Rates

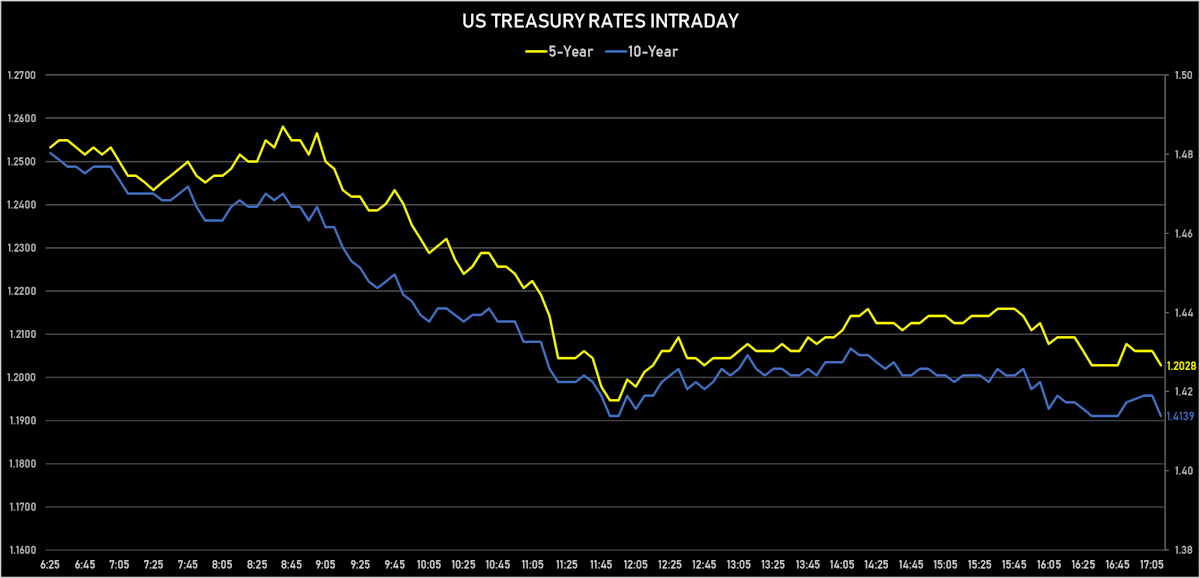

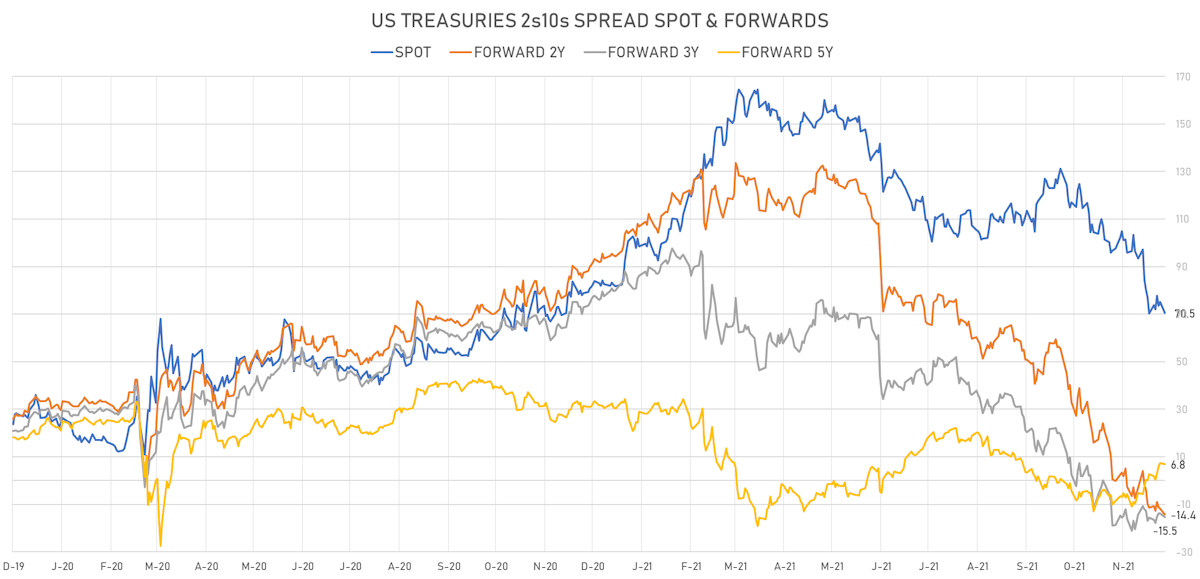

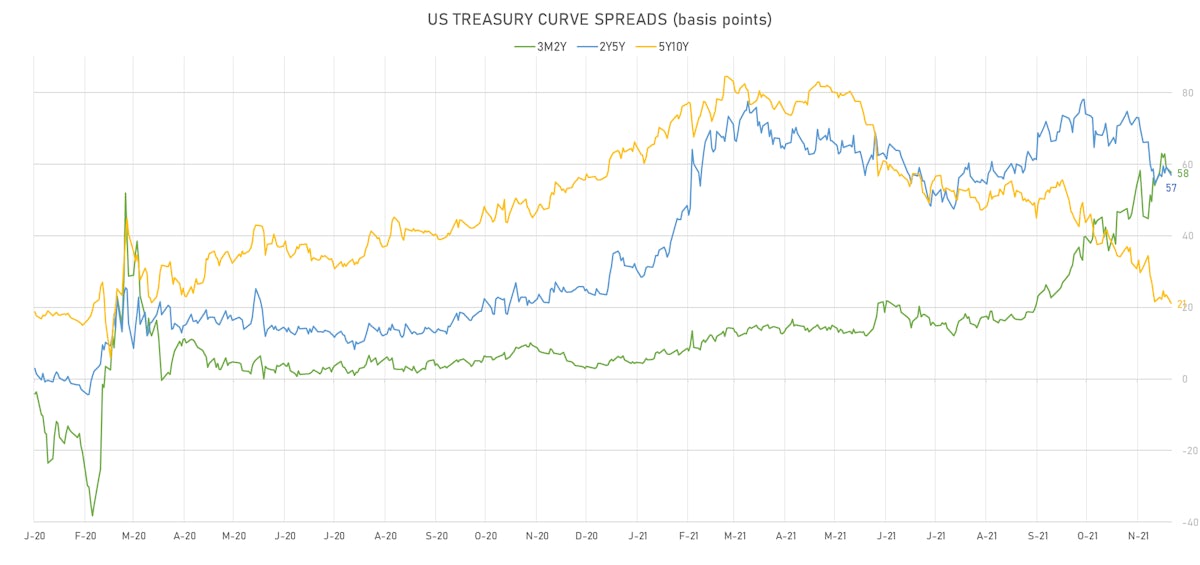

Bull Flattening In The US Treasury Yield Curve, As Omicron Fears Drive Bid For Duration

At the front end, the market has been paring down the number of hikes it expects from the Fed through 2022: the overnight Fed Funds rate is now expected to rise 67 basis points in '22, down from 72bp a week ago

Published ET

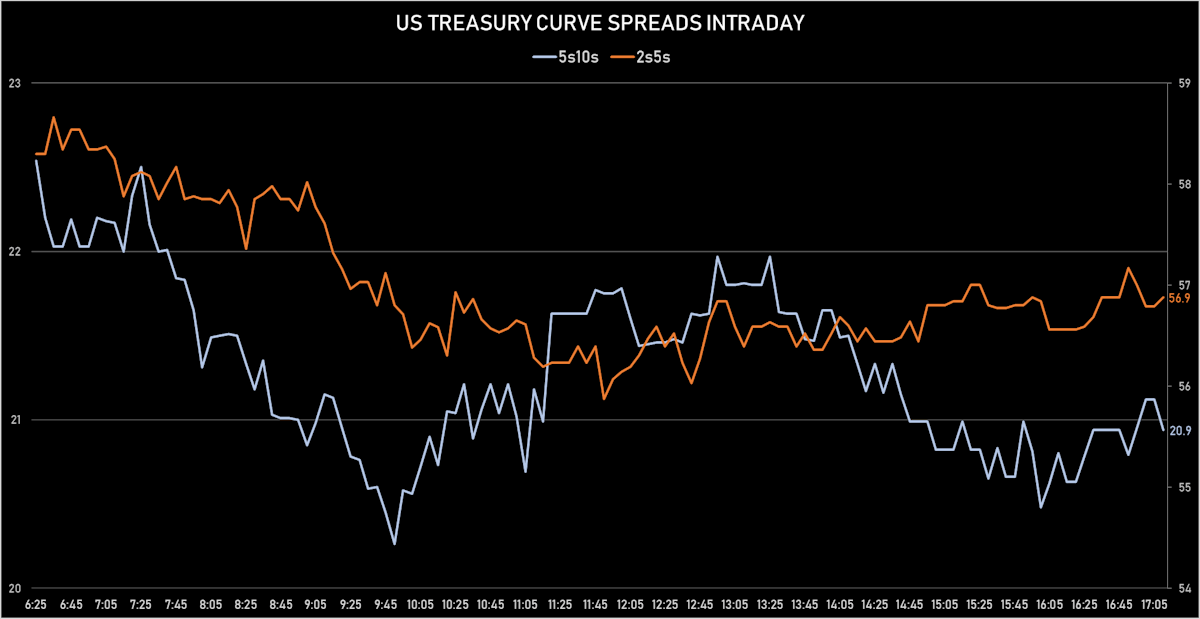

US Treasury Curve Spreads | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

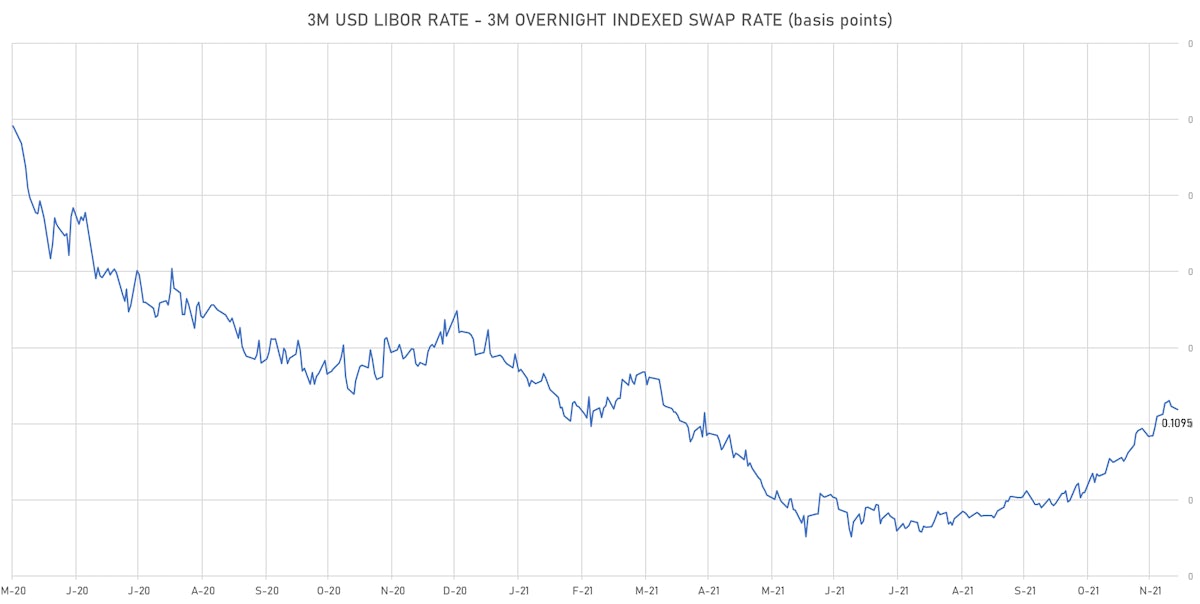

- 3-Month USD LIBOR +0.23bp today, now at 0.2005%; 3-Month OIS +0.5bp at 0.0910%

- The treasury yield curve flattened, with the 1s10s spread tightening -5.8 bp, now at 115.2 bp (YTD change: +34.7bp)

- 1Y: 0.2620% (down 1.0 bp)

- 2Y: 0.6324% (down 2.2 bp)

- 5Y: 1.2028% (down 4.4 bp)

- 7Y: 1.3596% (down 5.5 bp)

- 10Y: 1.4139% (down 6.8 bp)

- 30Y: 1.7991% (down 8.3 bp)

- US treasury curve spreads: 2s5s at 57.1bp (down -2.6bp), 5s10s at 21.1bp (down -2.1bp), 10s30s at 38.5bp (down -1.1bp)

- Treasuries butterfly spreads: 1s5s10s at -75.7bp (up 0.4bp today), 5s10s30s at 16.6bp (up 1.1bp)

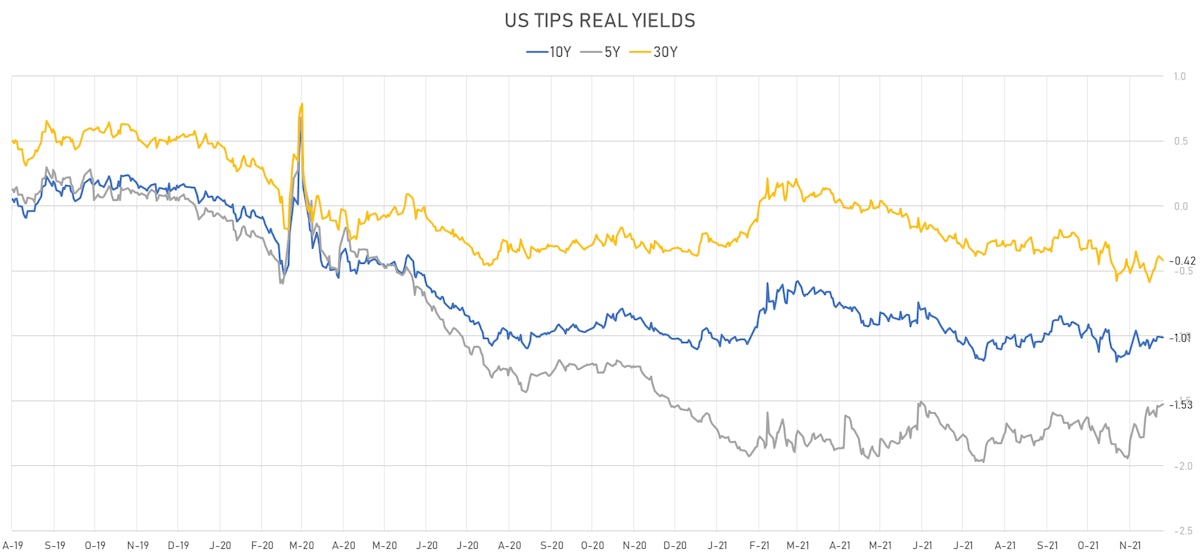

- US 5-Year TIPS Real Yield: +2.1 bp at -1.5250%; 10-Year TIPS Real Yield: -0.4 bp at -1.0130%; 30-Year TIPS Real Yield: -3.3 bp at -0.4160%

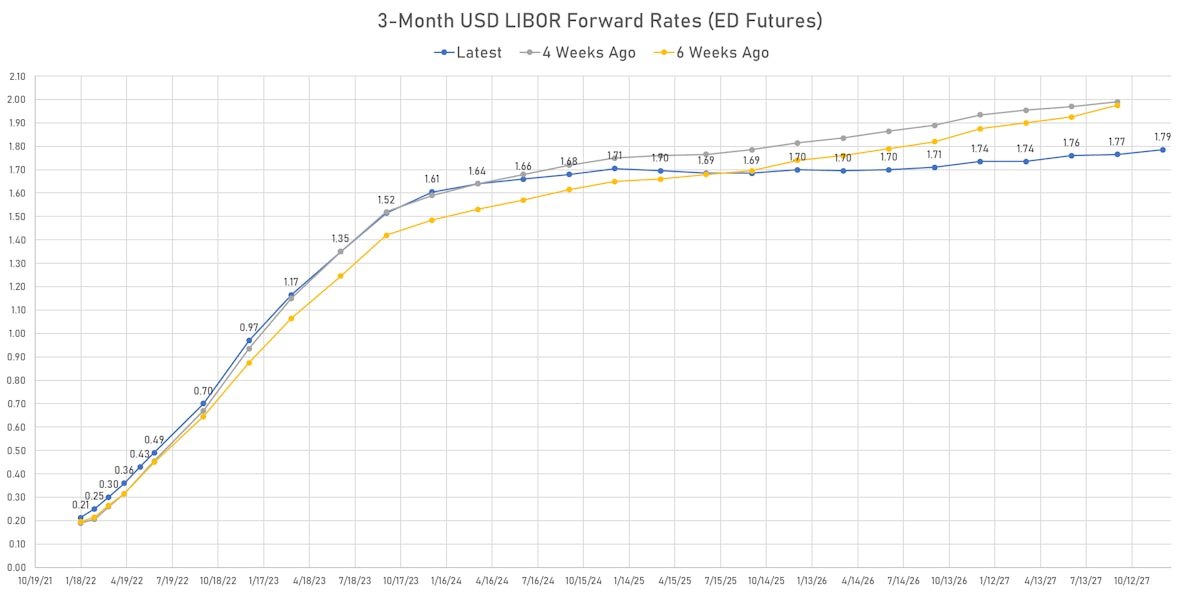

US FORWARD RATES

- 1-month USD OIS 12-months forward now price in 67.2 bp of Fed hikes by the end of 2022 (1-day change: -0.1 bp; 1-week change: -5.1 bp)

- The 3-month Eurodollar zero curve prices in 75.2 bp of rate hikes over the next 15 months (equivalent to 3.01 rate hikes) and 148.0 bp over the next 3 years (equivalent to 5.92 rate hikes)

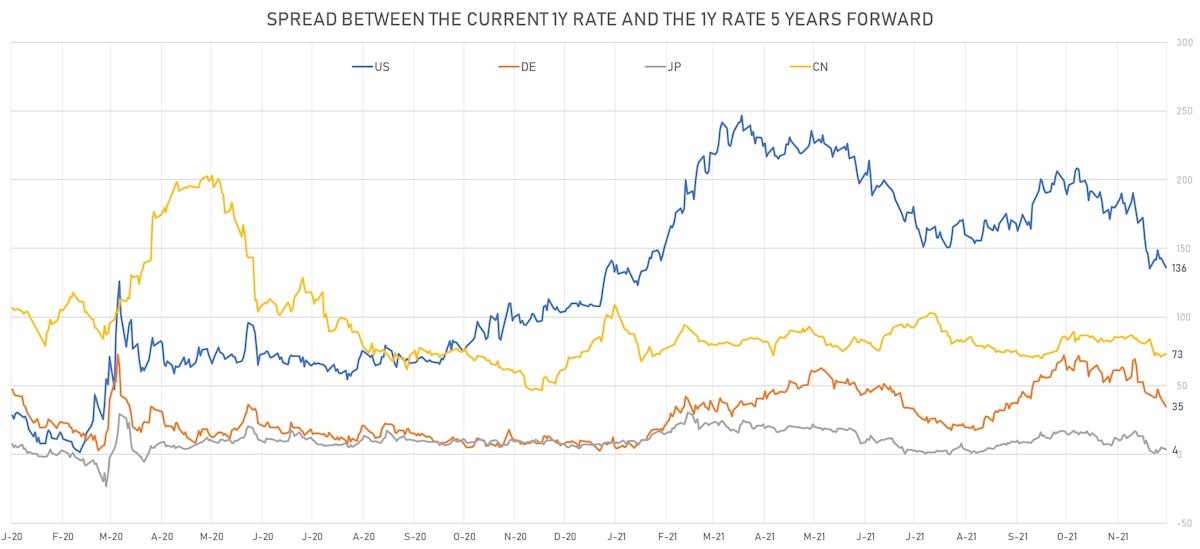

- 1-year US Treasury rate 5 years forward down 8.1 bp, now at 1.6679%, meaning that the 1-year Treasury rate is now expected to increase by 136.1 bp over the next 5 years (equivalent to 5.4 rate hikes)

US INFLATION & REAL RATES

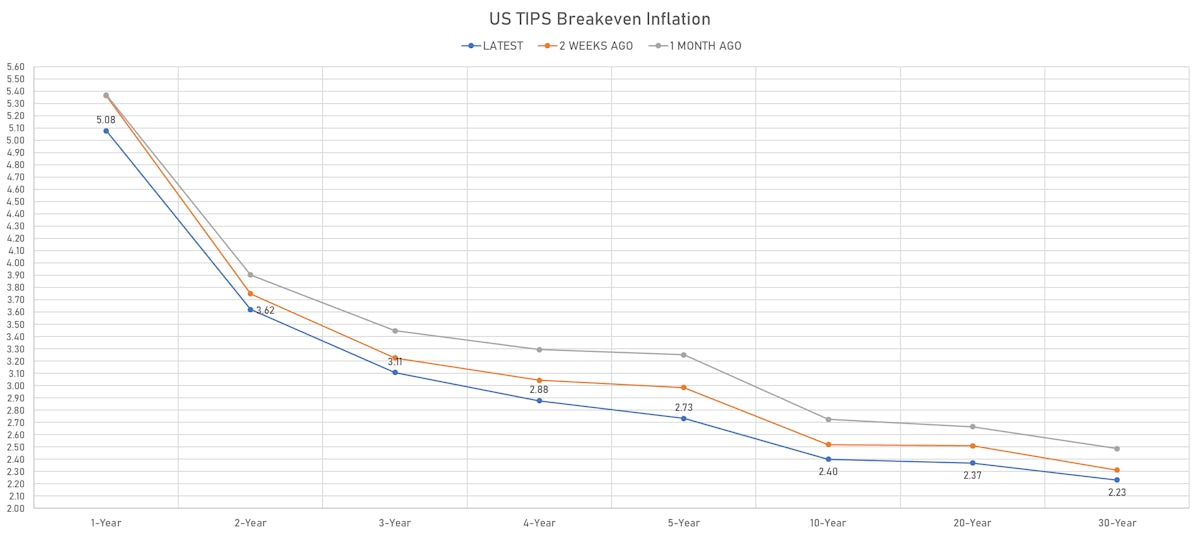

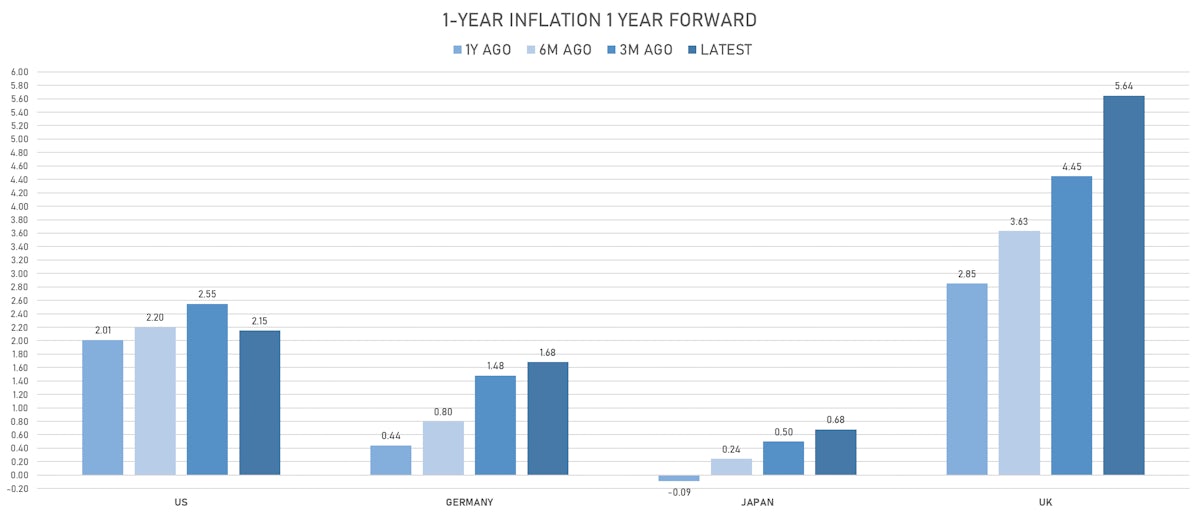

- TIPS 1Y breakeven inflation at 5.08% (down -3.1bp); 2Y at 3.62% (down -5.9bp); 5Y at 2.73% (down -6.5bp); 10Y at 2.40% (down -6.0bp); 30Y at 2.23% (down -5.1bp)

- 6-month spot US CPI swap up 15.6 bp to 4.298%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.5250%, +2.1 bp today; 10Y at -1.0130%, -0.4 bp today; 30Y at -0.4160%, -3.3 bp today

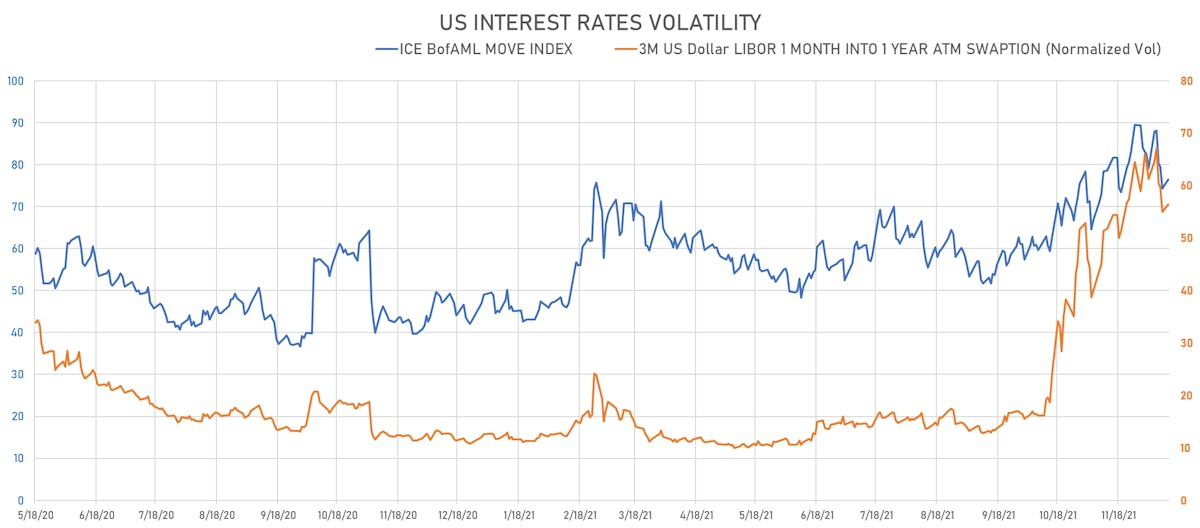

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 1.4% at 56.4%

- 3-Month LIBOR-OIS spread down -0.2 bp at 11.0 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.606% (down -2.3 bp); the German 1Y-10Y curve is 3.0 bp flatter at 34.8bp (YTD change: +19.7 bp)

- Japan 5Y: -0.092% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.5 bp flatter at 15.7bp (YTD change: +1.1 bp)

- China 5Y: 2.706% (up 0.6 bp); the Chinese 1Y-10Y curve is 1.4 bp steeper at 58.0bp (YTD change: +11.6 bp)

- Switzerland 5Y: -0.508% (up 2.9 bp); the Swiss 1Y-10Y curve is 0.6 bp flatter at 46.8bp (YTD change: +18.4 bp)