Rates

Flatter Curve Into The Weekend, Bringing The US Treasuries 1s10s Spread 8.4 bp Tighter For The Week

No rate hike expected at the FOMC next week, as the Fed is still actively buying securities (until the end of taper in March); but Powell will be cocking his gun, and the press conference should provide some detail about the Fed Funds rate liftoff, widely expected at the next meeting in March

Published ET

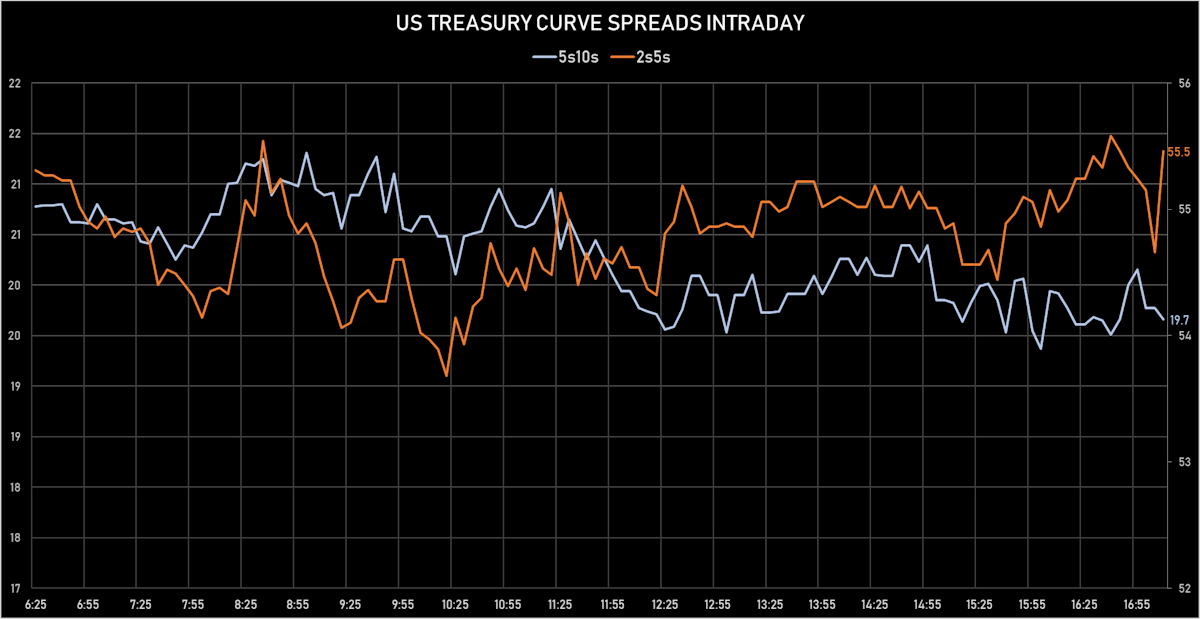

US Treasury Curve Spreads | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.95bp today, now at 0.2599%; 3-Month OIS -0.8bp at 0.1970%

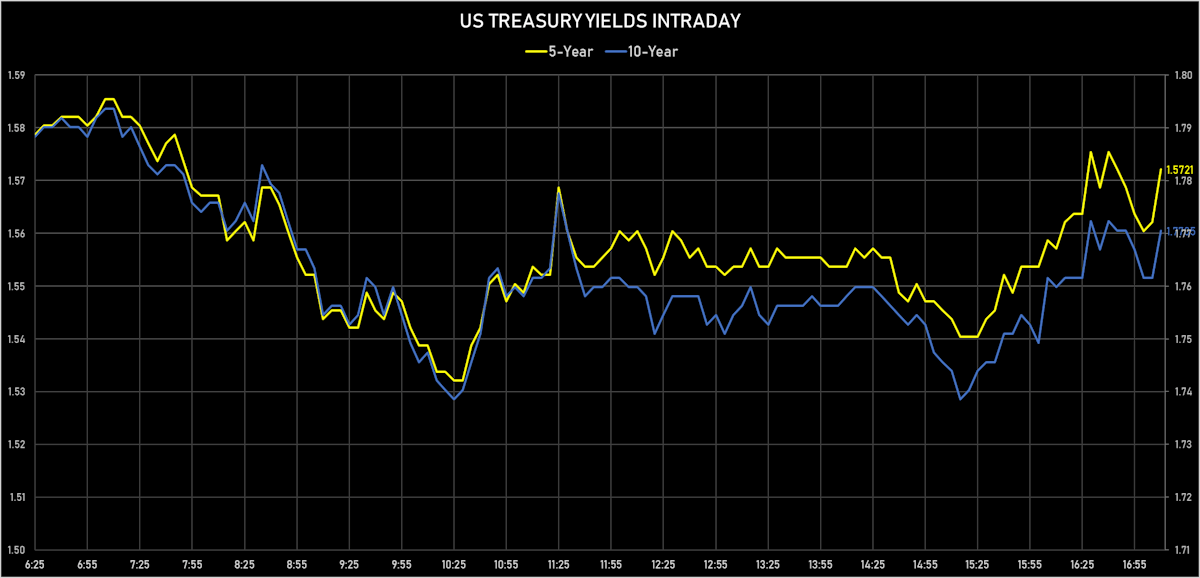

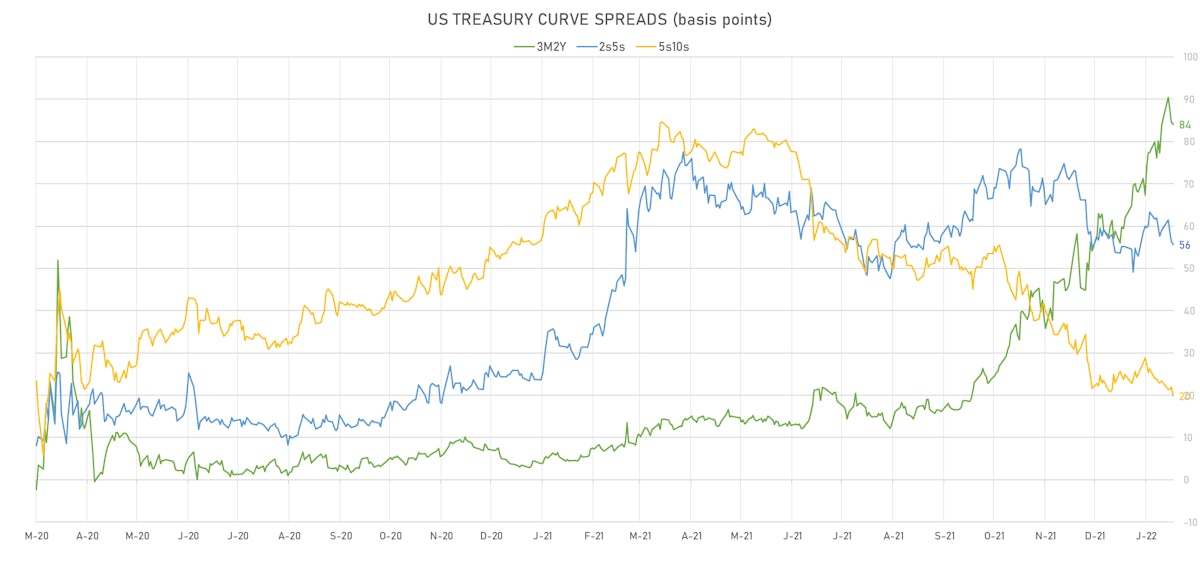

- The treasury yield curve flattened, with the 1s10s spread tightening -4.6 bp, now at 121.9 bp (YTD change: +9.1bp)

- 1Y: 0.5520% (up 0.5 bp)

- 2Y: 1.0158% (down 1.1 bp)

- 5Y: 1.5721% (down 1.9 bp)

- 7Y: 1.7279% (down 2.8 bp)

- 10Y: 1.7705% (down 4.1 bp)

- 30Y: 2.0848% (down 3.9 bp)

- US treasury curve spreads: 3m2Y at 84.1bp (down -0.6bp today), 2s5s at 55.7bp (down -0.7bp), 5s10s at 19.8bp (down -2.1bp), 10s30s at 31.4bp (up 0.3bp)

- Treasuries butterfly spreads: 1s5s10s at -82.9bp (up 0.3bp today), 5s10s30s at 10.5bp (up 1.2bp)

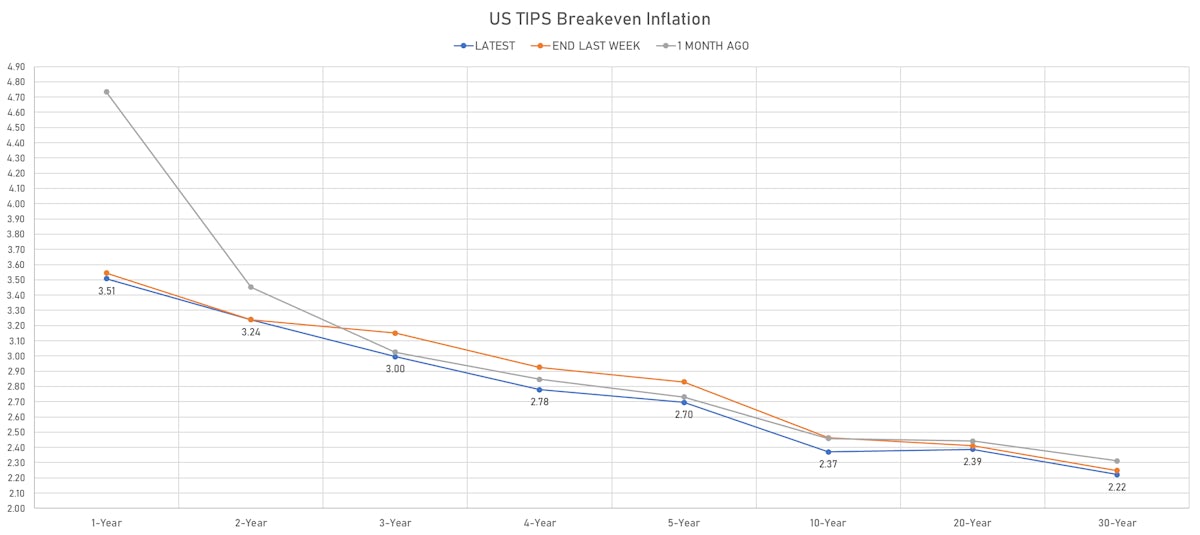

- TIPS 1Y breakeven inflation at 3.51% (up -1.2bp); 2Y at 3.24% (up 1.8bp); 5Y at 2.70% (up 2.4bp); 10Y at 2.37% (down -3.9bp); 30Y at 2.22% (up 3.9bp)

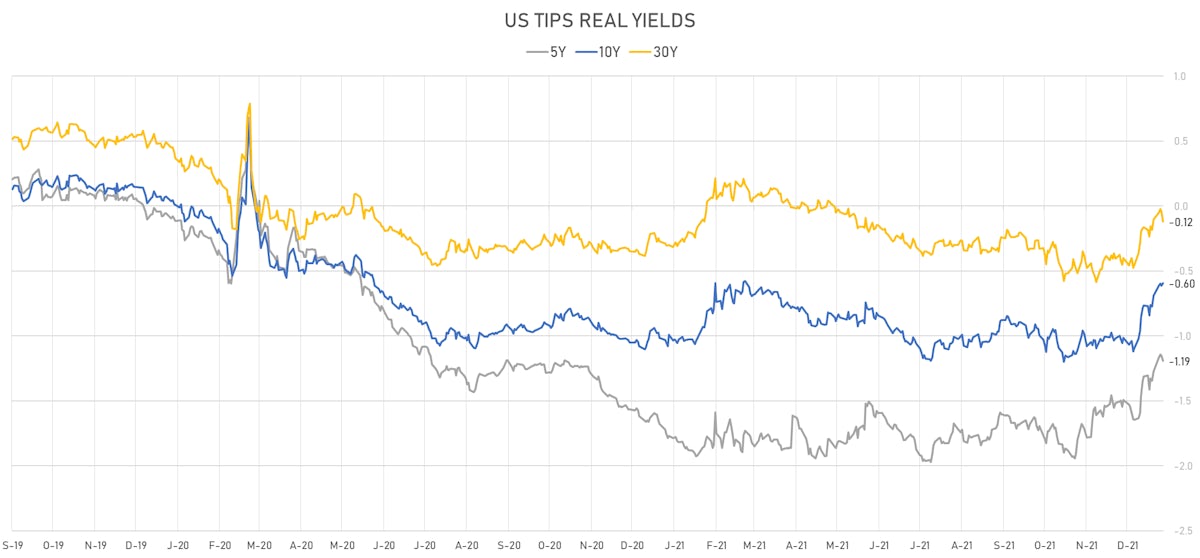

- US 5-Year TIPS Real Yield: -4.0 bp at -1.1930%; 10-Year TIPS Real Yield: +2.0 bp at -0.5950%; 30-Year TIPS Real Yield: -7.8 bp at -0.1200%

US MACRO RELEASES TODAY

- Leading Index, Change P/P for Dec 2021 (The Conference Board) at 0.80 % (vs 1.10 % prior), in line with consensus

FOMC PREVIEW

- No rate hike, but we will get an updated policy statement and Powell’s press conference

- The statement should indicate that the committee expects conditions to hike rates will be reached "soon" or "at upcoming meetings"

- Powell will likely also have something to say about the balance sheet runoff, as it is now expected to start after a couple of hikes

- That will leave the Fed able to start raising rates in March, with a 25bp hike at the 16 March FOMC (just after the conclusion of the QE taper)

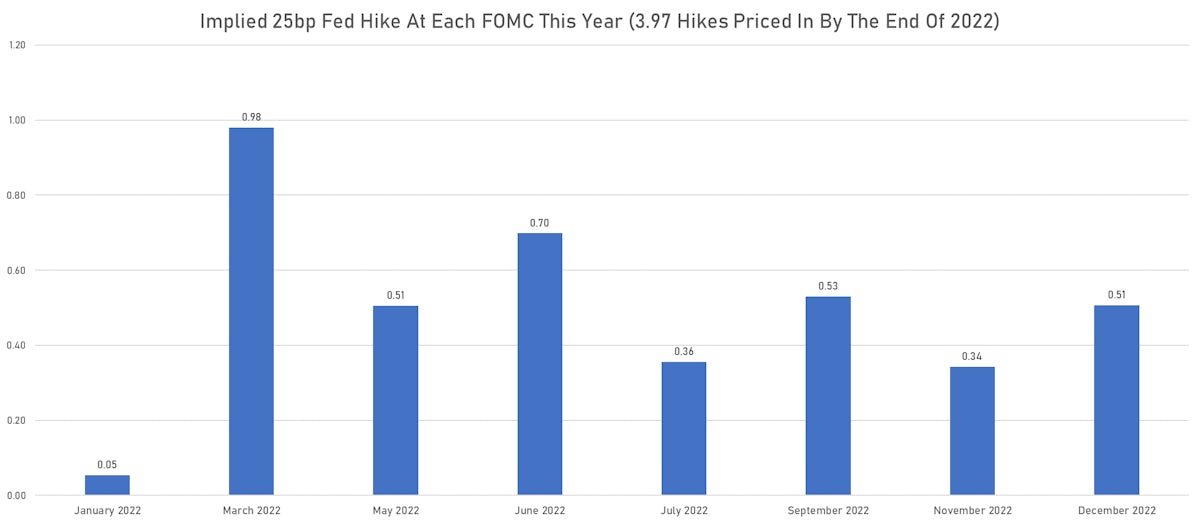

- With heightened focus on inflationary pressures, we now expect to see four 25bp hikes this year, at SEP FOMCs (when the Fed releases an updated Summary of Economic Projections): March, June, September, December

- The balance sheet runoff (quantitative tightening) is a more open question in terms of goals, timing and magnitude, but we expect it to start in July

- There is a tradeoff between QT and rate hikes: if the Fed just runs down its balance sheet passively, tightening financing conditions could require more than 4 hikes this year (which could lead to a spot Treasury curve inversion in 2s10s); if on the other hand the Fed uses QT offensively, as a policy tool targeting the belly and the back end of the curve, 4 hikes is probably on the high side for 2022.

- So, at current levels, the number of rate hikes looks like a fairly symmetric risk: the market prices in 4 hikes, but it could be 5 and could also be 3 depending on how QT shapes out.

- As we've mentioned before, a more asymmetric trade is to bet on a widening asset swap spread on Treasuries, with little upside QT risk priced into the curve at the moment

SUMMARY OF US MACRO RELEASES THIS PAST WEEK

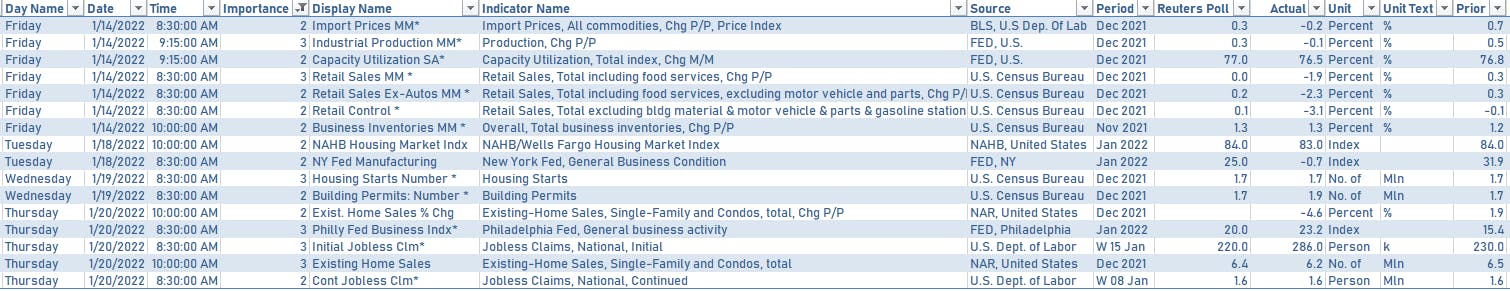

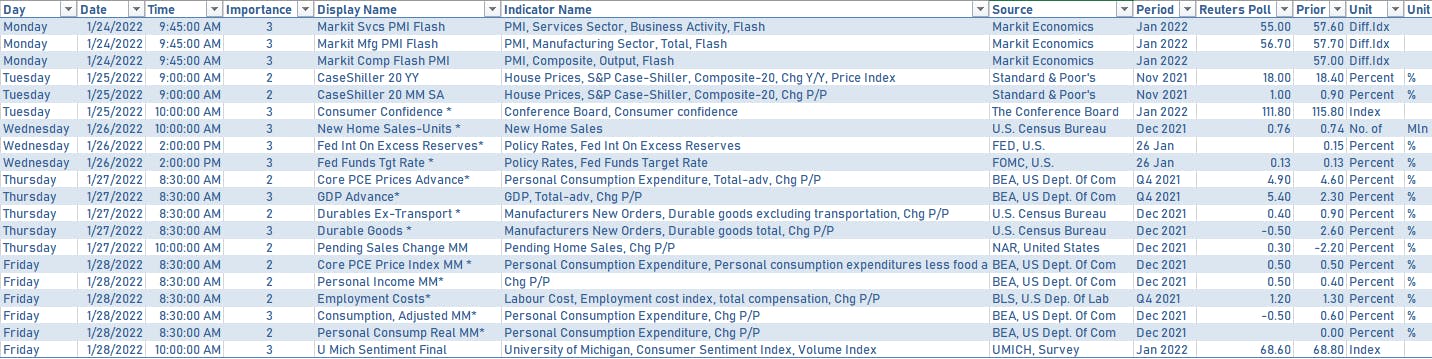

US MACRO RELEASES IN THE WEEK AHEAD

- A busy week ahead: on top of the FOMC, we will get Flash PMIs, new home sales, advance GDP data, core CPE

- US Treasury coupon-bearing auctions: 2Y on Monday (91282CDT5) with the when-issued currently yielding 1.0570%; 7Y on Thursday (91282CDW8) with the WI at 1.7350%

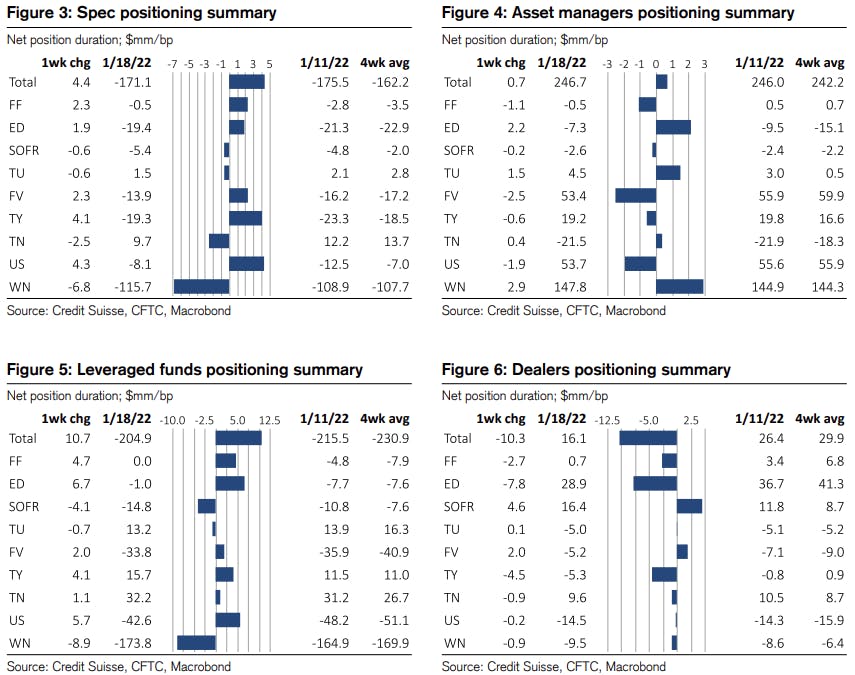

WEEKLY CFTC INTEREST RATEs POSITIONING UPDATE

- Specs: only modest changes in net exposure, with a slight increase in overall duration, though still massively net short (mostly at the long end of the curve)

- Same dynamics for leveraged funds, with the overall net short even more biased to the long end

US FORWARD RATES

- Fed Funds futures now imply changes of 25.8bp (103.4% probability of a 25bp hike) by the end of March 2022 and price in 4.0 hikes by the end of December 2022

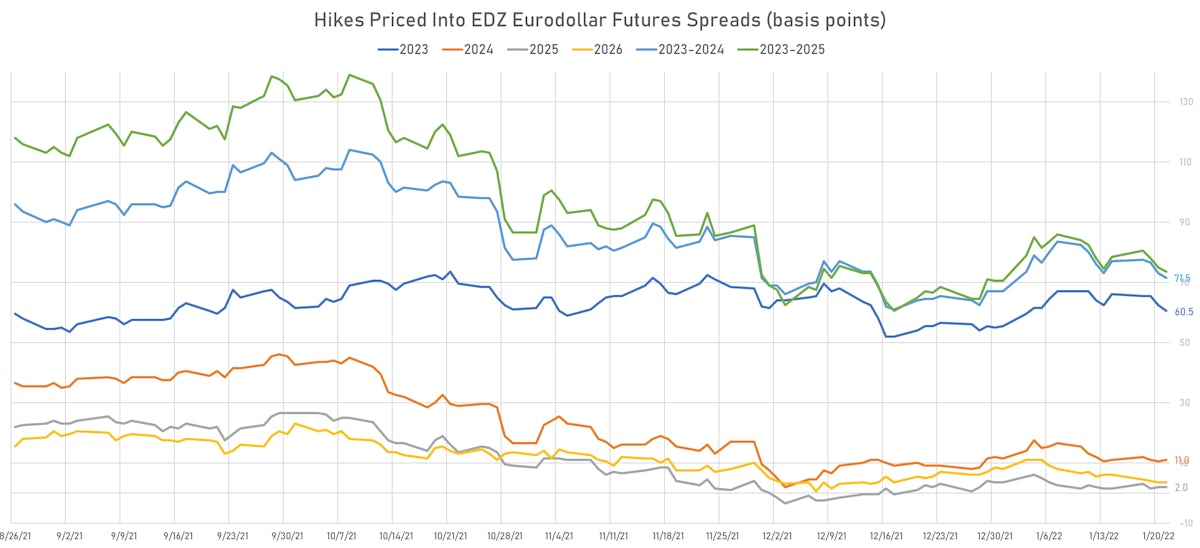

- Market still expecting a very shallow hiking cycle: 3-month Eurodollar futures (EDZ) spreads price in 60.5 bp of hikes in 2023 (equivalent to 2.4 x 25 bp hikes), down -2.0 bp today, and 11 bp of hikes in 2024 (equivalent to 0.4 x 25 bp hikes)

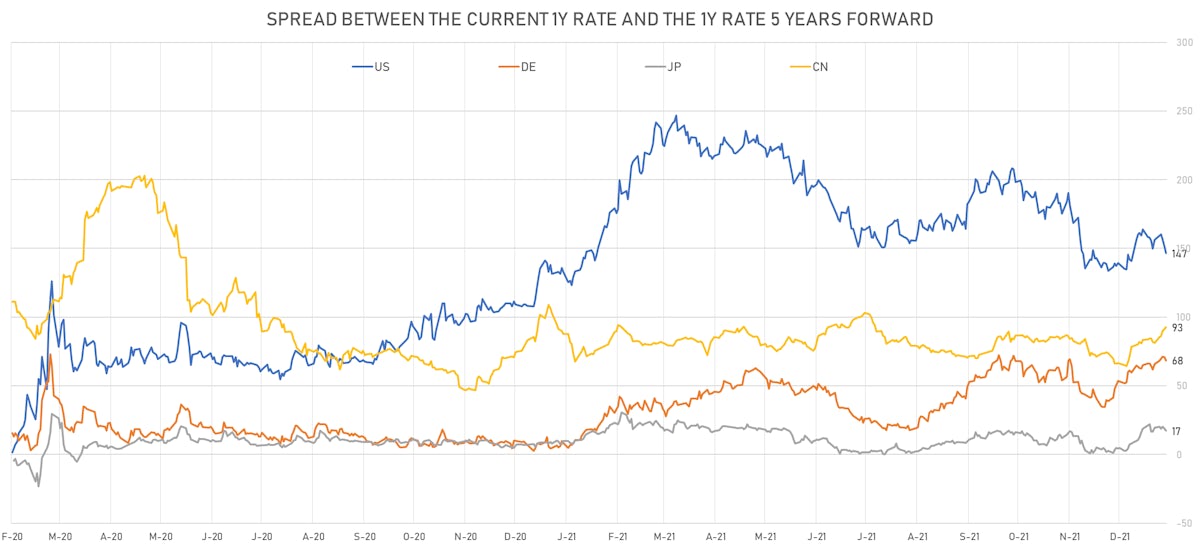

- 1-year US Treasury rate 5 years forward down 5.0 bp, now at 2.0736%, meaning that the 1-year Treasury rate is now expected to increase by 146.7 bp over the next 5 years (equivalent to 5.9 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.51% (down -1.2bp); 2Y at 3.24% (up 1.8bp); 5Y at 2.70% (up 2.4bp); 10Y at 2.37% (down -3.9bp); 30Y at 2.22% (up 3.9bp)

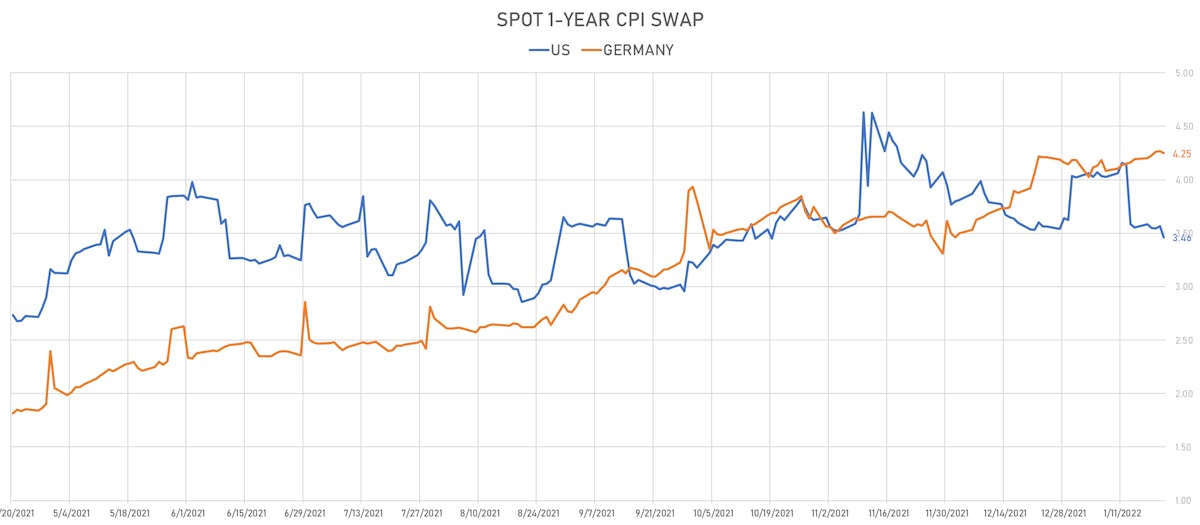

- 6-month spot US CPI swap down -12.2 bp to 3.703%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.1930%, -4.0 bp today; 10Y at -0.5950%, +2.0 bp today; 30Y at -0.1200%, -7.8 bp today

RATES VOLATILITY & LIQUIDITY

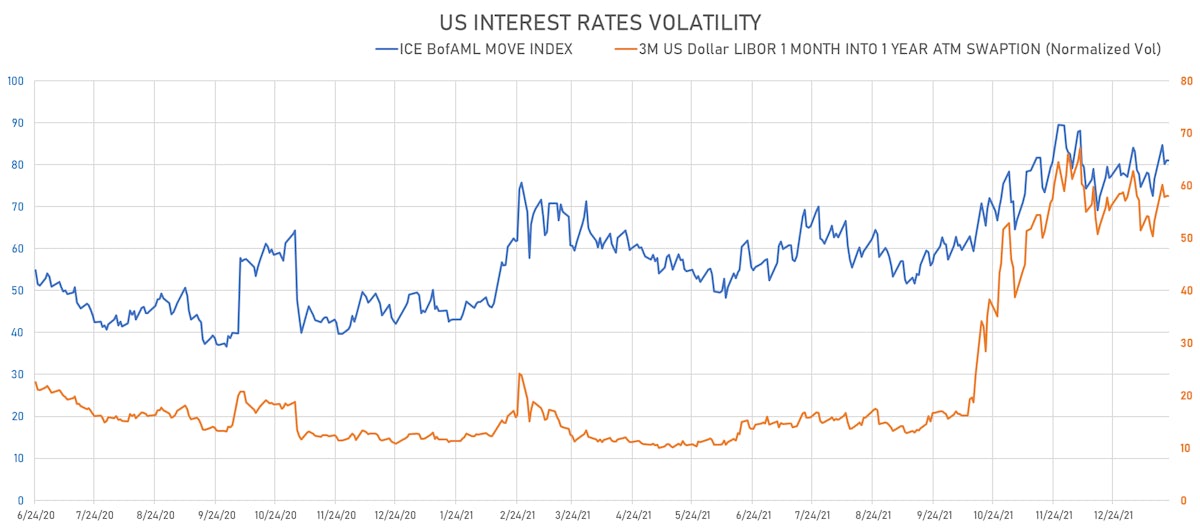

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) unchanged at 58.0%

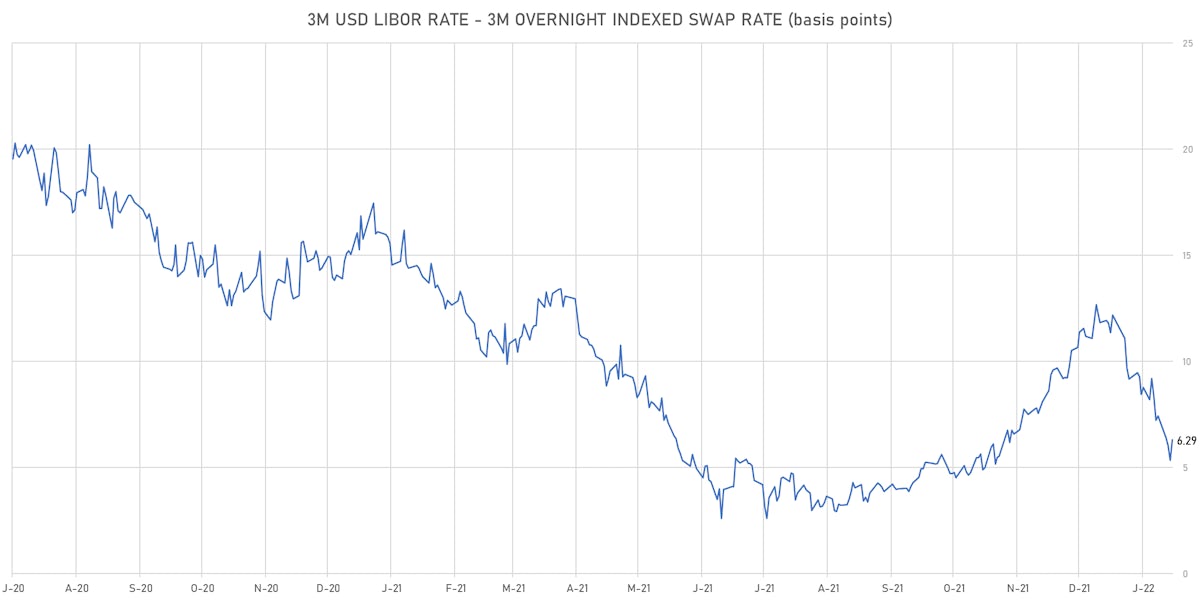

- 3-Month LIBOR-OIS spread up 1.0 bp at 6.3 bp (12-months range: 2.6-14.6 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.388% (down -3.1 bp); the German 1Y-10Y curve is 3.3 bp flatter at 59.2bp (YTD change: +15.9 bp)

- Japan 5Y: -0.027% (down -0.5 bp); the Japanese 1Y-10Y curve is 1.1 bp flatter at 20.9bp (YTD change: +5.7 bp)

- China 5Y: 2.398% (down -4.0 bp); the Chinese 1Y-10Y curve is 1.4 bp flatter at 68.0bp (YTD change: +17.0 bp)

- Switzerland 5Y: -0.279% (down -0.1 bp); the Swiss 1Y-10Y curve is 0.1 bp flatter at 72.1bp (YTD change: +14.0 bp)