Rates

Treasury Yields Rise At The Open, Fall Intraday To Close Just Off The Lows As Powell's Written Testimony Seen Tilting Dovish On Omicron

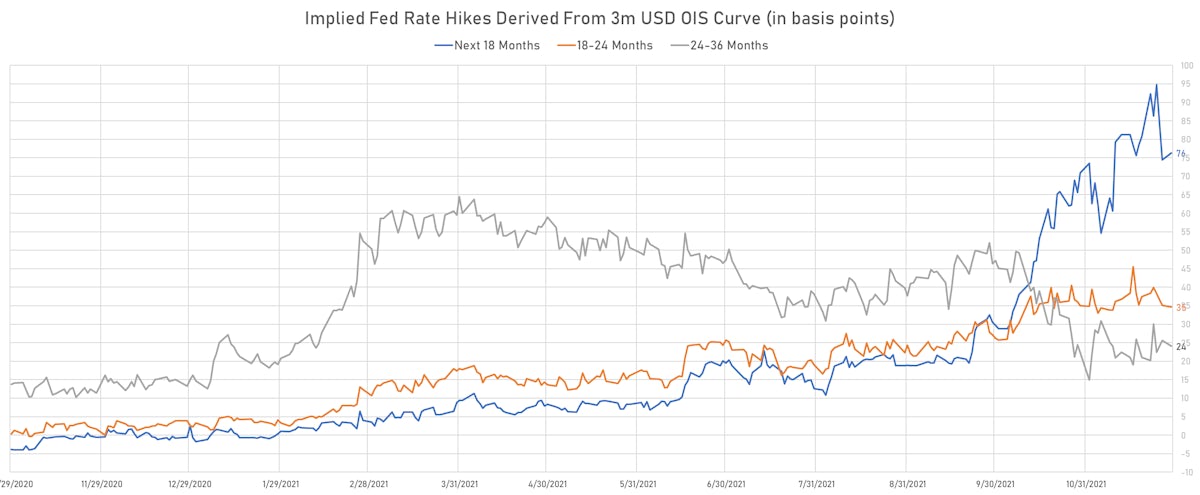

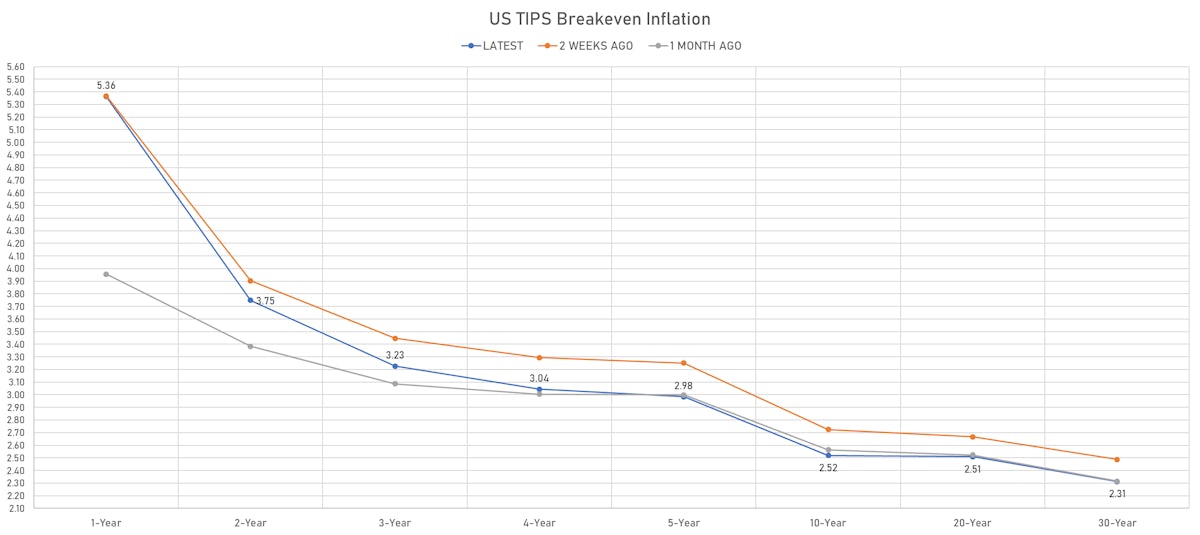

Inflation breakevens rose further as front-end rates have come down sharply in the last couple of sessions: total Fed hikes by the end of 2022, derived from December '22 Fed Funds Futures (FFZ2), are down 20bp since last Wednesday to just 44bp now

Published ET

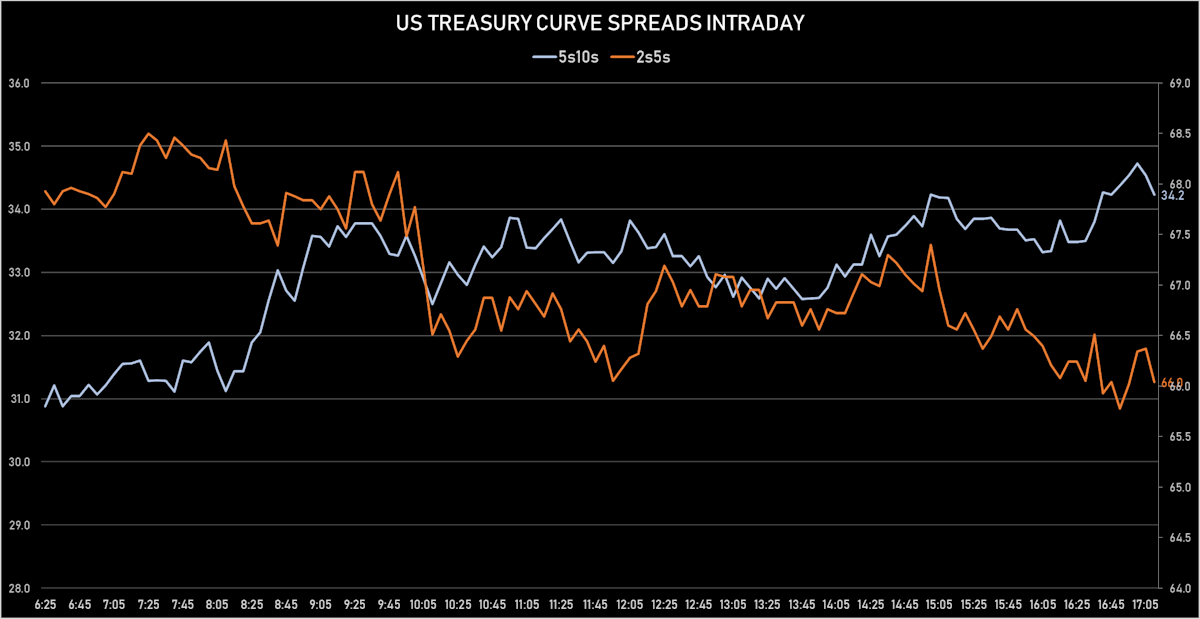

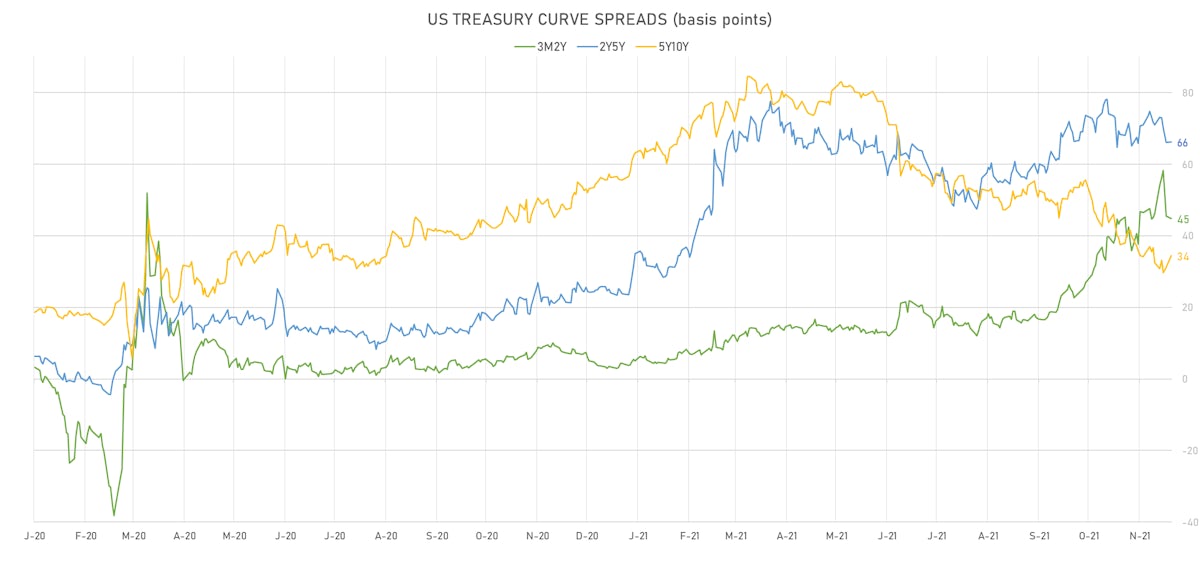

US Treasury Curve Spreads | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

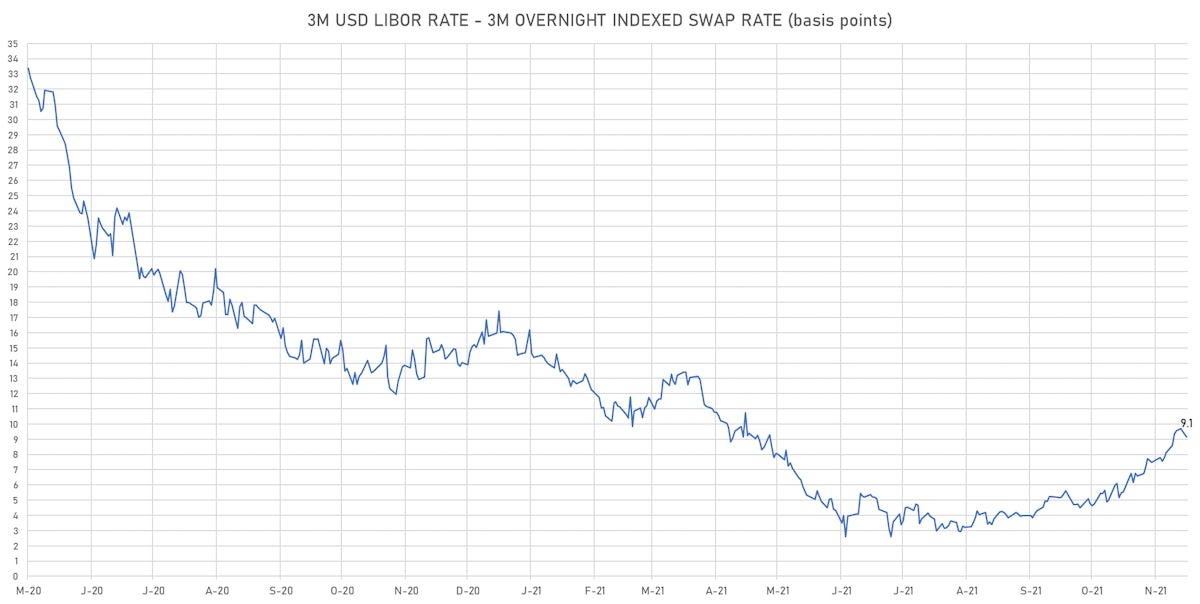

- 3-Month USD LIBOR -0.45bp today, now at 0.1754%; 3-Month OIS +0.1bp at 0.0795%

- The treasury yield curve flattened, with the 1s10s spread tightening -0.2 bp, now at 132.4 bp (YTD change: +52.0bp)

- 1Y: 0.1780% (up 2.3 bp)

- 2Y: 0.4961% (down 1.2 bp)

- 5Y: 1.1581% (down 1.1 bp)

- 7Y: 1.4036% (up 0.4 bp)

- 10Y: 1.5021% (up 2.1 bp)

- 30Y: 1.8559% (up 2.9 bp)

- US treasury curve spreads: 2s5s at 66.3bp (up 0.6bp today), 5s10s at 34.4bp (up 3.7bp today), 10s30s at 35.4bp (up 1.0bp today)

- Treasuries butterfly spreads: 1s5s10s at -63.8bp (up 6.1bp today), 5s10s30s at 0.4bp (down -2.3bp)

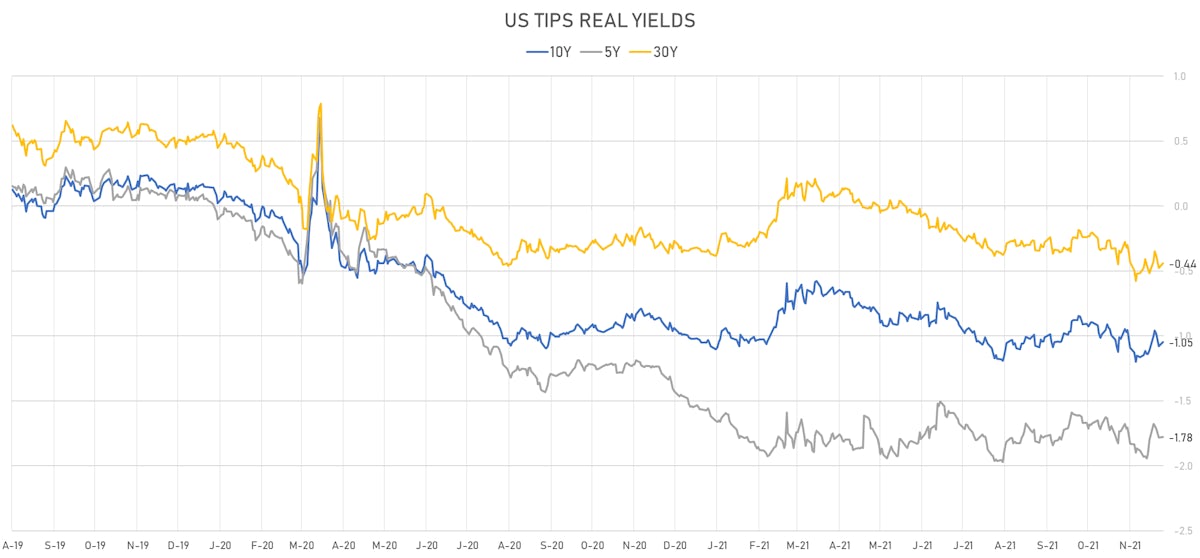

- US 5-Year TIPS Real Yield: +0.7 bp at -1.7770%; 10-Year TIPS Real Yield: +3.2 bp at -1.0480%; 30-Year TIPS Real Yield: +3.7 bp at -0.4400%

US MACRO RELEASES

- Dallas Fed, General Business Activity for Nov 2021 (Fed Reserve, Dallas) at 11.80 (vs 14.60 prior)

- Pending Home Sales, United States for Oct 2021 (NAR, United States) at 125.20 (vs 116.70 prior)

- Pending Home Sales, United States, Change P/P for Oct 2021 (NAR, United States) at 7.50 % (vs -2.30 % prior), above consensus estimate of 0.90 %

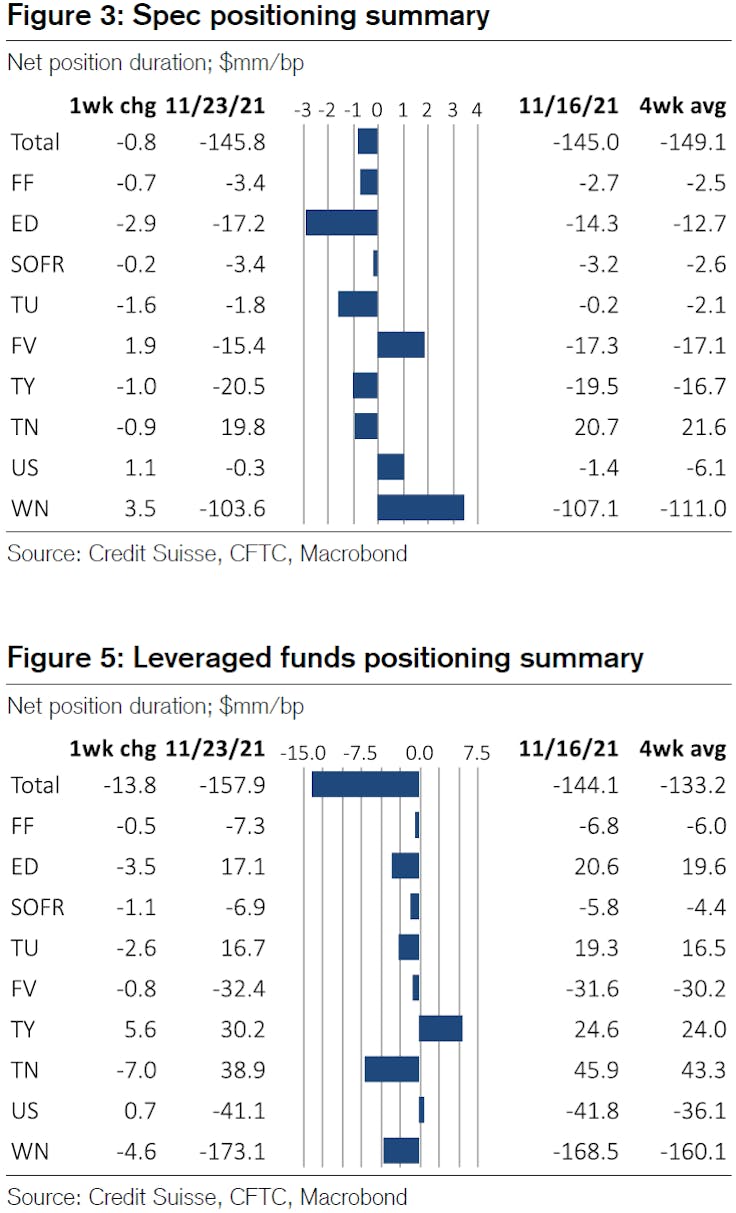

WEEKLY CFTC NET INTEREST RATES POSITIONING DATA

- Specs didn't change their net duration, but increased their net short duration at the front end of the curve and reduced their net short duration at the far end of the curve

- Leveraged increased their net short duration overall, with a slight decrease in net long duration at the front end and increase in net short duration at the far end

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 41.9 bp by the end of 2022 (equivalent to 1.7 hikes by end of 2022), down -3.1 bp today

- 1-month USD OIS 12-months forward now prices in 43.7 bp of Fed hikes by the end of December 2022

- The 3-month USD OIS forward curve prices in 34.6 bp of rate hikes over the next 12 months (down -1.8 bp today), 76.3 bp of rate hikes over the following year (up 3.3 bp today), and 29.8 bp total rate hikes in years 3 to 5 (up 7.2 bp today)

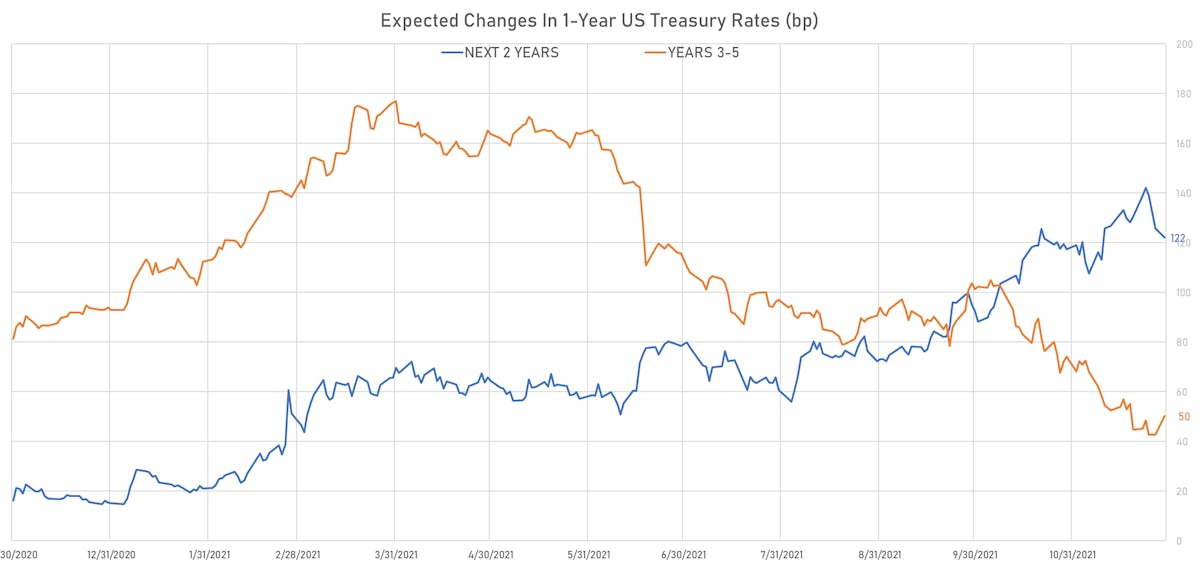

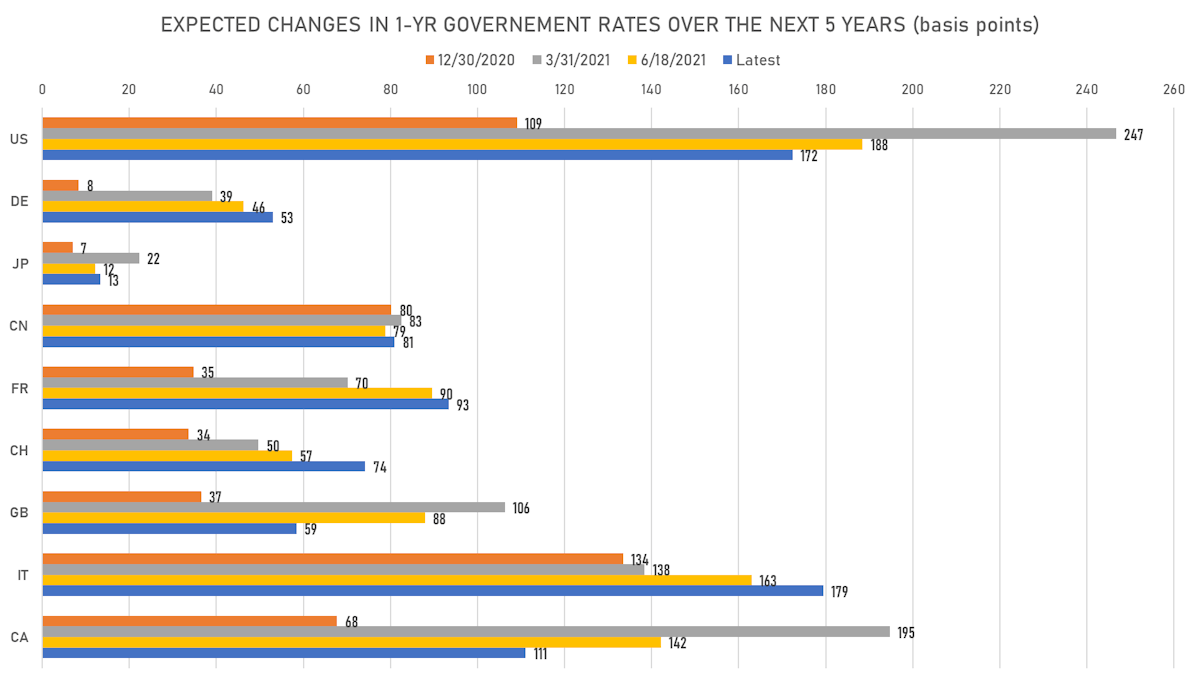

- 1-year US Treasury rate 5 years forward up 4.5 bp, now at 1.9163%, meaning that the 1-year Treasury rate is now expected to increase by 172.4 bp over the next 5 years (equivalent to 6.9 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.36% (up 15.7bp); 2Y at 3.75% (up 4.6bp); 5Y at 2.98% (down -2.2bp); 10Y at 2.52% (down -1.3bp); 30Y at 2.31% (down -0.9bp)

- 6-month spot US CPI swap up 8.9 bp to 4.464%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.7770%, +0.7 bp today; 10Y at -1.0480%, +3.2 bp today; 30Y at -0.4400%, +3.7 bp today

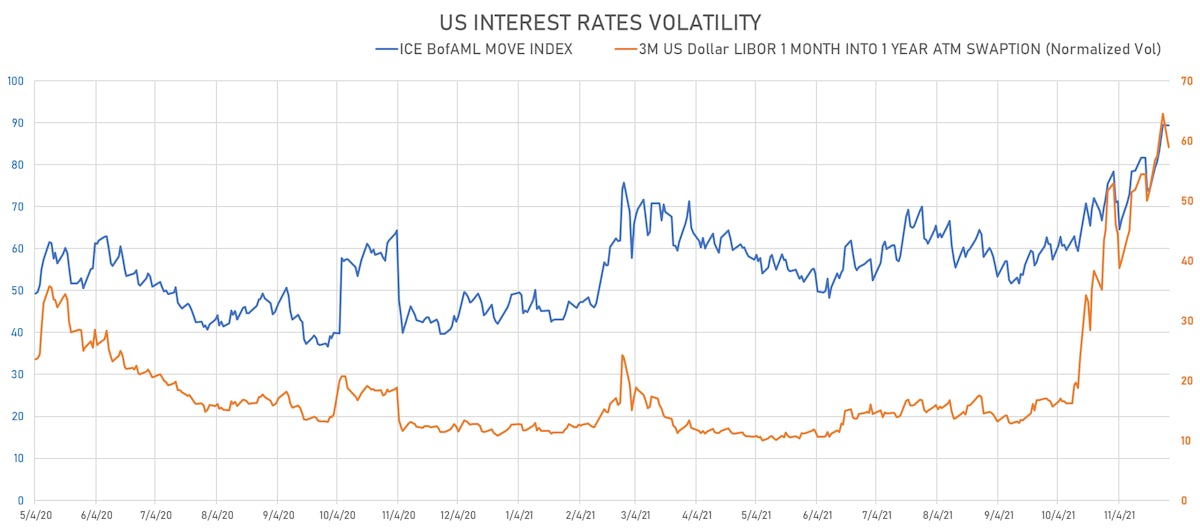

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -5.6% at 58.9%

- 3-Month LIBOR-OIS spread down -0.6 bp at 9.1 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

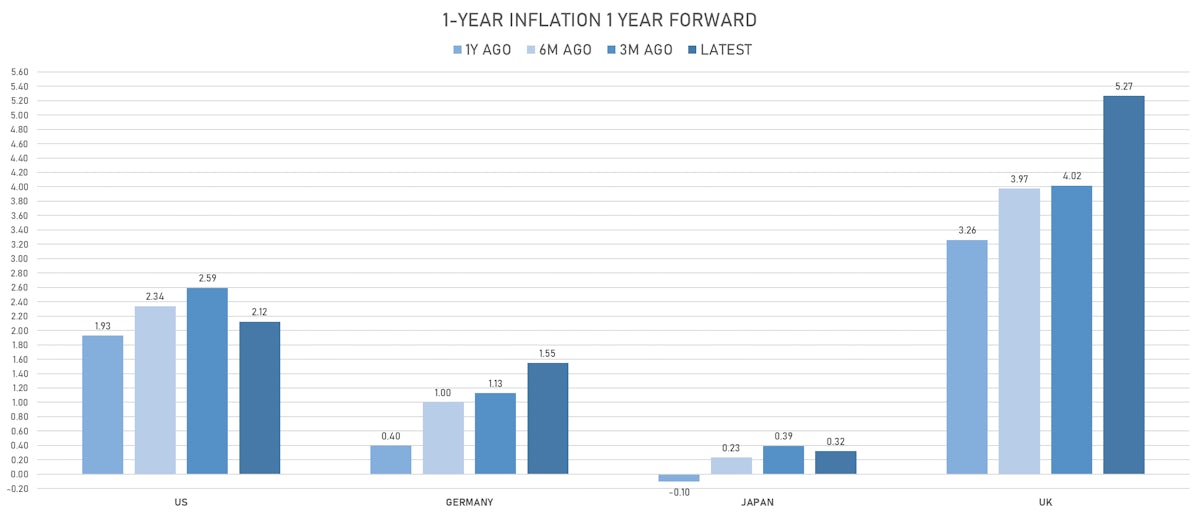

- Germany 5Y: -0.624% (up 1.8 bp); the German 1Y-10Y curve is 1.5 bp steeper at 45.7bp (YTD change: +29.4 bp)

- Japan 5Y: -0.085% (down -0.4 bp); the Japanese 1Y-10Y curve is 0.2 bp steeper at 19.9bp (YTD change: +6.8 bp)

- China 5Y: 2.670% (up 0.1 bp); the Chinese 1Y-10Y curve is 3.0 bp flatter at 71.2bp (YTD change: +24.8 bp)

- Switzerland 5Y: -0.496% (up 3.0 bp); the Swiss 1Y-10Y curve is 7.6 bp steeper at 55.3bp (YTD change: +28.9 bp)