Rates

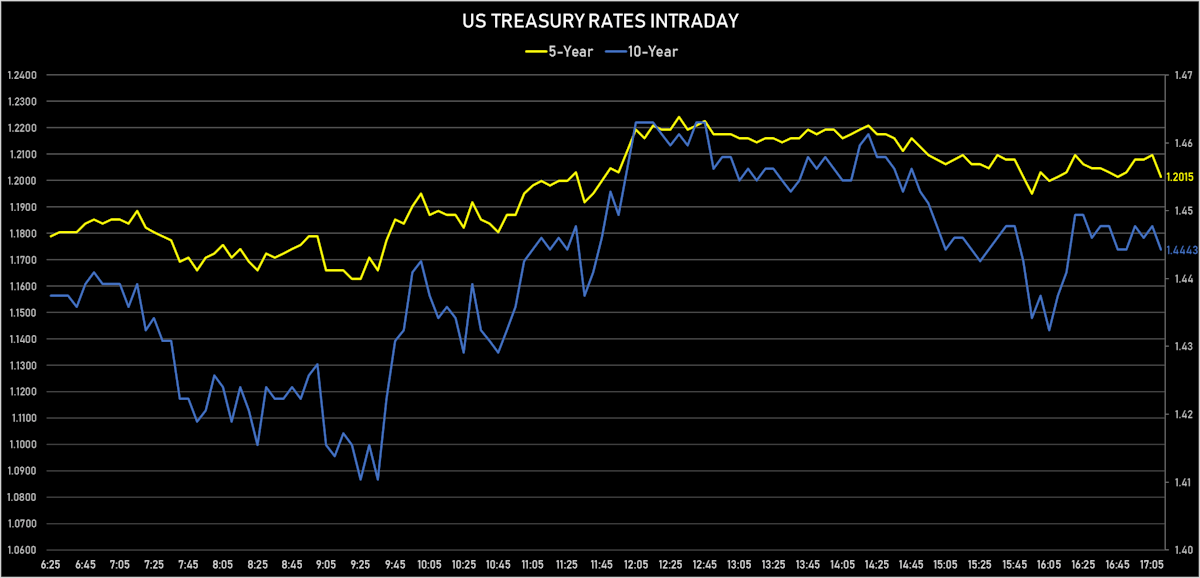

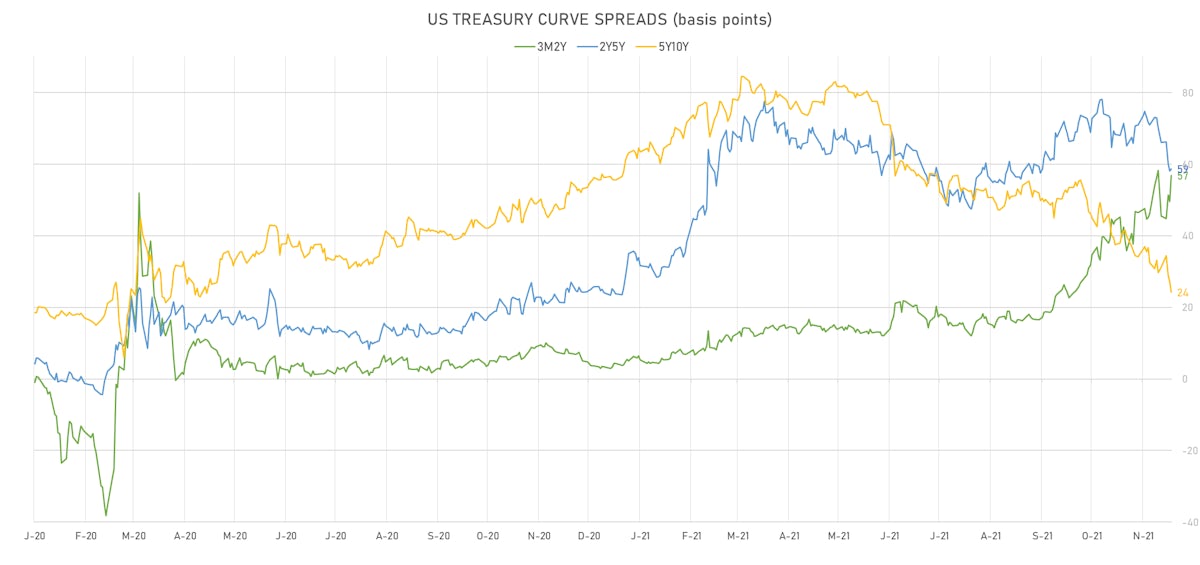

Big Rise In US Rates At The Front End Out To The Belly, With Further 5s10s Flattening

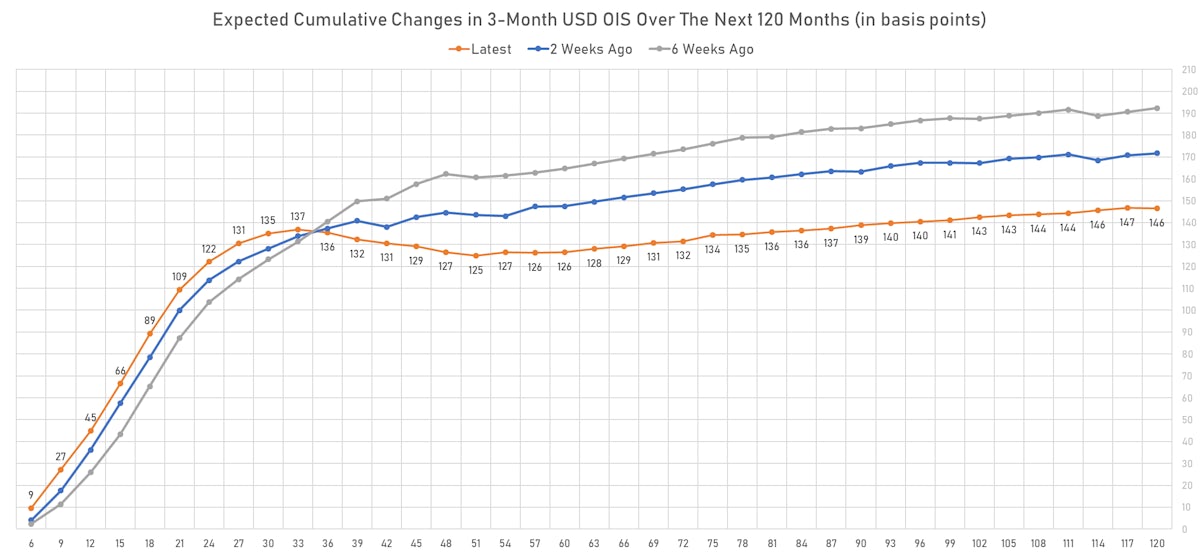

For the first time today, the implied yield in December 2025 eurodollar futures (ED) is lower than December 2024 ED, meaning the market sees a short and shallow hiking cycle till 2024 followed by a possible policy reversal starting in 2025

Published ET

EDZ25/EDZ24 Implied Yields Spread (%) | Source: Refinitiv

QUICK US SUMMARY

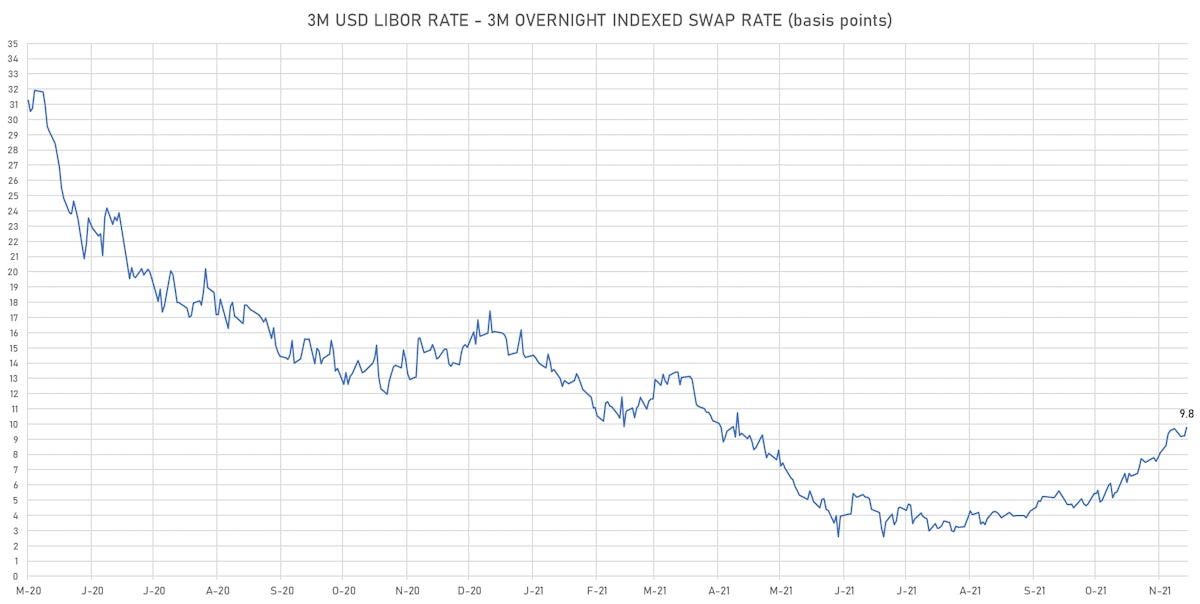

- 3-Month USD LIBOR +0.55bp today, now at 0.1746%; 3-Month OIS unchanged at 0.0825%

- The treasury yield curve steepened, with the 1s10s spread widening 2.5 bp, now at 119.0 bp (YTD change: +38.6bp)

- 1Y: 0.2540% (up 1.5 bp)

- 2Y: 0.6146% (up 6.3 bp)

- 5Y: 1.2015% (up 6.9 bp)

- 7Y: 1.3824% (up 5.4 bp)

- 10Y: 1.4443% (up 4.1 bp)

- 30Y: 1.7658% (up 2.1 bp)

- US treasury curve spreads: 2s5s at 58.7bp (up 0.9bp today), 5s10s at 24.3bp (down -3.1bp), 10s30s at 32.1bp (down -1.9bp)

- Treasuries butterfly spreads: 1s5s10s at -71.4bp (down -8.8bp), 5s10s30s at 7.6bp (up 1.1bp)

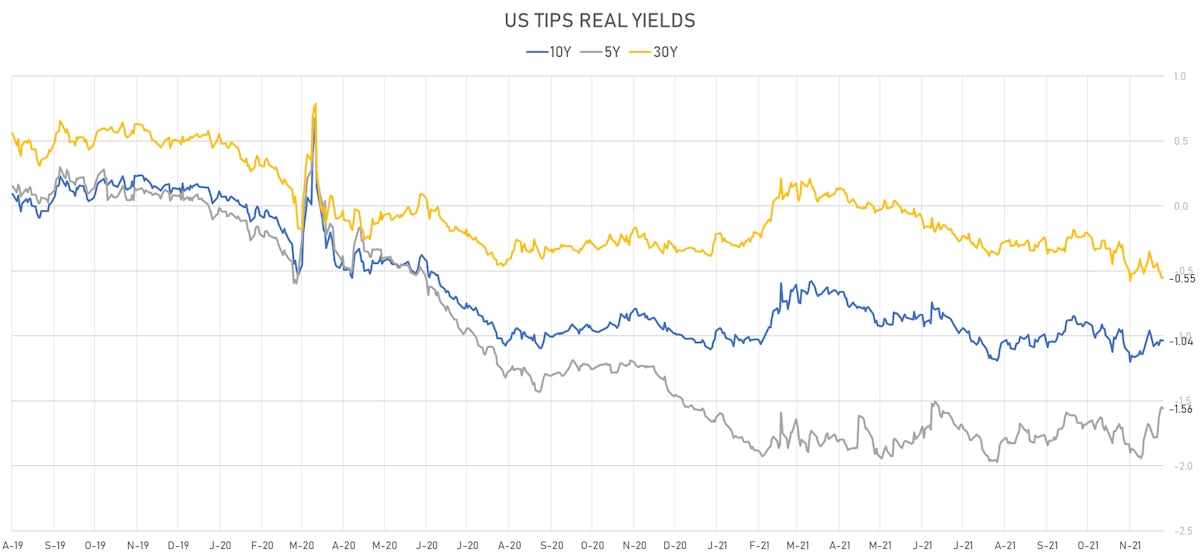

- US 5-Year TIPS Real Yield: -0.8 bp at -1.5570%; 10-Year TIPS Real Yield: -0.2 bp at -1.0370%; 30-Year TIPS Real Yield: -0.5 bp at -0.5540%

US MACRO RELEASES

- Jobless Claims, National, Continued for W 20 Nov (U.S. Dept. of Labor) at 1.96 Mln (vs 2.05 Mln prior), below consensus estimate of 2.00 Mln

- Jobless Claims, National, Initial for W 27 Nov (U.S. Dept. of Labor) at 222.00 k (vs 199.00 k prior), below consensus estimate of 240.00 k

- Jobless Claims, National, Initial, four week moving average for W 27 Nov (U.S. Dept. of Labor) at 238.75 k (vs 252.25 k prior)

- Unemployment, Announced job layoffs - Tally (Challenger, Gray & Christmas), Volume for Nov 2021 (Challenger) at 14.88 k (vs 22.82 k prior)

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 54.0 bp by the end of 2022 (equivalent to 2.2 hikes by end of 2022), up 3.9 bp today

- The 3-month USD OIS forward curve prices in 66.5 bp of rate hikes over the next 15 months (equivalent to 2.66 rate hikes) and 135.5 bp over the next 3 years (equivalent to 5.42 rate hikes)

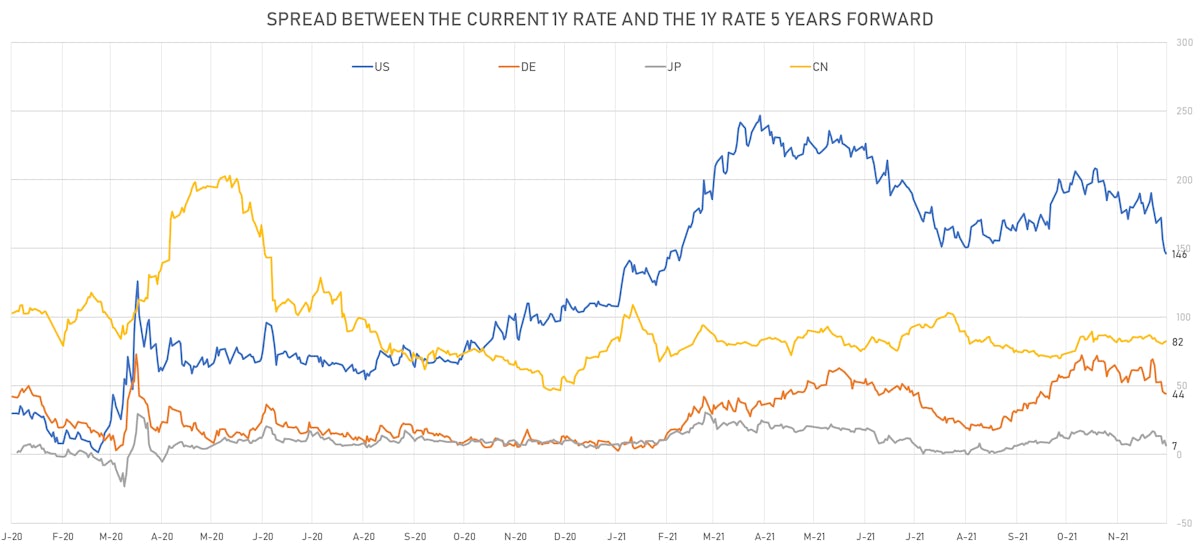

- 1-year US Treasury rate 5 years forward up 2.2 bp, now at 1.7526%, meaning that the 1-year Treasury rate is now expected to increase by 146.3 bp over the next 5 years (equivalent to 5.9 rate hikes)

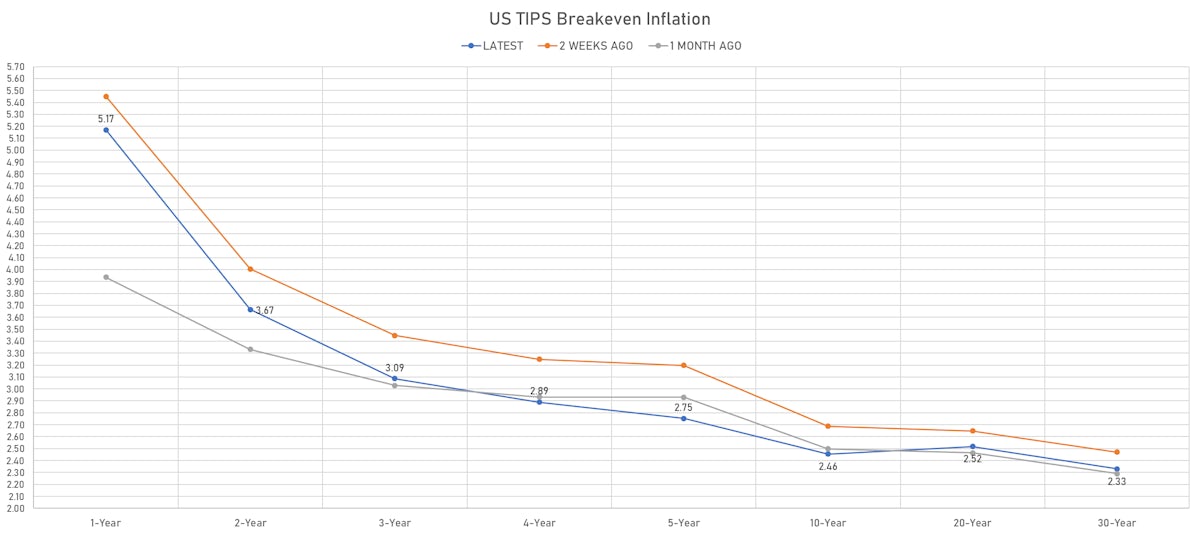

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.17% (down -2.4bp); 2Y at 3.67% (up 6.7bp); 5Y at 2.75% (down -0.5bp); 10Y at 2.46% (up 4.5bp); 30Y at 2.33% (up 5.3bp)

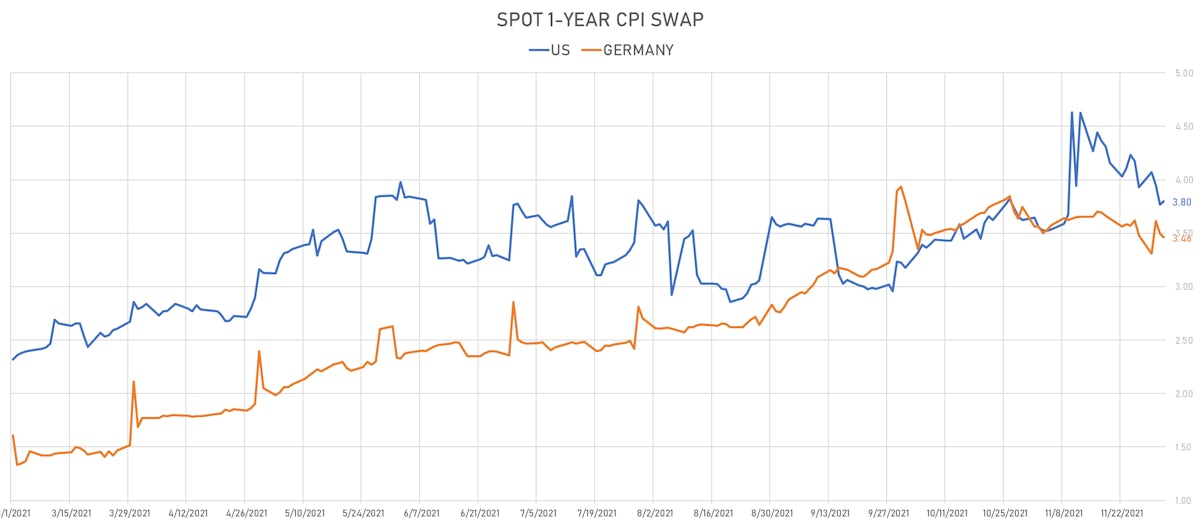

- 6-month spot US CPI swap down -0.8 bp to 4.147%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.5570%, -0.8 bp today; 10Y at -1.0370%, -0.2 bp today; 30Y at -0.5540%, -0.5 bp today

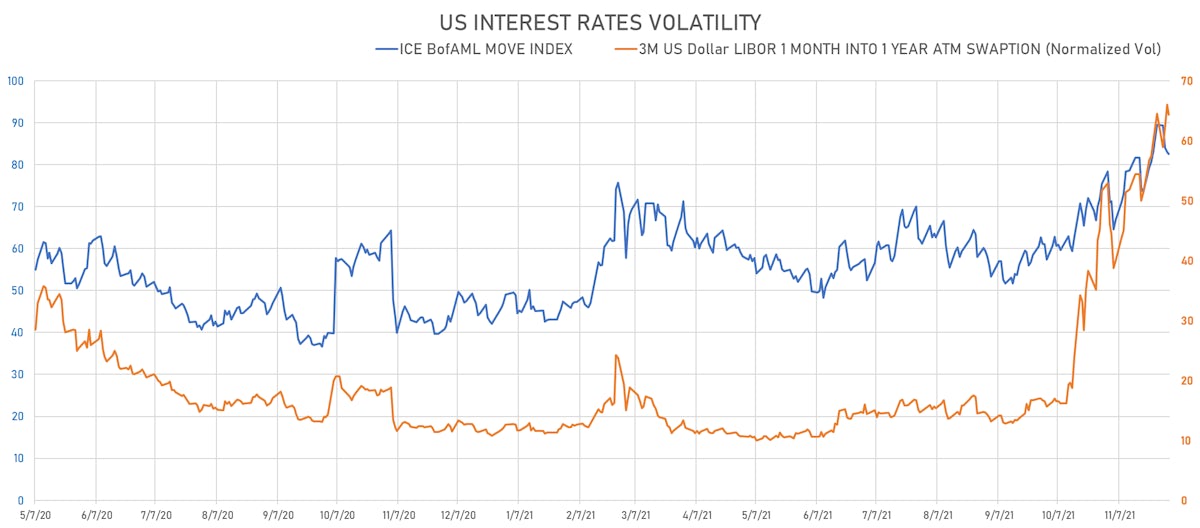

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -1.7% at 64.3%

- 3-Month LIBOR-OIS spread up 0.5 bp at 9.8 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.627% (down -4.5 bp); the German 1Y-10Y curve is 4.2 bp flatter at 39.8bp (YTD change: +24.4 bp)

- Japan 5Y: -0.089% (down -0.4 bp); the Japanese 1Y-10Y curve is 0.9 bp flatter at 17.7bp (YTD change: +3.2 bp)

- China 5Y: 2.722% (up 2.9 bp); the Chinese 1Y-10Y curve is 2.6 bp steeper at 75.2bp (YTD change: +28.8 bp)

- Switzerland 5Y: -0.520% (down -1.8 bp); the Swiss 1Y-10Y curve is 2.0 bp flatter at 43.2bp (YTD change: +15.8 bp)