Rates

Rates Rise Again From The Front Out, With Labor Cost And Productivity Data Pushing Up Inflation Breakevens

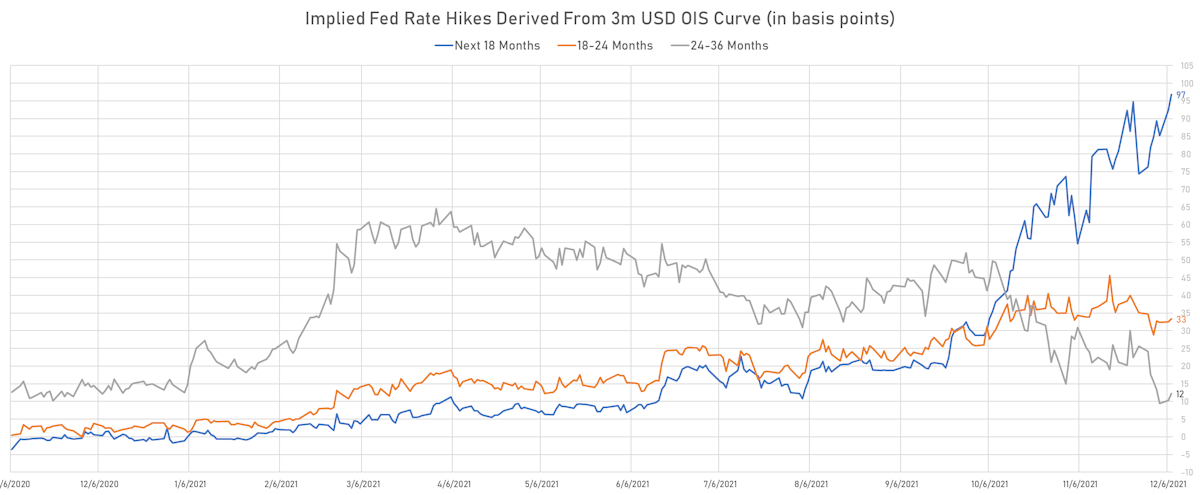

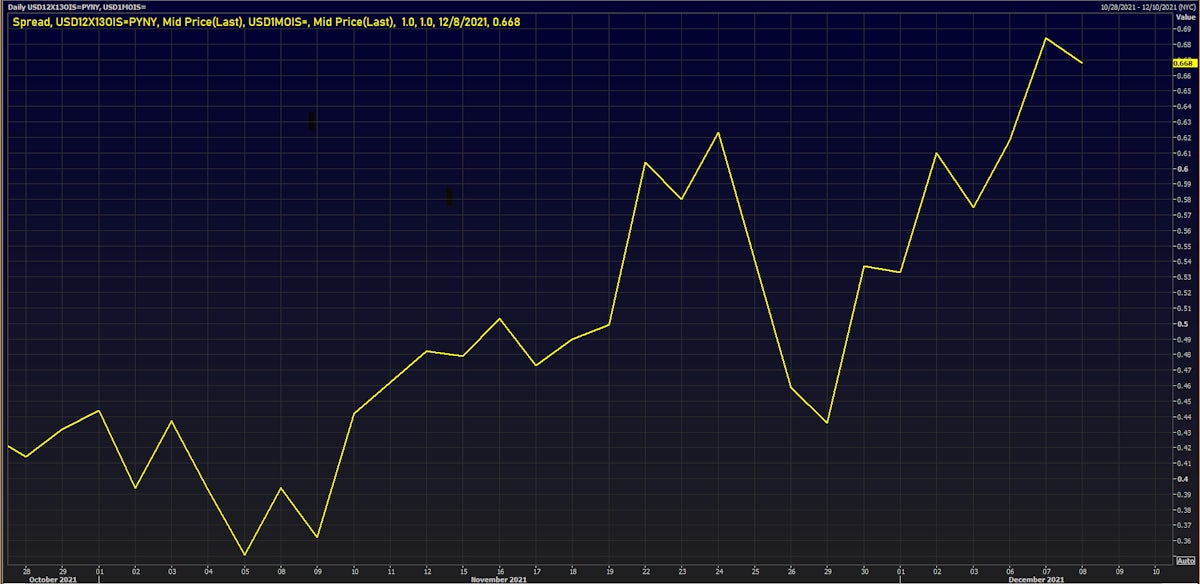

The front end of the US yield curve is getting closer to pricing in 3 rate hikes through 2022, with the most likely path being (based on forward OIS rates) the first hike in May or June, the next one in September, and one more in December

Published ET

Rate Hikes Implied In The 1-Month USD OIS 12 Months Forward | Source: Refinitiv

QUICK US SUMMARY

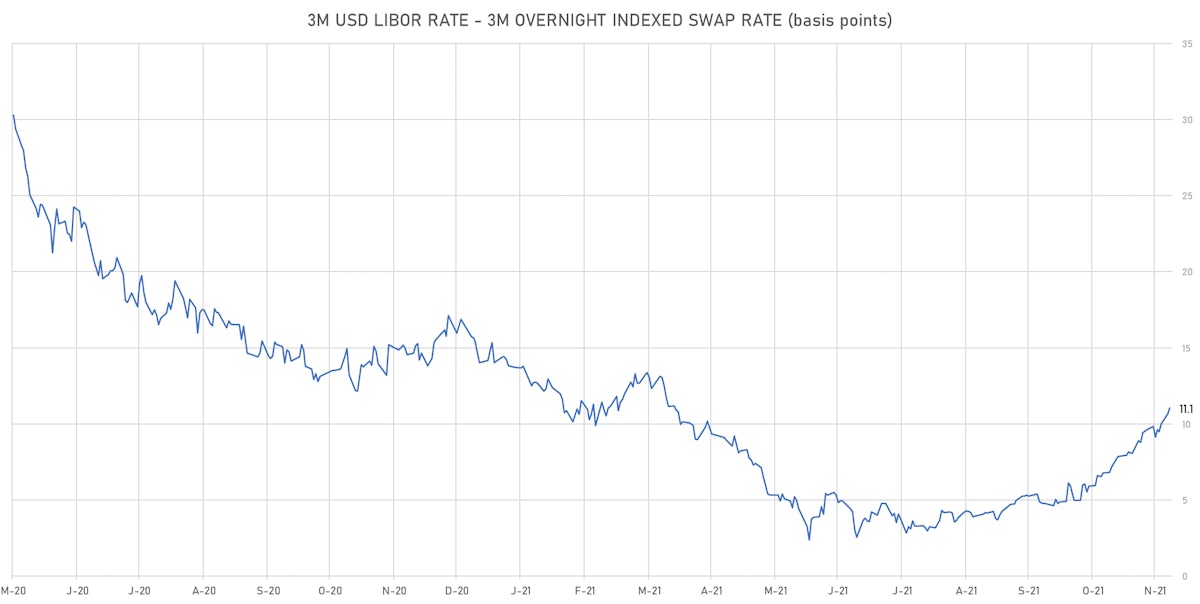

- 3-Month USD LIBOR +0.50bp today, now at 0.1950%; 3-Month OIS +0.1bp at 0.0845%

- The treasury yield curve steepened, with the 1s10s spread widening 1.6 bp, now at 120.3 bp (YTD change: +39.8bp)

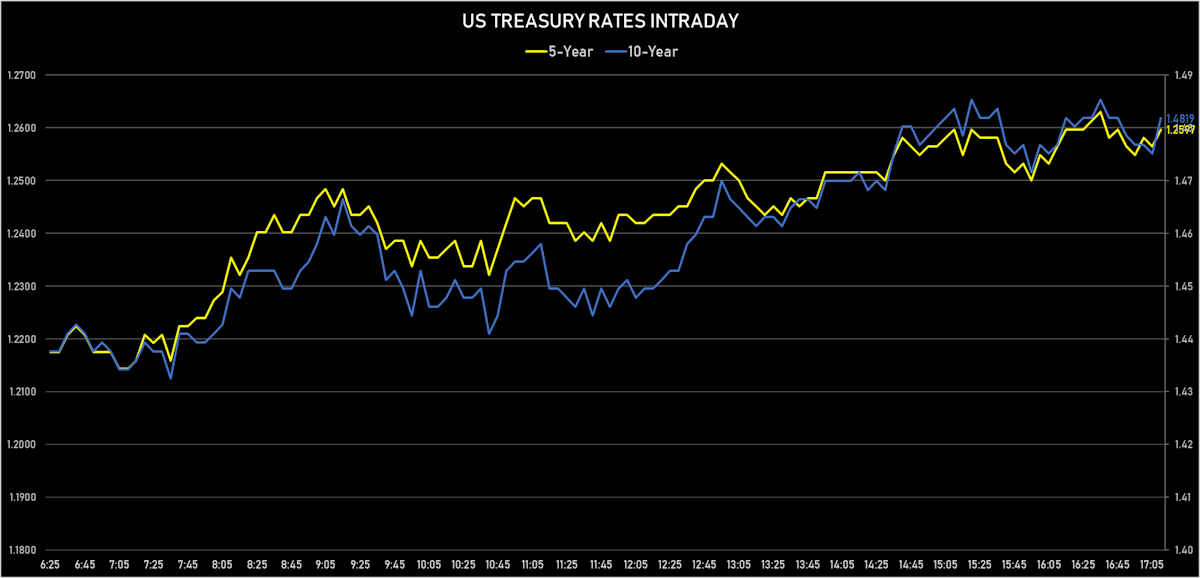

- 1Y: 0.2790% (up 3.3 bp)

- 2Y: 0.6932% (up 6.2 bp)

- 5Y: 1.2597% (up 5.5 bp)

- 7Y: 1.4303% (up 5.2 bp)

- 10Y: 1.4819% (up 4.9 bp)

- 30Y: 1.8092% (up 3.9 bp)

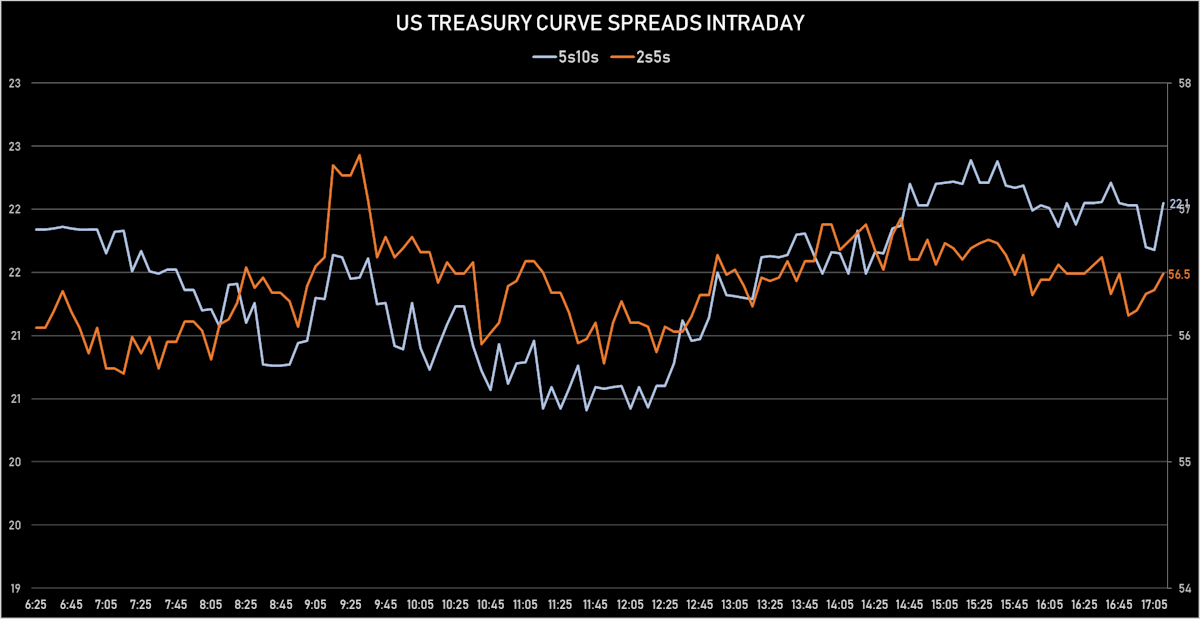

- US treasury curve spreads: 2s5s at 56.7bp (down -1.0bp), 5s10s at 22.2bp (down -1.1bp), 10s30s at 32.8bp (down -0.7bp)

- Treasuries butterfly spreads: 1s5s10s at -74.5bp (down -3.3bp), 5s10s30s at 10.5bp (up 0.4bp)

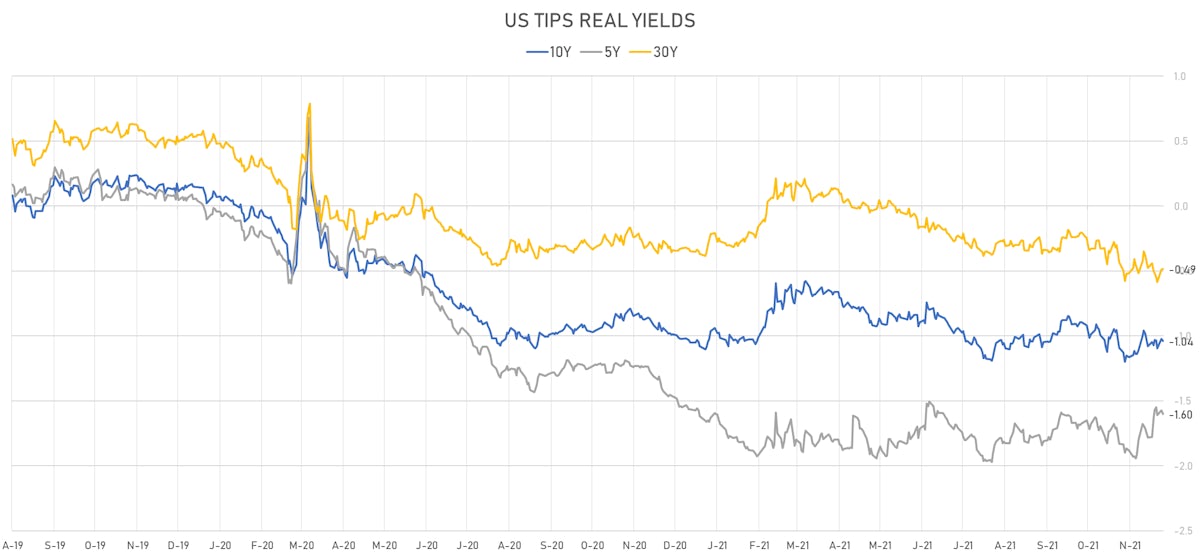

- US 5-Year TIPS Real Yield: -2.9 bp at -1.6010%; 10-Year TIPS Real Yield: -1.7 bp at -1.0410%; 30-Year TIPS Real Yield: +0.2 bp at -0.4870%

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 04 Dec (Redbook Research) at 15.30 % (vs 21.90 % prior)

- Consumer credit, total, Absolute change for Oct 2021 (FED, U.S.) at 16.90 Bln USD (vs 29.91 Bln USD prior), below consensus estimate of 25.00 Bln USD

- Labor Cost, Unit, business, nonfarm, Change P/P for Q3 2021 (BLS, U.S Dep. Of Lab) at 9.60 % (vs 8.30 % prior), above consensus estimate of 8.30 %

- Labor Productivity, Output per hour of all persons, nonfarm business for Q3 2021 (BLS, U.S Dep. Of Lab) at -5.20 % (vs -5.00 % prior), below consensus estimate of -4.90 %

- Trade Balance, Total, Goods and services for Oct 2021 (U.S. Census Bureau) at -67.10 Bln USD (vs -80.90 Bln USD prior), below consensus estimate of -66.80 Bln USD

$ 53.8 BN 3-YEAR 1% COUPON US TREASURY NOTE (91282CDN8)

- Mixed results, with decent pricing but below-average end-user demand (at 70.2% vs 72.1% average)

- Priced at par to yield 1%, a small 0.3bp stop-through vs the when-issued at the bid deadline

- Bid-to-cover ratio at 2.43 (vs 2.42 average)

- Indirects at 52.1% (vs 54.2% prior and 53.6% average)

- Directs at 18.01% (vs 18.3% prior and 18.05% average)

- Dealers at 29.81% (vs 27.6% prior and 27.9% average)

US FORWARD RATES

- 1-month USD OIS 12-months forward now prices in 67bp of Fed hikes, equivalent to 2 and 2/3 hikes

- The 3-month USD OIS forward curve prices in 72.1 bp of rate hikes over the next 15 months (equivalent to 2.88 rate hikes) and 142.4 bp over the next 3 years (equivalent to 5.70 rate hikes)

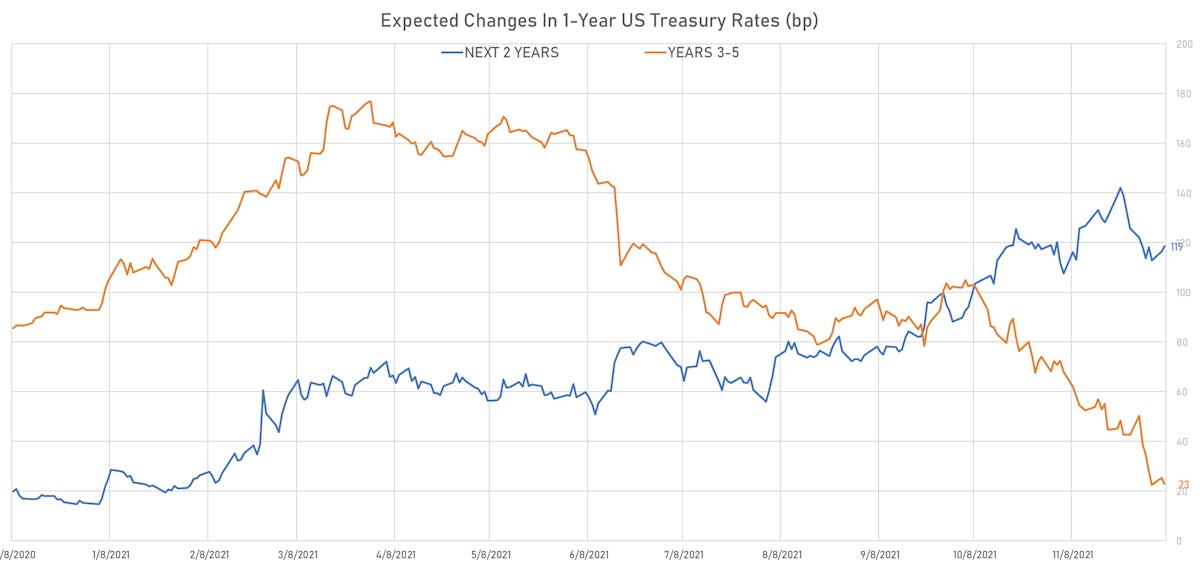

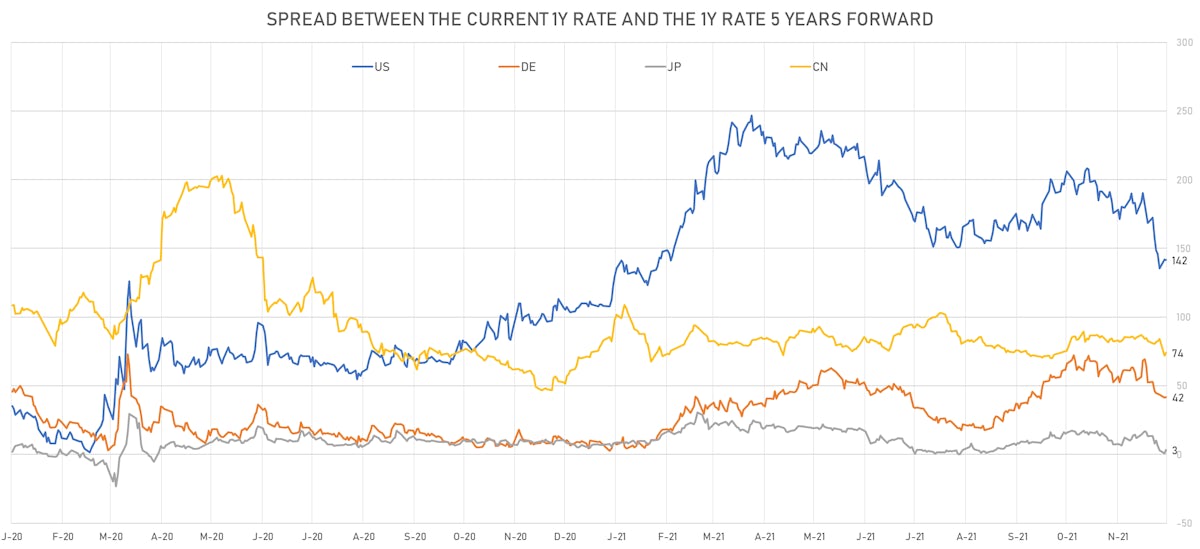

- 1-year US Treasury rate 5 years forward up 3.9 bp, now at 1.7740%, meaning that the 1-year Treasury rate is now expected to increase by 141.5 bp over the next 5 years (equivalent to 5.7 rate hikes)

US INFLATION & REAL RATES

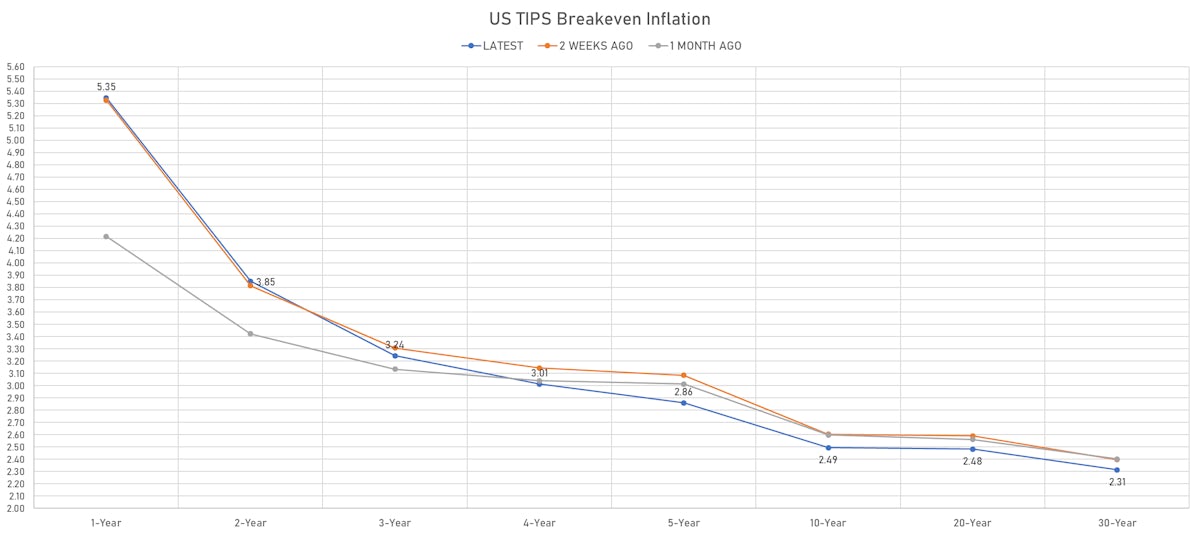

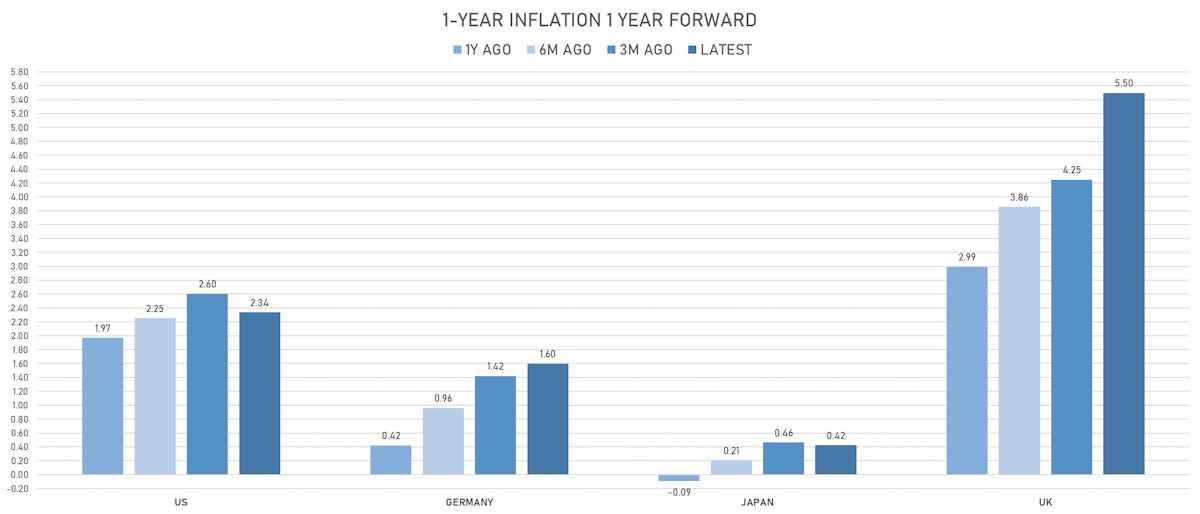

- TIPS 1Y breakeven inflation at 5.35% (up 13.3bp); 2Y at 3.85% (up 11.3bp); 5Y at 2.86% (up 8.0bp); 10Y at 2.49% (up 6.3bp); 30Y at 2.31% (up 3.9bp)

- 6-month spot US CPI swap up 7.1 bp to 4.312%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.6010%, -2.9 bp today; 10Y at -1.0410%, -1.7 bp today; 30Y at -0.4870%, +0.2 bp today

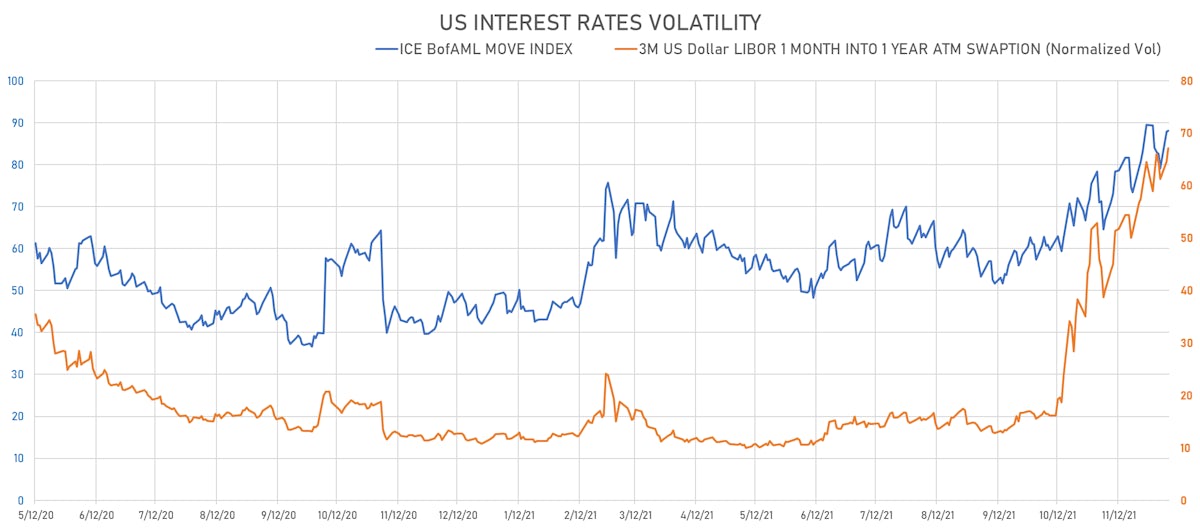

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 2.5% at 67.1%

- 3-Month LIBOR-OIS spread up 0.4 bp at 11.1 bp (12-months range: 2.4-17.1 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.597% (up 1.8 bp); the German 1Y-10Y curve is 1.2 bp steeper at 36.2bp (YTD change: +20.2 bp)

- Japan 5Y: -0.090% (up 1.0 bp); the Japanese 1Y-10Y curve is 1.4 bp steeper at 17.2bp (YTD change: +2.7 bp)

- China 5Y: 2.717% (up 3.5 bp); the Chinese 1Y-10Y curve is 0.6 bp steeper at 58.6bp (YTD change: +12.2 bp)

- Switzerland 5Y: -0.536% (down -1.0 bp); the Swiss 1Y-10Y curve is 3.3 bp steeper at 46.0bp (YTD change: +16.6 bp)