Rates

Nu Variant Brings Huge Drop In Rates, With Both Inflation Breakevens And Real Yields Sliding On Friday

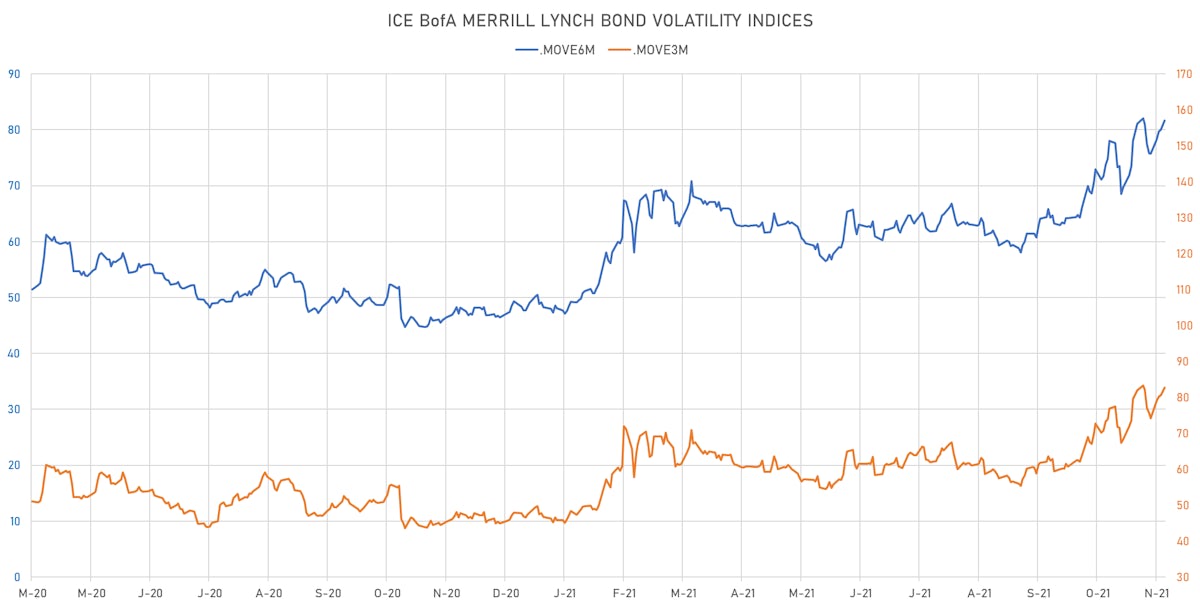

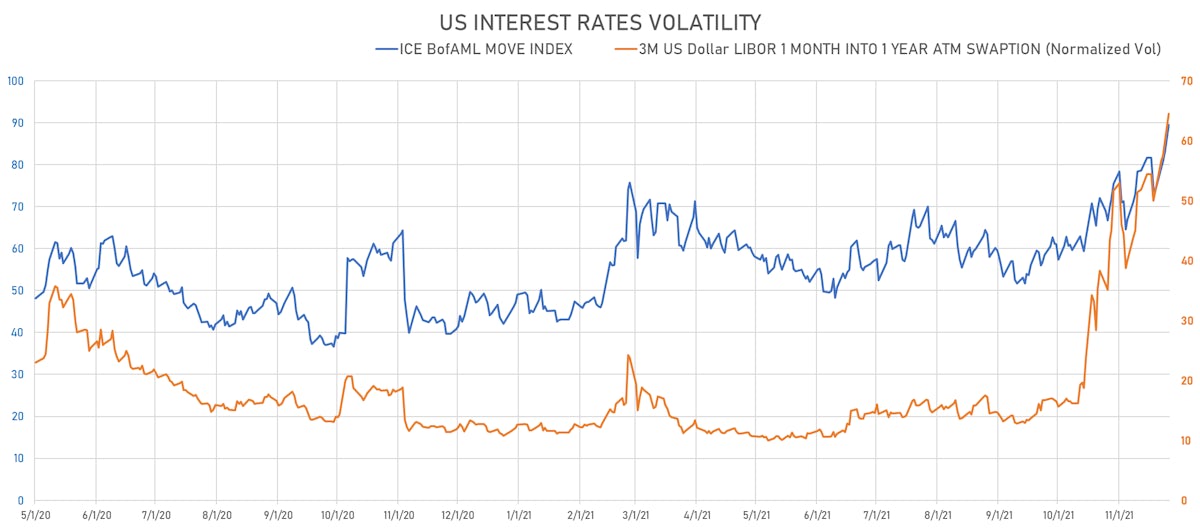

The 3M-2Y Treasury spread was down 13bp today, and short-term rates volatility is at the highest level since March 2020, an indication that uncertainty may soon be overpriced; Fed funds futures now price in 1.0 hike by the end of July '22 (down from 1.5) and 46 bp of hikes by end of 2022

Published ET

US Rates Volatility At Highest Level Since March 2020 | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

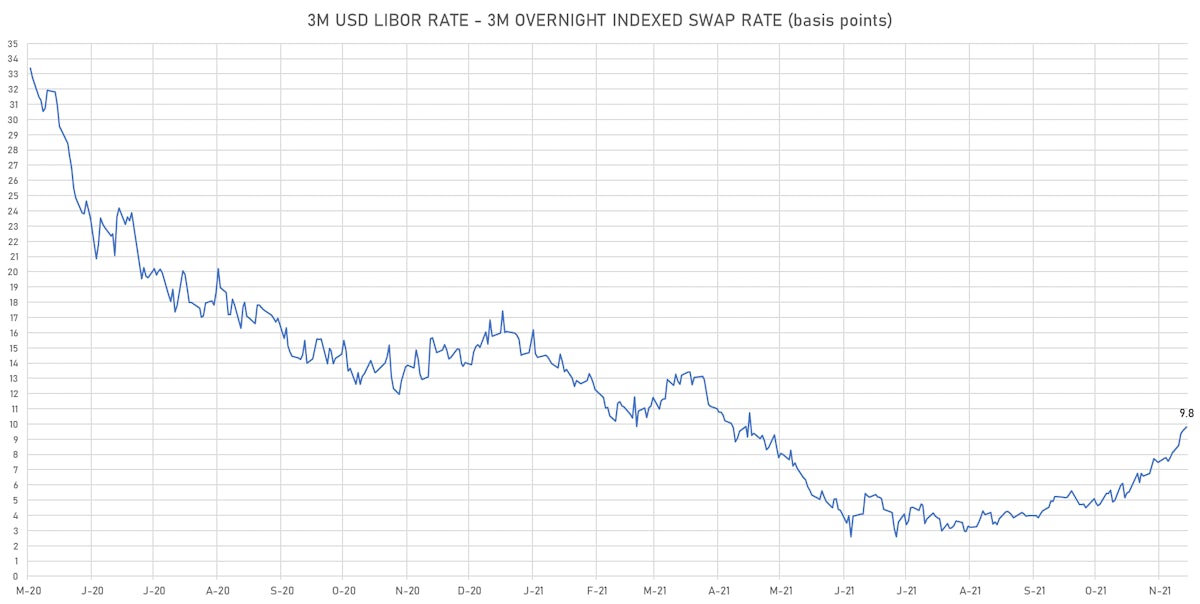

- 3-Month USD LIBOR -0.49bp today, now at 0.1756%; 3-Month OIS -0.7bp at 0.0775%

- The treasury yield curve flattened, with the 1s10s spread tightening -11.8 bp, now at 126.9 bp (YTD change: +46.4bp)

- 1Y: 0.2130% (down 4.3 bp)

- 2Y: 0.5078% (down 13.6 bp)

- 5Y: 1.1693% (down 17.6 bp)

- 7Y: 1.4001% (down 17.8 bp)

- 10Y: 1.4816% (down 16.1 bp)

- 30Y: 1.8274% (down 14.0 bp)

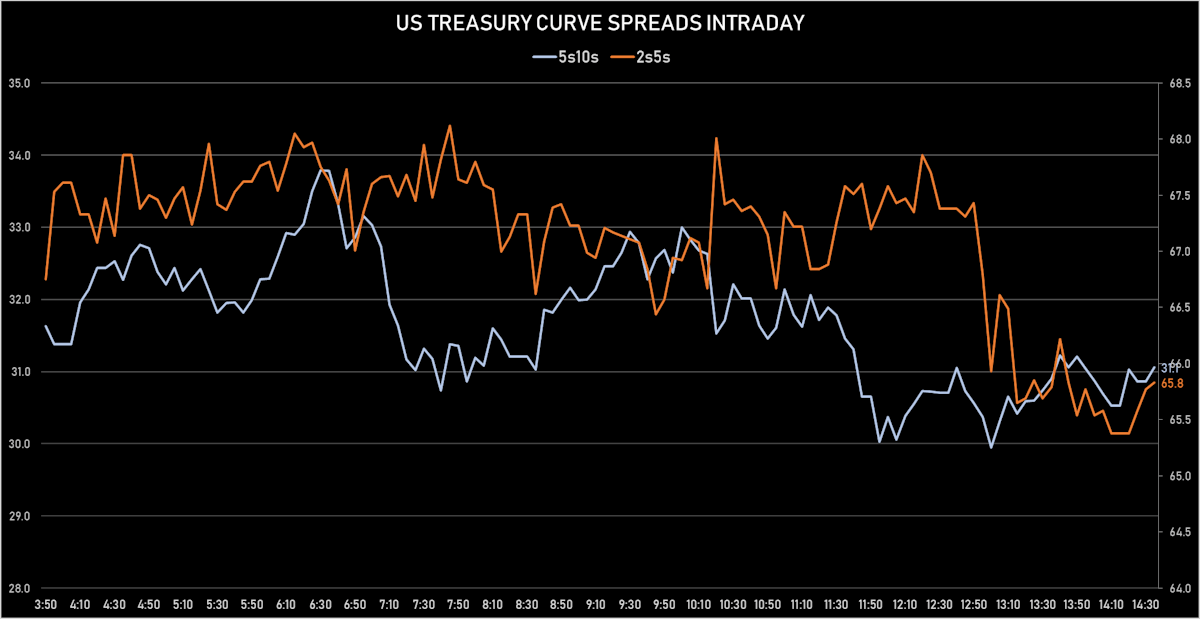

- US treasury curve spreads: 2s5s at 66.3bp (down -4.0bp), 5s10s at 31.3bp (up 1.8bp today), 10s30s at 34.5bp (up 2.1bp today)

- Treasuries butterfly spreads: 1s5s10s at -69.9bp (up 14.8bp today), 5s10s30s at 2.7bp (unchanged)

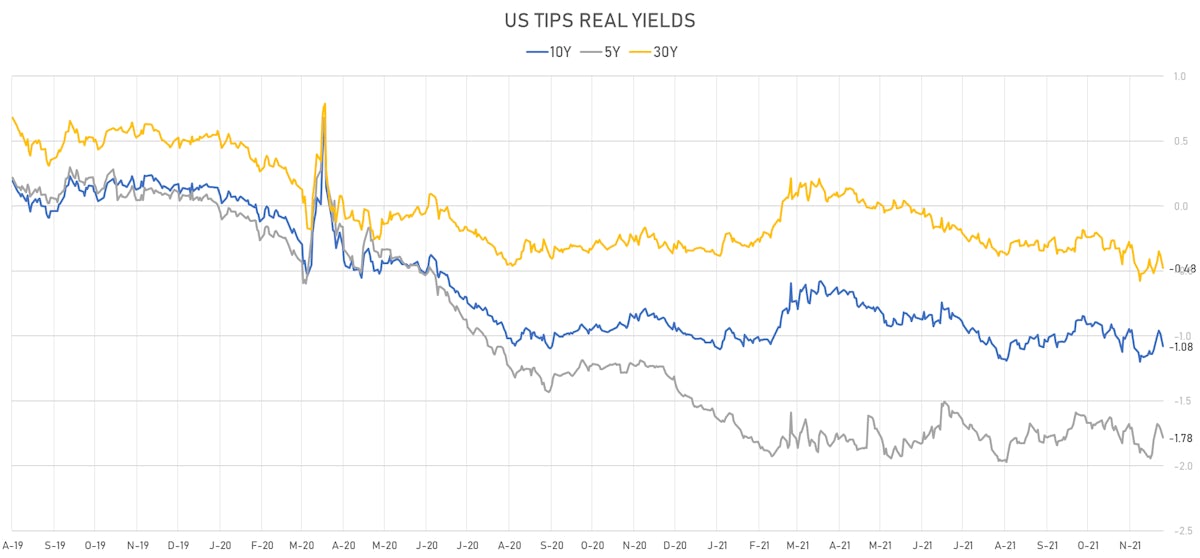

- US 5-Year TIPS Real Yield: -7.1 bp at -1.7840%; 10-Year TIPS Real Yield: -9.6 bp at -1.0800%; 30-Year TIPS Real Yield: -9.6 bp at -0.4770%

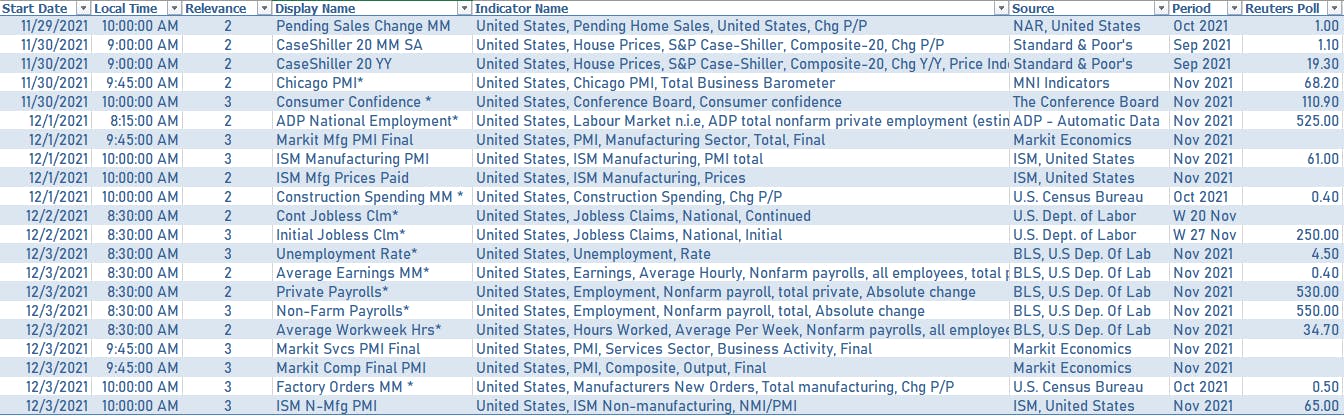

US MACRO RELEASES IN THE WEEK AHEAD

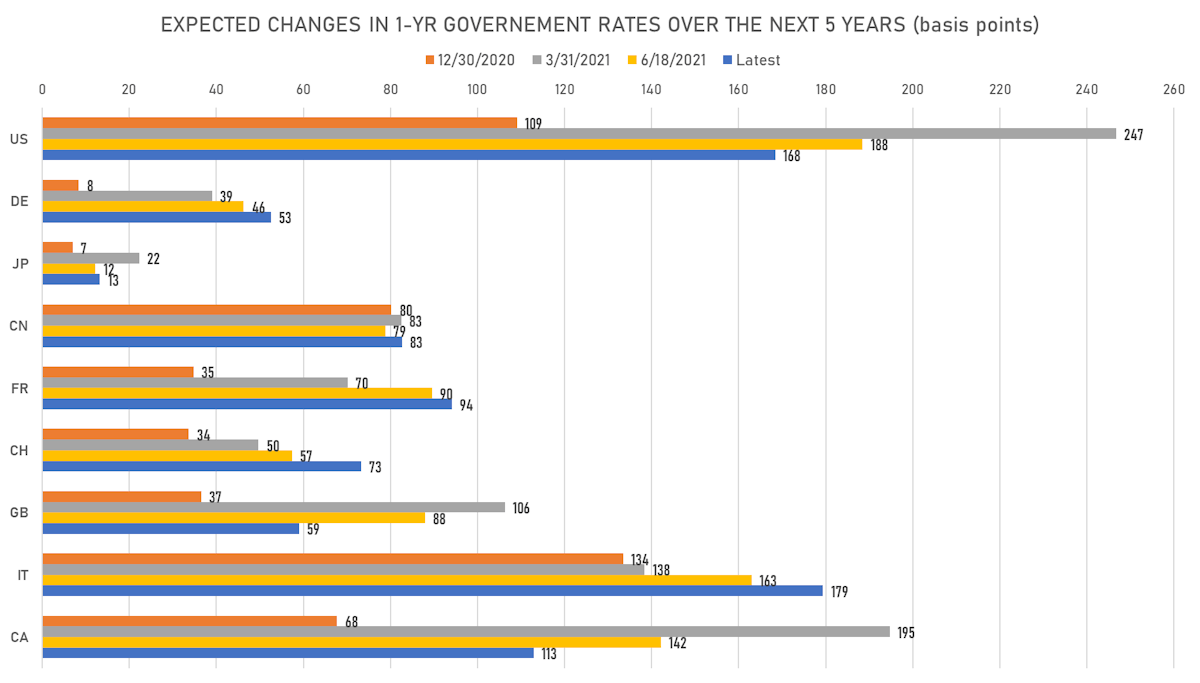

US FORWARD RATES

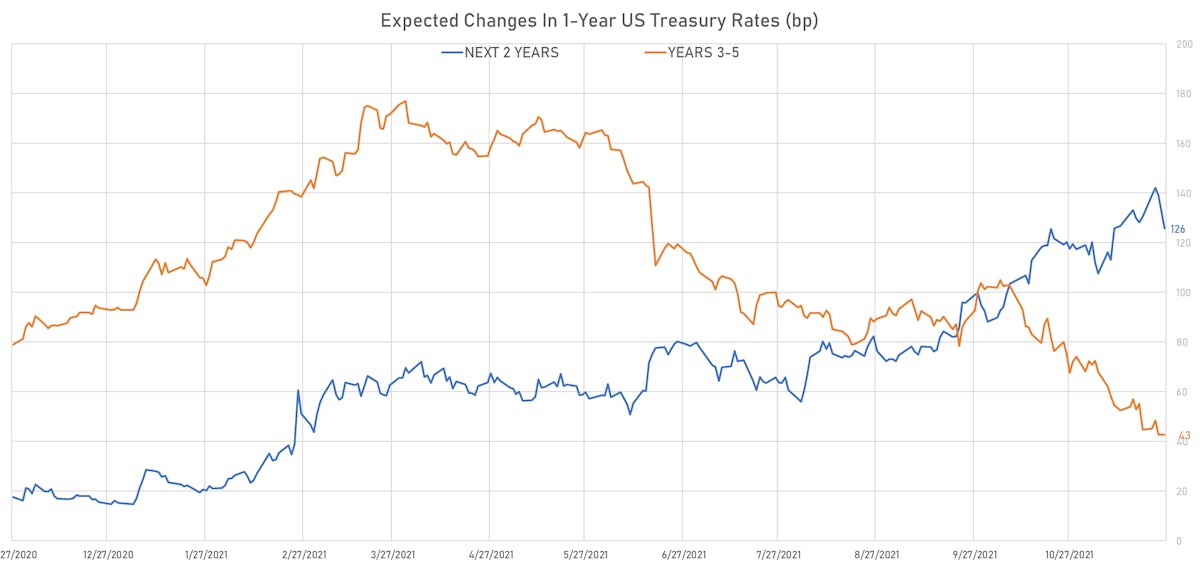

- 1-month USD OIS forward rates imply a change of 46bp by the end of 2022, equivalent to 1.8 Fed hikes

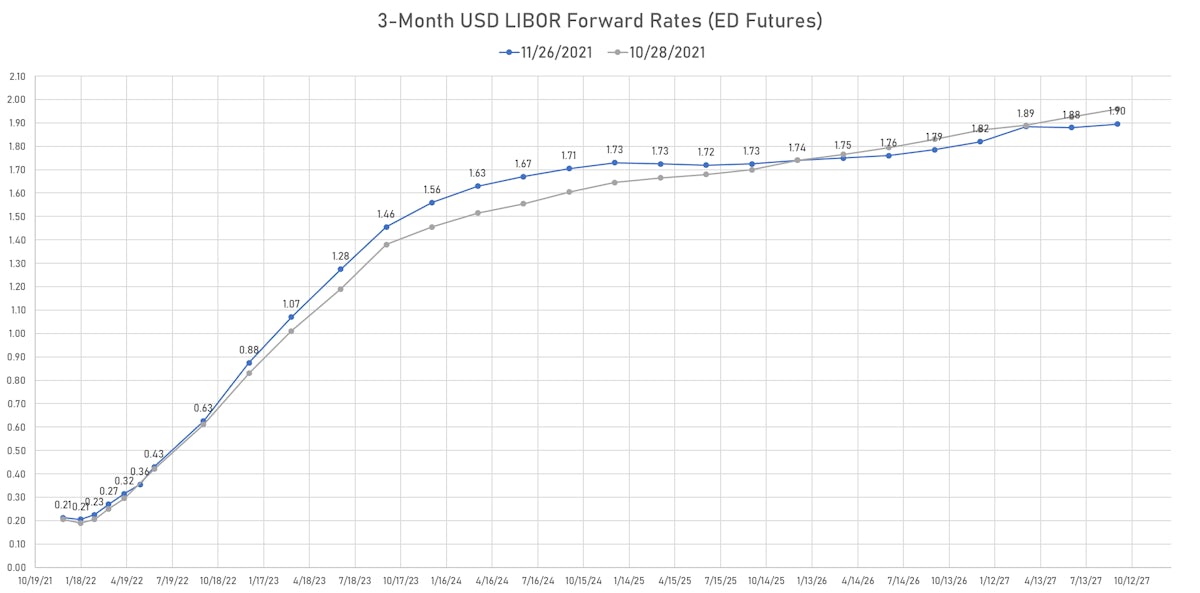

- 3-month Eurodollar future (EDU2) expected hike of 45.0 bp by the end of 2022 (equivalent to 1.8 hikes by end of 2022), down -15.5 bp today

- The 3-month USD OIS forward curve prices in 36.4 bp of rate hikes over the next 12 months (down -12.4 bp today), 73.1 bp of rate hikes over the following year (down -11.2 bp today), and 22.6 bp total rate hikes in years 3 to 5 (up 1.1 bp today)

- 1-year US Treasury rate 5 years forward down 19.4 bp, now at 1.8713%, meaning that the 1-year Treasury rate is now expected to increase by 168.4 bp over the next 5 years (equivalent to 6.7 rate hikes)

US INFLATION & REAL RATES

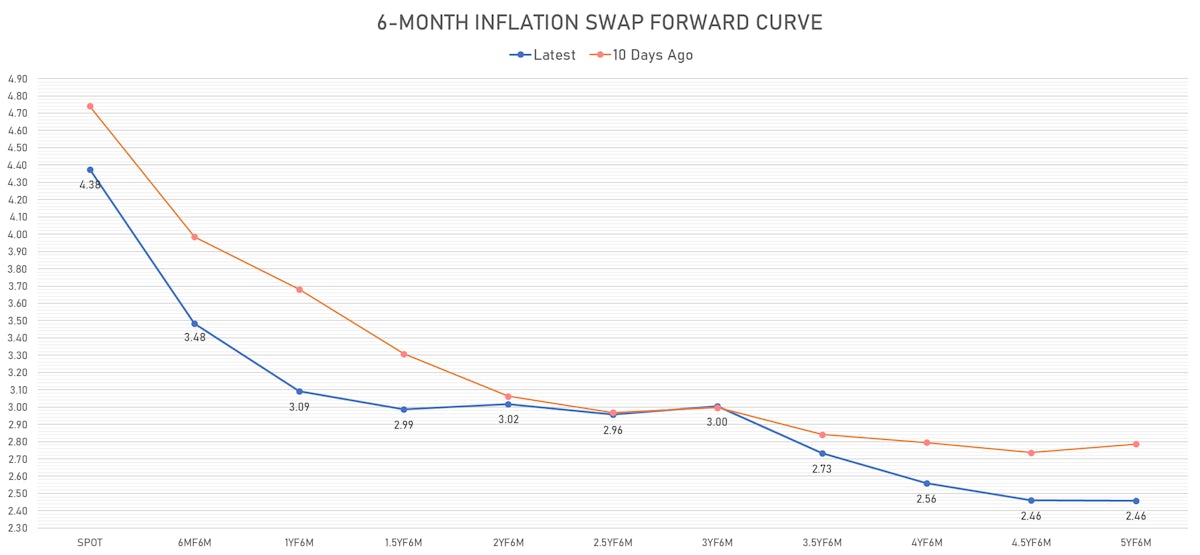

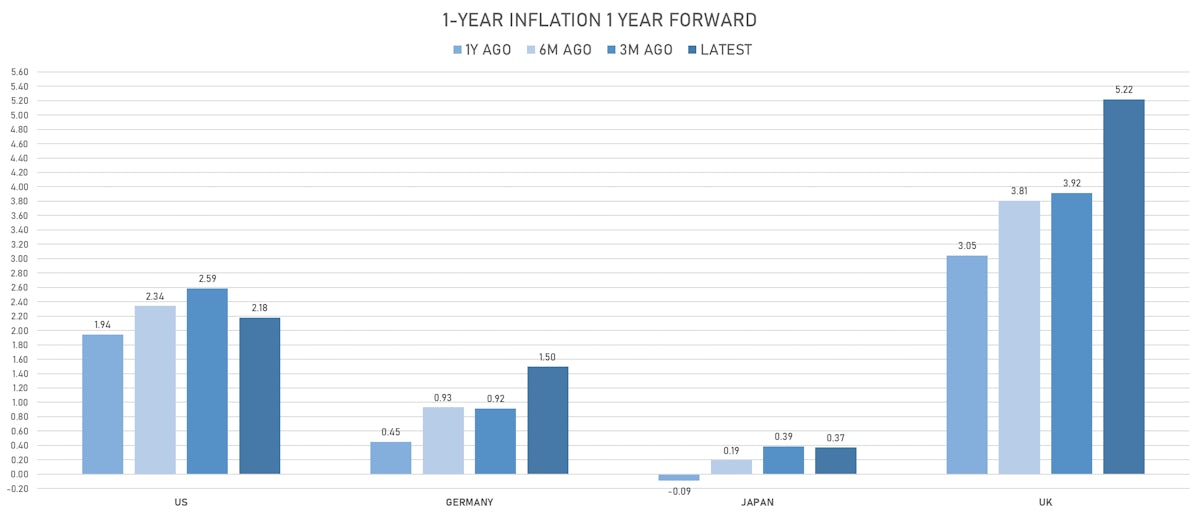

- TIPS 1Y breakeven inflation at 5.21% (down -38.2bp); 2Y at 3.70% (down -25.5bp); 5Y at 3.00% (down -11.8bp); 10Y at 2.53% (down -7.1bp); 30Y at 2.32% (down -4.8bp)

- 6-month spot US CPI swap down -29.1 bp to 4.375%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.7840%, -7.1 bp today; 10Y at -1.0800%, -9.6 bp today; 30Y at -0.4770%, -9.6 bp today

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 4.4% at 64.5%

- 3-Month LIBOR-OIS spread up 0.2 bp at 9.8 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.647% (down -7.3 bp); the German 1Y-10Y curve is 8.7 bp flatter at 43.2bp (YTD change: +27.9 bp)

- Japan 5Y: -0.012% (down -0.6 bp); the Japanese 1Y-10Y curve is 0.4 bp flatter at 20.1bp (YTD change: +6.6 bp)

- China 5Y: 2.669% (down -3.2 bp); the Chinese 1Y-10Y curve is 0.9 bp flatter at 74.2bp (YTD change: +27.8 bp)

- Switzerland 5Y: -0.511% (down -6.4 bp); the Swiss 1Y-10Y curve is 13.6 bp flatter at 47.8bp (YTD change: +21.3 bp)