Rates

US Treasury Curve Steepens, With Mixed Real Yields And Rising Inflation Breakevens

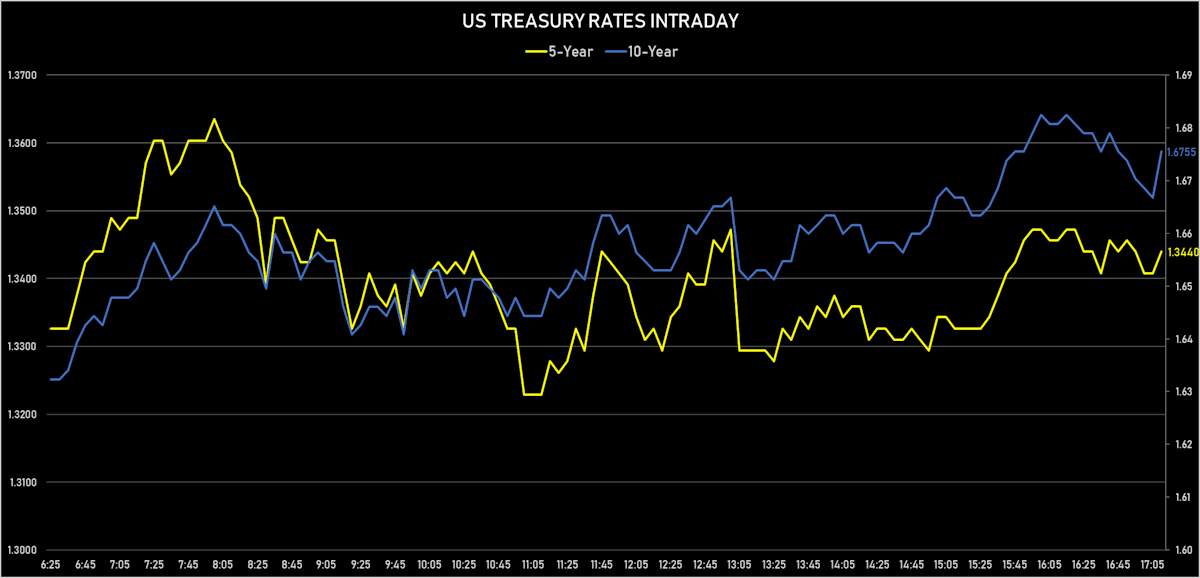

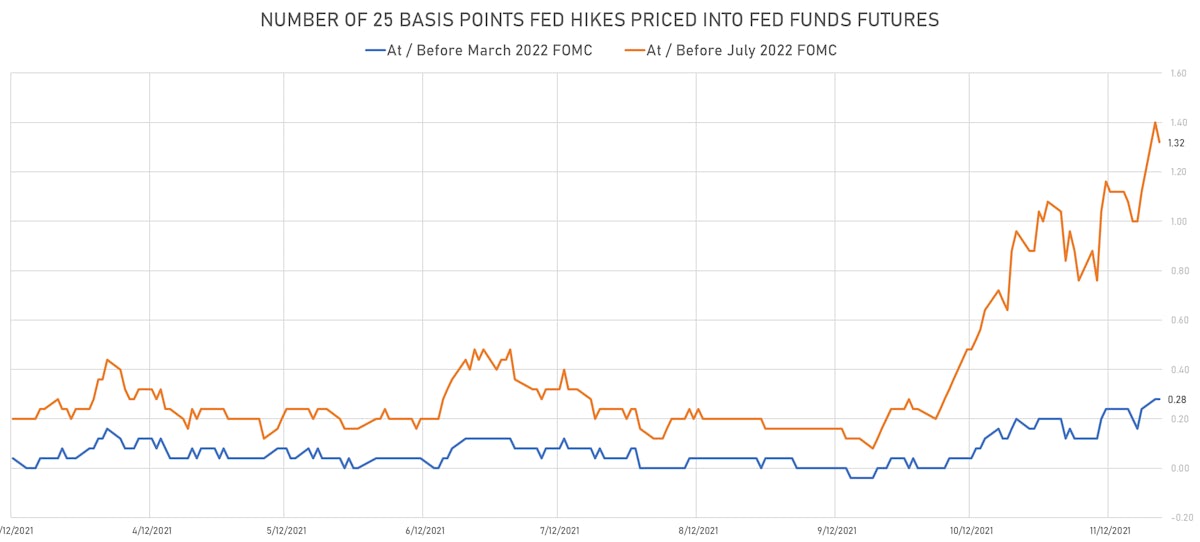

Front-end rates dipped with slightly lower Fed hikes expectations over the next year; Fed Fund futures still pricing in about one and a third hike by the end of July 2022

Published ET

US Treasury Curve 2s10s Spread Spot & Forward (Derived From The UST ZC Curve) | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

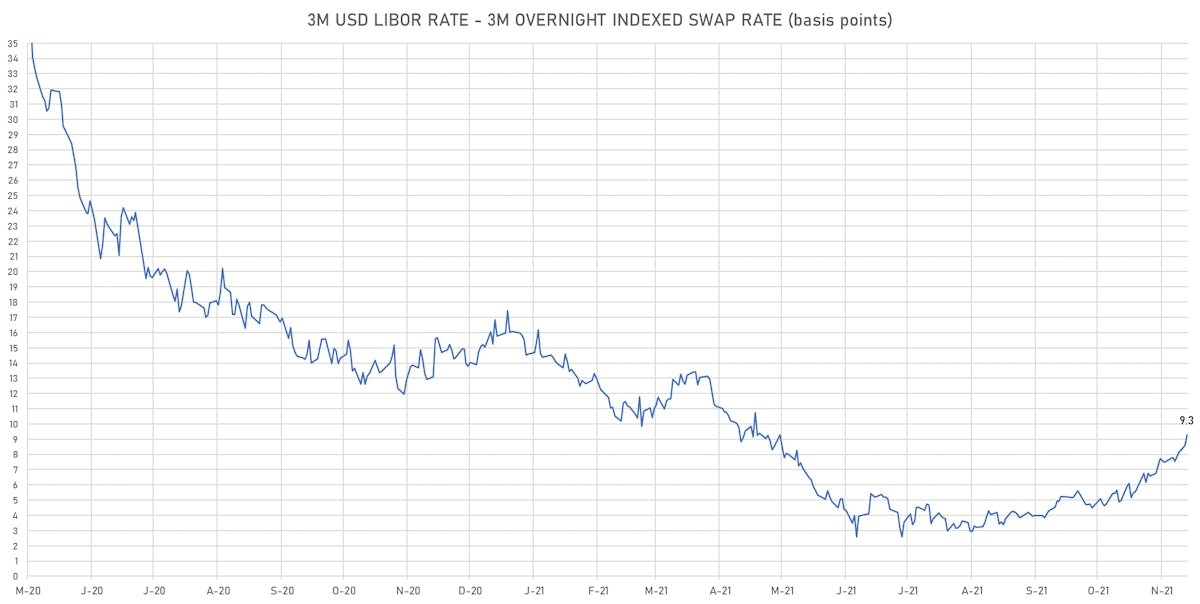

- 3-Month USD LIBOR +0.84bp today, now at 0.1696%; 3-Month OIS +0.2bp at 0.0850%

- The treasury yield curve steepened, with the 1s10s spread widening 4.3 bp, now at 144.7 bp (YTD change: +64.3bp)

- 1Y: 0.1850% (unchanged)

- 2Y: 0.5924% (up 2.2 bp)

- 5Y: 1.3234% (up 2.1 bp)

- 7Y: 1.5586% (up 2.7 bp)

- 10Y: 1.6322% (up 4.3 bp)

- 30Y: 1.9734% (up 5.7 bp)

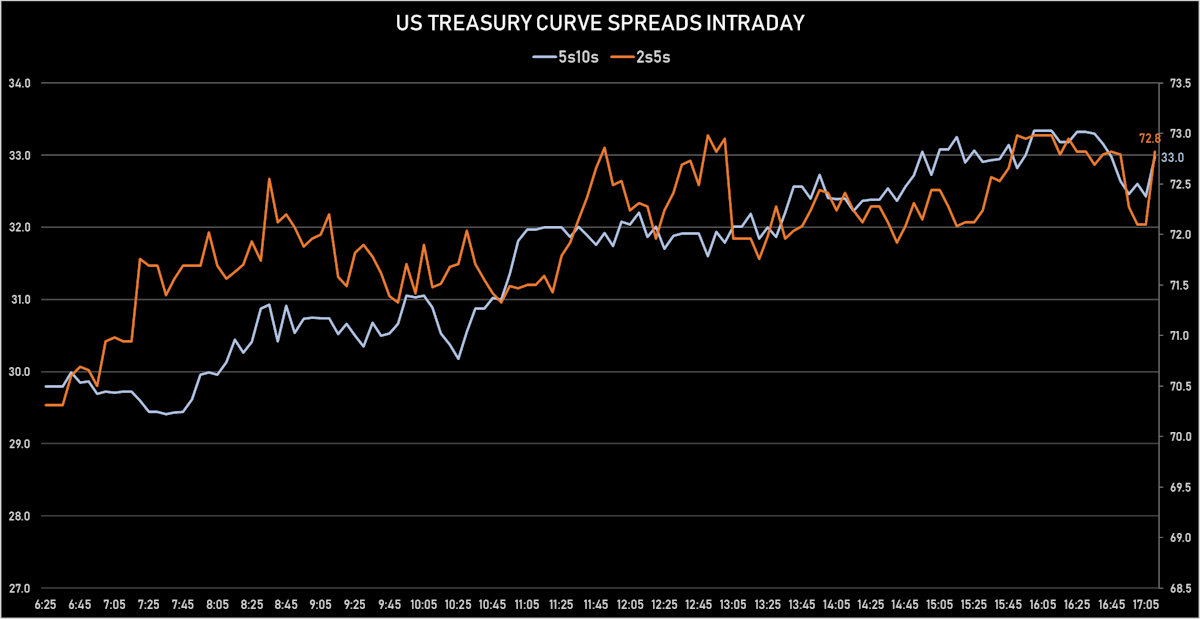

- US treasury curve spreads: 2s5s at 73.0bp (down -0.8bp), 5s10s at 33.2bp (up 2.1bp today), 10s30s at 35.5bp (up 2.0bp today)

- Treasuries butterfly spreads: 1s5s10s at -83.7bp (up 0.2bp today), 5s10s30s at 2.5bp (unchanged)

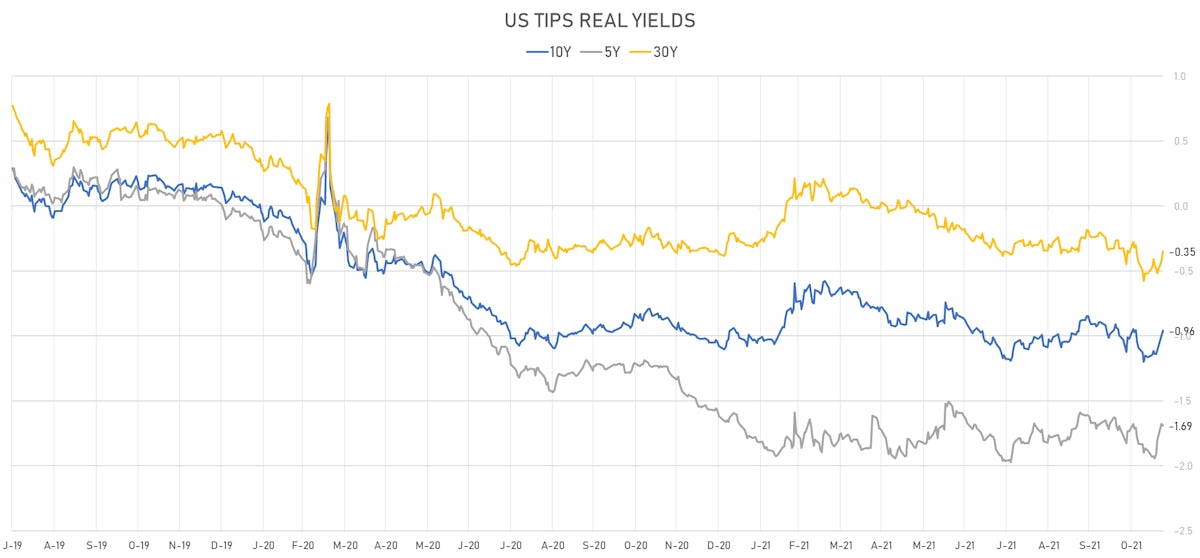

- US 5-Year TIPS Real Yield: -1.0 bp at -1.6890%; 10-Year TIPS Real Yield: +4.3 bp at -0.9580%; 30-Year TIPS Real Yield: +7.4 bp at -0.3490%

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 20 Nov (Redbook Research) at 15.40 % (vs 14.70 % prior)

- PMI, Composite, Output, Flash for Nov 2021 (Markit Economics) at 56.50 (vs 57.60 prior)

- PMI, Manufacturing Sector, Total, Flash for Nov 2021 (Markit Economics) at 59.10 (vs 58.40 prior), above consensus estimate of 59.00

- PMI, Services Sector, Business Activity, Flash for Nov 2021 (Markit Economics) at 57.00 (vs 58.70 prior), below consensus estimate of 59.00

- Richmond Fed Manufacturing, Manufacturing Index for Nov 2021 (FED, Richmond) at 11.00 (vs 12.00 prior)

- Richmond Fed Manufacturing, Shipments, current conditions for Nov 2021 (FED, Richmond) at 4.00 (vs 1.00 prior)

- Richmond Fed Services, Revenues for Nov 2021 (FED, Richmond) at 8.00 (vs 9.00 prior)

$59 BN 7-YEAR 1.50% COUPON TREASURY NOTE AUCTION (91282CDL2)

- Positive stats after the disastrous 2Y and 5Y auctions yesterday: good pricing and strong end-user demand at 82.6% (vs 83.4% prior and average of 78%)

- High yield at 1.588% (vs 1.461% prior), a 1.1 bp stop-through vs the when-issued at the bid deadline

- Direct bids at 23.3% (vs 19.5% prior and 19.2% average)

- Indirect bids at 59.3% (vs 63.9% prior and 58.8% average)

- Bid-to-cover at 2.42 (vs 2.25 prior and 2.28 average)

JP MORGAN TREASURY POSITIONING SURVEY

All Clients (November 22 vs November 15)

- Long: 13 vs 11 prior

- Neutral: 52 vs 58 prior

- Short: 35 vs 31 prior

- Net: -22 vs -20 prior

Active Clients

- Long: 20 vs 20 prior

- Neutral: 40 vs 50 prior

- Short: 40 vs 30 prior

- Net: -20 vs -10 prior

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 56.2 bp by the end of 2022 (equivalent to 2.2 hikes by end of 2022), down -3.8 bp today

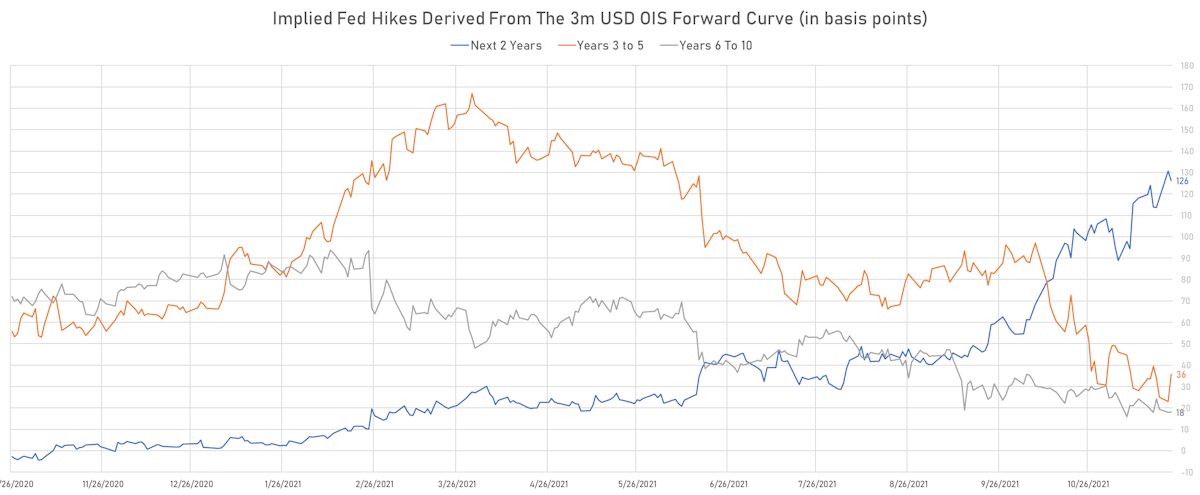

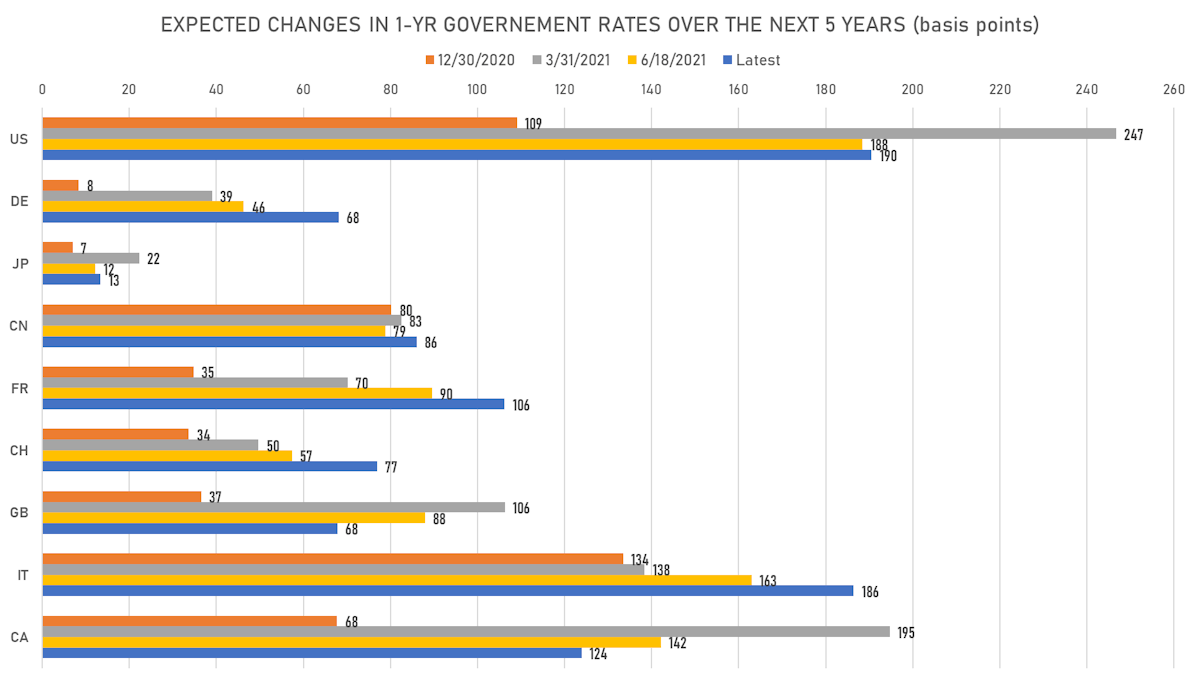

- The 3-month USD OIS forward curve prices in 46.3 bp of rate hikes over the next 12 months (down -0.9 bp today), 80.1 bp of rate hikes over the following year (down -3.5 bp today), and 35.8 bp total rate hikes in years 3 to 5 (up 12.9 bp today)

- 1-year US Treasury rate 5 years forward up 6.0 bp, now at 2.1238%, meaning that the 1-year Treasury rate is now expected to increase by 190.5 bp over the next 5 years (equivalent to 7.6 rate hikes)

US INFLATION & REAL RATES

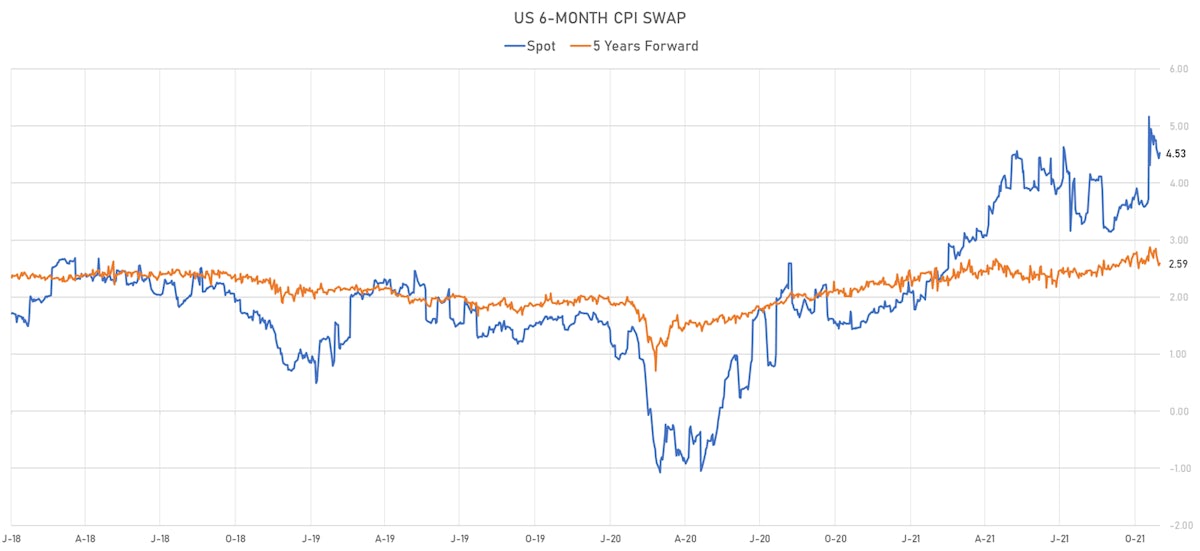

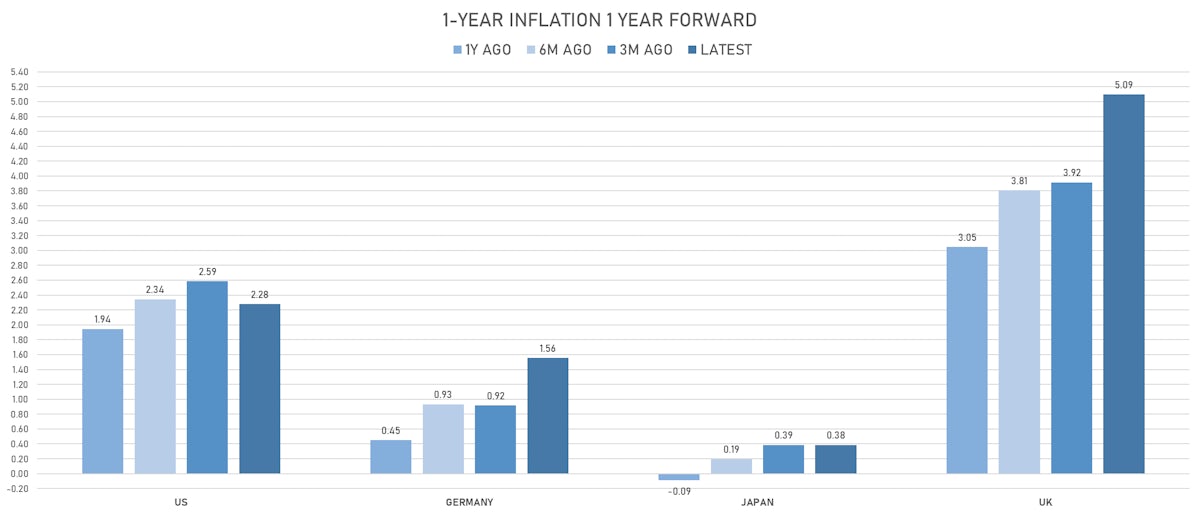

- TIPS 1Y breakeven inflation at 5.33% (up 8.2bp); 2Y at 3.82% (up 3.5bp); 5Y at 3.08% (up 2.3bp); 10Y at 2.60% (up 0.2bp); 30Y at 2.40% (down -1.7bp)

- 6-month spot US CPI swap up 9.8 bp to 4.529%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.6890%, -1.0 bp today; 10Y at -0.9580%, +4.3 bp today; 30Y at -0.3490%, +7.4 bp today

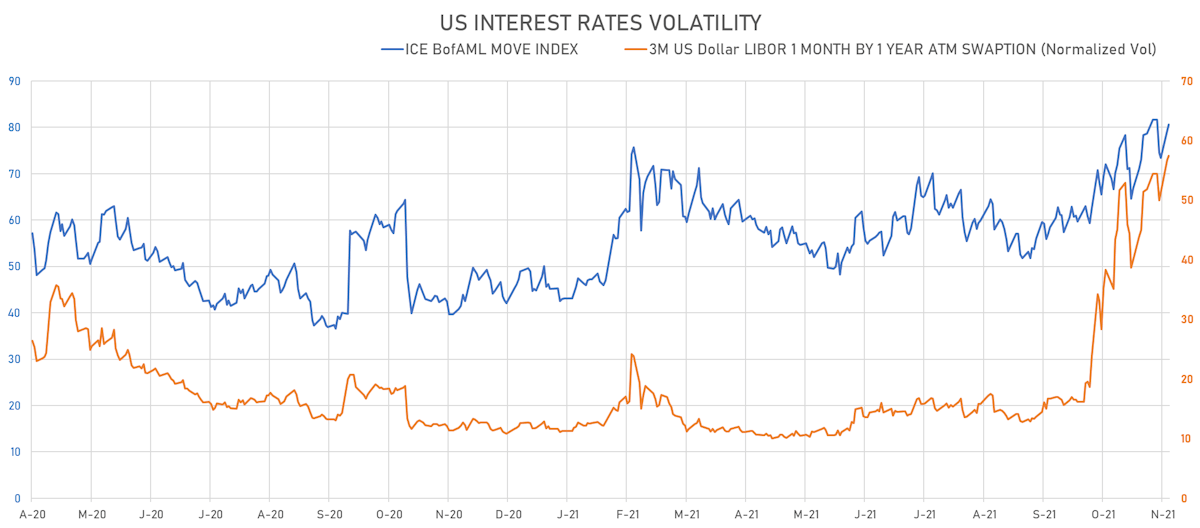

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.7% at 57.4%

- 3-Month LIBOR-OIS spread up 0.7 bp at 9.3 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.542% (up 4.6 bp); the German 1Y-10Y curve is 5.8 bp steeper at 52.3bp (YTD change: +35.9 bp)

- Japan 5Y at -0.084%, with the Japanese 1Y-10Y curve at 20.5bp (YTD change: +5.6 bp)

- China 5Y: 2.728% (down -0.2 bp); the Chinese 1Y-10Y curve is 1.4 bp steeper at 74.7bp (YTD change: +28.3 bp)

- Switzerland 5Y: -0.439% (up 1.6 bp); the Swiss 1Y-10Y curve is 6.2 bp steeper at 59.5bp (YTD change: +33.1 bp)