Rates

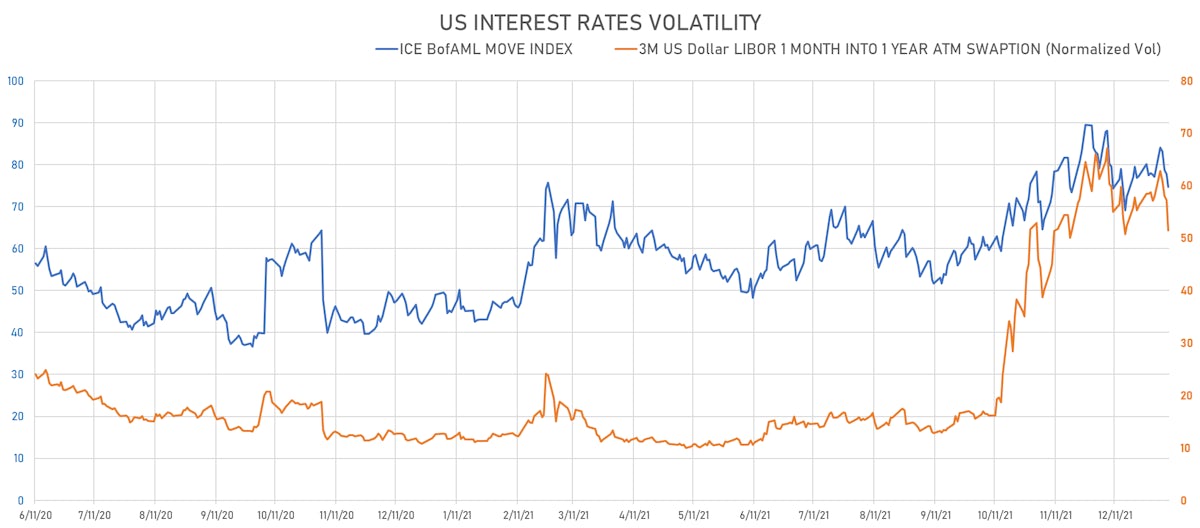

The Fed Is Resetting Expectations, Positioning Itself For 4 Possible Hikes In 2022

Fed Funds futures and forward OIS are currently pricing in about 3.3 hikes in 2022 (up 0.5 hike this week): 3 hikes are now firmly on the table, while some market participants see the start of quantitative tightening (Fed balance sheet runoff) as a substitute for one hike

Published ET

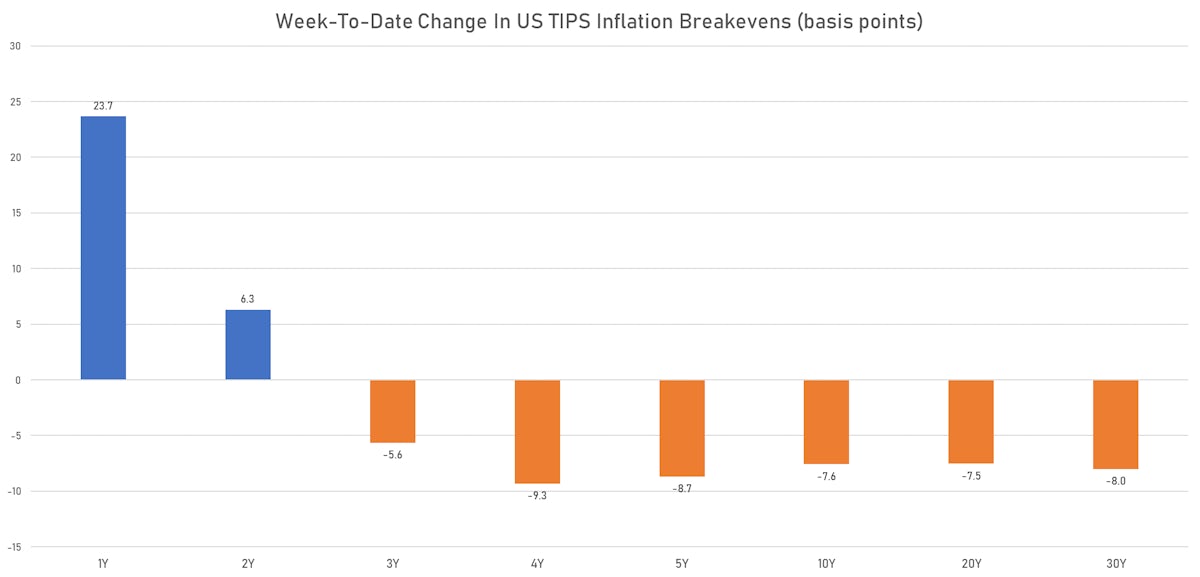

Weekly Change In US TIPS Inflation Breakevens | Sources: ϕpost, Refinitiv data

WEEKLY US SUMMARY

- The treasury yield curve steepened, with the 1s10s spread widening 22.1 bp, now at 134.9 bp (YTD change: +22.1bp). Most of the move higher was at the front end of the curve in 1s2s and 2s5s, with flattening at the long end:

- 1Y: 0.4170% (up 3.3 bp)

- 2Y: 0.8701% (up 13.6 bp)

- 5Y: 1.5036% (up 24.1 bp)

- 7Y: 1.6995% (up 26.3 bp)

- 10Y: 1.7655% (up 25.4 bp)

- 30Y: 2.1167% (up 21.1 bp)

- US treasury curve spreads: 2s5s at 63.4bp (up 10.6bp this week), 5s10s at 26.2bp (up 1.7bp), 10s30s at 35.1bp (down -3.7bp)

- TIPS 1Y breakeven inflation at 4.89% (up 23.7bp); 2Y at 3.57% (up 6.3bp); 5Y at 2.81% (down -8.7bp); 10Y at 2.50% (down -7.6bp); 30Y at 2.30% (down -8.0bp)

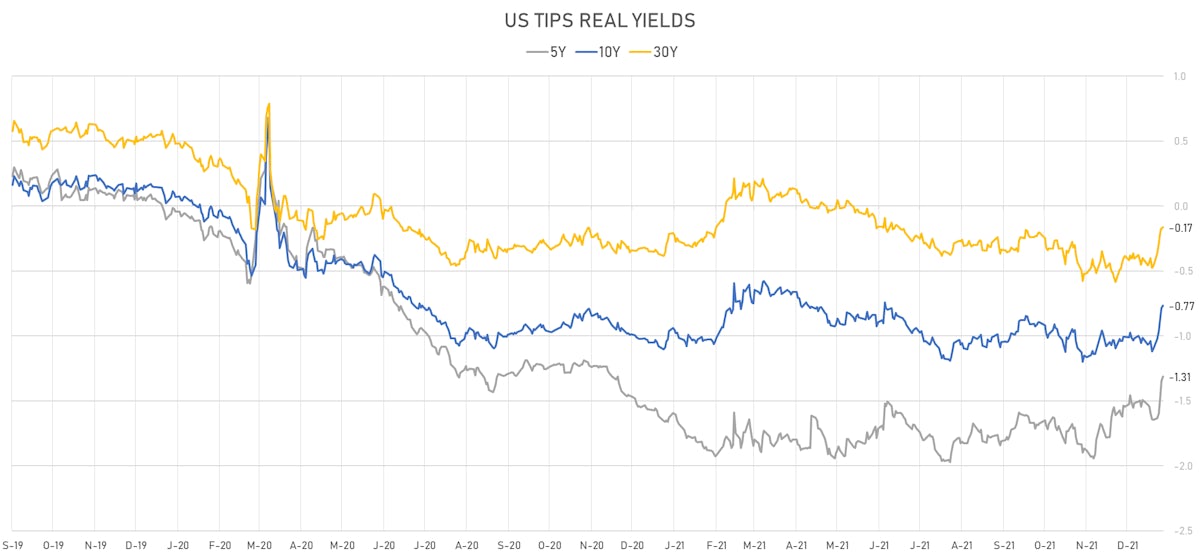

- US 5-Year TIPS Real Yield: +33.2 bp at -1.3140%; 10-Year TIPS Real Yield: +32.9 bp at -0.7650%; 30-Year TIPS Real Yield: +29.4 bp at -0.1650%

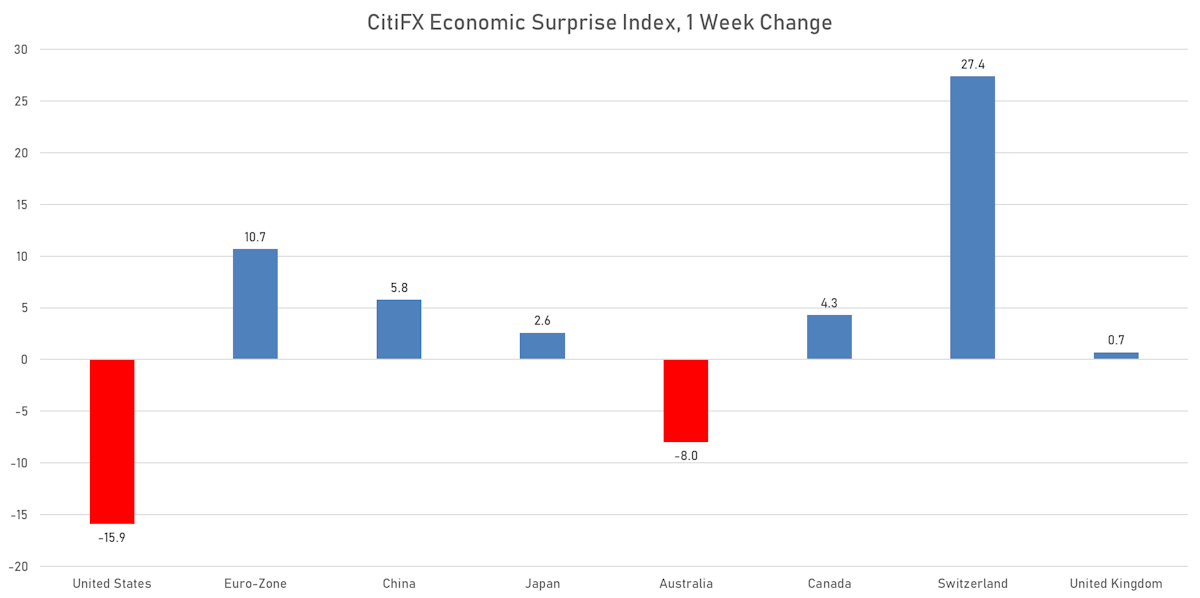

MAJOR US MACRO DATA LESS POSITIVE THAN EXPECTED THIS WEEK

OUR LATEST VIEWS ON RATES

- Although the tilt towards a more hawkish Fed has been building for months, the FOMC minutes brought home the message that the Fed is very concerned about inflation and will do everything it can to avoid a more durable anchoring of inflation expectations

- The sense of urgency regarding inflation, coupled with a possible start of the balance sheet runoff soon after liftoff, lifted yields across the curve

- TIPS saw higher short-term and lower long-term inflation breakevens: markets now expect the Fed's strong focus on inflation to be successful in bringing inflation down in the medium term

- But hiking will have a meaningful negative impact on real GDP growth, which can be seen in the flatter 5s30s real yield curve

- A rule of thumb is that each 1% increase on the 10Y TIPS takes 1.5% off GDP growth: the 33bp rise in 10Y TIPS yield over the past week would shave about 0.5% off GDP growth

- Finally, in addition to a more hawkish Fed, the past week brought weaker than expected ISM Manufacturing and much weaker nonfarm payrolls, which added to the flattening at the long end of the yield curve

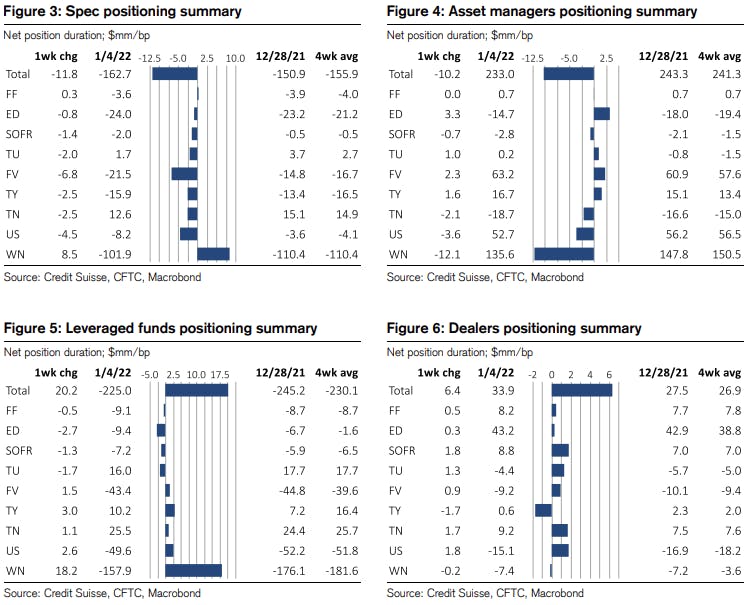

WEEKLY CFTC POSITIONING DATA

- Specs increased their net short duration, pretty much across the curve (with the usual long-end bias)

- Leveraged funds covered a significant part of their net short duration positioning, but still have a clear steepening bias (very much the pain trade)

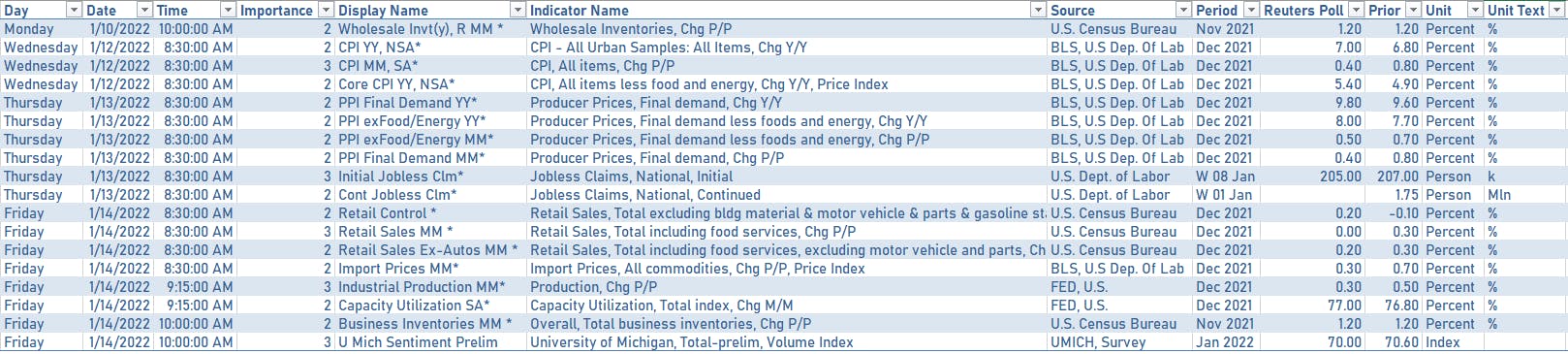

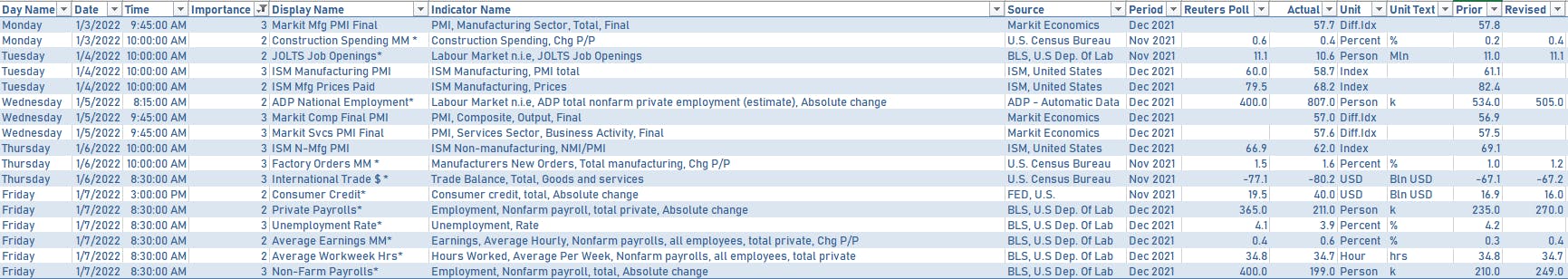

US MACRO WEEK AHEAD

- The focus this week will be on the latest CPI data (to be released on Wednesday), as well as major data points on Friday: retail sales, industrial production, and UMich sentiment survey

- Coupon auctions this week: 3-Year Note on Tuesday (1/11/22), 10-Year Note on Wednesday (1/12/22), 30-Year Bond (1/13/22)

- Scheduled remarks from several FOMC voting members, including appearances by Fed Chair Powell and vice chair nominee Brainard before the Senate Banking Committee