Rates

US Rates Rise On PPI Inflation Data: Lower Breakevens, Higher Real Yields, Flatter 5s30s TIPS Curve

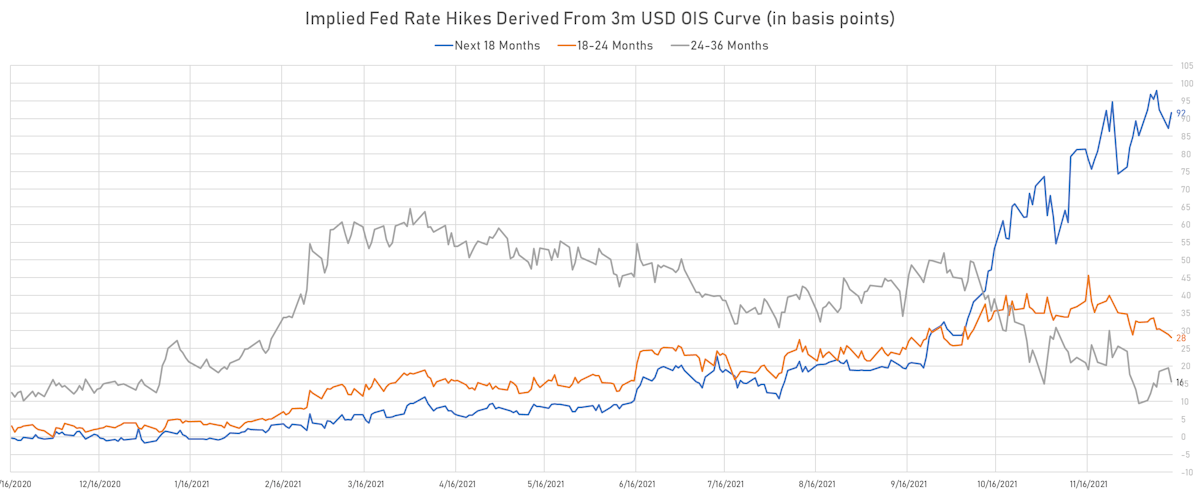

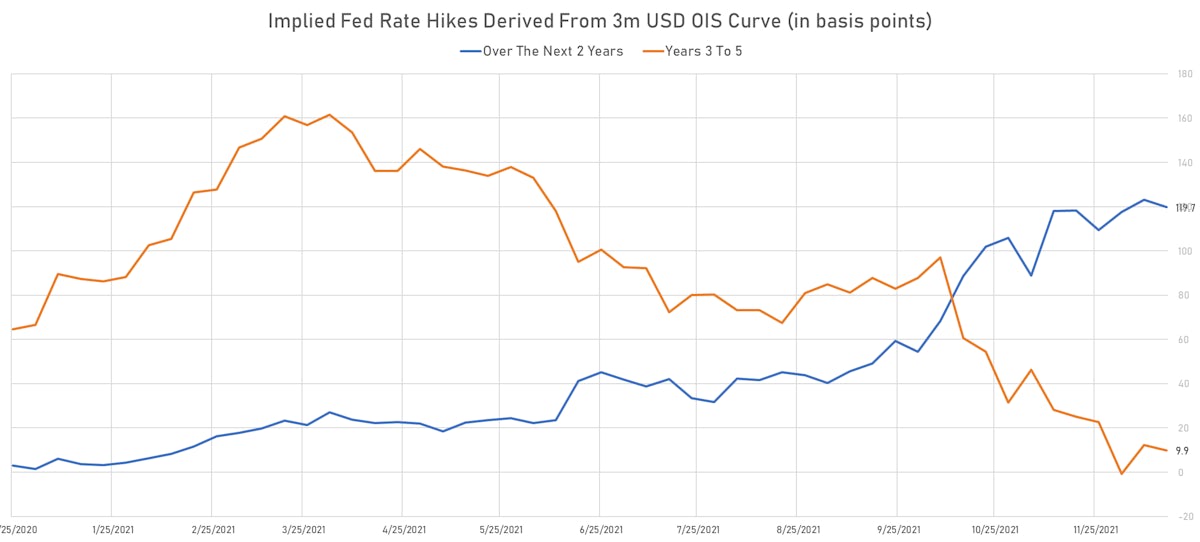

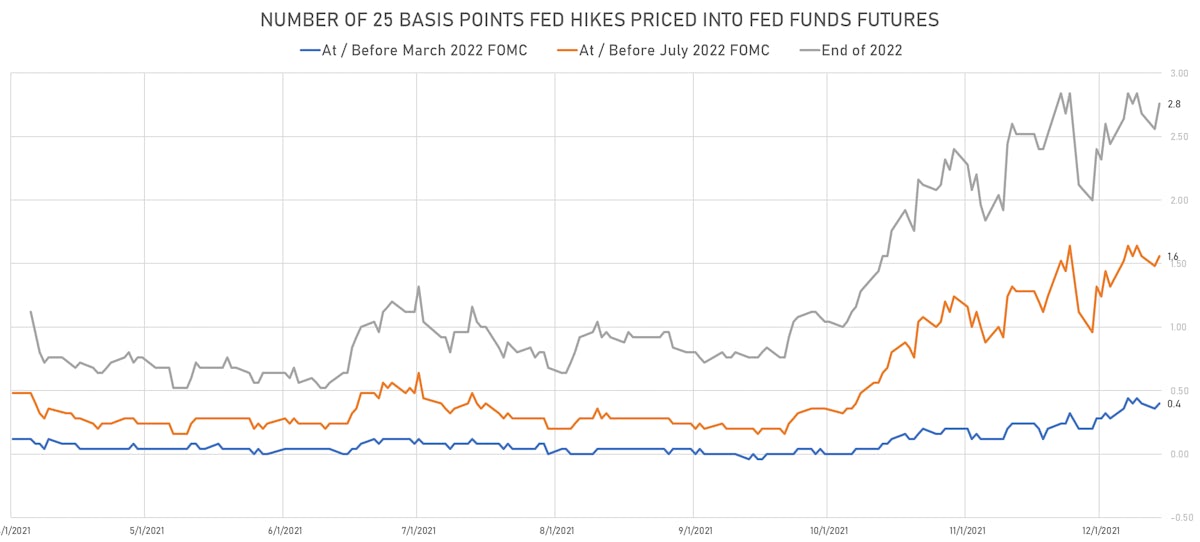

Market implied Fed hikes rose to 2.8 at the end of 2022, with the probability of a third hike rising from 68% yesterday to 82% today (according to 1-month OIS forward rates)

Published ET

Implied Fed Hikes Derived From Fed Funds Futures | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

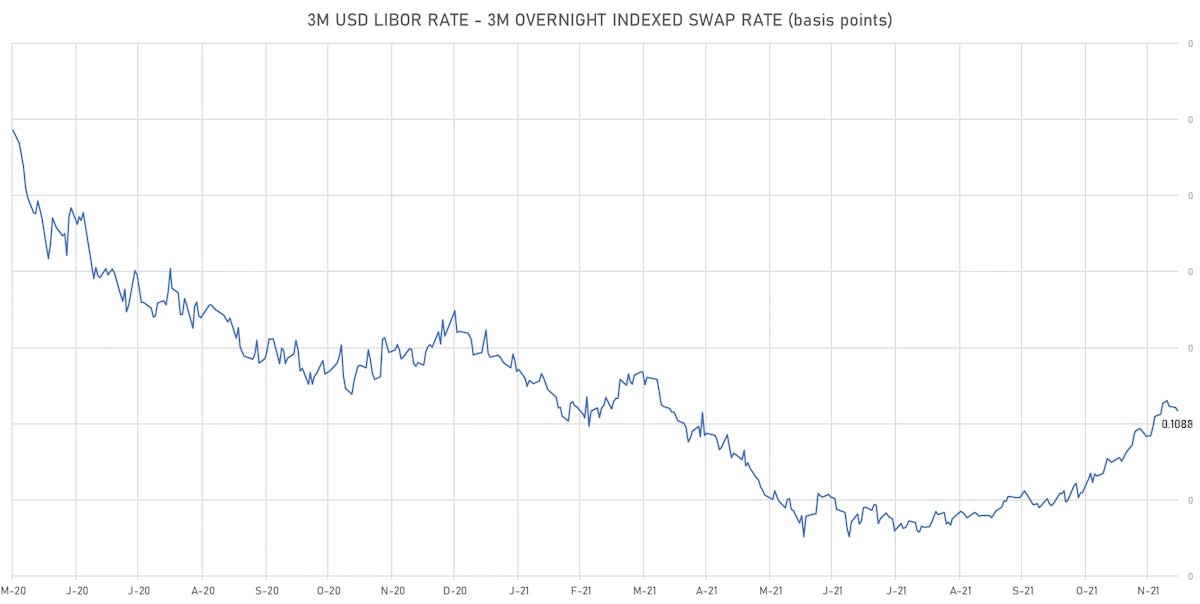

- 3-Month USD LIBOR unchanged at 0.2028%; 3-Month OIS +0.2bp at 0.0940%

- The treasury yield curve steepened, with the 1s10s spread widening 2.7 bp, now at 118.7 bp (YTD change: +38.3bp)

- 1Y: 0.2540% (unchanged 0.0 bp)

- 2Y: 0.6568% (up 2.4 bp)

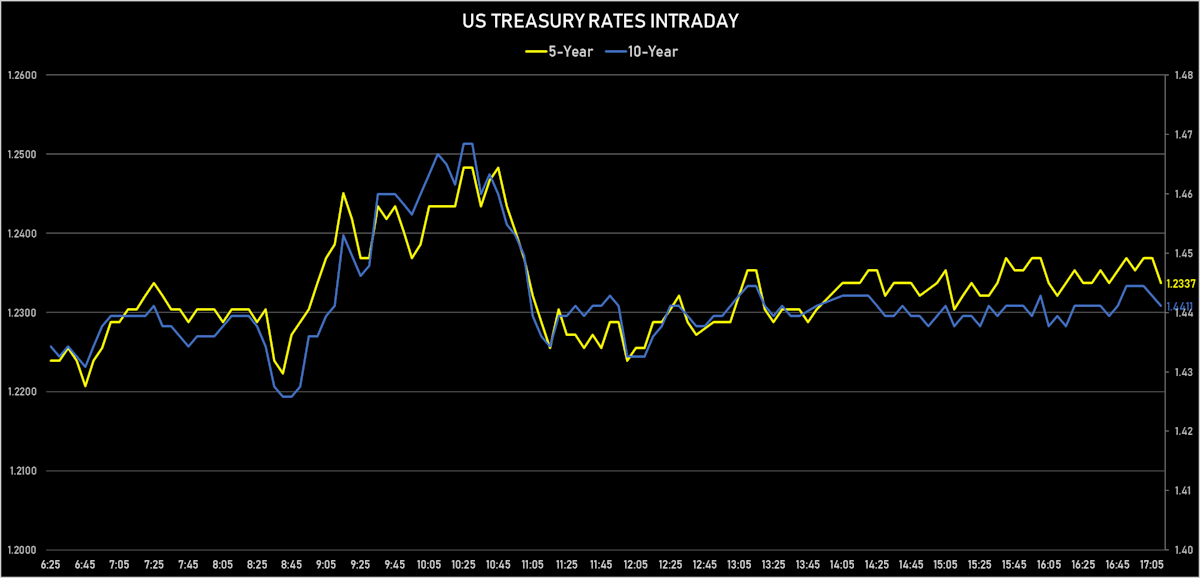

- 5Y: 1.2337% (up 3.1 bp)

- 7Y: 1.3912% (up 3.2 bp)

- 10Y: 1.4411% (up 2.7 bp)

- 30Y: 1.8267% (up 2.8 bp)

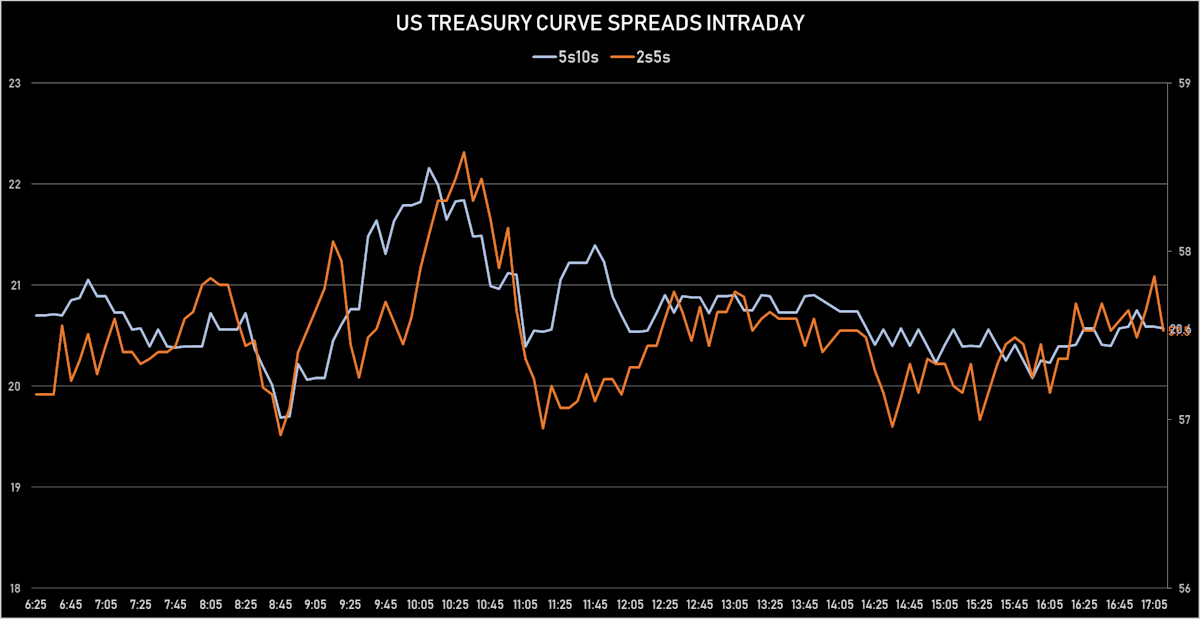

- US treasury curve spreads: 2s5s at 57.7bp (up 0.8bp today), 5s10s at 20.7bp (down -0.5bp), 10s30s at 38.6bp (up 0.3bp today)

- Treasuries butterfly spreads: 1s5s10s at -78.9bp (down -3.2bp), 5s10s30s at 17.4bp (up 0.8bp)

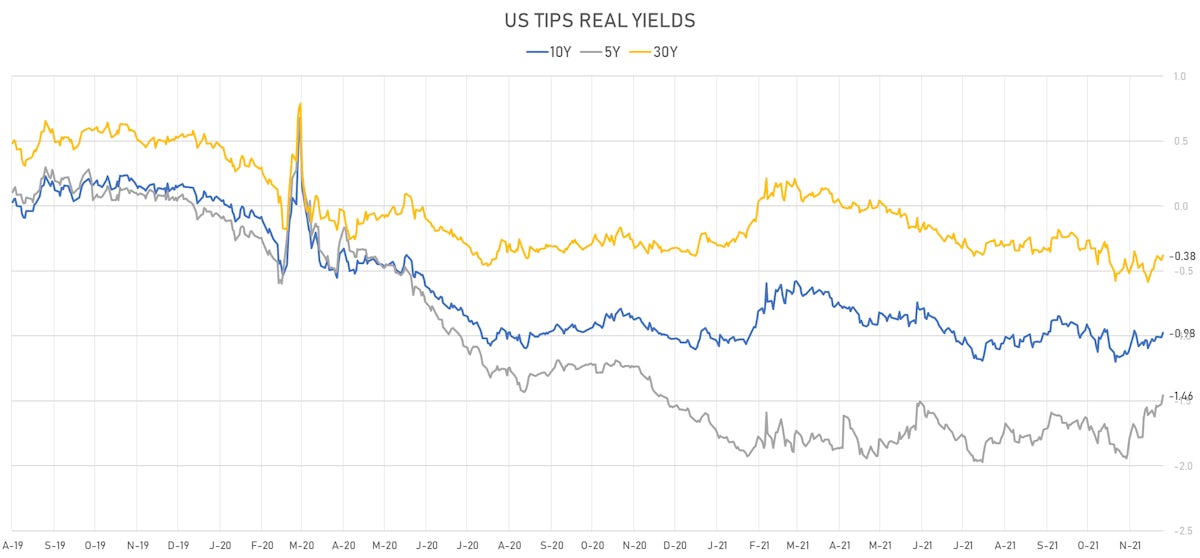

- US 5-Year TIPS Real Yield: +6.9 bp at -1.4560%; 10-Year TIPS Real Yield: +3.7 bp at -0.9760%; 30-Year TIPS Real Yield: +3.5 bp at -0.3810%

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 11 Dec (Redbook Research) at 16.00 % (vs 15.30 % prior)

- NFIB, Index of Small Business Optimism for Nov 2021 (NFIB, United States) at 98.40 (vs 98.20 prior)

- PPI ex Food/Energy/Trade MM, Change P/P for Nov 2021 (BLS, U.S Dep. Of Lab) at 0.70 % (vs 0.40 % prior)

- PPI ex Food/Energy/Trade YY, Change Y/Y, Price Index for Nov 2021 (BLS, U.S Dep. Of Lab) at 6.90 % (vs 6.20 % prior)

- Producer Prices, Final demand less foods and energy, Change P/P for Nov 2021 (BLS, U.S Dep. Of Lab) at 0.70 % (vs 0.40 % prior), above consensus estimate of 0.40 %

- Producer Prices, Final demand less foods and energy, Change Y/Y for Nov 2021 (BLS, U.S Dep. Of Lab) at 7.70 % (vs 6.80 % prior), above consensus estimate of 7.20 %

- Producer Prices, Final demand, Change P/P for Nov 2021 (BLS, U.S Dep. Of Lab) at 0.80 % (vs 0.60 % prior), above consensus estimate of 0.50 %

- Producer Prices, Final demand, Change Y/Y for Nov 2021 (BLS, U.S Dep. Of Lab) at 9.60 % (vs 8.60 % prior), above consensus estimate of 9.20 %

US FORWARD RATES

- 1-month USD OIS 12-months forward now price in 70.4 bp of Fed hikes by the end of 2022 (1-day change: 3.5 bp; 1-week change: -1.5 bp)

- The 3-month Eurodollar zero curve prices in 83.0 bp of rate hikes over the next 15 months (equivalent to 3.32 rate hikes) and 155.2 bp over the next 3 years (equivalent to 6.21 rate hikes)

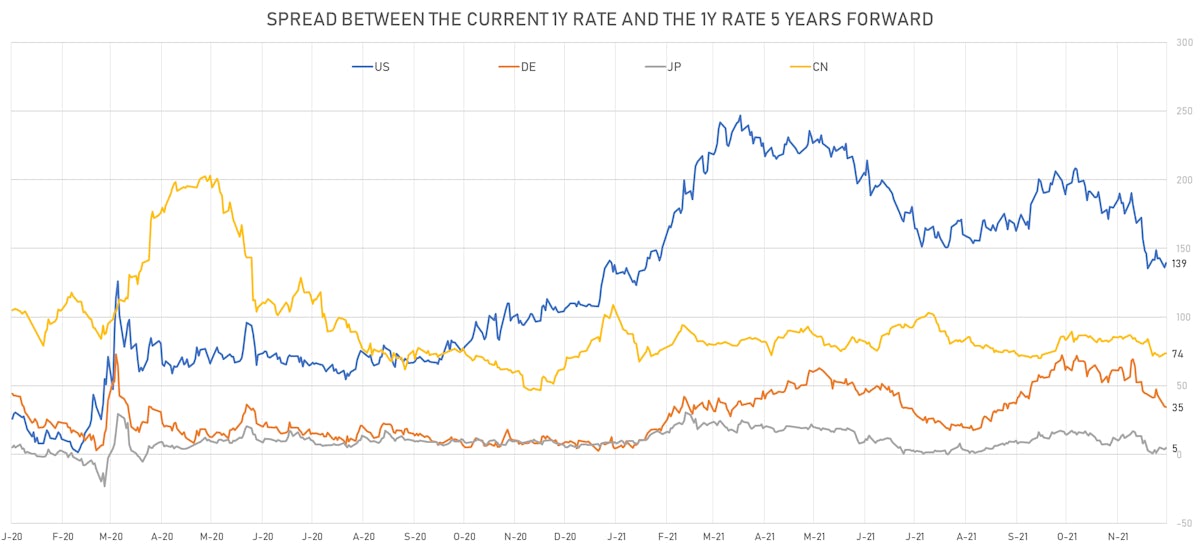

- 1-year US Treasury rate 5 years forward up 3.5 bp, now at 1.7032%, meaning that the 1-year Treasury rate is now expected to increase by 139.2 bp over the next 5 years (equivalent to 5.6 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.00% (down -7.9bp); 2Y at 3.52% (down -10.3bp); 5Y at 2.70% (down -3.4bp); 10Y at 2.39% (down -0.9bp); 30Y at 2.23% (down -0.6bp)

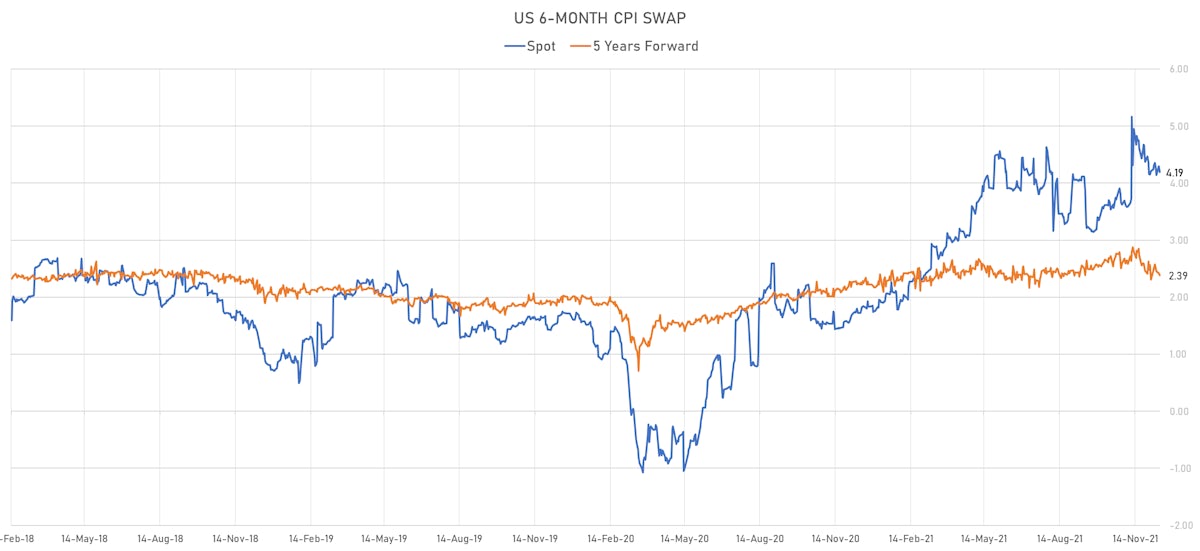

- 6-month spot US CPI swap down -10.9 bp to 4.189%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.4560%, +6.9 bp today; 10Y at -0.9760%, +3.7 bp today; 30Y at -0.3810%, +3.5 bp today

RATES VOLATILITY & LIQUIDITY

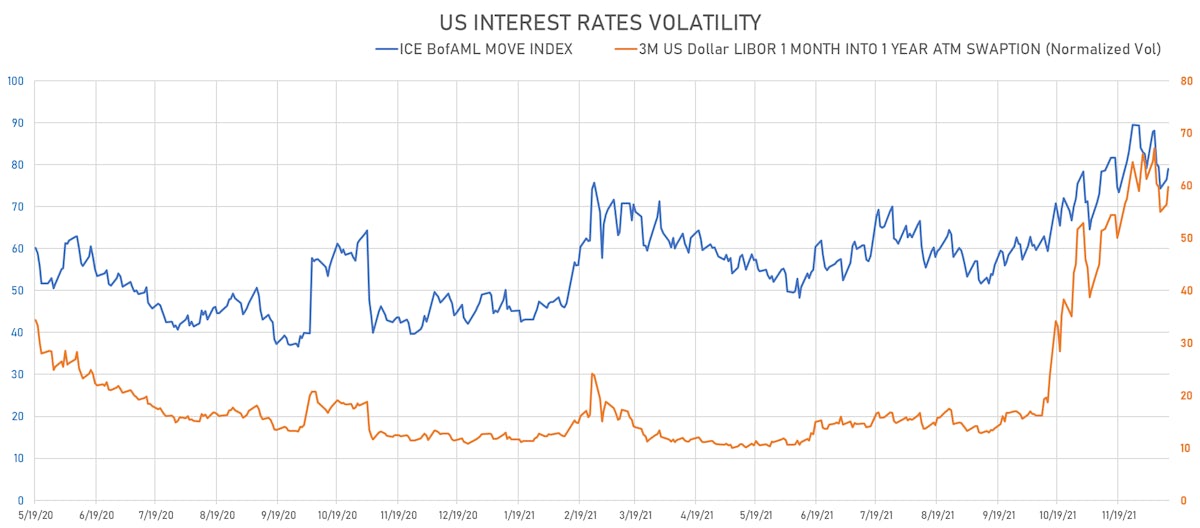

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 3.4% at 59.8%

- 3-Month LIBOR-OIS spread down -0.2 bp at 10.9 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.585% (up 1.9 bp); the German 1Y-10Y curve is 1.7 bp steeper at 36.9bp (YTD change: +21.4 bp)

- Japan 5Y: -0.095% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.2 bp steeper at 15.7bp (YTD change: +1.3 bp)

- China 5Y: 2.680% (down -2.6 bp); the Chinese 1Y-10Y curve is 1.4 bp flatter at 56.6bp (YTD change: +10.2 bp)

- Switzerland 5Y: -0.501% (down -0.4 bp); the Swiss 1Y-10Y curve is 0.6 bp steeper at 46.4bp (YTD change: +19.0 bp)