Rates

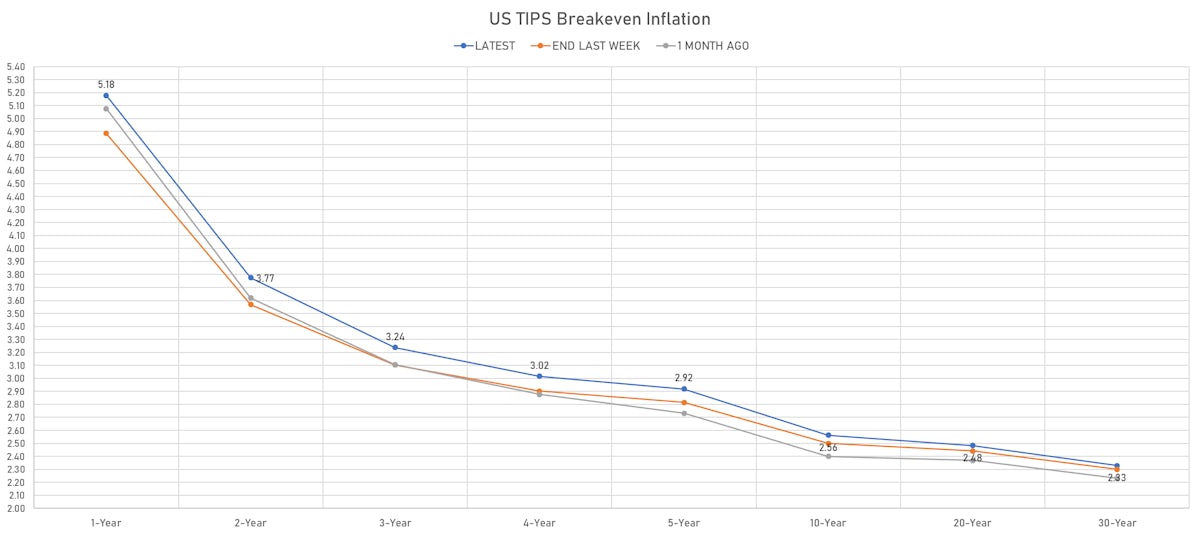

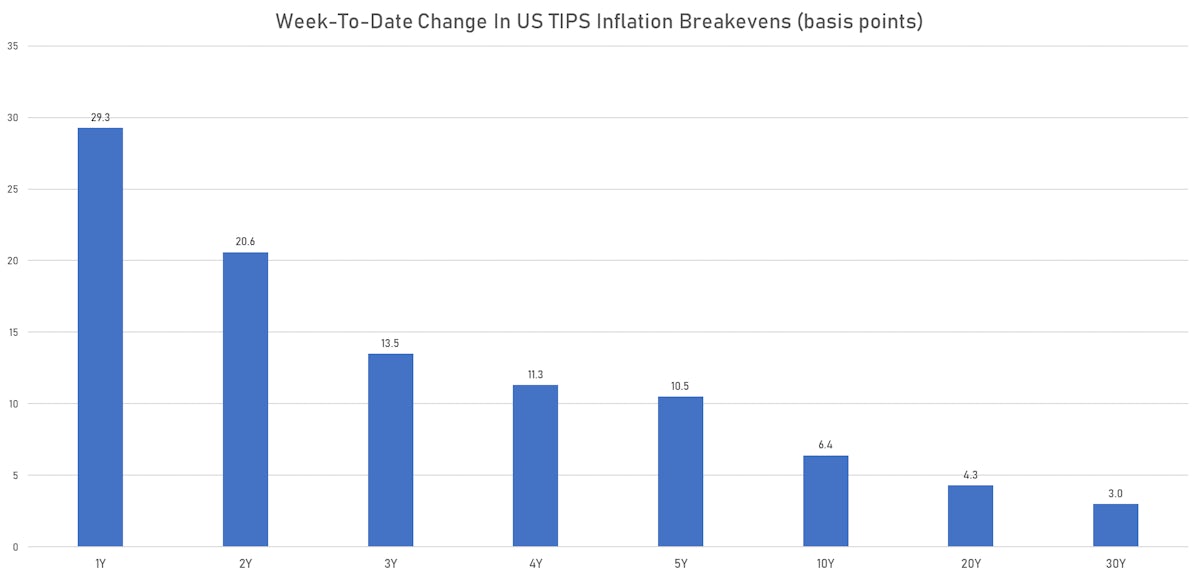

Real Yields Drop And Breakevens Rise Across The Curve As Powell Appears Less Hawkish Than Expected In Senate Hearing

Market moves are looking increasingly binary: less hawkish Fed leading to reflationary trade with stronger medium-term economic outlook (rising TIPS 5s30s spread), versus extremely hawkish Fed rapidly bringing front-end rates much higher and hurting forward economic growth (falling TIPS 5s30s spread)

Published ET

Week-to-date change in TIPS Breakevens | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

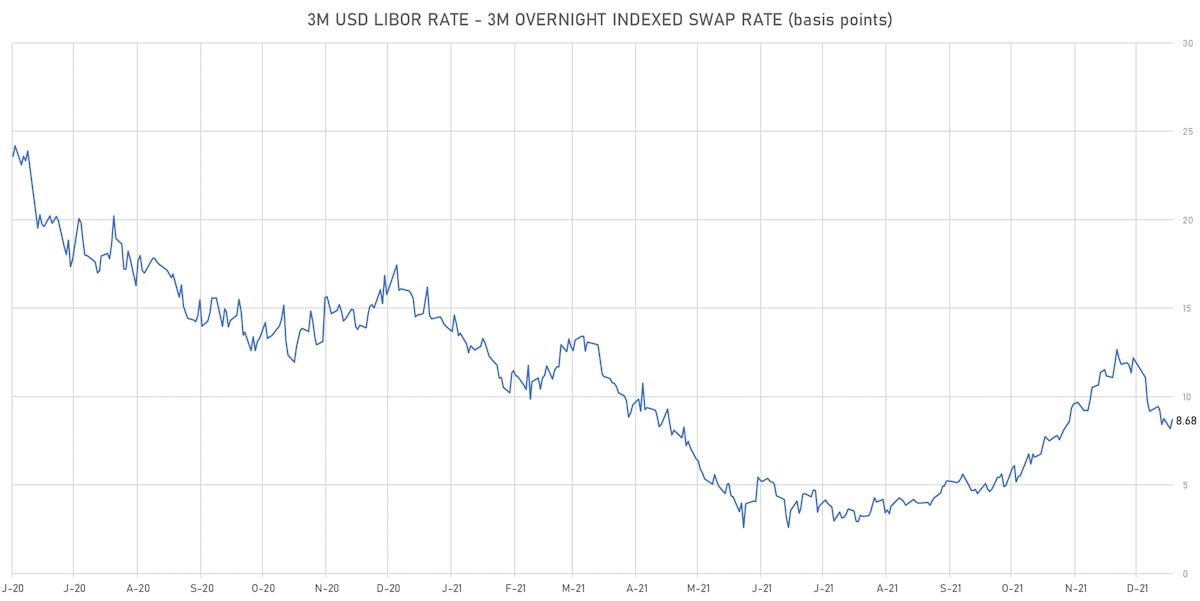

- 3-Month USD LIBOR +0.50bp today, now at 0.2378%; 3-Month OIS -0.5bp at 0.1510%

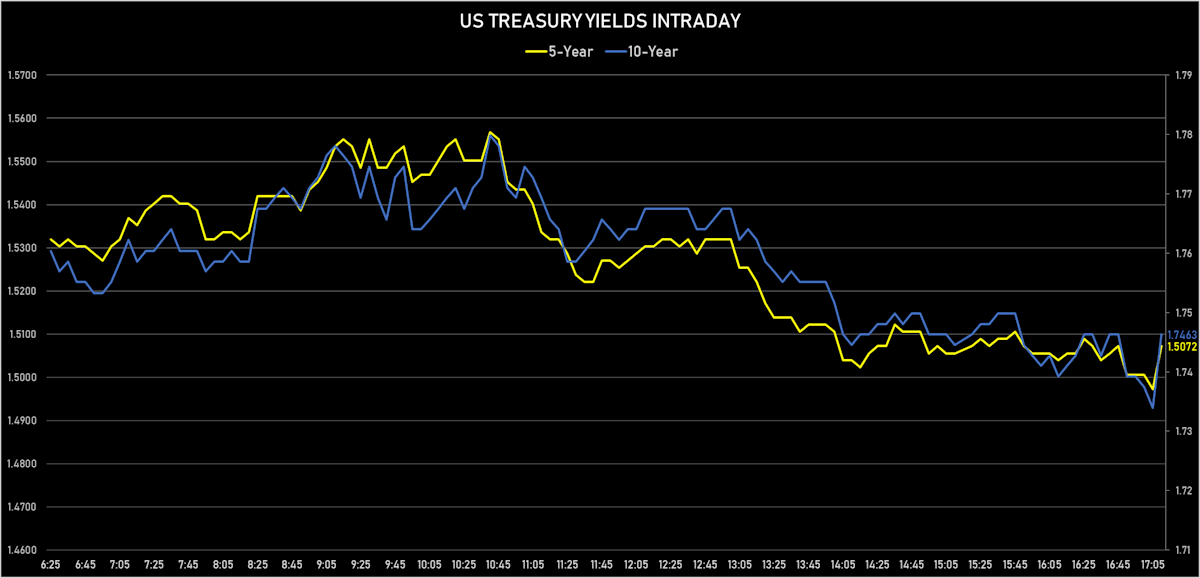

- The treasury yield curve flattened, with the 1s10s spread tightening -1.1 bp, now at 130.4 bp (YTD change: +17.7bp)

- 1Y: 0.4420% (up 0.3 bp)

- 2Y: 0.8885% (down 1.0 bp)

- 5Y: 1.5072% (down 0.8 bp)

- 7Y: 1.6900% (down 0.7 bp)

- 10Y: 1.7463% (down 0.9 bp)

- 30Y: 2.0759% (down 1.2 bp)

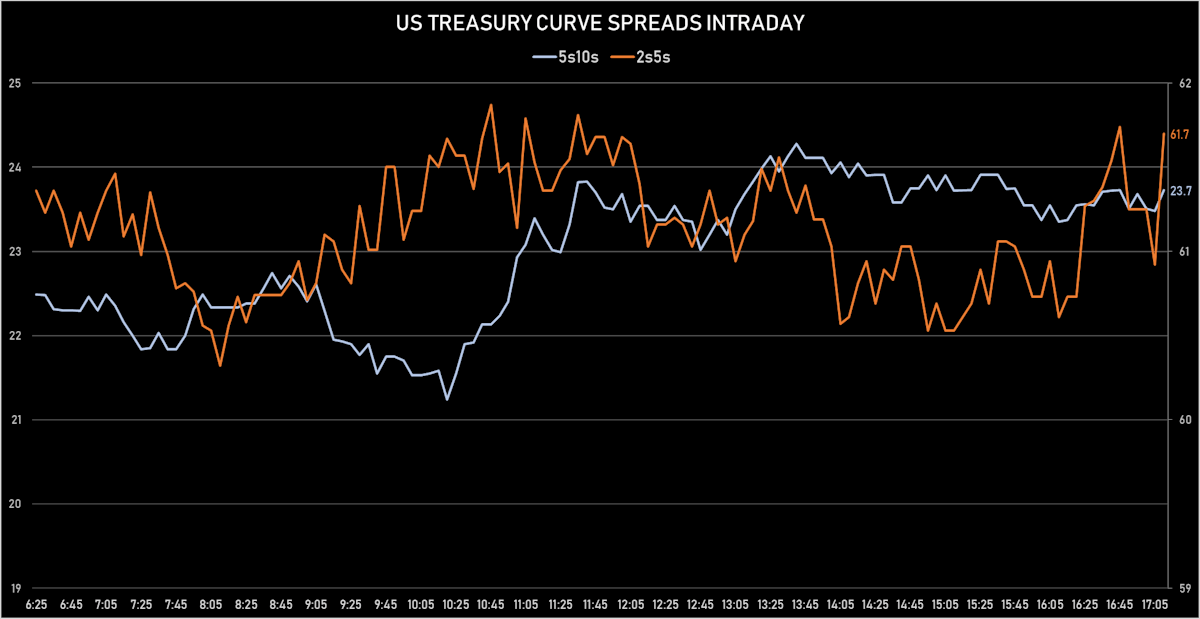

- US treasury curve spreads: 2s5s at 62.0bp (down -0.9bp), 5s10s at 23.9bp (down -0.5bp), 10s30s at 33.0bp (down -0.3bp)

- Treasuries butterfly spreads: 1s5s10s at -83.5bp (up 1.3bp today), 5s10s30s at 8.7bp (up 0.2bp)

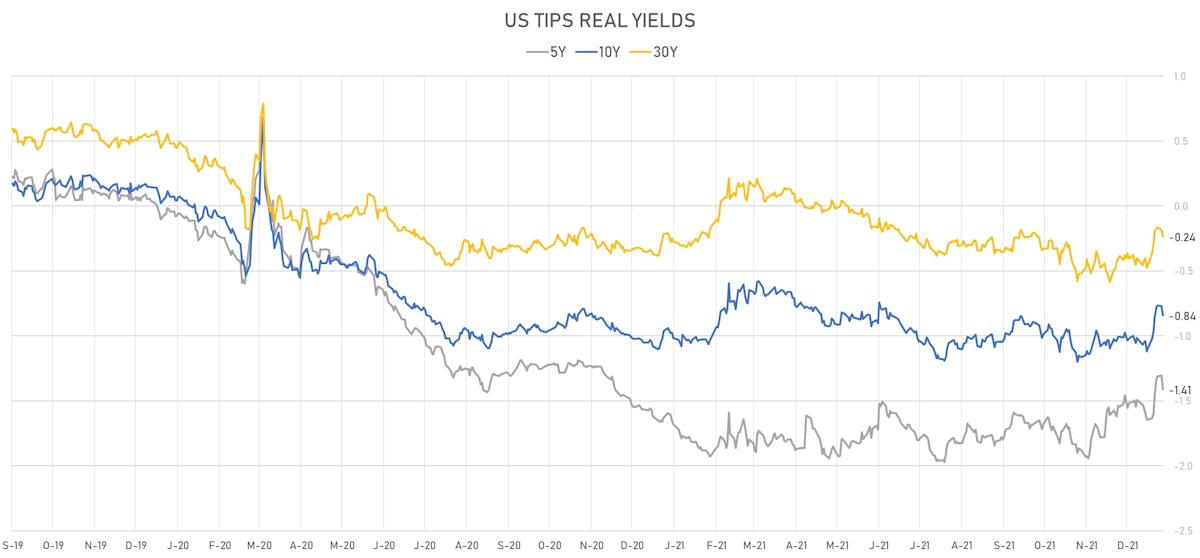

- US 5-Year TIPS Real Yield: -10.9 bp at -1.4130%; 10-Year TIPS Real Yield: -7.0 bp at -0.8420%; 30-Year TIPS Real Yield: -5.2 bp at -0.2360%

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 08 Jan (Redbook Research) at 14.40 % (vs 18.80 % prior)

- NFIB, Index of Small Business Optimism for Dec 2021 (NFIB, United States) at 98.90 (vs 98.40 prior)

$51.9BN 3-YEAR 1.125% COUPON TREASURY NOTE AUCTION (91282CDS7)

- Excellent results with good pricing and record-high end-user demand at 77.16% (vs. six-auction average of 71.6%)

- High yield at 1.237%, a 0.4 bp stop-through vs. the when-issued at the bid deadline

- Direct bids: 15.5% (vs 18.0% prior and 17.6% average)

- Indirect bids: 61.6% (vs 52.2% prior and 52.2% average)

- Bid-to-cover: 2.47 (vs 2.43 prior and 2.44 average)

- Dealers at a record low 22.84% (vs. average of 28.4%)

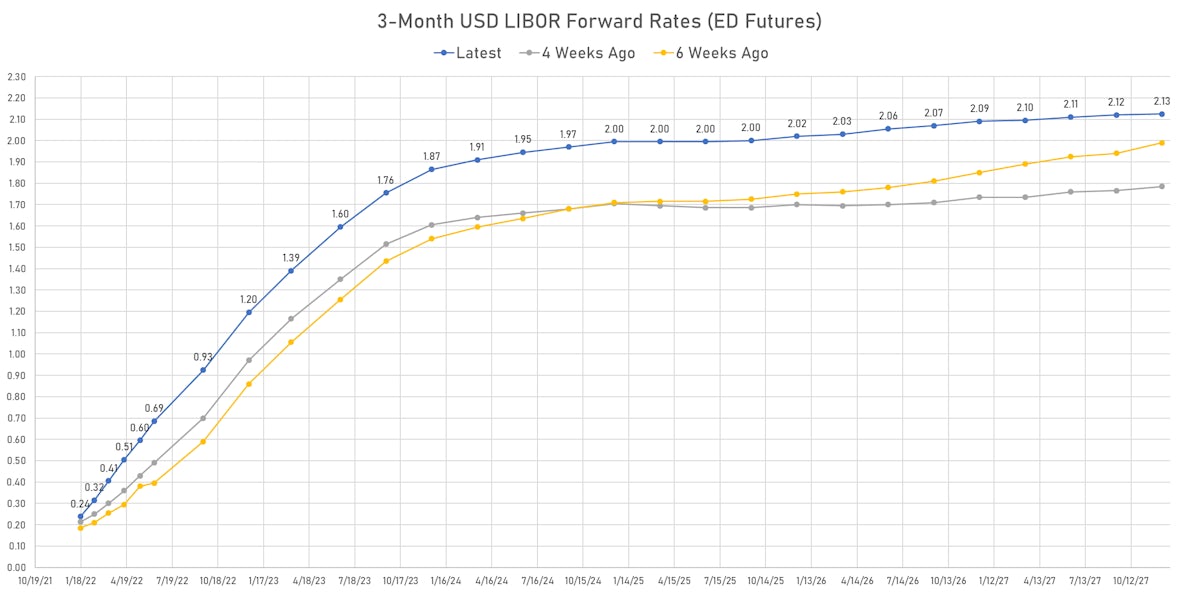

US FORWARD RATES

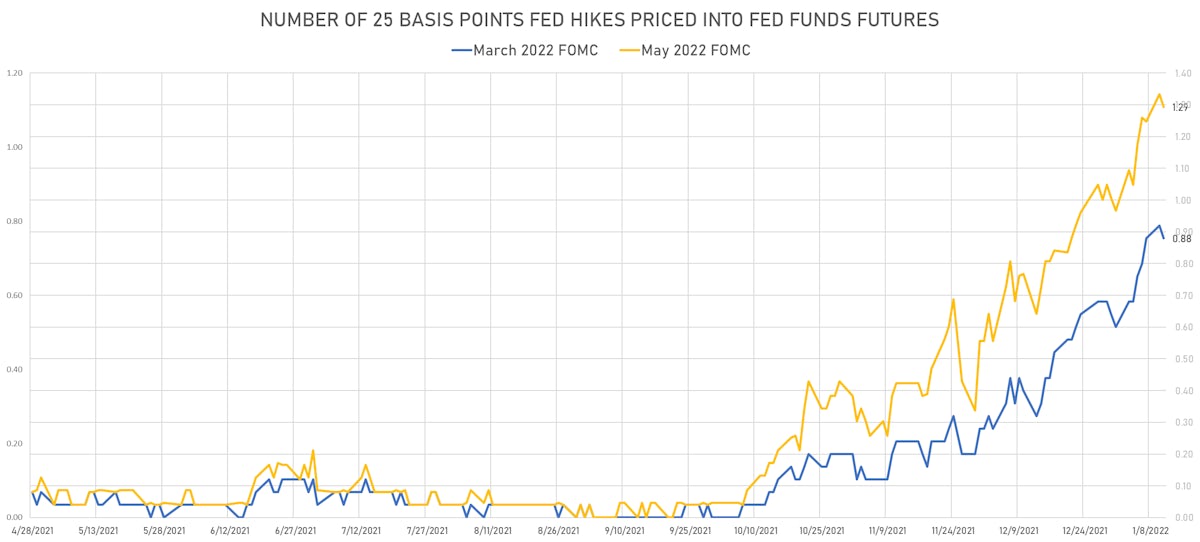

- Fed Funds futures now imply changes of 22.0bp (88.0% probability of a 25bp hike) by the end of March 2022 and price in 3.5 hikes by the end of December 2022

- The 3-month USD OIS forward curve prices in 89.0 bp of rate hikes over the next 15 months (equivalent to 3.56 rate hikes) and 152.0 bp over the next 3 years (equivalent to 6.08 rate hikes)

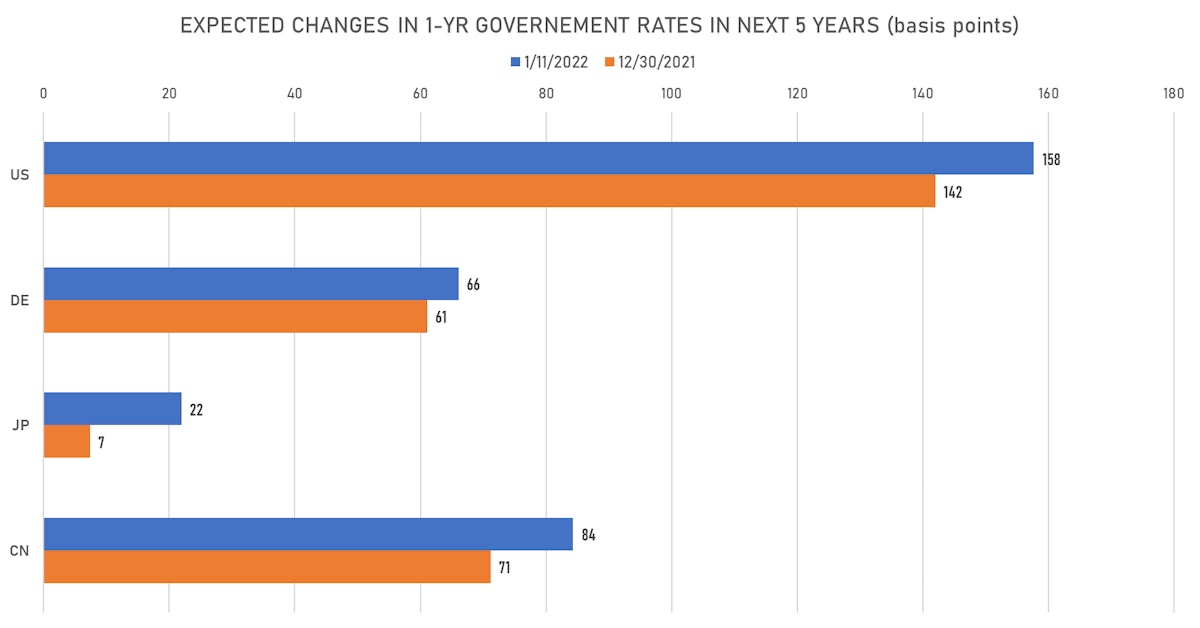

- 1-year US Treasury rate 5 years forward down 0.7 bp, now at 2.0792%, meaning that the 1-year Treasury rate is now expected to increase by 157.6 bp over the next 5 years (equivalent to 6.3 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.18% (up 18.7bp); 2Y at 3.77% (up 13.6bp); 5Y at 2.92% (up 10.0bp); 10Y at 2.56% (up 6.3bp); 30Y at 2.33% (up 4.0bp)

- 6-month spot US CPI swap up 14.4 bp to 4.650%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.4130%, -10.9 bp today; 10Y at -0.8420%, -7.0 bp today; 30Y at -0.2360%, -5.2 bp today

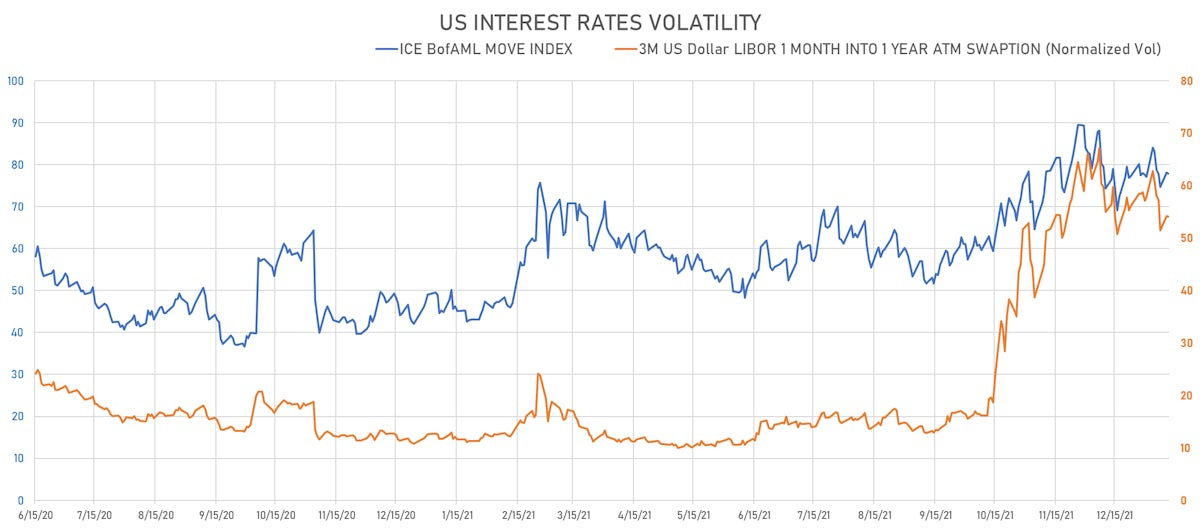

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.1% at 54.1%

- 3-Month LIBOR-OIS spread up 0.5 bp at 8.7 bp (12-months range: 2.6-16.2 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.363% (up 1.5 bp); the German 1Y-10Y curve is 0.5 bp steeper at 58.0bp (YTD change: +13.3 bp)

- Japan 5Y: -0.026% (up 1.7 bp); the Japanese 1Y-10Y curve is 2.0 bp steeper at 23.5bp (YTD change: +6.3 bp)

- China 5Y: 2.575% (down -1.6 bp); the Chinese 1Y-10Y curve is 1.6 bp flatter at 64.0bp (YTD change: +13.0 bp)

- Switzerland 5Y: -0.259% (up 2.1 bp); the Swiss 1Y-10Y curve is 1.3 bp flatter at 72.1bp (YTD change: +14.4 bp)