Rates

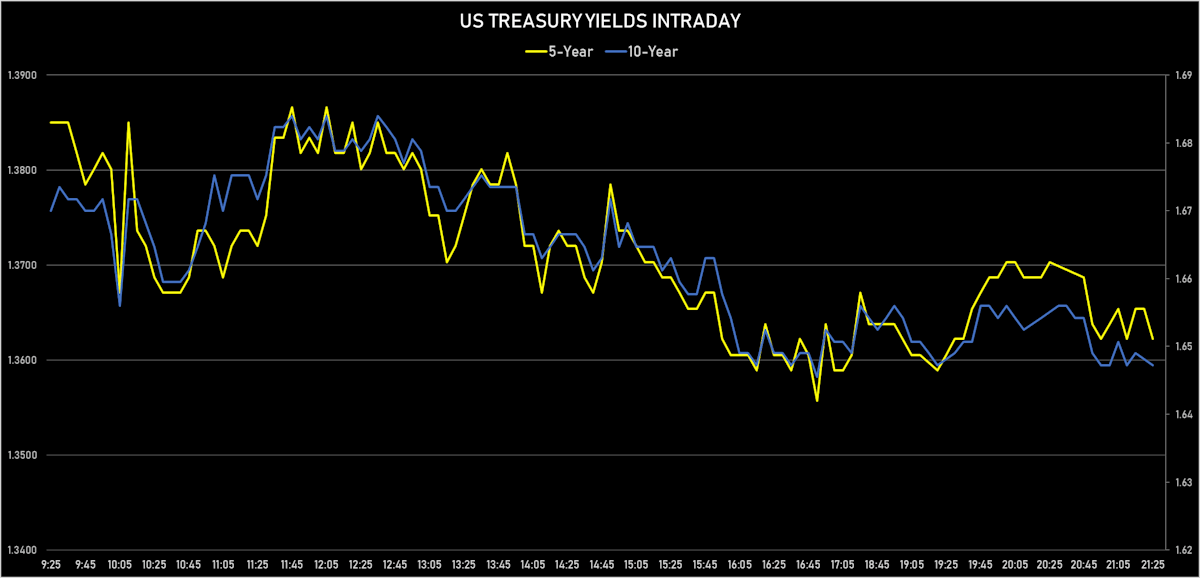

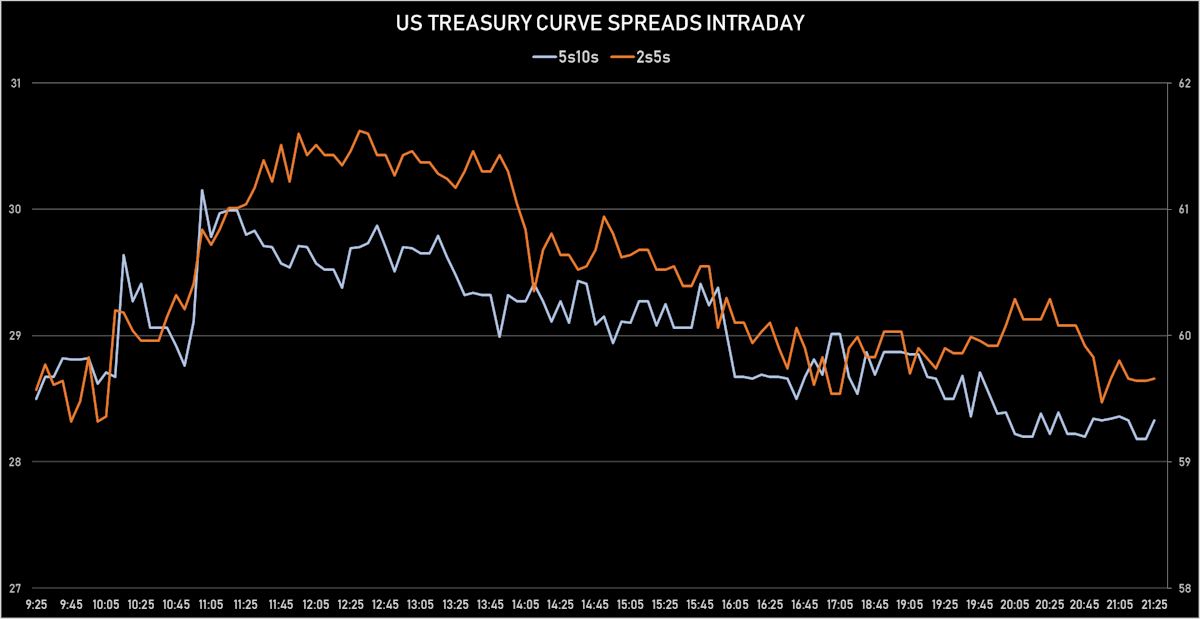

US Treasury Yield Curve Falls At The Front End, Steepens Slightly After Disappointing Macro Data

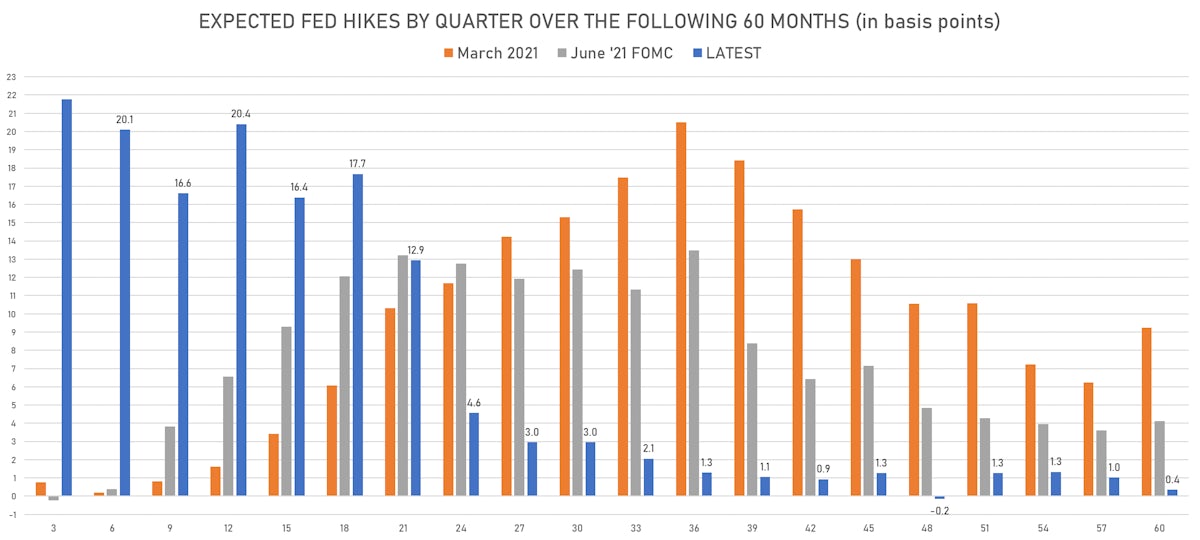

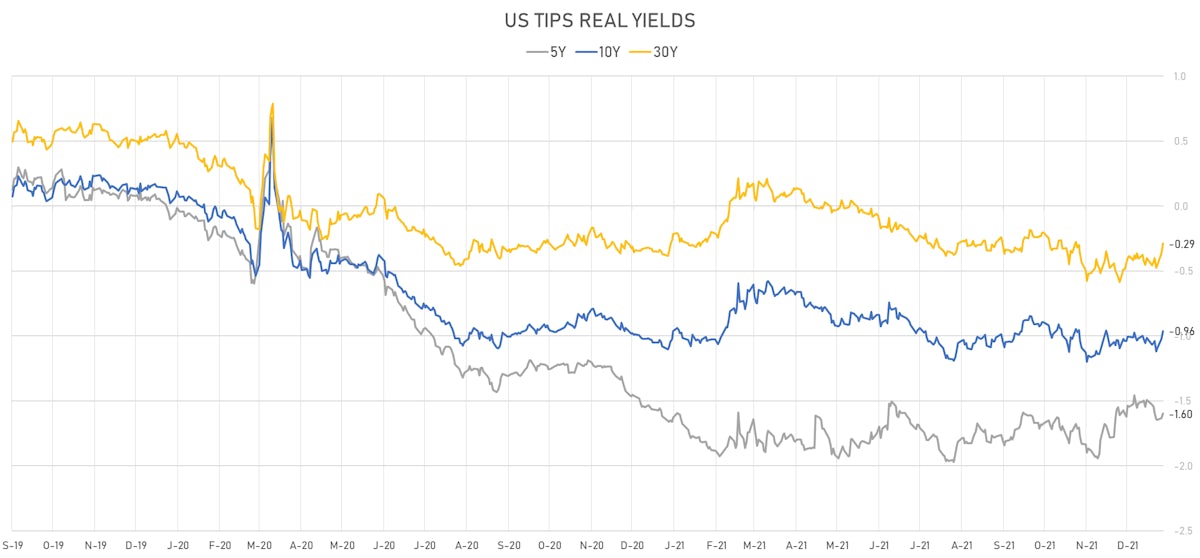

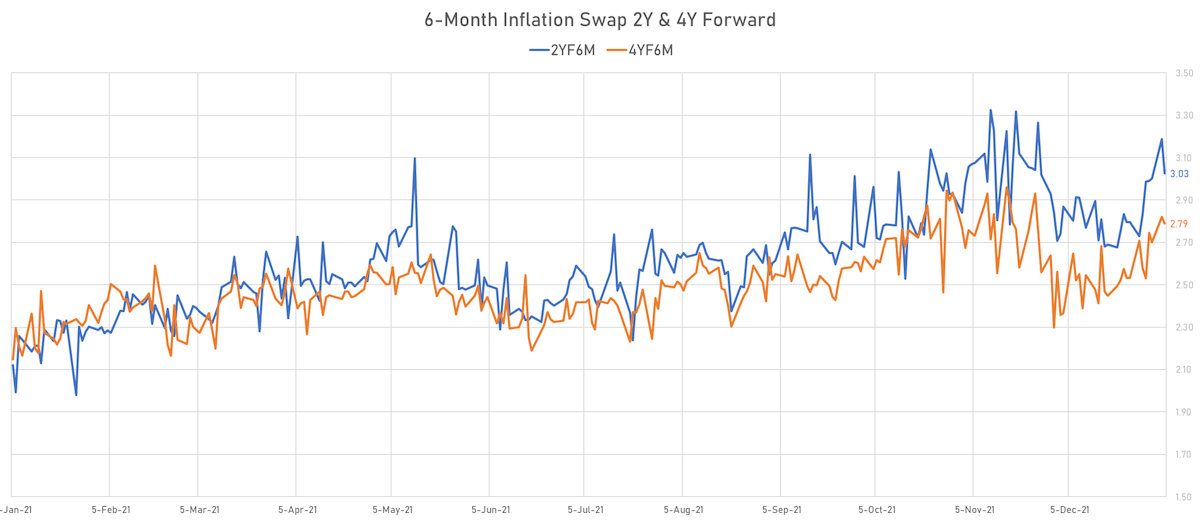

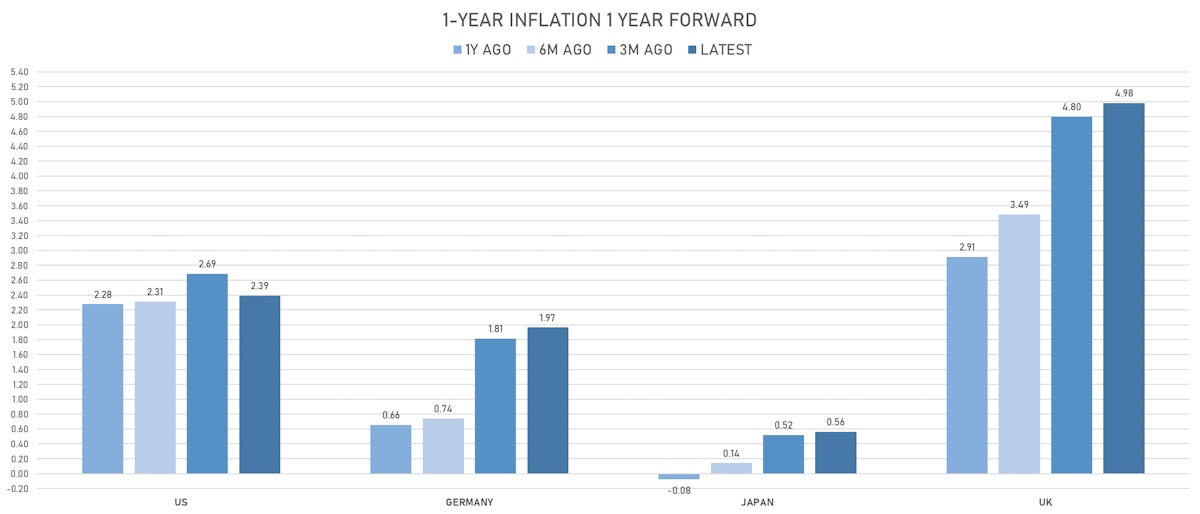

Breakeven inflation and inflation forwards were down today, while the real rates curve steepened, a reflection that the market sees slower rate hikes leading to higher forward growth / a higher terminal rate

Published ET

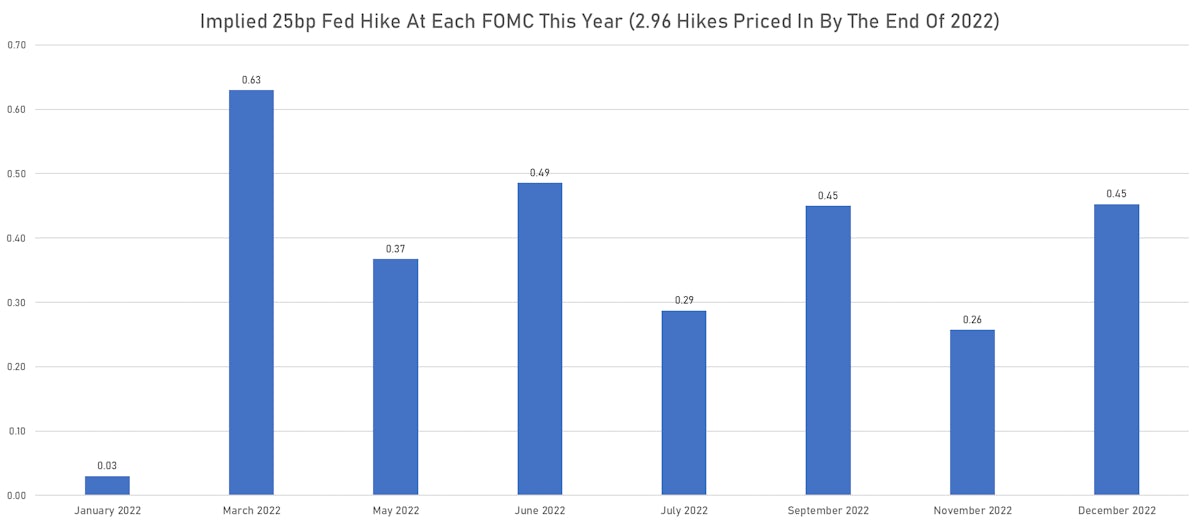

Timing Of Rate Hikes In 2022 Implied From Fed Funds Futures | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

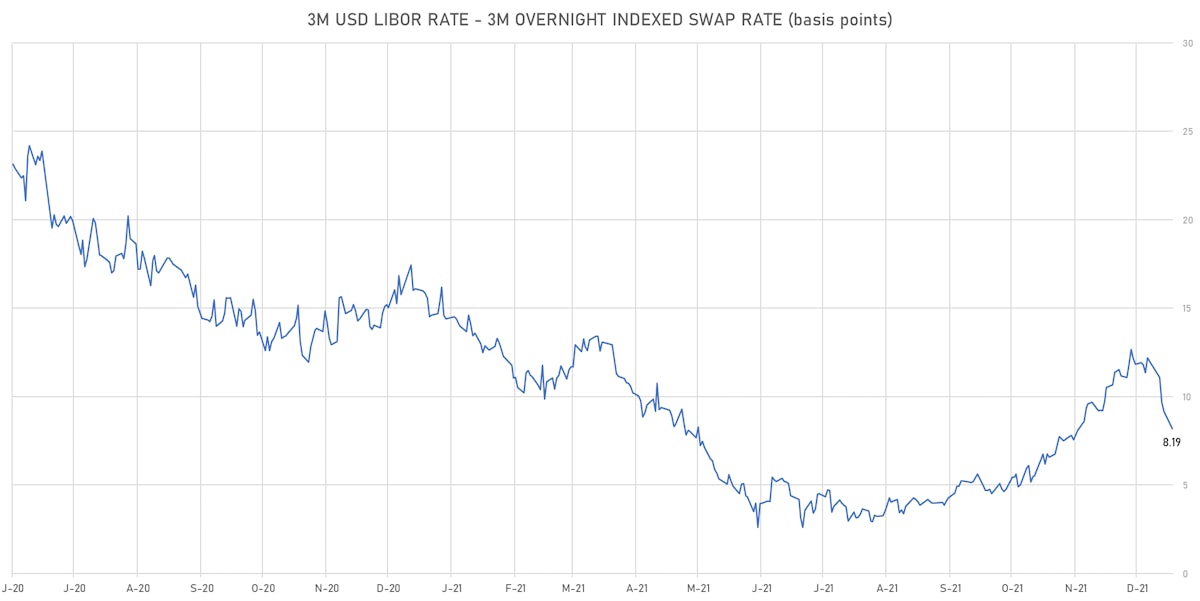

- 3-Month USD LIBOR -0.97bp today, now at 0.2034%; 3-Month OIS -0.1bp at 0.1215%

- The treasury yield curve steepened, with the 1s10s spread widening 3.0 bp, now at 124.0 bp (YTD change: +11.2bp)

- 1Y: 0.3970% (down 1.8 bp)

- 2Y: 0.7758% (down 1.6 bp)

- 5Y: 1.3605% (down 0.0 bp)

- 7Y: 1.5562% (up 0.7 bp)

- 10Y: 1.6367% (up 1.2 bp)

- 30Y: 2.0312% (up 2.7 bp)

- US treasury curve spreads: 2s5s at 59.9bp (up 1.1bp today), 5s10s at 28.5bp (up 1.7bp today), 10s30s at 40.9bp (up 2.0bp today)

- Treasuries butterfly spreads: 1s5s10s at -70.8bp (down -0.1bp), 5s10s30s at 12.0bp (up 0.1bp)

- US 5-Year TIPS Real Yield: +3.4 bp at -1.5980%; 10-Year TIPS Real Yield: +6.1 bp at -0.9610%; 30-Year TIPS Real Yield: +7.6 bp at -0.2890%

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 01 Jan (Redbook Research) at 18.80 % (vs 21.40 % prior)

- ISM Manufacturing, Employment for Dec 2021 (ISM, United States) at 54.20 (vs 53.30 prior), above consensus estimate of 53.50

- ISM Manufacturing, New orders for Dec 2021 (ISM, United States) at 60.40 (vs 61.50 prior)

- ISM Manufacturing, PMI total for Dec 2021 (ISM, United States) at 58.70 (vs 61.10 prior), below consensus estimate of 60.00

- ISM Manufacturing, Prices for Dec 2021 (ISM, United States) at 68.20 (vs 82.40 prior), below consensus estimate of 79.50

- JOLTS Job Openings for Nov 2021 (BLS, U.S Dep. Of Lab) at 10.56 Mln (vs 11.03 Mln prior), below consensus estimate of 11.08 Mln

- Atlanta Fed Q4 2021 GDP Now at 7.4% (vs 7.6% Dec 23)

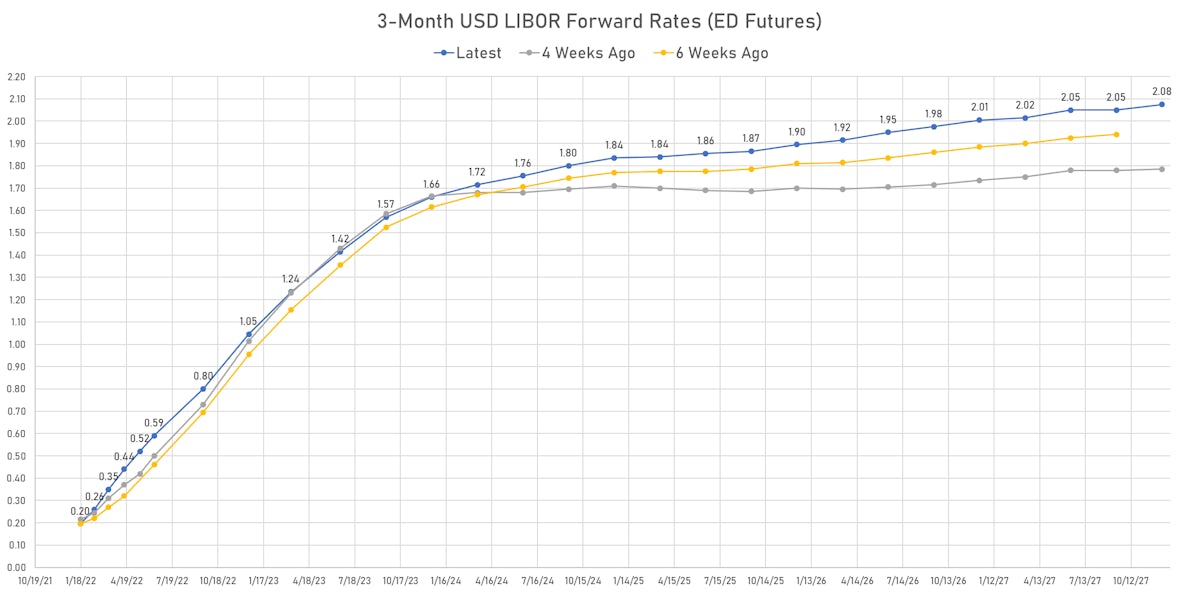

US FORWARD RATES

- Fed Funds futures now imply changes of 16.5bp by the end of March 2022 (66.0% probability of a 25bp hike) and price in 3.0 hikes by the end of December 2022

- The 3-month Eurodollar zero curve prices in 91.2 bp of rate hikes over the next 15 months (equivalent to 3.65 rate hikes) and 164.7 bp over the next 3 years (equivalent to 6.59 rate hikes)

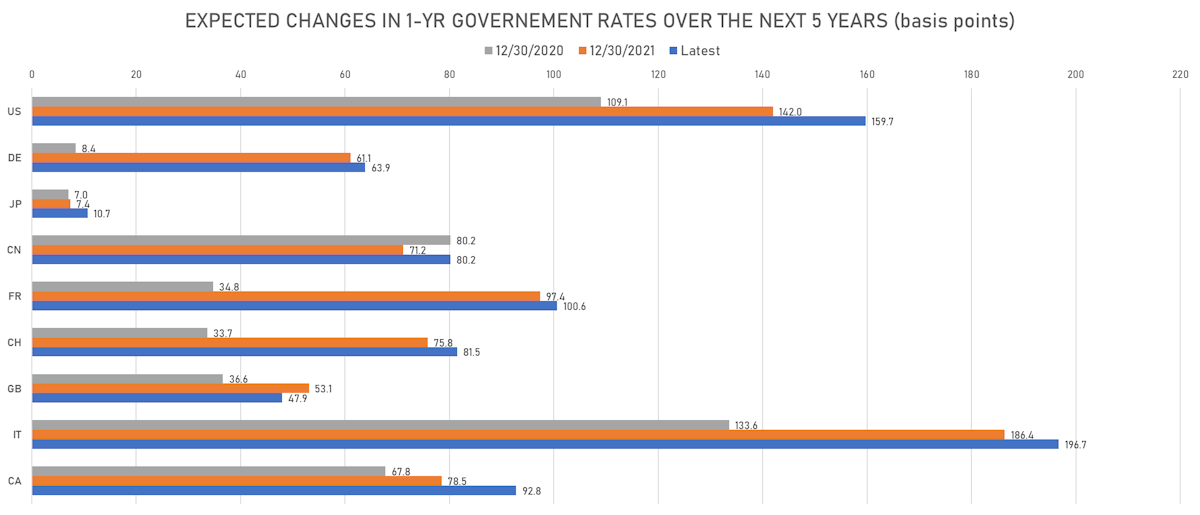

- 1-year US Treasury rate 5 years forward up 2.5 bp, now at 2.0048%, meaning that the 1-year Treasury rate is now expected to increase by 159.4 bp over the next 5 years (equivalent to 6.4 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 4.74% (up 2.6bp); 2Y at 3.57% (down -1.7bp); 5Y at 2.96% (down -3.4bp); 10Y at 2.57% (down -5.2bp); 30Y at 2.36% (down -4.9bp)

- 6-month spot US CPI swap down -7.5 bp to 4.471%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.5980%, +3.4 bp today; 10Y at -0.9610%, +6.1 bp today; 30Y at -0.2890%, +7.6 bp today

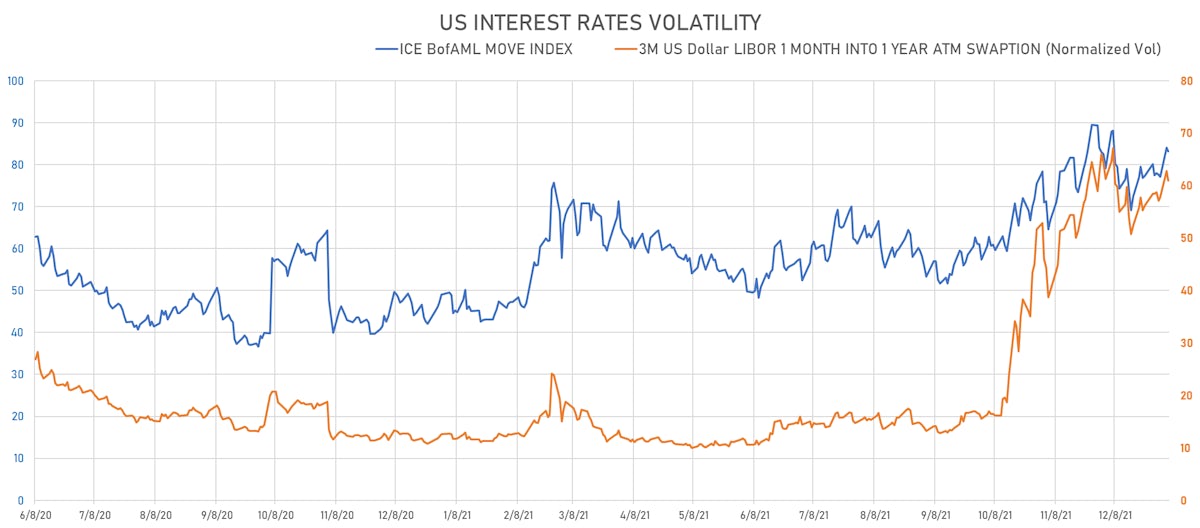

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -1.8% at 61.0%

- 3-Month LIBOR-OIS spread down -1.0 bp at 8.2 bp (12-months range: 2.6-16.2 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.427% (down -1.3 bp); the German 1Y-10Y curve is 0.4 bp flatter at 49.1bp (YTD change: +5.6 bp)

- Japan 5Y: -0.064% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.7 bp steeper at 17.4bp (YTD change: +0.7 bp)

- China 5Y: 2.583% (down -0.5 bp); the Chinese 1Y-10Y curve is 1.5 bp steeper at 60.8bp (YTD change: +9.3 bp)

- Switzerland 5Y: -0.380% (up 0.2 bp); the Swiss 1Y-10Y curve is 8.5 bp flatter at 64.2bp (YTD change: +4.7 bp)