Rates

US Rates Modestly Lower As CPI Data Brought No Surprise; Market Expects 2/3 Chance Of 3 Hikes Next Year

Short-term inflation breakevens fell sharply (2Y down 11bp), while longer-term expectations and TIPS real yields were little changed (TIPS 5s30s slightly steeper)

Published ET

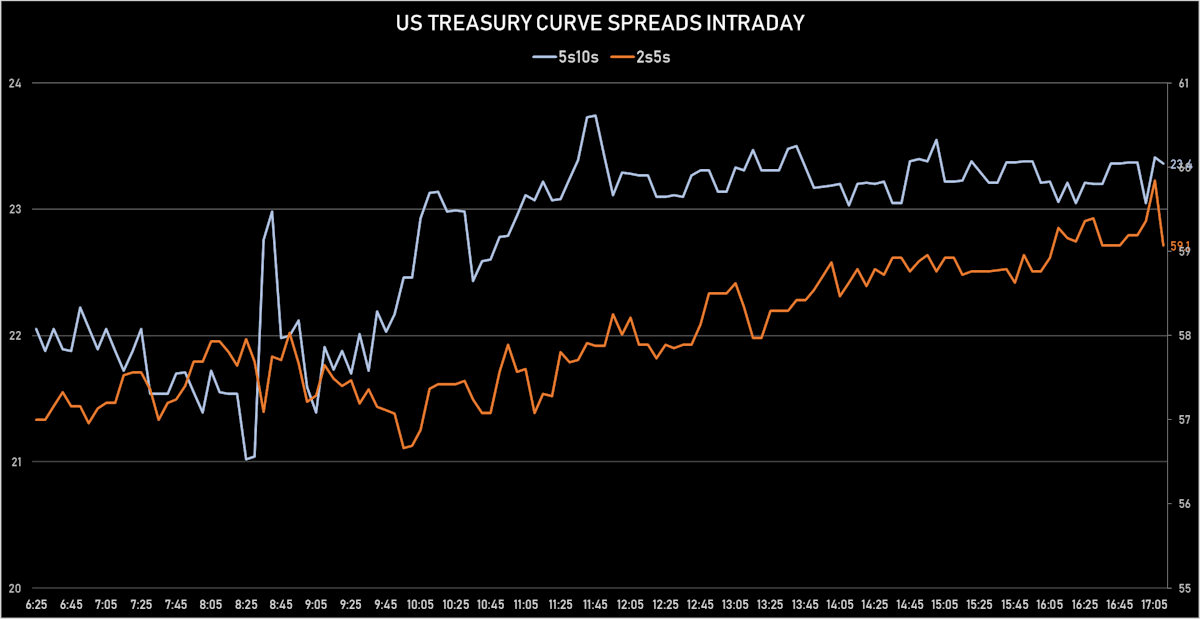

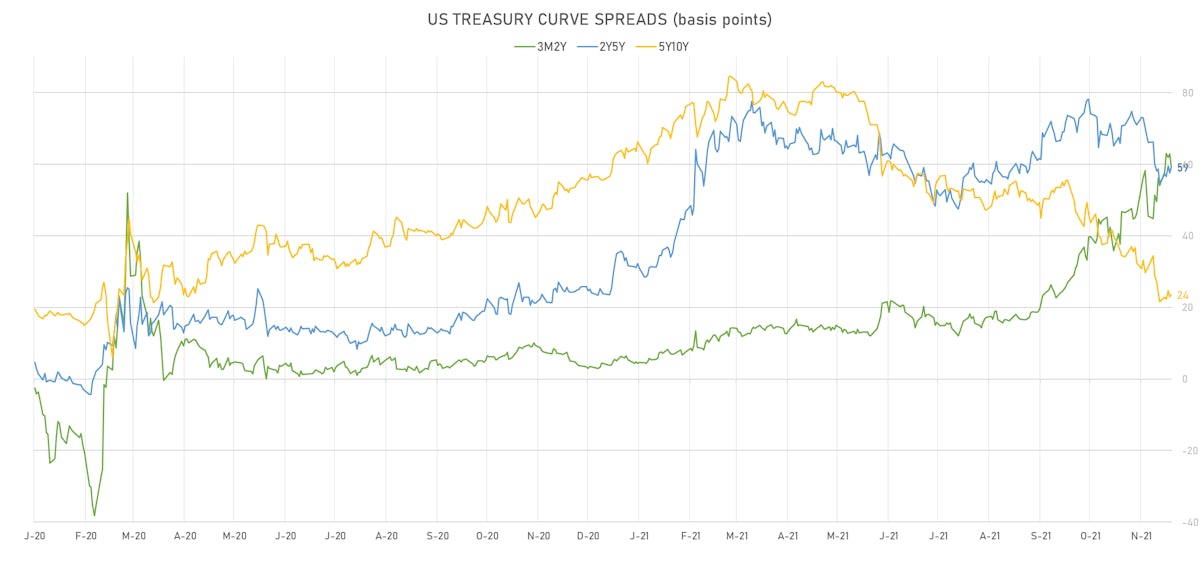

US Treasury Curve Spreads | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

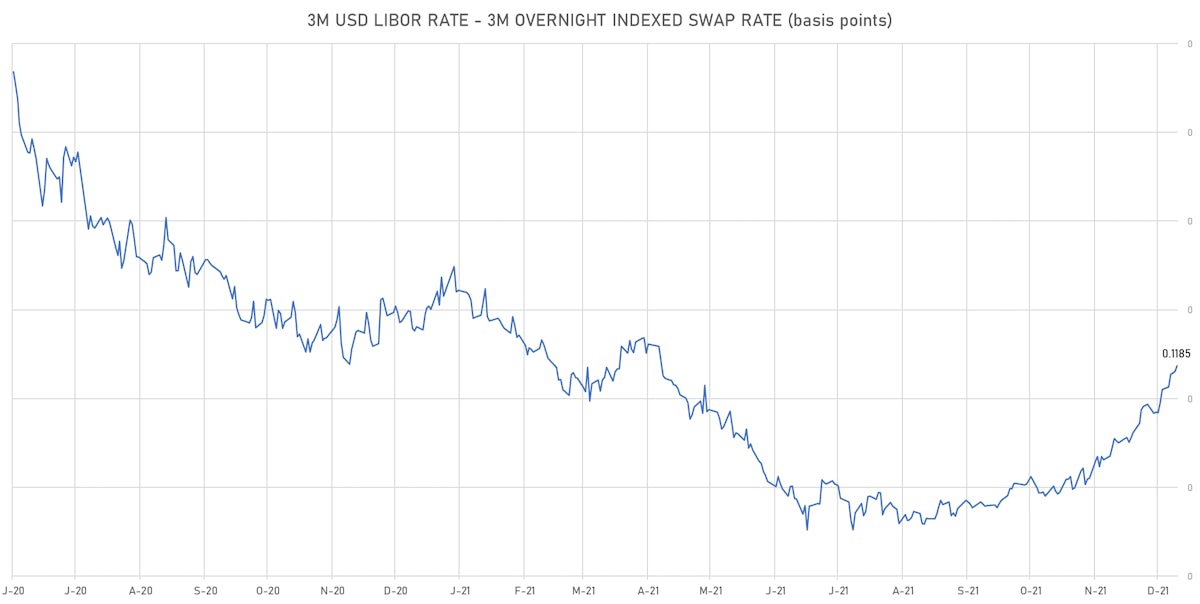

- 3-Month USD LIBOR +0.41bp today, now at 0.2050%; 3-Month OIS +0.1bp at 0.0865%

- The treasury yield curve flattened, with the 1s10s spread tightening -0.5 bp, now at 121.8 bp (YTD change: +41.4bp)

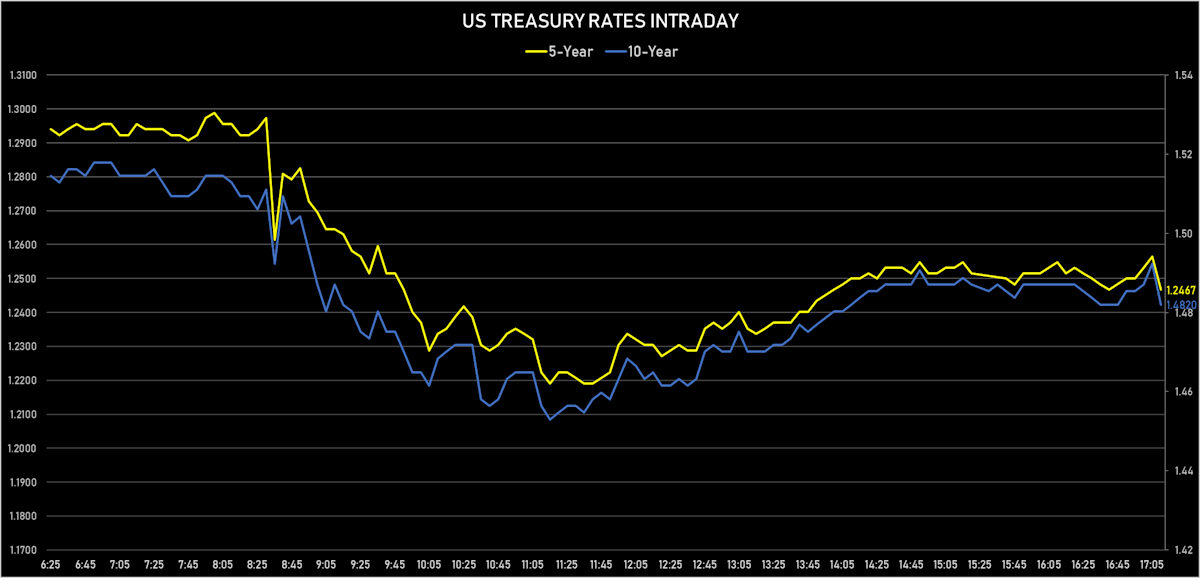

- 1Y: 0.2640% (down 1.0 bp)

- 2Y: 0.6544% (down 3.7 bp)

- 5Y: 1.2467% (down 2.1 bp)

- 7Y: 1.4149% (down 1.9 bp)

- 10Y: 1.4820% (down 1.5 bp)

- 30Y: 1.8818% (up 0.7 bp)

- US treasury curve spreads: 2s5s at 59.3bp (up 1.7bp today), 5s10s at 23.5bp (up 0.2bp today), 10s30s at 40.0bp (up 1.7bp today)

- Treasuries butterfly spreads: 1s5s10s at -76.2bp (up 2.2bp today), 5s10s30s at 15.5bp (up 1.3bp)

- US 5-Year TIPS Real Yield: -0.8 bp at -1.5460%; 10-Year TIPS Real Yield: -0.2 bp at -1.0090%; 30-Year TIPS Real Yield: +2.1 bp at -0.3830%

US MACRO RELEASES

- CPI - All Urban Samples: All Items, Change Y/Y for Nov 2021 (BLS, U.S Dep. Of Lab) at 6.80 % (vs 6.20 % prior), in line with consensus

- CPI, All items less food and energy for Nov 2021 (BLS, U.S Dep. Of Lab) at 283.20 (vs 281.70 prior)

- CPI, All items less food and energy, Change P/P for Nov 2021 (BLS, U.S Dep. Of Lab) at 0.50 % (vs 0.60 % prior), in line with consensus

- CPI, All items less food and energy, Change Y/Y, Price Index for Nov 2021 (BLS, U.S Dep. Of Lab) at 4.90 % (vs 4.60 % prior), in line with consensus

- CPI, All items, Change P/P for Nov 2021 (BLS, U.S Dep. Of Lab) at 0.80 % (vs 0.90 % prior), above consensus estimate of 0.70 %

- CPI, All items, Price Index for Nov 2021 (BLS, U.S Dep. Of Lab) at 277.95 (vs 276.59 prior), below consensus estimate of 278.11

- CPI, FRB Cleveland Median, 1 month, Change M/M for Nov 2021 (Fed Resrv, Cleveland) at 0.50 % (vs 0.60 % prior)

- Earnings, Average Weekly, Total Private, Change P/P for Nov 2021 (BLS, U.S Dep. Of Lab) at -0.20 % (vs -0.90 % prior)

- Federal Budget, Current Prices for Nov 2021 (Fiscal Service, USA) at -191.00 Bln USD (vs -165.00 Bln USD prior), above consensus estimate of -195.00 Bln USD

- University of Michigan, Current Conditions Index-prelim, Volume Index for Dec 2021 (UMICH, Survey) at 74.60 (vs 73.60 prior), above consensus estimate of 71.00

- University of Michigan, Total-prelim, Change Y/Y for Dec 2021 (UMICH, Survey) at 3.00 % (vs 3.00 % prior)

- University of Michigan, Total-prelim, Volume Index for Dec 2021 (UMICH, Survey) at 67.80 (vs 63.50 prior), above consensus estimate of 62.00

- University of Michigan, Total-prelim, Volume Index for Dec 2021 (UMICH, Survey) at 70.40 (vs 67.40 prior), above consensus estimate of 67.10

- 1-Year Inflation Expectations (median), preliminary for Dec 2021 (UMICH, Survey) at 4.90 % (vs 4.90 % prior)

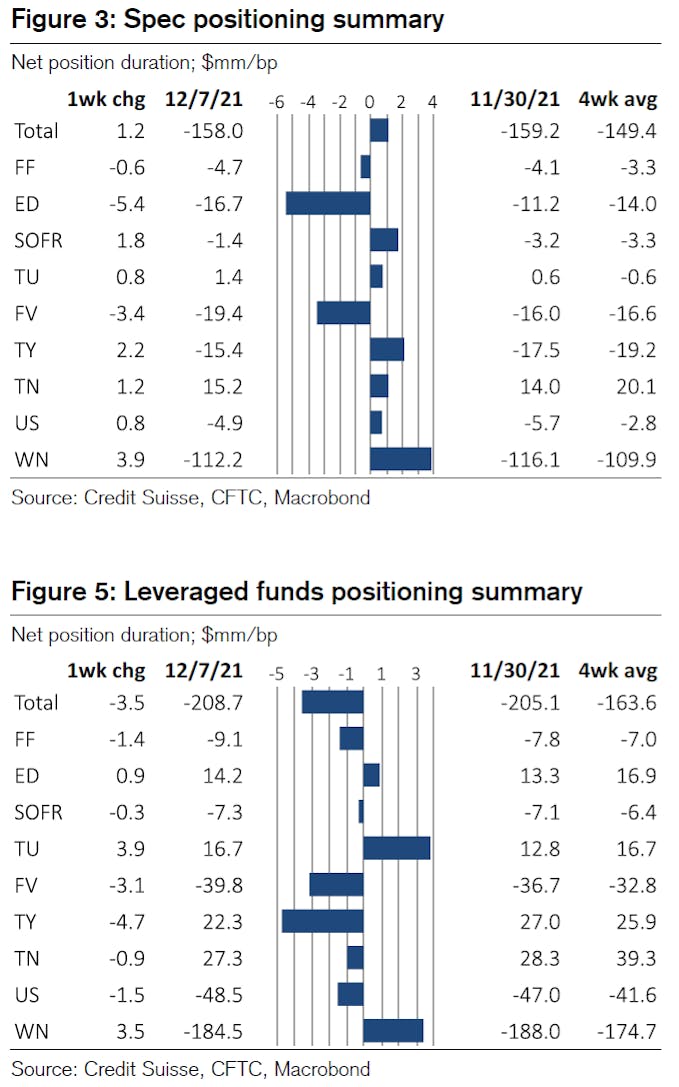

WEEKLY COTR NET DURATION POSITIONING

- Specs net duration was little changed, with a flattening bias: covered some shorts at the long end and increased shorts at the front end

- Leveraged funds increased their net short duration with a steepening bias: increased net longs in the next 2 years and increased their net shorts from the belly out

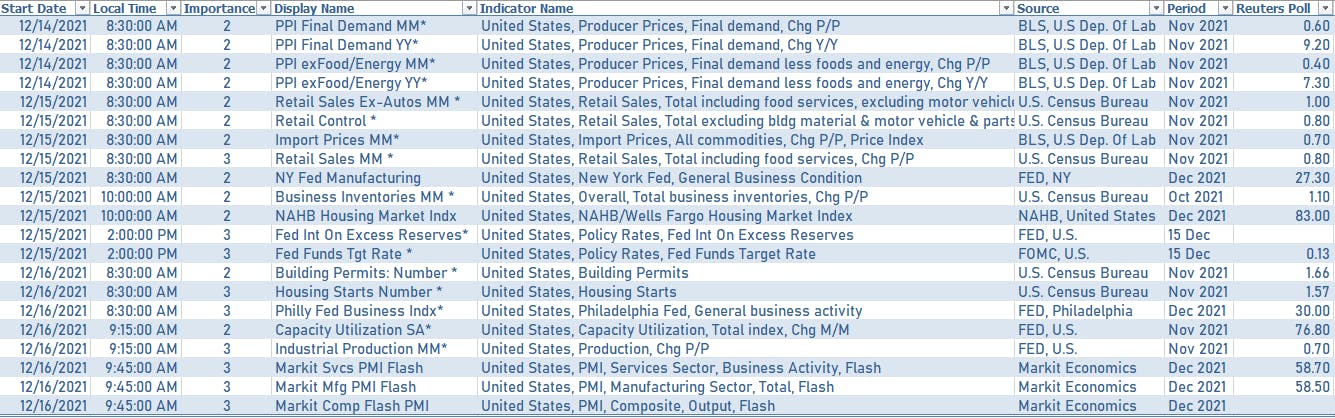

US MACRO WEEK AHEAD

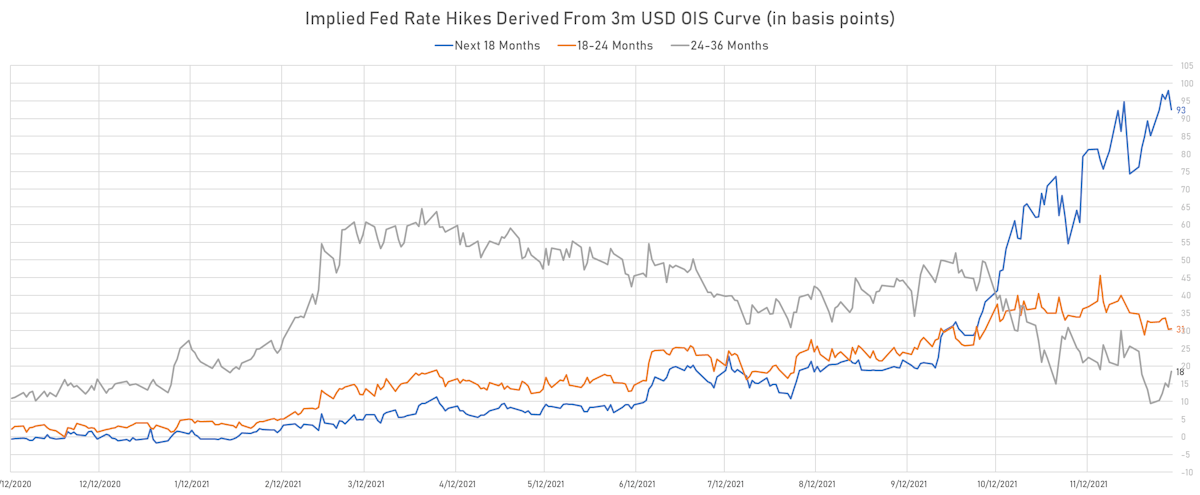

- Obviously, the most important event next week is the FOMC, with the updated economic projections and dot plot

- In short, the taper acceleration and 2 hikes for 2022 are baked in the cake. We would be extremely surprised to see 3 hikes in 2022 at this point, as that would spook the market.

- We'll have a more detailed FOMC preview up over the weekend

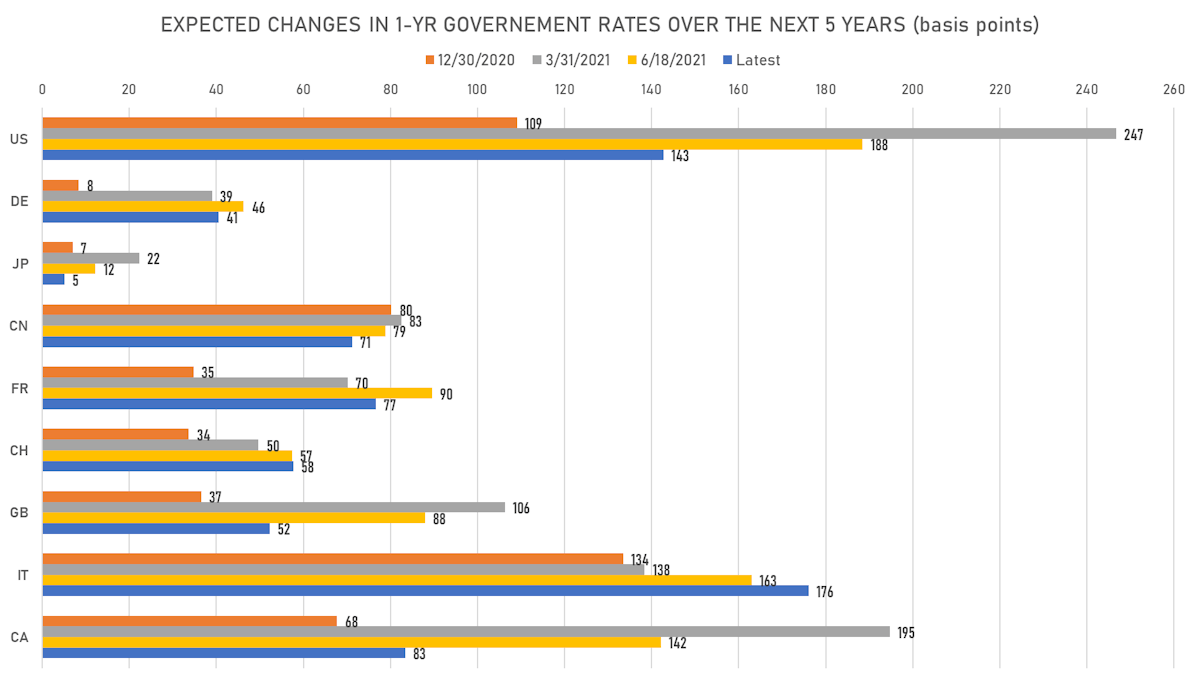

US FORWARD RATES

- 1-month USD OIS 12-months forward now price in 67.1 bp of Fed hikes by the end of 2022 (1-day change: -1.4 bp; 1-week change: 4.8 bp)

- The 3-month USD OIS forward curve prices in 67.8 bp of rate hikes over the next 15 months (equivalent to 2.71 rate hikes) and 141.5 bp over the next 3 years (equivalent to 5.66 rate hikes)

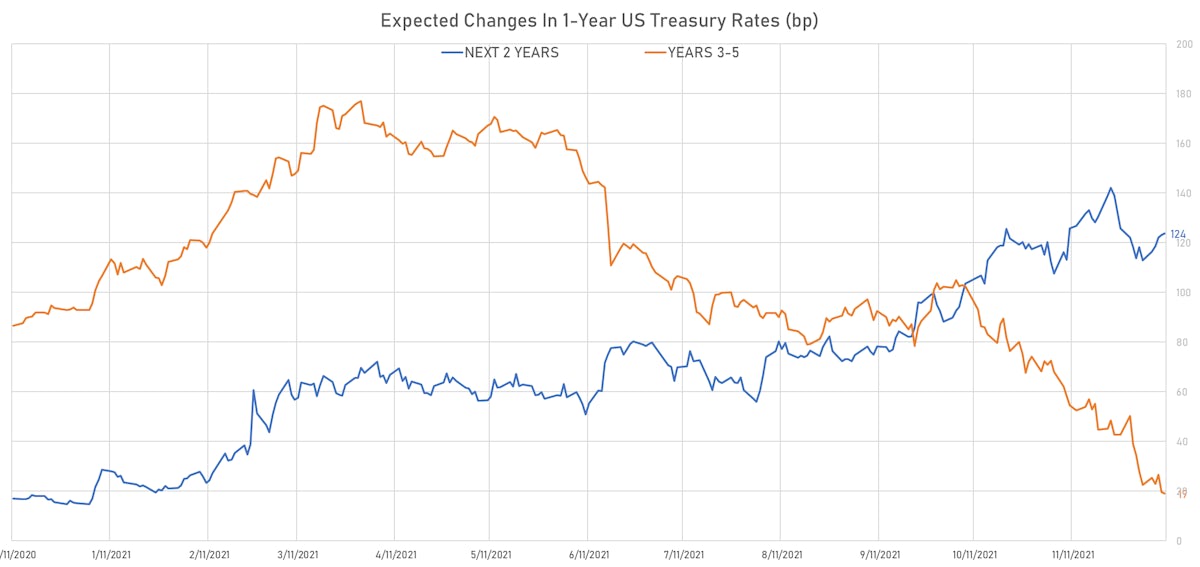

- 1-year US Treasury rate 5 years forward down 1.7 bp, now at 1.7484%, meaning that the 1-year Treasury rate is now expected to increase by 142.8 bp over the next 5 years (equivalent to 5.7 rate hikes)

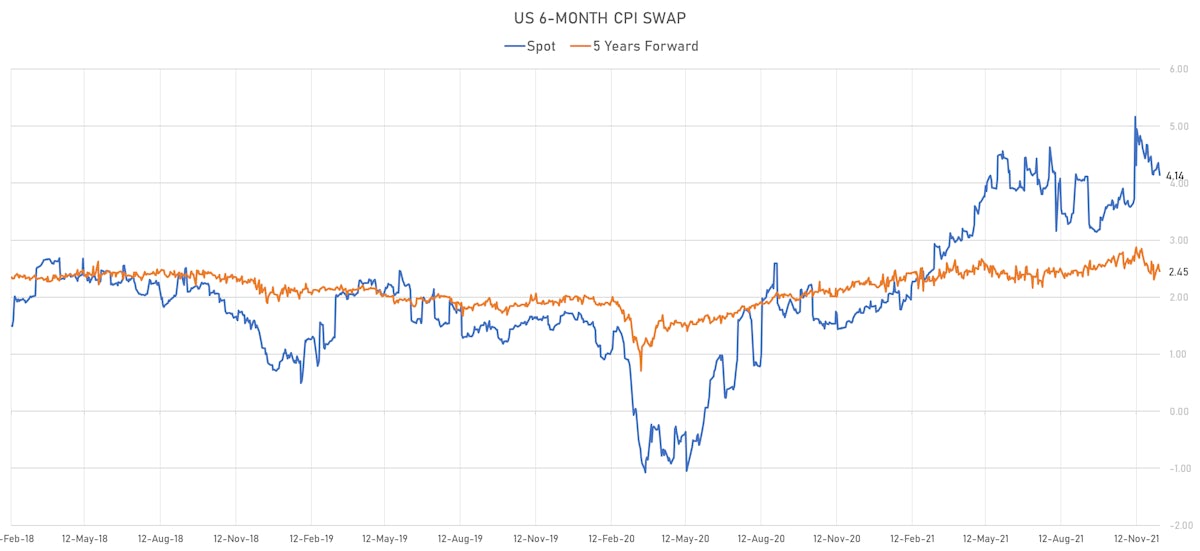

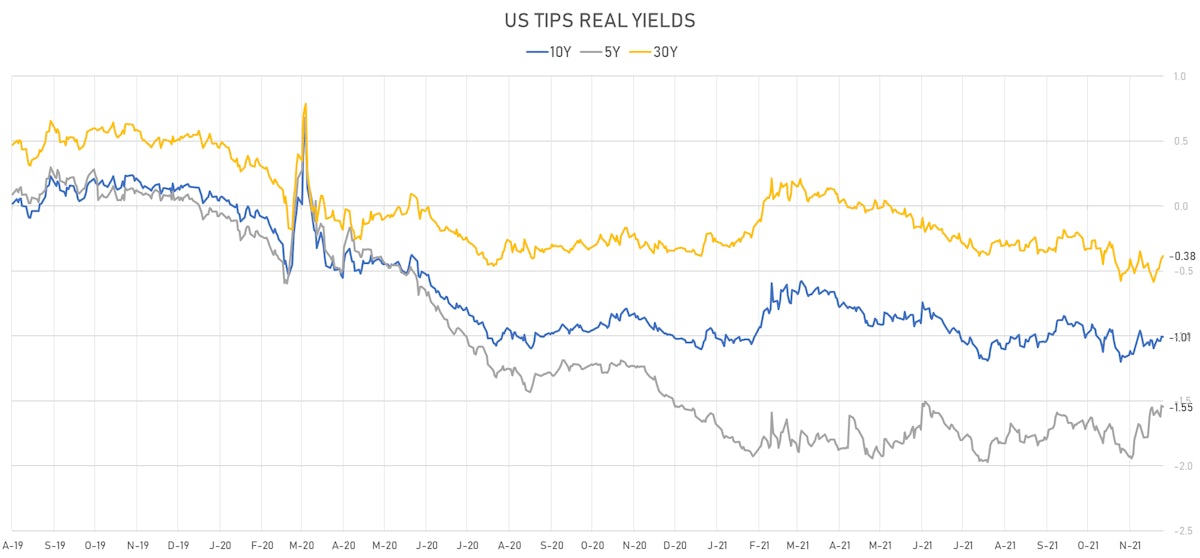

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.11% (down -19.6bp); 2Y at 3.68% (down -10.9bp); 5Y at 2.80% (down -1.0bp); 10Y at 2.46% (down -1.5bp); 30Y at 2.28% (down -1.4bp)

- 6-month spot US CPI swap down -12.0 bp to 4.142%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.5460%, -0.8 bp today; 10Y at -1.0090%, -0.2 bp today; 30Y at -0.3830%, +2.1 bp today

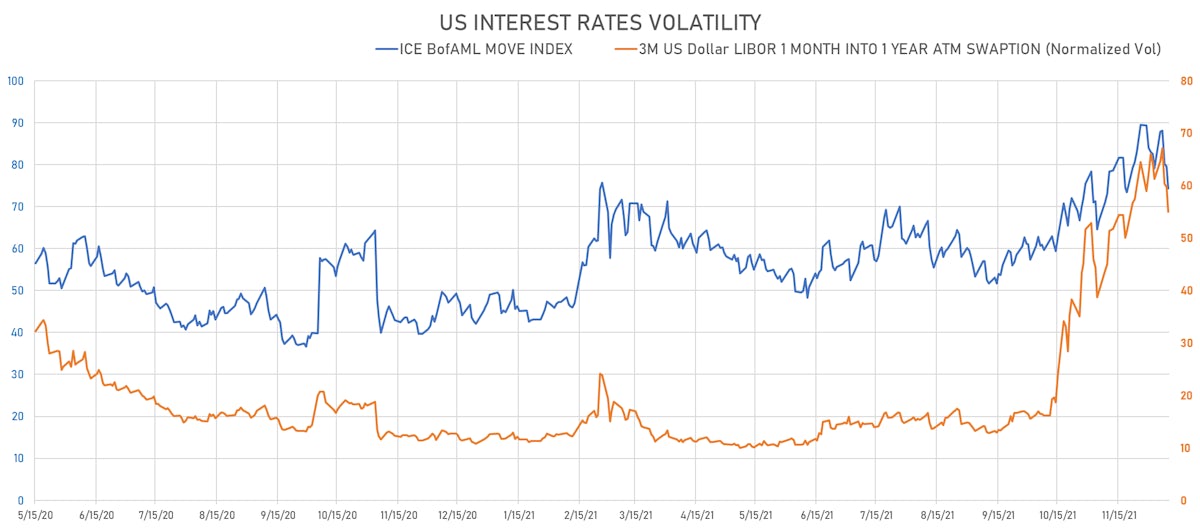

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -4.7% at 55.0%

- 3-Month LIBOR-OIS spread up 0.3 bp at 11.9 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.570% (up 1.0 bp); the German 1Y-10Y curve is 0.1 bp steeper at 39.1bp (YTD change: +22.7 bp)

- Japan 5Y: -0.018% (up 0.1 bp); the Japanese 1Y-10Y curve is 0.2 bp flatter at 15.9bp (YTD change: +1.6 bp)

- China 5Y: 2.700% (down -1.4 bp); the Chinese 1Y-10Y curve is 0.1 bp steeper at 56.6bp (YTD change: +10.2 bp)

- Switzerland 5Y: -0.537% (down -1.0 bp); the Swiss 1Y-10Y curve is 3.4 bp steeper at 46.1bp (YTD change: +19.0 bp)