Rates

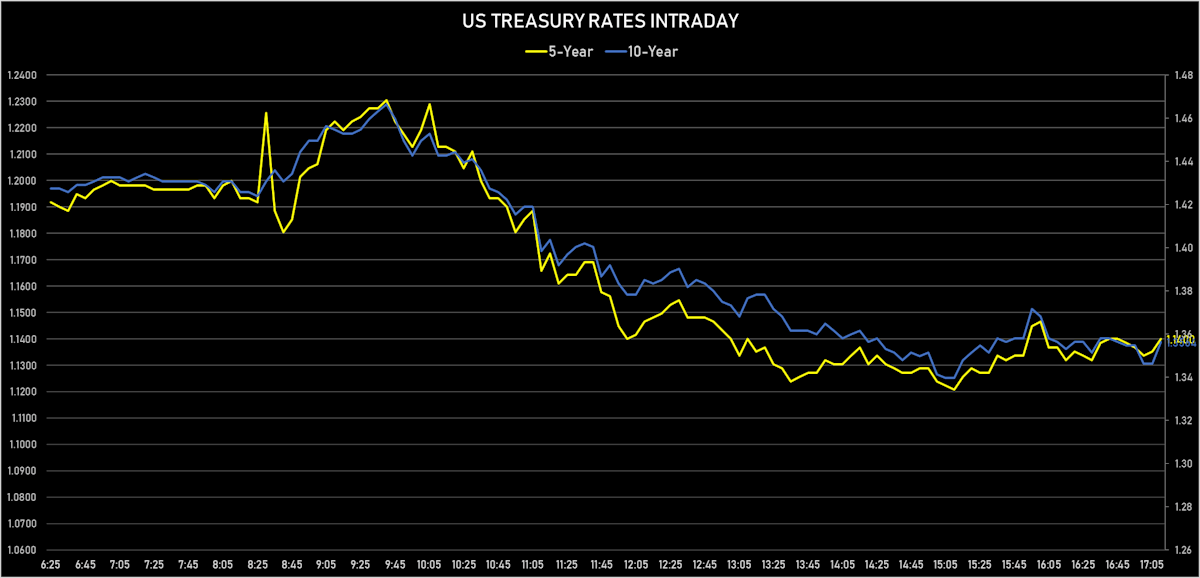

US Rates Drop, Mostly From The Belly Out, On Disappointing Private Payrolls (235K vs 530K Expected)

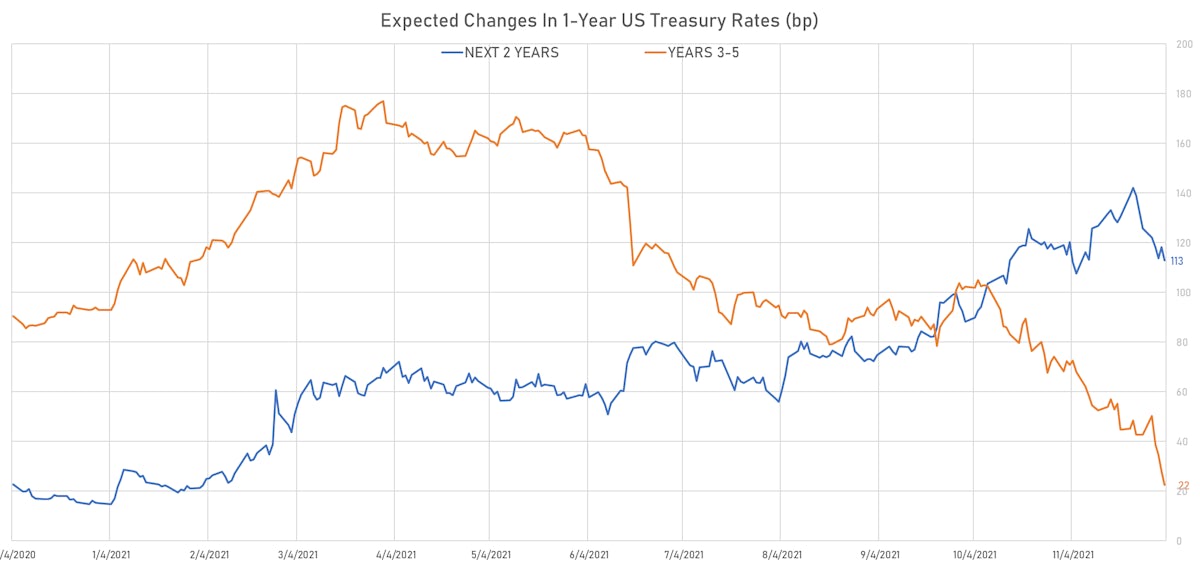

The ISM Services was very strong, which (coupled with the weak NFP) points to higher wage growth and more price increases, keeping short-term rate hikes expectations relatively unchanged

Published ET

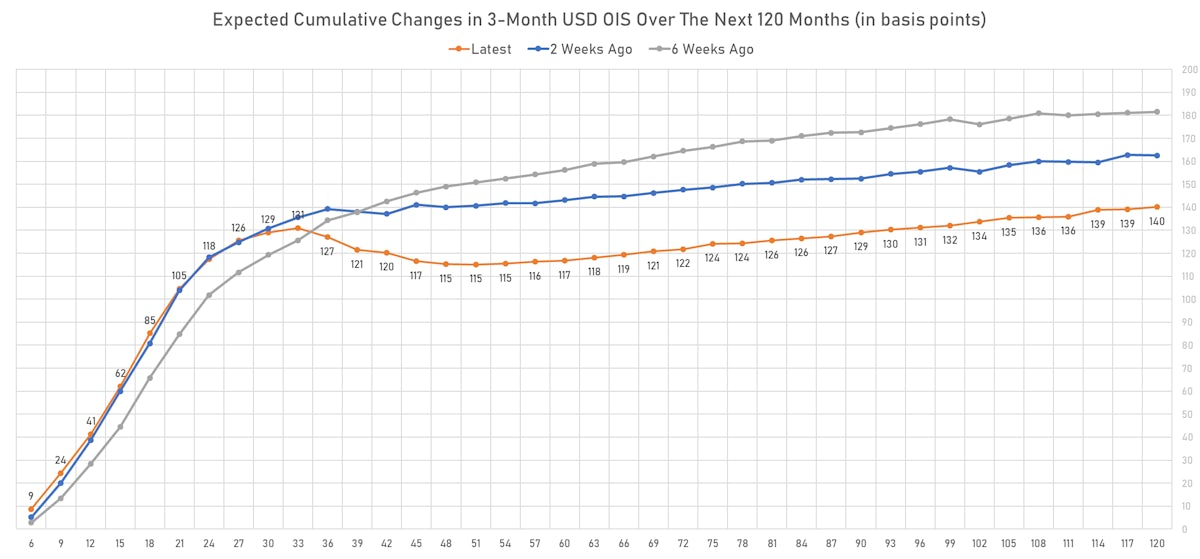

Changes In The Timing & Magnitude of Fed Hikes Priced Into 3M USD OIS Forward Rates | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

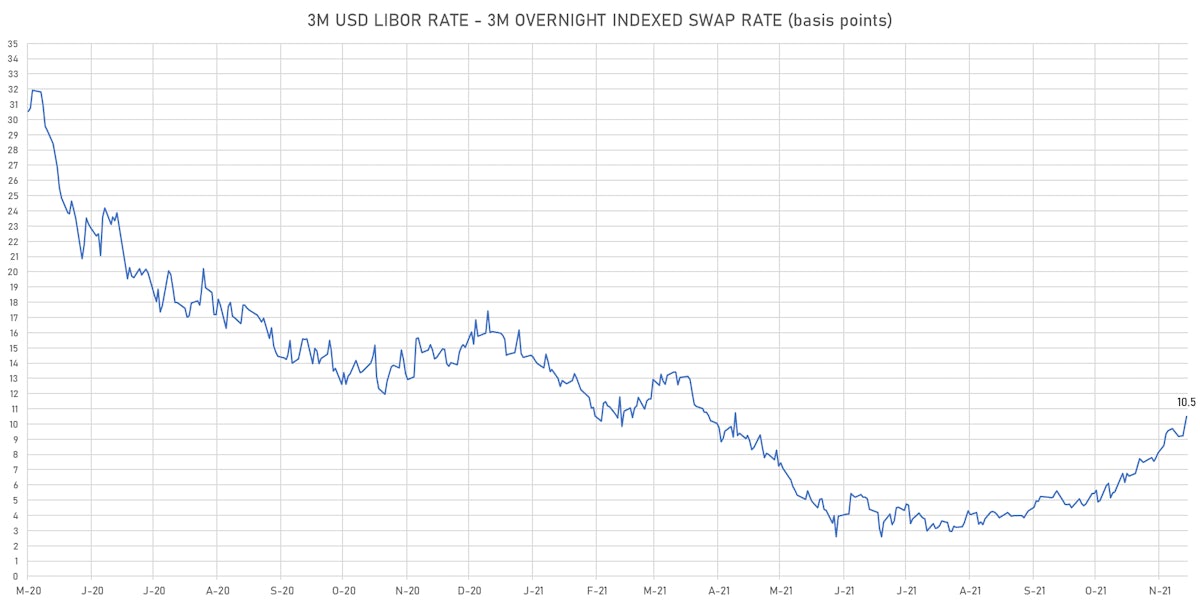

- 3-Month USD LIBOR +0.75bp today, now at 0.1801%; 3-Month USD OIS unchanged at 0.0825%

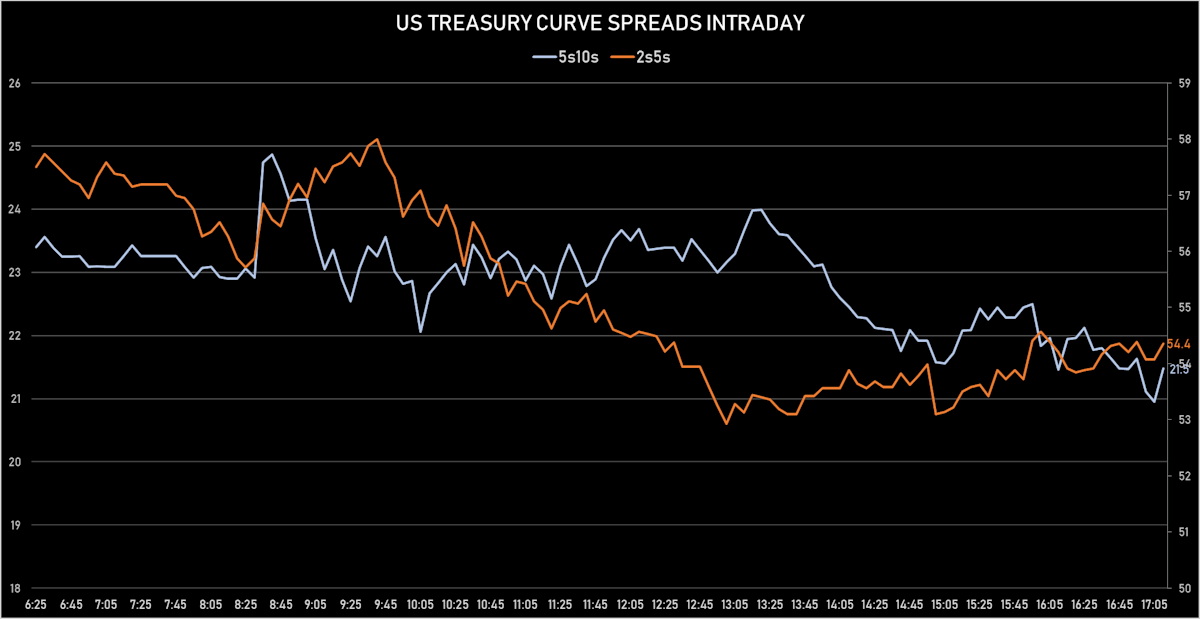

- The treasury yield curve flattened, with the 1s10s spread tightening -8.8 bp, now at 109.4 bp (YTD change: +29.0bp)

- 1Y: 0.2620% (unchanged)

- 2Y: 0.5932% (down 2.1 bp)

- 5Y: 1.1400% (down 6.2 bp)

- 7Y: 1.3074% (down 7.5 bp)

- 10Y: 1.3564% (down 8.8 bp)

- 30Y: 1.6843% (down 8.2 bp)

- US treasury curve spreads: 2s5s at 54.6bp (down -4.6bp), 5s10s at 21.7bp (down -2.6bp), 10s30s at 32.8bp (up 1.2bp today)

- Treasuries butterfly spreads: 1s5s10s at -67.9bp (up 3.5bp today), 5s10s30s at 11.6bp (up 4.0bp)

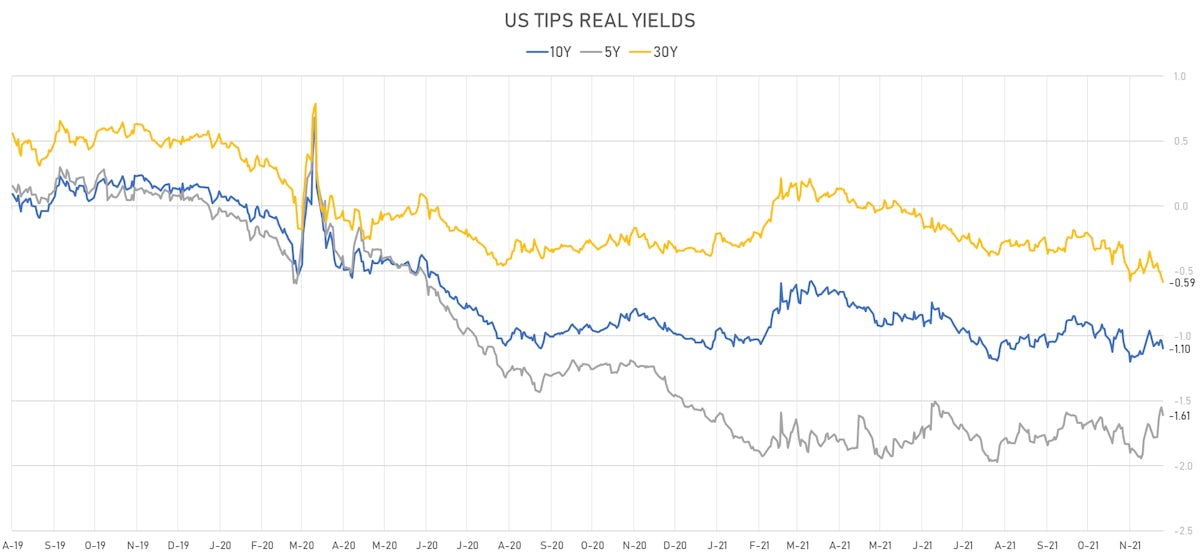

- US 5-Year TIPS Real Yield: -6.1 bp at -1.6100%; 10-Year TIPS Real Yield: -6.2 bp at -1.0970%; 30-Year TIPS Real Yield: -3.7 bp at -0.5860%

US MACRO RELEASES

- Average Earnings YY, Change Y/Y for Nov 2021 (BLS, U.S Dep. Of Lab) at 4.80 % (vs 4.90 % prior), below consensus estimate of 5.00 %

- Civilian participation, total for Nov 2021 (BLS, U.S Dep. Of Lab) at 61.80 % (vs 61.60 % prior)

- Earnings, Average Hourly, Nonfarm payrolls, all employees, total private, Change P/P for Nov 2021 (BLS, U.S Dep. Of Lab) at 0.30 % (vs 0.40 % prior), below consensus estimate of 0.40 %

- Employment, Nonfarm payroll, goods-producing, manufacturing, total, Absolute change for Nov 2021 (BLS, U.S Dep. Of Lab) at 31.00 k (vs 60.00 k prior), below consensus estimate of 45.00 k

- Employment, Nonfarm payroll, service-producing, government, Absolute change for Nov 2021 (BLS, U.S Dep. Of Lab) at -25.00 k (vs -73.00 k prior)

- Employment, Nonfarm payroll, total private, Absolute change for Nov 2021 (BLS, U.S Dep. Of Lab) at 235.00 k (vs 604.00 k prior), below consensus estimate of 530.00 k

- Employment, Nonfarm payroll, total, Absolute change for Nov 2021 (BLS, U.S Dep. Of Lab) at 210.00 k (vs 531.00 k prior), below consensus estimate of 550.00 k

- Hours Worked, Average Per Week, Nonfarm payrolls, all employees, total private for Nov 2021 (BLS, U.S Dep. Of Lab) at 34.80 hrs (vs 34.70 hrs prior), above consensus estimate of 34.70 hrs

- ISM Non-manufacturing, Business activity for Nov 2021 (ISM, United States) at 74.60 (vs 69.80 prior)

- ISM Non-manufacturing, Employment for Nov 2021 (ISM, United States) at 56.50 (vs 51.60 prior)

- ISM Non-manufacturing, New orders for Nov 2021 (ISM, United States) at 69.70 (vs 69.70 prior)

- ISM Non-manufacturing, NMI/PMI for Nov 2021 (ISM, United States) at 69.10 (vs 66.70 prior), above consensus estimate of 65.00

- ISM Non-manufacturing, Prices for Nov 2021 (ISM, United States) at 82.30 (vs 82.90 prior)

- Manufacturers New Orders, Durable goods excluding defense, Change P/P for Oct 2021 (U.S. Census Bureau) at 0.80 % (vs 0.80 % prior)

- Manufacturers New Orders, Durable goods excluding transportation, Change P/P for Oct 2021 (U.S. Census Bureau) at 0.50 % (vs 0.50 % prior)

- Manufacturers New Orders, Durable goods total, Change P/P for Oct 2021 (U.S. Census Bureau) at -0.40 % (vs -0.50 % prior)

- Manufacturers New Orders, Nondefense capital goods excluding aircraft, Change P/P for Oct 2021 (U.S. Census Bureau) at 0.70 % (vs 0.60 % prior)

- Manufacturers New Orders, Total manufacturing excluding transportation, Change P/P for Oct 2021 (U.S. Census Bureau) at 1.60 % (vs 0.70 % prior)

- Manufacturers New Orders, Total manufacturing, Change P/P for Oct 2021 (U.S. Census Bureau) at 1.00 % (vs 0.20 % prior), above consensus estimate of 0.50 %

- PMI, Composite, Output, Final for Nov 2021 (Markit Economics) at 57.20 (vs 56.50 prior)

- PMI, Services Sector, Business Activity, Final for Nov 2021 (Markit Economics) at 58.00 (vs 57.00 prior)

- Unemployment, Rate for Nov 2021 (BLS, U.S Dep. Of Lab) at 4.20 % (vs 4.60 % prior), below consensus estimate of 4.50 %

- Unemployment, Rate, Special (U-6) for Nov 2021 (BLS, U.S Dep. Of Lab) at 7.80 % (vs 8.30 % prior)

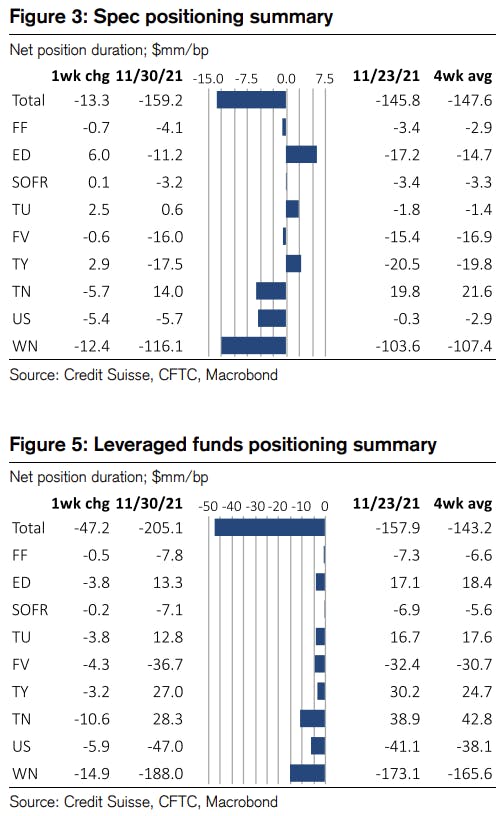

WEEKLY DURATION NET POSITIONING UPDATE

- Increased net short duration for both specs and leveraged funds, with the heaviest positioning still at the far end of the curve

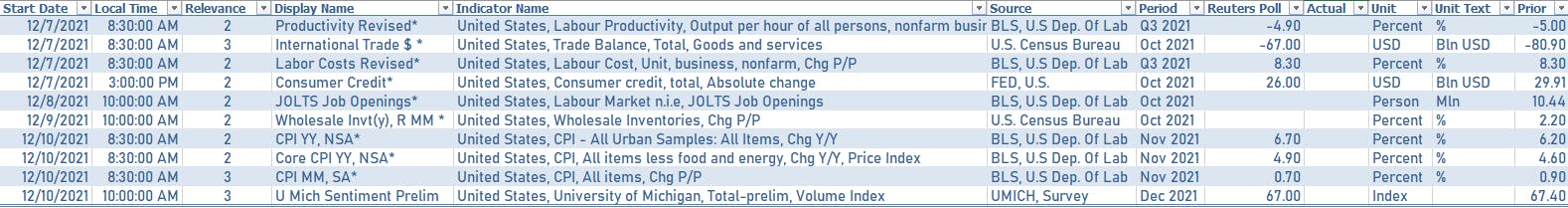

WEEK AHEAD IN US MACRO

- Most important data point next week will be the CPI, coming just ahead of the FOMC in the following week

- 3 coupon-bearing auctions for the Treasury: 3-year on Tuesday (91282CDN8), 10-year on Wednesday (91282CDJ7), 30-year on Thursday (912810TB4)

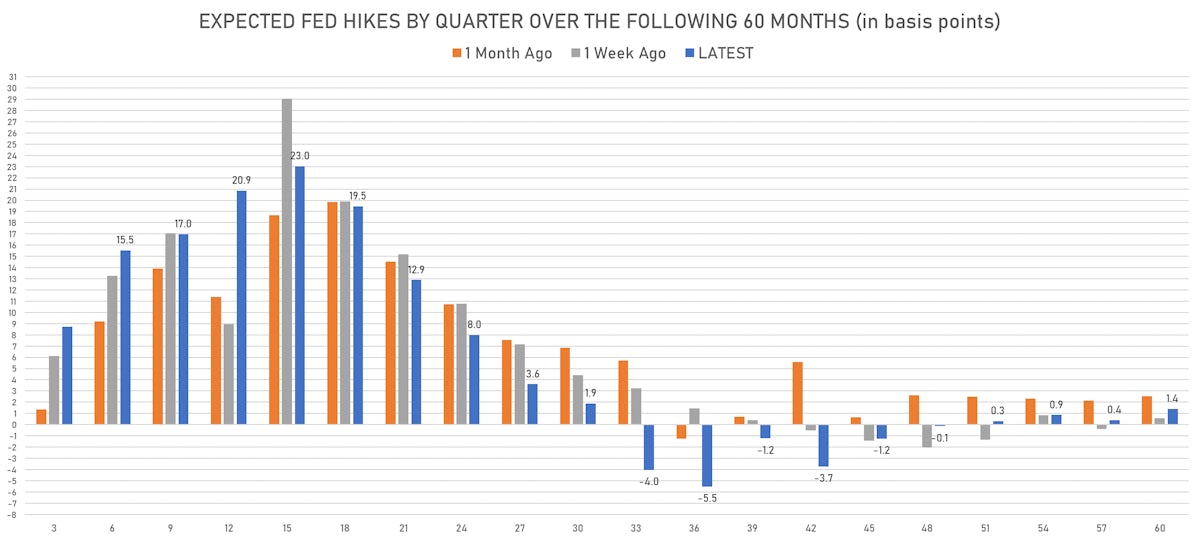

US FORWARD RATES

- 3-month Eurodollar future (EDU2) expected hike of 49.7 bp by the end of 2022 (equivalent to 2.0 hikes by end of 2022), down -4.2 bp today

- The 3-month USD OIS forward curve prices in 41.3 bp of rate hikes over the next 12 months (down -3.6 bp today), 76.3 bp of rate hikes over the following year (down -1.0 bp today), and -0.8 bp total rate hikes in years 3 to 5 (down -5.1 bp today)

- 1-year US Treasury rate 5 years forward down 11.6 bp, now at 1.6368%, meaning that the 1-year Treasury rate is now expected to increase by 135.3 bp over the next 5 years (equivalent to 5.4 rate hikes)

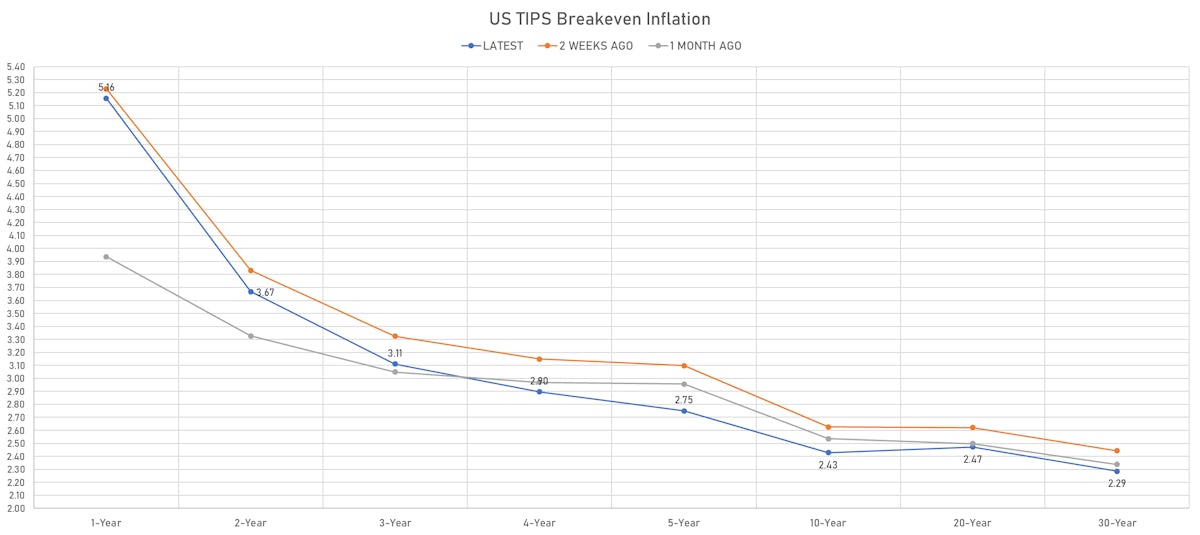

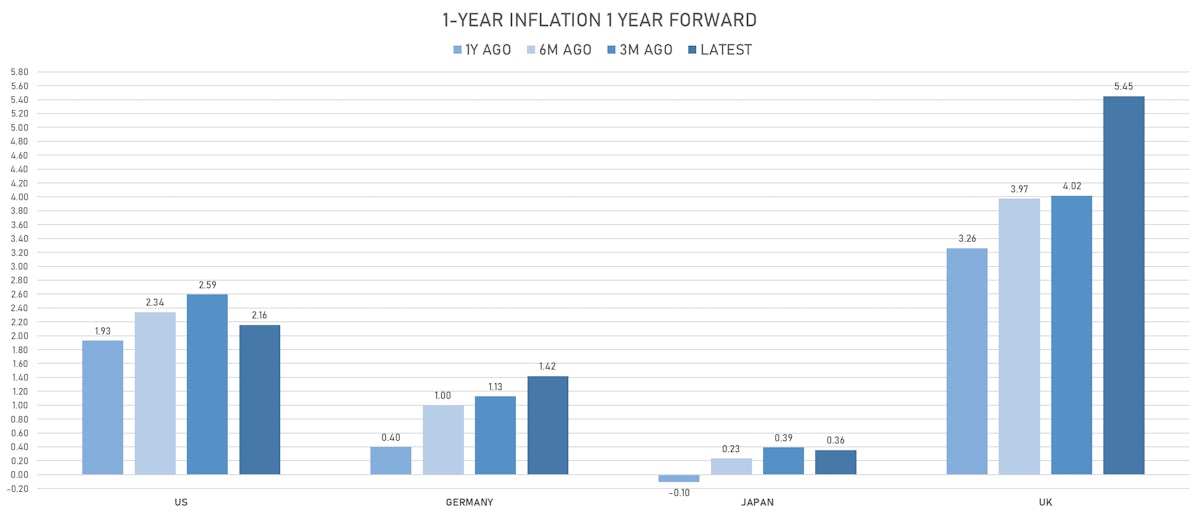

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.16% (down -1.3bp); 2Y at 3.67% (up 0.2bp); 5Y at 2.75% (down -0.3bp); 10Y at 2.43% (down -2.7bp); 30Y at 2.29% (down -4.4bp)

- 6-month spot US CPI swap up 6.0 bp to 4.207%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.6100%, -6.1 bp today; 10Y at -1.0970%, -6.2 bp today; 30Y at -0.5860%, -3.7 bp today

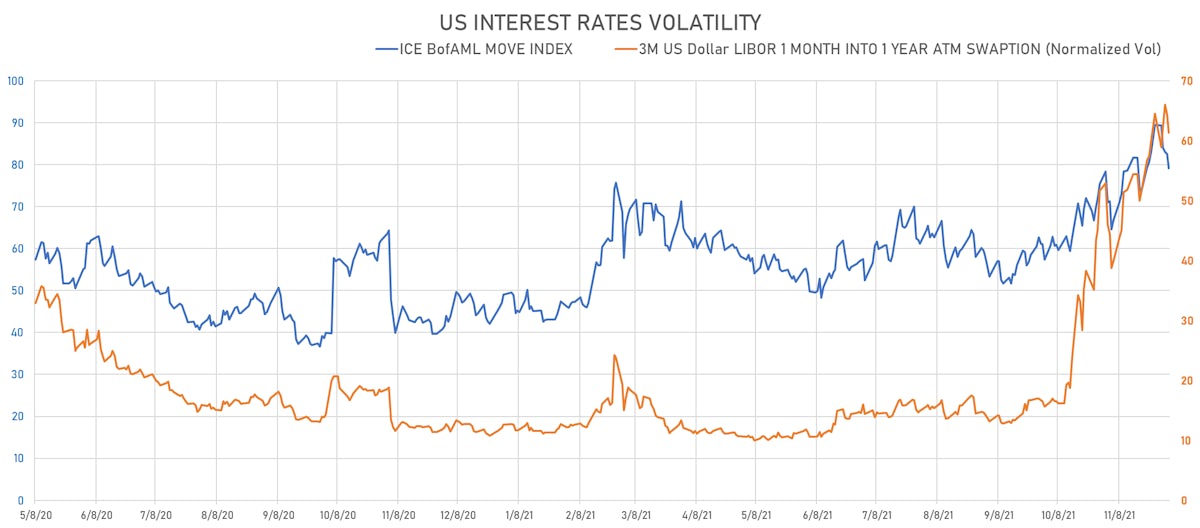

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -3.0% at 61.3%

- 3-Month LIBOR-OIS spread up 0.8 bp at 10.5 bp (12-months range: 2.6-17.4 bp)

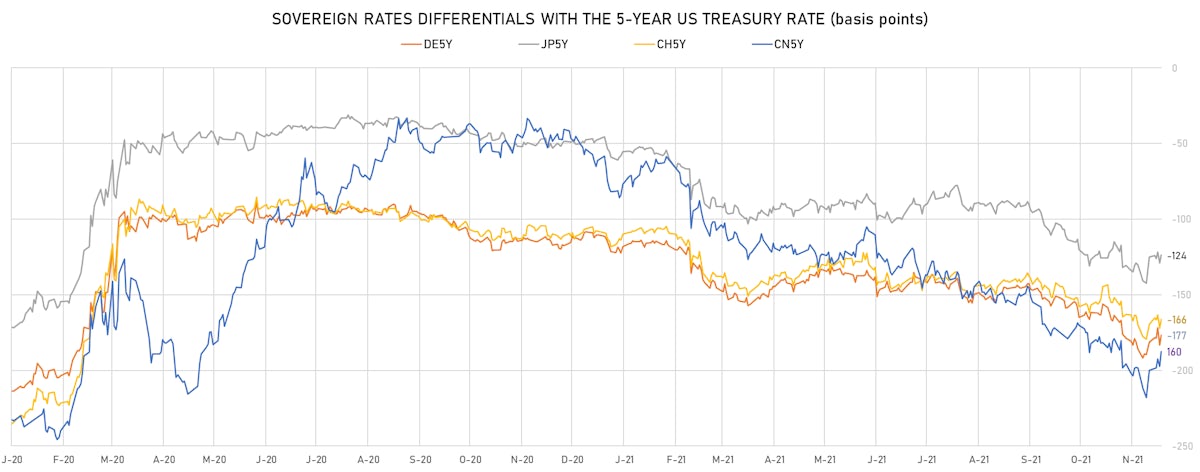

KEY INTERNATIONAL RATES

- Germany 5Y: -0.629% (up 0.5 bp); the German 1Y-10Y curve is 2.5 bp flatter at 36.0bp (YTD change: +21.9 bp)

- Japan 5Y: -0.087% (down -0.9 bp); the Japanese 1Y-10Y curve is 0.9 bp flatter at 17.4bp (YTD change: +2.3 bp)

- China 5Y: 2.740% (up 1.8 bp); the Chinese 1Y-10Y curve is 2.0 bp steeper at 77.2bp (YTD change: +30.8 bp)

- Switzerland 5Y: -0.523% (down -0.3 bp); the Swiss 1Y-10Y curve is 4.5 bp steeper at 46.7bp (YTD change: +20.3 bp)