Rates

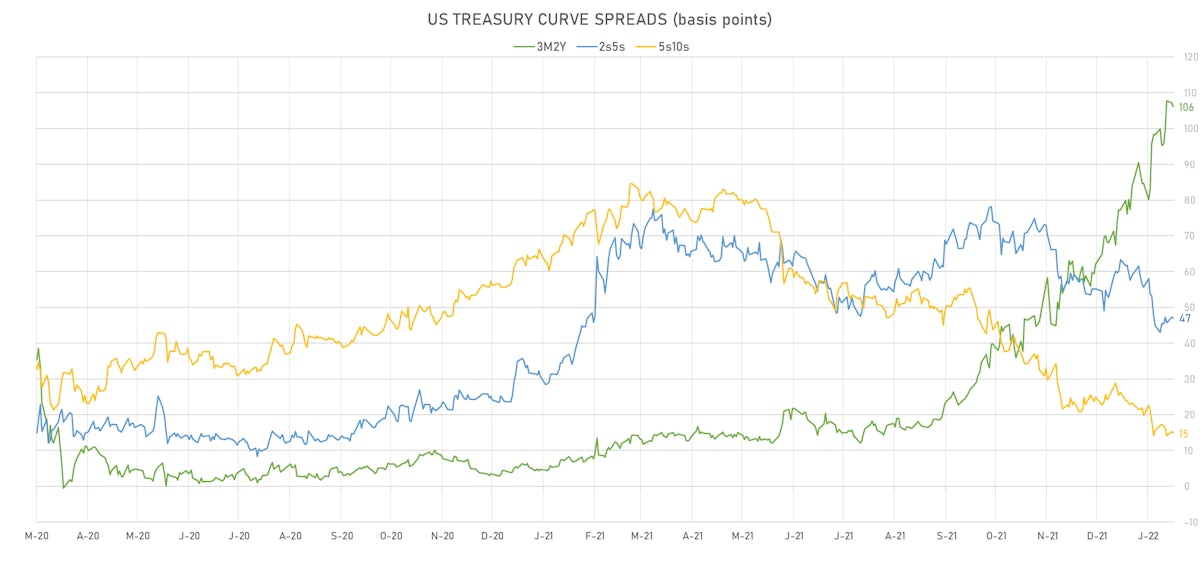

US Treasury Yields Rise Out To The Belly, Flatten Further Down The Curve As Macro Uncertainty Keeps Volatility High

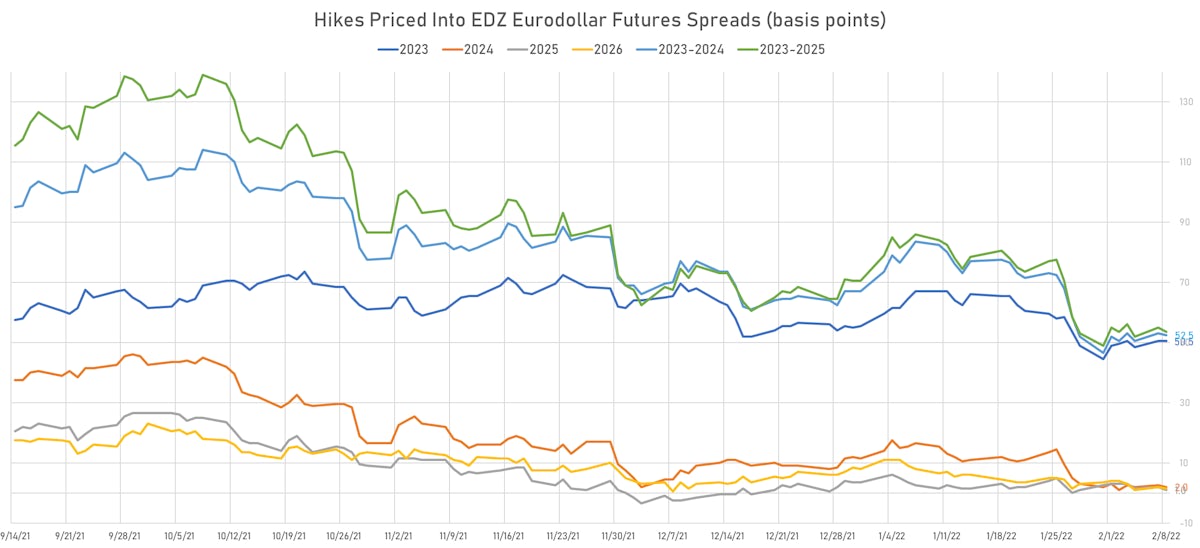

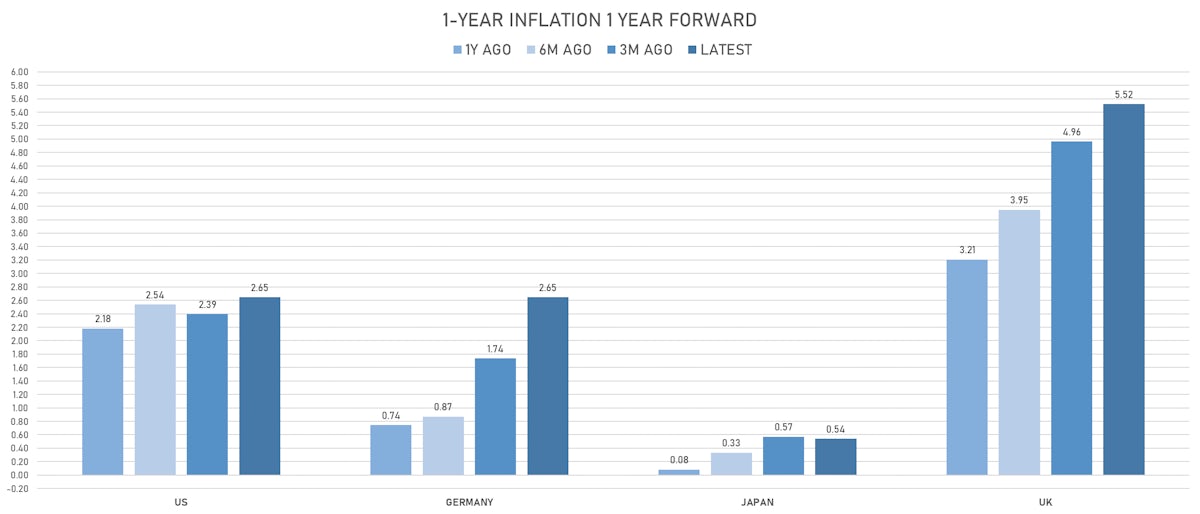

Eurodollar futures continue to see a very short rate normalization cycle, with almost no hike expected after 2023, while the 3M USD OIS forward curve is getting more deeply inverted (-11bp 2023 / 2026 spread)

Published ET

3-Month USD OIS Forward Rates | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR -0.71bp today, now at 0.3663%; 3-Month OIS +1.1bp at 0.3050%

- The treasury yield curve steepened, with the 1s10s spread widening 2.8 bp, now at 110.0 bp (YTD change: -2.8bp)

- 1Y: 0.8650% (up 1.8 bp)

- 2Y: 1.3455% (up 5.1 bp)

- 5Y: 1.8167% (up 5.0 bp)

- 7Y: 1.9388% (up 4.7 bp)

- 10Y: 1.9650% (up 4.6 bp)

- 30Y: 2.2601% (up 4.2 bp)

- US treasury curve spreads: 3m2Y at 106.1bp (down -1.0bp today), 2s5s at 47.1bp (down -0.1bp), 5s10s at 14.8bp (down -0.4bp), 10s30s at 29.5bp (down -0.4bp)

- Treasuries butterfly spreads: 1s5s10s at -79.8bp (down -3.1bp), 5s10s30s at 14.5bp (down -0.2bp)

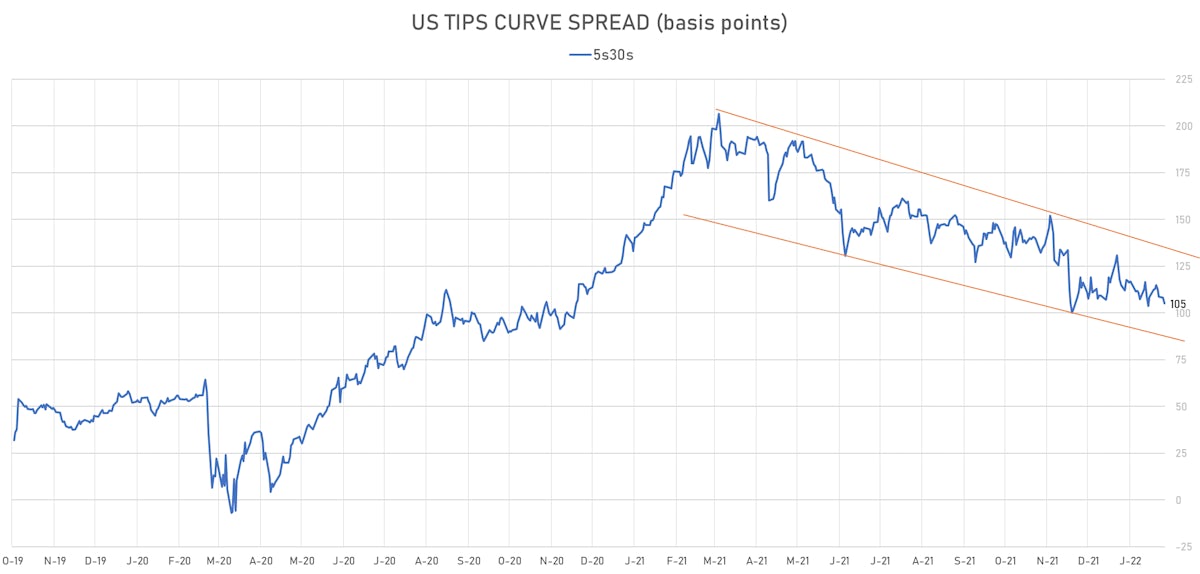

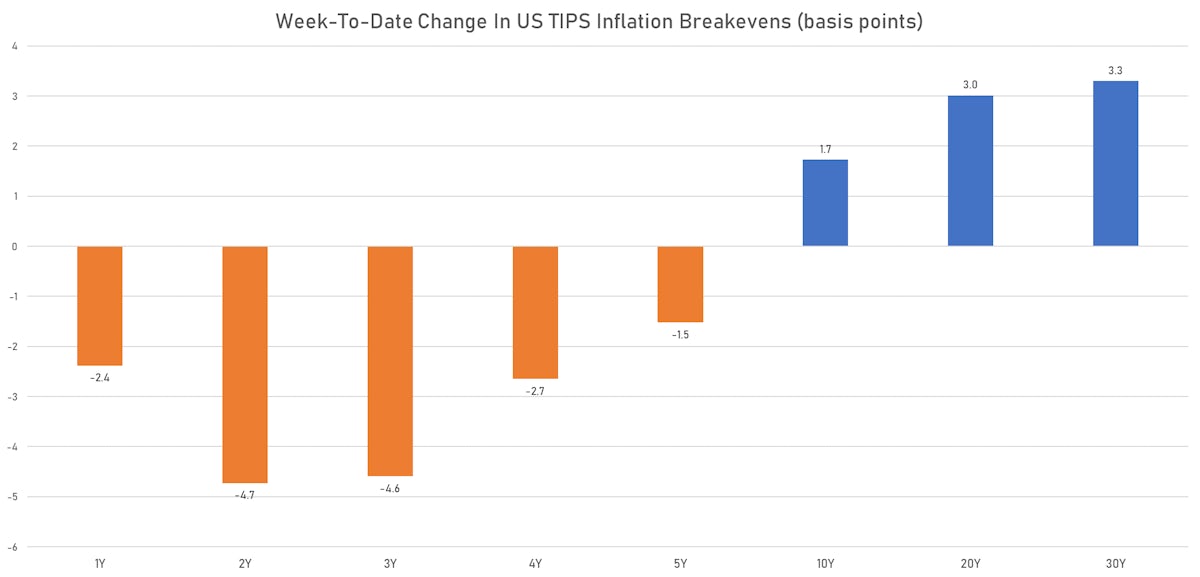

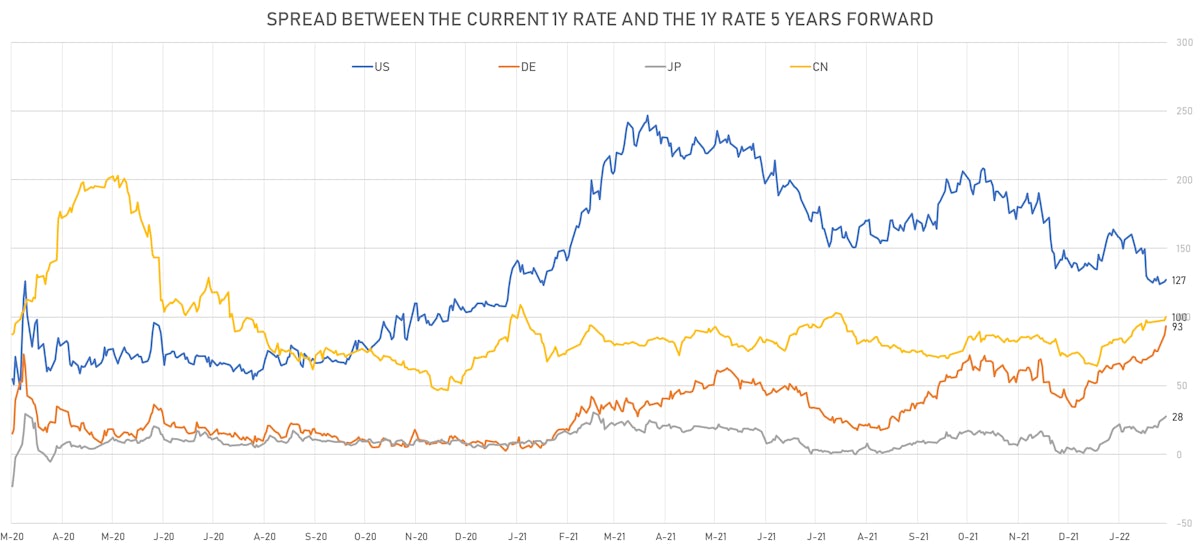

- TIPS 1Y breakeven inflation at 3.68% (down -1.2bp); 2Y at 3.17% (down -1.4bp); 5Y at 2.72% (up 0.8bp); 10Y at 2.43% (up 1.9bp); 30Y at 2.22% (up 2.6bp)

- US 5-Year TIPS Real Yield: +4.5 bp at -0.9900%; 10-Year TIPS Real Yield: +2.7 bp at -0.4610%; 30-Year TIPS Real Yield: +1.6 bp at 0.0620%

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 05 Feb (Redbook Research) at 13.30 % (vs 15.80 % prior)

- NFIB, Index of Small Business Optimism for Jan 2022 (NFIB, United States) at 97.10 (vs 98.90 prior)

- Trade Balance, Total, Goods and services for Dec 2021 (U.S. Census Bureau) at -80.70 Bn USD (vs -80.20 Bn USD prior), above consensus estimate of -83.00 Bn USD

AUCTION RESULTS: $49.8BN 1.5% COUPON 3-YEAR TREASURY NOTE (91282CDZ1)

- Solid pricing and record-high end-user demand (at 79.6% vs 70.7 average)

- High Yield: 1.592% (vs 1.237% prior), 0.3bp stop-through vs 1.595% when-issued at the bid deadline

- Indirect bids: 68.5% (vs 61.6% prior and 53.0% average), highest on record

- Direct bids: 11.1% (vs 15.5% prior and 17.7% average)

- Bid-to-cover: 2.45 (vs 2.47 prior and 2.44 average)

US FORWARD RATES

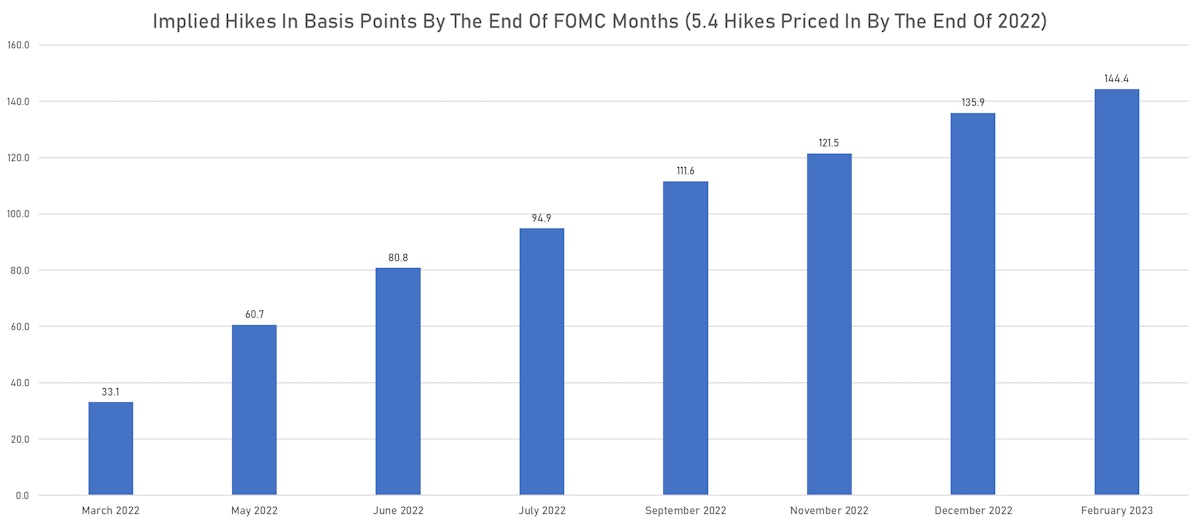

- Fed Funds futures now price in 33.1bp of Fed hikes by the end of March 2022, 60.7bp (2.43 x 25bp hikes) by the end of May 2022, and price in 5.44 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 50.5 bp of hikes in 2023 (equivalent to 2.0 x 25 bp hikes), unchanged today, and 2.0 bp of hikes in 2024 (i.e. no more hike after 2023)

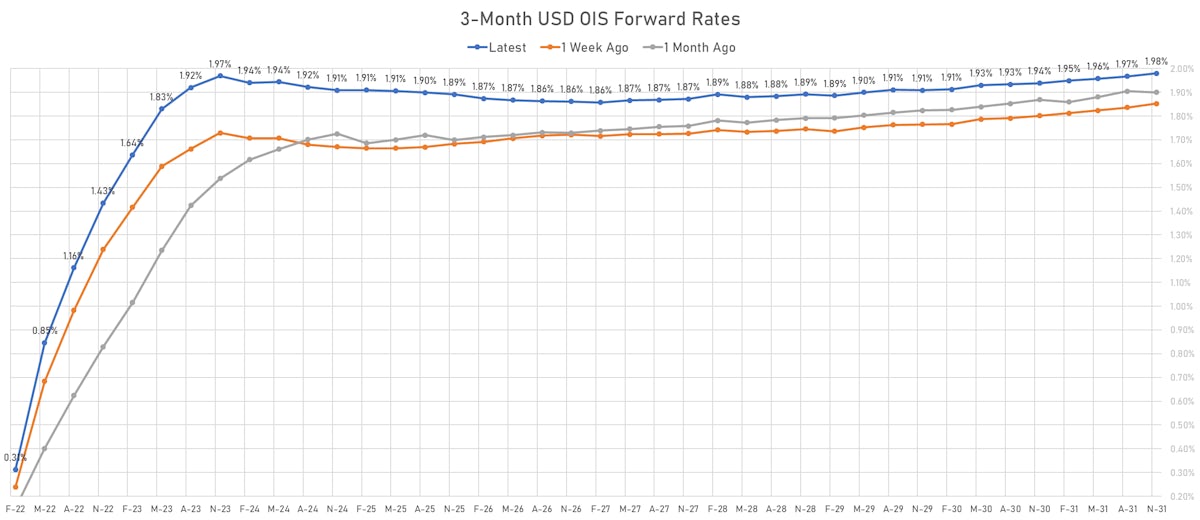

- 1-year US Treasury rate 5 years forward up 4.4 bp, now at 2.2160%, meaning that the 1-year Treasury rate is now expected to increase by 127.0 bp over the next 5 years

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.68% (down -1.2bp); 2Y at 3.17% (down -1.4bp); 5Y at 2.72% (up 0.8bp); 10Y at 2.43% (up 1.9bp); 30Y at 2.22% (up 2.6bp)

- 6-month spot US CPI swap down 0.0 bp to 3.858%, with a steepening of the forward curve

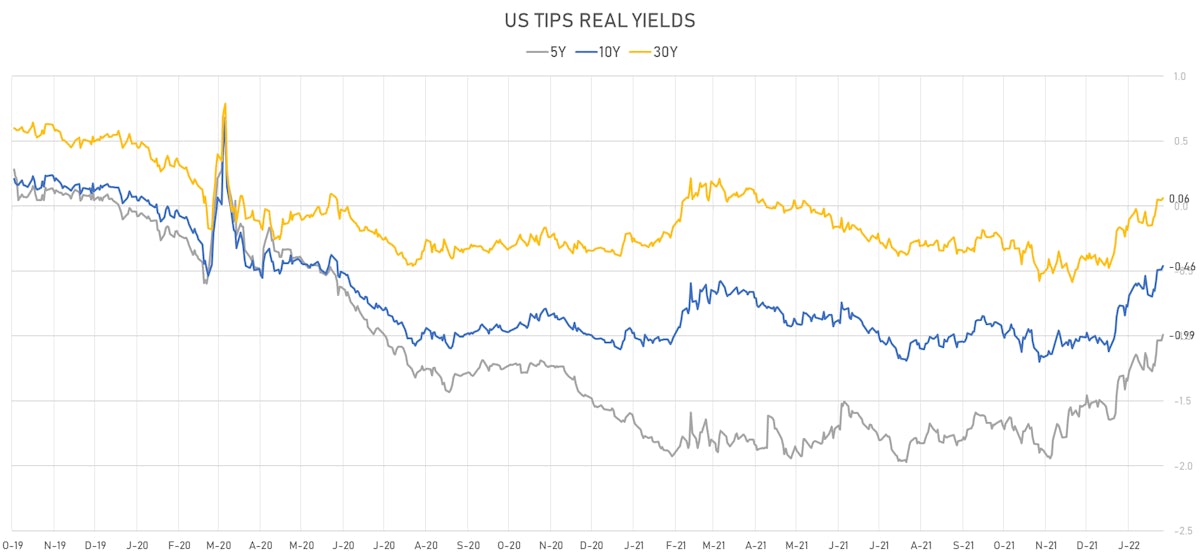

- US Real Rates: 5Y at -0.9900%, +4.5 bp today; 10Y at -0.4610%, +2.7 bp today; 30Y at 0.0620%, +1.6 bp today

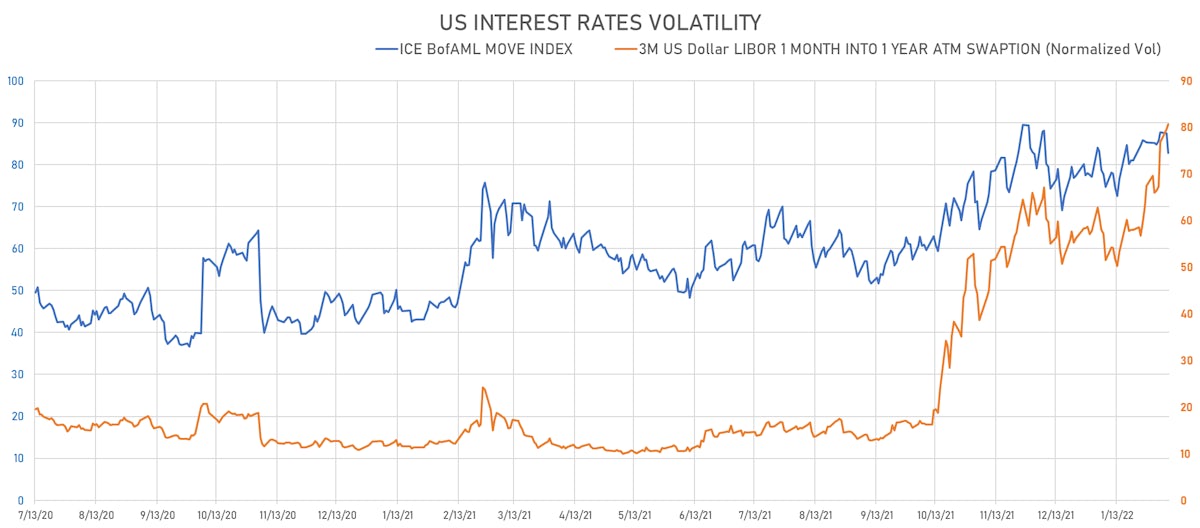

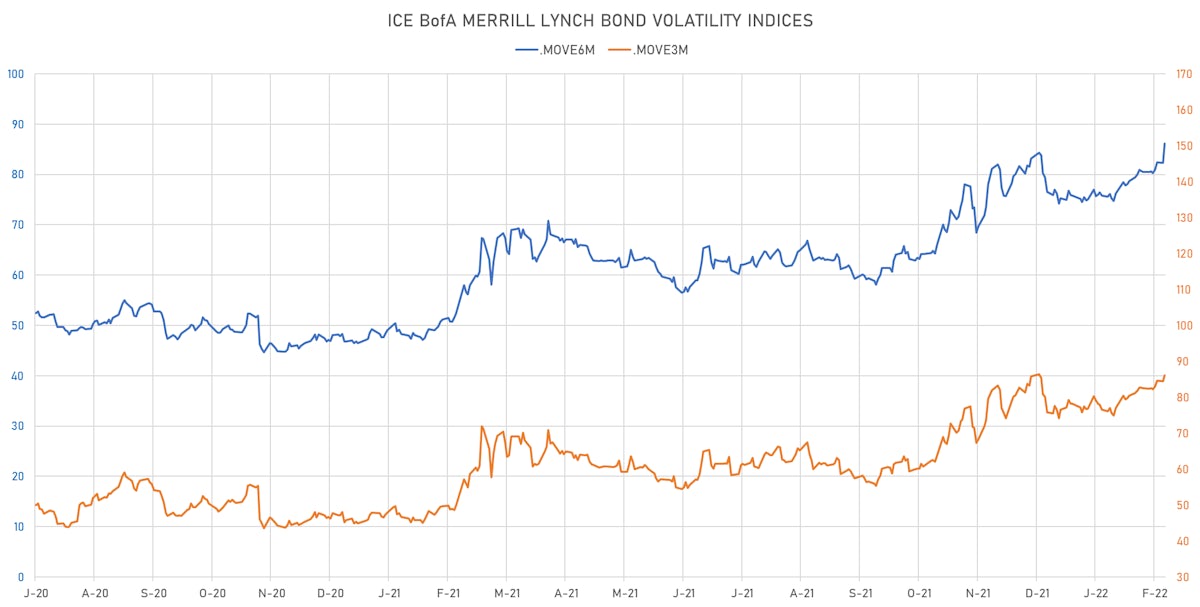

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 1.1% at 80.7%

- 3-Month LIBOR-OIS spread down -0.7 bp at 6.1 bp (12-months range: 2.6-13.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: 0.011% (up 3.2 bp); the German 1Y-10Y curve is 5.6 bp steeper at 86.4bp (YTD change: +42.4 bp)

- Japan 5Y: 0.022% (up 0.6 bp); the Japanese 1Y-10Y curve is 0.9 bp steeper at 29.1bp (YTD change: +11.8 bp)

- China 5Y: 2.410% (up 0.6 bp); the Chinese 1Y-10Y curve is 4.8 bp steeper at 80.9bp (YTD change: +29.9 bp)

- Switzerland 5Y: 0.071% (up 4.0 bp); the Swiss 1Y-10Y curve is 5.2 bp steeper at 91.2bp (YTD change: +34.7 bp)