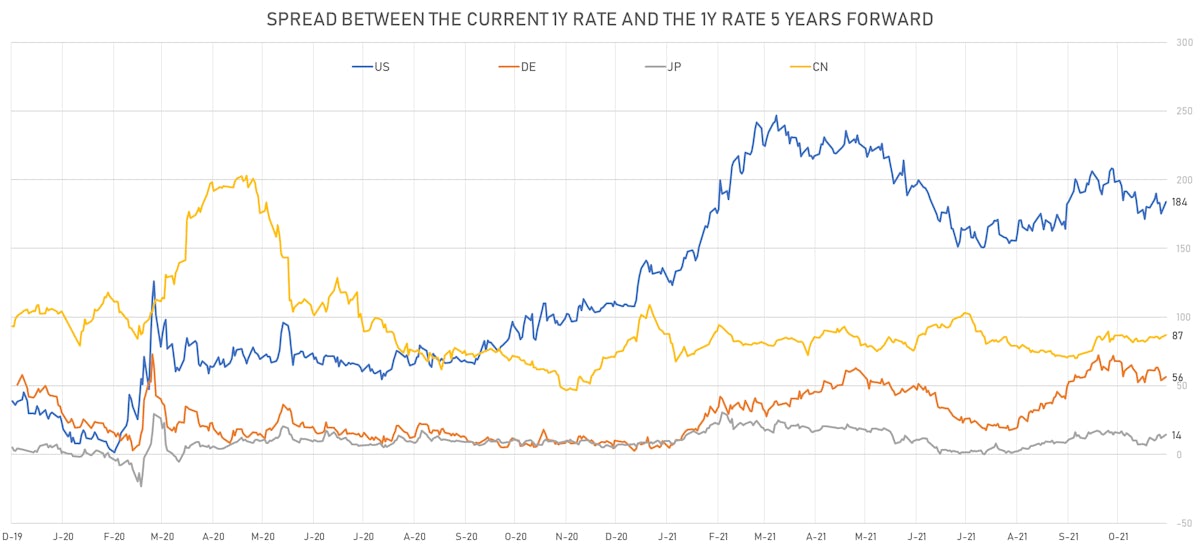

- 1-year US Treasury rate 5 years forward up 12.0 bp, now at 2.0638%, meaning that the 1-year Treasury rate is now expected to increase by 184.1 bp over the next 5 years (equivalent to 7.4 rate hikes)

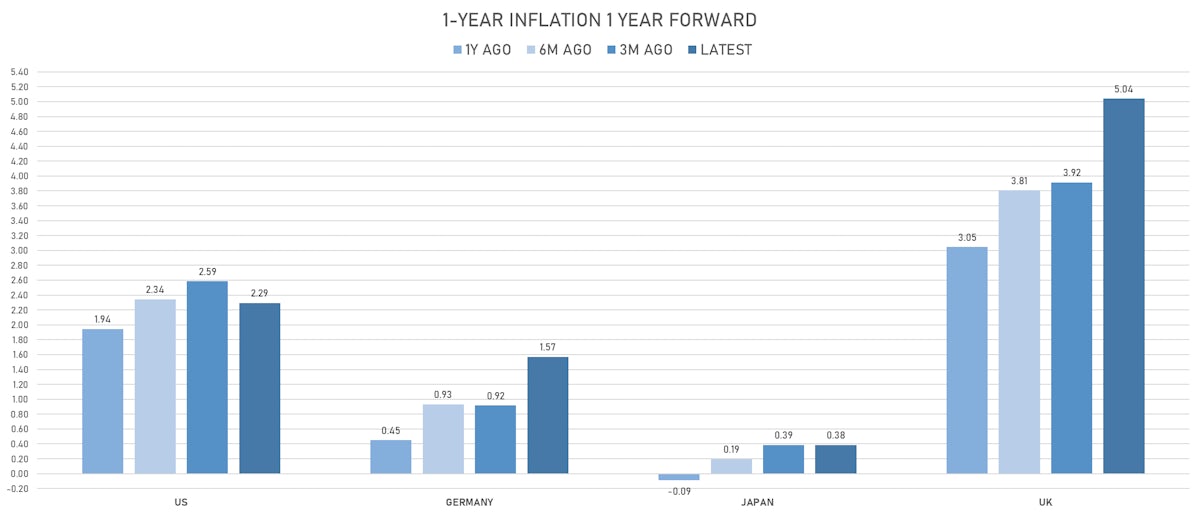

US INFLATION & REAL RATES

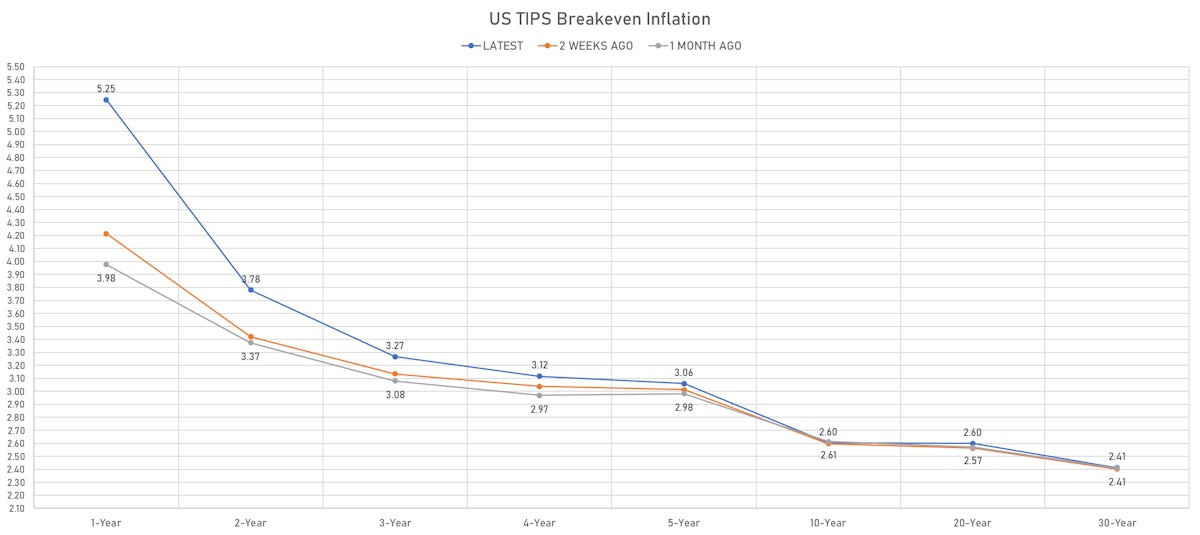

- TIPS 1Y breakeven inflation at 5.25% (up 1.6bp); 2Y at 3.78% (down -5.2bp); 5Y at 3.06% (down -3.7bp); 10Y at 2.60% (down -2.5bp); 30Y at 2.41% (down -3.1bp)

- 6-month spot US CPI swap down -18.4 bp to 4.431%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.6790%, +12.2 bp today; 10Y at -1.0010%, +11.0 bp today; 30Y at -0.4230%, +9.4 bp today

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 5.4% at 56.7%

- 3-Month LIBOR-OIS spread up 0.3 bp at 8.4 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.588% (up 4.2 bp); the German 1Y-10Y curve is 1.5 bp steeper at 45.9bp (YTD change: +30.1 bp)

- Japan 5Y: -0.084% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.2 bp flatter at 20.5bp (YTD change: +5.6 bp)

- China 5Y: 2.730% (down -0.6 bp); the Chinese 1Y-10Y curve is 1.3 bp flatter at 73.3bp (YTD change: +26.9 bp)

- Switzerland 5Y: -0.449% (up 2.2 bp); the Swiss 1Y-10Y curve is 2.4 bp steeper at 53.3bp (YTD change: +26.9 bp)