Rates

Rates Rise At The Front End Of The Curve As Powell Says It's Time to Retire The Word Transitory To Describe Inflation

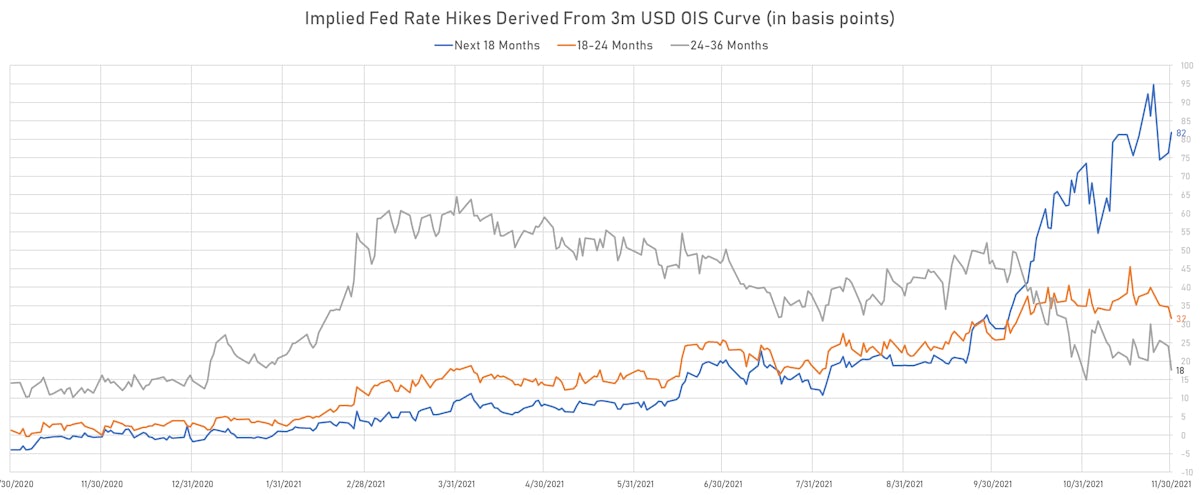

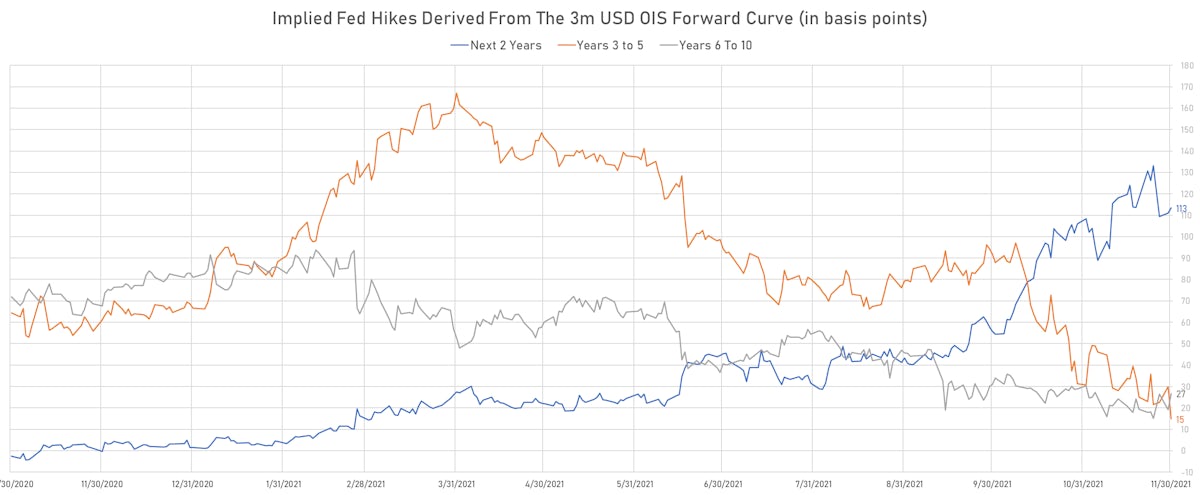

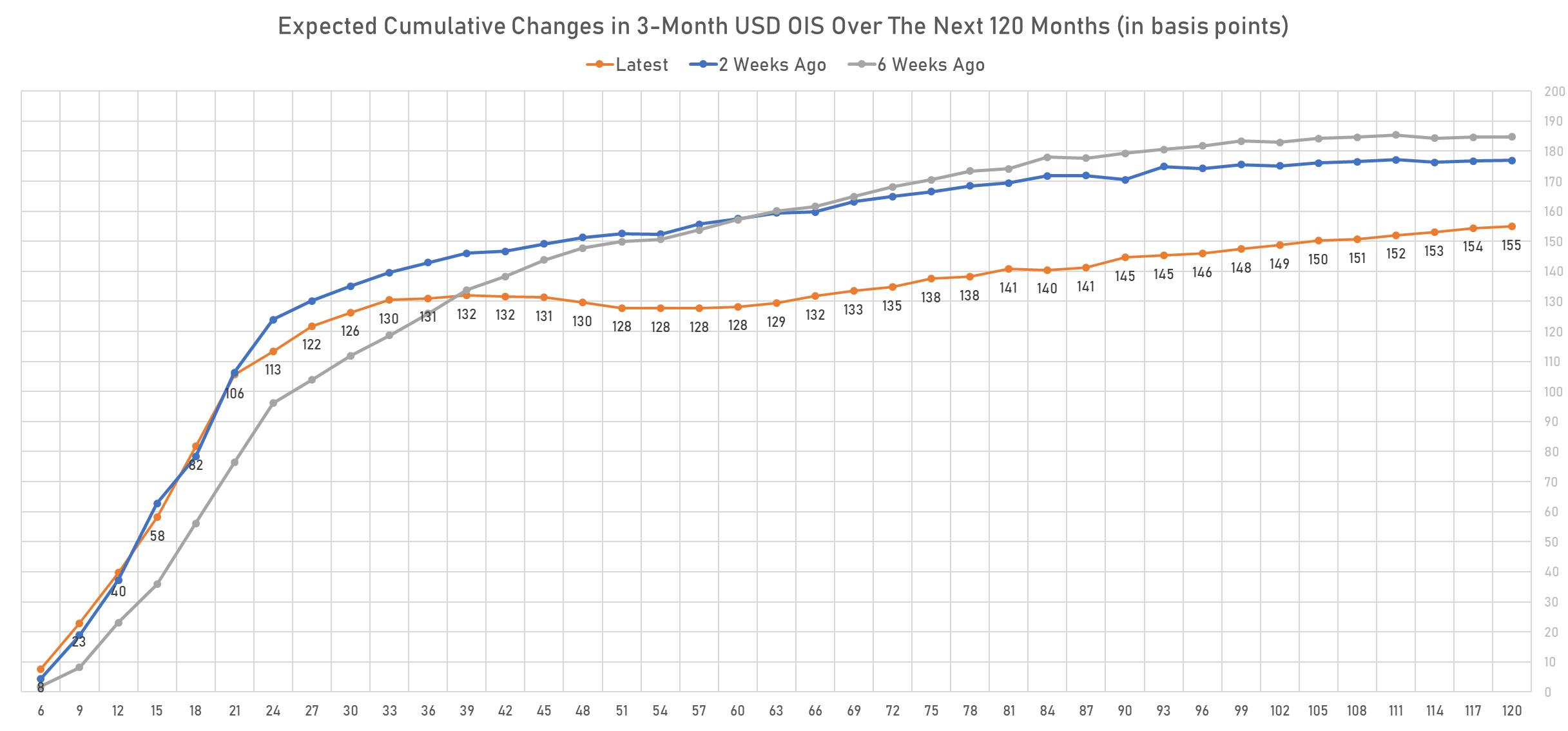

A lot of volatility as forward rates are again pricing in at least 2 hikes through 2022, with implied yields in December 2022 Fed Funds futures (FFZ2) rising 10bp in a reversal of Monday's drop

Published ET

Fed Hikes Priced Into The 3M USD OIS Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

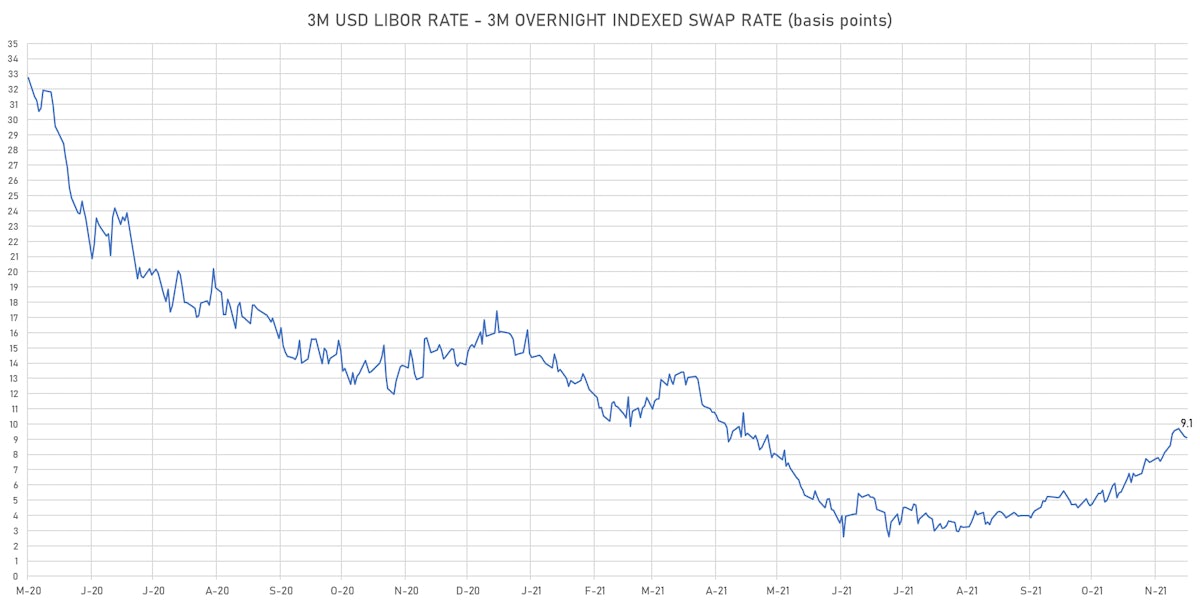

- 3-Month USD LIBOR +0.24bp today, now at 0.1709%; 3-Month OIS +0.3bp at 0.0820%

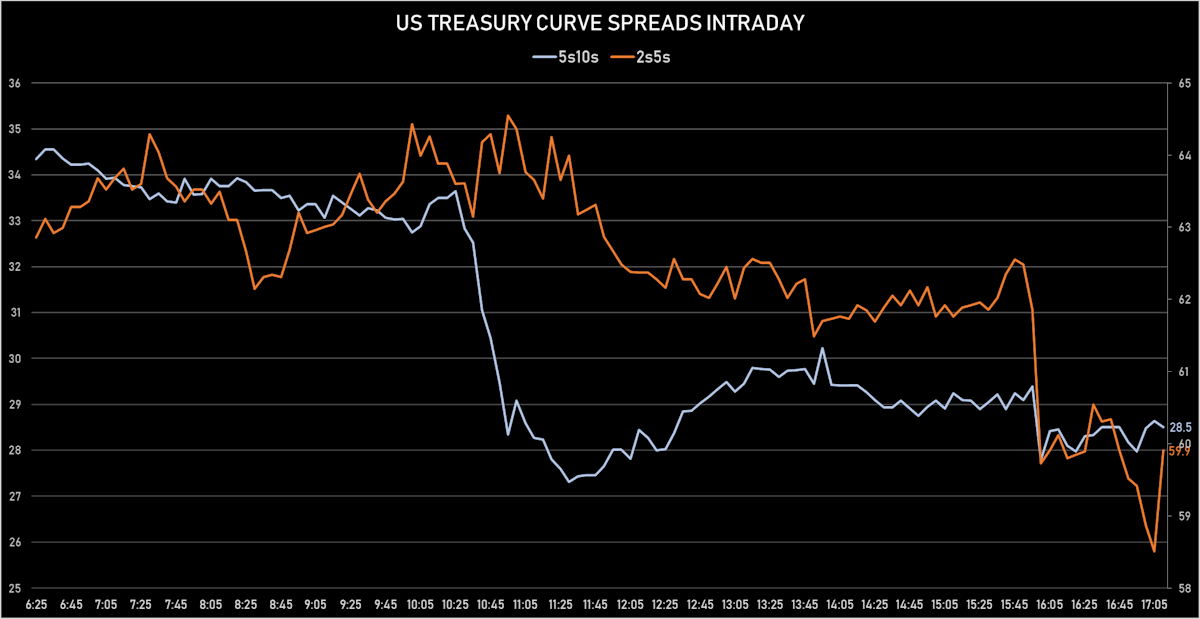

- The treasury yield curve flattened, with the 1s10s spread tightening -8.2 bp, now at 126.3 bp (YTD change: +45.9bp)

- 1Y: 0.1930% (up 3.6 bp)

- 2Y: 0.5670% (up 7.1 bp)

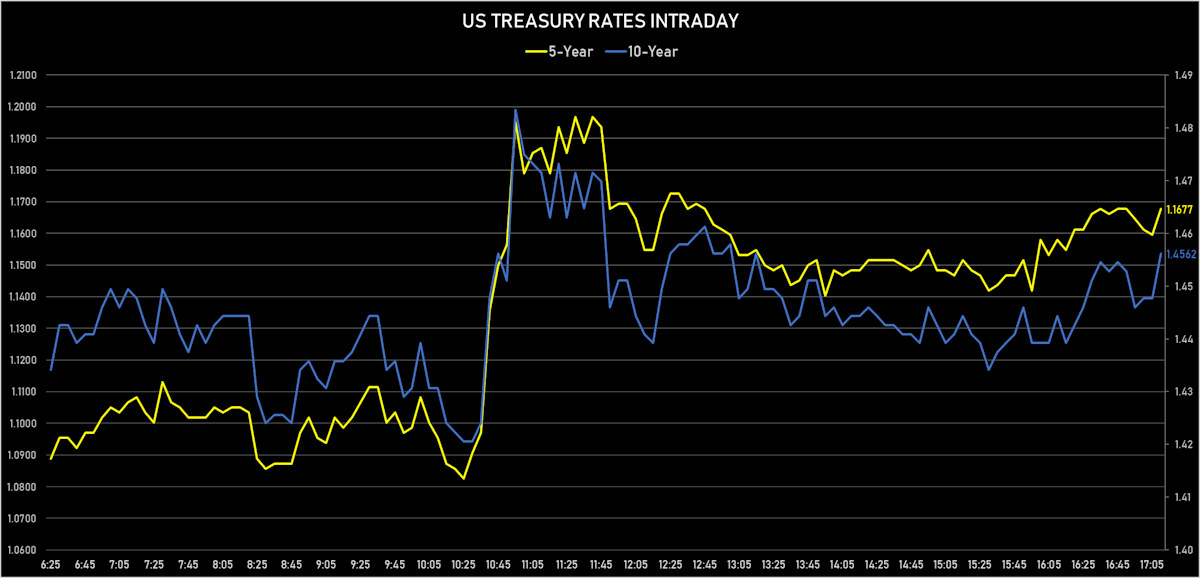

- 5Y: 1.1677% (up 1.0 bp)

- 7Y: 1.3813% (down 2.2 bp)

- 10Y: 1.4562% (down 4.6 bp)

- 30Y: 1.8025% (down 5.3 bp)

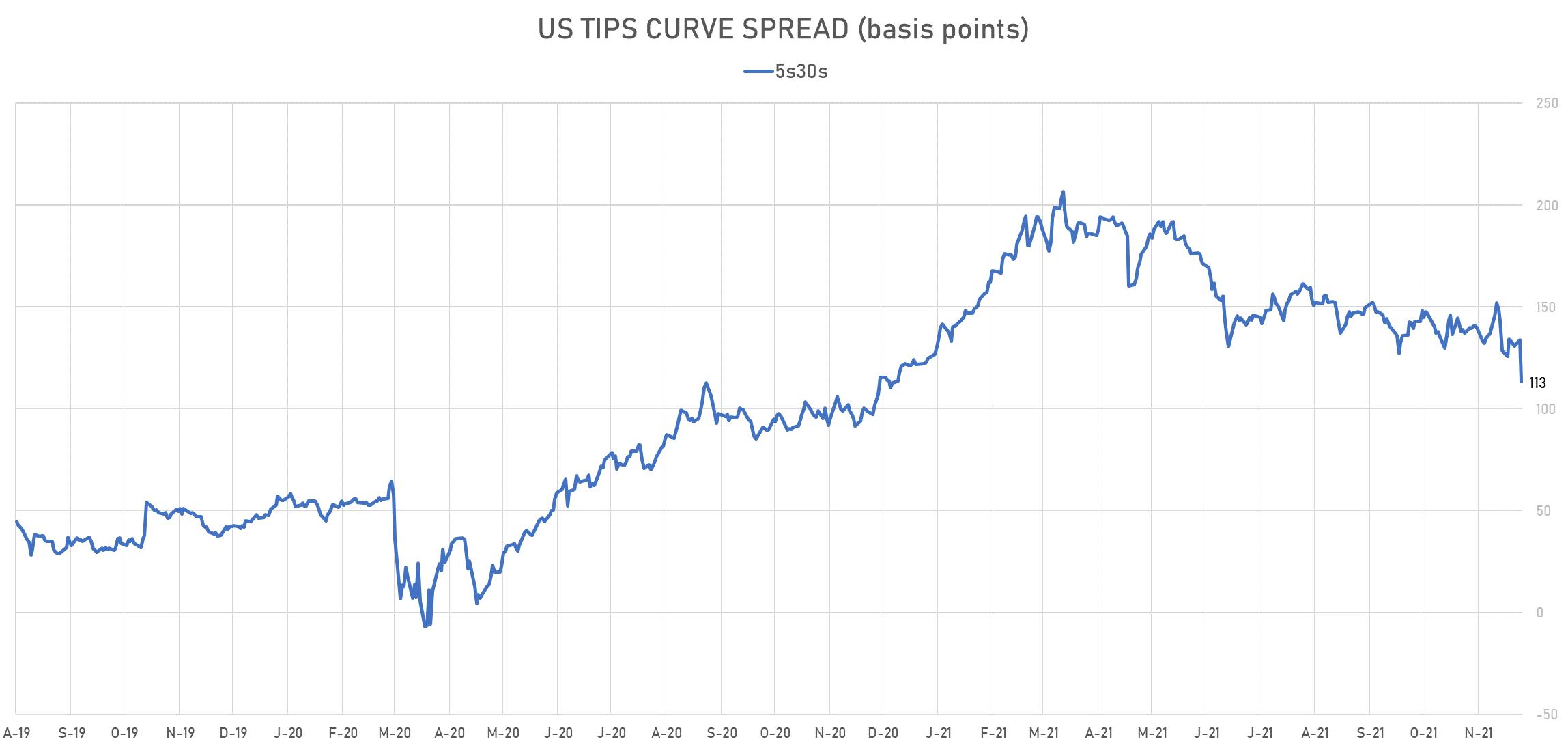

- US treasury curve spreads: 2s5s at 60.2bp (down -7.5bp), 5s10s at 28.8bp (down -6.2bp), 10s30s at 34.8bp (down -1.0bp)

- Treasuries butterfly spreads: 1s5s10s at -66.9bp (down -3.1bp), 5s10s30s at 5.6bp (up 5.2bp)

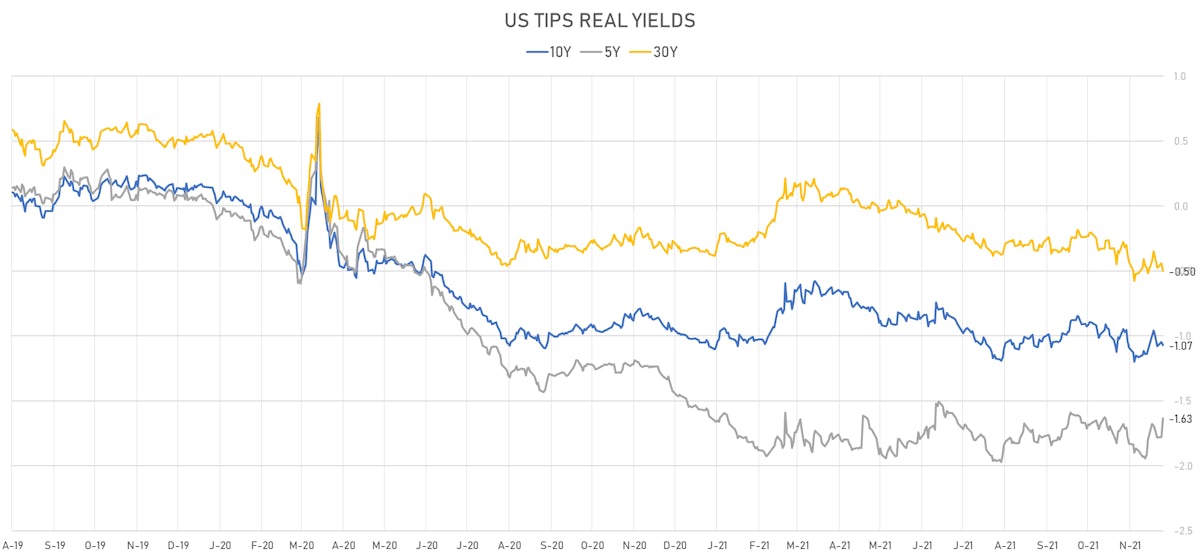

- US 5-Year TIPS Real Yield: +14.5 bp at -1.6320%; 10-Year TIPS Real Yield: -2.2 bp at -1.0700%; 30-Year TIPS Real Yield: -6.0 bp at -0.5000%

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 27 Nov (Redbook Research) at 21.90 % (vs 15.40 % prior)

- Chicago PMI, Total Business Barometer for Nov 2021 (MNI Indicators) at 61.80 (vs 68.40 prior), below consensus estimate of 67.00

- Consumer confidence for Nov 2021 (The Conference Board) at 109.50 (vs 113.80 prior), below consensus estimate of 111.00

- Dallas Fed, General Business Activity for Nov 2021 (Fed Reserve, Dallas) at 22.70 (vs 20.70 prior)

- Dallas Fed, Revenue (Sales for TROS) for Nov 2021 (Fed Reserve, Dallas) at 25.40 (vs 19.60 prior)

- House Prices, FHFA, USA (Purchase-Only) for Sep 2021 (OFHEO, United States) at 354.60 (vs 351.70 prior)

- House Prices, FHFA, USA (Purchase-Only), Change P/P for Sep 2021 (OFHEO, United States) at 0.90 % (vs 1.00 % prior)

- House Prices, FHFA, USA (Purchase-Only), Change Y/Y for Sep 2021 (OFHEO, United States) at 17.70 % (vs 18.50 % prior)

- House Prices, S&P Case-Shiller, Composite-20, Change P/P for Sep 2021 (Standard & Poor's) at 1.00 % (vs 1.20 % prior), below consensus estimate of 1.20 %

- House Prices, S&P Case-Shiller, Composite-20, Change P/P, Price Index for Sep 2021 (Standard & Poor's) at 0.80 % (vs 0.90 % prior)

- House Prices, S&P Case-Shiller, Composite-20, Change Y/Y, Price Index for Sep 2021 (Standard & Poor's) at 19.10 % (vs 19.70 % prior), below consensus estimate of 19.30 %

OUR TRANSLATION OF WHAT RATES MARKETS ARE SAYING

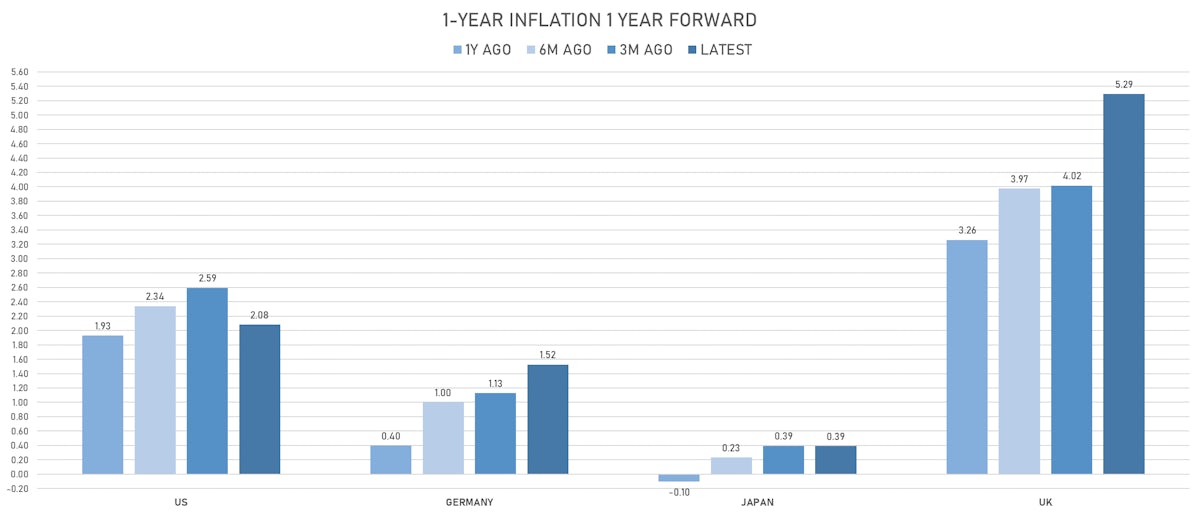

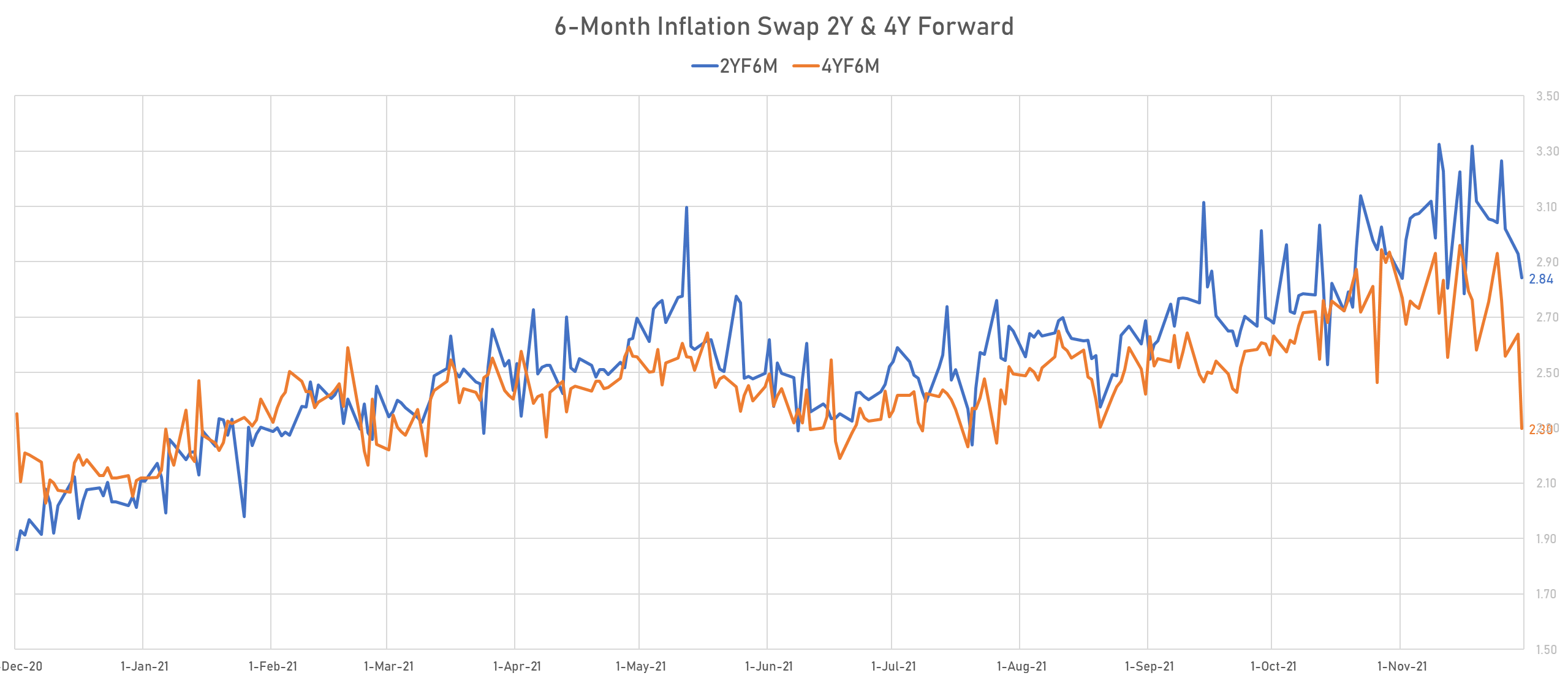

- They are starting to believe the Fed is serious and will be successful in containing inflation, as evidenced by the slide in inflation expectations today

- They also see GDP growth seriously impacted by efforts to bring back price stability: the US TIPS 5s10s spread, an indicator of forward growth, fell hard today

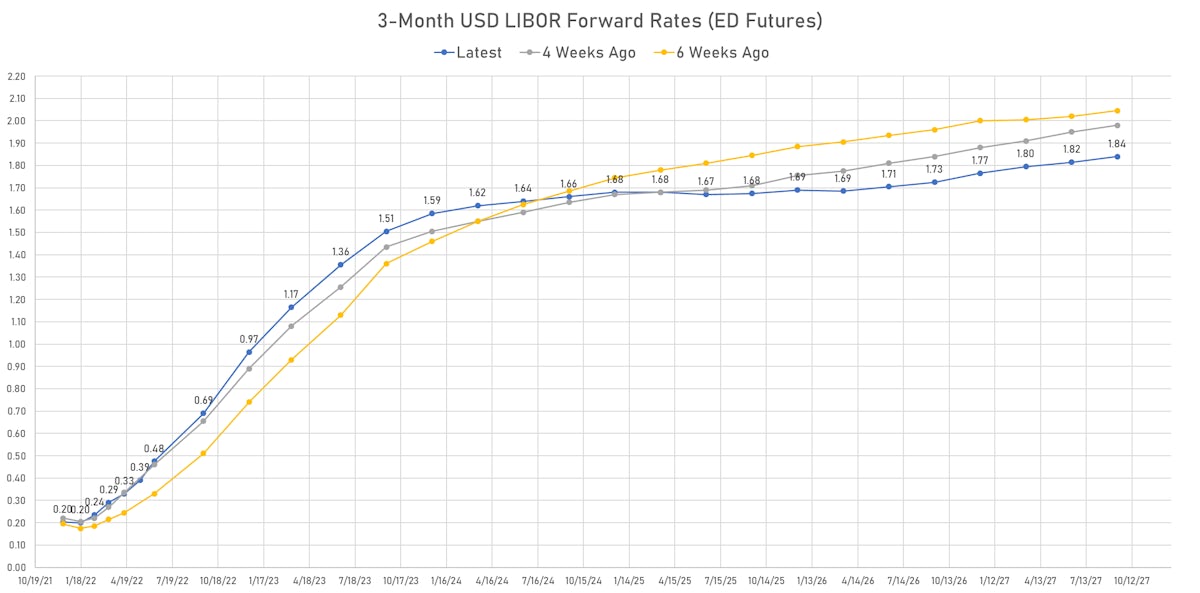

- The Fed policy normalization will be fast and short: short-term interest rates 3 years forward (3M USD OIS and 3M USD LIBOR) are flat to lower. It means STIR markets are pricing in a non-zero probability that the Fed may have to go into reverse and cut rates again once inflation expectations are back in desired range

- We would not characterize that as a policy error anymore, as it's now a Sophie's choice: with unanchored inflation expectations, it's become impossible for the Fed to fulfill the two pillars of its mandate simultaneously

US FORWARD RATES

- 1-month USD OIS 12-months forward now prices in 53.3 bp of Fed hikes by the end of 2022

- 3-month Eurodollar future (EDU2) expected hike of 51.7 bp by the end of 2022 (equivalent to 2.1 hikes by end of 2022), up 9.8 bp today

- The 3-month USD OIS forward curve prices in 39.7 bp of rate hikes by the end of November '22 (up 5.1 bp today), 73.7 bp of rate hikes over the following year (down -2.6 bp today), and 14.8 bp total rate hikes in years 3 to 5 (down -15.0 bp today)

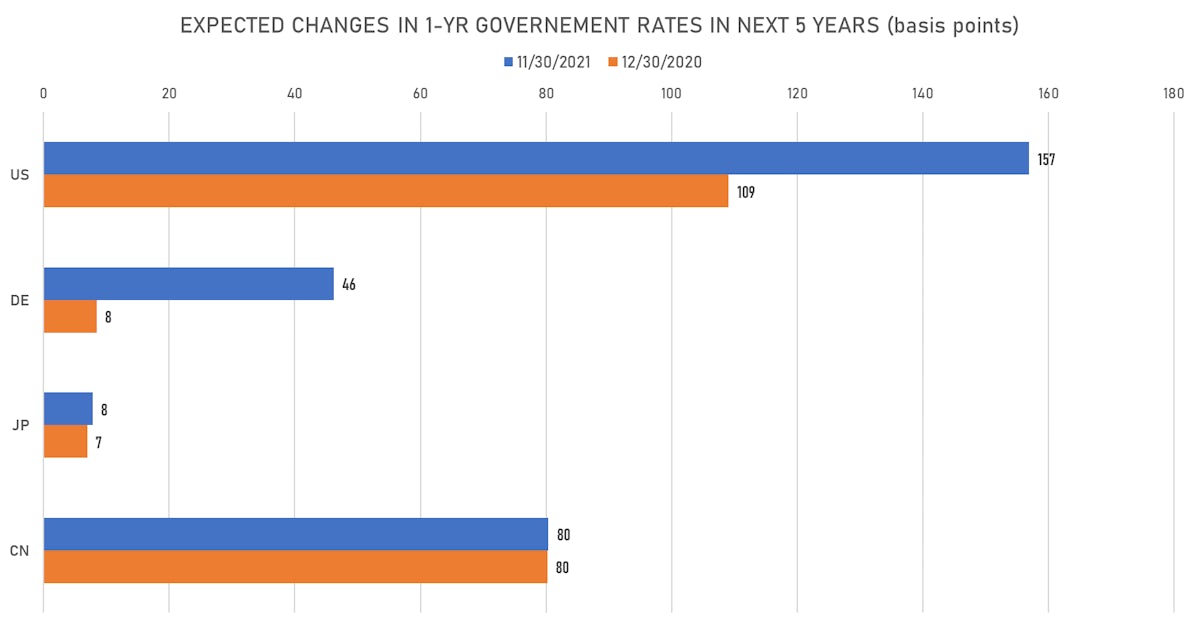

- 1-year US Treasury rate 5 years forward down 10.3 bp, now at 1.8132%, meaning that the 1-year Treasury rate is now expected to increase by 156.9 bp over the next 5 years (equivalent to 6.3 rate hikes)

US INFLATION & REAL RATES

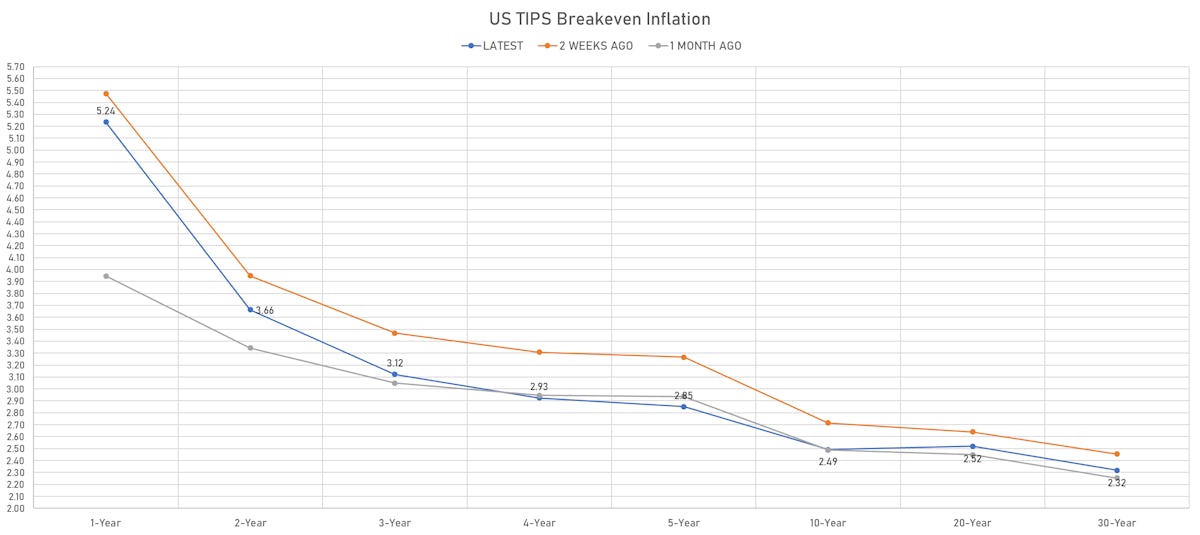

- TIPS 1Y breakeven inflation at 5.24% (down -12.7bp); 2Y at 3.66% (down -8.6bp); 5Y at 2.85% (down -13.3bp); 10Y at 2.49% (down -2.7bp); 30Y at 2.32% (up 0.6bp)

- 6-month spot US CPI swap down -10.5 bp to 4.359%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.6320%, +14.5 bp today; 10Y at -1.0700%, -2.2 bp today; 30Y at -0.5000%, -6.0 bp today

RATES VOLATILITY & LIQUIDITY

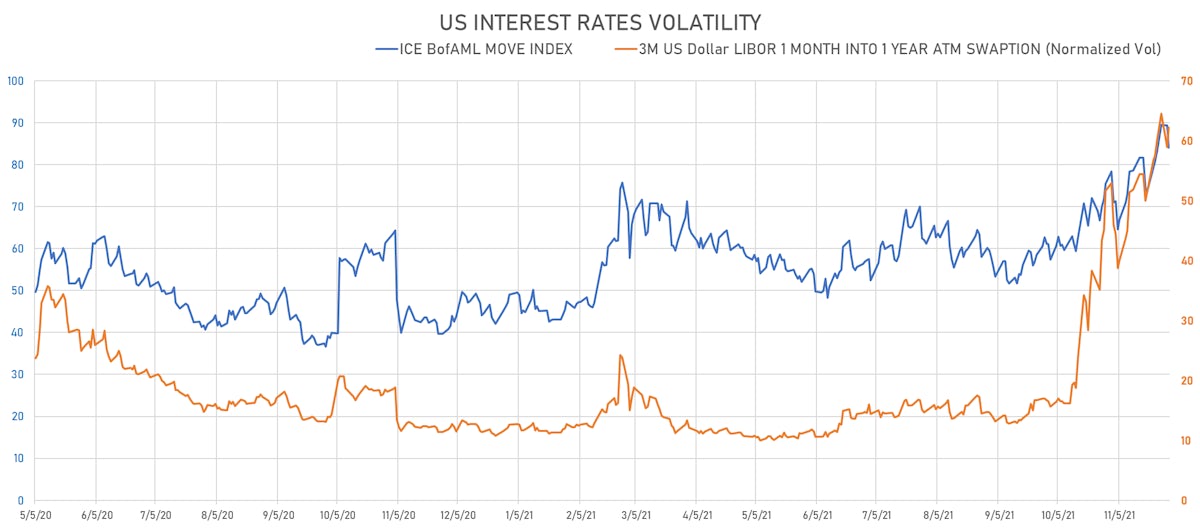

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 3.3% at 62.2%

- 3-Month LIBOR-OIS spread down -0.1 bp at 9.1 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.618% (up 0.7 bp); the German 1Y-10Y curve is 2.0 bp flatter at 42.6bp (YTD change: +27.4 bp)

- Japan 5Y: -0.094% (down -1.0 bp); the Japanese 1Y-10Y curve is 2.8 bp flatter at 18.5bp (YTD change: +4.0 bp)

- China 5Y: 2.680% (up 1.0 bp); the Chinese 1Y-10Y curve is 1.4 bp flatter at 69.8bp (YTD change: +23.4 bp)

- Switzerland 5Y: -0.497% (down -0.1 bp); the Swiss 1Y-10Y curve is 5.0 bp flatter at 51.1bp (YTD change: +23.9 bp)