Rates

US Rates Move Towards Flatter Curve And Higher Volatility, As Expected After The FOMC

The front end of the curve rose about 20bp this week (almost a full additional hike priced into Fed Funds futures for this year), but the curve flattened by the same amount, with inflation breakevens higher and real yields lower (probably not what the Fed had in mind)

Published ET

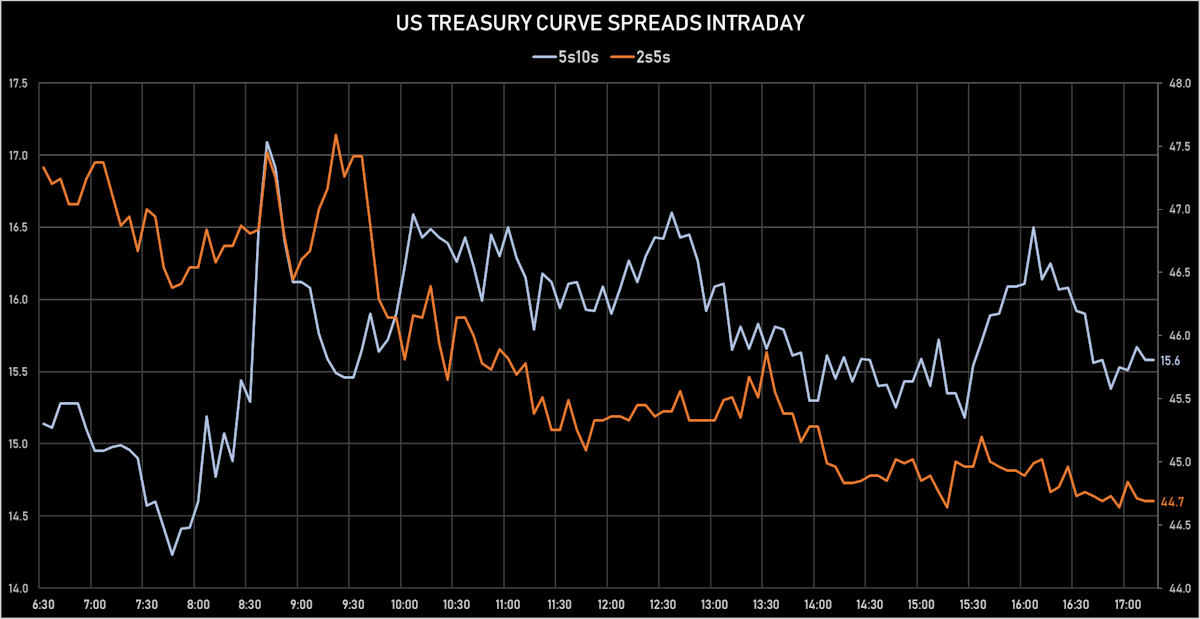

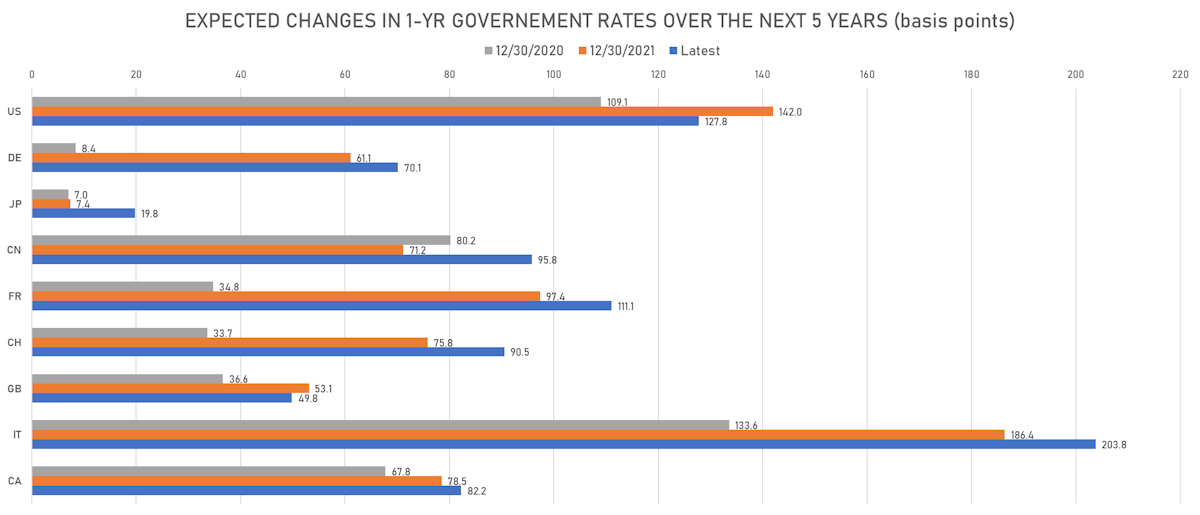

US Treasury Curve Spreads | Sources: ϕpost, Refinitiv data

WEEKLY US SUMMARY

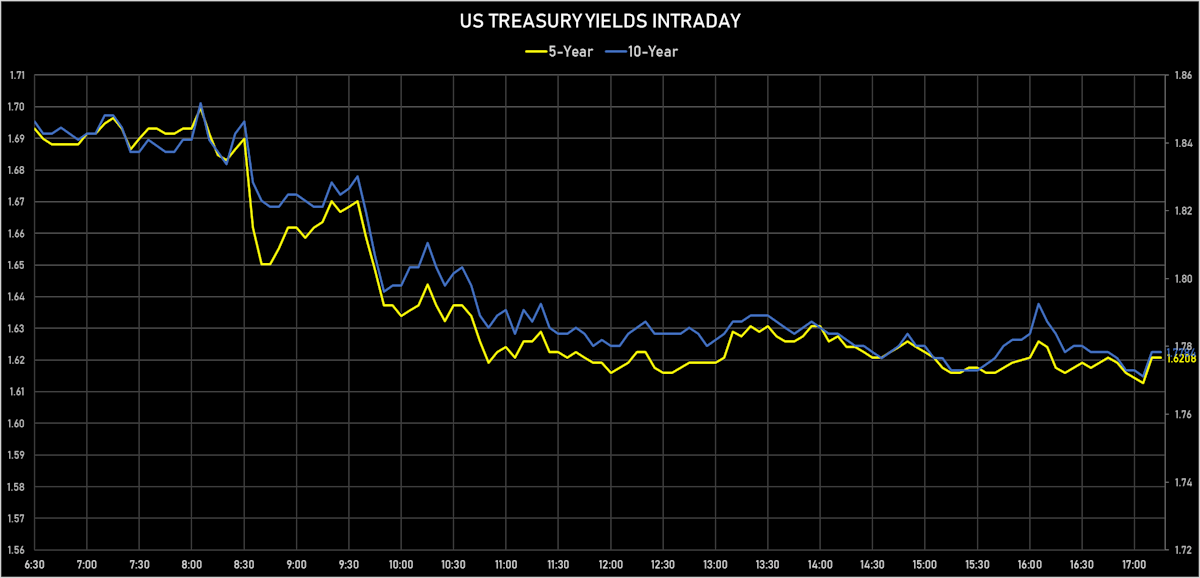

- The Treasury yield curve flattened, with the 1s10s spread tightening -19.4 bp, now at 102.4 bp (YTD change: -10.3bp)

- 1Y: 0.7540% (up 20.2 bp)

- 2Y: 1.1723% (up 15.7 bp)

- 5Y: 1.6208% (up 4.9 bp)

- 7Y: 1.7452% (up 1.7 bp)

- 10Y: 1.7784% (up 0.8 bp)

- 30Y: 2.0805% (down 0.4 bp)

- US treasury curve spreads: 3m2Y at 98.2bp (up 13.7bp this week), 2s5s at 45.0bp (down -10.8bp), 5s10s at 15.8bp (down -4.1bp), 10s30s at 30.2bp (down -1.2bp)

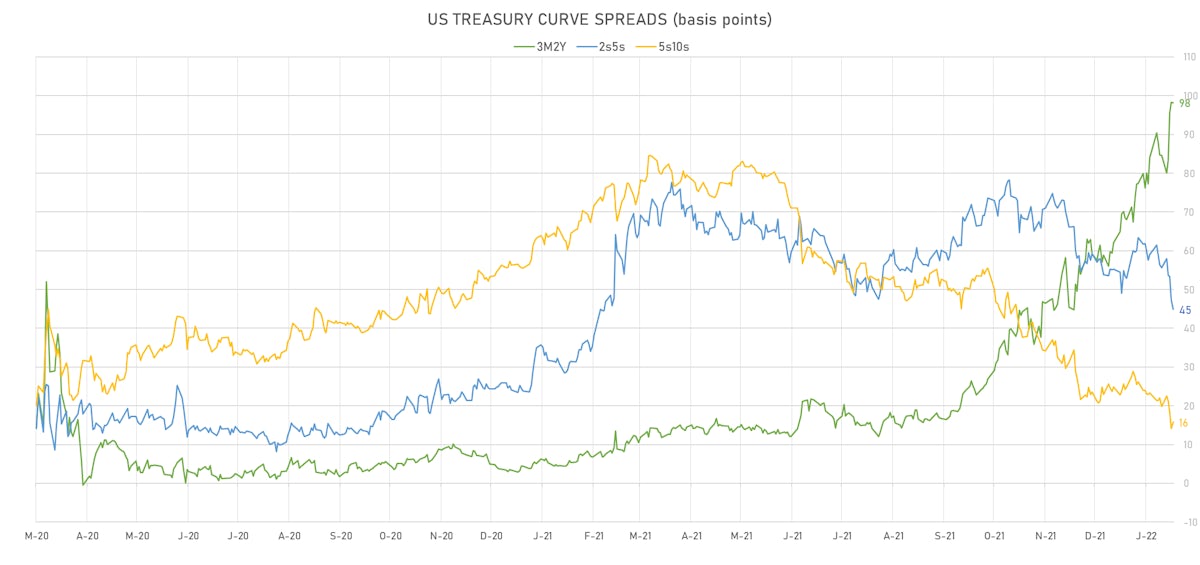

- TIPS 1Y breakeven inflation at 3.52% (up 1.1bp); 2Y at 3.27% (up 3.2bp); 5Y at 2.78% (up 8.6bp); 10Y at 2.46% (up 9.3bp); 30Y at 2.25% (up 2.5bp)

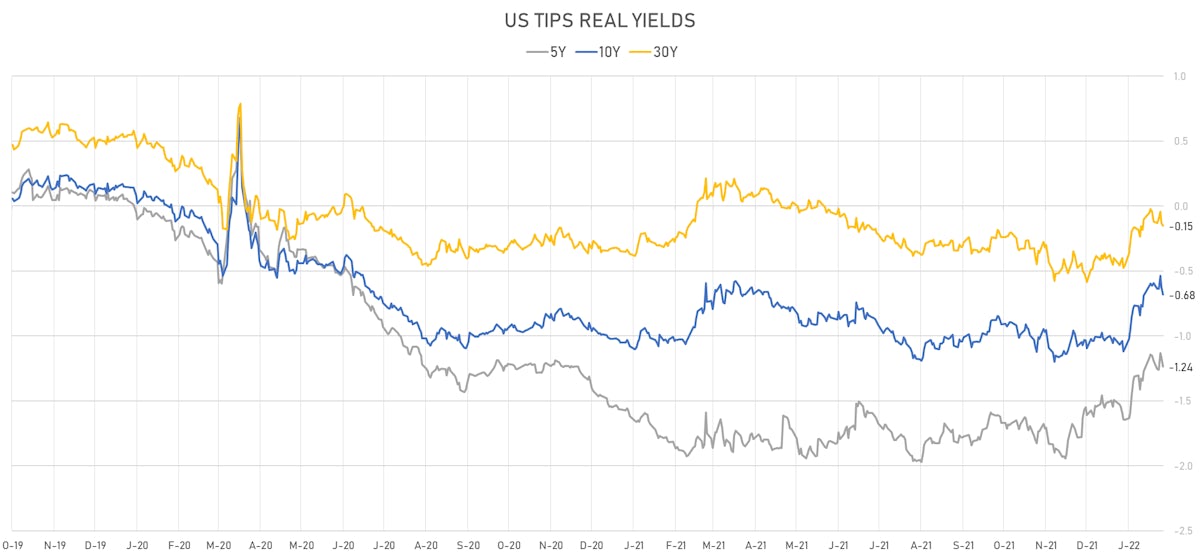

- US 5-Year TIPS Real Yield: -4.2 bp at -1.2350%; 10-Year TIPS Real Yield: -8.6 bp at -0.6810%; 30-Year TIPS Real Yield: -3.1 bp at -0.1510%

US MACRO RELEASES ON FRIDAY

- Personal consumption expenditures less food and energy, Change P/P for Dec 2021 (BEA, US Dept. Of Com) at 0.50 % (vs 0.50 % prior), in line with consensus

- Personal consumption expenditures less food and energy, Change Y/Y for Dec 2021 (BEA, US Dept. Of Com) at 4.90 % (vs 4.70 % prior), above consensus estimate of 4.80 %

- Personal Consumption Expenditure, Change P/P for Dec 2021 (BEA, US Dept. Of Com) at -0.60 % (vs 0.60 % prior), in line with consensus

- Personal Consumption Expenditure, Total, trimmed mean inflation rate (1-month annualized), Change M/M for Dec 2021 (Fed Reserve, Dallas) at 3.90 % (vs 4.30 % prior)

- Labour Cost, Employment cost index, benefit costs, Change P/P for Q4 2021 (BLS, U.S Dep. Of Lab) at 0.90 % (vs 0.90 % prior)

- Labour Cost, Employment cost index, wages and salaries, Change P/P for Q4 2021 (BLS, U.S Dep. Of Lab) at 1.10 % (vs 1.50 % prior)

- Labour Cost, Employment cost index, total compensation, Change P/P for Q4 2021 (BLS, U.S Dep. Of Lab) at 1.00 % (vs 1.30 % prior), below consensus estimate of 1.20 %

- University of Michigan, 5 Year Inflation Expectations (median), Change Y/Y for Jan 2022 (UMICH, Survey) at 3.10 % (vs 3.10 % prior)

- 1 Year Inflation Expectations (median) for Jan 2022 (UMICH, Survey) at 4.90 % (vs 4.90 % prior)

- University of Michigan, Consumer Expectations Index, Volume Index for Jan 2022 (UMICH, Survey) at 64.10 (vs 65.90 prior), below consensus estimate of 65.80

- University of Michigan, Consumer Sentiment Index, Volume Index for Jan 2022 (UMICH, Survey) at 67.20 (vs 68.80 prior), below consensus estimate of 68.70

- University of Michigan, Current Conditions Index, Volume Index for Jan 2022 (UMICH, Survey) at 72.00 (vs 73.20 prior)

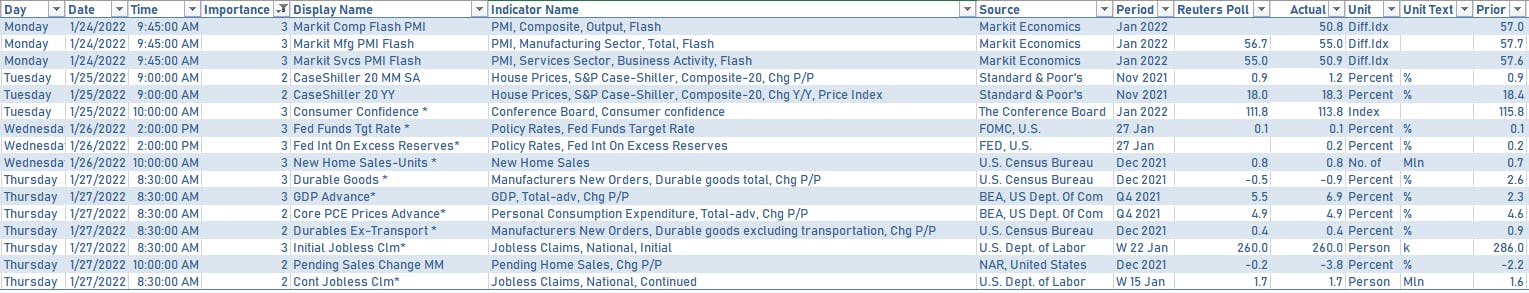

SUMMARY OF US MACRO DATA THIS WEEK

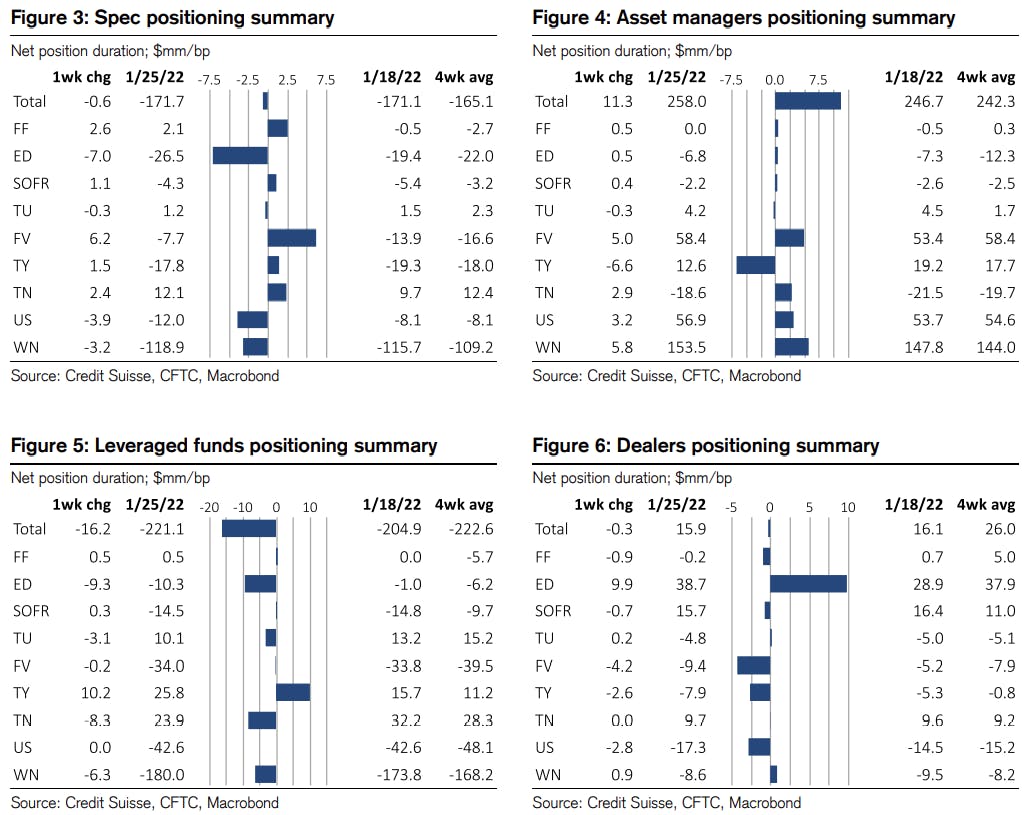

WEEKLY CFTC INTEREST RATES POSITIONING UPDATE

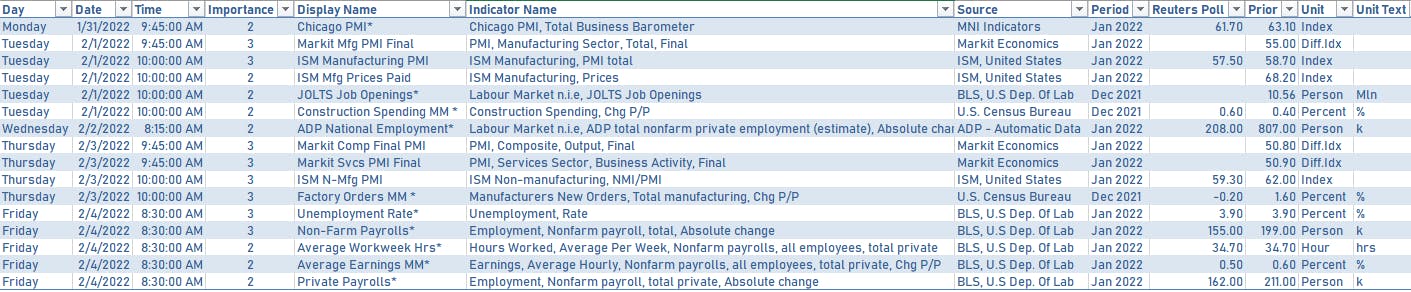

US MACRO RELEASES IN THE WEEK AHEAD

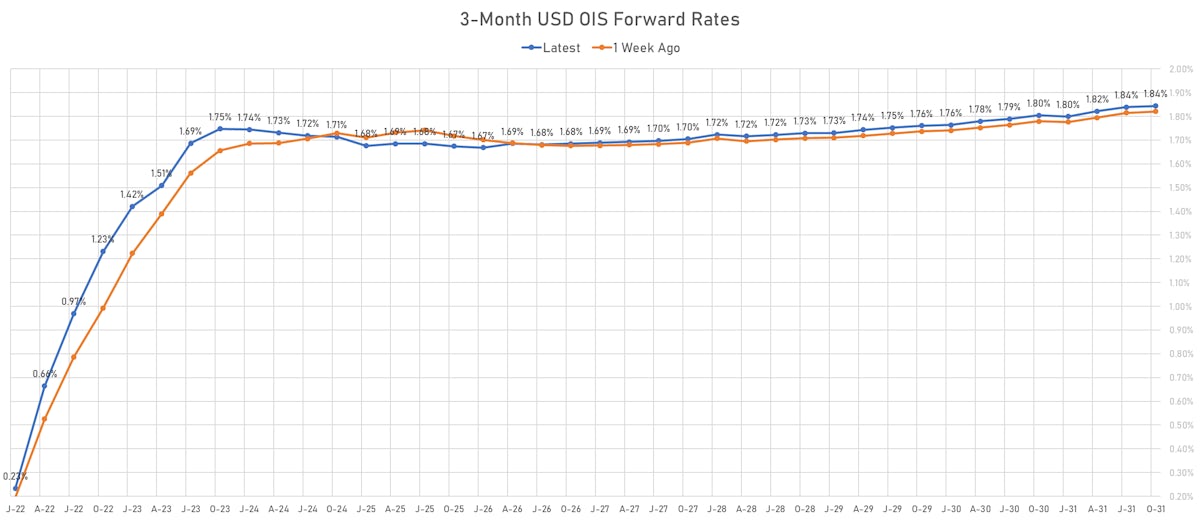

US FORWARD RATES

- Fed Funds futures now imply changes of 29.0bp (116.0% probability of a 25bp hike) by the end of March 2022, 48.8bp (1.95 x 25bp hikes) by the end of May 2022, and price in 4.75 hikes by the end of December 2022

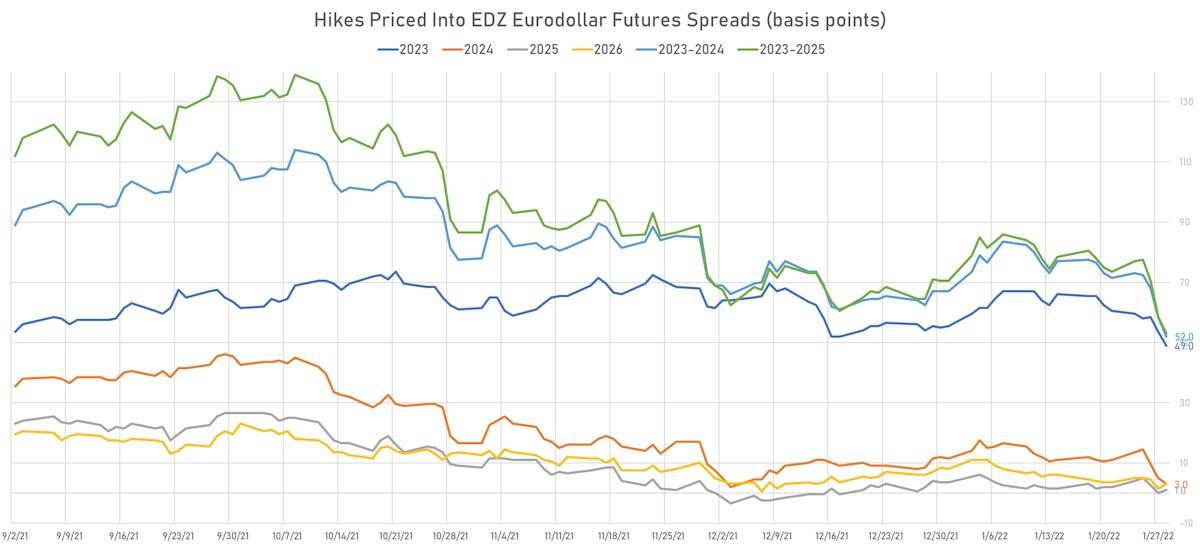

- 3-month Eurodollar futures (EDZ) spreads price in 49 bp of hikes in 2023 (equivalent to 2.0 x 25 bp hikes), down -4.5 bp today, and 3.0 bp of hikes in 2024 (equivalent to 0.1 x 25 bp hikes)

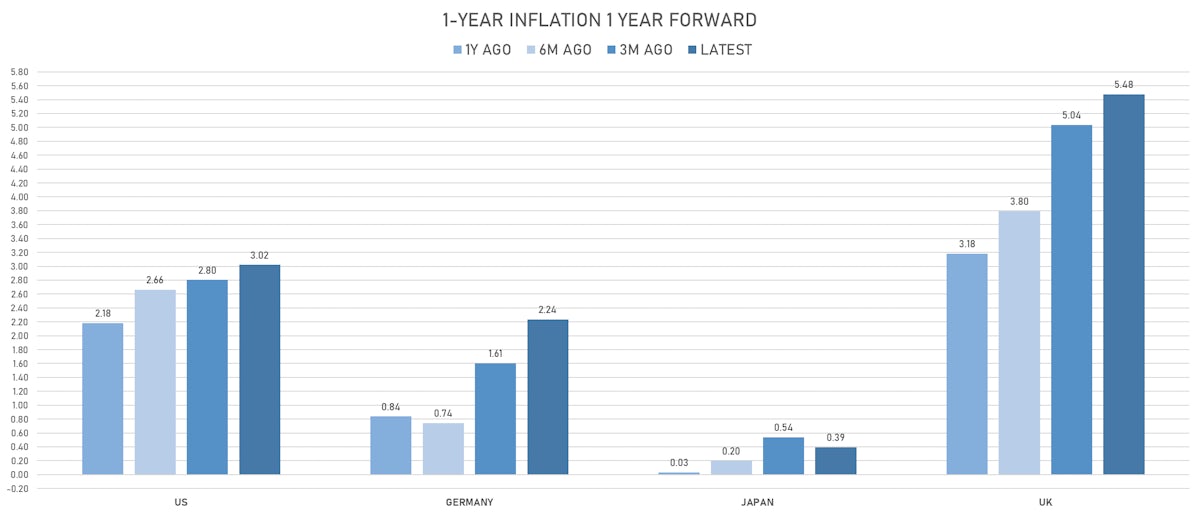

- 1-year US Treasury rate 5 years forward down 1.3 bp, now at 2.0371%, meaning that the 1-year Treasury rate is now expected to increase by 127.8 bp over the next 5 years (equivalent to 5.1 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.52% (up 2.5bp); 2Y at 3.27% (up 3.0bp); 5Y at 2.78% (up 2.7bp); 10Y at 2.46% (up 3.2bp); 30Y at 2.25% (up 1.0bp)

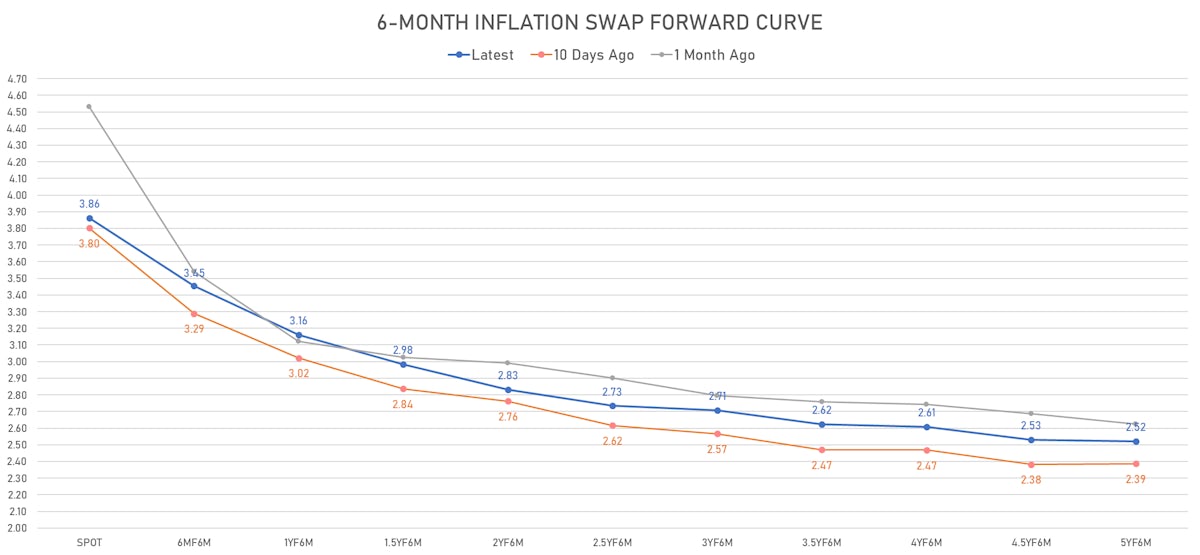

- 6-month spot US CPI swap up 111.1 bp to 3.862%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.2350%, -6.7 bp today; 10Y at -0.6810%, -5.7 bp today; 30Y at -0.1510%, -2.0 bp today

RATES VOLATILITY & LIQUIDITY

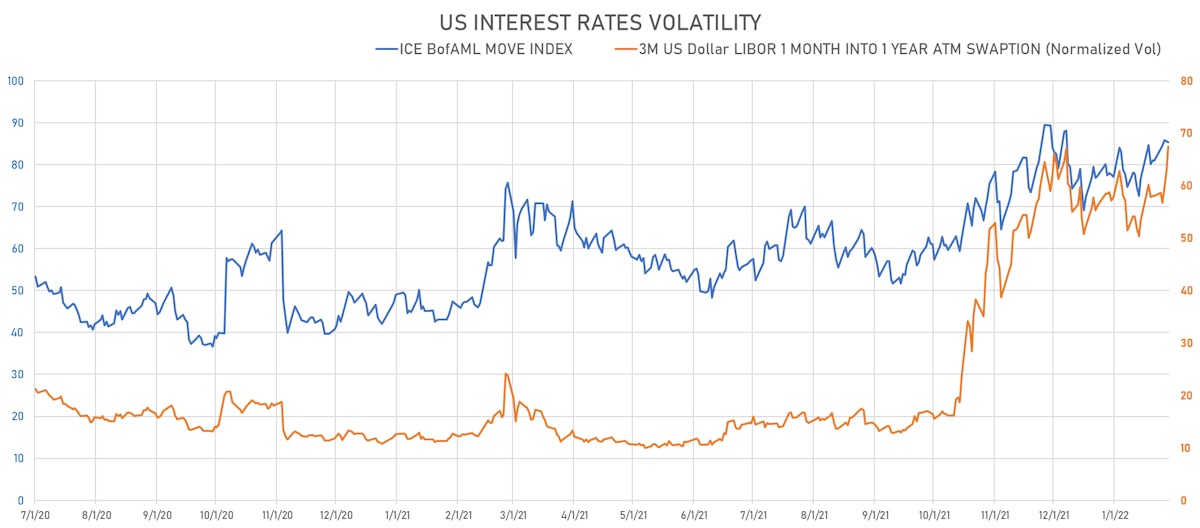

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 4.4% at 67.4%

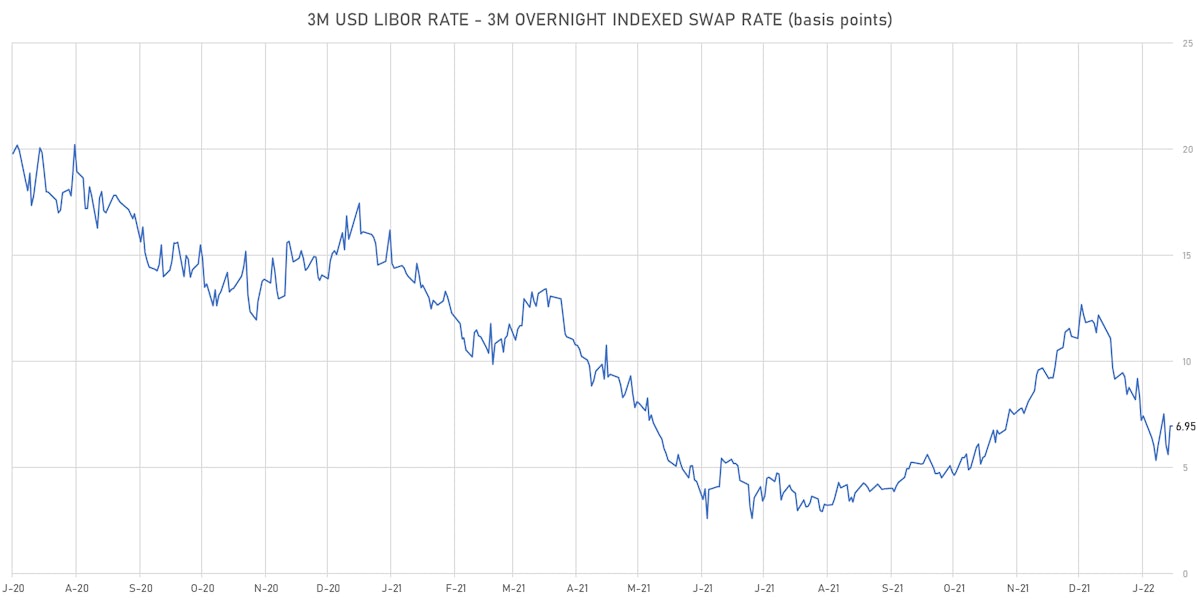

- 3-Month LIBOR-OIS spread at 7.0 bp (12-months range: 2.6-13.6 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: -0.354% (up 1.2 bp); the German 1Y-10Y curve is 1.0 bp steeper at 62.0bp (YTD change: +18.5 bp)

- Japan 5Y: -0.016% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.4 bp steeper at 23.7bp (YTD change: +7.6 bp)

- China 5Y: 2.418% (down -2.2 bp); the Chinese 1Y-10Y curve is 5.2 bp flatter at 69.4bp (YTD change: +18.4 bp)

- Switzerland 5Y: -0.250% (up 2.3 bp); the Swiss 1Y-10Y curve is 2.7 bp steeper at 70.2bp (YTD change: +14.7 bp)