Rates

Familiar Story Playing Out As The Fed Appears Committed To Dealing With Inflation: Front-End Rates Rose Today And The Curve Flattened

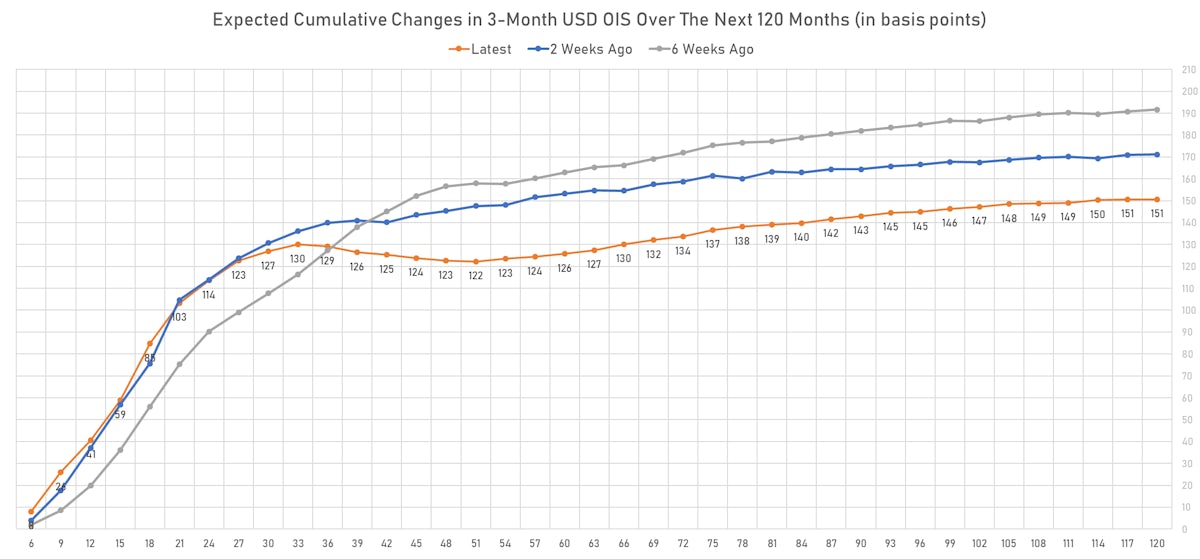

The market is currently pricing in just a little more than 2 hikes through 2022, with about 80% chance of a hike by the end of June; that is less hawkish than notable sell-side economists like GS who see 3 hikes through 2022

Published ET

Fed Hikes Priced Into 1M USD OIS Forward Rates | Source: Refinitiv

QUICK US SUMMARY

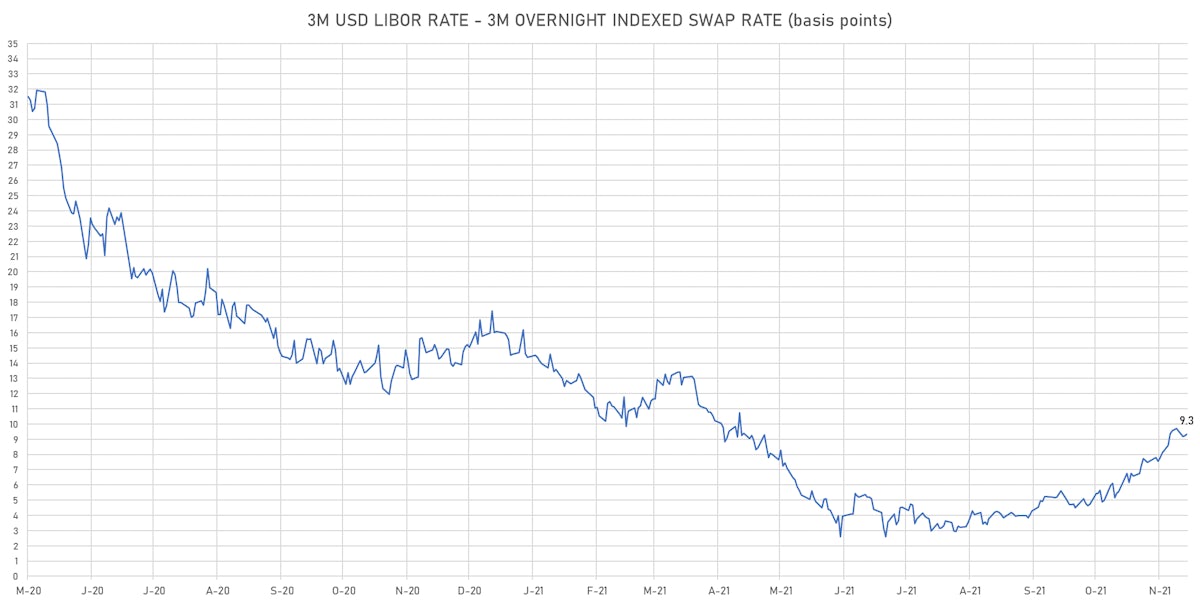

- 3-Month USD LIBOR +0.13bp today, now at 0.1733%; 3-Month OIS +0.1bp at 0.0815%

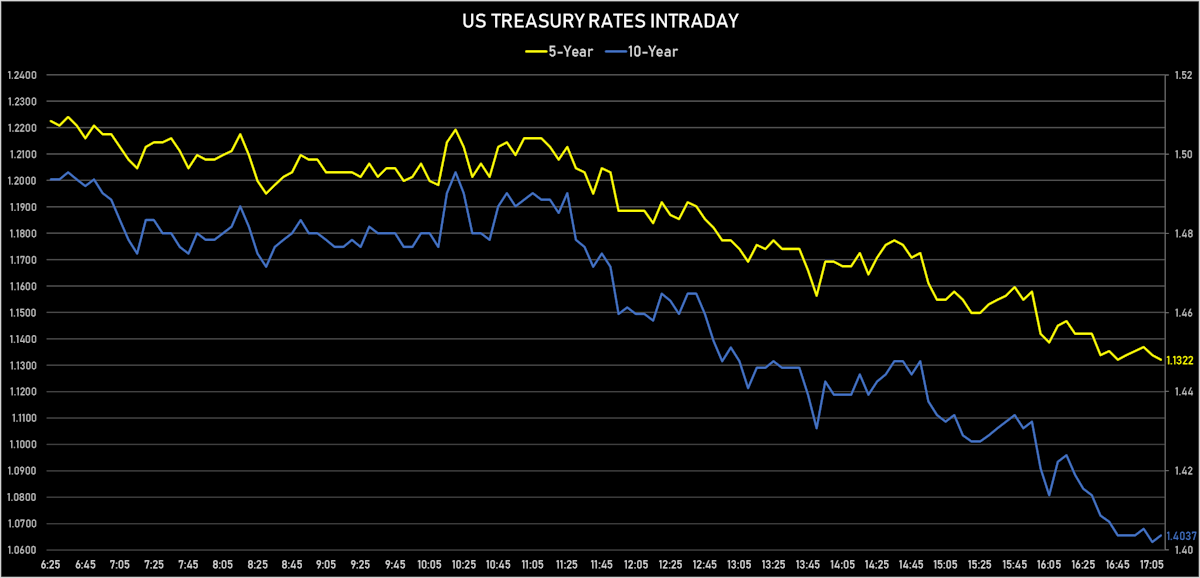

- The treasury yield curve flattened, with the 1s10s spread tightening -6.5 bp, now at 123.5 bp (YTD change: +43.1bp)

- 1Y: 0.2210% (up 1.3 bp)

- 2Y: 0.5670% (down 1.6 bp)

- 5Y: 1.1677% (down 3.5 bp)

- 7Y: 1.3813% (down 5.3 bp)

- 10Y: 1.4562% (down 5.3 bp)

- 30Y: 1.8025% (down 5.8 bp)

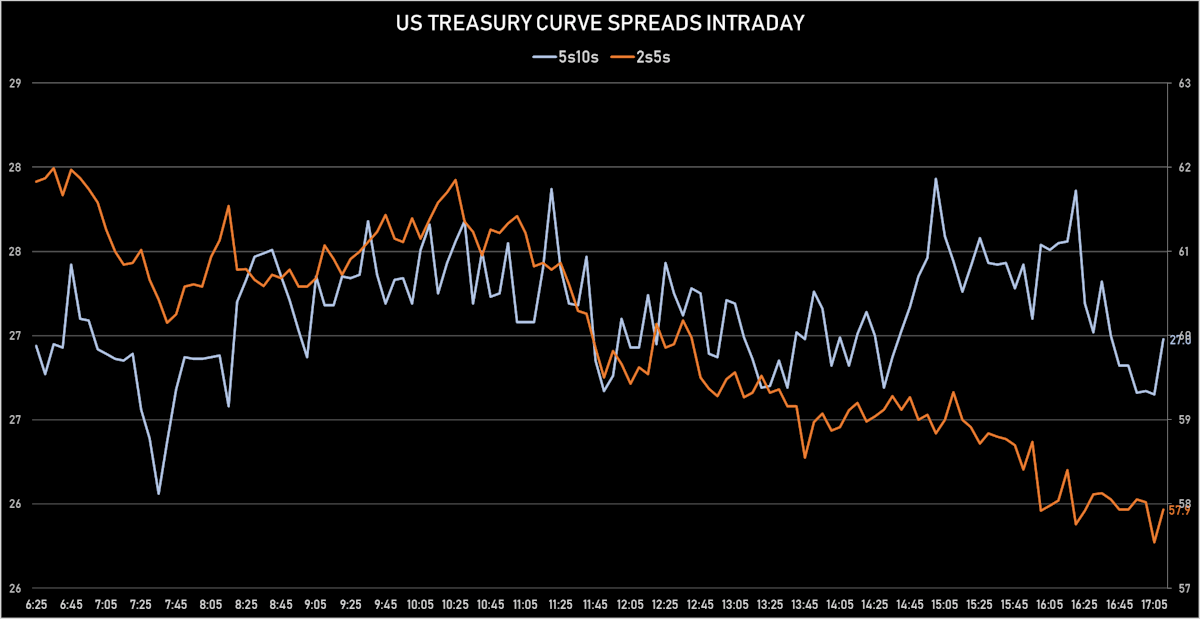

- US treasury curve spreads: 2s5s at 58.2bp (down -0.9bp), 5s10s at 27.2bp (down -1.8bp), 10s30s at 34.1bp (down -0.9bp)

- Treasuries butterfly spreads: 1s5s10s at -62.6bp (up 4.3bp today), 5s10s30s at 6.5bp (up 0.9bp)

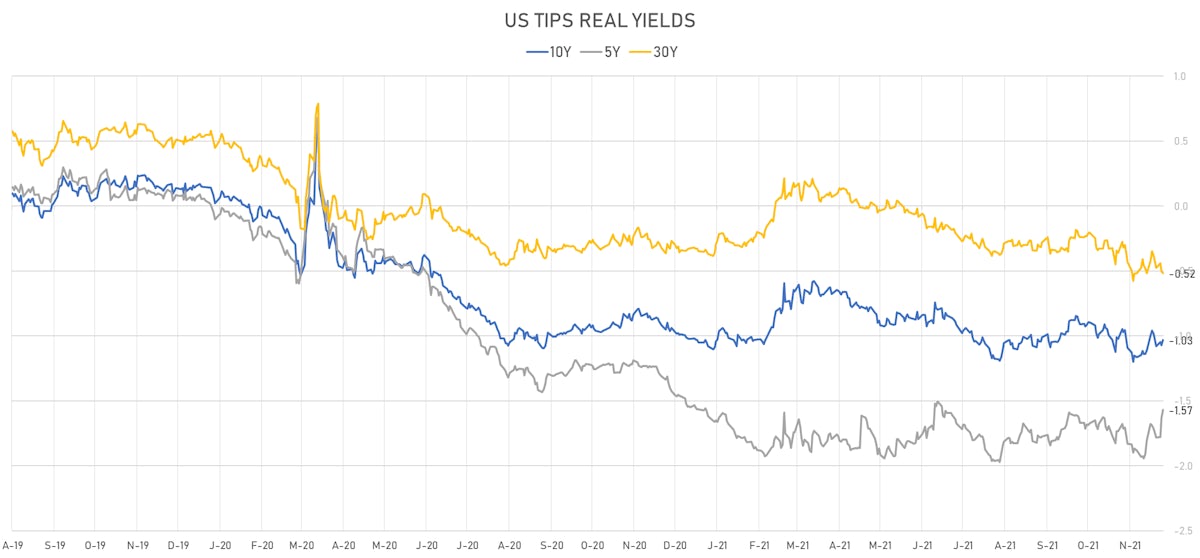

- US 5-Year TIPS Real Yield: +6.1 bp at -1.5710%; 10-Year TIPS Real Yield: +3.7 bp at -1.0330%; 30-Year TIPS Real Yield: -1.8 bp at -0.5180%

US MACRO RELEASES

- Construction Spending, Change P/P for Oct 2021 (U.S. Census Bureau) at 0.20 % (vs -0.50 % prior), below consensus estimate of 0.40 %

- ISM Manufacturing, Employment for Nov 2021 (ISM, United States) at 53.30 (vs 52.00 prior)

- ISM Manufacturing, New orders for Nov 2021 (ISM, United States) at 61.50 (vs 59.80 prior)

- ISM Manufacturing, PMI total for Nov 2021 (ISM, United States) at 61.10 (vs 60.80 prior), above consensus estimate of 61.00

- ISM Manufacturing, Prices for Nov 2021 (ISM, United States) at 82.40 (vs 85.70 prior), below consensus estimate of 85.50

- ADP total nonfarm private employment (estimate), Absolute change for Nov 2021 (ADP - Automatic Data) at 534.00 k (vs 571.00 k prior), above consensus estimate of 525.00 k

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 26 Nov (MBA, USA) at -7.20 % (vs 1.80 % prior)

- Mortgage applications, market composite index for W 26 Nov (MBA, USA) at 604.20 (vs 651.30 prior)

- Mortgage applications, market composite index, purchase for W 26 Nov (MBA, USA) at 310.70 (vs 295.70 prior)

- Mortgage applications, market composite index, refinancing for W 26 Nov (MBA, USA) at 2304.50 (vs 2706.20 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 26 Nov (MBA, USA) at 3.31 % (vs 3.24 % prior)

- PMI, Manufacturing Sector, Total, Final for Nov 2021 (Markit Economics) at 58.30 (vs 59.10 prior)

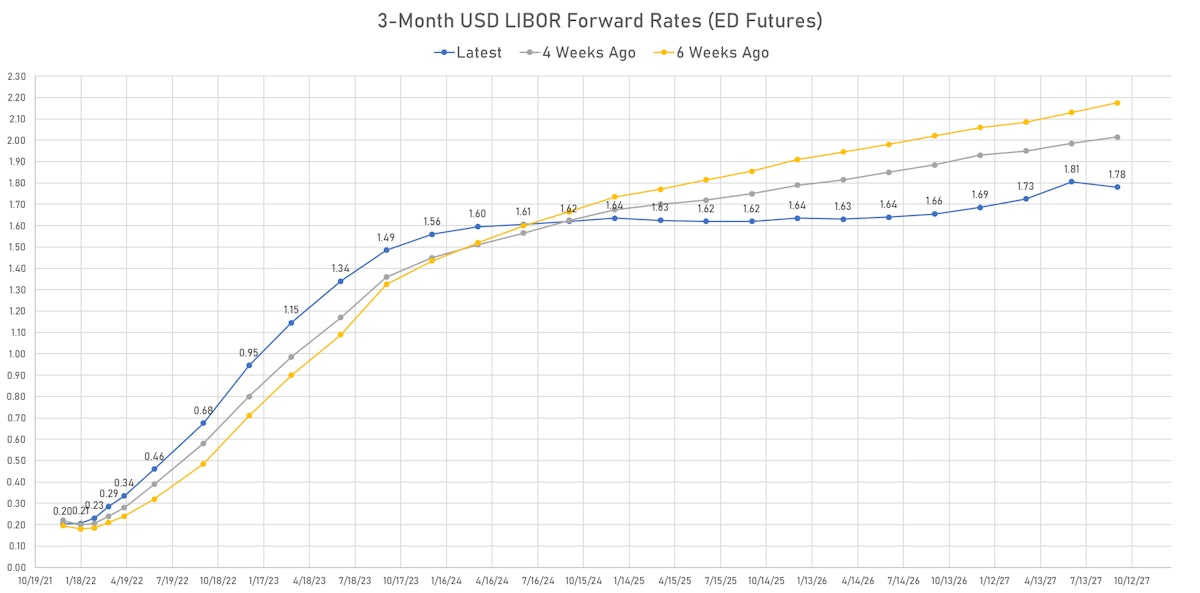

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 50.0 bp by the end of 2022 (equivalent to 2.0 hikes by end of 2022), down -1.6 bp today

- 1-month USD OIS 12-months forward now prices in 54.3 bp of Fed hikes through 2022

- The 3-month USD OIS forward curve prices in 58.9 bp of rate hikes over the next 15 months (equivalent to 2.35 rate hikes) and 129.2 bp over the next 3 years (equivalent to 5.17 rate hikes)

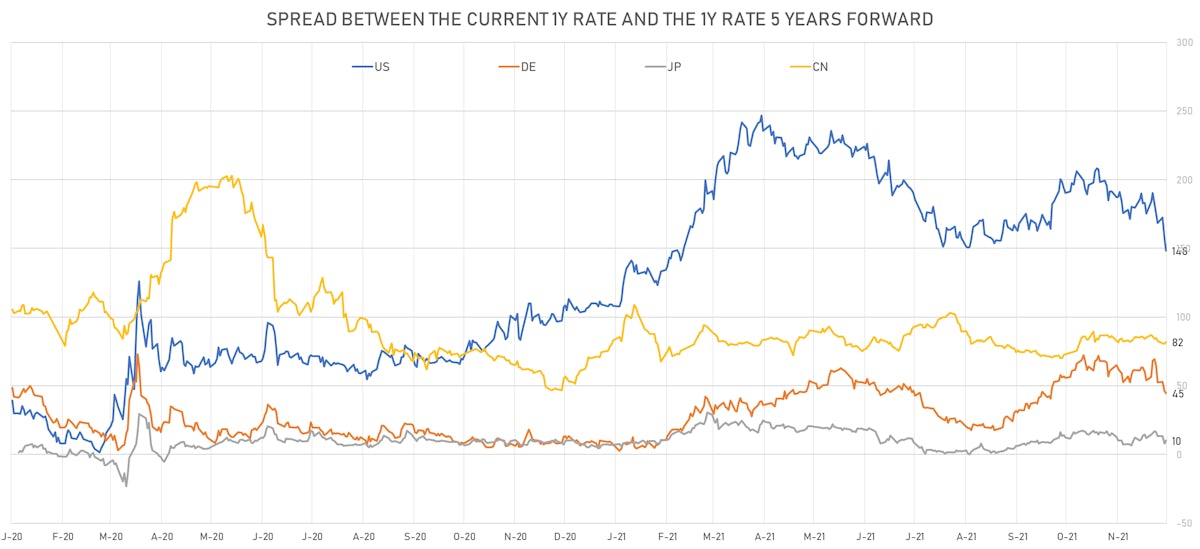

- 1-year US Treasury rate 5 years forward down 8.3 bp, now at 1.7304%, meaning that the 1-year Treasury rate is now expected to increase by 148.2 bp over the next 5 years (equivalent to 5.9 rate hikes)

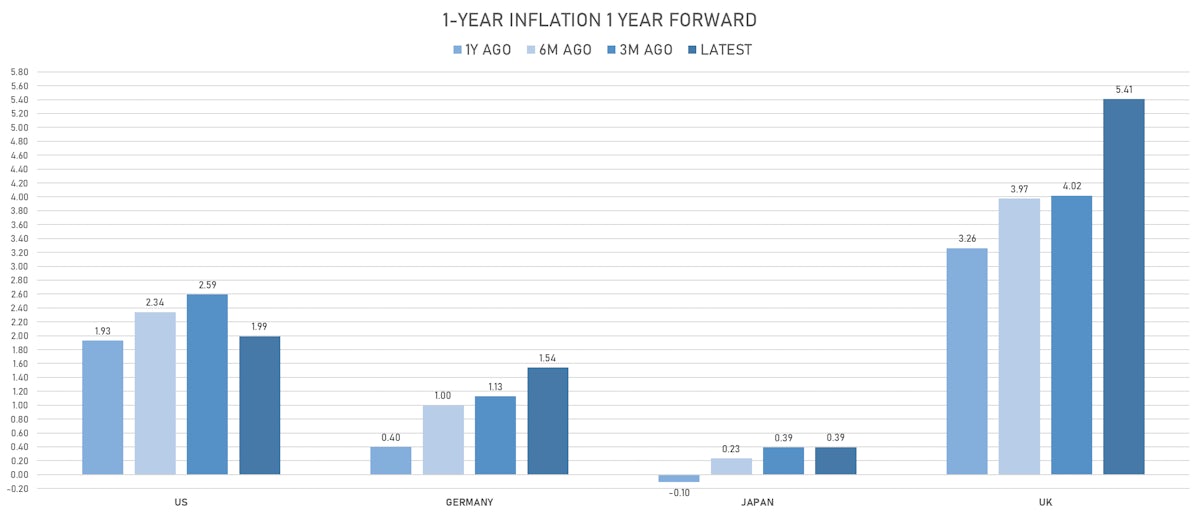

US INFLATION & REAL RATES

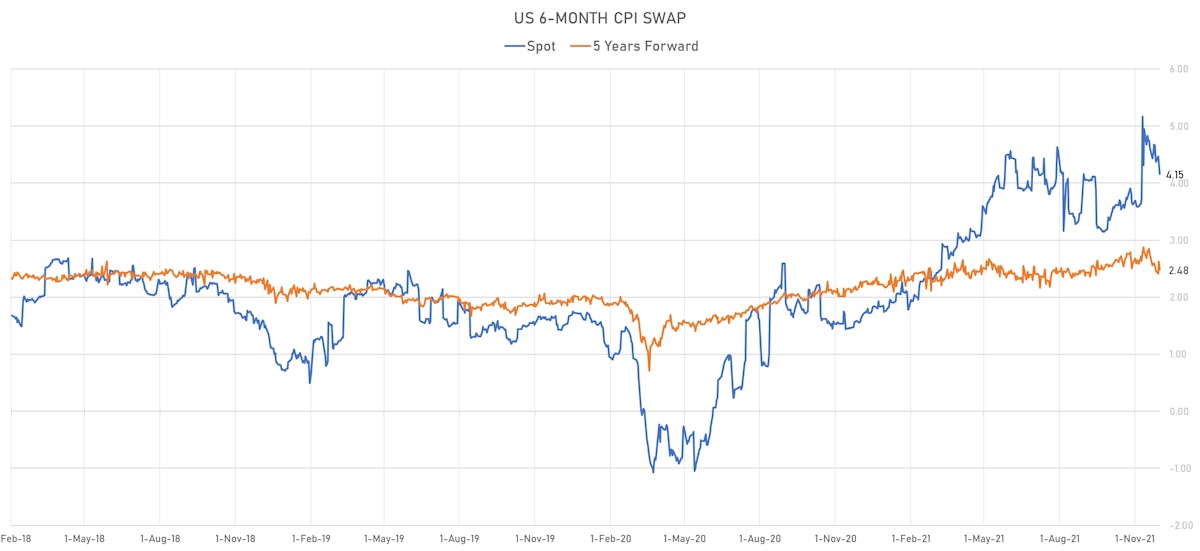

- TIPS 1Y breakeven inflation at 5.19% (down -4.3bp); 2Y at 3.60% (down -6.5bp); 5Y at 2.76% (down -9.4bp); 10Y at 2.41% (down -8.3bp); 30Y at 2.28% (down -4.1bp)

- 6-month spot US CPI swap down -20.4 bp to 4.155%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.5710%, +6.1 bp today; 10Y at -1.0330%, +3.7 bp today; 30Y at -0.5180%, -1.8 bp today

RATES VOLATILITY & LIQUIDITY

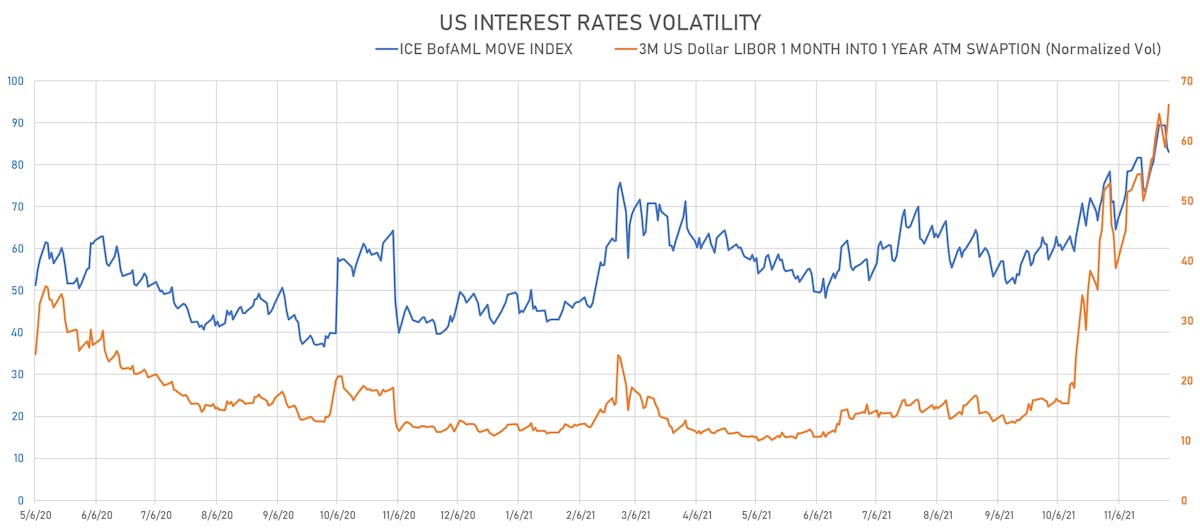

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 3.8% at 66.0%

- 3-Month LIBOR-OIS spread up 0.1 bp at 9.3 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.601% (up 3.4 bp); the German 1Y-10Y curve is 1.2 bp steeper at 42.3bp (YTD change: +28.6 bp)

- Japan 5Y: -0.077% (up 0.8 bp); the Japanese 1Y-10Y curve is 0.1 bp steeper at 17.7bp (YTD change: +4.1 bp)

- China 5Y: 2.693% (up 1.3 bp); the Chinese 1Y-10Y curve is 2.8 bp steeper at 72.6bp (YTD change: +26.2 bp)

- Switzerland 5Y: -0.498% (down -0.5 bp); the Swiss 1Y-10Y curve is 6.1 bp flatter at 48.4bp (YTD change: +17.8 bp)