Rates

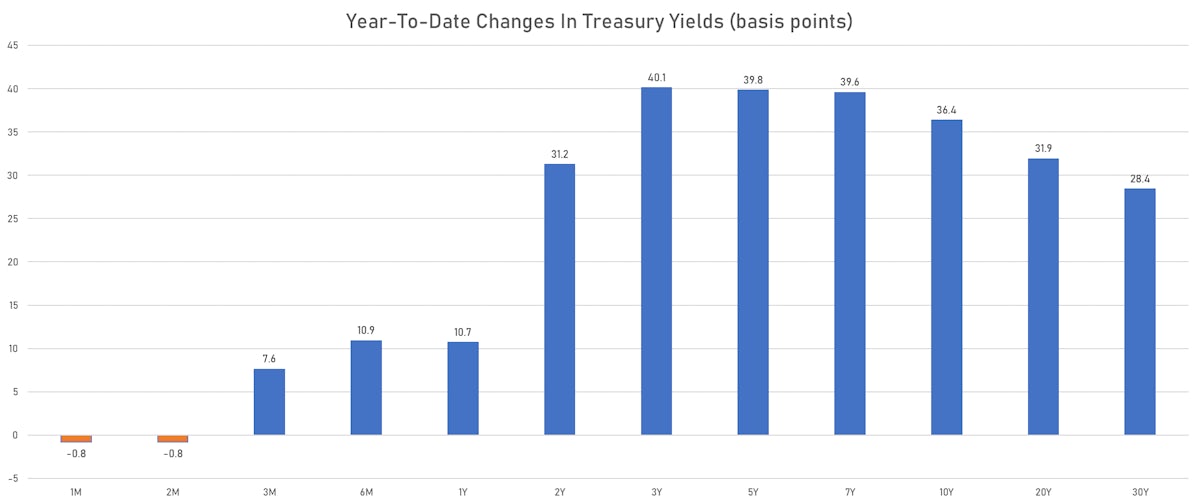

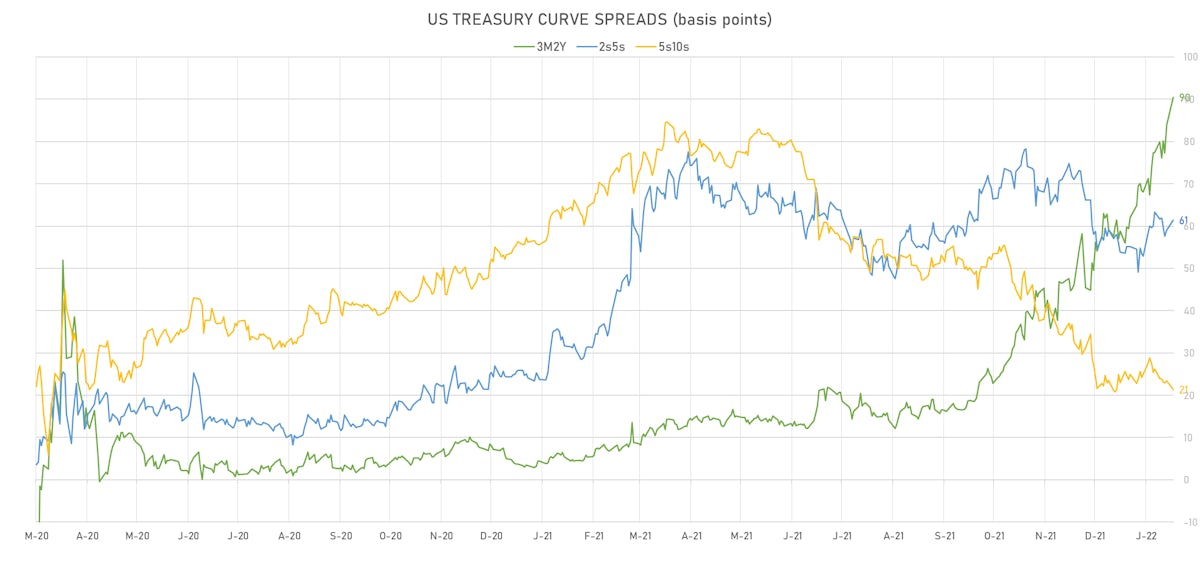

US Yields Rise Out To The Belly, With Further Flattening At The Long End Of The Curve

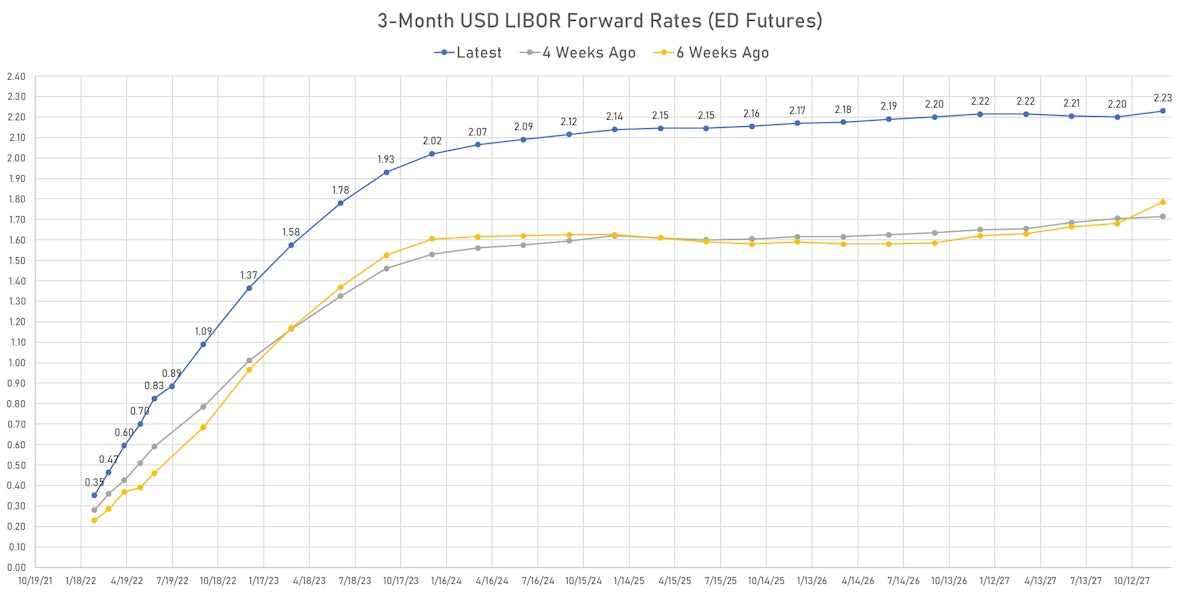

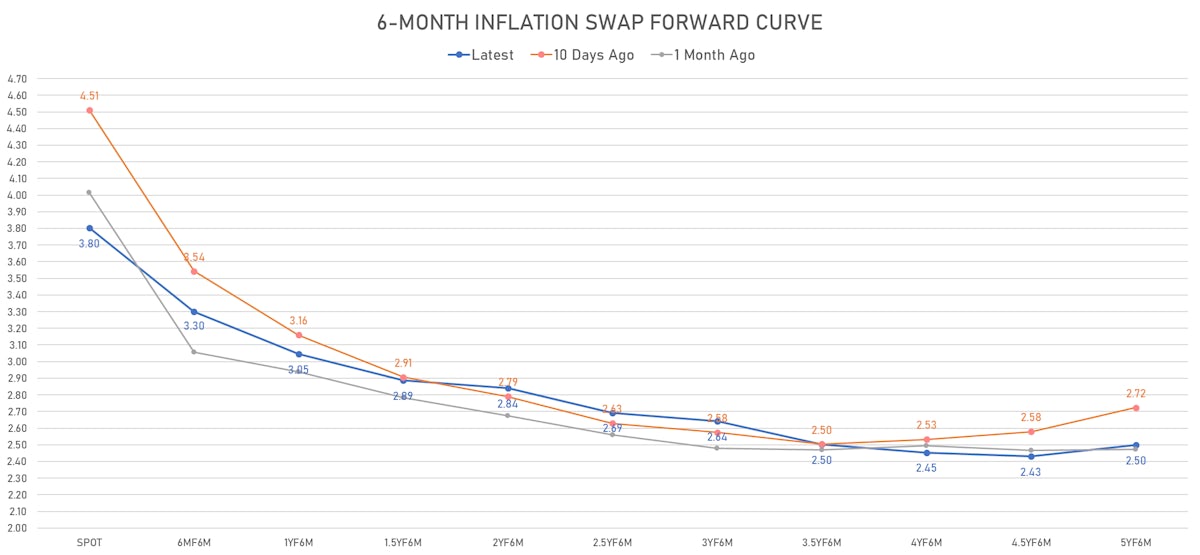

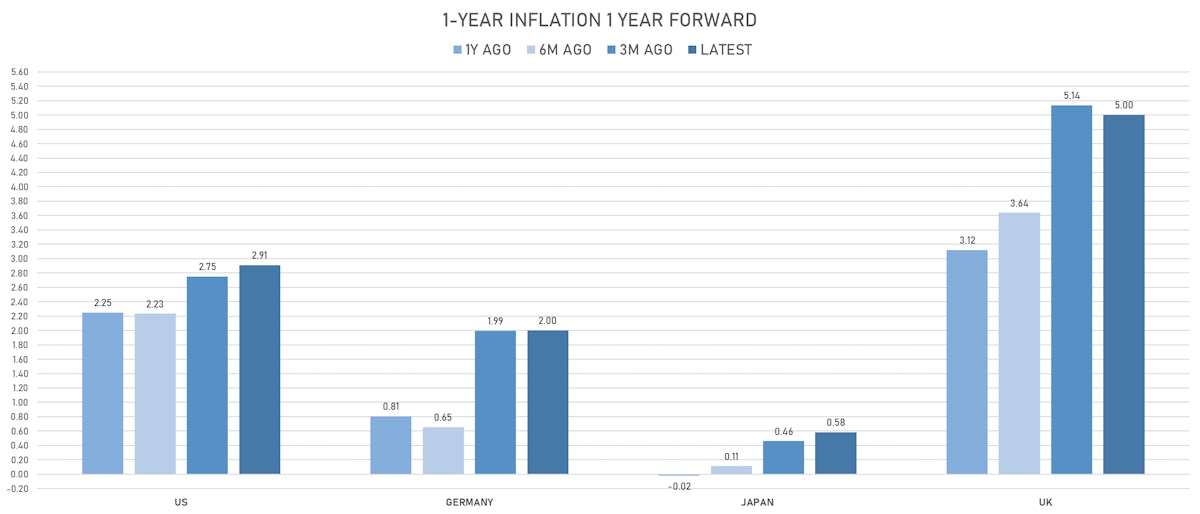

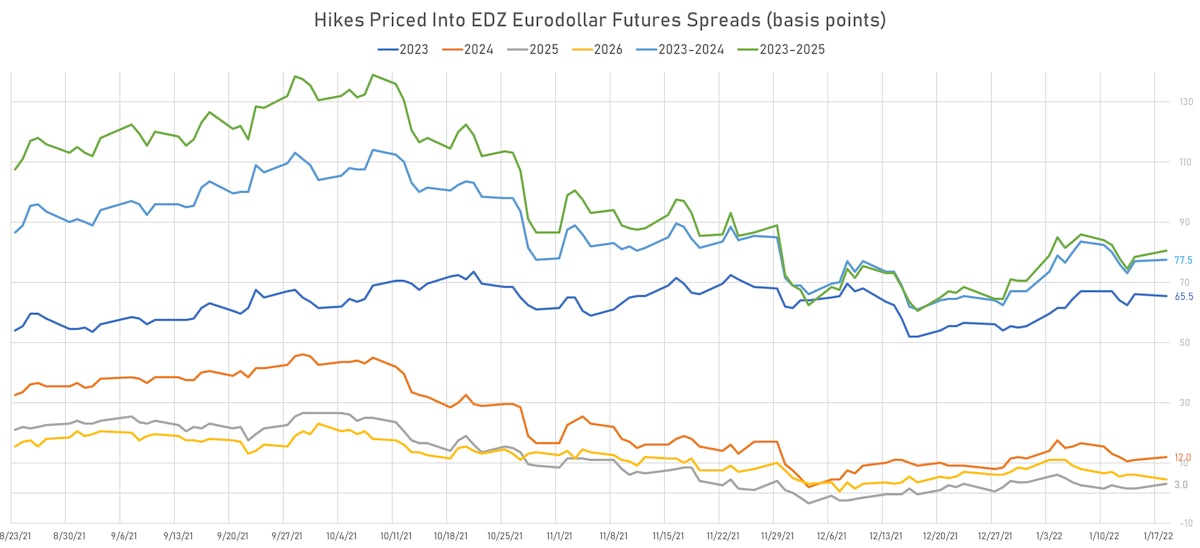

Forward rates continue to price in a very shallow hiking cycle, with only 3 hikes expected from 2023 to 25: this reflects both anemic forward growth expectations (flattening US TIPS 5s30s) and the Fed's possible use of more aggressive QT to accelerate its normalization efforts

Published ET

Fed Hikes Priced Into Eurodollar Futures For 2023, 2024, 2025 | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

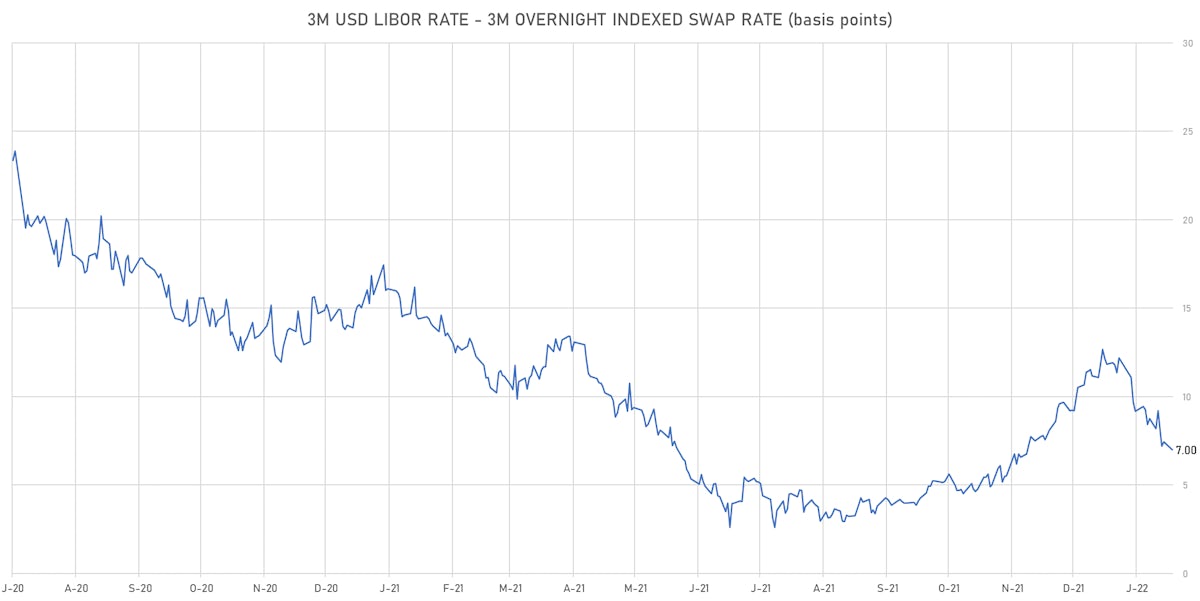

- 3-Month USD LIBOR -0.43bp today, now at 0.2600%; 3-Month OIS +2.3bp at 0.1900%

- The treasury yield curve steepened, with the 1s10s spread widening 2.6 bp, now at 138.4 bp (YTD change: +25.7bp)

- 1Y: 0.4910% (up 5.6 bp)

- 2Y: 1.0465% (up 7.8 bp)

- 5Y: 1.6611% (up 10.2 bp)

- 7Y: 1.8320% (up 9.8 bp)

- 10Y: 1.8753% (up 8.2 bp)

- 30Y: 2.1894% (up 6.2 bp)

- US treasury curve spreads: 3m2Y at 90.5bp (up 6.5bp today), 2s5s at 61.5bp (up 2.4bp), 5s10s at 21.5bp (down -1.9bp), 10s30s at 31.2bp (down -2.0bp)

- Treasuries butterfly spreads: 1s5s10s at -90.9bp (down -6.0bp), 5s10s30s at 9.4bp (down -0.8bp)

- TIPS 1Y breakeven inflation at 3.52% (up -3.0bp); 2Y at 3.22% (down -2.4bp); 5Y at 2.76% (down -7.0bp); 10Y at 2.47% (up 1.0bp); 30Y at 2.26% (up 1.0bp)

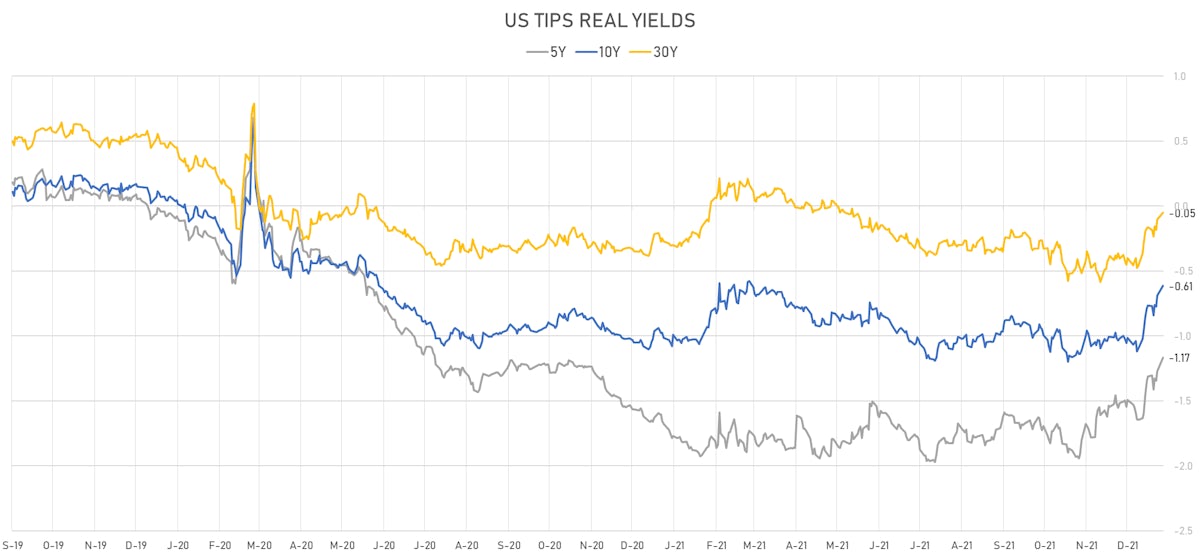

- US 5-Year TIPS Real Yield: +10.7 bp at -1.1660%; 10-Year TIPS Real Yield: +7.8 bp at -0.6130%; 30-Year TIPS Real Yield: +5.3 bp at -0.0510%

US MACRO RELEASES

- New York Fed, General Business Condition for Jan 2022 (FED, NY) at -0.70 (vs 31.90 prior), below consensus estimate of 25.00

- NAHB/Wells Fargo Housing Market Index for Jan 2022 (NAHB, United States) at 83.00 (vs 84.00 prior), below consensus estimate of 84.00

- Net flows total, Current Prices for Nov 2021 (U.S. Dept. Treas.) at 223.90 Bln USD (vs 143.00 Bln USD prior)

- Net foreign acquisition of long-term securities, Current Prices for Nov 2021 (U.S. Dept. Treas.) at 105.30 Bln USD (vs -22.20 Bln USD prior)

- Net purchases (net long-term capital inflows), total, Current Prices for Nov 2021 (U.S. Dept. Treas.) at 137.40 Bln USD (vs 7.10 Bln USD prior)

- Net purchases of U.S. treasury bonds & notes, total net foreign purchases, Current Prices for Nov 2021 (U.S. Dept. Treas.) at 66.40 Bln USD (vs -43.50 Bln USD prior)

US FORWARD RATES

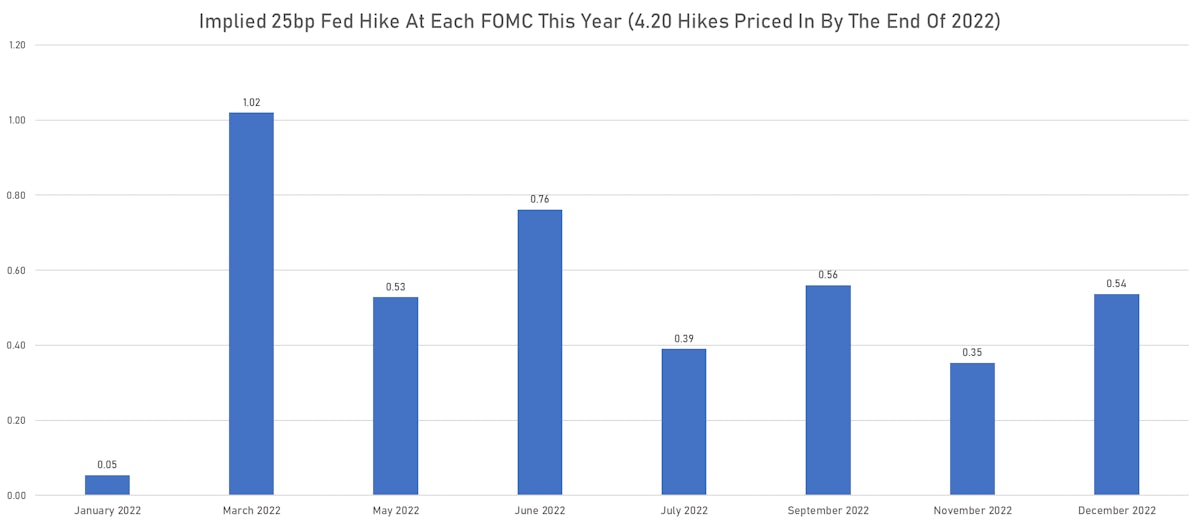

- Fed Funds futures now imply changes of 26.8bp (107.4% probability of a 25bp hike) by the end of March 2022 and price in 4.2 hikes by the end of December 2022

- 1-month USD OIS 12-months forward now price in 4.2 bp of Fed hikes by the end of 2022 (1-day change: 6.8 bp; 1-week change: 20.6 bp)

- 3-month Eurodollar futures (EDZ) spreads price in 65.5 bp of hikes in 2023 (equivalent to 2.6 x 25 bp hikes), down -0.5 bp today, and 12 bp of hikes in 2024 (equivalent to 0.5 x 25 bp hike)

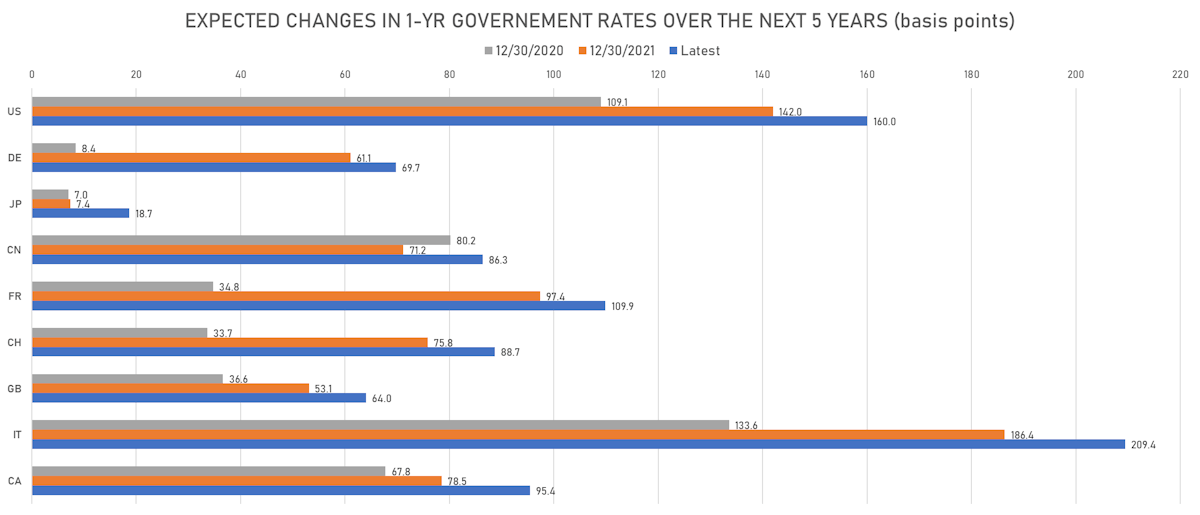

- 1-year US Treasury rate 5 years forward up 9.3 bp, now at 2.2137%, meaning that the 1-year Treasury rate is now expected to increase by 160.0 bp over the next 5 years (equivalent to 6.4 x 25 bp hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.52% (down -3.0bp); 2Y at 3.22% (down -2.4bp); 5Y at 2.76% (down -7.0bp); 10Y at 2.47% (up 1.0bp); 30Y at 2.26% (up 1.0bp)

- 6-month spot US CPI swap down -5.3 bp to 3.802%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.1660%, +10.7 bp today; 10Y at -0.6130%, +7.8 bp today; 30Y at -0.0510%, +5.3 bp today

RATES VOLATILITY & LIQUIDITY

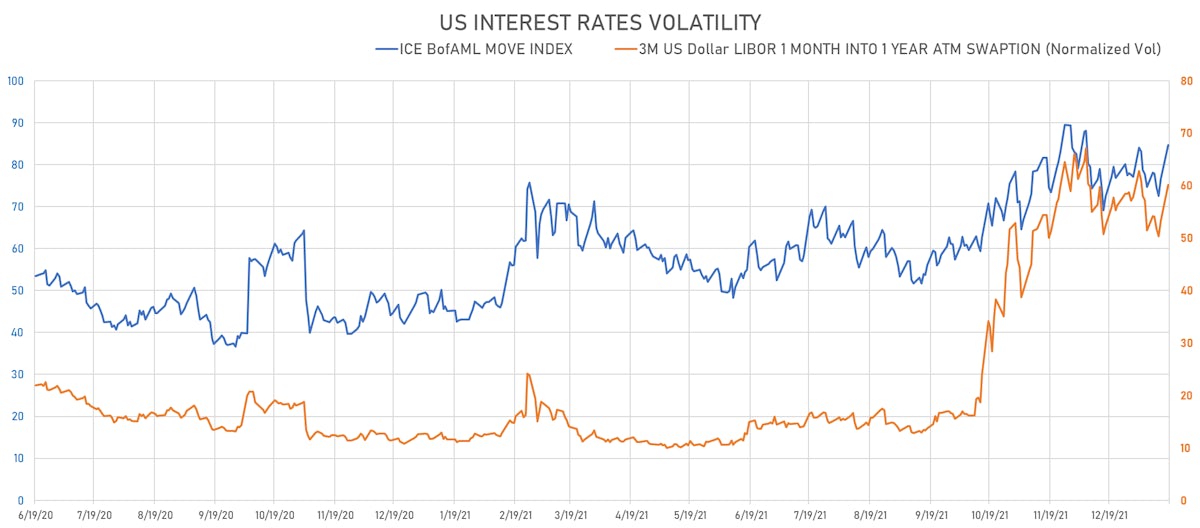

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 6.9% at 60.2%

- 3-Month LIBOR-OIS spread down -0.4 bp at 7.0 bp (12-months range: 2.6-14.6 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.329% (down -0.1 bp); the German 1Y-10Y curve is 1.9 bp steeper at 64.2bp (YTD change: +19.1 bp)

- Japan 5Y: -0.026% (down -0.1 bp); the Japanese 1Y-10Y curve is 0.5 bp steeper at 23.1bp (YTD change: +6.8 bp)

- China 5Y: 2.490% (down -7.1 bp); the Chinese 1Y-10Y curve is 0.6 bp steeper at 66.0bp (YTD change: +14.9 bp)

- Switzerland 5Y: -0.264% (down -0.1 bp); the Swiss 1Y-10Y curve is 1.7 bp steeper at 72.2bp (YTD change: +14.0 bp)