Rates

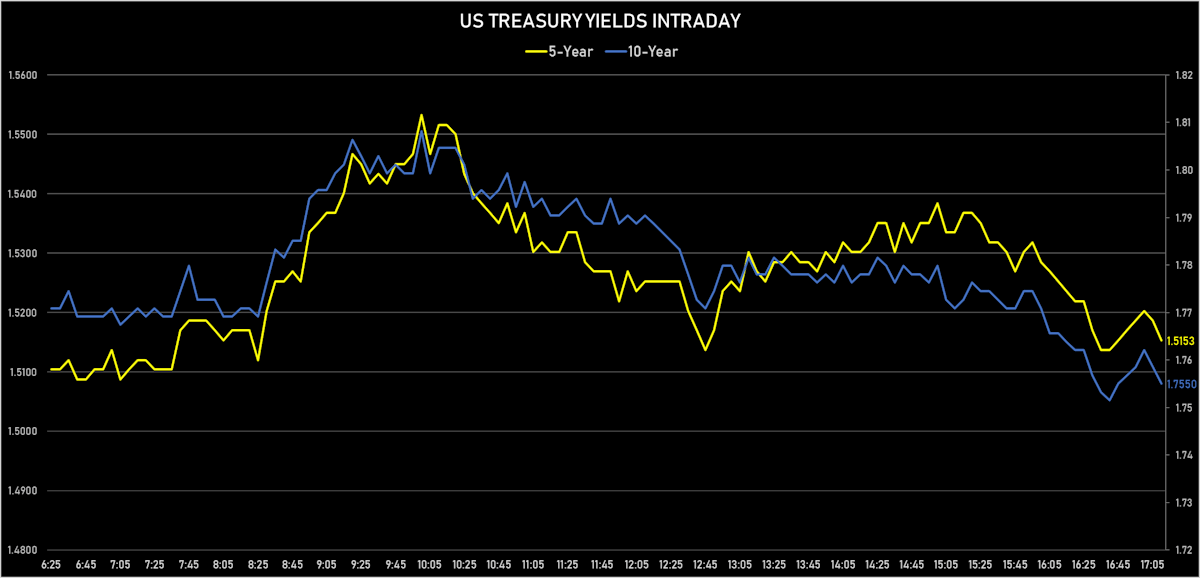

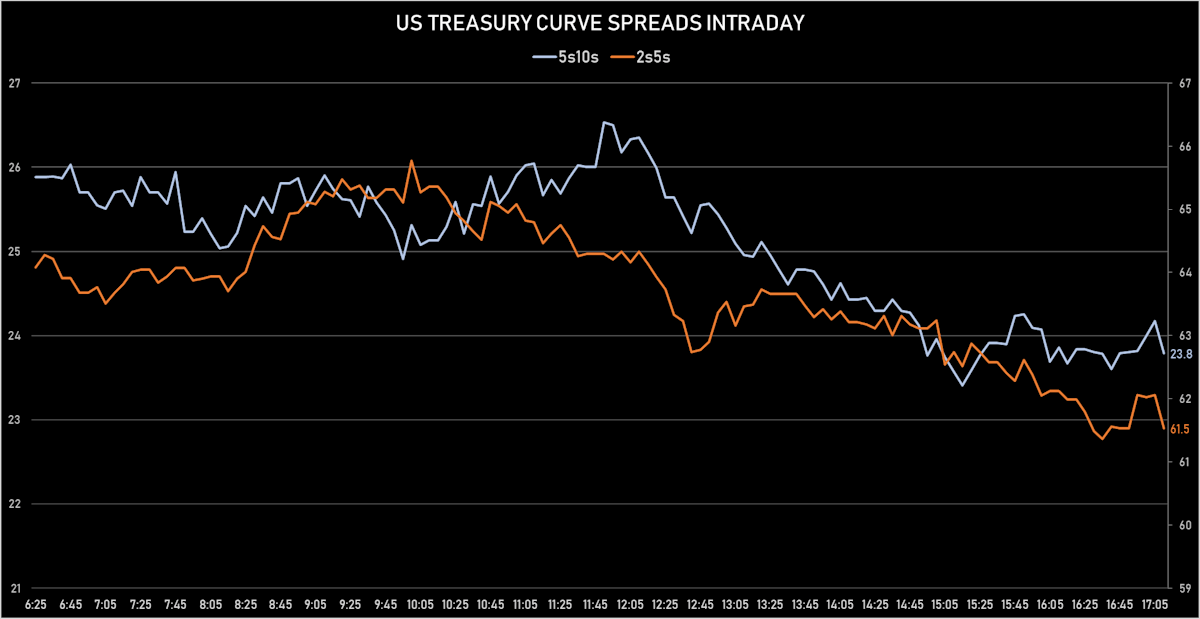

Yields Rise At The Front End, Curve Flattens: 2s5s, 5s10s, 10s30s Spreads All Modestly Tighter

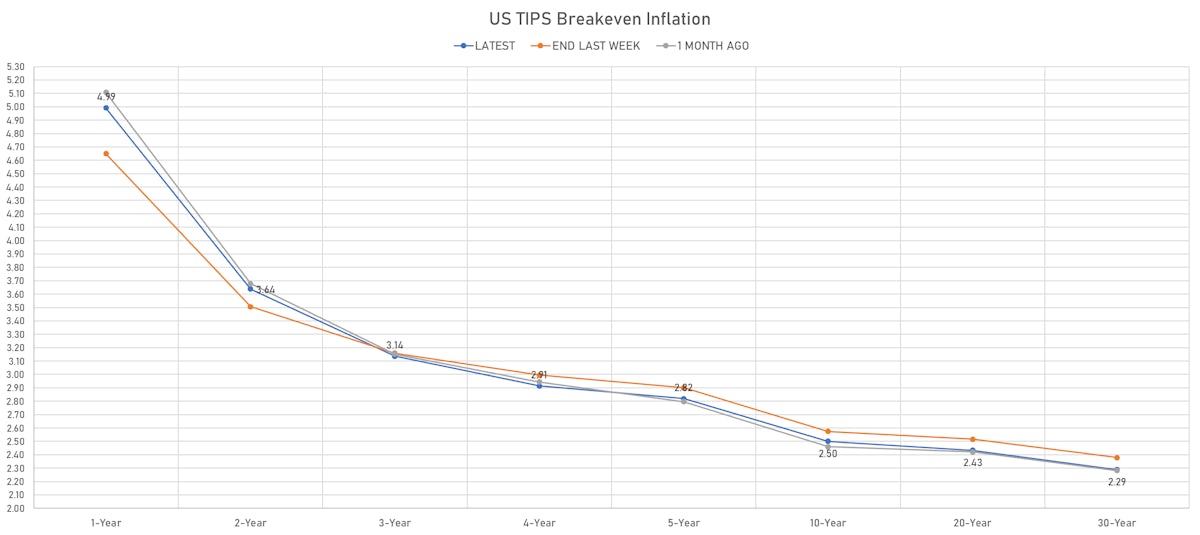

In TIPS, short-term inflation breakevens were much higher, with a continued flattening of the 5s30s reflecting the Fed's strong focus on inflation expectations (at the expense of forward growth)

Published ET

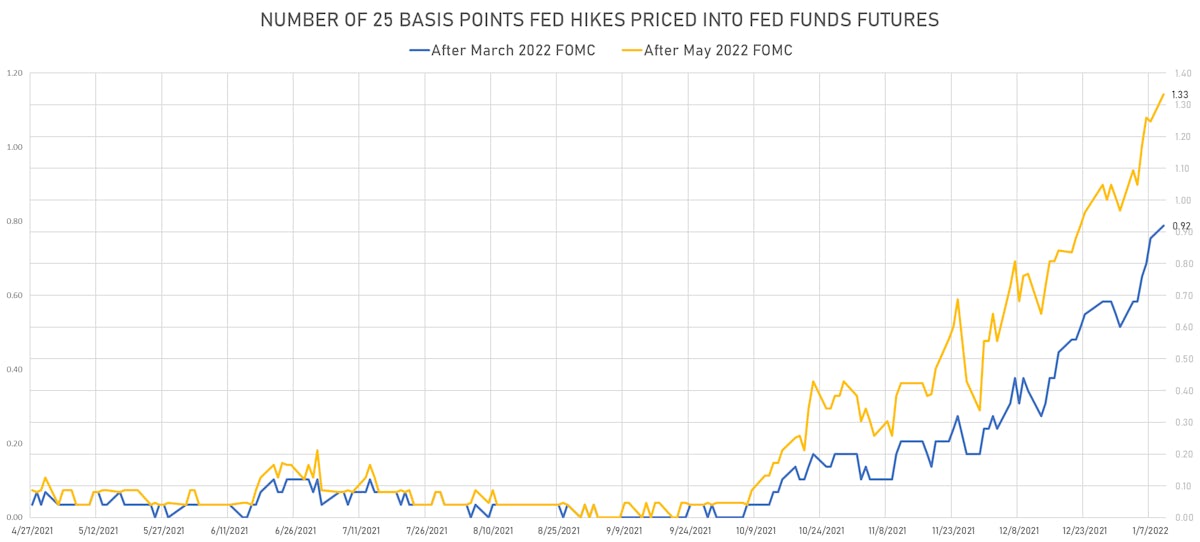

Number of Fed Hikes By The End Of 2022, Implied From Fed Funds Futures | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

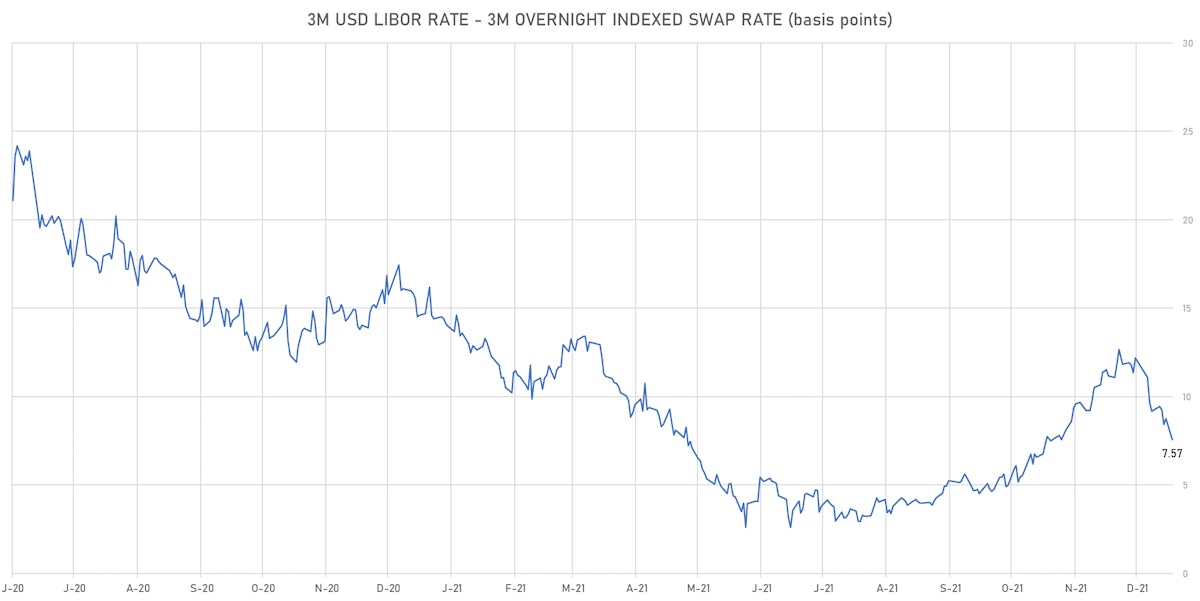

- 3-Month USD LIBOR -1.19bp today, now at 0.2317%; 3-Month OIS +0.8bp at 0.1560%

- The treasury yield curve flattened, with the 1s10s spread tightening -3.4 bp, now at 133.8 bp (YTD change: +21.0bp)

- 1Y: 0.4170% (up 2.3 bp)

- 2Y: 0.8984% (up 2.8 bp)

- 5Y: 1.5153% (up 1.2 bp)

- 7Y: 1.6972% (down 0.2 bp)

- 10Y: 1.7550% (down 1.1 bp)

- 30Y: 2.0875% (down 2.9 bp)

- US treasury curve spreads: 2s5s at 61.7bp (down -1.2bp), 5s10s at 24.0bp (down -2.2bp), 10s30s at 33.2bp (down -2.5bp)

- Treasuries butterfly spreads: 1s5s10s at -84.8bp (down -1.1bp), 5s10s30s at 8.5bp (down -0.3bp)

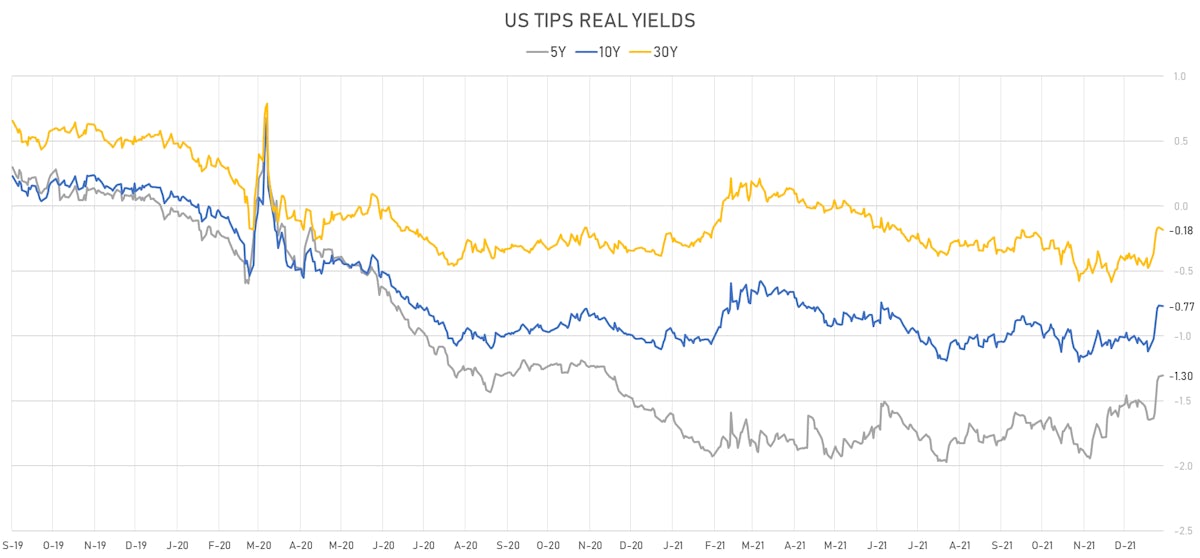

- US 5-Year TIPS Real Yield: +1.0 bp at -1.3040%; 10-Year TIPS Real Yield: -0.7 bp at -0.7720%; 30-Year TIPS Real Yield: -1.9 bp at -0.1840%

US MACRO RELEASES

- The Conference Board Employment Trends Index (ETI) for Dec 2021 (The Conference Board) at 116.63 (vs 114.49 prior)

- Wholesale Inventories, Change P/P for Nov 2021 (U.S. Census Bureau) at 1.40 % (vs 1.20 % prior), above consensus estimate of 1.20 %

- Wholesale Trade, Change P/P for Nov 2021 (U.S. Census Bureau) at 1.30 % (vs 2.20 % prior), below consensus estimate of 1.50 %

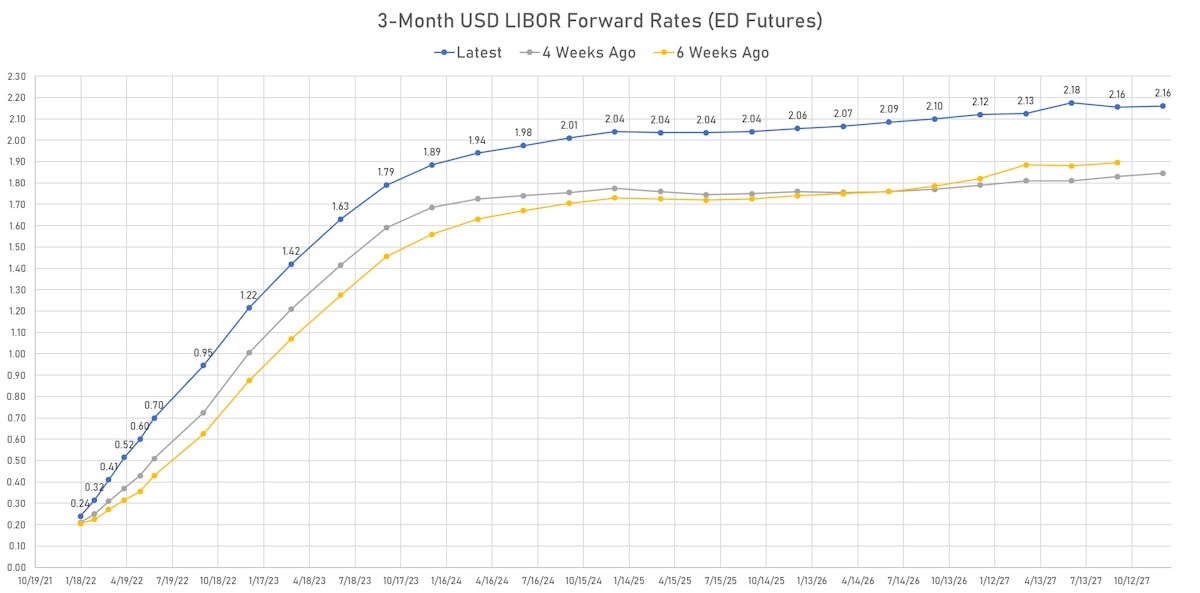

US FORWARD RATES

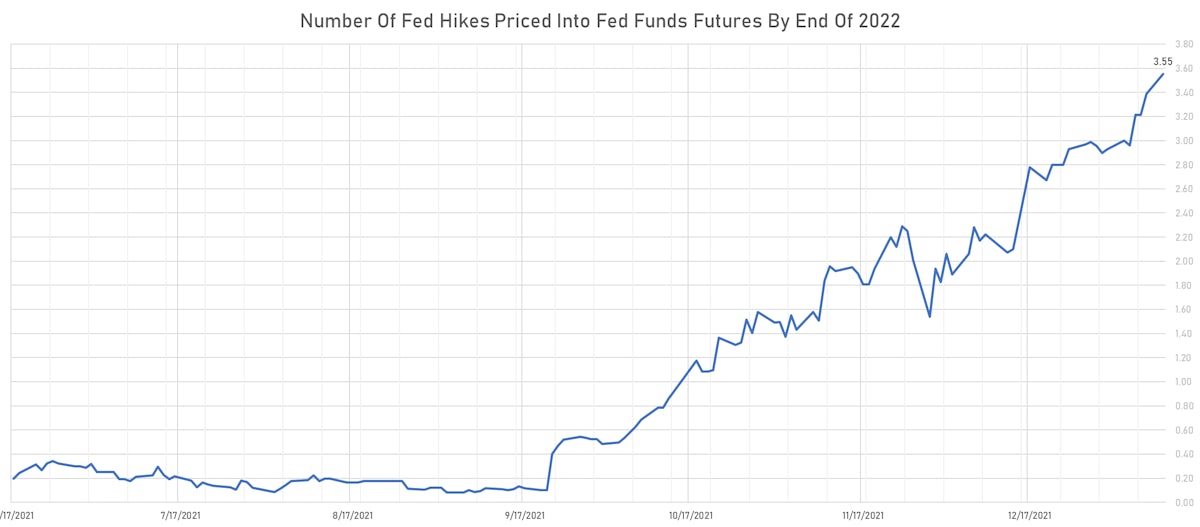

- Fed Funds futures now imply changes of 22.4bp (89.5% probability of a 25bp hike) by the end of March 2022 and price in 3.5 hikes by the end of December 2022

- The 3-month Eurodollar zero curve prices in 105.9 bp of rate hikes over the next 15 months (equivalent to 4.23 rate hikes) and 180.1 bp over the next 3 years (equivalent to 7.20 rate hikes)

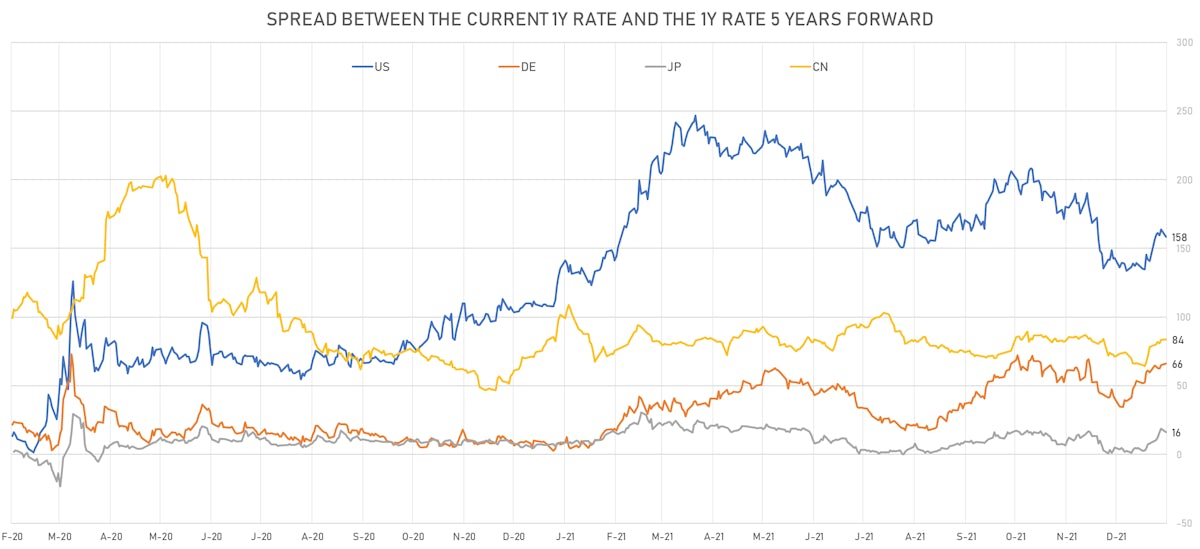

- 1-year US Treasury rate 5 years forward down 2.8 bp, now at 2.0864%, meaning that the 1-year Treasury rate is now expected to increase by 158.4 bp over the next 5 years (equivalent to 6.3 rate hikes), implying a terminal rate around 2% (50bp below the median Fed projection)

US INFLATION & REAL RATES

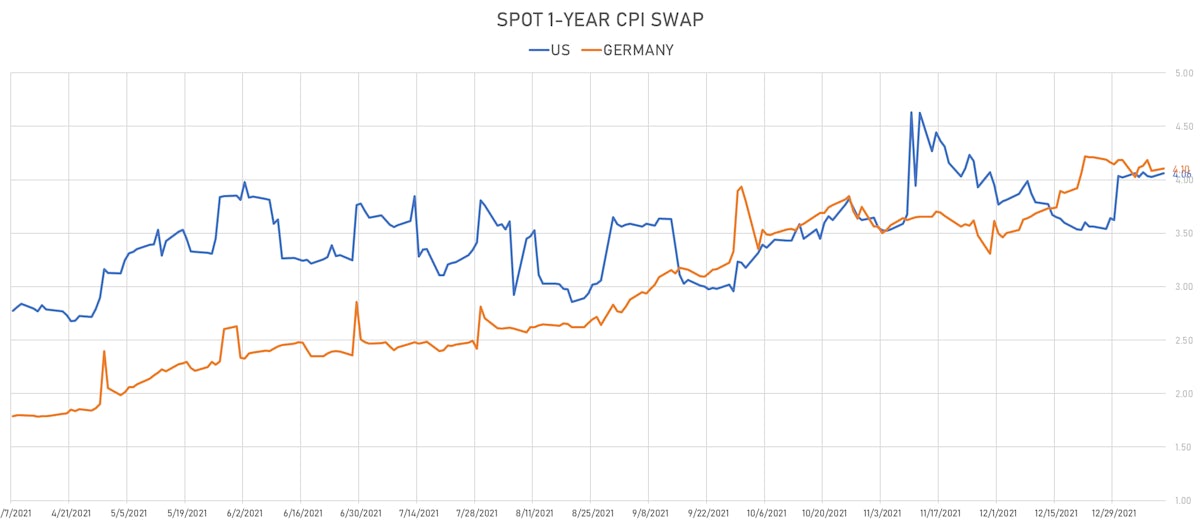

- TIPS 1Y breakeven inflation at 4.99% (up 10.6bp); 2Y at 3.64% (up 7.0bp); 5Y at 2.82% (up 0.5bp); 10Y at 2.50% (up 0.1bp); 30Y at 2.29% (down -1.0bp)

- 6-month spot US CPI swap down -0.5 bp to 4.506%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.3040%, +1.0 bp today; 10Y at -0.7720%, -0.7 bp today; 30Y at -0.1840%, -1.9 bp today

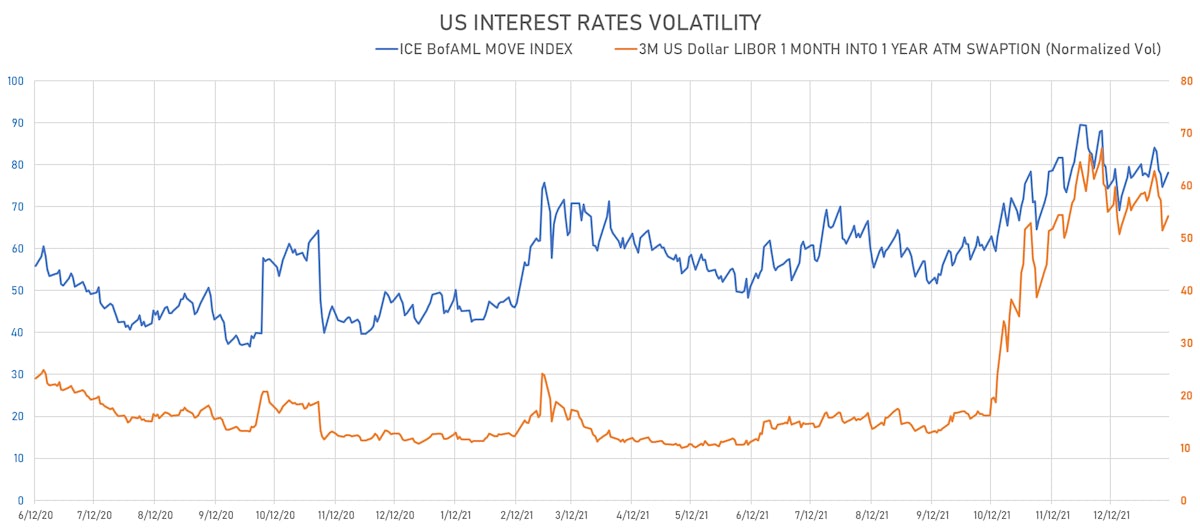

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 2.7% at 54.2%

- 3-Month LIBOR-OIS spread down -1.2 bp at 7.6 bp (12-months range: 2.6-16.2 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.368% (down -0.5 bp); the German 1Y-10Y curve is 2.6 bp flatter at 56.7bp (YTD change: +12.8 bp)

- Japan 5Y: -0.034% (up 0.4 bp); the Japanese 1Y-10Y curve is 0.5 bp steeper at 20.5bp (YTD change: +4.3 bp)

- China 5Y: 2.591% (down -3.3 bp); the Chinese 1Y-10Y curve is 0.1 bp steeper at 65.6bp (YTD change: +14.6 bp)

- Switzerland 5Y: -0.280% (up 0.6 bp); the Swiss 1Y-10Y curve is 0.7 bp steeper at 72.2bp (YTD change: +15.7 bp)