Rates

US Yield Curve Bull Flattens On Weaker Than Expected Jobless Claims, With Lower Inflation Breakevens, Lower Real Yields

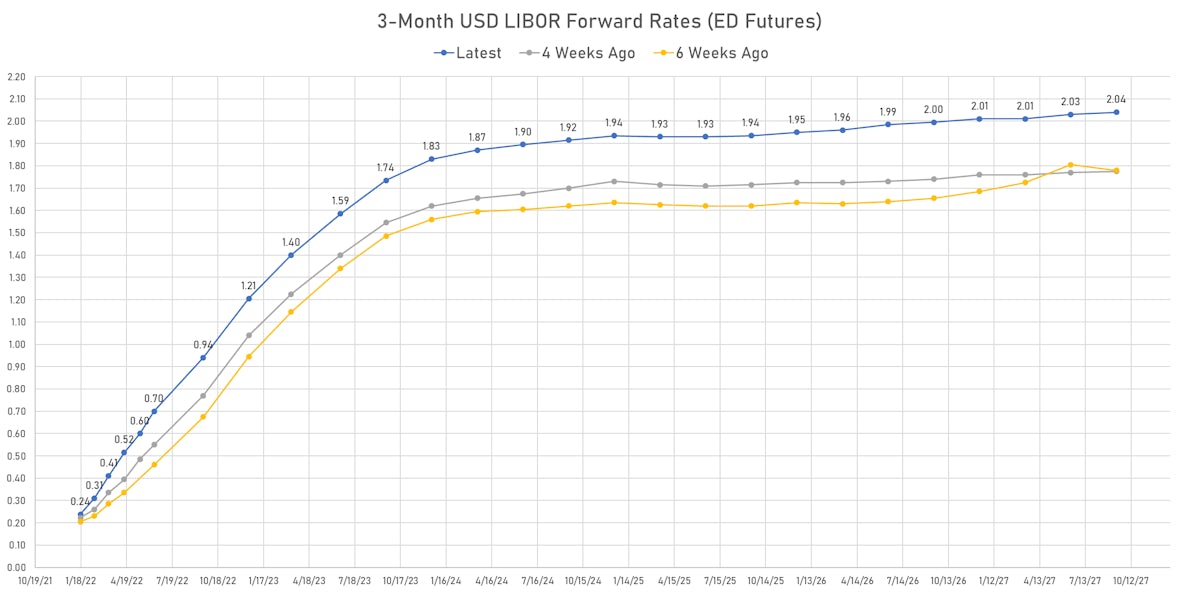

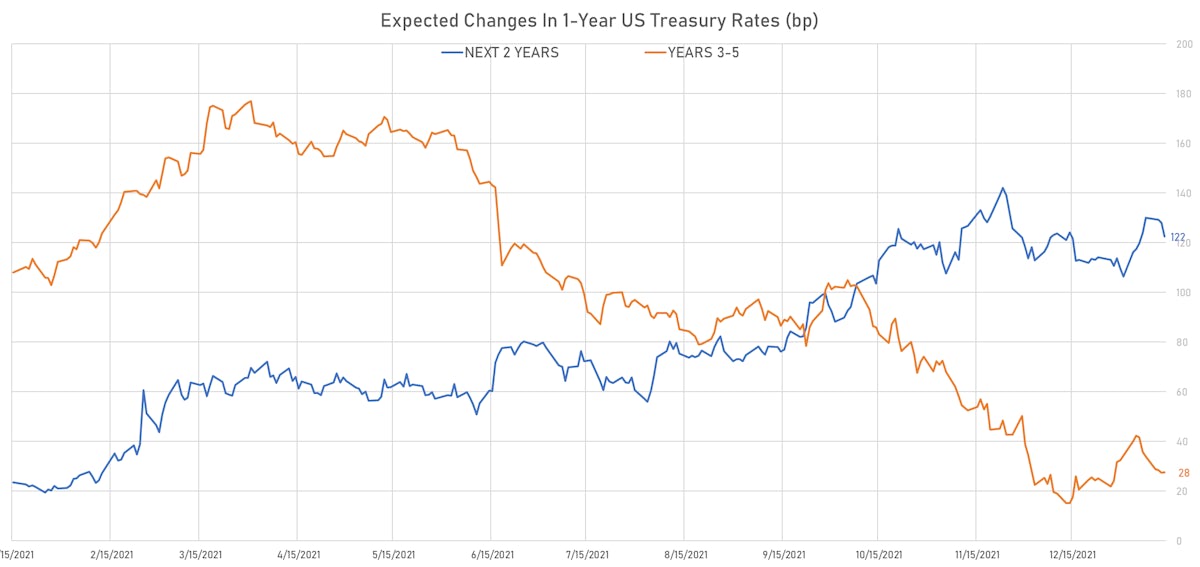

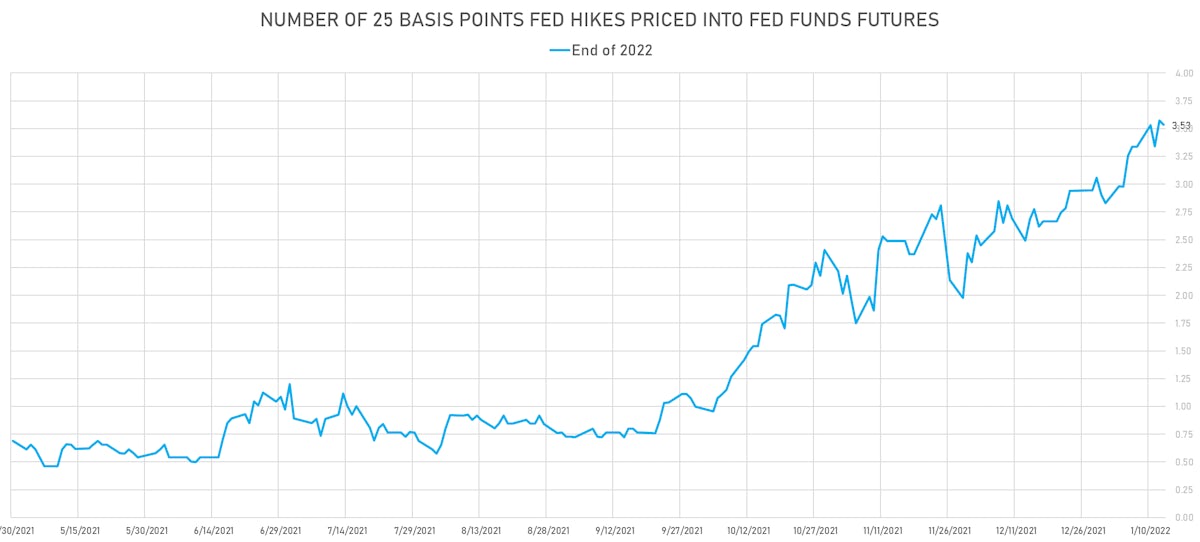

The front end could rise further still (towards 5 hikes if inflation doesn't peak soon) but with nearly 4 hikes priced in for 2022 it's not a great quality trade; slightly further down the curve, only 2.5 hikes are priced in for 2023 and just 0.4 hike for 2024 (fewer than 3 over 2 years), selling EDZ23 or EDZ24 looks like a more asymmetric / attractive opportunity

Published ET

Hikes Priced Into Fed Funds Futures For 2022 | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

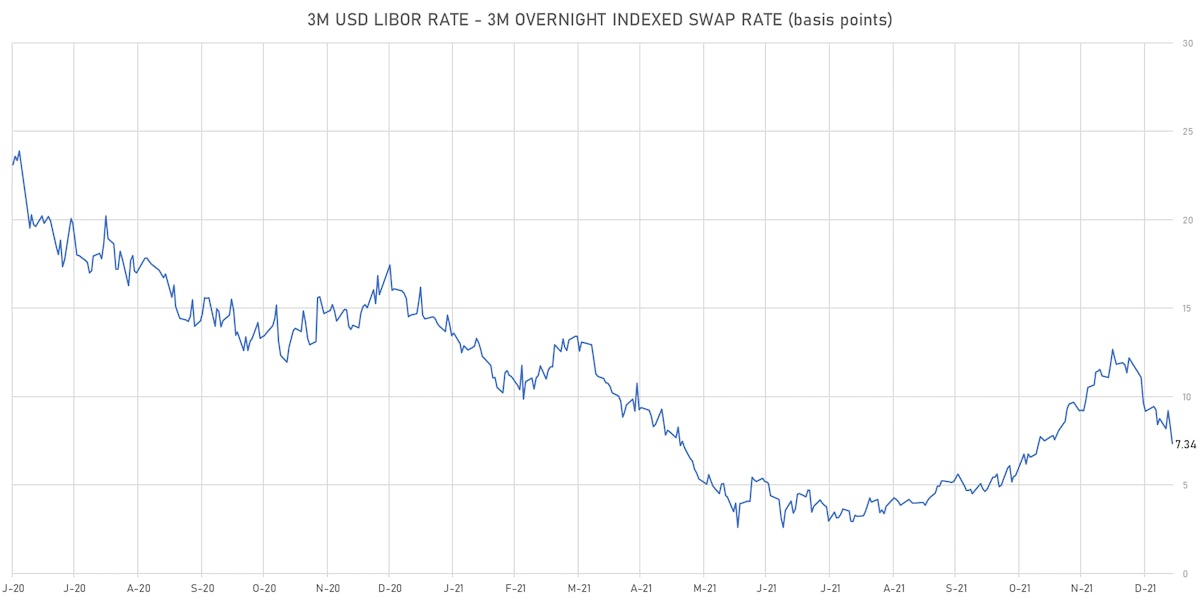

- 3-Month USD LIBOR -1.0bp today, now at 0.2404%; 3-Month OIS +1.2bp at 0.1670%

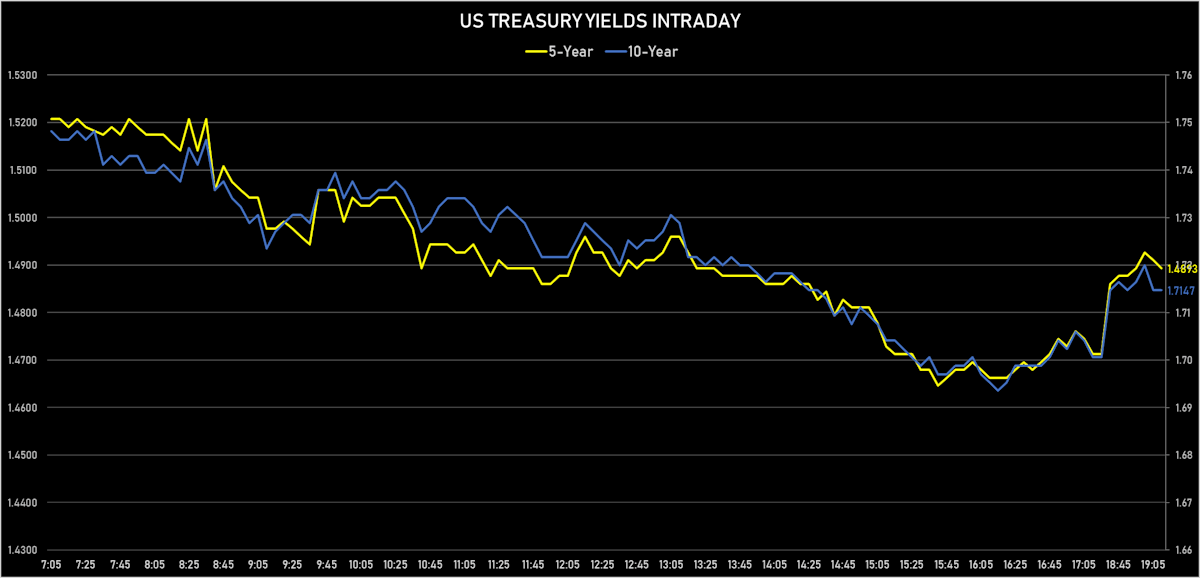

- The treasury yield curve flattened, with the 1s10s spread tightening -4.9 bp, now at 124.8 bp (YTD change: +12.0bp)

- 1Y: 0.4530% (down 0.3 bp)

- 2Y: 0.8949% (down 2.8 bp)

- 5Y: 1.4712% (down 4.9 bp)

- 7Y: 1.6396% (down 5.4 bp)

- 10Y: 1.7006% (down 5.1 bp)

- 30Y: 2.0406% (down 5.4 bp)

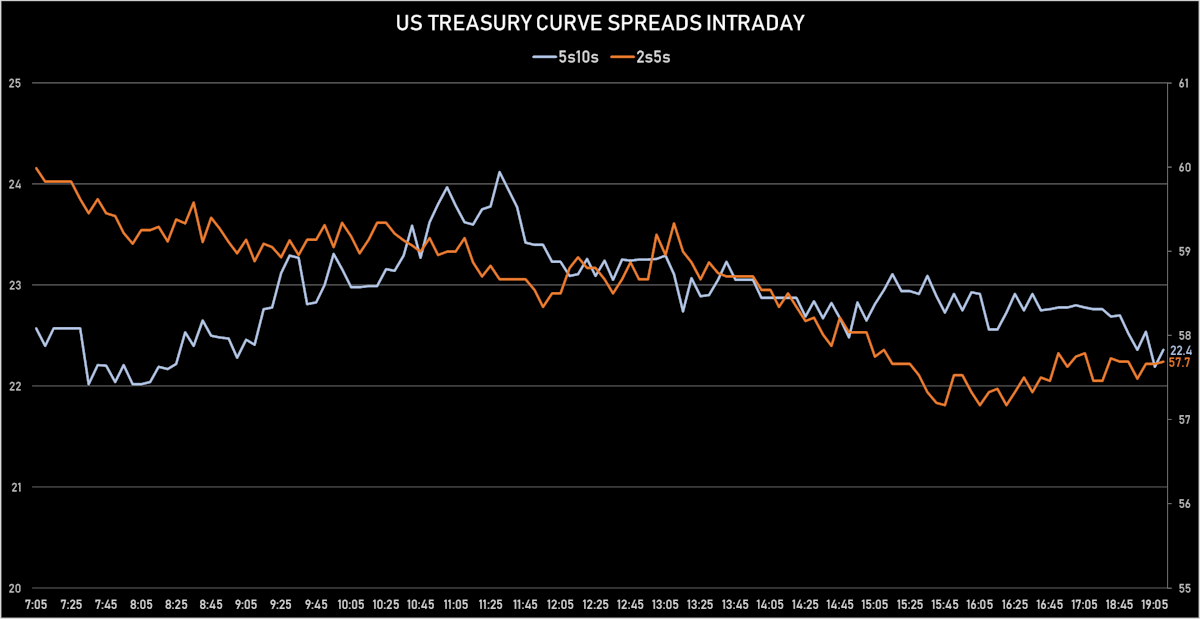

- US treasury curve spreads: 2s5s at 57.7bp (down -1.6bp), 5s10s at 22.9bp (down -1.3bp), 10s30s at 34.0bp (up 1.6bp)

- Treasuries butterfly spreads: 1s5s10s at -80.1bp (up 4.8bp today), 5s10s30s at 10.5bp (down -1.0bp)

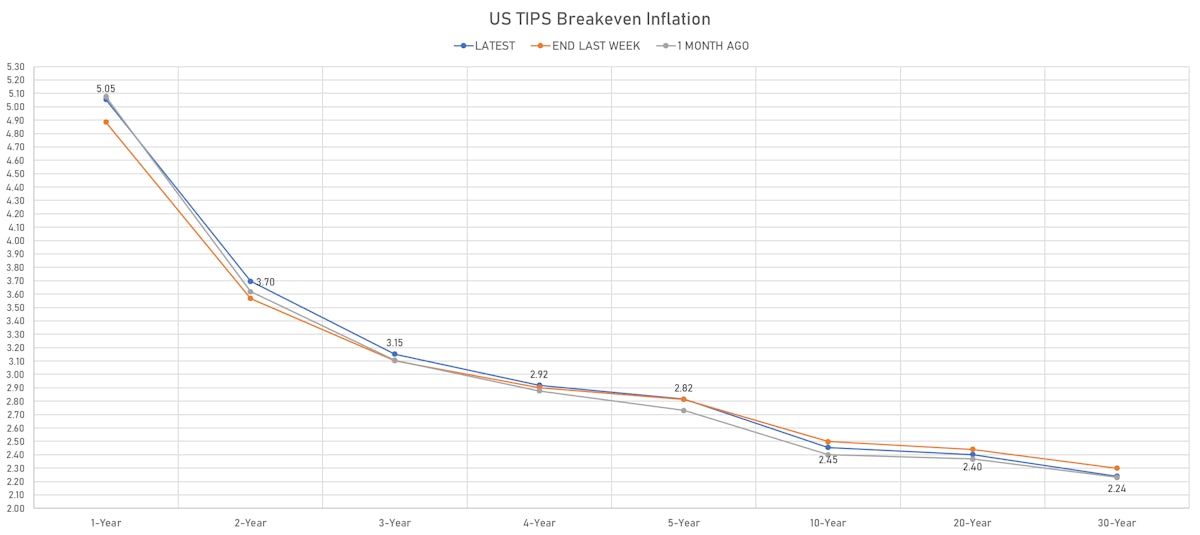

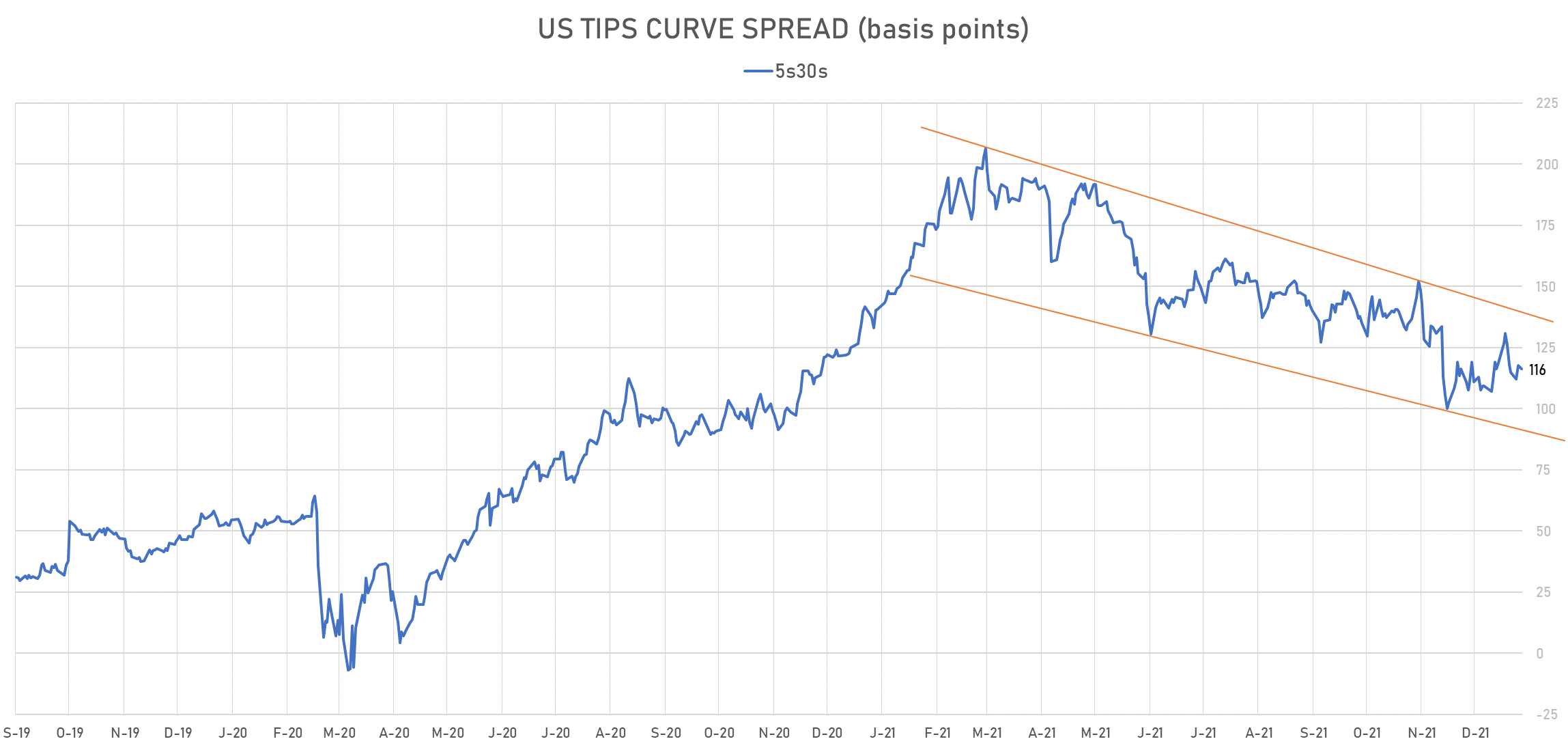

- TIPS 1Y breakeven inflation at 5.05% (up -1.8bp); 2Y at 3.70% (down -3.2bp); 5Y at 2.82% (down -3.3bp); 10Y at 2.45% (down -3.3bp); 30Y at 2.24% (down -2.7bp)

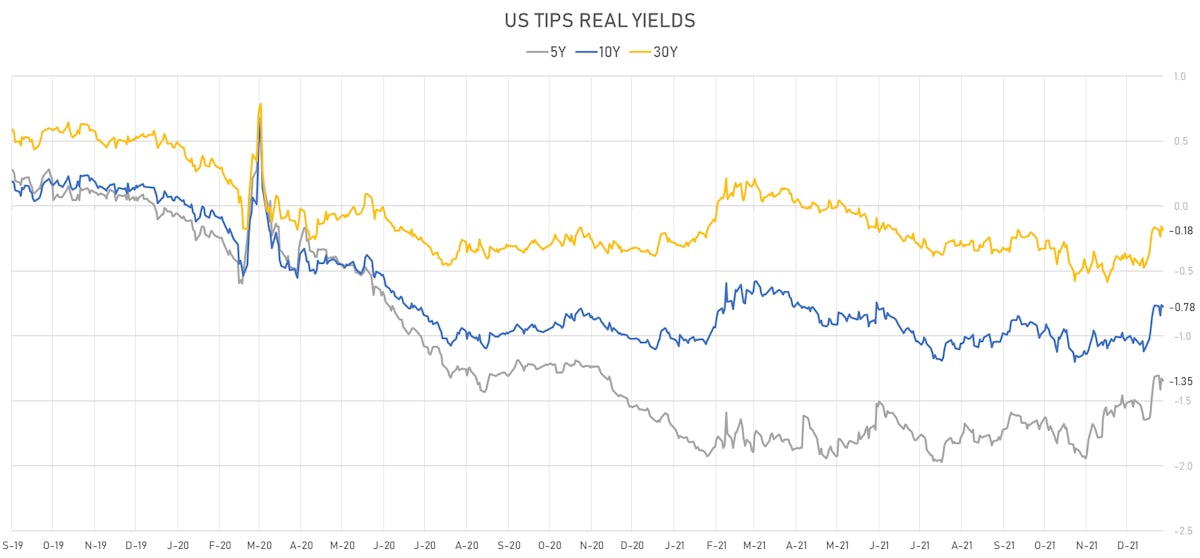

- US 5-Year TIPS Real Yield: -1.7 bp at -1.3460%; 10-Year TIPS Real Yield: -1.5 bp at -0.7760%; 30-Year TIPS Real Yield: -2.7 bp at -0.1840%

US MACRO RELEASES

- Jobless Claims, National, Continued for W 01 Jan (U.S. Dept. of Labor) at 1.56 Mln (vs 1.75 Mln prior), below consensus estimate of 1.73 Mln

- Jobless Claims, National, Initial for W 08 Jan (U.S. Dept. of Labor) at 230.00 k (vs 207.00 k prior), above consensus estimate of 200.00 k

- Jobless Claims, National, Initial, four week moving average for W 08 Jan (U.S. Dept. of Labor) at 210.75 k (vs 204.50 k prior)

- PPI ex Food/Energy/Trade MM, Change P/P for Dec 2021 (BLS, U.S Dep. Of Lab) at 0.40 % (vs 0.70 % prior)

- PPI ex Food/Energy/Trade YY, Change Y/Y, Price Index for Dec 2021 (BLS, U.S Dep. Of Lab) at 6.90 % (vs 6.90 % prior)

- Producer Prices, Final demand less foods and energy, Change P/P for Dec 2021 (BLS, U.S Dep. Of Lab) at 0.50 % (vs 0.70 % prior), in line with consensus estimate

- Producer Prices, Final demand less foods and energy, Change Y/Y for Dec 2021 (BLS, U.S Dep. Of Lab) at 8.30 % (vs 7.70 % prior), above consensus estimate of 8.00 %

- Producer Prices, Final demand, Change P/P for Dec 2021 (BLS, U.S Dep. Of Lab) at 0.20 % (vs 0.80 % prior), below consensus estimate of 0.40 %

- Producer Prices, Final demand, Change Y/Y for Dec 2021 (BLS, U.S Dep. Of Lab) at 9.70 % (vs 9.60 % prior), below consensus estimate of 9.80 %

$22BN 30-YEAR 1.875% COUPON TREASURY BOND AUCTION (912810TB4)

- Pretty good pricing and solid end-user demand at 82.1% of the offering (vs 79.3% prior and 81.4% average)

- High yield at 2.075% (vs 1.895% prior), 0.3 bp through the when-issued at the bid deadline

- Direct bids at 17.1% (vs 18.5% prior and 18.4% average)

- Indirect bids at 65.0% (vs 60.8% prior and 63.0% average)

- Bid-to-cover at 2.35 (vs 2.22 prior and 2.30 average)

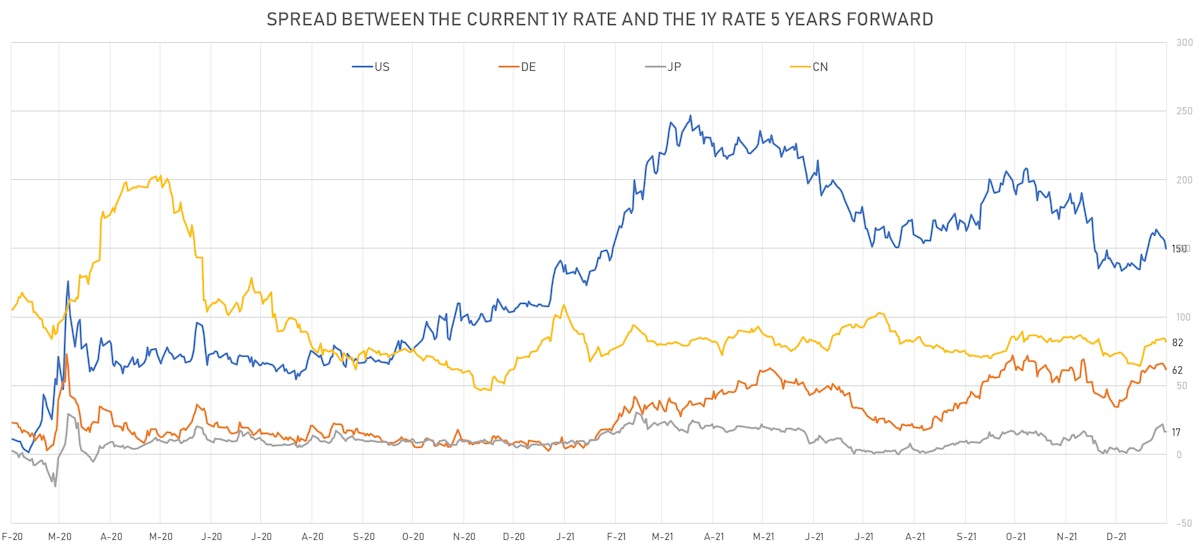

US FORWARD RATES

- Fed Funds futures now imply changes of 23.2bp (93.0% probability of a 25bp hike) by the end of March 2022 and price in 3.6 hikes by the end of December 2022

- Eurodollar futures imply only 3 additional hikes over the 2023-2024 period: 2.5 hikes in 2023 and 0.5 hike in 2024

- 1-year US Treasury rate 5 years forward down 5.8 bp, now at 2.0108%, meaning that the 1-year Treasury rate is now expected to increase by 150.0 bp over the next 5 years (equivalent to 6.0 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.05% (down -1.8bp); 2Y at 3.70% (down -3.2bp); 5Y at 2.82% (down -3.3bp); 10Y at 2.45% (down -3.3bp); 30Y at 2.24% (down -2.7bp)

- 6-month spot US CPI swap down -75.1 bp to 3.832%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.3460%, -1.7 bp today; 10Y at -0.7760%, -1.5 bp today; 30Y at -0.1840%, -2.7 bp today

RATES VOLATILITY & LIQUIDITY

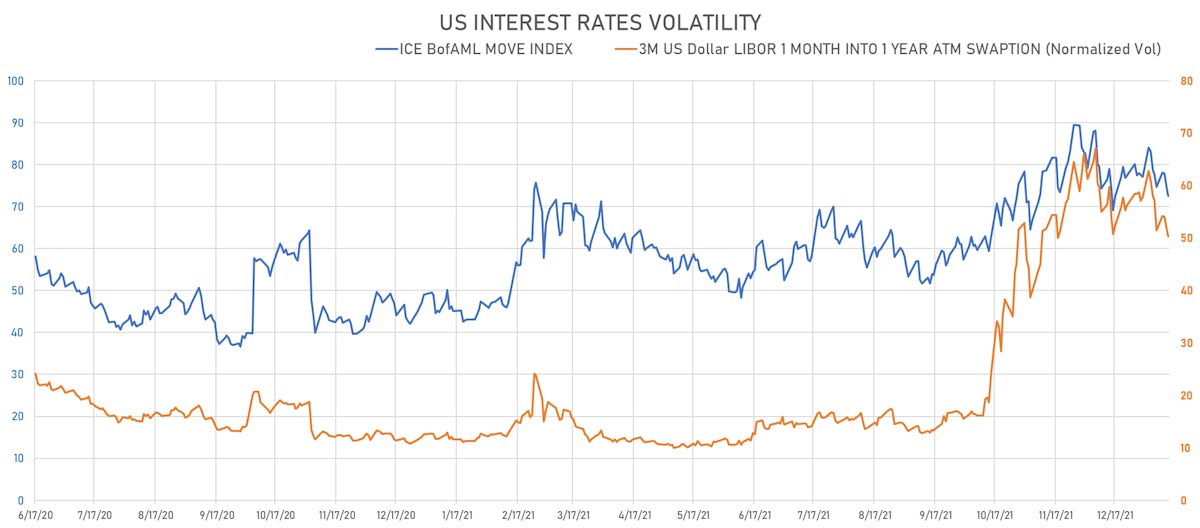

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -1.5% at 50.3%

- 3-Month LIBOR-OIS spread down -1.0 bp at 7.3 bp (12-months range: 2.6-14.6 bp)

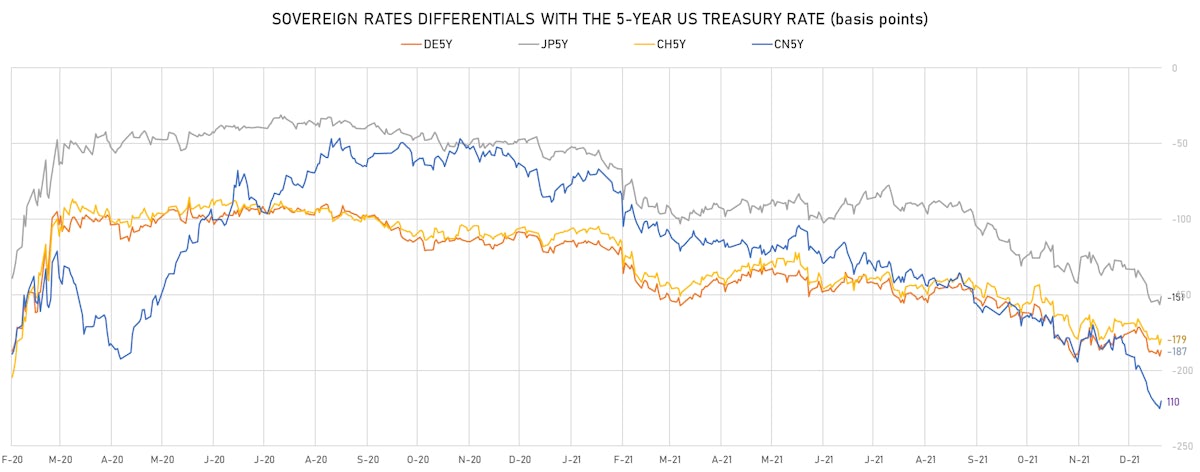

KEY INTERNATIONAL RATES

- Germany 5Y: -0.415% (down -1.5 bp); the German 1Y-10Y curve is 2.9 bp flatter at 52.5bp (YTD change: +9.7 bp)

- Japan 5Y: -0.035% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.6 bp steeper at 21.2bp (YTD change: +4.9 bp)

- China 5Y: 2.568% (unchanged); the Chinese 1Y-10Y curve is 0.4 bp flatter at 62.4bp (YTD change: +11.4 bp)

- Switzerland 5Y: -0.322% (down -1.2 bp); the Swiss 1Y-10Y curve is 4.2 bp flatter at 63.9bp (YTD change: +7.4 bp)