Rates

Yields Rise As US Rates Markets Look Through Big Miss In Retail Sales, Weaker Industrial Production

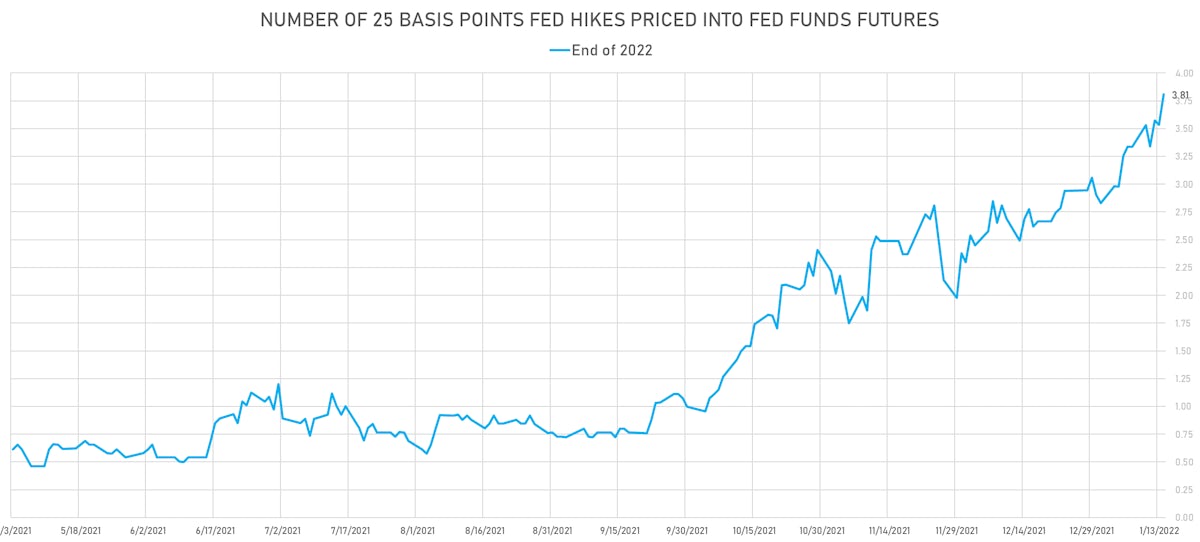

The Fed is in a difficult situation as there is limited scope for more than 5 hikes in 2022 without inverting the spot curve (many forward curves are already inverted); so they will likely choose to use QT as a policy tool to steepen the forward curve, despite the reduced market appetite for duration

Published ET

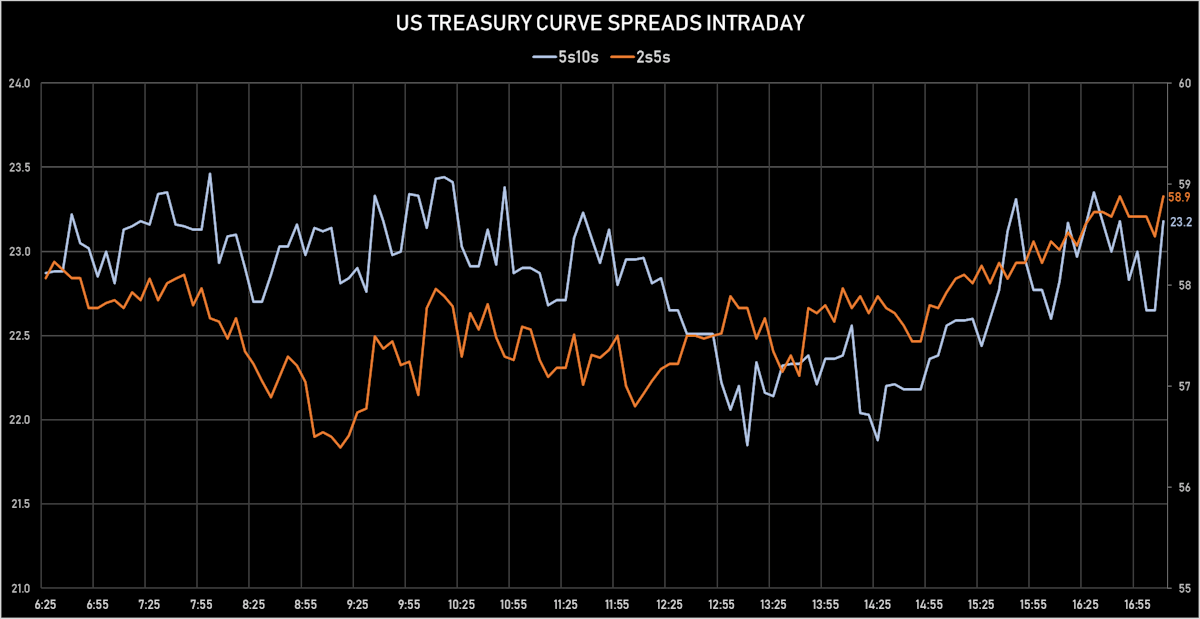

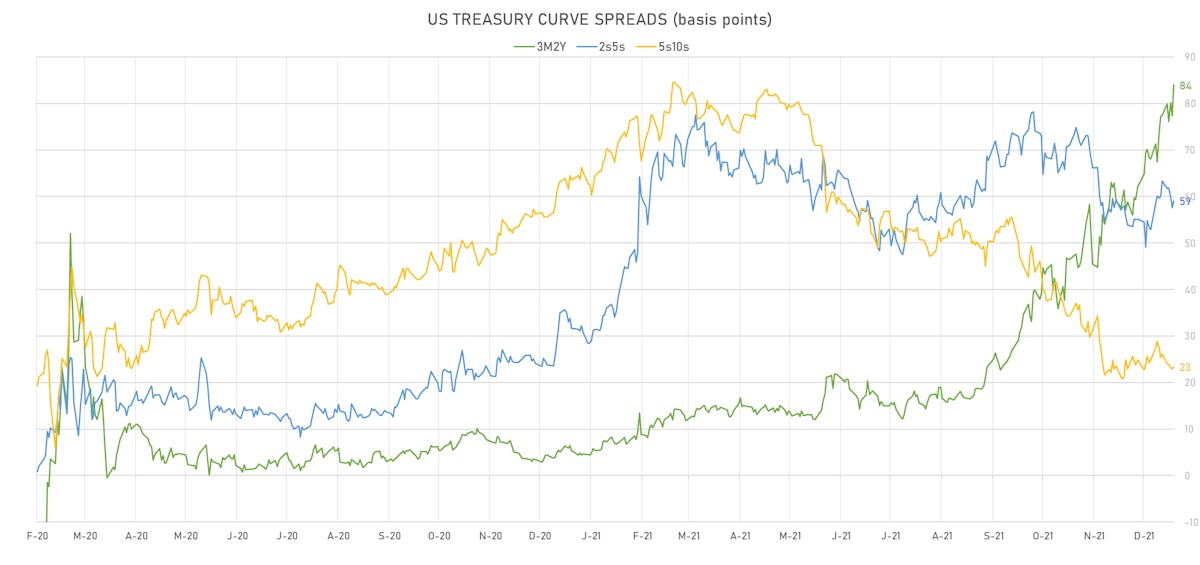

US Treasury Curve Spreads | Sources: ϕpost, Refinitiv data

US RATES TODAY

- 3-Month USD LIBOR -0.93bp today, now at 0.2388%; 3-Month OIS +0.9bp at 0.1760%

- The treasury yield curve steepened, with the 1s10s spread widening 5.2 bp, now at 130.2 bp (YTD change: +17.4bp)

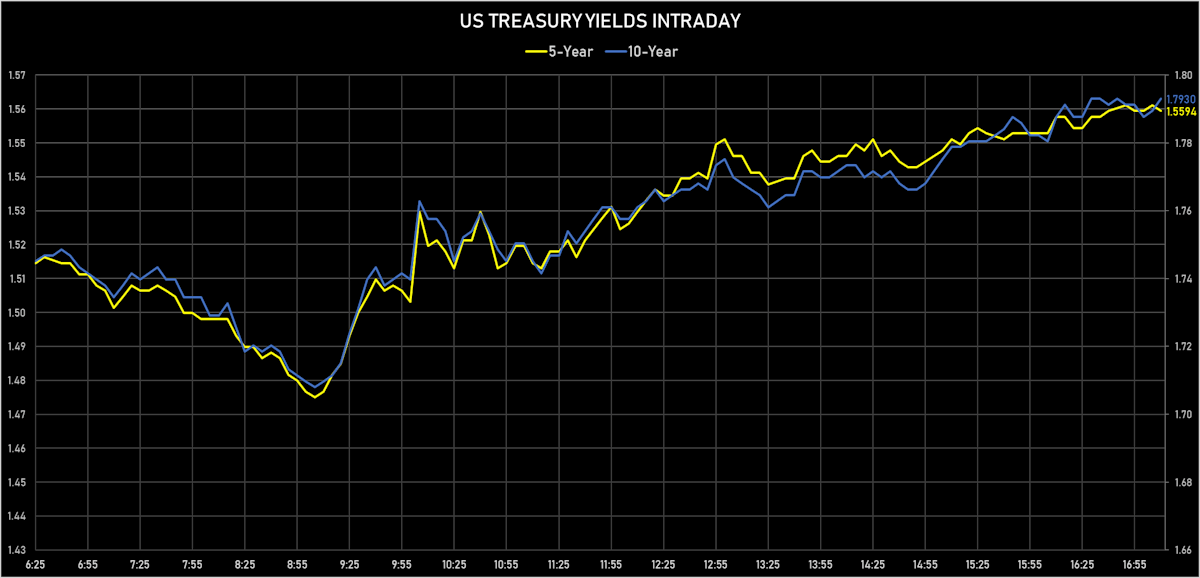

- 1Y: 0.4910% (up 4.1 bp)

- 2Y: 0.9689% (up 7.4 bp)

- 5Y: 1.5594% (up 8.8 bp)

- 7Y: 1.7344% (up 9.5 bp)

- 10Y: 1.7930% (up 9.2 bp)

- 30Y: 2.1271% (up 8.7 bp)

- US treasury curve spreads: 2s5s at 59.1bp (up 1.4bp today), 5s10s at 23.4bp (up 0.4bp), 10s30s at 33.4bp (down -0.6bp)

- Treasuries butterfly spreads: 1s5s10s at -85.0bp (down -4.8bp), 5s10s30s at 10.2bp (down -0.3bp)

- TIPS inflation breakevens: 5Y at 2.83% (up 1.4bp); 10Y at 2.46% (up 0.9bp); 30Y at 2.25% (up 0.8bp)

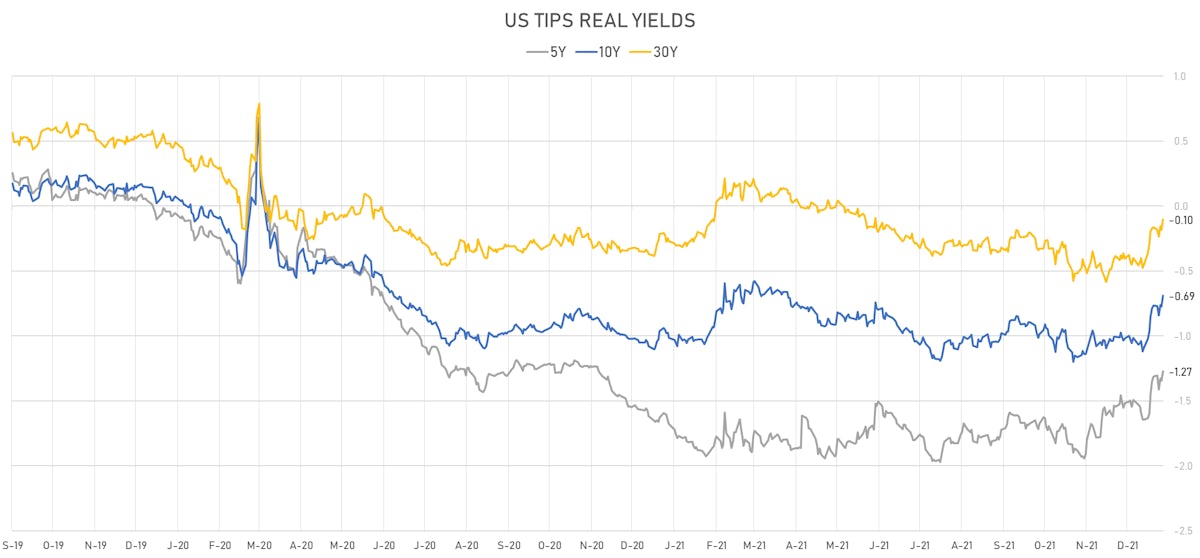

- US 5-Year TIPS Real Yield: +7.3 bp at -1.2730%; 10-Year TIPS Real Yield: +8.5 bp at -0.6910%; 30-Year TIPS Real Yield: +8.0 bp at -0.1040%

US MACRO RELEASES

- Capacity Utilization, Total index, Change M/M for Dec 2021 (FED, U.S.) at 76.50 % (vs 76.80 % prior), below consensus estimate of 77.00 %

- Export Prices, All commodities, Change P/P, Price Index for Dec 2021 (BLS, U.S Dep. Of Lab) at -1.80 % (vs 1.00 % prior), below consensus estimate of 0.30 %

- Import Prices, All commodities, Change P/P, Price Index for Dec 2021 (BLS, U.S Dep. Of Lab) at -0.20 % (vs 0.70 % prior), below consensus estimate of 0.30 %

- Overall, Total business inventories, Change P/P for Nov 2021 (U.S. Census Bureau) at 1.30 % (vs 1.20 % prior), in line with consensus

- Production, Change P/P for Dec 2021 (FED, U.S.) at -0.10 % (vs 0.50 % prior), below consensus estimate of 0.30 %

- Production, Manufacturing, Total (SIC), Change P/P for Dec 2021 (FED, U.S.) at -0.30 % (vs 0.70 % prior), below consensus estimate of 0.50 %

- Retail Sales, Total excluding bldg material & motor vehicle & parts & gasoline station & food svc, Change P/P for Dec 2021 (U.S. Census Bureau) at -3.10 % (vs -0.10 % prior), below consensus estimate of 0.10 %

- Retail Sales, Total excluding motor vehicle dealers and gasoline station, Change P/P for Dec 2021 (U.S. Census Bureau) at -2.50 % (vs 0.20 % prior)

- Retail Sales, Total including food services, Change P/P for Dec 2021 (U.S. Census Bureau) at -1.90 % (vs 0.30 % prior), below consensus estimate of 0.00 %

- Retail Sales, Total including food services, excluding motor vehicle and parts, Change P/P for Dec 2021 (U.S. Census Bureau) at -2.30 % (vs 0.30 % prior), below consensus estimate of 0.20 %

- University of Michigan, Current Conditions Index-prelim, Volume Index for Jan 2022 (UMICH, Survey) at 73.20 (vs 74.20 prior), below consensus estimate of 73.30

- University of Michigan, Total-prelim, Change Y/Y for Jan 2022 (UMICH, Survey) at 3.10 % (vs 2.90 % prior)

- University of Michigan, Total-prelim, Volume Index for Jan 2022 (UMICH, Survey) at 65.90 (vs 68.30 prior), below consensus estimate of 66.50

- University of Michigan, Total-prelim, Volume Index for Jan 2022 (UMICH, Survey) at 68.80 (vs 70.60 prior), below consensus estimate of 70.00

- University of Michigan, 1 Year Inflation Expectations (median), preliminary for Jan 2022 (UMICH, Survey) at 4.90 % (vs 4.80 % prior)

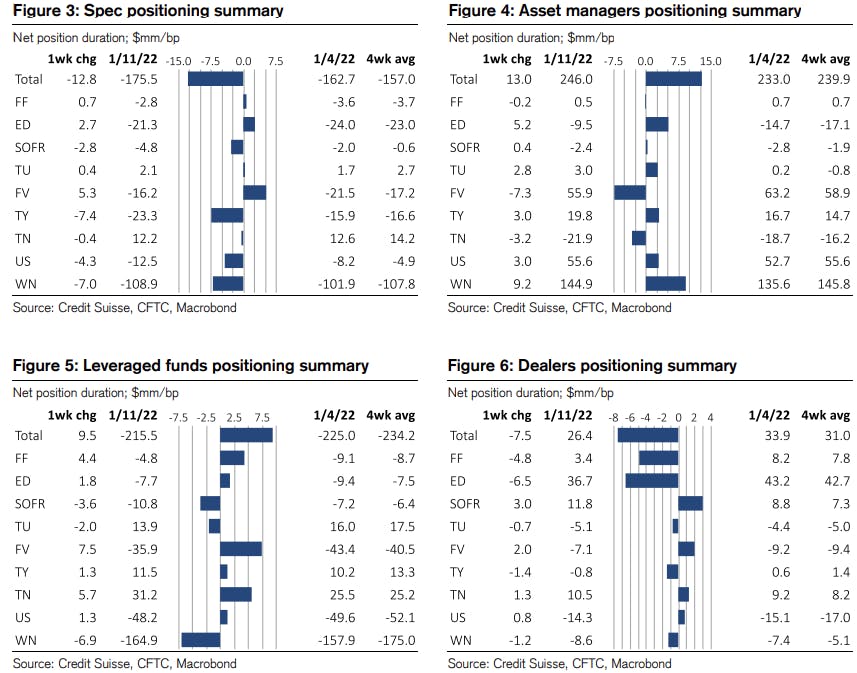

WEEKLY CFTC NET DURATION POSITIONING

- Specs added to net short duration at the long end

- Leveraged funds covered some of their net short exposures in fives and adding to longs in tens

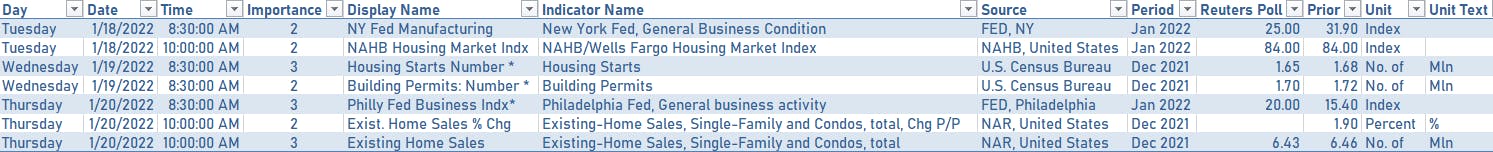

US MACRO WEEK AHEAD

- Pretty light macro schedule next week in the US

- Fed speakers will also stay quiet during the blackout period ahead of the January FOMC (on 25-26 January)

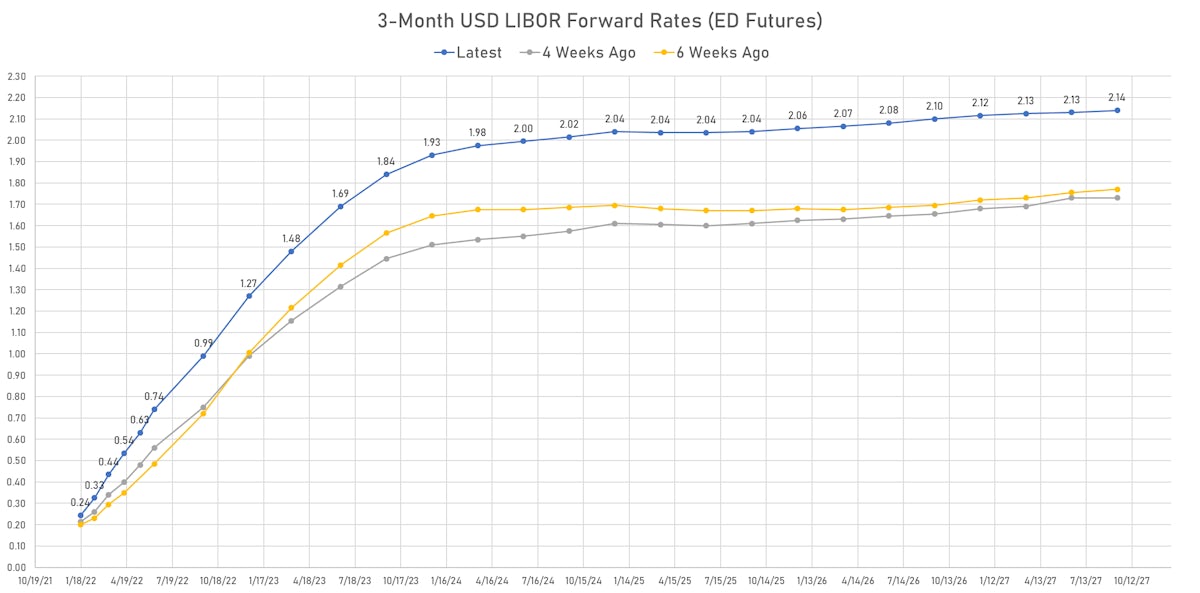

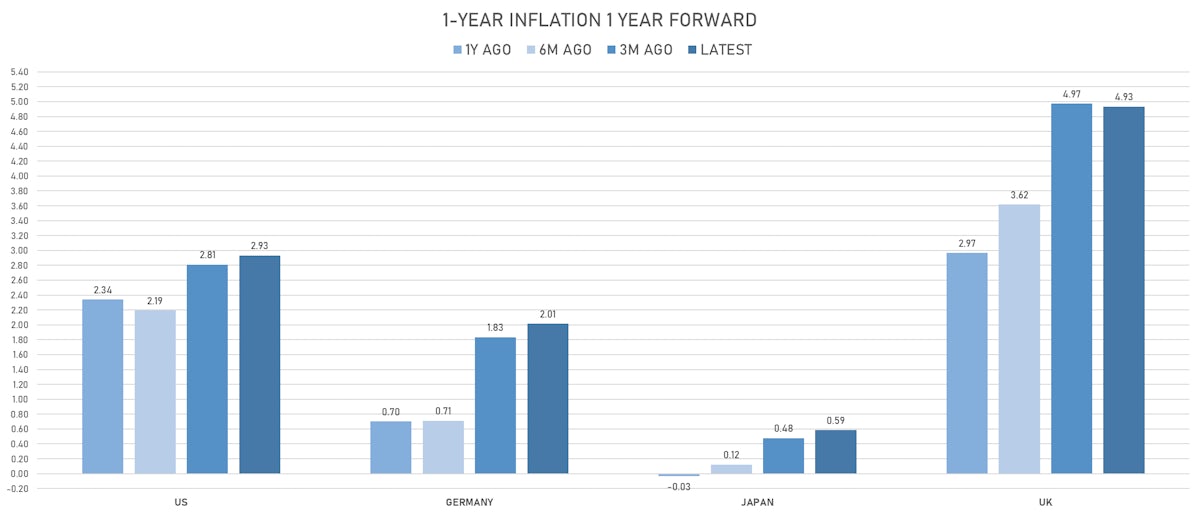

US FORWARD RATES

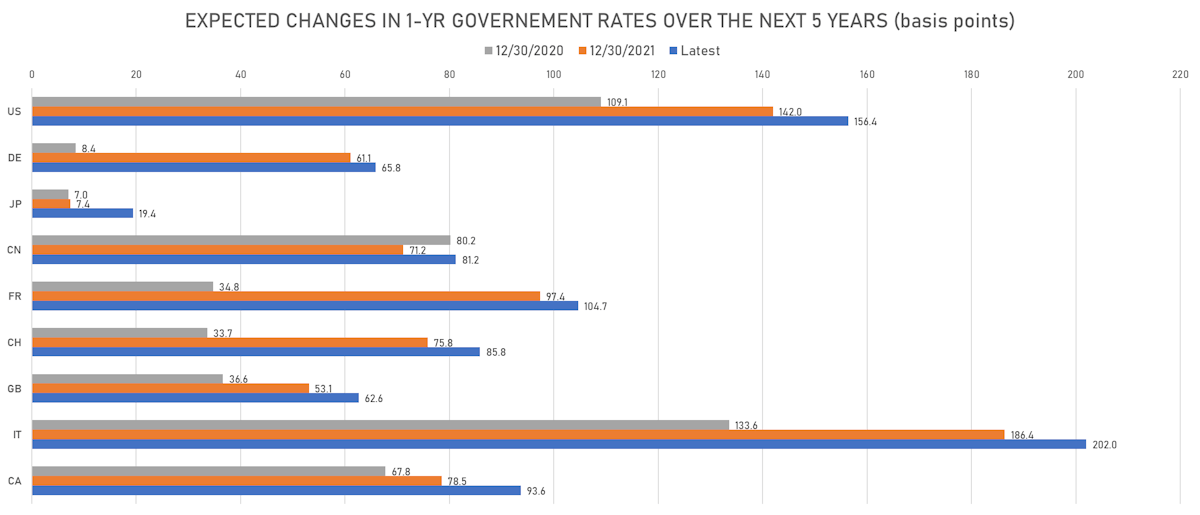

- Fed Funds futures now imply changes of 25bp (100% probability of a hike) by the end of March 2022 and price in 3.8 hikes by the end of December 2022

- The Eurodollar spread EDZ2-Z26 is now at 81bp, indicating the market expects just over 3 hikes in the 4 years following 2022 (from the end of 2022 to the end of 2026). If realized (unlikely), it would be an incredibly shallow hiking cycle for a period of elevated inflationary pressures

- 1-year US Treasury rate 5 years forward up 11.0 bp, now at 2.1212%, meaning that the 1-year Treasury rate is now expected to increase by 156.4 bp over the next 5 years (equivalent to 6.3 rate hikes)

US INFLATION & REAL RATES

- TIPS breakeven inflation: 5Y at 2.83% (up 1.4bp); 10Y at 2.46% (up 0.9bp); 30Y at 2.25% (up 0.8bp)

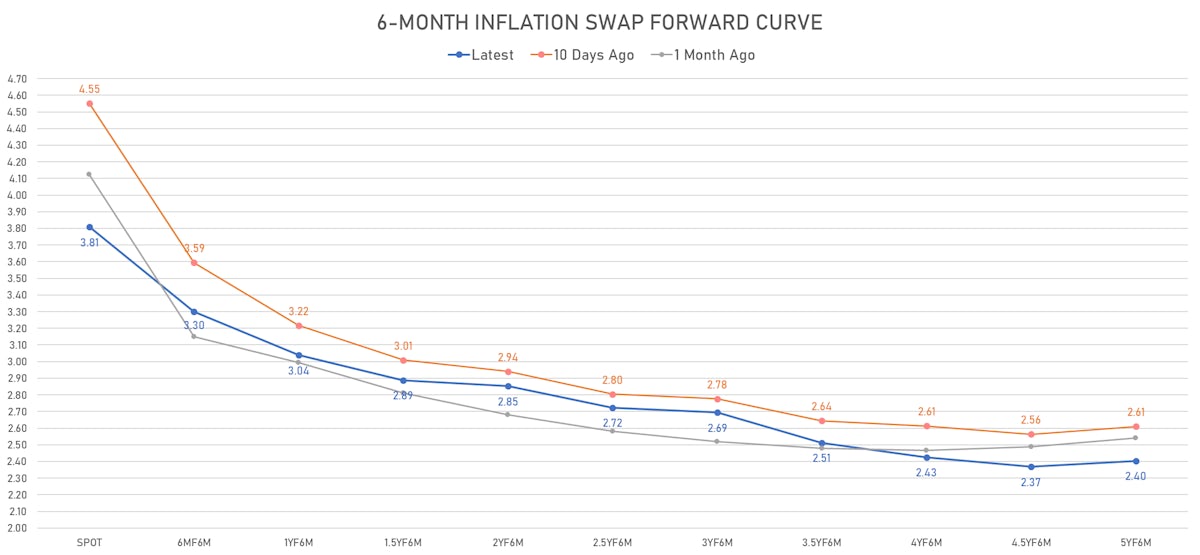

- 6-month spot US CPI swap down -2.3 bp to 3.809%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.2730%, +7.3 bp today; 10Y at -0.6910%, +8.5 bp today; 30Y at -0.1040%, +8.0 bp today

RATES VOLATILITY & LIQUIDITY

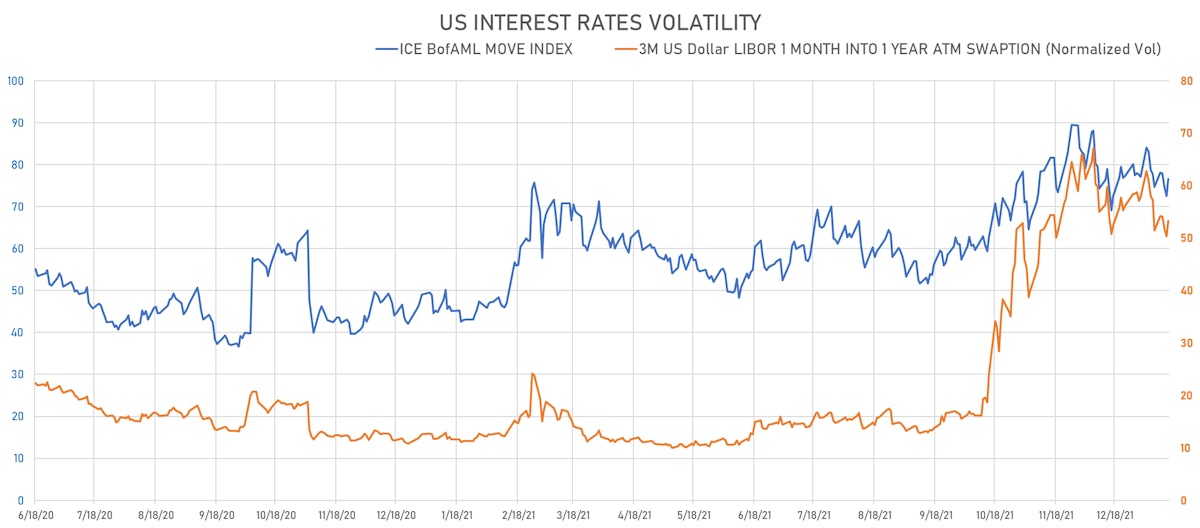

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 3.0% at 53.3%

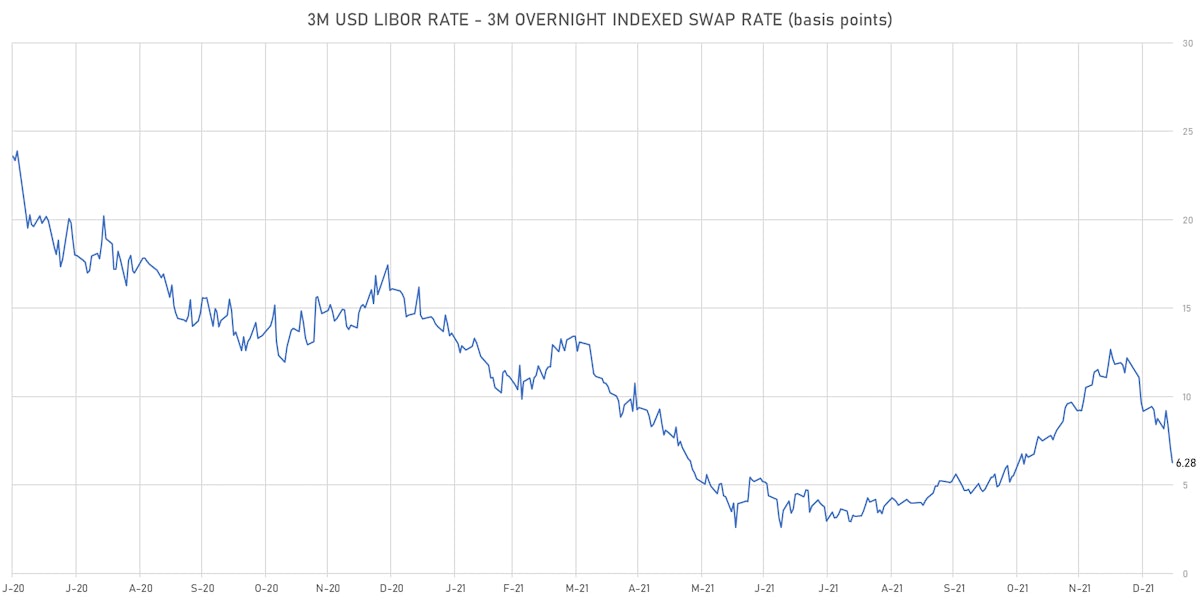

- 3-Month LIBOR-OIS spread down -0.9 bp at 6.3 bp (12-months range: 2.6-14.6 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.355% (up 3.1 bp); the German 1Y-10Y curve is 3.4 bp steeper at 57.4bp (YTD change: +13.1 bp)

- Japan 5Y: -0.012% (up 2.4 bp); the Japanese 1Y-10Y curve is 1.9 bp steeper at 24.3bp (YTD change: +6.8 bp)

- China 5Y: 2.575% (up 0.7 bp); the Chinese 1Y-10Y curve is 1.0 bp steeper at 63.4bp (YTD change: +12.4 bp)

- Switzerland 5Y: -0.297% (up 2.5 bp); the Swiss 1Y-10Y curve is 4.7 bp steeper at 69.6bp (YTD change: +12.1 bp)