Rates

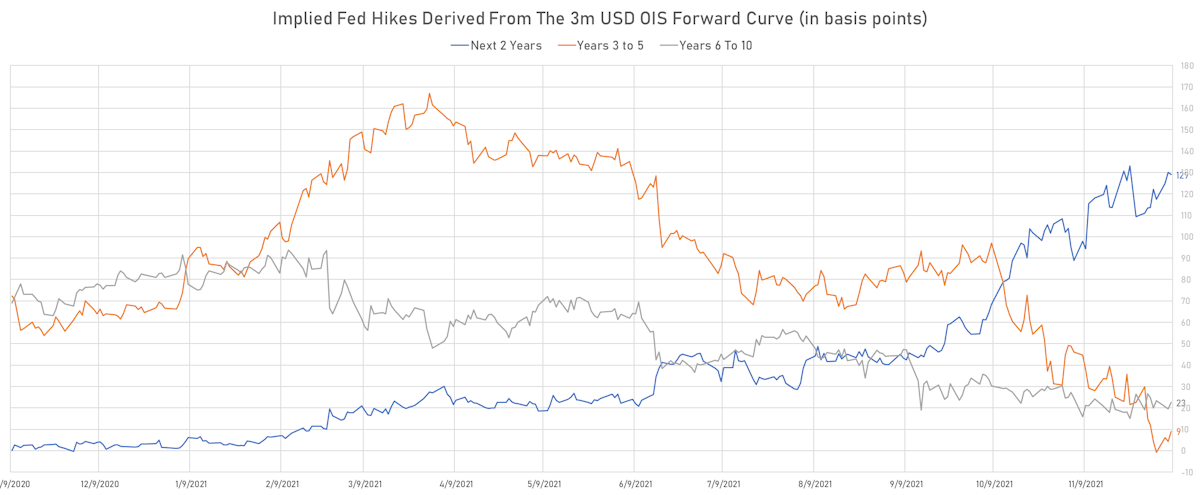

US Front-End Rates And Volatility Fall, Curve Steepens As Market Awaits CPI Report On Friday

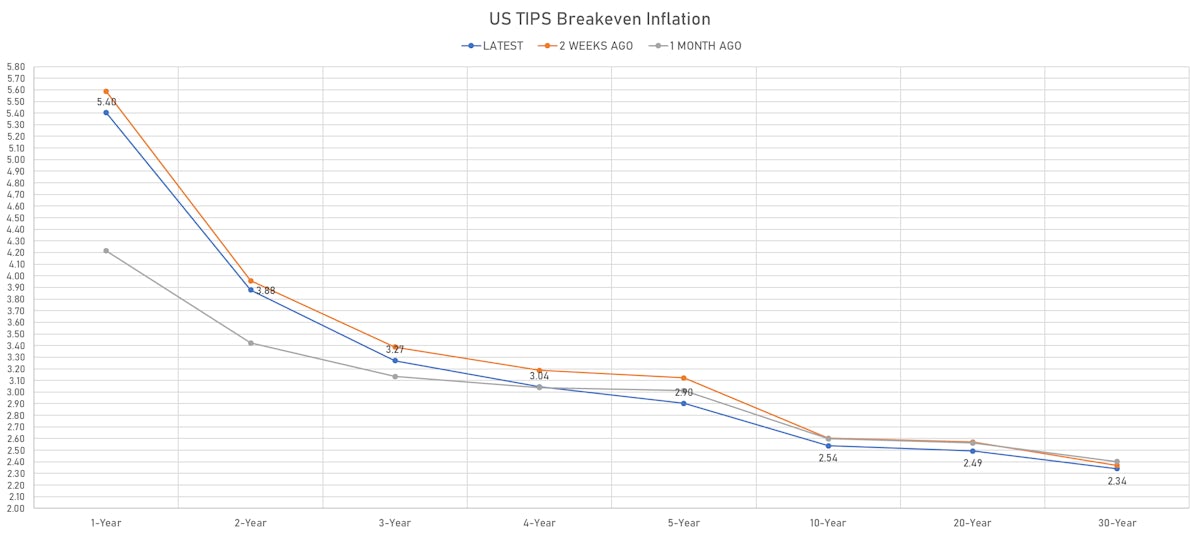

Good bounce in the TIPS 5s30s spread, as the reflation trade is seeing a little revival this week: lower front-end rates, delayed hikes, higher inflation breakevens, higher terminal rate

Published ET

US TIPS 5s30s Spread | Source: Refinitiv

QUICK US SUMMARY

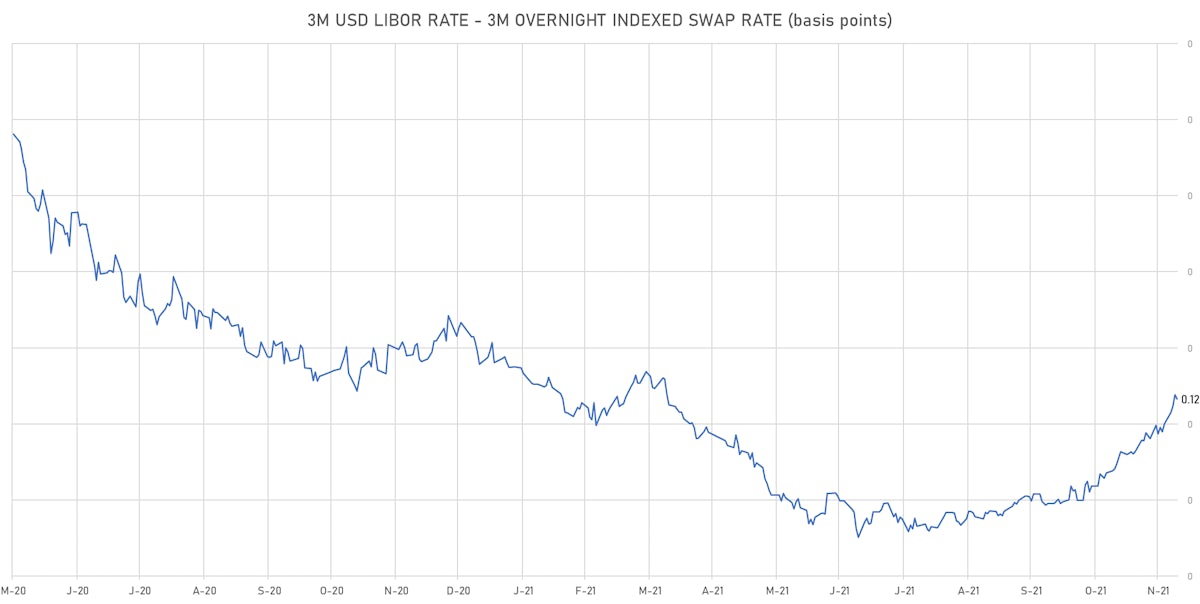

- 3-Month USD LIBOR -0.12bp today, now at 0.2025%; 3-Month OIS +0.2bp at 0.0860%

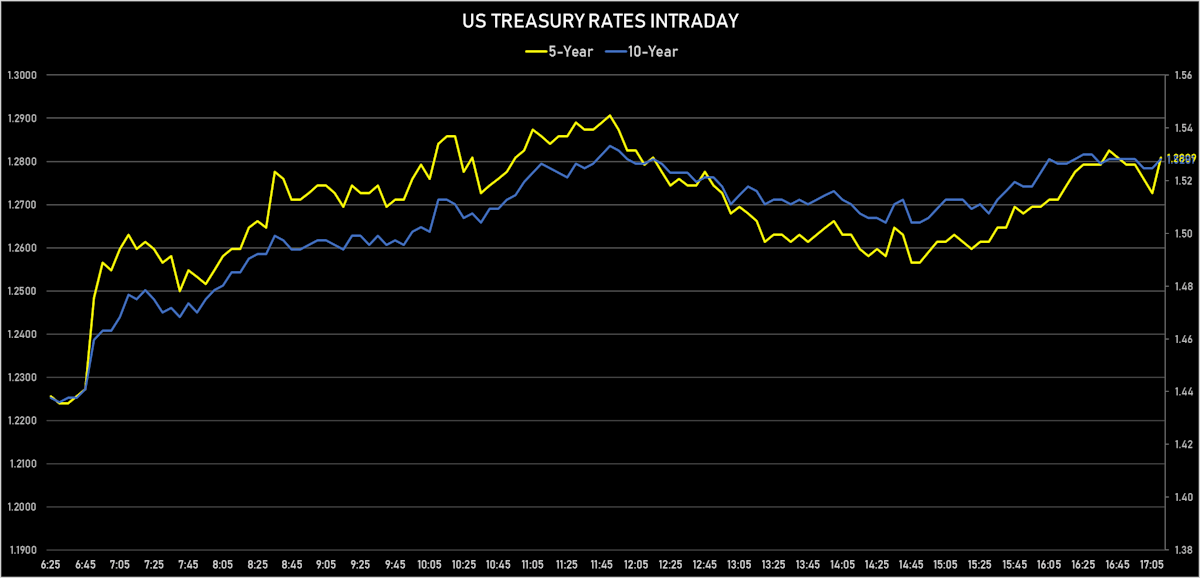

- The treasury yield curve steepened, with the 1s10s spread widening 6.7 bp, now at 122.3 bp (YTD change: +41.9bp)

- 1Y: 0.3050% (down 2.0 bp)

- 2Y: 0.6855% (down 0.8 bp)

- 5Y: 1.2809% (up 2.1 bp)

- 7Y: 1.4622% (up 3.2 bp)

- 10Y: 1.5281% (up 4.6 bp)

- 30Y: 1.8935% (up 8.4 bp)

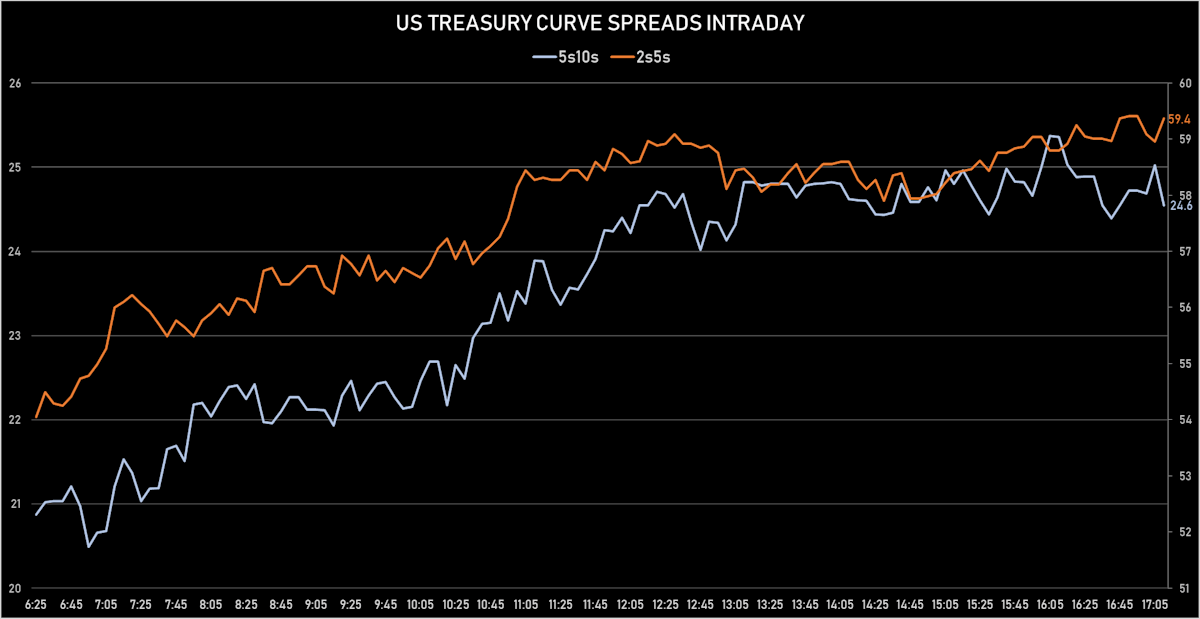

- US treasury curve spreads: 2s5s at 59.6bp (up 2.8bp today), 5s10s at 24.7bp (up 3.0bp today), 10s30s at 36.6bp (up 4.3bp today)

- Treasuries butterfly spreads: 1s5s10s at -76.4bp (down -1.9bp), 5s10s30s at 11.8bp (up 1.3bp)

- US 5-Year TIPS Real Yield: -2.0 bp at -1.6210%; 10-Year TIPS Real Yield: +0.2 bp at -1.0390%; 30-Year TIPS Real Yield: +5.6 bp at -0.4310%

US MACRO RELEASES

- JOLTS Job Openings for Oct 2021 (BLS, U.S Dep. Of Lab) at 11.03 Mln (vs 10.44 Mln prior), above consensus estimate of 10.37 Mln

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 03 Dec (MBA, USA) at 2.00 % (vs -7.20 % prior)

- Mortgage applications, market composite index for W 03 Dec (MBA, USA) at 616.40 (vs 604.20 prior)

- Mortgage applications, market composite index, purchase for W 03 Dec (MBA, USA) at 295.20 (vs 310.70 prior)

- Mortgage applications, market composite index, refinancing for W 03 Dec (MBA, USA) at 2,511.50 (vs 2,304.50 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 03 Dec (MBA, USA) at 3.30 % (vs 3.31 % prior)

- Refinitiv / Ipsos Primary Consumer Sentiment Index (CSI) for Dec 2021 (Refinitiv/Ipsos) at 56.53 (vs 53.61 prior)

US$ 36 BN 1.375% COUPON 10-YEAR TREASURY NOTE AUCTION (91282CDJ7)

- Mixed auction with poor pricing but solid end-user demand at 86.6% (vs 84.8% prior and 82.0% average)

- High yield at 1.518% (vs 1.444% prior), a 0.3b tail versus the when issued at the bid deadline

- Direct bids at 17.8% (vs 13.8% prior and 16.7% average)

- Indirect bids at 68.8% (vs 71.0% prior and 65.3% average)

- Bid-to-cover at 2.43 (vs 2.35 prior and 2.48 average)

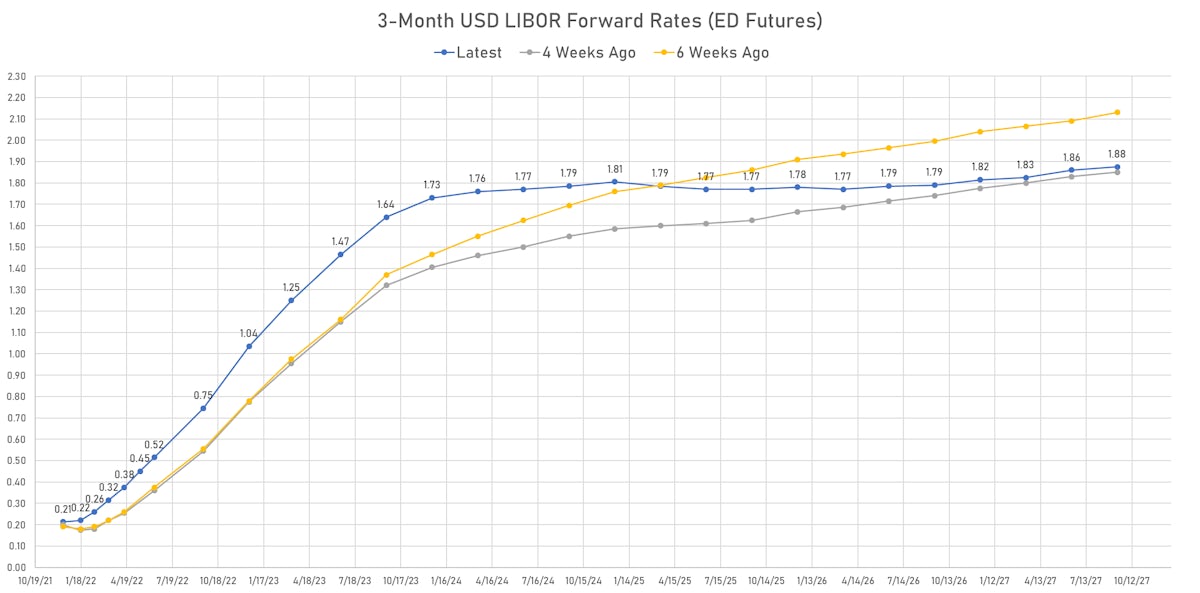

US FORWARD RATES

- 1-month USD OIS 12-months forward now prices in 66.8 bp of Fed hikes

- The 3-month USD OIS forward curve prices in 67.5 bp of rate hikes over the next 15 months (equivalent to 2.70 rate hikes) and 144.2 bp over the next 3 years (equivalent to 5.77 rate hikes)

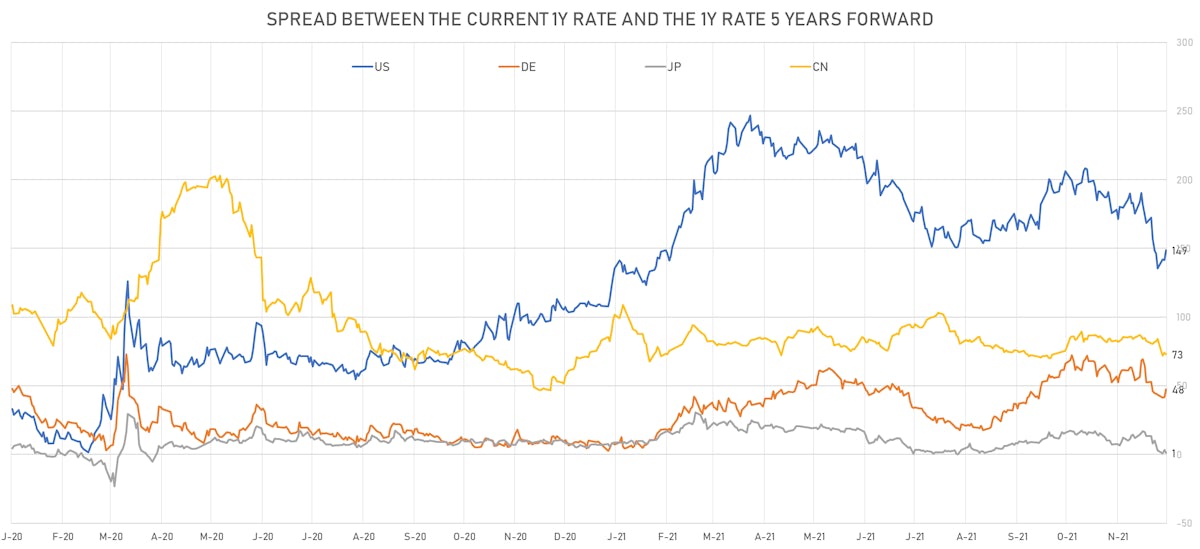

- 1-year US Treasury rate 5 years forward up 5.8 bp, now at 1.8320%, meaning that the 1-year Treasury rate is now expected to increase by 148.6 bp over the next 5 years (equivalent to 5.9 rate hikes)

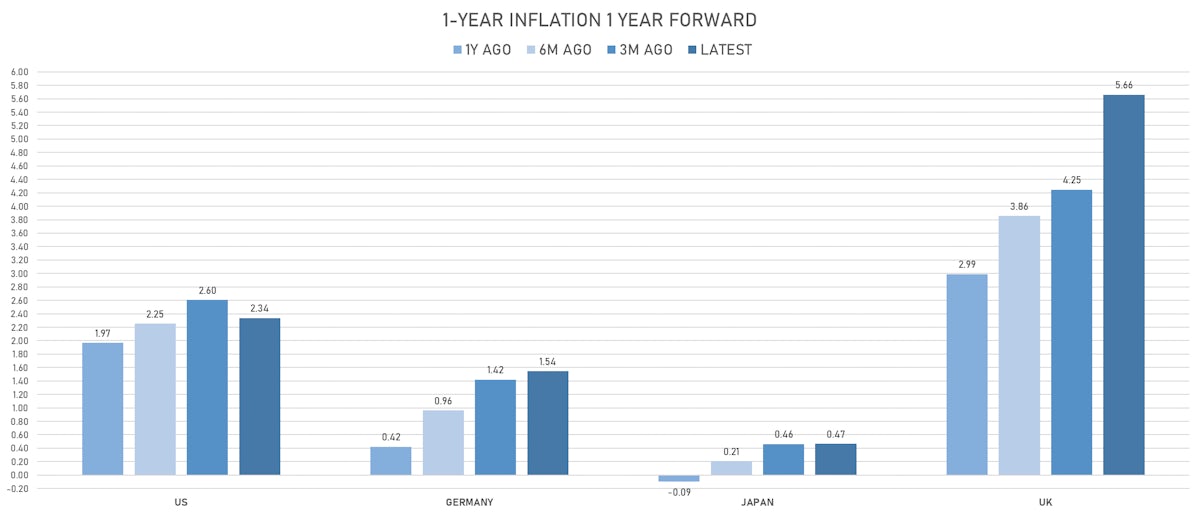

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.40% (up 5.8bp); 2Y at 3.88% (up 2.9bp); 5Y at 2.90% (up 4.3bp); 10Y at 2.54% (up 4.5bp); 30Y at 2.34% (up 2.7bp)

- 6-month spot US CPI swap up 4.3 bp to 4.356%, with a flattening of the forward curve

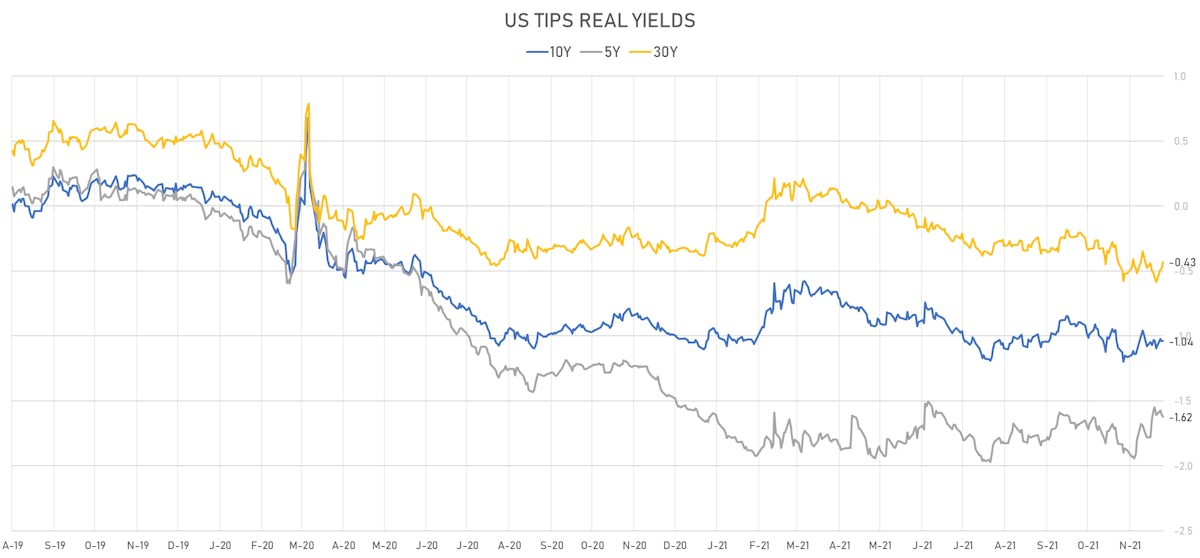

- US Real Rates: 5Y at -1.6210%, -2.0 bp today; 10Y at -1.0390%, +0.2 bp today; 30Y at -0.4310%, +5.6 bp today

RATES VOLATILITY & LIQUIDITY

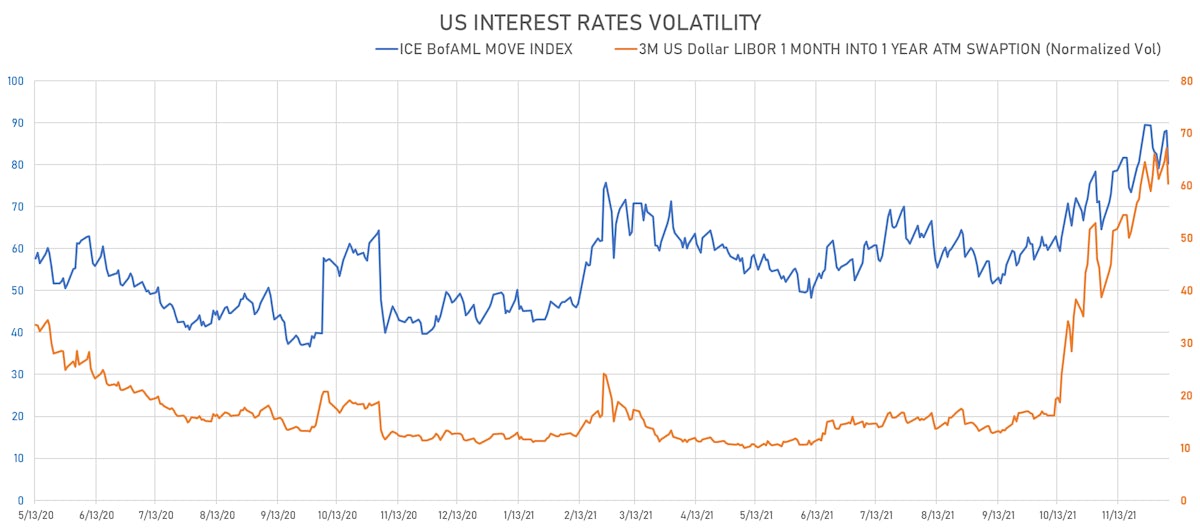

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -6.7% at 60.4%

- 3-Month LIBOR-OIS spot spread down -0.3 bp at 11.7 bp (12-months range: 2.6-17.1 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.561% (up 5.4 bp); the German 1Y-10Y curve is 6.6 bp steeper at 41.3bp (YTD change: +26.8 bp)

- Japan 5Y: -0.090% (unchanged); the Japanese 1Y-10Y curve is 0.9 bp flatter at 16.2bp (YTD change: +1.8 bp)

- China 5Y: 2.723% (up 0.6 bp); the Chinese 1Y-10Y curve is 0.2 bp steeper at 58.8bp (YTD change: +12.4 bp)

- Switzerland 5Y: -0.484% (up 4.1 bp); the Swiss 1Y-10Y curve is 4.2 bp steeper at 48.2bp (YTD change: +20.8 bp)