Rates

US Rates Rise, With Lower Inflation Breakevens And Higher TIPS Real Yields; Volatility Close To Highest Level This Year

Today saw a decent rebound in the TIPS 5s30s spread, an indicator of forward economic growth expectations, after a big drop last week; it's not necessarily sustainable though, as the Fed might come closer to the GS view of 3 rate hikes in 2022 in its new economic projections / dot plot next week

Published ET

US TIPS 5s30s Spread (%) | Source: Refinitiv

QUICK US SUMMARY

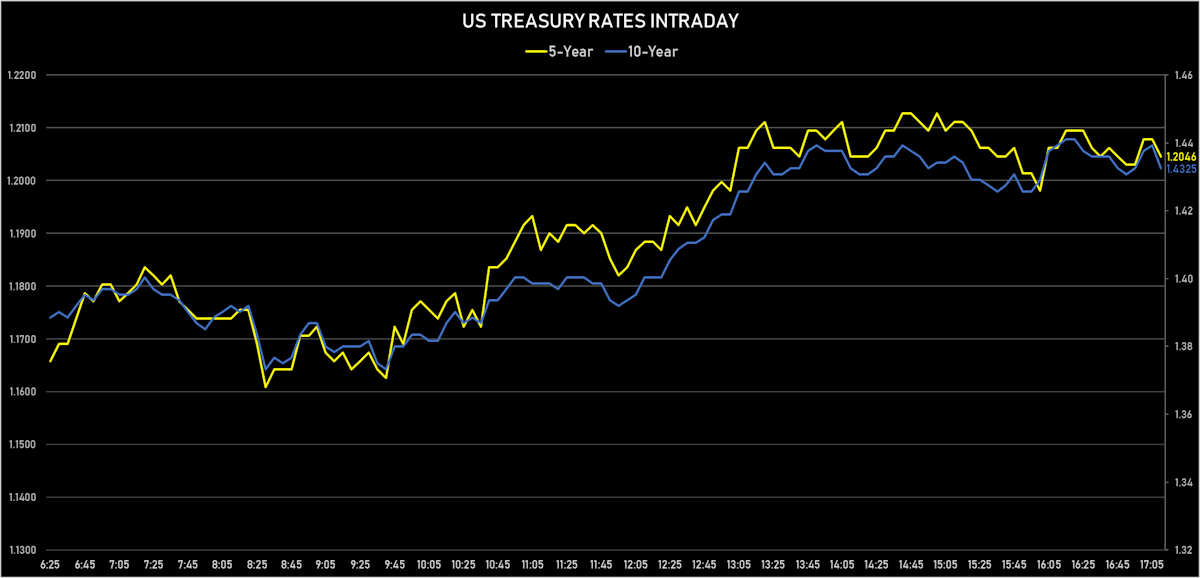

- The treasury yield curve steepened, with the 1s10s spread widening 6.1 bp, now at 117.7 bp (YTD change: +37.2bp)

- 1Y: 0.2560% (up 1.5 bp)

- 2Y: 0.6312% (up 3.8 bp)

- 5Y: 1.2046% (up 6.5 bp)

- 7Y: 1.3787% (up 7.1 bp)

- 10Y: 1.4325% (up 7.6 bp)

- 30Y: 1.7697% (up 8.5 bp)

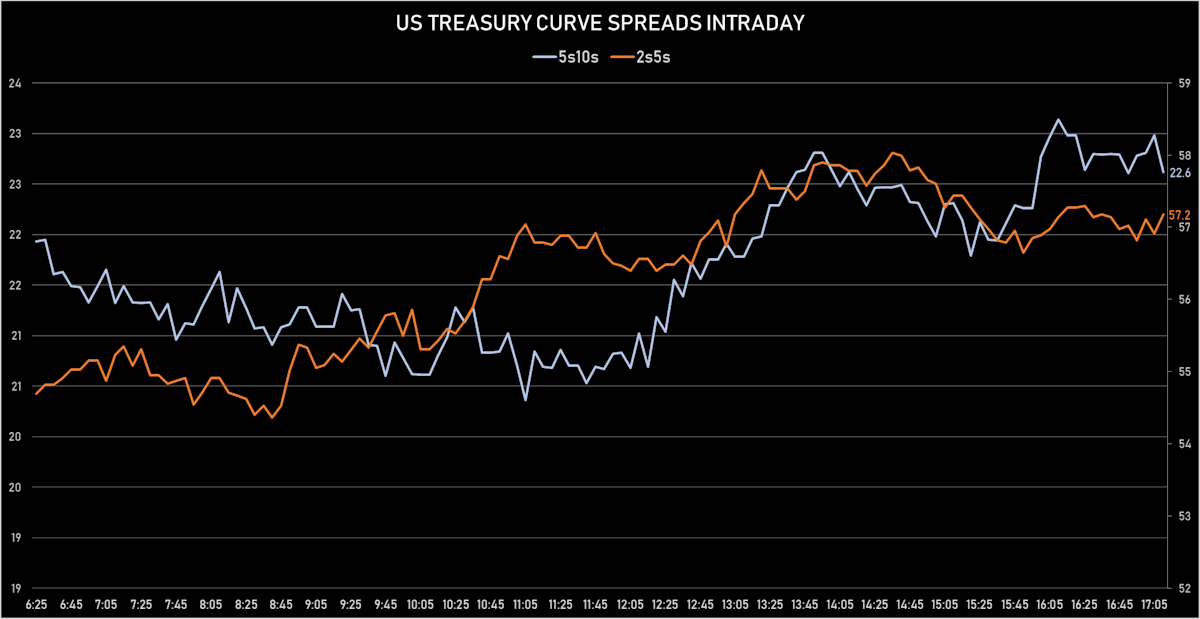

- US treasury curve spreads: 2s5s at 57.4bp (up 3.0bp today), 5s10s at 22.8bp (up 1.8bp today), 10s30s at 33.7bp (up 0.5bp today)

- Treasuries butterfly spreads: 1s5s10s at -71.2bp (down -3.3bp), 5s10s30s at 10.1bp (down -1.5bp)

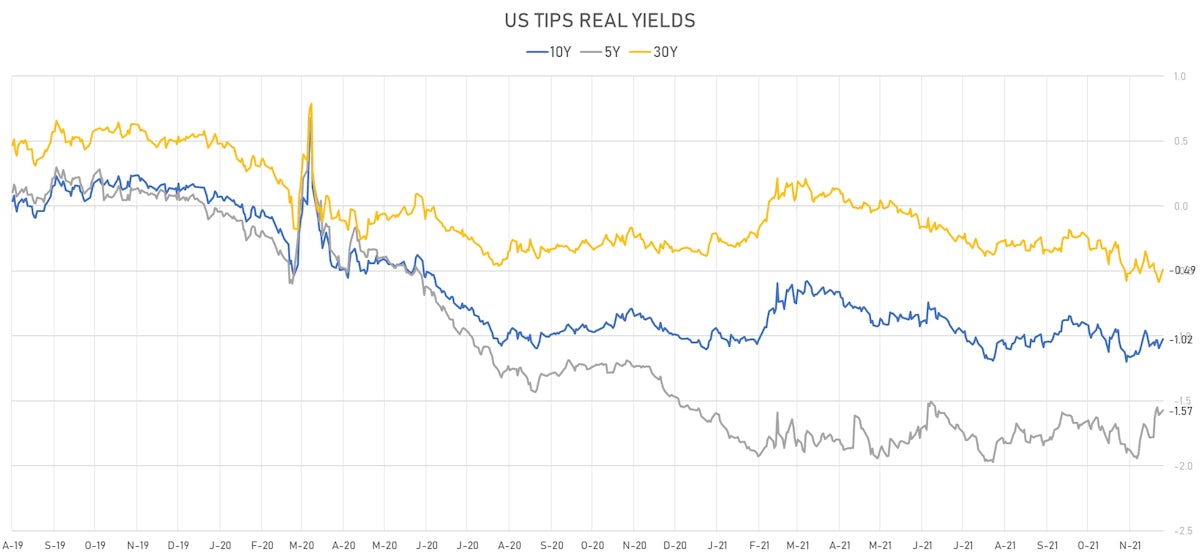

- US 5-Year TIPS Real Yield: +3.8 bp at -1.5720%; 10-Year TIPS Real Yield: +7.3 bp at -1.0240%; 30-Year TIPS Real Yield: +9.7 bp at -0.4890%

US MACRO RELEASES

- The Conference Board Employment Trends Index (ETI) for Nov 2021 (The Conference Board) at 114.49 (vs 112.23 prior)

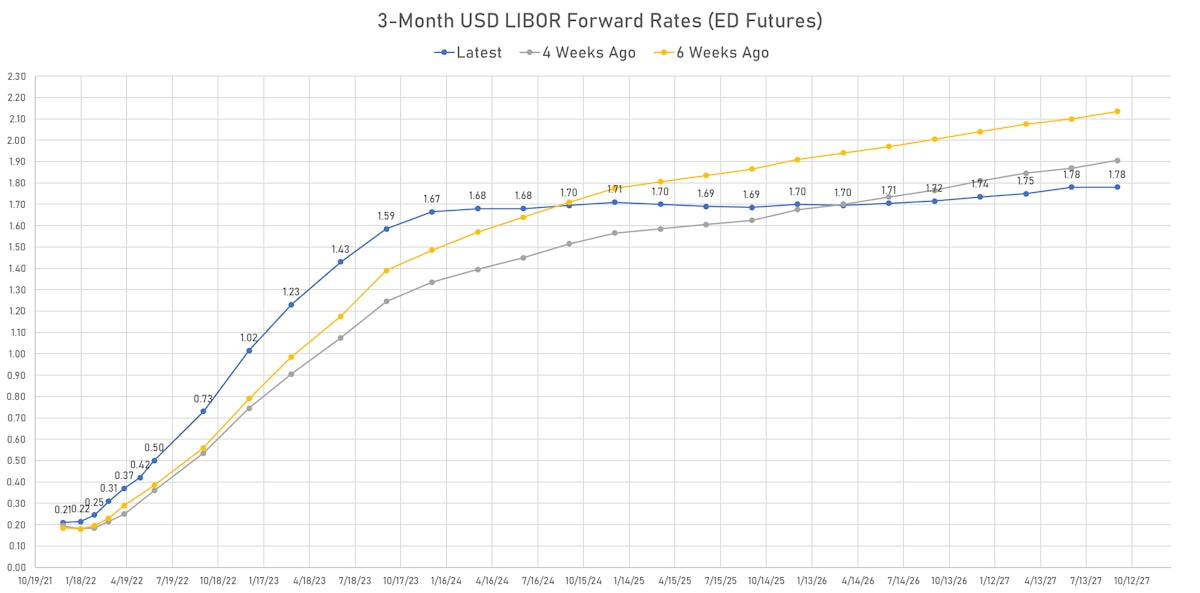

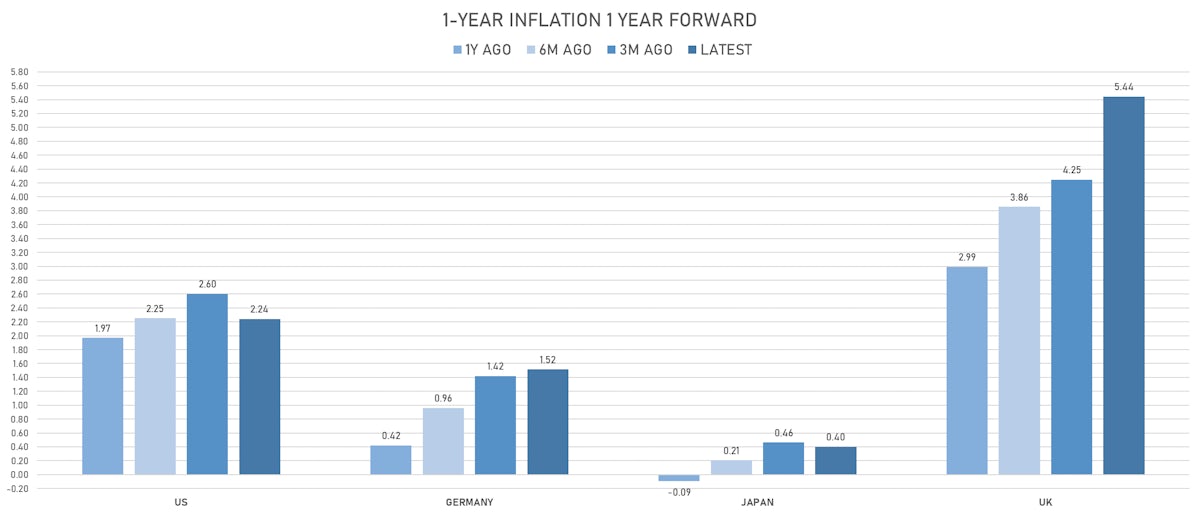

US FORWARD RATES

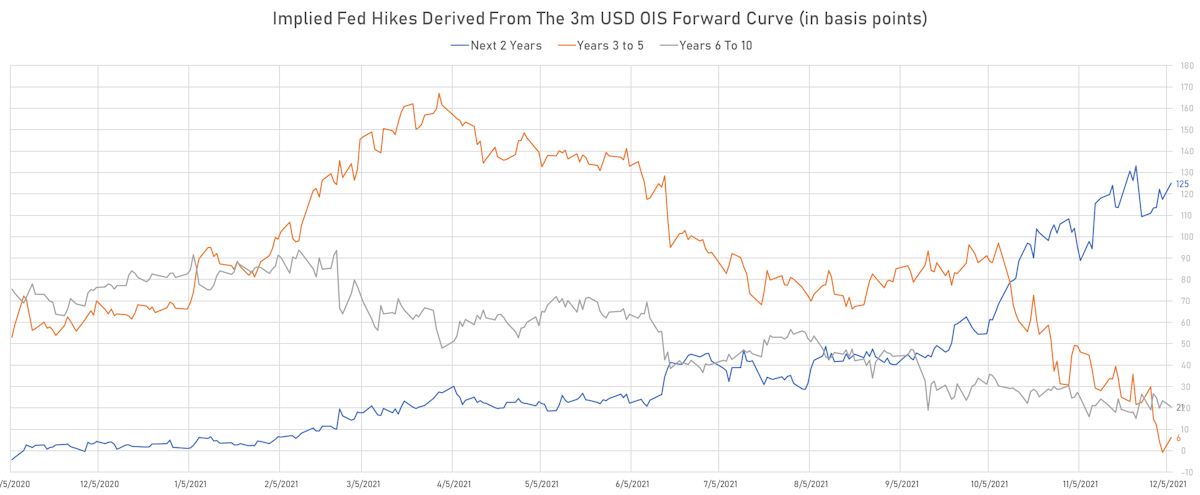

- 1-month USD OIS 12-months forward now prices in 60.0 bp of Fed hikes through the end of 2022

- The 3-month USD OIS forward curve prices in 47.0 bp of rate hikes over the next 12 months (up 5.7 bp today), 78.0 bp of rate hikes over the following year (up 1.7 bp today), and 6.2 bp total rate hikes in years 3 to 5 (up 7.0 bp today). Note that markets expect a rate hike at the 14 December 2022 FOMC, which is not accounted for in next 12 months period (but is in the following year).

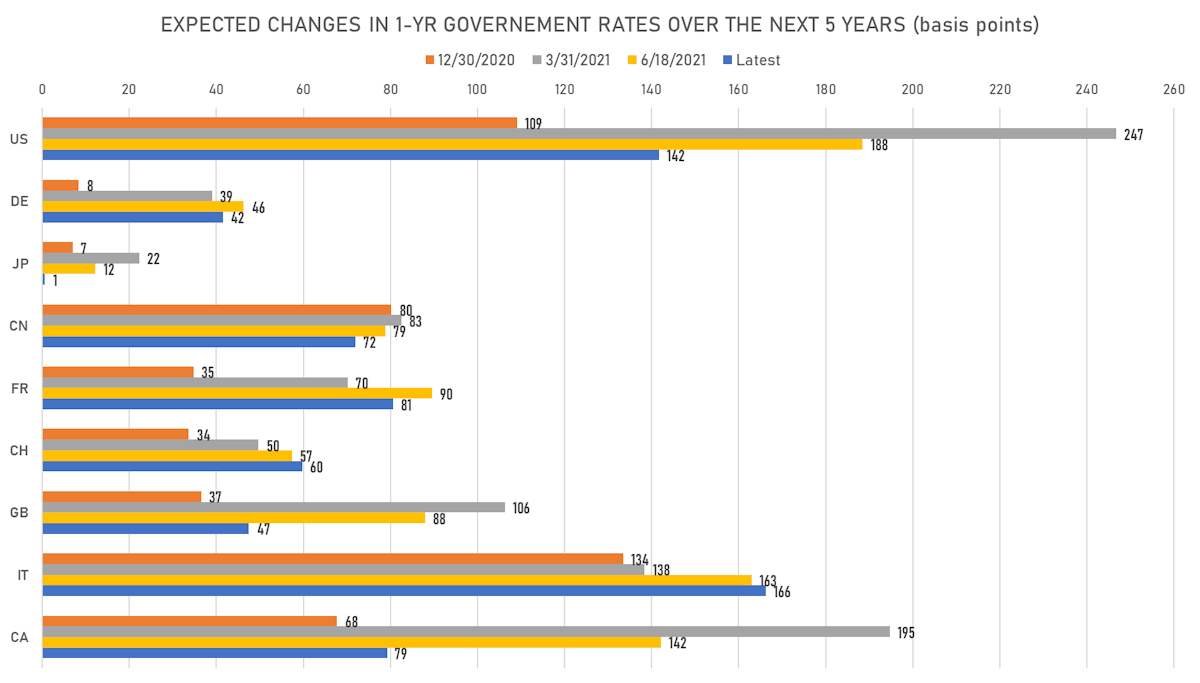

- 1-year US Treasury rate 5 years forward up 9.8 bp, now at 1.7346%, meaning that the 1-year Treasury rate is now expected to increase by 141.7 bp over the next 5 years (equivalent to 5.7 rate hikes)

US INFLATION & REAL RATES

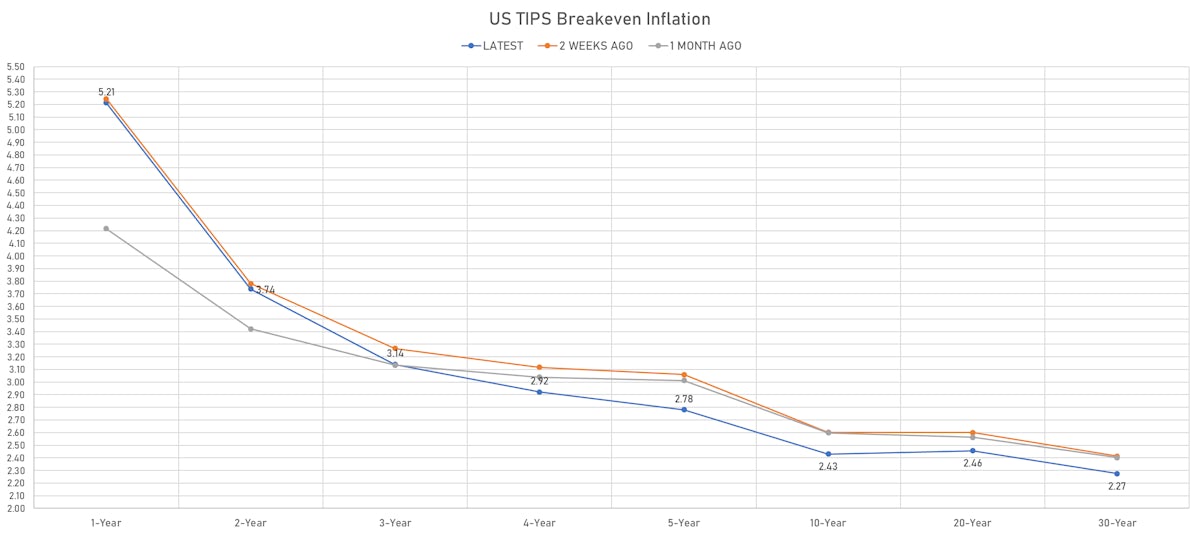

- TIPS 1Y breakeven inflation at 5.21% (up 5.6bp); 2Y at 3.74% (up 7.0bp); 5Y at 2.78% (up 3.1bp); 10Y at 2.43% (up 0.2bp); 30Y at 2.27% (down -1.1bp)

- 6-month spot US CPI swap up 3.4 bp to 4.241%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.5720%, +3.8 bp today; 10Y at -1.0240%, +7.3 bp today; 30Y at -0.4890%, +9.7 bp today

RATES VOLATILITY & LIQUIDITY

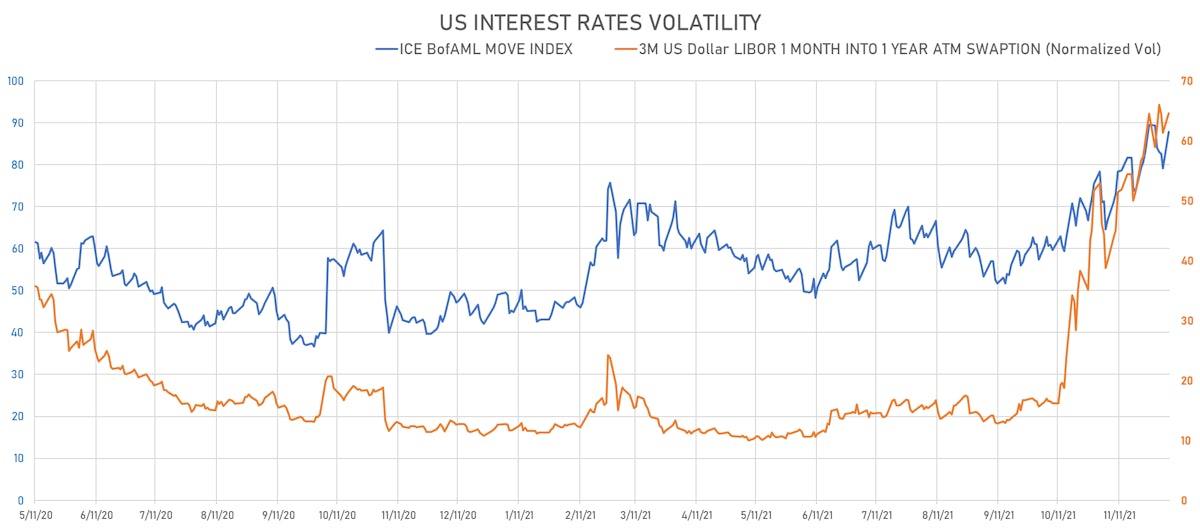

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 3.3% at 64.6%

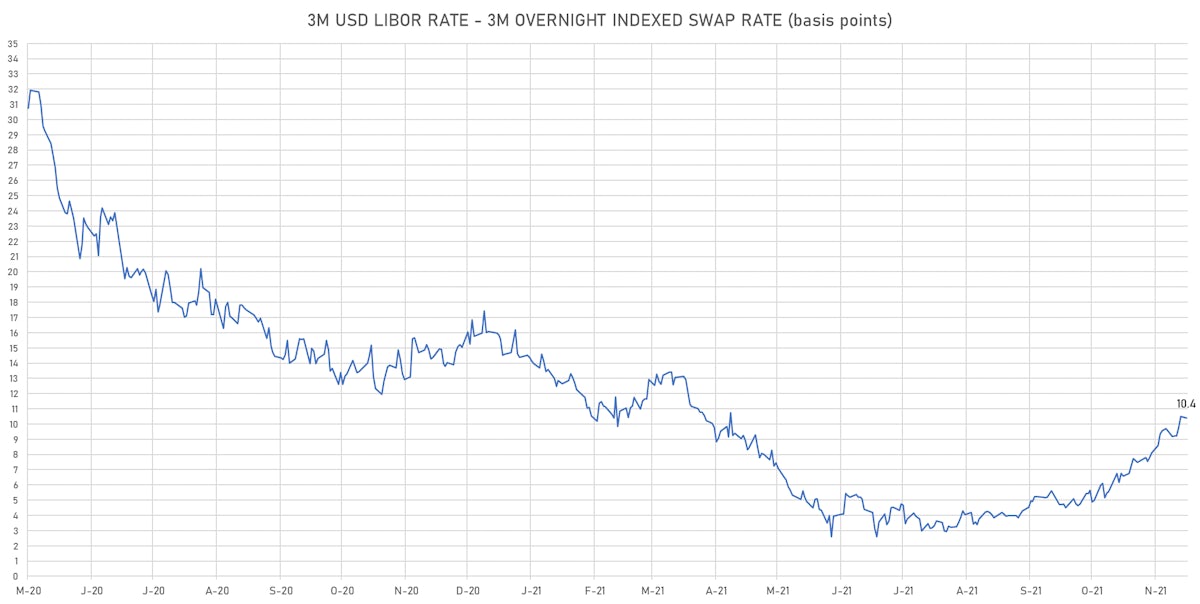

- 3-Month LIBOR-OIS spread down -0.1 bp at 10.4 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.613% (up 0.3 bp); the German 1Y-10Y curve is 2.9 bp flatter at 35.3bp (YTD change: +19.0 bp)

- Japan 5Y: -0.100% (down -0.1 bp); the Japanese 1Y-10Y curve is 1.0 bp flatter at 15.6bp (YTD change: +1.3 bp)

- China 5Y: 2.682% (down -5.8 bp); the Chinese 1Y-10Y curve is 19.2 bp flatter at 58.0bp (YTD change: +11.6 bp)

- Switzerland 5Y: -0.526% (down -0.3 bp); the Swiss 1Y-10Y curve is 7.0 bp flatter at 42.2bp (YTD change: +13.3 bp)