Rates

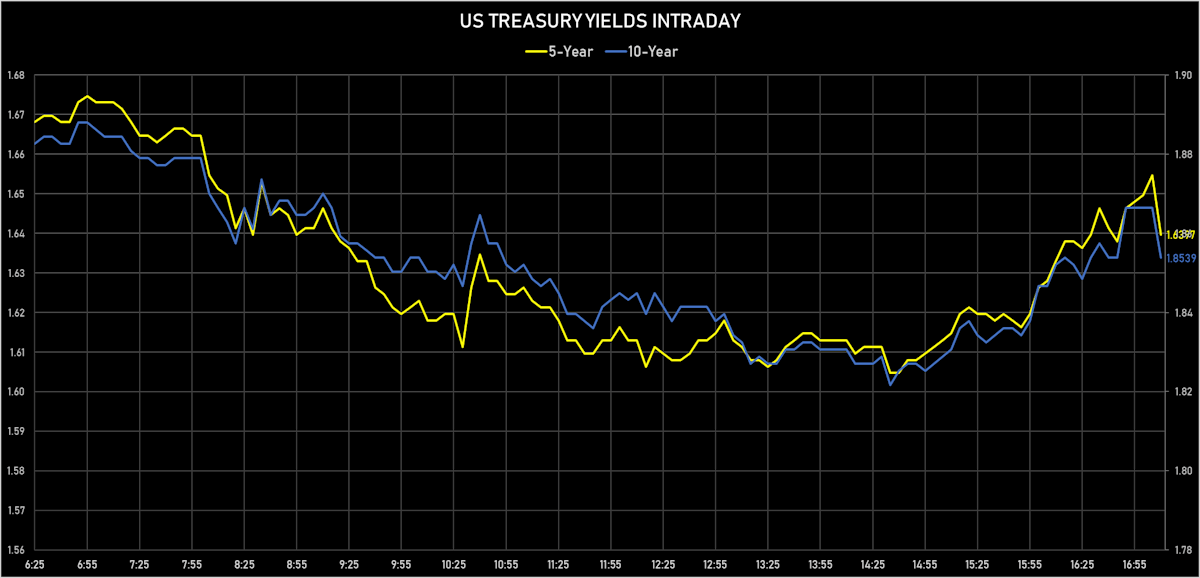

Yields Down Across The US Curve, With A Modest Flattening Out To The Belly

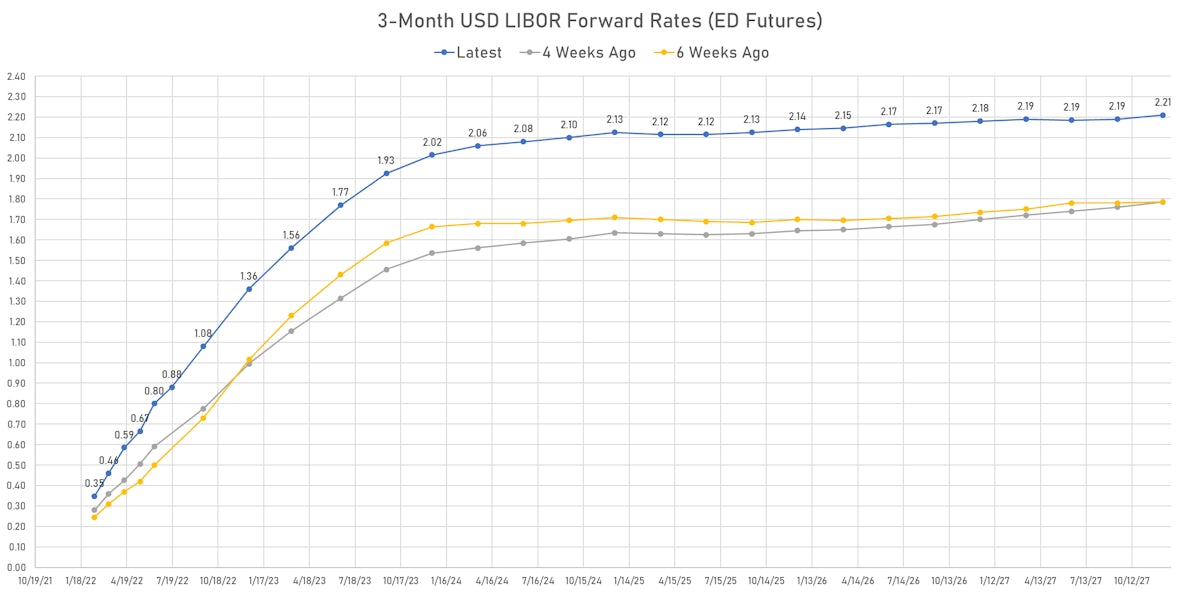

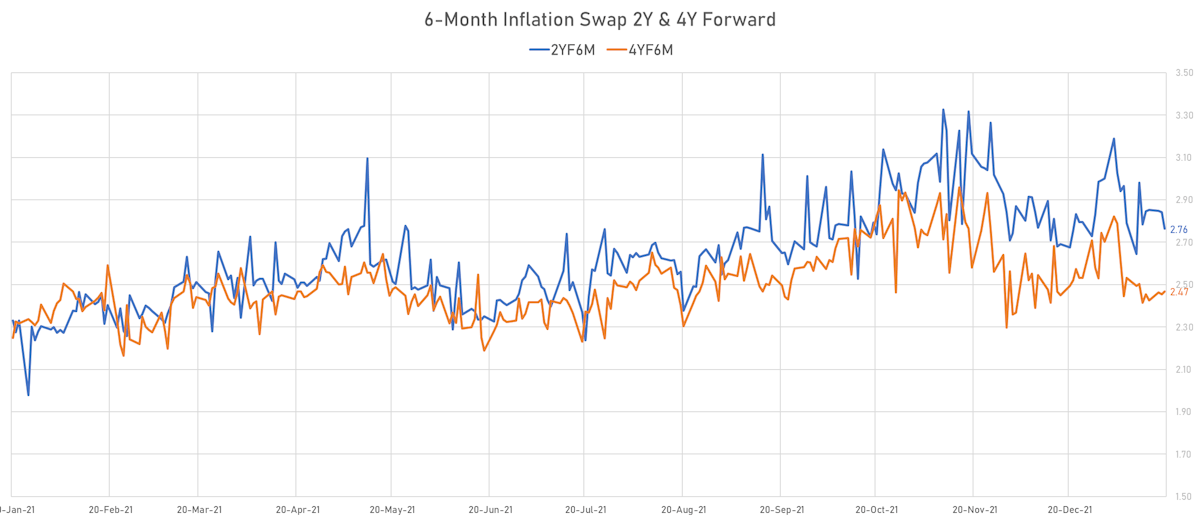

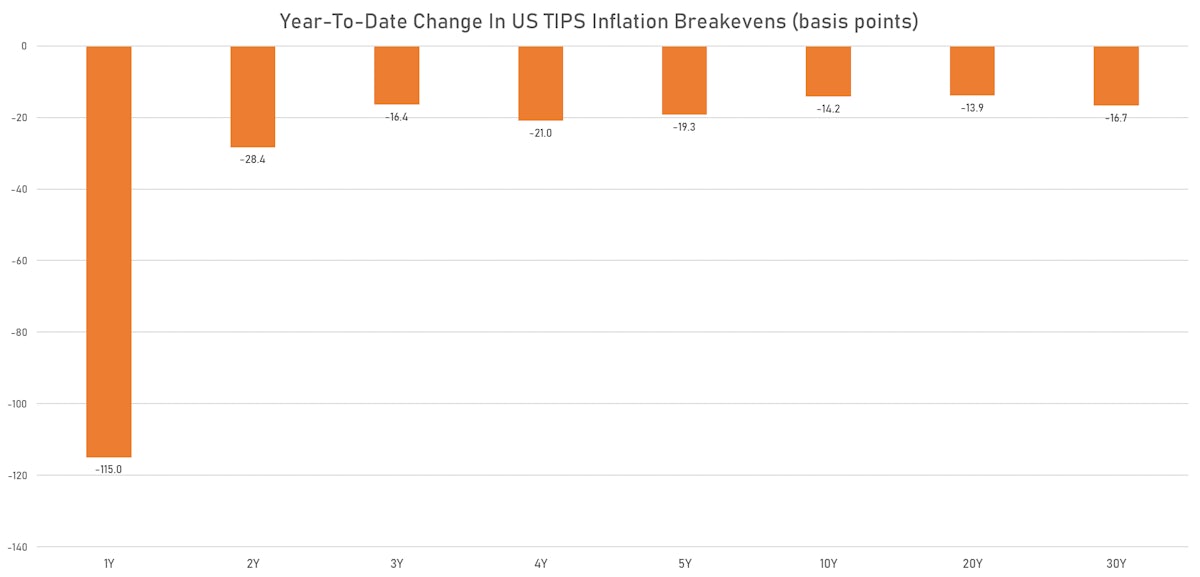

We've seen a dramatic repricing of front-end inflation expectations since the beginning of the year, though the curve is still well above where the Fed would want it to be

Published ET

YTD Change In US TIPS Inflation Breakevens | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

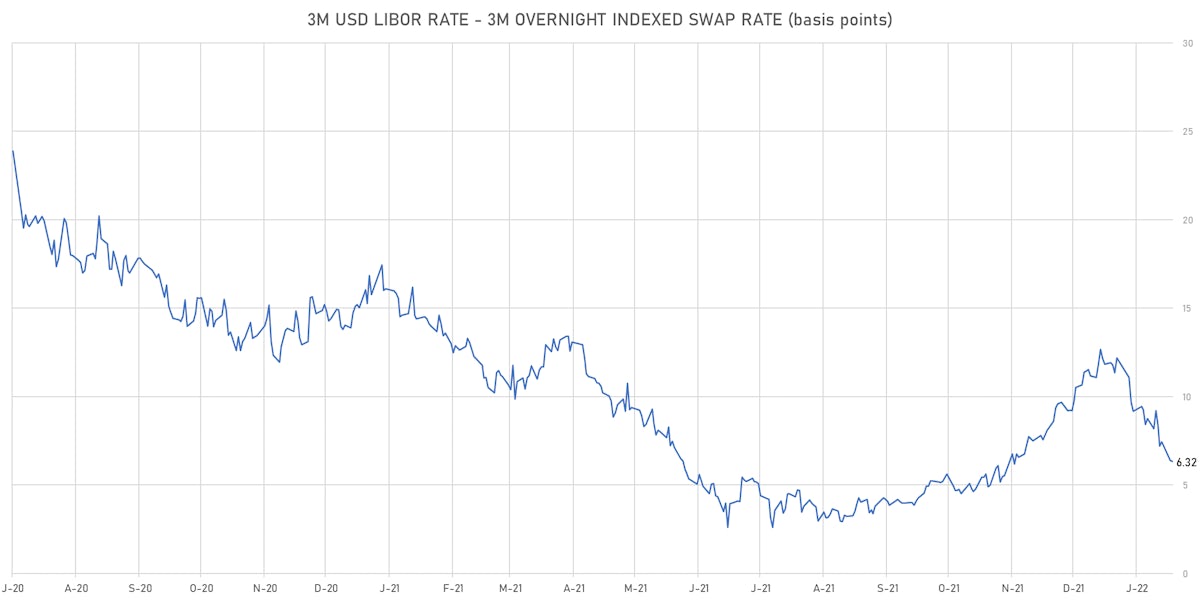

- 3-Month USD LIBOR -0.08bp today, now at 0.2602%; 3-Month OIS +0.7bp at 0.1970%

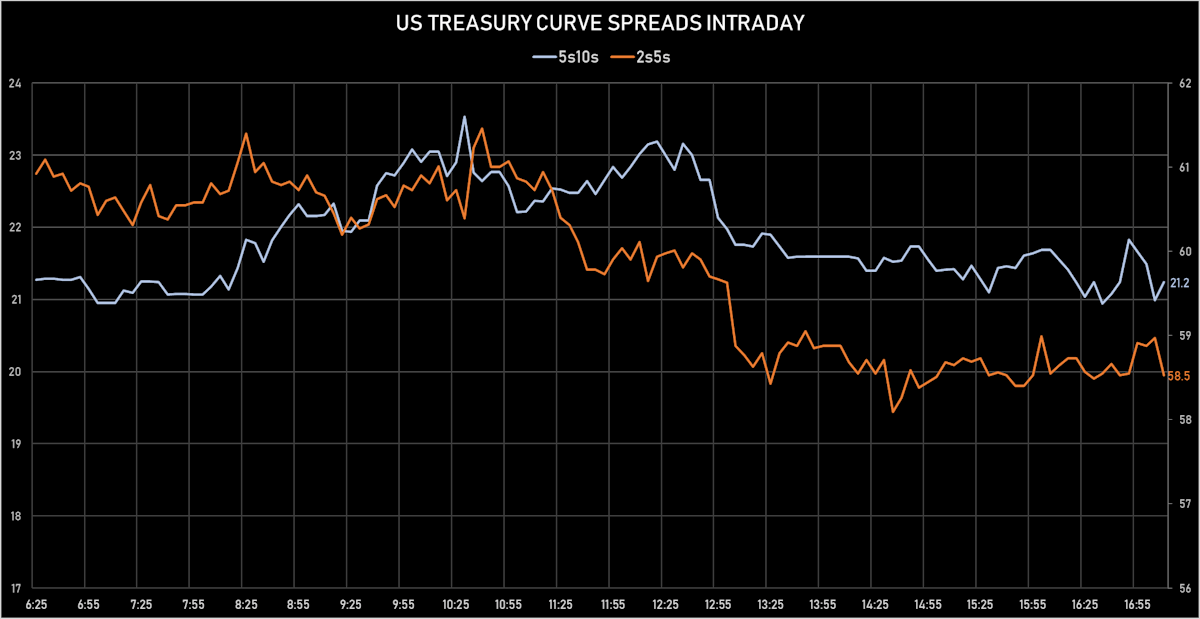

- The treasury yield curve flattened, with the 1s10s spread tightening -2.1 bp, now at 130.4 bp (YTD change: +17.6bp)

- 1Y: 0.5500% (unchanged)

- 2Y: 1.0510% (up 0.4 bp)

- 5Y: 1.6397% (down 2.1 bp)

- 7Y: 1.8065% (down 2.6 bp)

- 10Y: 1.8539% (down 2.1 bp)

- 30Y: 2.1722% (down 1.7 bp)

- US treasury curve spreads: 3m2Y at 87.1bp (down -3.4bp today), 2s5s at 58.8bp (down -2.8bp), 5s10s at 21.5bp (unchanged), 10s30s at 31.8bp (up 0.4bp)

- Treasuries butterfly spreads: 1s5s10s at -89.3bp (up 1.6bp today), 5s10s30s at 9.3bp (down -0.1bp)

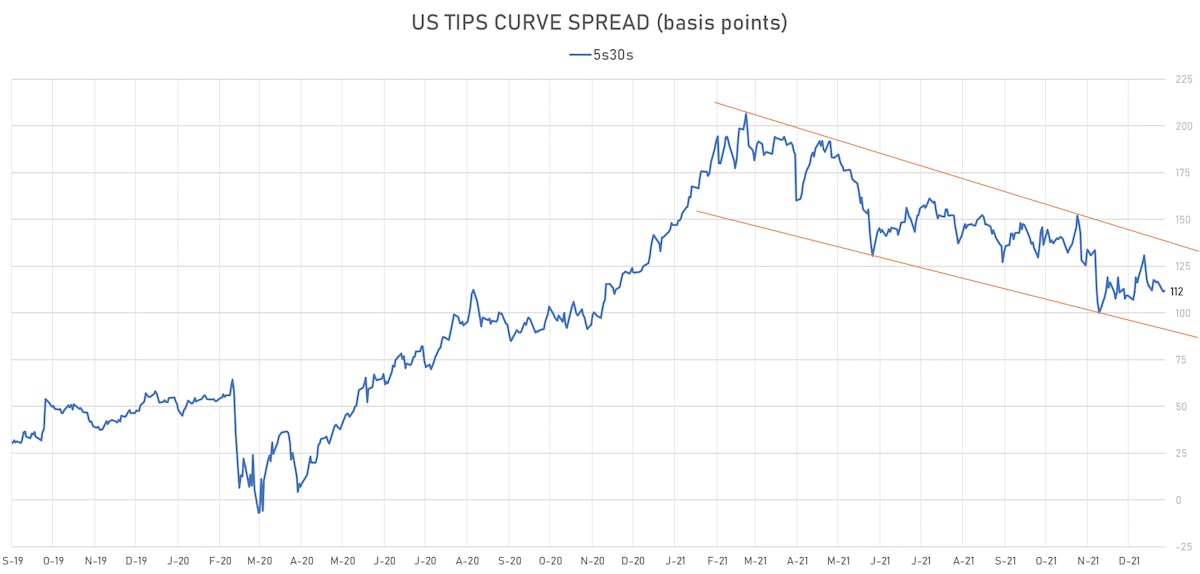

- TIPS 1Y breakeven inflation at 3.50% (up -0.6bp); 2Y at 3.22% (up 0.2bp); 5Y at 2.71% (down -11.5bp); 10Y at 2.43% (down -3.5bp); 30Y at 2.21% (down -4.4bp)

- US 5-Year TIPS Real Yield: +2.4 bp at -1.1420%; 10-Year TIPS Real Yield: +1.6 bp at -0.5970%; 30-Year TIPS Real Yield: +2.6 bp at -0.0250%

US MACRO RELEASES

- Mortgage applications, market composite index, refinancing for W 14 Jan (MBA, USA) at 2,276.30 (vs 2,349.80 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 14 Jan (MBA, USA) at 3.64 % (vs 3.52 % prior)

- Mortgage applications, market composite index, purchase for W 14 Jan (MBA, USA) at 305.70 (vs 283.40 prior)

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 14 Jan (MBA, USA) at 2.30 % (vs 1.40 % prior)

- Mortgage applications, market composite index for W 14 Jan (MBA, USA) at 593.70 (vs 580.60 prior)

- Housing Starts for Dec 2021 (U.S. Census Bureau) at 1.70 Mln (vs 1.68 Mln prior), above consensus estimate of 1.65 Mln

- Housing Starts, Change P/P for Dec 2021 (U.S. Census Bureau) at 1.40 % (vs 11.80 % prior)

- Building Permits, Change P/P for Dec 2021 (U.S. Census Bureau) at 9.10 % (vs 3.90 % prior)

- Building Permits for Dec 2021 (U.S. Census Bureau) at 1.87 Mln (vs 1.72 Mln prior), above consensus estimate of 1.70 Mln

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 15 Jan (Redbook Research) at 15.20 % (vs 14.40 % prior)

$20BN 20-YEAR 2% COUPON TREASURY BOND AUCTION (912810TC2)

- Very solid auction in terms of both pricing and end-user demand (at 83.2% vs 85.7% prior and 79.2% average)

- High yield at 2.210% (vs 1.942% prior), 1.5 bp through the when-issued at the bid deadline

- Direct bids at 17.0% (vs 20.8% prior and 18.3% average)

- Indirect bids at 66.2% (vs 64.8% prior and 60.8% average)

- Bid-to-cover at 2.48 (vs 2.59 prior and 2.36 average)

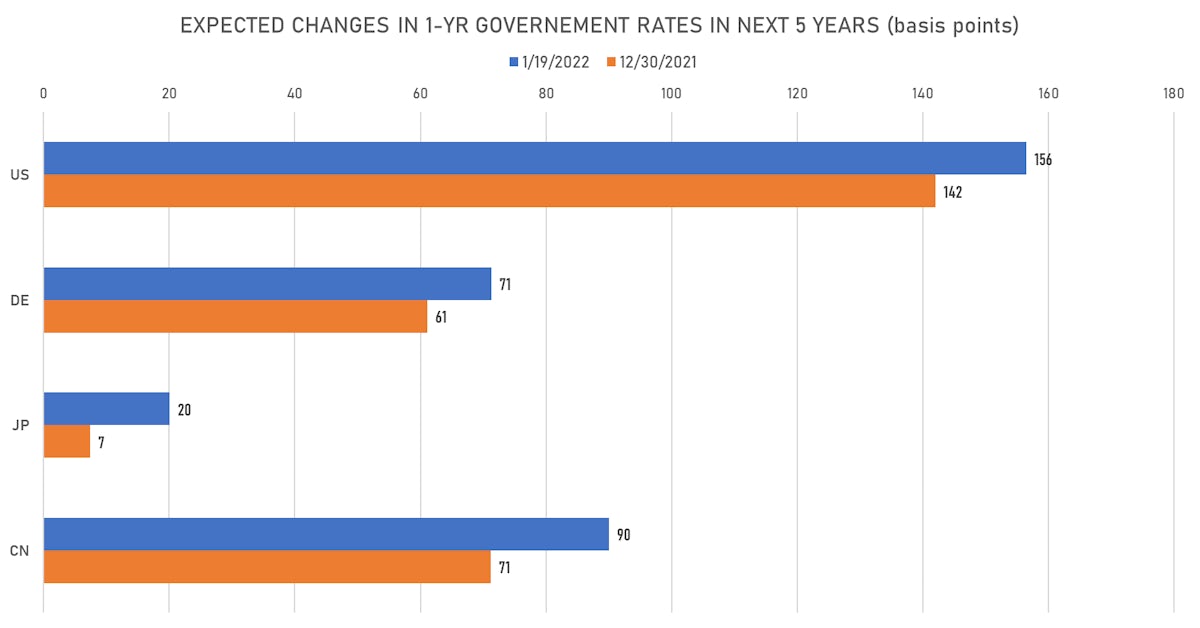

US FORWARD RATES

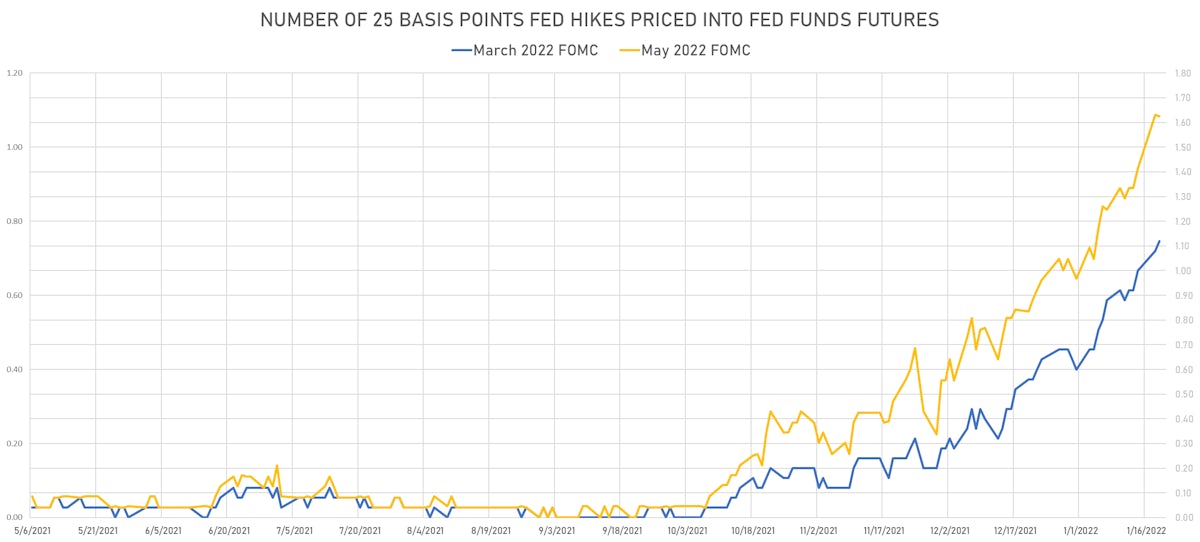

- Fed Funds futures now imply changes of 27.9bp (111.7% probability of a 25bp hike) by the end of March 2022 and price in 4.2 hikes by the end of December 2022

- 1-month USD OIS 12-months forward now price in 4.1 bp of Fed hikes by the end of 2022 (1-day change: -0.5 bp; 1-week change: 16.1 bp)

- 3-month Eurodollar futures (EDZ) spreads price in 65.5 bp of hikes in 2023 (equivalent to 2.6 x 25 bp hikes), unchanged today, and 11 bp of hikes in 2024 (equivalent to 0.4 x 25 bp hikes). So a total of 3 hikes for 2023 and 2024.

- 1-year US Treasury rate 5 years forward down 3.6 bp, now at 2.1780%, meaning that the 1-year Treasury rate is now expected to increase by 156.4 bp over the next 5 years (equivalent to 6.3 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.50% (down -0.6bp); 2Y at 3.22% (up 0.2bp); 5Y at 2.71% (down -11.5bp); 10Y at 2.43% (down -3.5bp); 30Y at 2.21% (down -4.4bp)

- 6-month spot US CPI swap up 0.1 bp to 3.803%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.1420%, +2.4 bp today; 10Y at -0.5970%, +1.6 bp today; 30Y at -0.0250%, +2.6 bp today

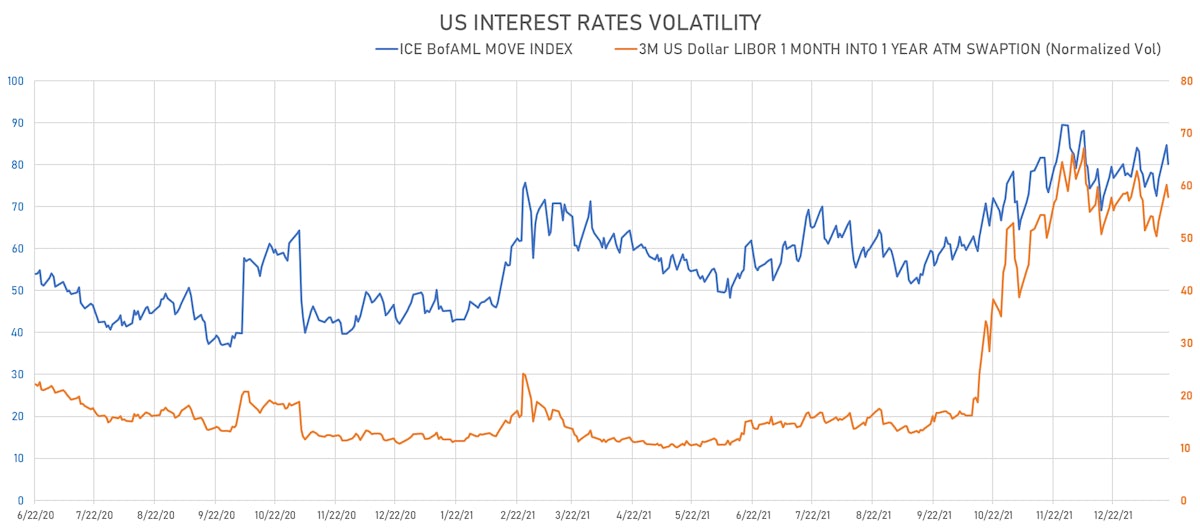

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -2.4% at 57.8%

- 3-Month LIBOR-OIS spread down -0.1 bp at 6.3 bp (12-months range: 2.6-14.6 bp)

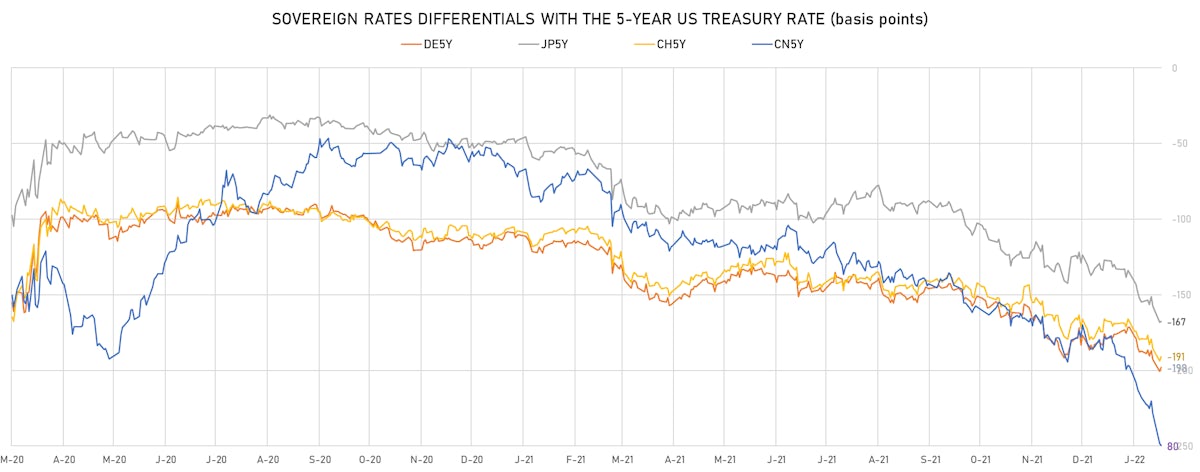

KEY INTERNATIONAL RATES

- Germany 5Y: -0.334% (up 0.3 bp); the German 1Y-10Y curve is 1.4 bp steeper at 64.3bp (YTD change: +20.5 bp)

- Japan 5Y: -0.034% (down -1.5 bp); the Japanese 1Y-10Y curve is 0.8 bp flatter at 22.6bp (YTD change: +6.0 bp)

- China 5Y: 2.442% (down -3.6 bp); the Chinese 1Y-10Y curve is 2.7 bp steeper at 68.6bp (YTD change: +17.6 bp)

- Switzerland 5Y: -0.267% (up 1.0 bp); the Swiss 1Y-10Y curve is 3.9 bp steeper at 72.4bp (YTD change: +17.9 bp)