Rates

Mixed US Data, With Positive Philly Fed Survey But Weaker Than Expected Jobless Claims

Not a ton of movement in rates today as the market now awaits the FOMC next week, with a limited number of new releases until then (most notably flash PMIs on Monday and consumer confidence on Tuesday)

Published ET

US 6-Month Inflation Swaps (Spot & 5Y Forward) | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

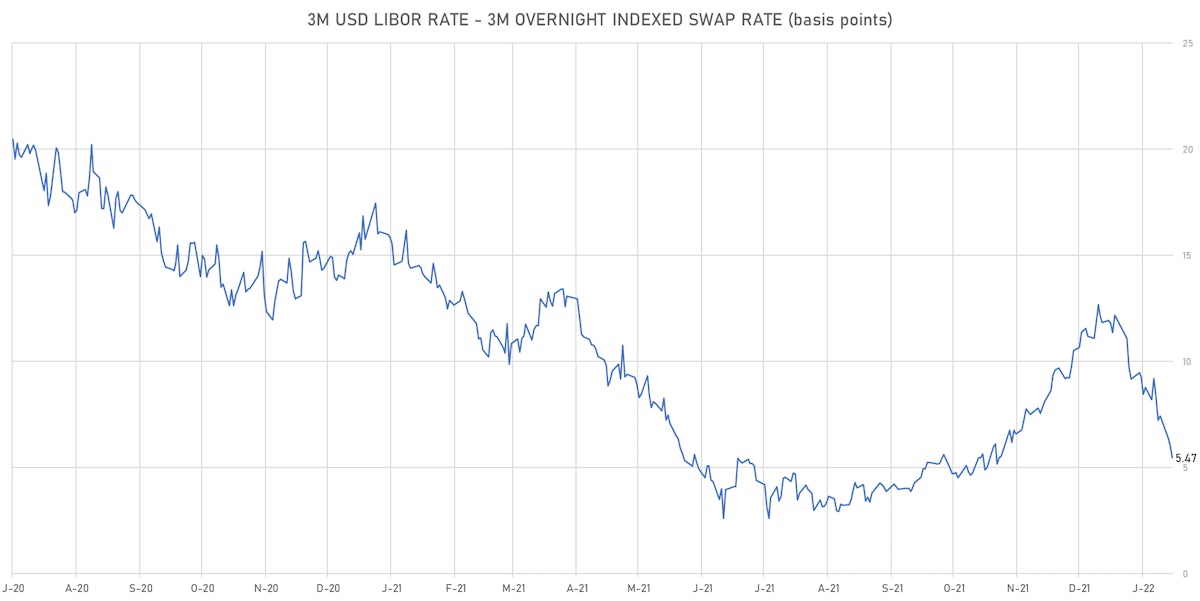

- 3-Month USD LIBOR -0.55bp today, now at 0.2602%; 3-Month OIS +1.1bp at 0.2055%

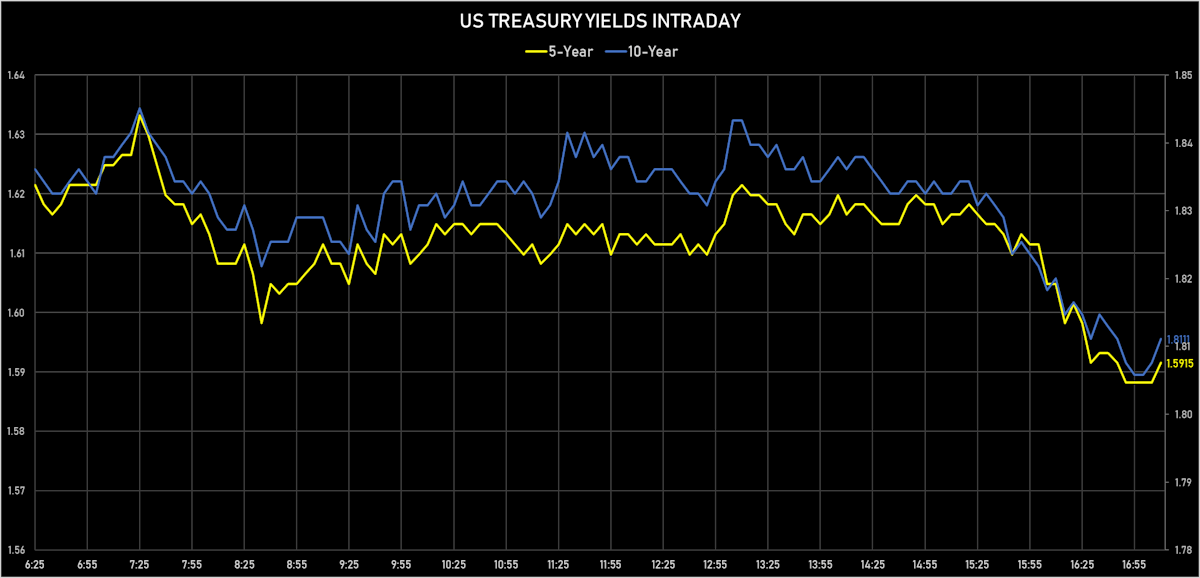

- The treasury yield curve flattened, with the 1s10s spread tightening -5.1 bp, now at 127.4 bp (YTD change: +14.6bp)

- 1Y: 0.5370% (up 0.8 bp)

- 2Y: 1.0269% (down 2.4 bp)

- 5Y: 1.5915% (down 4.8 bp)

- 7Y: 1.7554% (down 5.1 bp)

- 10Y: 1.8111% (down 4.3 bp)

- 30Y: 2.1235% (down 4.9 bp)

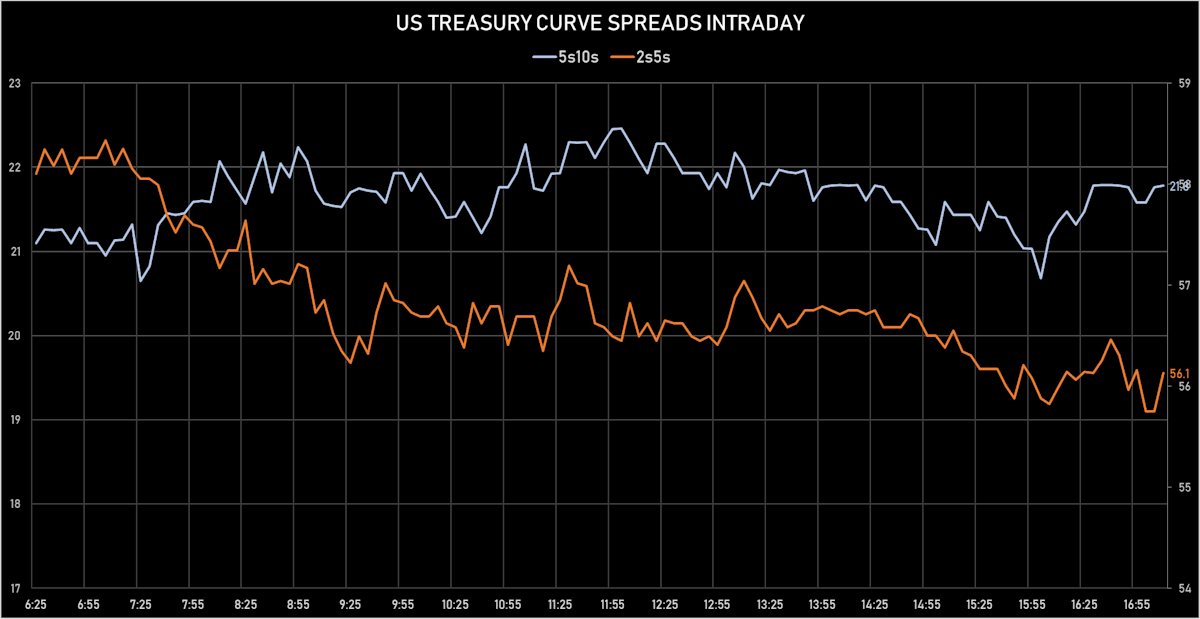

- US treasury curve spreads: 3m2Y at 84.9bp (down -3.0bp today), 2s5s at 56.5bp (down -2.4bp), 5s10s at 22.0bp (up 0.5bp), 10s30s at 31.2bp (down -0.6bp)

- Treasuries butterfly spreads: 1s5s10s at -83.2bp (up 6.1bp today), 5s10s30s at 9.3bp (unchanged)

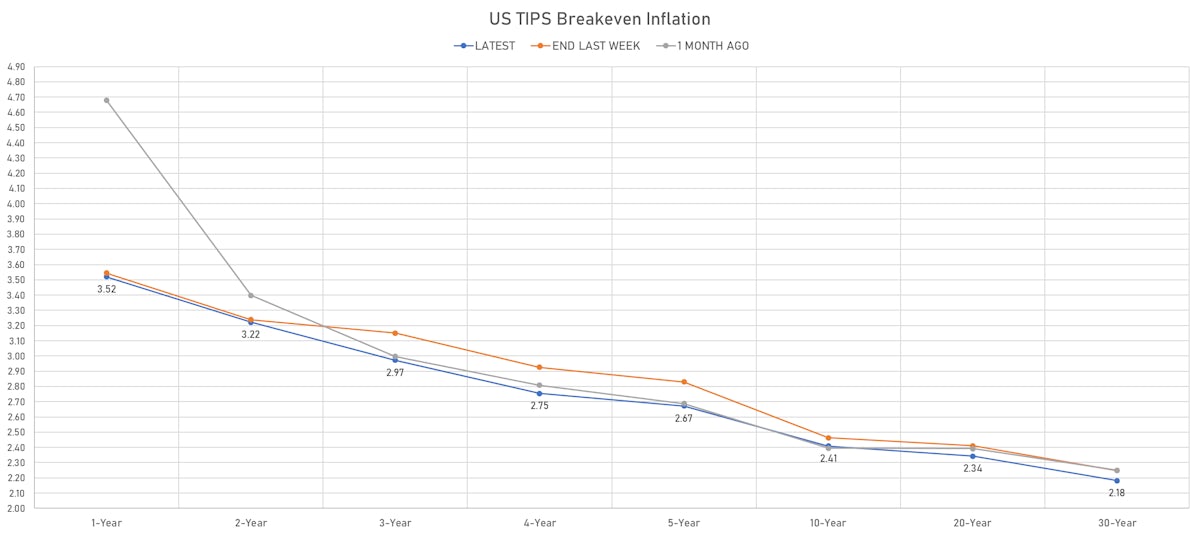

- TIPS 1Y breakeven inflation at 3.52% (up 2.2bp); 2Y at 3.22% (down -0.1bp); 5Y at 2.67% (down -3.6bp); 10Y at 2.41% (down -2.4bp); 30Y at 2.18% (down -3.0bp)

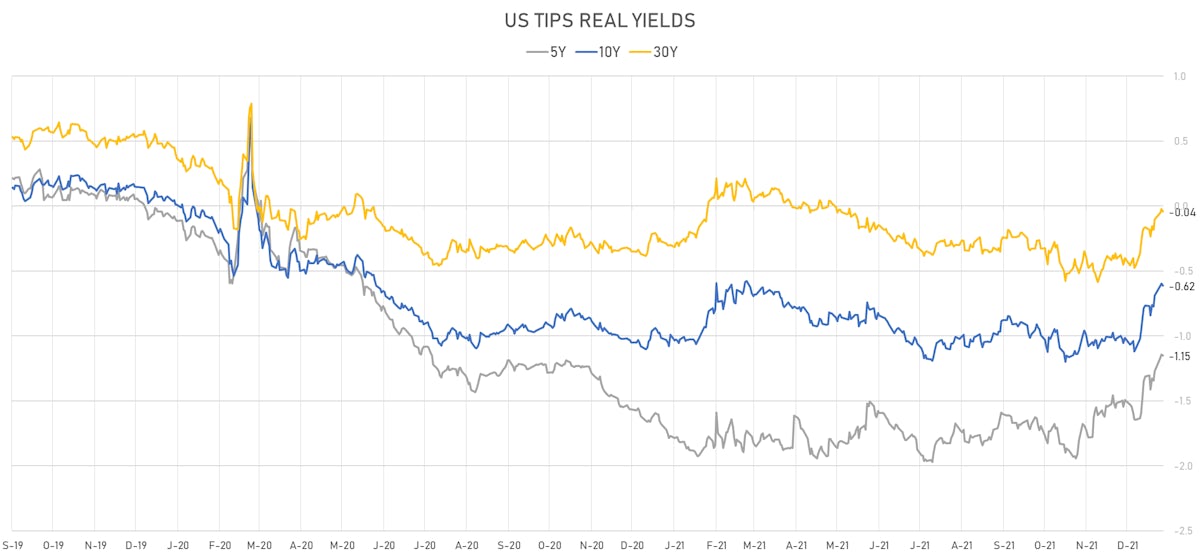

- US 5-Year TIPS Real Yield: -1.1 bp at -1.1530%; 10-Year TIPS Real Yield: -1.8 bp at -0.6150%; 30-Year TIPS Real Yield: -1.7 bp at -0.0420%

US MACRO RELEASES

- Philadelphia Fed, Number of employees for Jan 2022 (FED, Philadelphia) at 26.10 (vs 33.90 prior)

- Philadelphia Fed, Future capital expenditures for Jan 2022 (FED, Philadelphia) at 26.20 (vs 20.00 prior)

- Philadelphia Fed, New orders for Jan 2022 (FED, Philadelphia) at 17.90 (vs 13.70 prior)

- Philadelphia Fed, Prices paid for Jan 2022 (FED, Philadelphia) at 72.50 (vs 66.10 prior)

- Philadelphia Fed, Future general business activity for Jan 2022 (FED, Philadelphia) at 28.70 (vs 19.00 prior)

- Jobless Claims, National, Initial, four week moving average for W 15 Jan (U.S. Dept. of Labor) at 231.00 k (vs 210.75 k prior)

- Jobless Claims, National, Initial for W 15 Jan (U.S. Dept. of Labor) at 286.00 k (vs 230.00 k prior), above consensus estimate of 220.00 k

- Philadelphia Fed, General business activity for Jan 2022 (FED, Philadelphia) at 23.20 (vs 15.40 prior), above consensus estimate of 20.00

- Jobless Claims, National, Continued for W 08 Jan (U.S. Dept. of Labor) at 1.64 Mln (vs 1.56 Mln prior), above consensus estimate of 1.58 Mln

- Existing-Home Sales, Single-Family and Condos, total, Change P/P for Dec 2021 (NAR, United States) at -4.60 % (vs 1.90 % prior)

- Existing-Home Sales, Single-Family and Condos, total for Dec 2021 (NAR, United States) at 6.18 Mln (vs 6.46 Mln prior), below consensus estimate of 6.44 Mln

EIA STOCK LEVELS

- Total Crude Oil excluding SPR, Absolute change, Volume for W 14 Jan (EIA, United States) at 0.52 Mln, above consensus estimate of -0.94 Mln

- Total Distillate, Absolute change, Volume for W 14 Jan (EIA, United States) at -1.43 Mln, below consensus estimate of -0.85 Mln

- Gasoline, Absolute change, Volume for W 14 Jan (EIA, United States) at 5.87 Mln, above consensus estimate of 2.63 Mln

- Natural Gas in Underground Storage, Lower 48 States, Absolute change, Volume for W 14 Jan (EIA, United States) at -206.00 bcf, below consensus estimate of -194.00 bcf

- Refinery Capacity Utilization, Absolute change, Volume for W 14 Jan (EIA, United States) at -0.30 %, above consensus estimate of -0.40 %

$16BN 10-YEAR 0.125% COUPON TIPS AUCTION (91282CDX6)

- Less-than-stellar results for this auction, with poor pricing and mediocre end-user demand (85% vs 89.8% prior)

- High yield at -0.540% (vs -1.145% prior), a 2.6bp tail vs -0.566% at the bid deadline

- Direct bids at 15.7% (vs 13.0% prior)

- Indirect bids at 69.3% (vs 76.8% prior)

- Bid-to-cover at 2.30 (vs 2.43 prior)

US FORWARD RATES

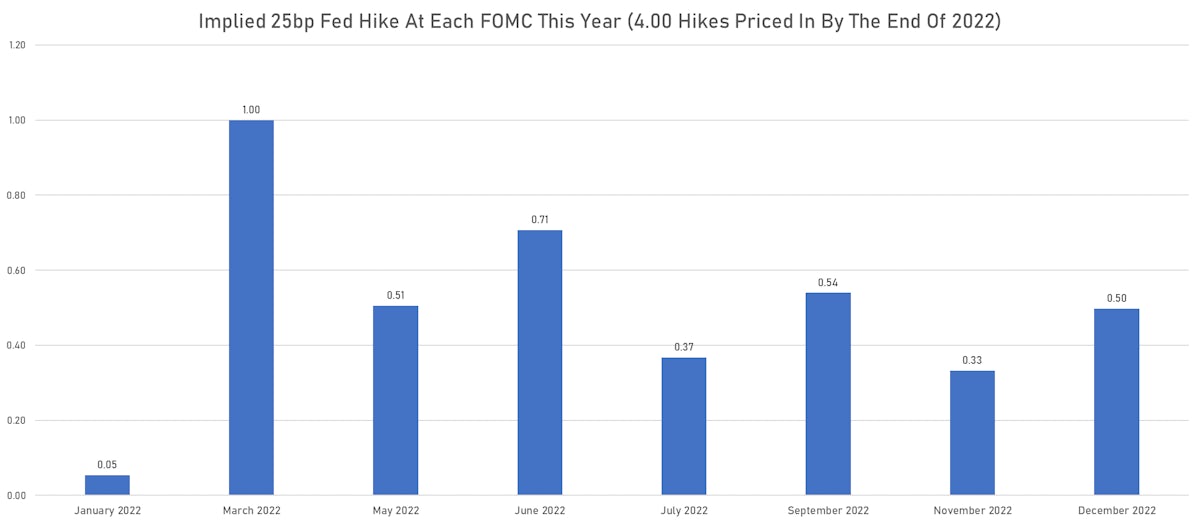

- Fed Funds futures now imply changes of 26.3bp (105.4% probability of a 25bp hike) by the end of March 2022 and price in 4.0 hikes by the end of December 2022

- 1-month USD OIS 12-months forward now price in 3.9 bp of Fed hikes by the end of 2022 (1-day change: -1.5 bp; 1-week change: 5.5 bp)

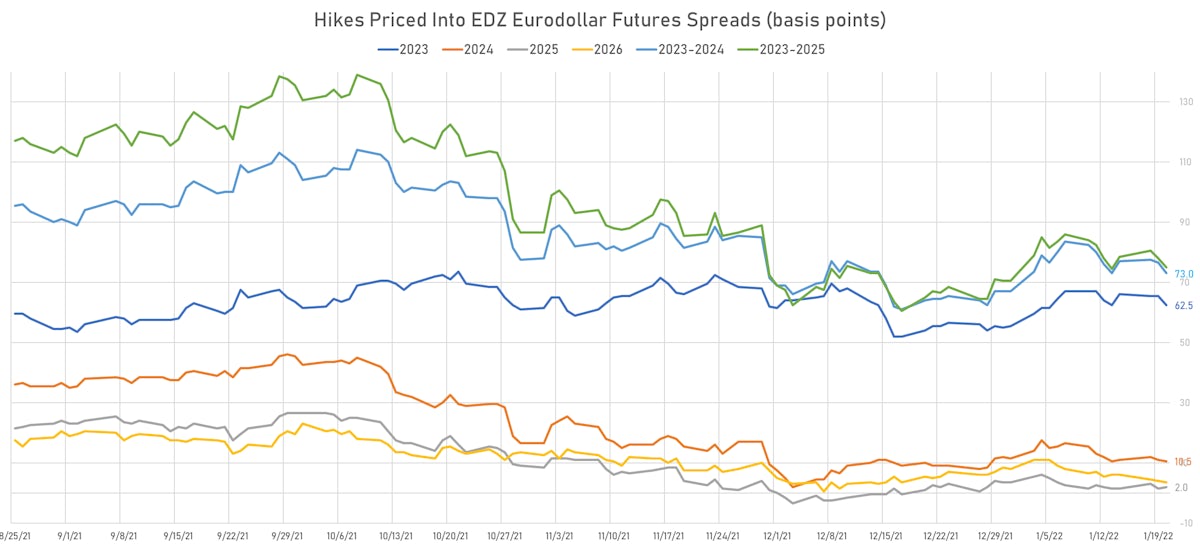

- 3-month Eurodollar futures (EDZ) spreads price in 62.5 bp of hikes in 2023 (equivalent to 2.5 x 25 bp hikes), down -3.0 bp today, and 10.5 bp of hikes in 2024 (equivalent to 0.4 x 25 bp hikes)

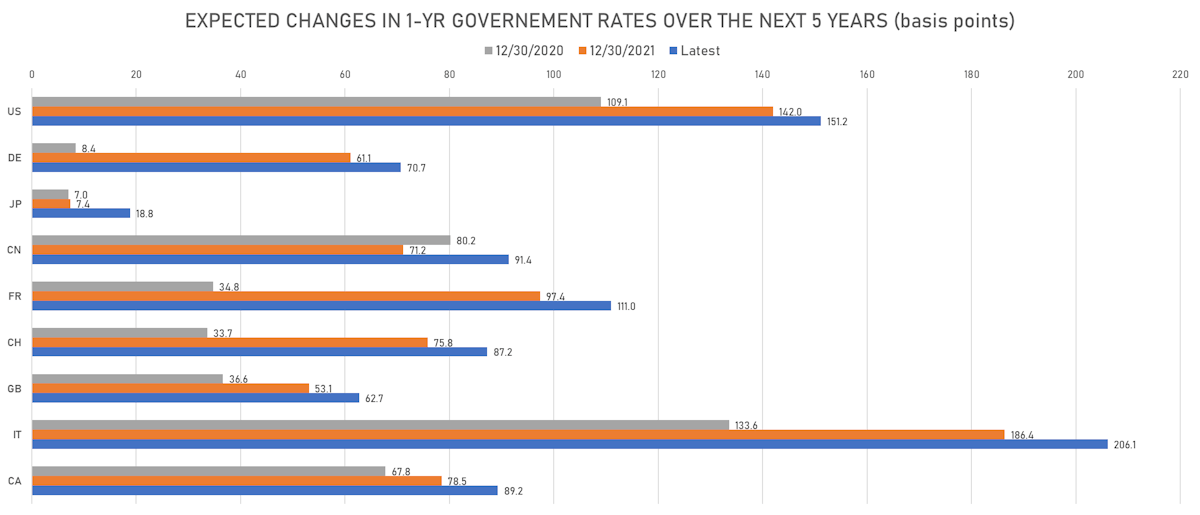

- 1-year US Treasury rate 5 years forward down 5.4 bp, now at 2.1237%, meaning that the 1-year Treasury rate is now expected to increase by 151.2 bp over the next 5 years (equivalent to 6.0 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.52% (up 2.2bp); 2Y at 3.22% (down -0.1bp); 5Y at 2.67% (down -3.6bp); 10Y at 2.41% (down -2.4bp); 30Y at 2.18% (down -3.0bp)

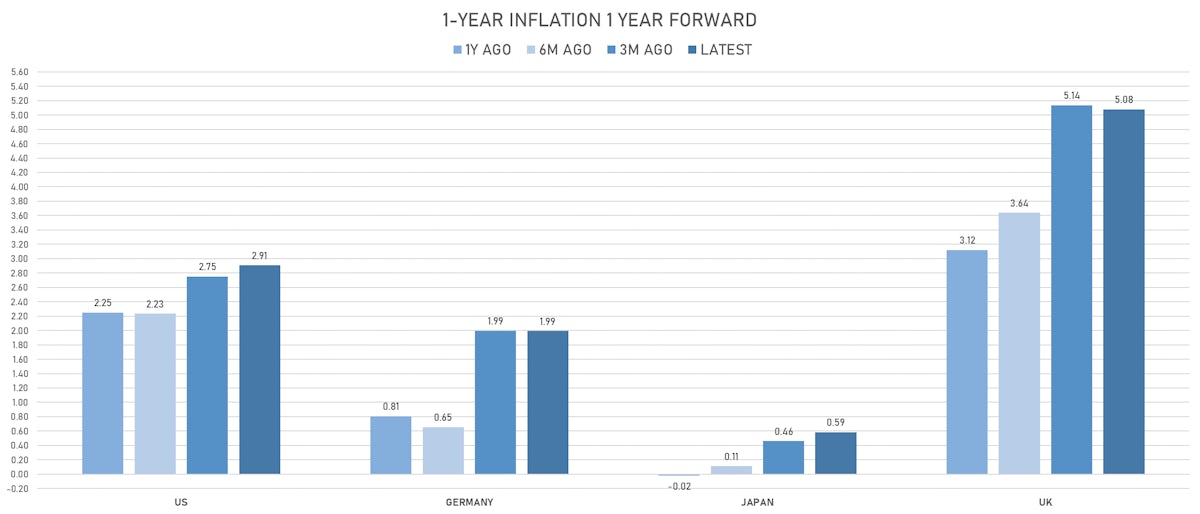

- 6-month spot US CPI swap up 2.2 bp to 3.825%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.1530%, -1.1 bp today; 10Y at -0.6150%, -1.8 bp today; 30Y at -0.0420%, -1.7 bp today

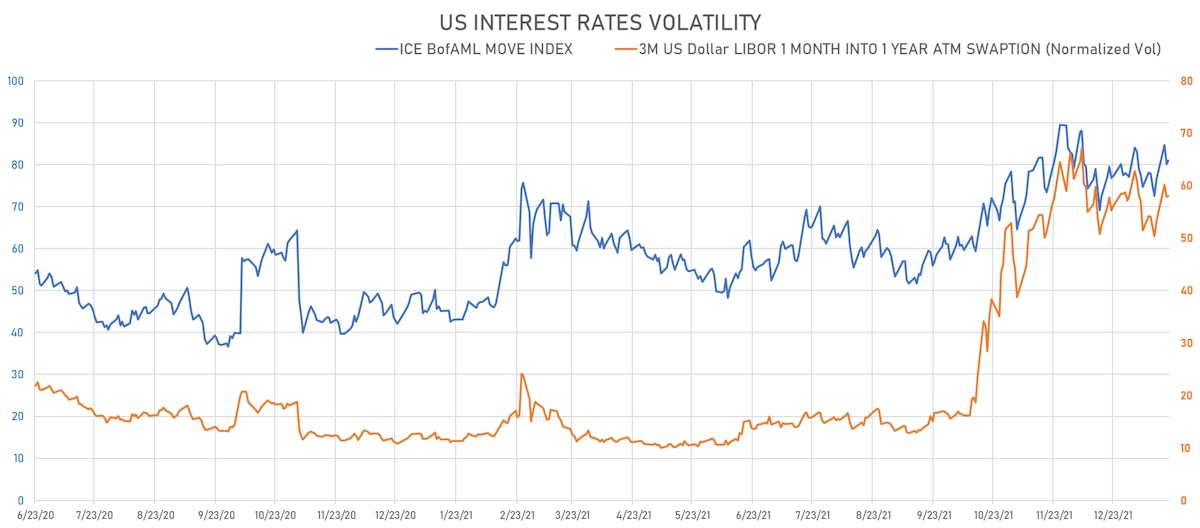

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.2% at 58.0%

- 3-Month LIBOR-OIS spread down -0.5 bp at 5.5 bp (12-months range: 2.6-14.6 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.350% (down -0.7 bp); the German 1Y-10Y curve is 1.3 bp flatter at 63.1bp (YTD change: +19.2 bp)

- Japan 5Y: -0.026% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.8 bp steeper at 22.8bp (YTD change: +6.8 bp)

- China 5Y: 2.438% (down -0.4 bp); the Chinese 1Y-10Y curve is 0.8 bp steeper at 69.4bp (YTD change: +18.4 bp)

- Switzerland 5Y: -0.281% (down -1.4 bp); the Swiss 1Y-10Y curve is 3.8 bp flatter at 67.6bp (YTD change: +14.1 bp)