Rates

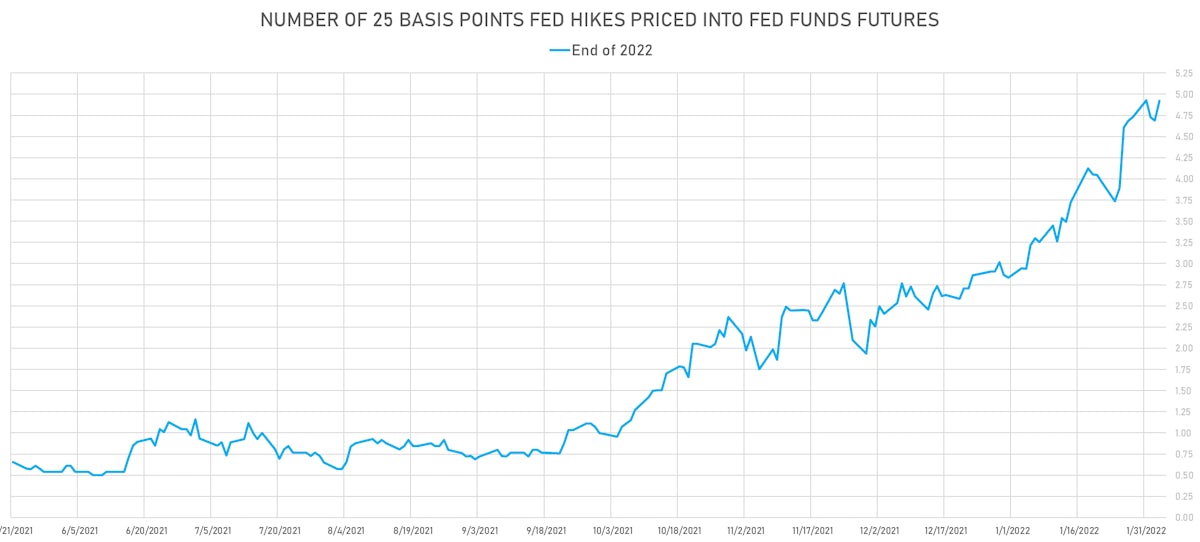

US Rates Curve Steepens At The Front End And Flattens From The Belly Out, With Market Implied Fed Hikes Up To 4.9 By End 2022

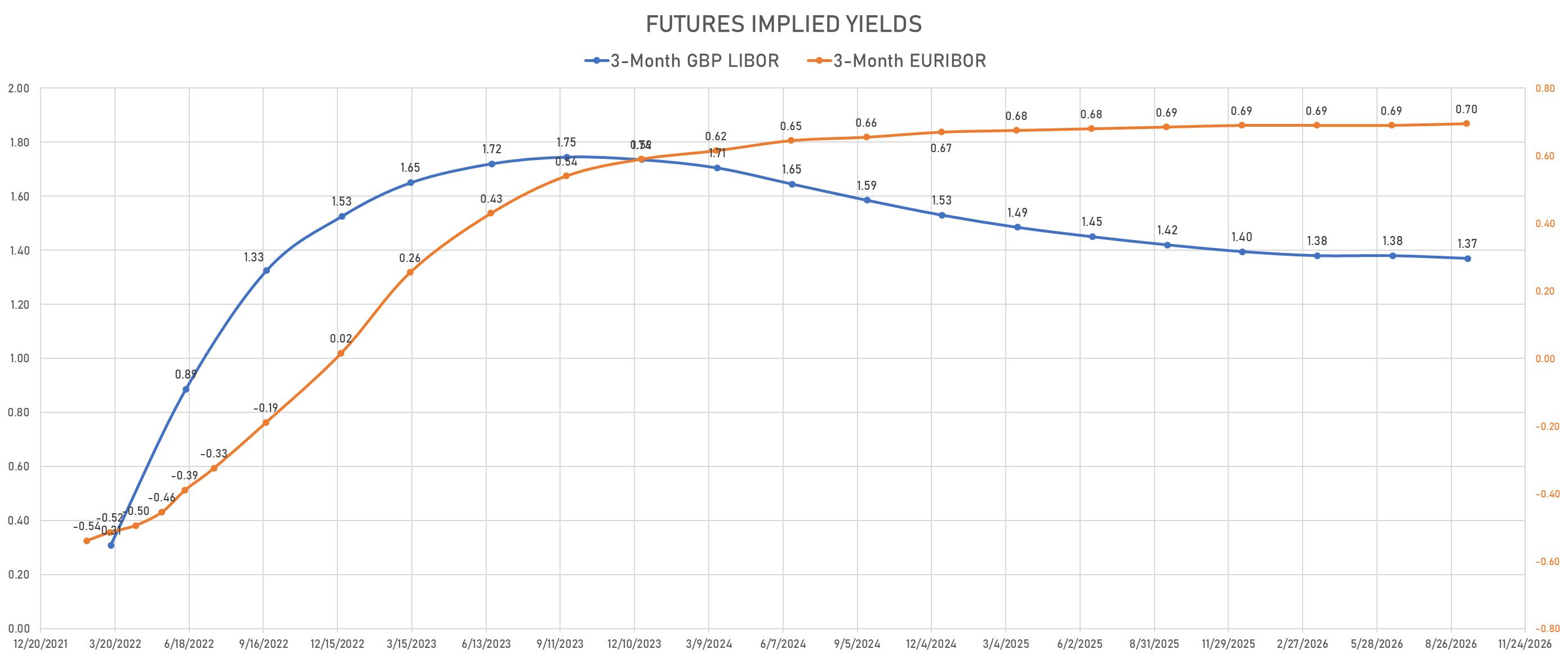

In Europe, the BoE raised rates by 25bp and the ECB didn't (both as expected), but the tone of their communication tilted hawkish, driving 1-year forward 3-month rates up 17bp in the UK, 20bp in the EZ, with market pricing now implying 4.2 hikes and 2.7 hikes over the next year respectively

Published ET

Euro, GBP 3-Month OIS 12-Month Forward | Source: Refinitiv

DAILY US SUMMARY

- 3-Month USD LIBOR -2.36bp today, now at 0.3225%; 3-Month OIS +3.6bp at 0.2685%

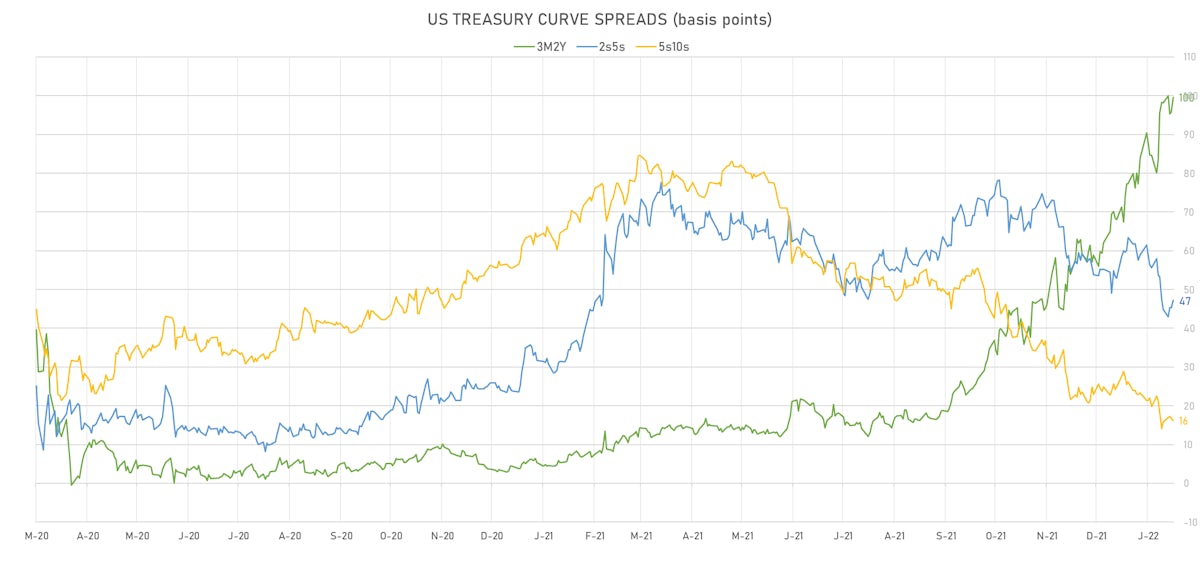

- The treasury yield curve steepened, with the 1s10s spread widening 3.4 bp, now at 109.2 bp (YTD change: -3.6bp)

- 5Y: 1.6737% (up 7.1 bp)

- 7Y: 1.8025% (up 6.8 bp)

- 10Y: 1.8360% (up 6.5 bp)

- 30Y: 2.1562% (up 5.0 bp)

- US treasury curve spreads: 3m2Y at 99.7bp (up 4.0bp today), 2s5s at 47.2bp (up 2.0bp), 5s10s at 16.2bp (down -0.6bp), 10s30s at 32.1bp (down -1.4bp)

- TIPS 1Y breakeven inflation at 3.59% (up 5.3bp); 2Y at 3.17% (down -2.3bp); 5Y at 2.73% (down -2.7bp); 10Y at 2.41% (down -2.1bp); 30Y at 2.18% (down -2.0bp)

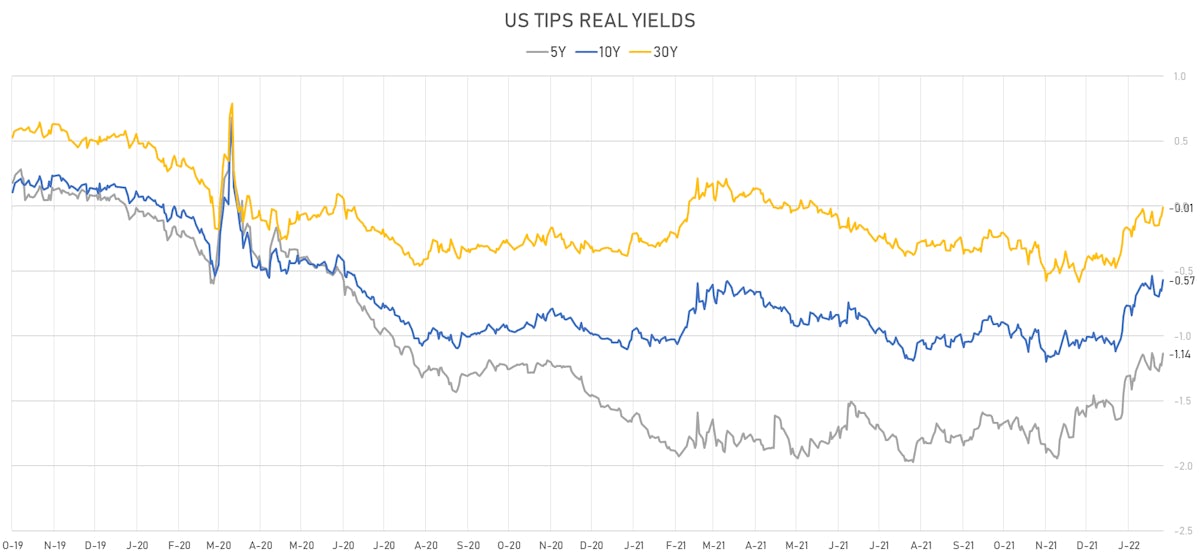

- US 5-Year TIPS Real Yield: +9.3 bp at -1.1360%; 10-Year TIPS Real Yield: +8.6 bp at -0.5680%; 30-Year TIPS Real Yield: +7.0 bp at -0.0100%

GLOBAL MACRO RELEASES

- Australia, Current Account, Goods and Services, Net for Dec 2021 (AU Bureau of Stat) at 8,356.00 Mln AUD (vs 9,423.00 Mln AUD prior)

- Australia, Dwellings Approved, Total building, Australia, Change P/P for Dec 2021 (AU Bureau of Stat) at 8.20 % (vs 3.60 % prior), above consensus estimate of -1.00 %

- Brazil, PMI, Composite, Output, Total for Jan 2022 (Markit Economics) at 50.90 (vs 52.00 prior)

- Brazil, PMI, Services Sector, Business Activity for Jan 2022 (Markit Economics) at 52.80 (vs 53.60 prior)

- Czech Republic, Policy Rates, Repo Rate (2 Week) for 04 Feb (Czech National Bank) at 4.50 % (vs 3.75 % prior), in line with consensus

- Egypt, Policy Rates, Overnight Deposit Rate for 07 Feb (Central Bank, Egypt) at 8.25 % (vs 8.25 % prior), in line with consensus

- Egypt, Policy Rates, Overnight Lending Rate for 07 Feb (Central Bank, Egypt) at 9.25 % (vs 9.25 % prior), in line with consensus

- Euro Zone, Domestic Producer Prices, Total excluding construction (EA19), Change P/P, Price Index for Dec 2021 (Eurostat) at 2.90 % (vs 1.80 % prior), above consensus estimate of 2.80 %

- Euro Zone, Domestic Producer Prices, Total excluding construction (EA19), Change Y/Y, Price Index for Dec 2021 (Eurostat) at 26.20 % (vs 23.70 % prior), above consensus estimate of 26.10 %

- Euro Zone, PMI, Composite, Output, Final for Jan 2022 (Markit Economics) at 52.30 (vs 52.40 prior), below consensus estimate of 52.40

- Euro Zone, PMI, Services Sector, Business Activity, Final for Jan 2022 (Markit Economics) at 51.10 (vs 51.20 prior), below consensus estimate of 51.20

- Euro Zone, Policy Rates, ECB Deposit Rate for Feb 2022 (ECB) at -0.50 % (vs -0.50 % prior), in line with consensus

- Euro Zone, Policy Rates, ECB Main refinancing, Fixed Rate (Announcement Dates) for Feb 2022 (ECB) at 0.00 % (vs 0.00 % prior), in line with consensus

- France, PMI, Composite, Output, Final for Jan 2022 (Markit/CDAF, France) at 52.70 (vs 52.70 prior), in line with consensus

- France, PMI, Services Sector, Business Activity, Final for Jan 2022 (Markit Economics) at 53.10 (vs 53.10 prior), in line with consensus

- Germany, PMI, Composite, Output, Final for Jan 2022 (Markit Economics) at 53.80 (vs 54.30 prior), below consensus estimate of 54.30

- Germany, PMI, Services Sector, Business Activity, Final for Jan 2022 (Markit Economics) at 52.20 (vs 52.20 prior), in line with consensus

- India, IHS Markit, PMI, Services Sector, Business Activity for Jan 2022 (Markit Economics) at 51.50 (vs 55.50 prior), below consensus estimate of 53.00

- Ireland, PMI, Services Sector, Business Activity for Jan 2022 (Markit Economics) at 56.20 (vs 55.40 prior)

- Italy, PMI, Services Sector, Business Activity for Jan 2022 (Markit Economics) at 48.50 (vs 53.00 prior), below consensus estimate of 50.00

- Japan, Jibun Bank, PMI, Services Sector, Service PMI for Jan 2022 (Markit Economics) at 47.60 (vs 52.10 prior)

- Malaysia, IHS Markit, PMI, Manufacturing Sector, IHS Markit Mfg PMI for Jan 2022 (Markit Economics) at 50.50 (vs 52.80 prior)

- Norway, Housing Prices YY for Jan 2022 (EN/REN, Finn, Eiendo) at 6.80 % (vs 5.20 % prior)

- Qatar, QFC PMI, Non-Oil Private Sector, Total for Jan 2022 (Markit Economics) at 57.60 (vs 61.40 prior)

- Qatar, QFC PMI, Non-Oil Private Sector, Total for Jan 2022 (Markit Economics) at 59.30 (vs 63.00 prior)

- Russia, PMI, Services Sector, Business Activity for Jan 2022 (Markit Economics) at 49.80 (vs 49.50 prior)

- Saudi Arabia, IHS Markit, PMI, Composite, Output, IHS Markit PMI for Jan 2022 (Markit Economics) at 53.20 (vs 53.90 prior)

- South Africa, Standard Bank PMI for Jan 2022 (Markit Economics) at 50.90 (vs 48.40 prior)

- South Korea, CPI, Change P/P, Price Index for Jan 2022 (KOSTAT - Korea) at 0.60 % (vs 0.20 % prior), above consensus estimate of 0.40 %

- South Korea, CPI, Change Y/Y, Price Index for Jan 2022 (KOSTAT - Korea) at 3.60 % (vs 3.70 % prior), above consensus estimate of 3.30 %

- South Korea, IHS Markit, PMI, Manufacturing Sector, IHS Markit PMI, Manufacturing for Jan 2022 (Markit Economics) at 52.80 (vs 51.90 prior)

- Spain, PMI, Services Sector, Business Activity for Jan 2022 (Markit Economics) at 46.60 (vs 55.80 prior), below consensus estimate of 51.50

- Turkey, CPI, Change P/P, Price Index for Jan 2022 (TURKSTAT) at 11.10 % (vs 13.58 % prior), above consensus estimate of 9.80 %

- United Arab Emirates, IHS Markit, PMI, Composite, Output, IHS Markit PMI for Jan 2022 (Markit Economics) at 54.10 (vs 55.60 prior)

- United Kingdom, PMI, Services Sector, Business Activity, Markit/CIPS for Jan 2022 (Markit Economics) at 54.10 (vs 53.30 prior), above consensus estimate of 53.30

- United Kingdom, Policy Rates, BOE MPC Vote Cut, Volume for Feb 2022 (Bank of England) at 0.00 (vs 0.00 prior), in line with consensus

- United Kingdom, Policy Rates, BOE MPC Vote Hike, Volume for Feb 2022 (Bank of England) at 9.00 (vs 8.00 prior), in line with consensus

- United Kingdom, Policy Rates, BOE MPC Vote Unchanged, Volume for Feb 2022 (Bank of England) at 0.00 (vs 1.00 prior), in line with consensus

- United Kingdom, Policy Rates, Bank Rate for Feb 2022 (Bank of England) at 0.50 % (vs 0.25 % prior), in line with consensus

- United Kingdom, Reserves, Gross, Government, Current Prices for Jan 2022 (HM Treasury) at 19,6480.43 Mln USD (vs 20,3709.23 Mln USD prior)

- United States, ISM Non-manufacturing, NMI/PMI for Jan 2022 (ISM, United States) at 59.90 (vs 62.00 prior), above consensus estimate of 59.50

- United States, Jobless Claims, National, Continued for W 22 Jan (U.S. Dept. of Labor) at 1.63 Mln (vs 1.68 Mln prior), above consensus estimate of 1.62 Mln

- United States, Jobless Claims, National, Initial for W 29 Jan (U.S. Dept. of Labor) at 238.00 k (vs 260.00 k prior), below consensus estimate of 245.00 k

- United States, Labour Cost, Total-prelim for Q4 2021 (BLS, U.S Dep. Of Lab) at 0.30 % (vs 9.60 % prior), below consensus estimate of 1.50 %

- United States, Labour Productivity, Total-prelim for Q4 2021 (BLS, U.S Dep. Of Lab) at 6.60 % (vs -5.20 % prior), above consensus estimate of 3.20 %

- United States, Manufacturers New Orders, Total manufacturing, Change P/P for Dec 2021 (U.S. Census Bureau) at -0.40 % (vs 1.60 % prior), below consensus estimate of -0.20 %

- United States, PMI, Composite, Output, Final for Jan 2022 (Markit Economics) at 51.10 (vs 50.80 prior)

- United States, PMI, Services Sector, Business Activity, Final for Jan 2022 (Markit Economics) at 51.20 (vs 50.90 prior)

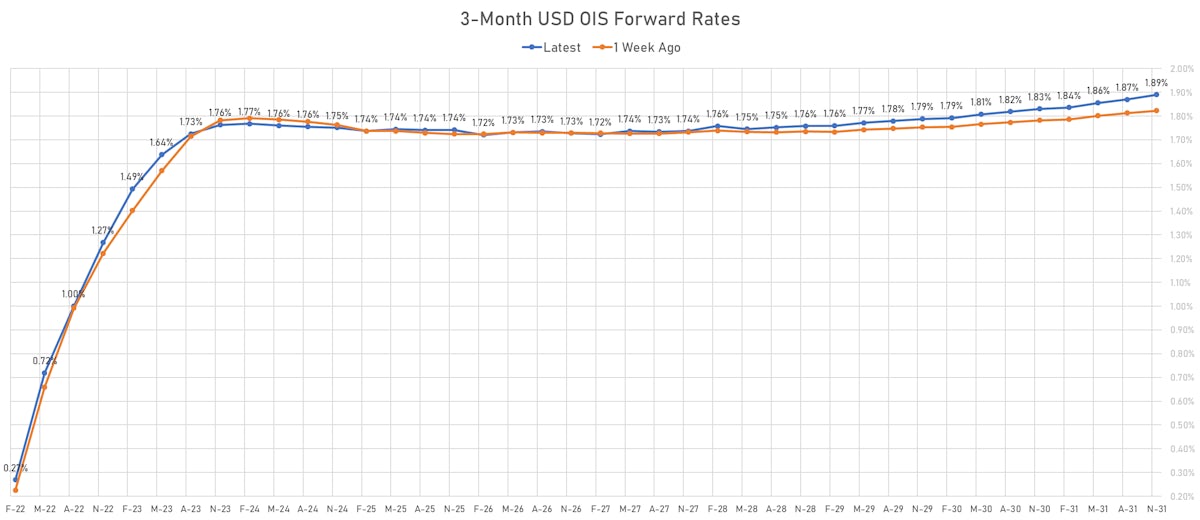

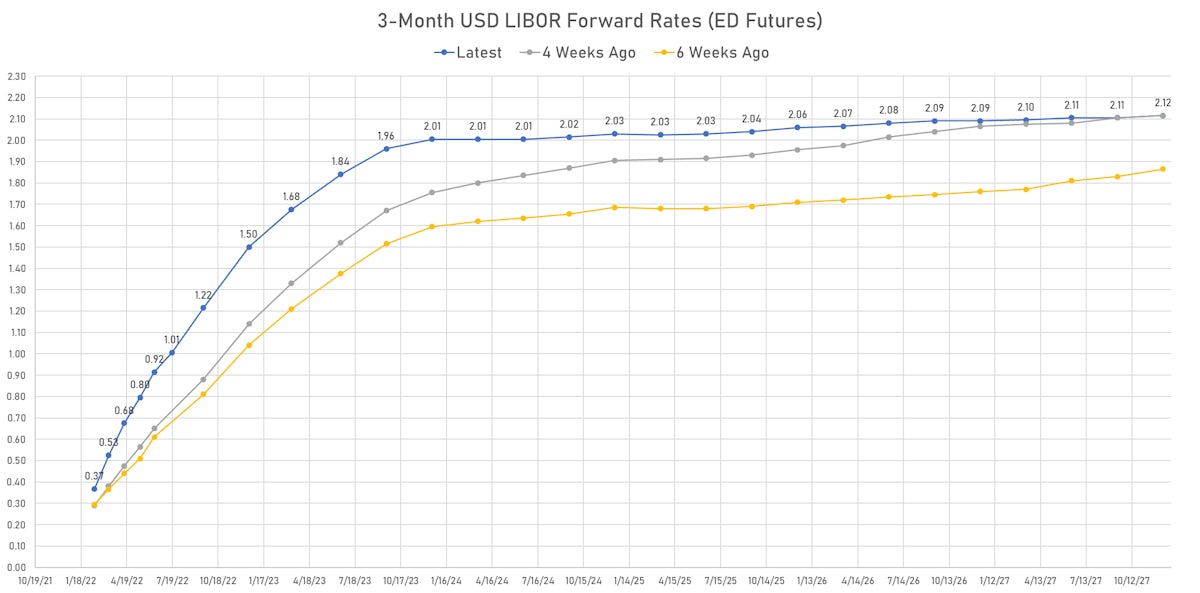

US FORWARD RATES

- Fed Funds futures now price in 30.6bp of Fed hikes by the end of March 2022, 51.3bp (2.05 x 25bp hikes) by the end of May 2022, and price in 4.89 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 50.5 bp of hikes in 2023 (equivalent to 2.0 x 25 bp hikes), up TRUE bp today, and 2.5 bp of hikes in 2024 (equivalent to 0.1 x 25 bp hikes)

- 1-year US Treasury rate 5 years forward up 6.4 bp, now at 2.0988%, meaning that the 1-year Treasury rate is now expected to increase by 129.3 bp over the next 5 years

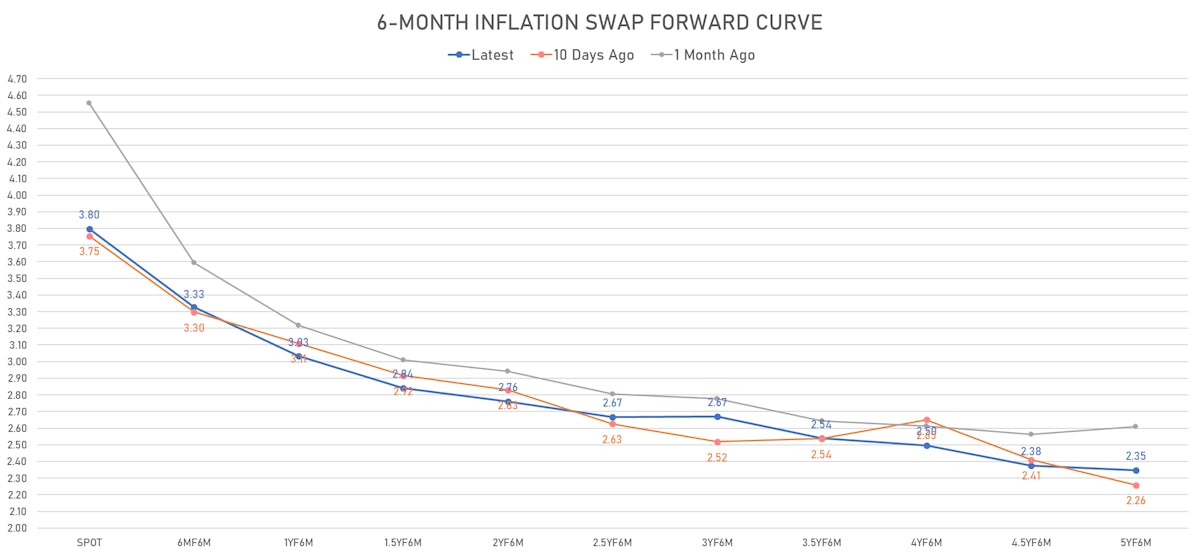

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.59% (up 5.3bp); 2Y at 3.17% (down -2.3bp); 5Y at 2.73% (down -2.7bp); 10Y at 2.41% (down -2.1bp); 30Y at 2.18% (down -2.0bp)

- 6-month spot US CPI swap down -1.8 bp to 3.797%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.1360%, +9.3 bp today; 10Y at -0.5680%, +8.6 bp today; 30Y at -0.0100%, +7.0 bp today

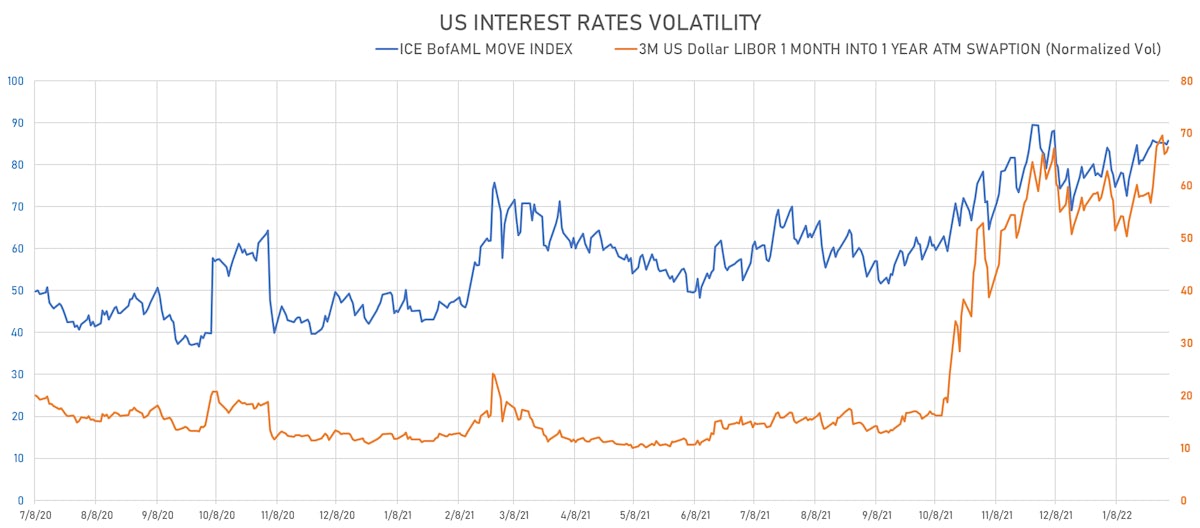

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.9% at 67.3%

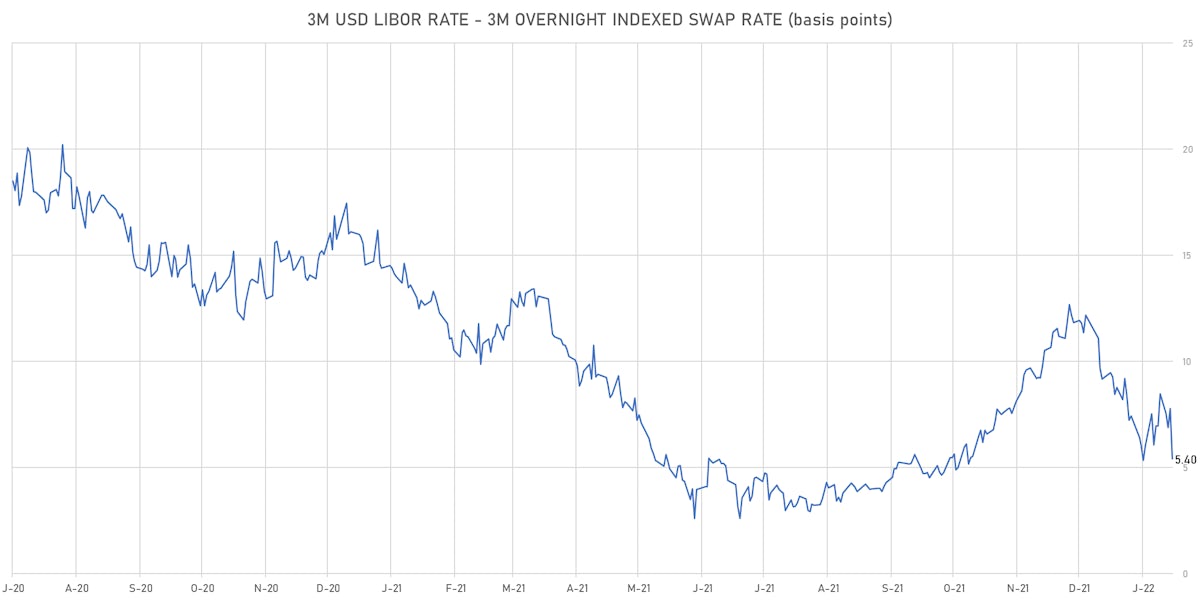

- 3-Month LIBOR-OIS spread down -2.4 bp at 5.4 bp (12-months range: 2.6-13.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.083% (up 16.0 bp); the German 1Y-10Y curve is 9.0 bp steeper at 79.6bp (YTD change: +36.8 bp)

- Japan 5Y: -0.003% (unchanged); the Japanese 1Y-10Y curve is 0.4 bp steeper at 26.8bp (YTD change: +9.1 bp)

- China 5Y: 2.412% (down -0.6 bp); the Chinese 1Y-10Y curve is 1.0 bp steeper at 75.4bp (YTD change: +21.2 bp)

- Switzerland 5Y: -0.053% (up 13.1 bp); the Swiss 1Y-10Y curve is 9.2 bp steeper at 77.4bp (YTD change: +27.9 bp)

EURO & GBP MONEY MARKET FUTURES IMPLIED YIELDS

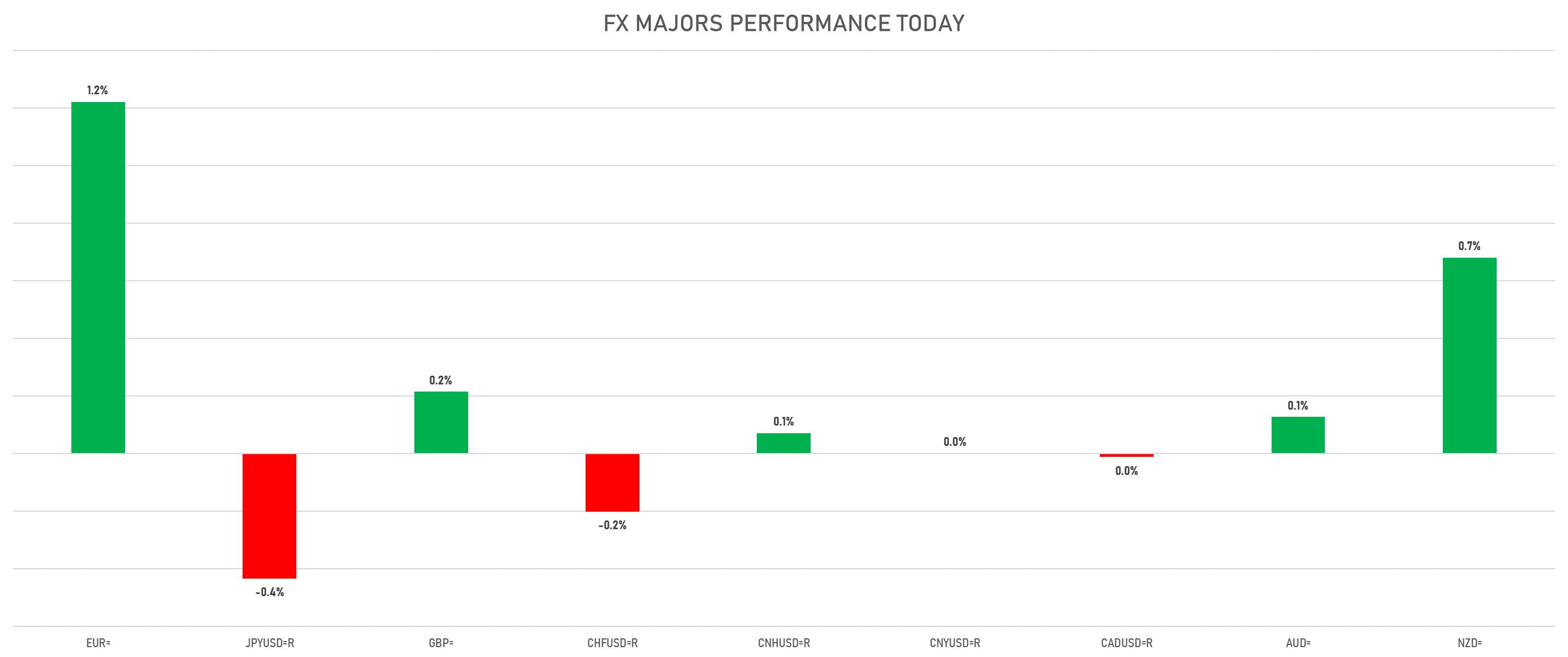

EURO UP 1.2% TODAY ON ECB HAWKISH TILT