Rates

Slight Drop In Rates Across The Curve, With Lower Breakevens And A Flatter 5s30s TIPS Curve

Initial claims fell sharply to their lowest level since 1969, and focus is now on tomorrow’s CPI report, with core and headline inflation forecasted to jump to 4.9% and 6.8% respectively

Published ET

Fed Hikes by the end of 2022 priced into 1M USD OIS 12M Forward & Fed Funds Futures (FFZ2) | Source: Refinitiv

QUICK US SUMMARY

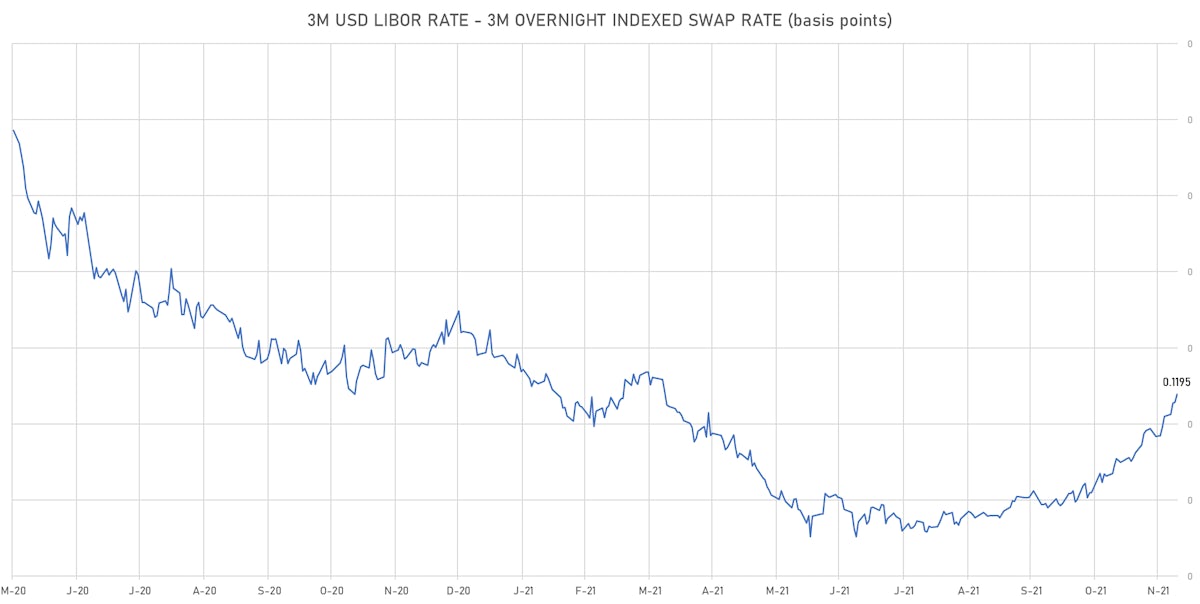

- 3-Month USD LIBOR +0.45bp today, now at 0.2050%; 3-Month OIS unchanged at 0.0855%

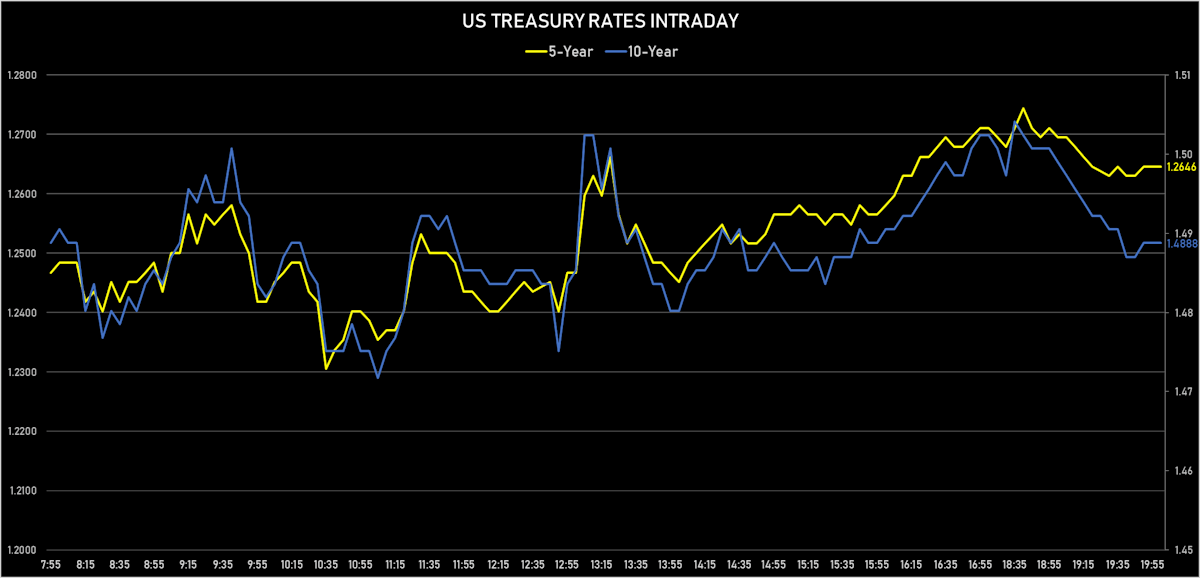

- The treasury yield curve flattened, with the 1s10s spread tightening -1.3 bp, now at 123.3 bp (YTD change: +42.9bp)

- 1Y: 0.2640% (down 1.8 bp)

- 2Y: 0.6917% (up 0.6 bp)

- 5Y: 1.2679% (down 1.3 bp)

- 7Y: 1.4338% (down 2.8 bp)

- 10Y: 1.4973% (down 3.1 bp)

- 30Y: 1.8750% (down 1.9 bp)

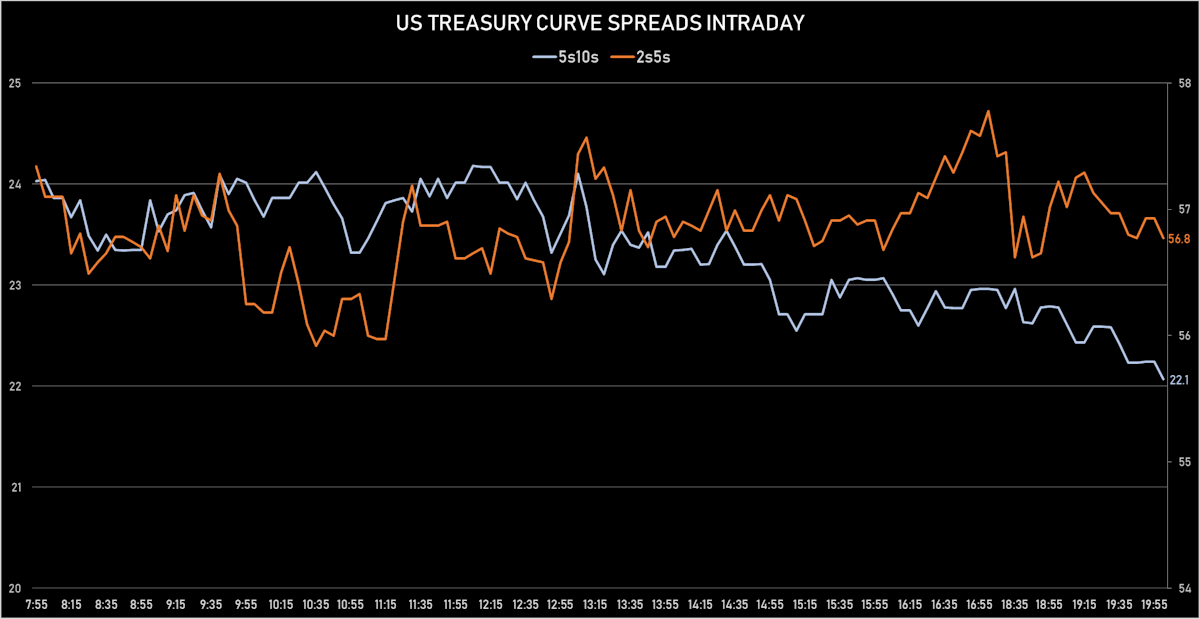

- US treasury curve spreads: 2s5s at 57.1bp (down -1.4bp), 5s10s at 22.3bp (down -1.7bp), 10s30s at 37.8bp (up 0.6bp today)

- Treasuries butterfly spreads: 1s5s10s at -78.4bp (down -2.0bp), 5s10s30s at 14.2bp (up 2.4bp)

- US 5-Year TIPS Real Yield: +8.3 bp at -1.5380%; 10-Year TIPS Real Yield: +3.2 bp at -1.0070%; 30-Year TIPS Real Yield: +2.7 bp at -0.4040%

US$ 22BN 1.875% COUPON 30-YEAR BOND AUCTION (912810TB4)

- Dismal results despite a reduced size, with terrible pricing and below average end-user demand at 79.3% (vs 74.8% prior and 81.7% average)

- High yield at 1.895% (vs 1.940% prior), a huge 3.2 bp tail versus the when issued at the bid deadline

- Direct bids at 18.5% (vs 15.8% prior and 18.3% average)

- Indirect bids at 60.8% (vs 59.0% prior and 63.4% average)

- Bid-to-cover: 2.22 (vs 2.20 prior and 2.32 average)

US MACRO RELEASES

- Jobless Claims, National, Continued for W 27 Nov (U.S. Dept. of Labor) at 1.99 Mln (vs 1.96 Mln prior), above consensus estimate of 1.90 Mln

- Jobless Claims, National, Initial for W 04 Dec (U.S. Dept. of Labor) at 184.00 k (vs 222.00 k prior), below consensus estimate of 215.00 k

- Jobless Claims, National, Initial, four week moving average for W 04 Dec (U.S. Dept. of Labor) at 218.75 k (vs 238.75 k prior)

- Wholesale Inventories, Change P/P for Oct 2021 (U.S. Census Bureau) at 2.30 % (vs 2.20 % prior), above consensus estimate of 2.20 %

- Wholesale Trade, Change P/P for Oct 2021 (U.S. Census Bureau) at 2.20 % (vs 1.10 % prior), above consensus estimate of 1.00 %

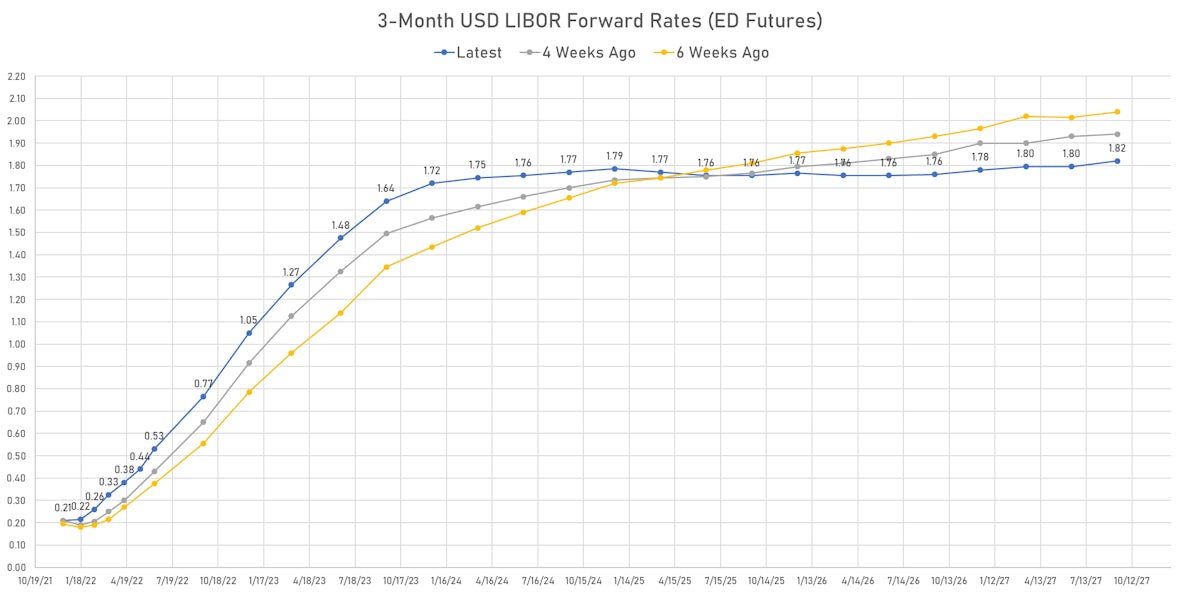

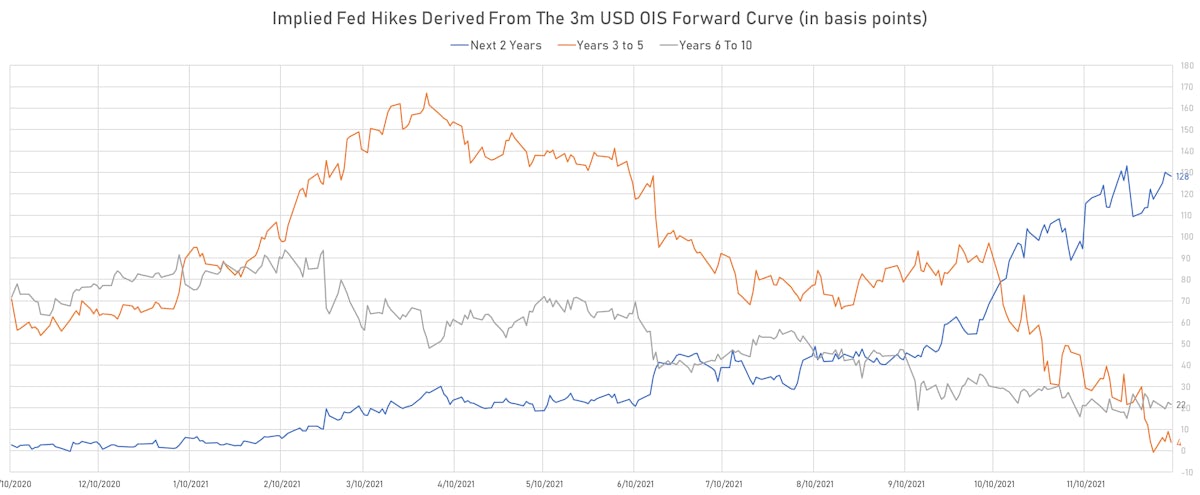

US FORWARD RATES

- 1-month USD OIS 12-months forward now prices in 69.5 bp of Fed hikes (equivalent to 2.8 hikes), while Fed Funds Futures (FFZ2) price in 64 bp (2.6 hikes)

- The 3-month USD OIS forward curve prices in 72.7 bp of rate hikes over the next 15 months (equivalent to 2.91 rate hikes) and 142.4 bp over the next 3 years (equivalent to 5.69 rate hikes)

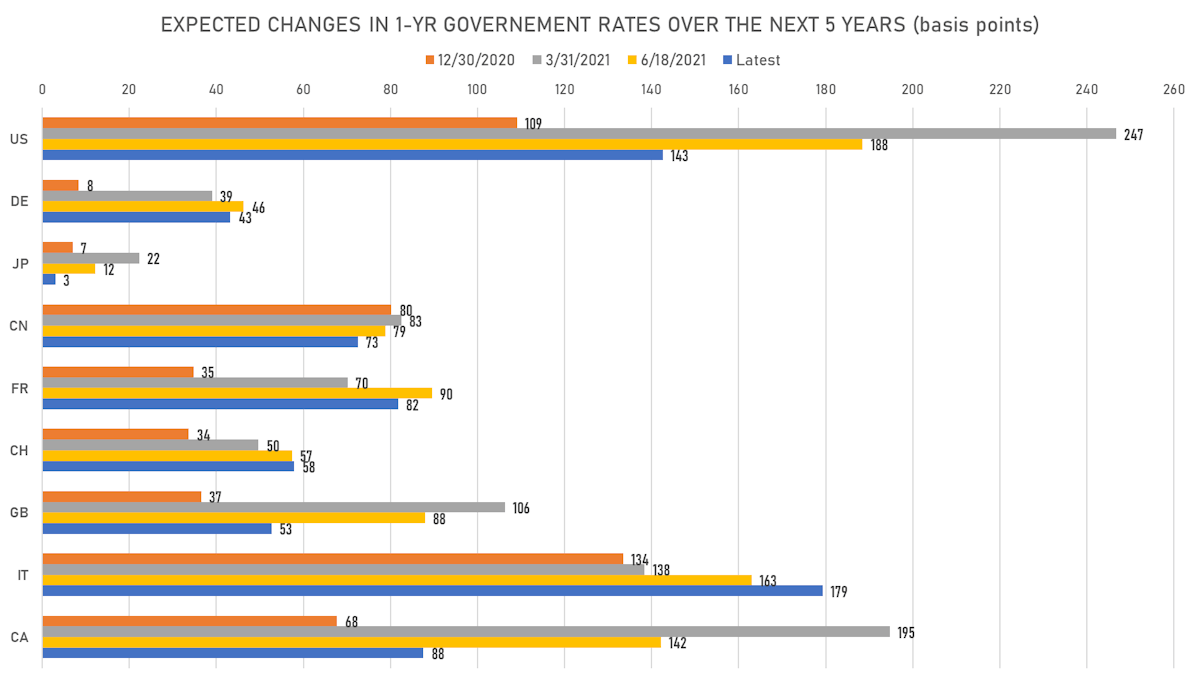

- 1-year US Treasury rate 5 years forward down 6.6 bp, now at 1.7658%, meaning that the 1-year Treasury rate is now expected to increase by 140.5 bp over the next 5 years (equivalent to 5.6 rate hikes)

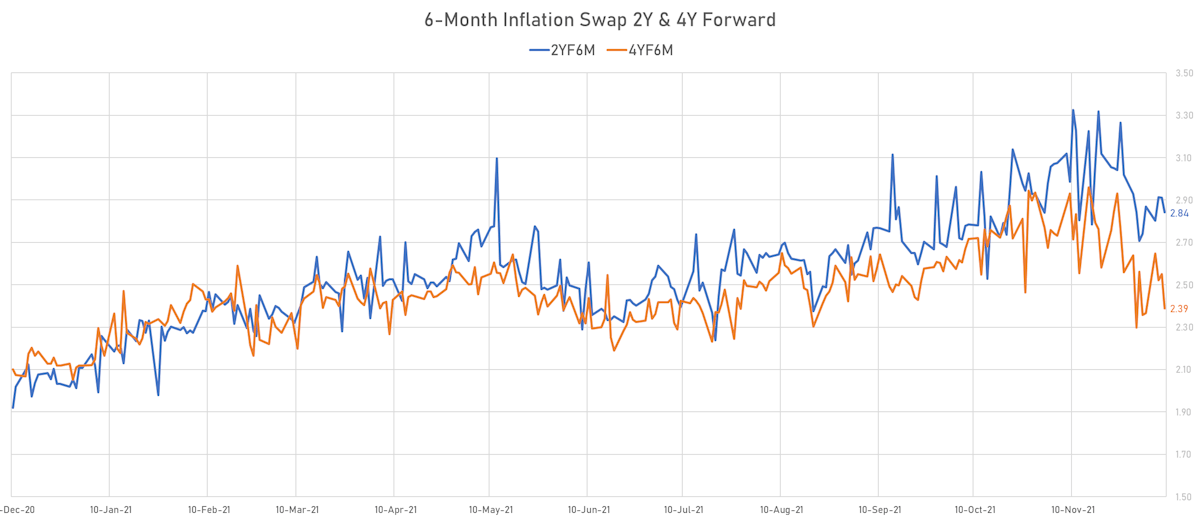

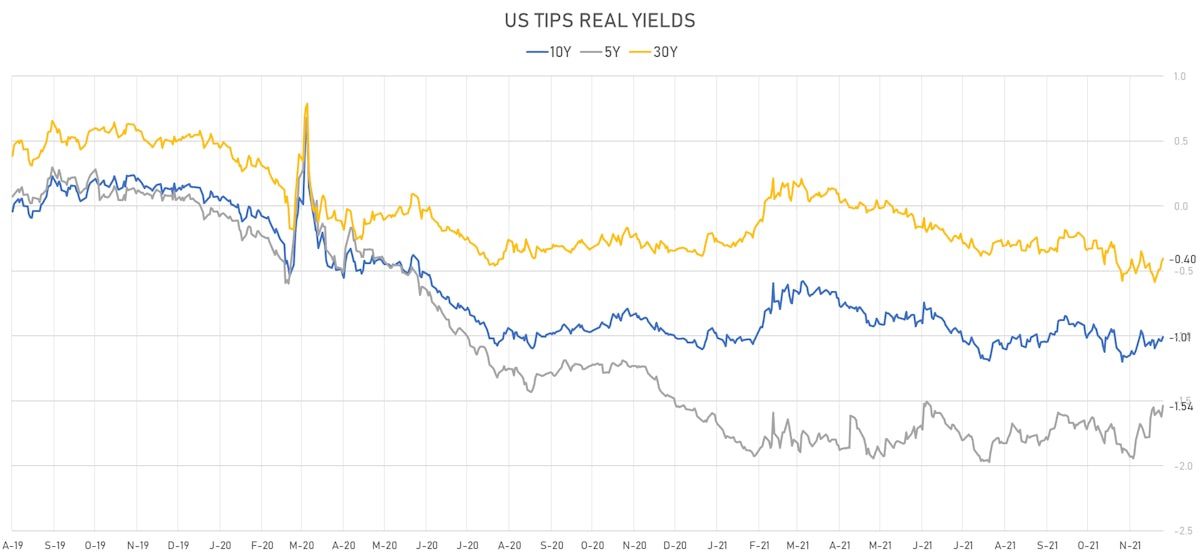

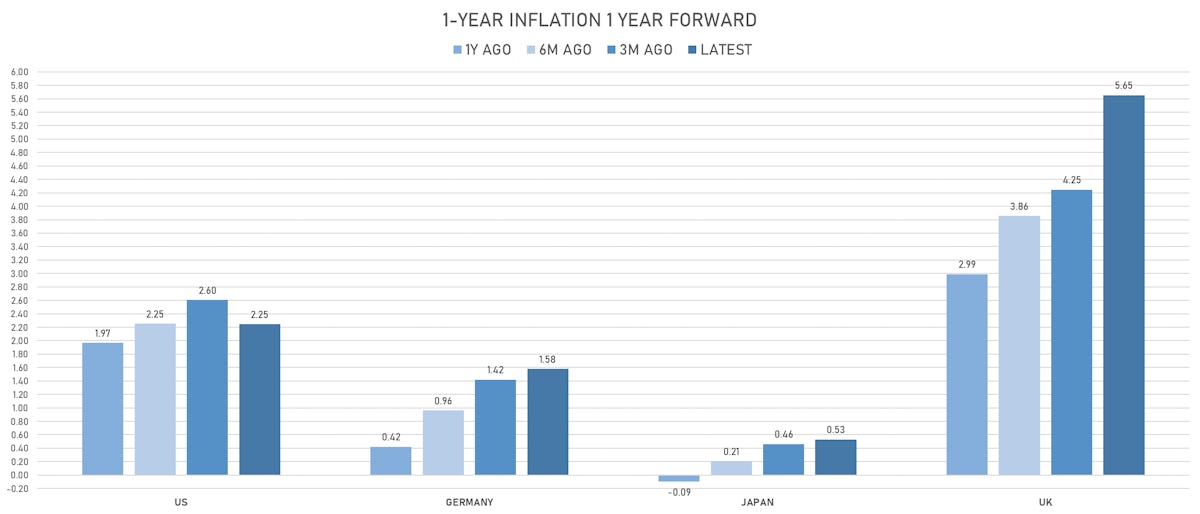

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.27% (down -13.7bp); 2Y at 3.76% (down -12.1bp); 5Y at 2.80% (down -10.3bp); 10Y at 2.46% (down -7.8bp); 30Y at 2.28% (down -5.7bp)

- 6-month spot US CPI swap down -9.4 bp to 4.262%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.5380%, +8.3 bp today; 10Y at -1.0070%, +3.2 bp today; 30Y at -0.4040%, +2.7 bp today

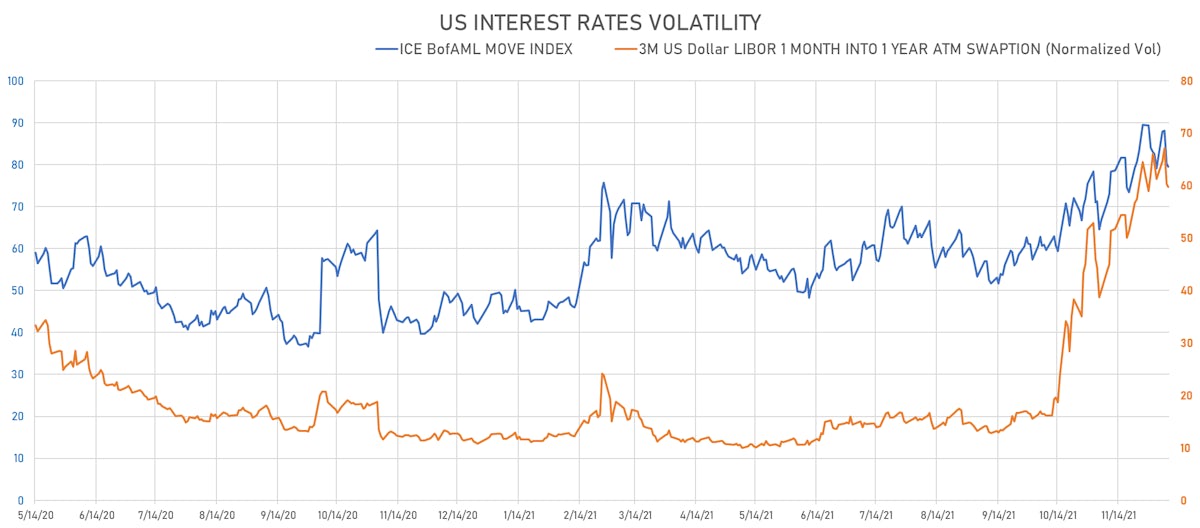

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.7% at 59.7%

- 3-Month LIBOR-OIS spread up 0.5 bp at 12.0 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.594% (down -4.3 bp); the German 1Y-10Y curve is 4.2 bp flatter at 38.2bp (YTD change: +22.6 bp)

- Japan 5Y: -0.090% (up 0.5 bp); the Japanese 1Y-10Y curve is unchanged at 15.2bp (YTD change: +1.8 bp)

- China 5Y: 2.714% (down -0.9 bp); the Chinese 1Y-10Y curve is 2.3 bp flatter at 55.6bp (YTD change: +10.1 bp)

- Switzerland 5Y: -0.527% (down -3.2 bp); the Swiss 1Y-10Y curve is 5.2 bp flatter at 46.0bp (YTD change: +15.6 bp)