Rates

Very Slight Steepening Of The US Yield Curve After The Fed Confirms New Hawkish Bias

It's a wrap: the last major US macro event of 2021 is behind us, with some surprises (for us) in the Fed's reaction function, as the FOMC is now single-mindedly focused on inflation

Published ET

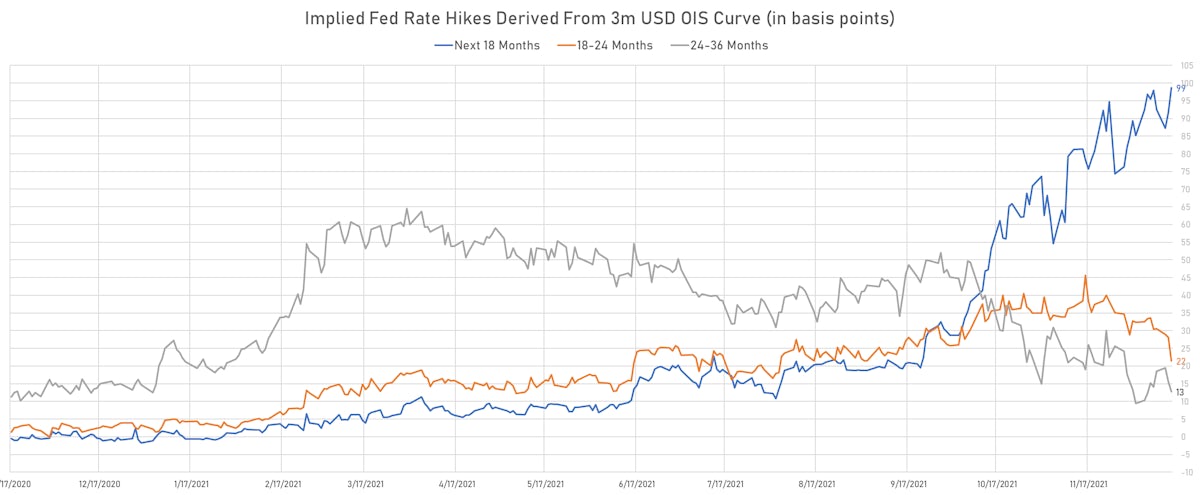

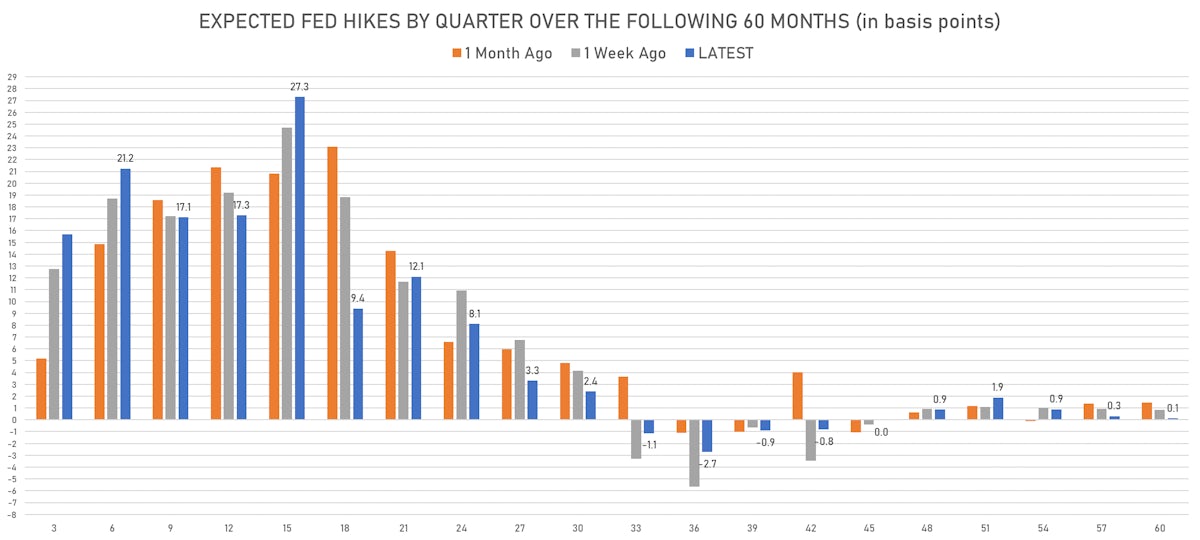

Fed Hikes Priced Into 3M USD OIS Forward Rates | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.25bp today, now at 0.2134%; 3-Month OIS -0.4bp at 0.0890%

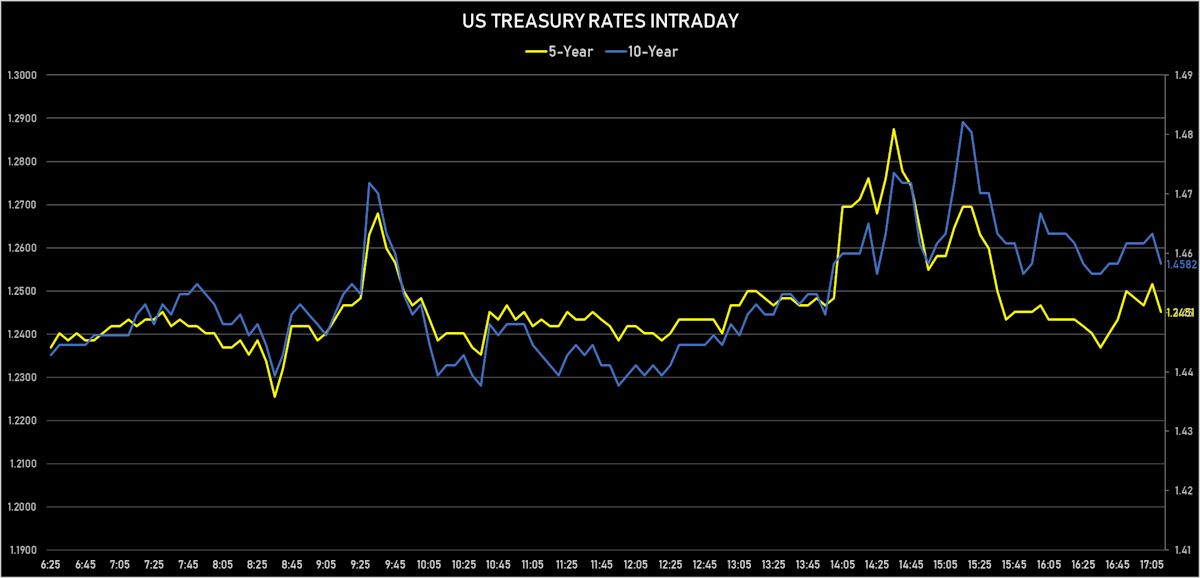

- The treasury yield curve steepened, with the 1s10s spread widening 0.7 bp, now at 120.9 bp (YTD change: +40.5bp)

- 1Y: 0.2490% (up 1.0 bp)

- 2Y: 0.6651% (up 0.8 bp)

- 5Y: 1.2451% (up 1.1 bp)

- 7Y: 1.4006% (up 0.9 bp)

- 10Y: 1.4582% (up 1.7 bp)

- 30Y: 1.8579% (up 3.1 bp)

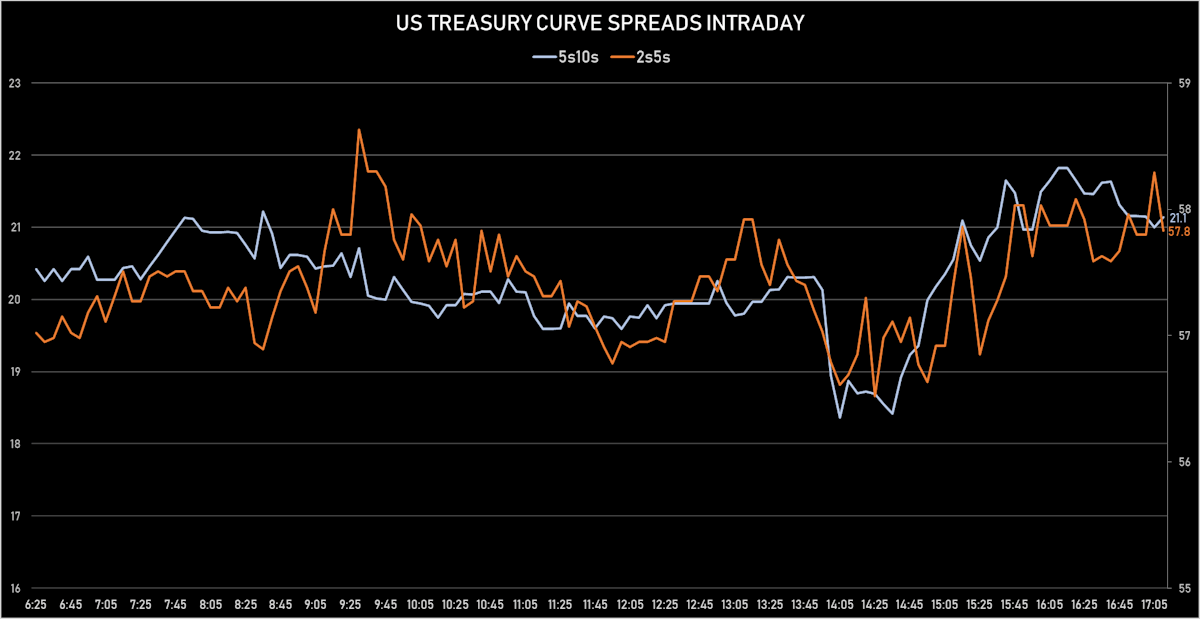

- US treasury curve spreads: 2s5s at 58.0bp (unchanged, 5s10s at 21.3bp (up 0.5bp today), 10s30s at 39.9bp (up 1.5bp today)

- Treasuries butterfly spreads: 1s5s10s at -78.7bp (up 0.2bp today), 5s10s30s at 18.0bp (up 0.6bp)

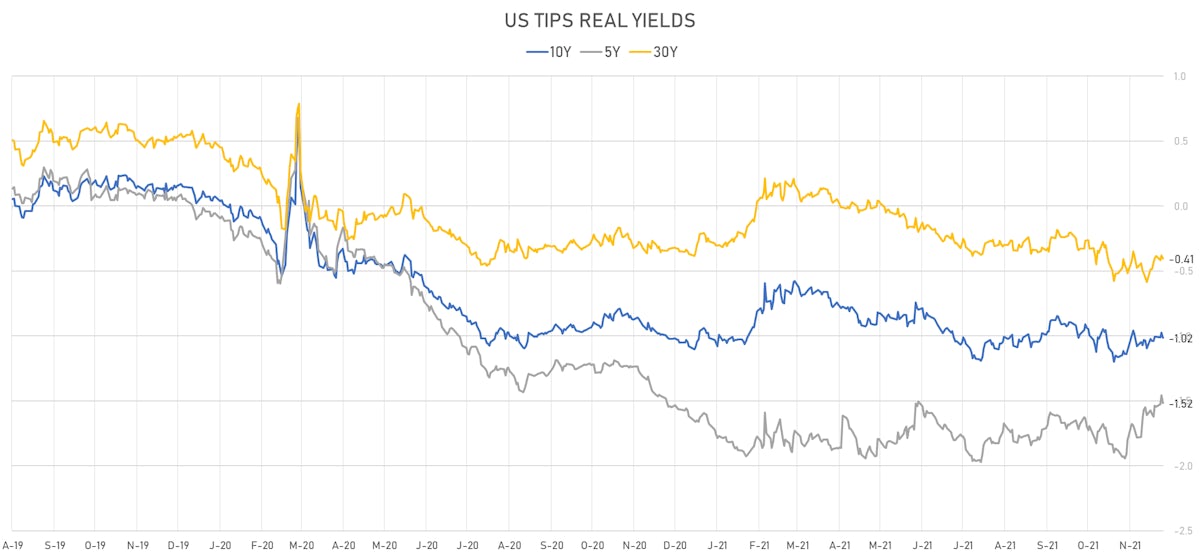

- US 5-Year TIPS Real Yield: -6.2 bp at -1.5180%; 10-Year TIPS Real Yield: -3.9 bp at -1.0150%; 30-Year TIPS Real Yield: -2.4 bp at -0.4050%

US MACRO RELEASES

- Export Prices, All commodities, Change P/P, Price Index for Nov 2021 (BLS, U.S Dep. Of Lab) at 1.00 % (vs 1.50 % prior), above consensus estimate of 0.50 %

- Import Prices, All commodities, Change P/P, Price Index for Nov 2021 (BLS, U.S Dep. Of Lab) at 0.70 % (vs 1.20 % prior), in line with consensus

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 10 Dec (MBA, USA) at -4.00 % (vs 2.00 % prior)

- Mortgage applications, market composite index for W 10 Dec (MBA, USA) at 591.70 (vs 616.40 prior)

- Mortgage applications, market composite index, purchase for W 10 Dec (MBA, USA) at 297.20 (vs 295.20 prior)

- Mortgage applications, market composite index, refinancing for W 10 Dec (MBA, USA) at 2,350.50 (vs 2,511.50 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 10 Dec (MBA, USA) at 3.30 % (vs 3.30 % prior)

- NAHB/Wells Fargo Housing Market Index for Dec 2021 (NAHB, United States) at 84.00 (vs 83.00 prior), above consensus estimate of 83.00

- Net flows total, Current Prices for Oct 2021 (U.S. Dept. Treas.) at 143.00 Bln USD (vs -26.80 Bln USD prior)

- Net foreign acquisition of long-term securities, Current Prices for Oct 2021 (U.S. Dept. Treas.) at -22.20 Bln USD (vs -1.80 Bln USD prior)

- Net purchases (net long-term capital inflows), total, Current Prices for Oct 2021 (U.S. Dept. Treas.) at 7.10 Bln USD (vs 26.30 Bln USD prior)

- Net purchases of U.S. treasury bonds & notes, total net foreign purchases, Current Prices for Oct 2021 (U.S. Dept. Treas.) at -43.50 Bln USD (vs 1.40 Bln USD prior)

- New York Fed, General Business Condition for Dec 2021 (FED, NY) at 31.90 (vs 30.90 prior), above consensus estimate of 25.00

- Overall, Total business inventories, Change P/P for Oct 2021 (U.S. Census Bureau) at 1.20 % (vs 0.70 % prior), above consensus estimate of 1.10 %

- Policy Rates, Fed Funds Target Rate for 16 Dec (FOMC, U.S.) at 0.125 % (vs 0.125 % prior), in line with consensus

- Policy Rates, Fed Interest On Excess Reserves for 16 Dec (FED, U.S.) at 0.15 % (vs 0.15 % prior)

- Retail Sales, Total excluding building material & motor vehicle & parts & gasoline station & food svc, Change P/P for Nov 2021 (U.S. Census Bureau) at -0.10 % (vs 1.60 % prior), below consensus estimate of 0.70 %

- Retail Sales, Total excluding motor vehicle dealers and gasoline station, Change P/P for Nov 2021 (U.S. Census Bureau) at 0.20 % (vs 1.40 % prior)

- Retail Sales, Total including food services, Change P/P for Nov 2021 (U.S. Census Bureau) at 0.30 % (vs 1.70 % prior), below consensus estimate of 0.80 %

- Retail Sales, Total including food services, excluding motor vehicle and parts, Change P/P for Nov 2021 (U.S. Census Bureau) at 0.30 % (vs 1.70 % prior), below consensus estimate of 0.90 %

FOMC WRAP-UP

- No surprise regarding the taper, which will be accelerated next month: "the Committee decided to reduce the monthly pace of its net asset purchases by $20 billion for Treasury securities and $10 billion for agency mortgage-backed securities"

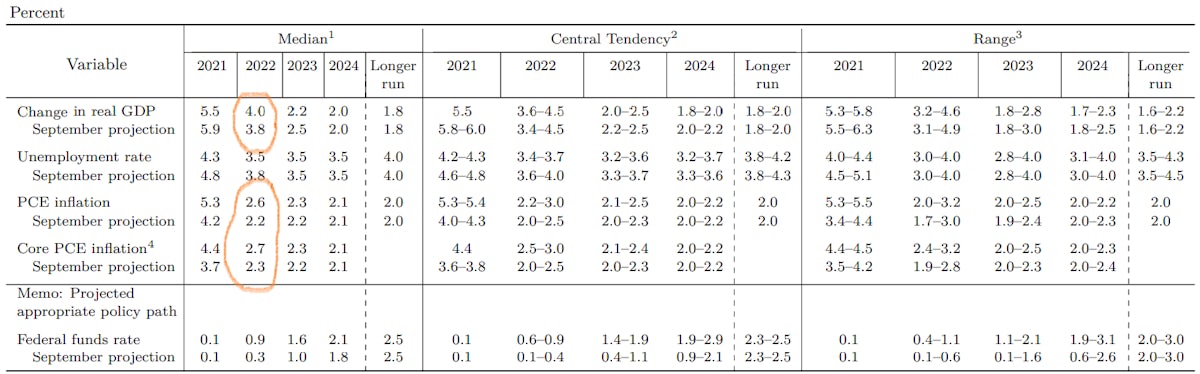

- The updated economic projections show higher real GDP growth in 2022 than the September projections (4.0% vs 3.8%), and importantly much higher inflation forecasts next year (core PCE at 2.7% vs 2.3%)

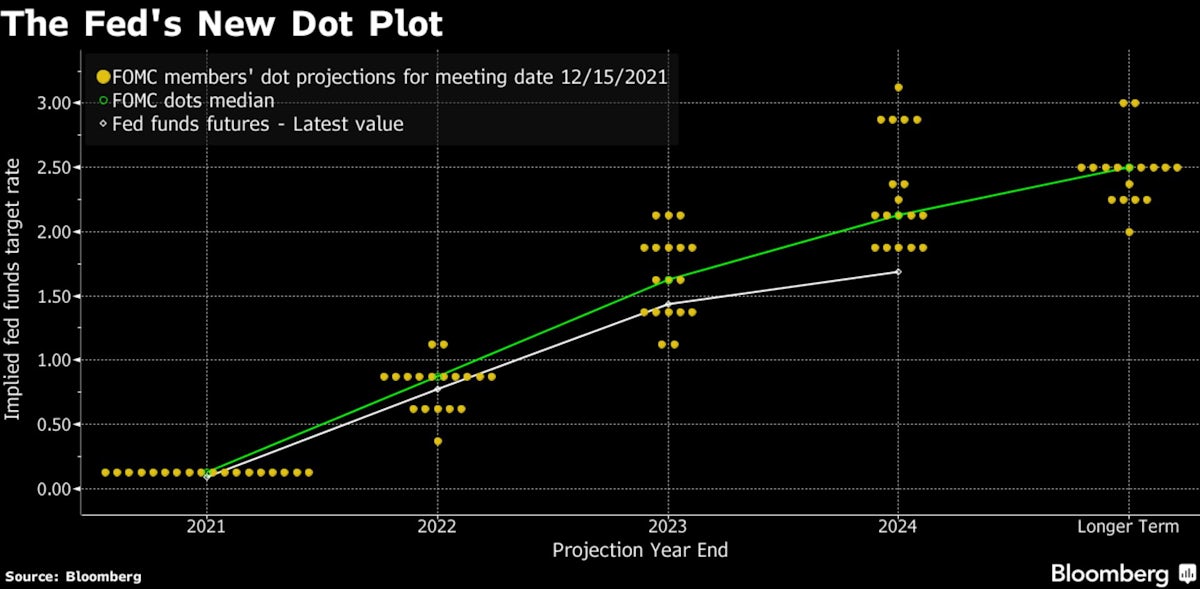

- The Fed proved more hawkish than market expectations (something we didn't believe would happen), with the dot plot now showing 3 hikes for 2022, 3 hikes for 2023, 2 hikes for 2024. It means the Fed is entirely focused on bringing inflation expectations back towards "price stability"

- We wrongly thought the Fed would also be concerned about the impact of rate hikes on future economic growth, as front-loading hikes leads to a shorter hiking cycle, an inversion of the curve 2 years forward and lower terminal rates. That is a tradeoff they recognize in their latest projections, with a lower real GDP forecast in 2023 than in the September projections (2.2% vs 2.5%).

- Something that did not surprise us: the eurodollar EDM2022 / EDM2024 spread is 5.5bp tighter, as expectations of higher rates at the front end led to the usual forward flattening. We expect to see more rates volatility in the next couple of days before the market goes into holiday mode.

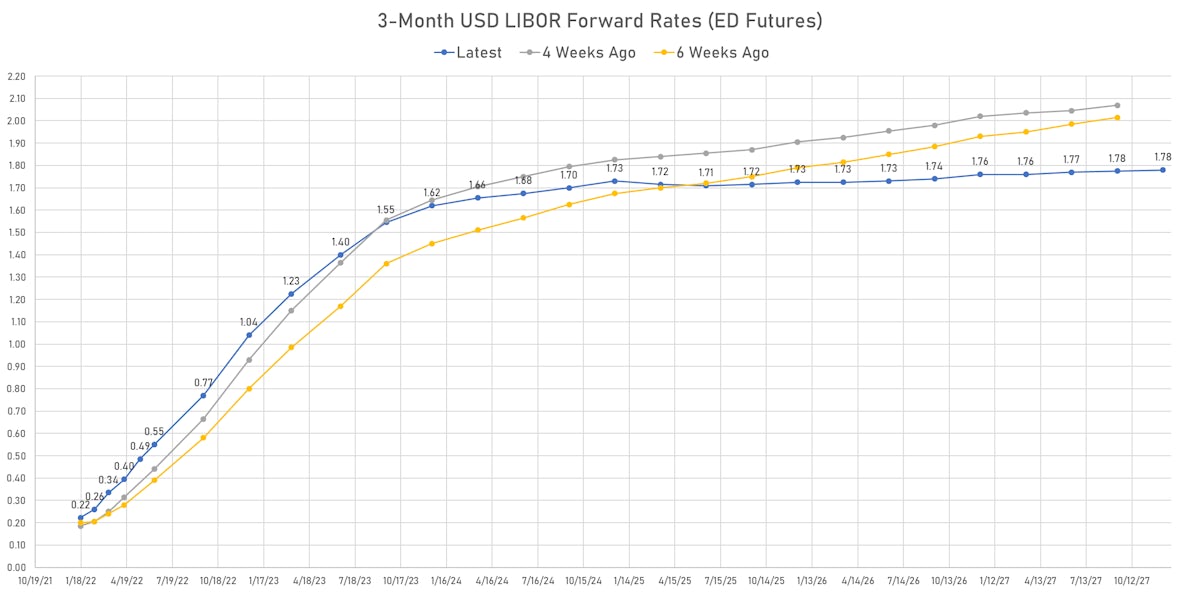

- At this point the market does not take the Fed's path of 8 hikes through 2024 at face value: forward rates see only about 6 hikes over the next 3 years

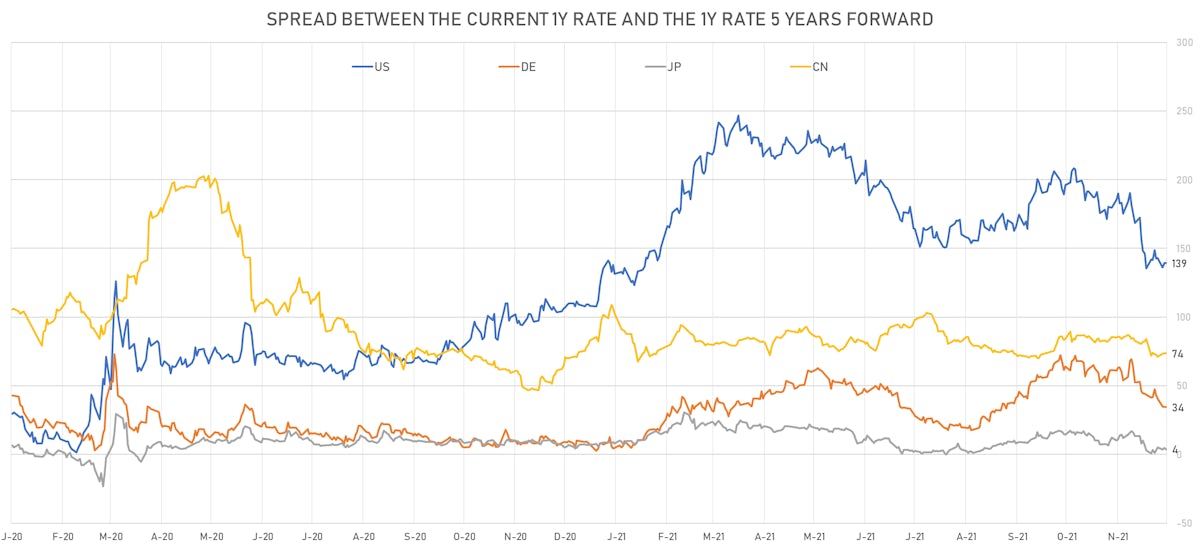

US FORWARD RATES

- 1-month USD OIS 12-months forward now price in 75.2 bp of Fed hikes by the end of 2022 (1-day change: 1.6 bp; 1-week change: 7.2 bp)

- The 3-month Eurodollar zero curve prices in 85.5 bp of rate hikes over the next 15 months (equivalent to 3.42 rate hikes) and 153.7 bp over the next 3 years (equivalent to 6.15 rate hikes)

- 1-year US Treasury rate 5 years forward up 1.6 bp, now at 1.7194%, meaning that the 1-year Treasury rate is now expected to increase by 139.4 bp over the next 5 years (equivalent to 5.6 rate hikes)

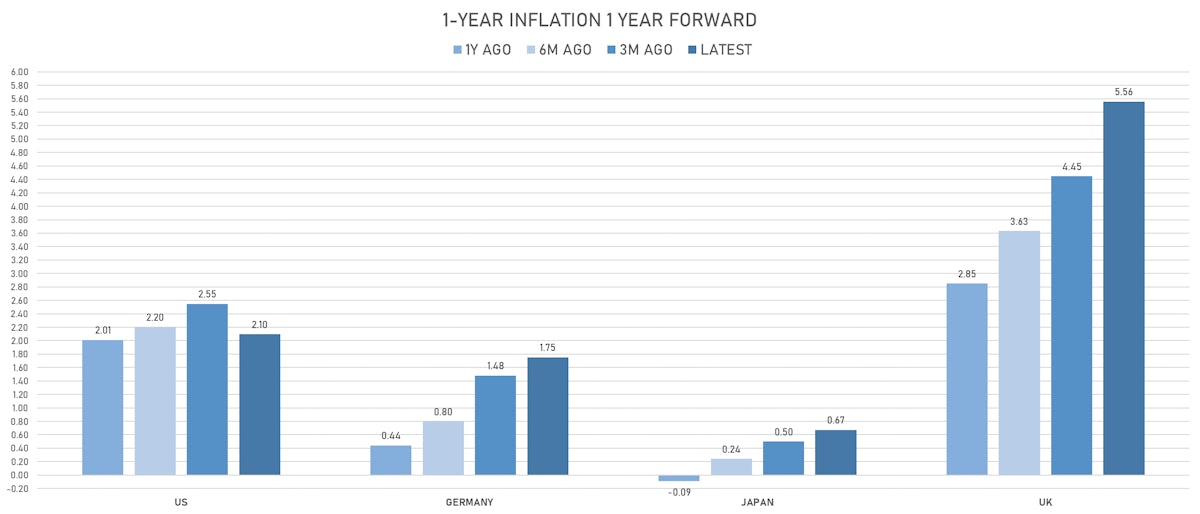

US INFLATION & REAL RATES

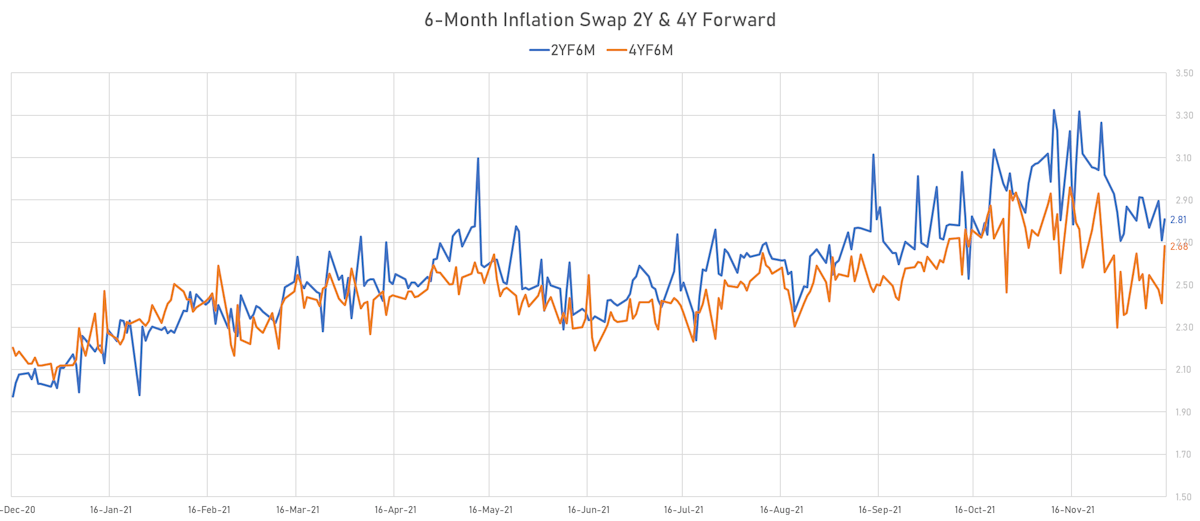

- TIPS 1Y breakeven inflation at 5.06% (up 6.1bp); 2Y at 3.58% (up 6.8bp); 5Y at 2.77% (up 7.5bp); 10Y at 2.45% (up 5.7bp); 30Y at 2.28% (up 5.6bp)

- 6-month spot US CPI swap down -6.5 bp to 4.124%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.5180%, -6.2 bp today; 10Y at -1.0150%, -3.9 bp today; 30Y at -0.4050%, -2.4 bp today

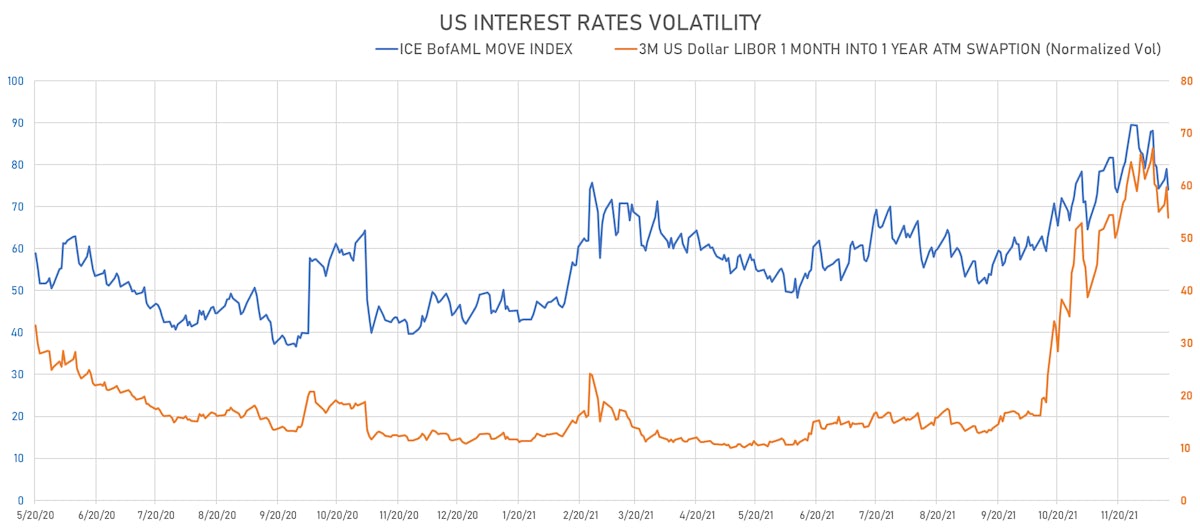

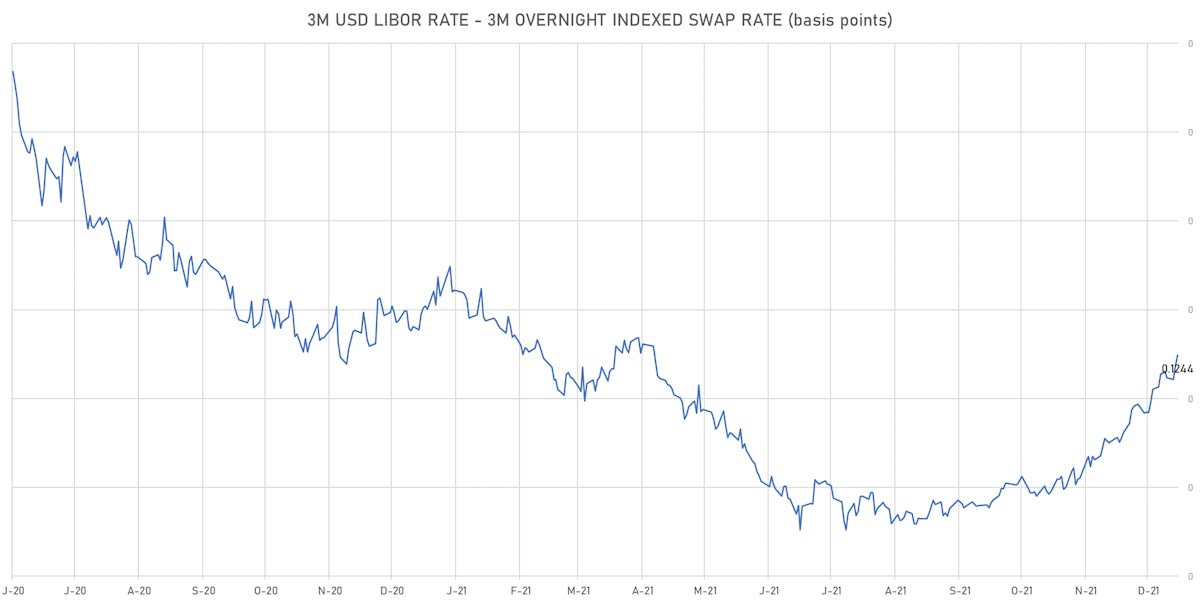

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -5.9% at 53.9%

- 3-Month LIBOR-OIS spread up 0.6 bp at 12.4 bp (12-months range: 2.6-17.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.579% (down -0.1 bp); the German 1Y-10Y curve is 9.3 bp flatter at 28.2bp (YTD change: +12.1 bp)

- Japan 5Y: -0.094% (down -0.1 bp); the Japanese 1Y-10Y curve is 0.7 bp flatter at 15.6bp (YTD change: +0.6 bp)

- China 5Y: 2.678% (down -0.2 bp); the Chinese 1Y-10Y curve is 0.6 bp flatter at 56.0bp (YTD change: +9.6 bp)

- Switzerland 5Y: -0.498% (up 1.4 bp); the Swiss 1Y-10Y curve is 3.5 bp steeper at 48.9bp (YTD change: +22.5 bp)