Rates

Hot CPI Data Pushes US Rates Volatility Ever Higher, With 2s10s Inversion Now Expected Over Next 12 Months

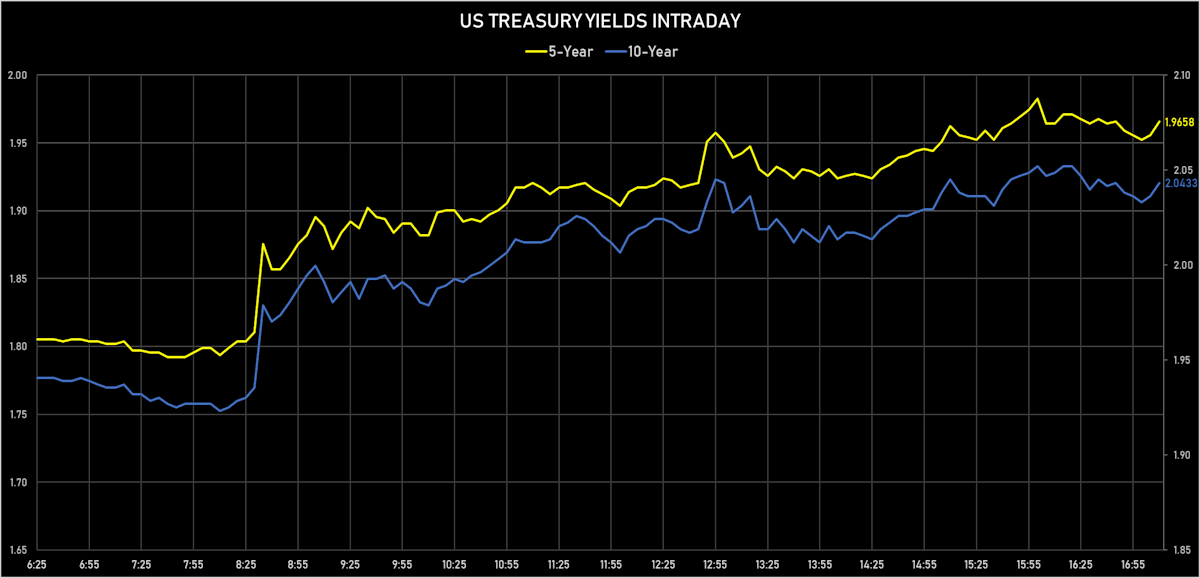

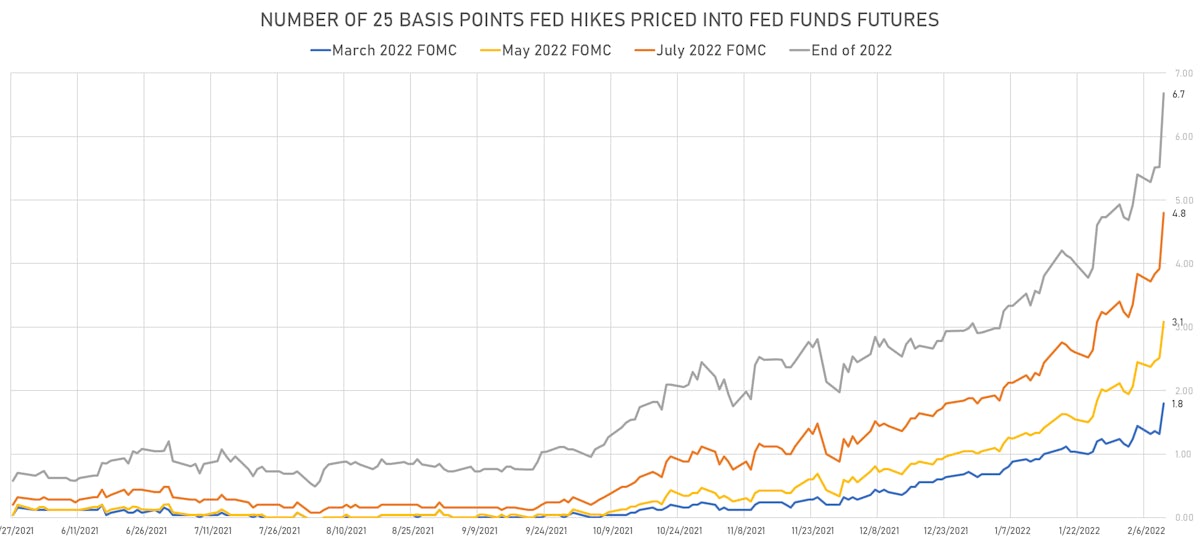

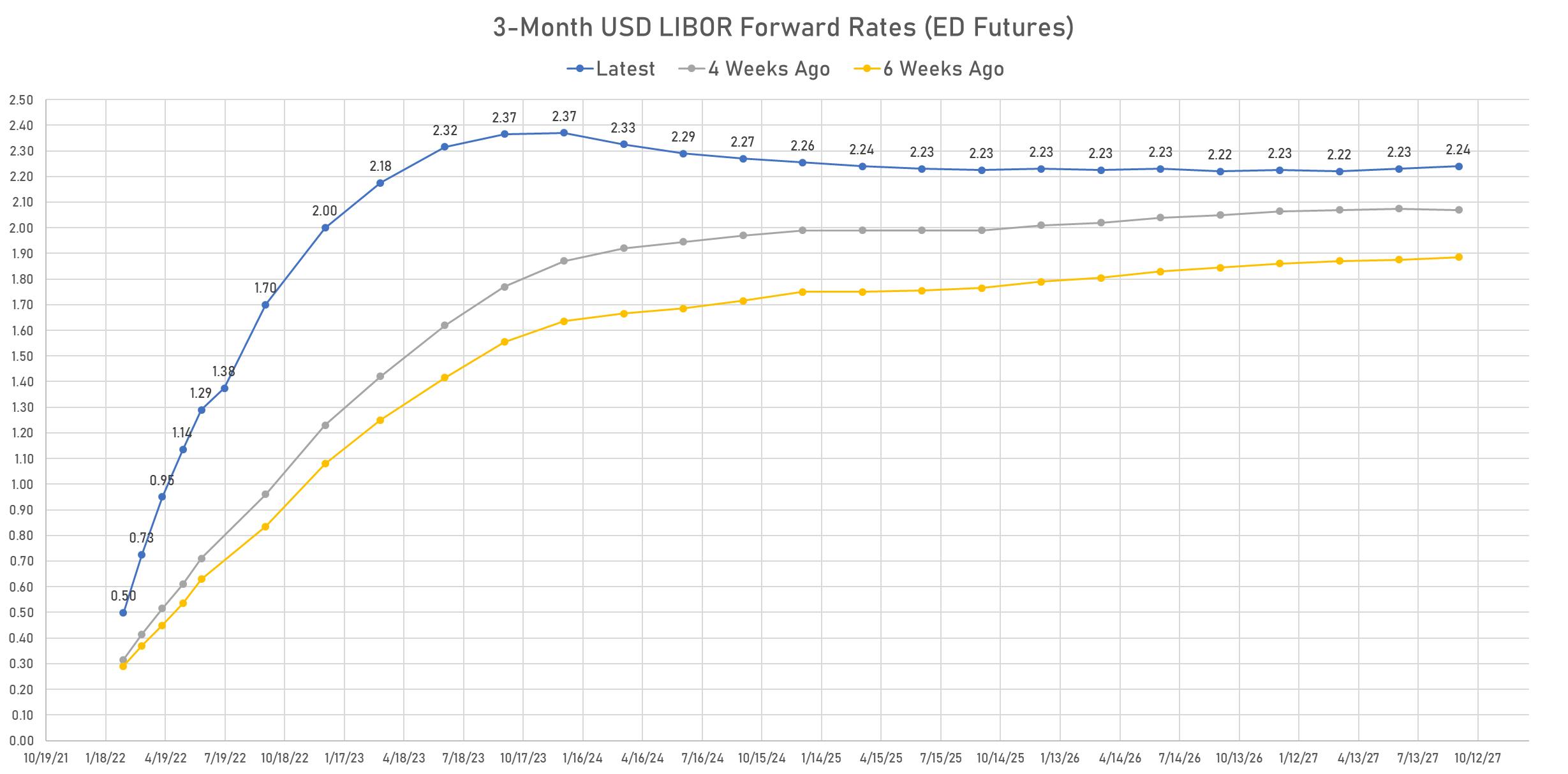

It's hard to overstate the jump in front-end yields today, with a 50bp hike in March now turning into the baseline scenario, and Fed Funds futures getting closer to pricing in 7 hikes for the year

Published ET

Fed Hikes Priced Into FF Futures | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR -14.64bp today, now at 0.3925%; 3-Month OIS +16.2bp at 0.4660%

- The treasury yield curve flattened, with the 1s10s spread tightening -13.9 bp, now at 116.0 bp (YTD change: +3.2bp)

- 1Y: 0.8830% (up 23.7 bp)

- 2Y: 1.6092% (up 24.3 bp)

- 5Y: 1.9658% (up 14.4 bp)

- 7Y: 2.0460% (up 12.3 bp)

- 10Y: 2.0433% (up 9.8 bp)

- 30Y: 2.3233% (up 7.2 bp)

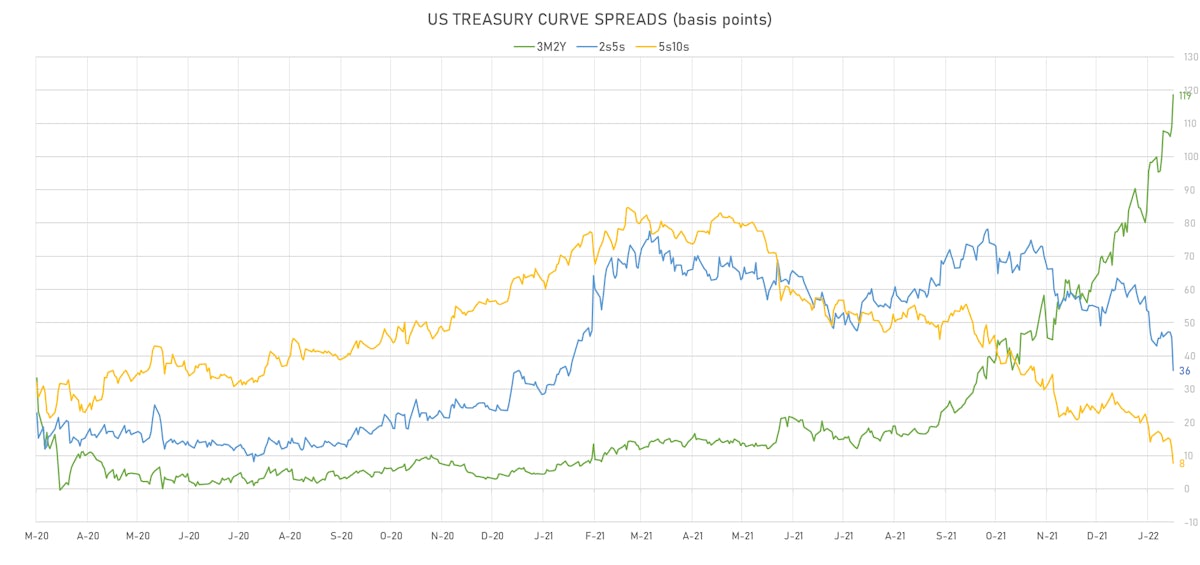

- US treasury curve spreads: 3m2Y at 118.6bp (up 9.8bp today), 2s5s at 35.7bp (down -9.7bp), 5s10s at 7.8bp (down -4.6bp), 10s30s at 28.0bp (down -2.7bp)

- Treasuries butterfly spreads: 1s5s10s at -80.4bp (up 1.8bp today), 5s10s30s at 19.9bp (up 2.3bp)

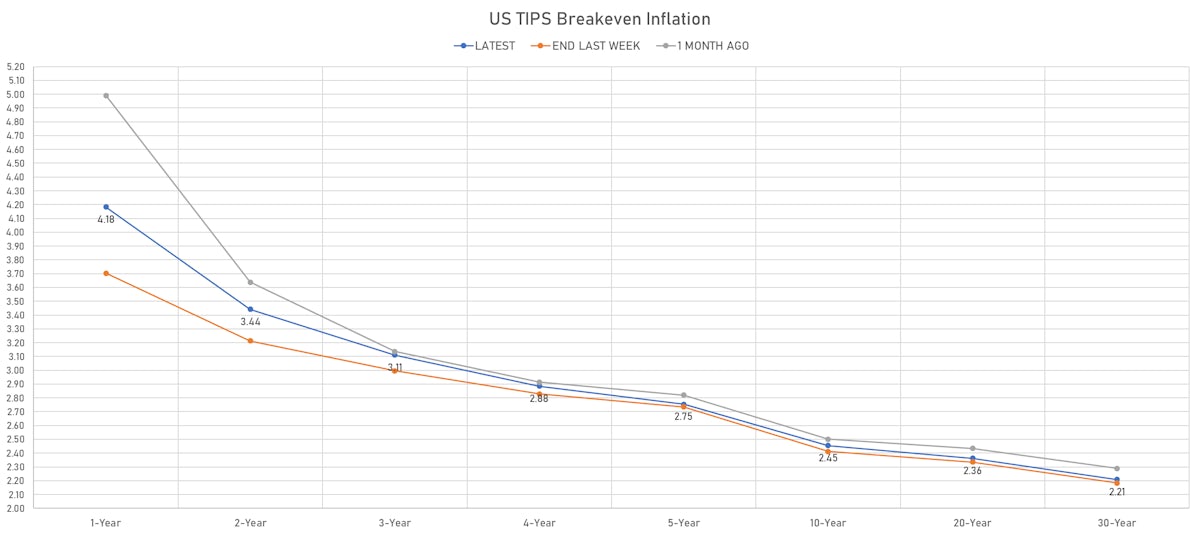

- TIPS 1Y breakeven inflation at 4.18% (up 43.9bp); 2Y at 3.44% (up 23.6bp); 5Y at 2.75% (up 2.7bp); 10Y at 2.45% (up 0.9bp); 30Y at 2.21% (down -1.5bp)

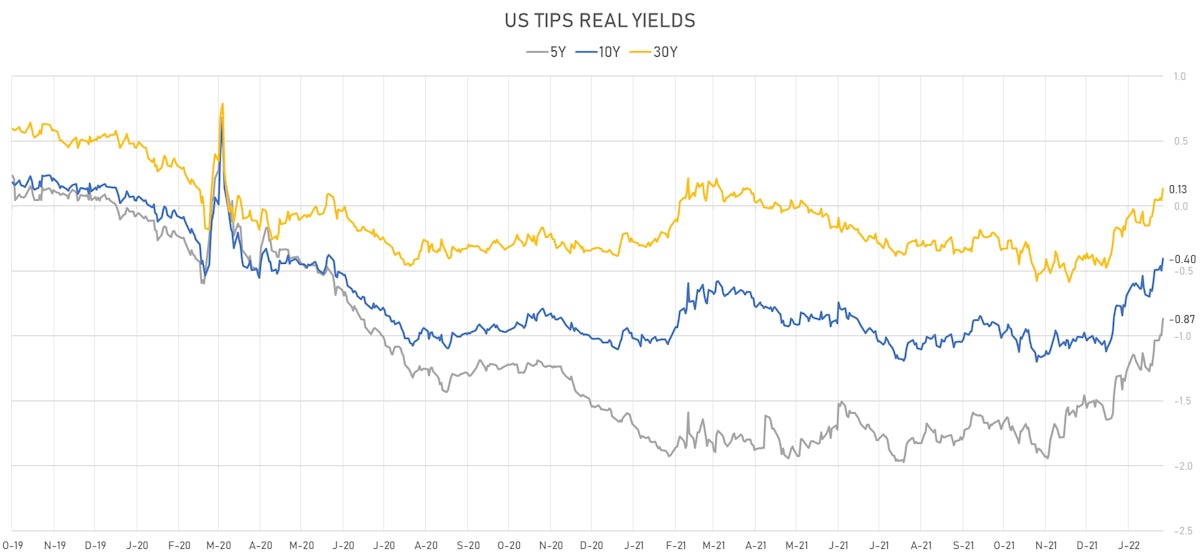

- US 5-Year TIPS Real Yield: +12.8 bp at -0.8660%; 10-Year TIPS Real Yield: +9.4 bp at -0.4040%; 30-Year TIPS Real Yield: +8.8 bp at 0.1340%

US MACRO RELEASES

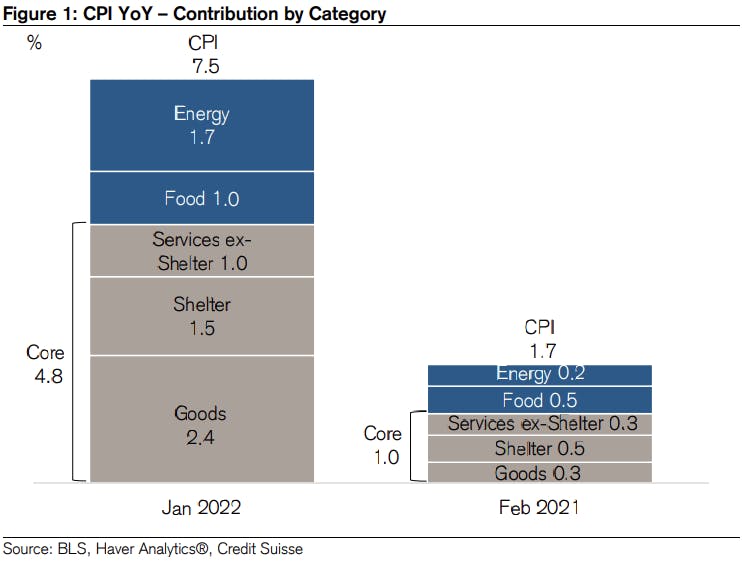

- CPI - All Urban Samples: All Items, Change Y/Y for Jan 2022 (BLS, U.S Dep. Of Lab) at 7.50 % (vs 7.00 % prior), above consensus estimate of 7.30 %

- CPI, All items less food and energy for Jan 2022 (BLS, U.S Dep. Of Lab) at 286.43 (vs 284.76 prior)

- CPI, All items less food and energy, Change P/P for Jan 2022 (BLS, U.S Dep. Of Lab) at 0.60 % (vs 0.60 % prior), above consensus estimate of 0.50 %

- CPI, All items less food and energy, Change Y/Y, Price Index for Jan 2022 (BLS, U.S Dep. Of Lab) at 6.00 % (vs 5.50 % prior), above consensus estimate of 5.90 %

- CPI, All items, Change P/P for Jan 2022 (BLS, U.S Dep. Of Lab) at 0.60 % (vs 0.50 % prior), above consensus estimate of 0.50 %

- CPI, All items, Price Index for Jan 2022 (BLS, U.S Dep. Of Lab) at 281.15 (vs 278.80 prior), above consensus estimate of 280.39

- CPI, FRB Cleveland Median, 1 month, Change M/M for Jan 2022 (Fed Reserve, Cleveland) at 0.60 % (vs 0.40 % prior)

- Earnings, Average Weekly, Total Private, Change P/P for Jan 2022 (BLS, U.S Dep. Of Lab) at -0.50 % (vs 0.10 % prior)

- Federal Budget, Current Prices for Jan 2022 (Fiscal Service, USA) at 119.00 Bn USD (vs -21.00 Bn USD prior), above consensus estimate of 25.00 Bn USD

- Jobless Claims, National, Continued for W 29 Jan (U.S. Dept. of Labor) at 1.62 Mn (vs 1.63 Mn prior), in line with consensus

- Jobless Claims, National, Initial for W 05 Feb (U.S. Dept. of Labor) at 223.00 k (vs 238.00 k prior), below consensus estimate of 230.00 k

- Jobless Claims, National, Initial, four week moving average for W 05 Feb (U.S. Dept. of Labor) at 253.25 k (vs 255.00 k prior)

MARKET IMPACT OF THE CPI DATA

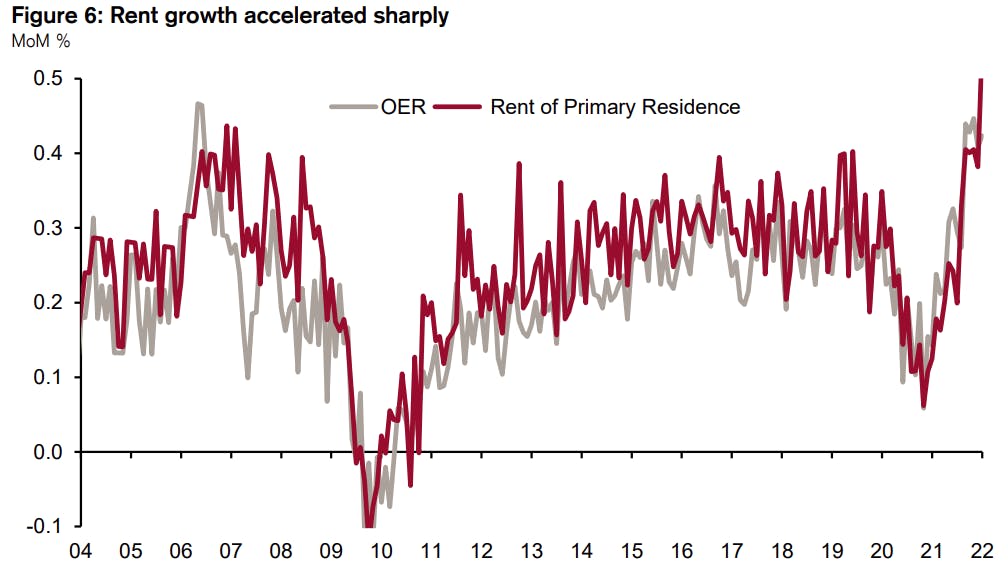

- CPI data outperformance was driven by persistent items like rent (with a share of over 32% in CPI, shelter is the most important item) and medical services, which turns the 50bp in March scenario into the market baseline

- Bullard pushing for 50bp hike in March, says FOMC should be open to considering inter-meeting rate hikes, and would "like to see 100 basis points in the bag by July 1"

- Barkin adding that we are going to "steadily move rates up toward neutral"

- Note that even if the CPI drops back towards 3%, neutral means Fed Funds rate at 3%, which is 12 x 25bp hikes away from the current position

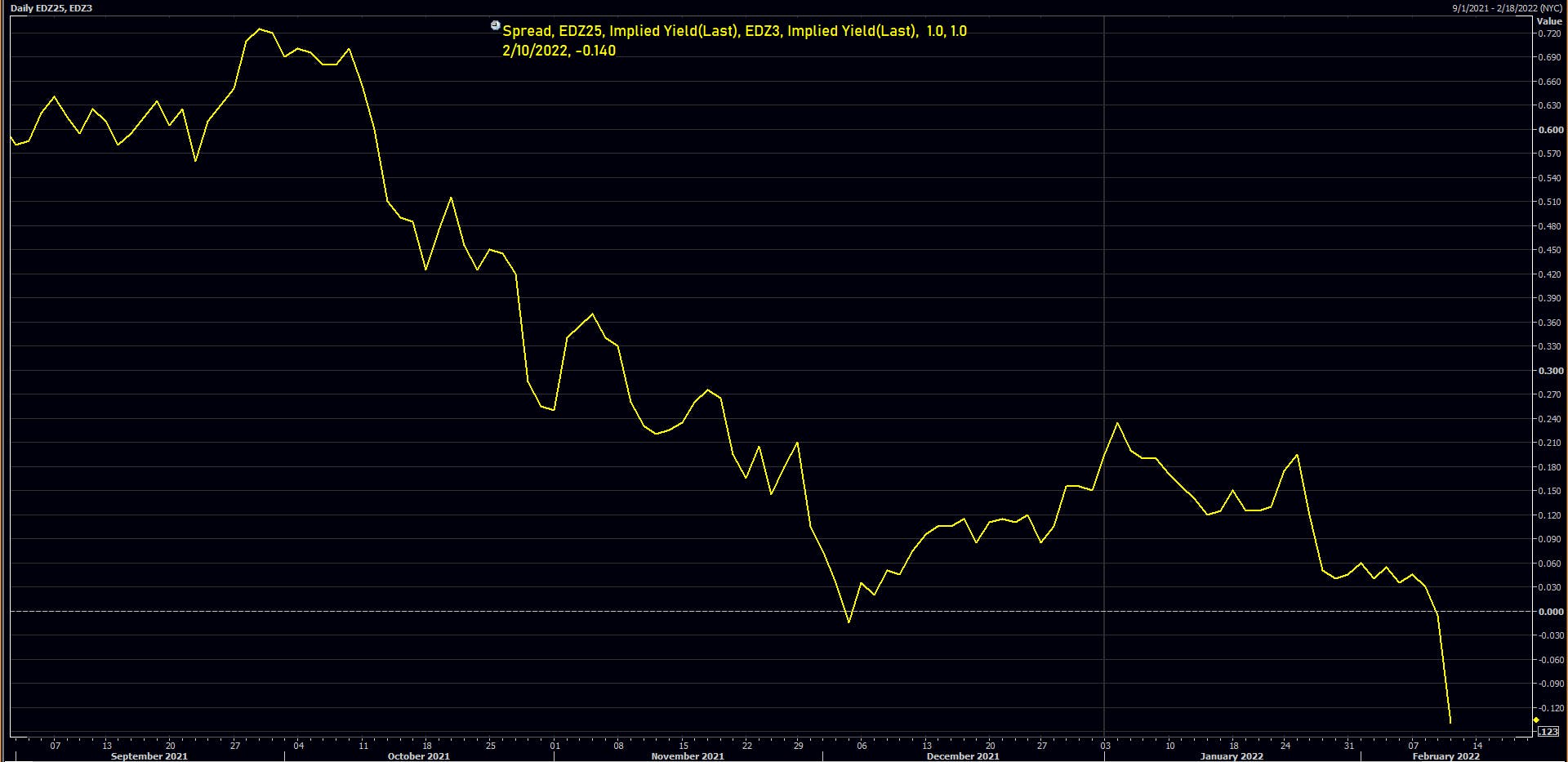

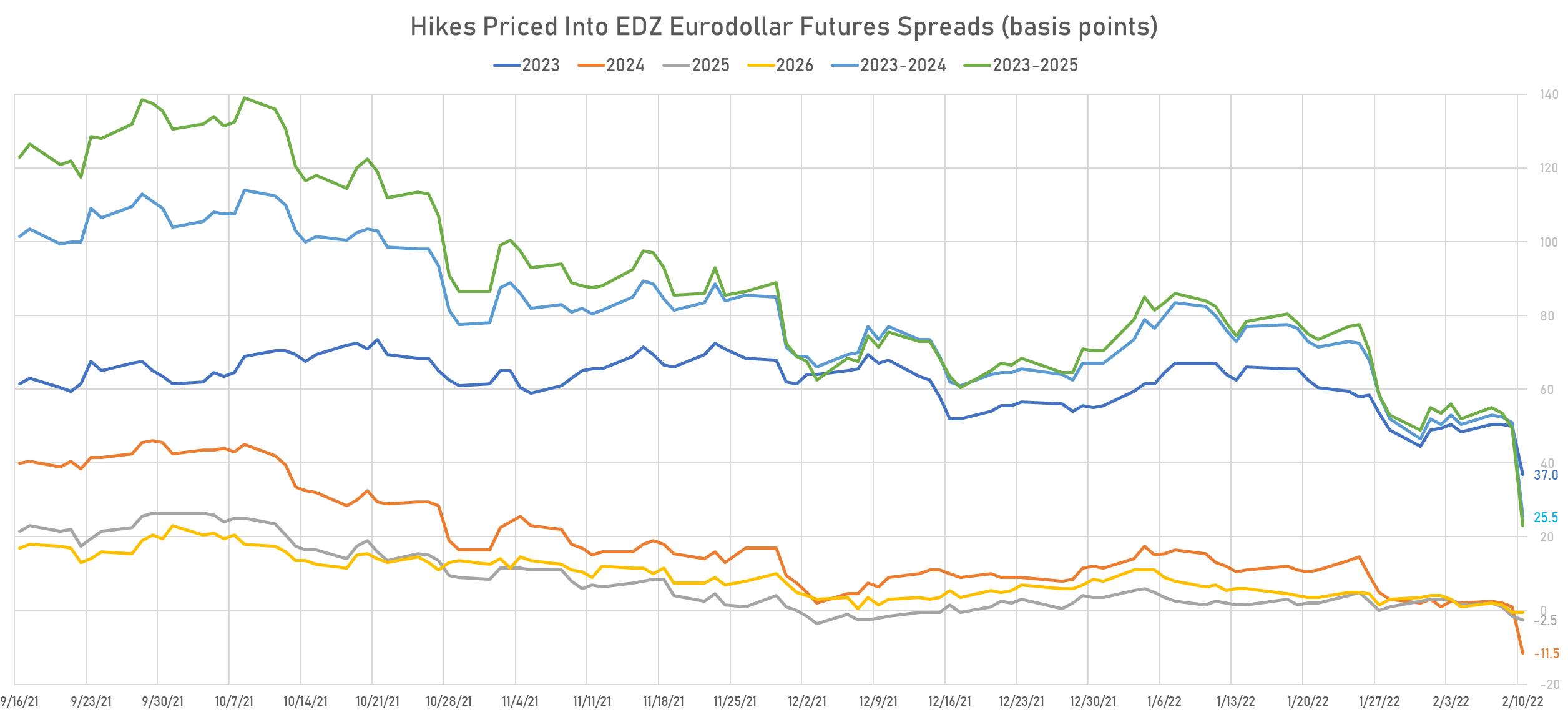

- It's fair to say that futures markets do not believe the Fed: Fed Funds futures now price in about 6.7 hikes this year, but Eurodollars see only 1.5 hike (37bp) in 2023, and the spread between ED December 2023 and ED December 2025 contracts is now inverted (-12bp), a clear policy mistake scenario (Fed raising rates too fast in 2022)

- 7 hikes this year would be the most in a year since 2005 (200bps) and the third most since 1994 (250bps)

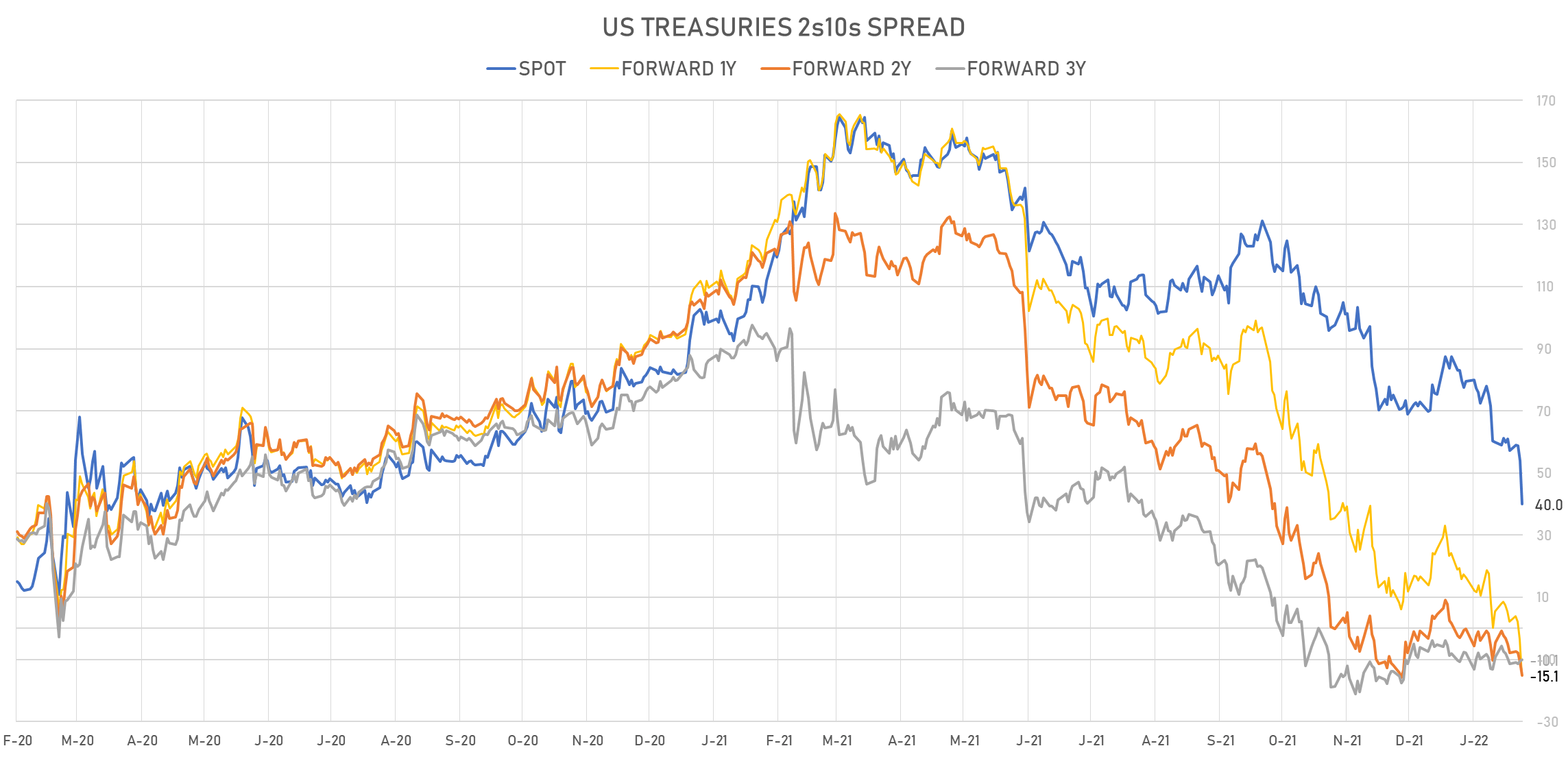

- The Treasury 2s10s spread 1-year forward was down 12bp today (now at -15bp); with the 2s10s inversion expected in less than a year

- Considering the historical lag between inversions and recessions, many participants now forecast a recession starting somewhere between mid-2023 to early-2024

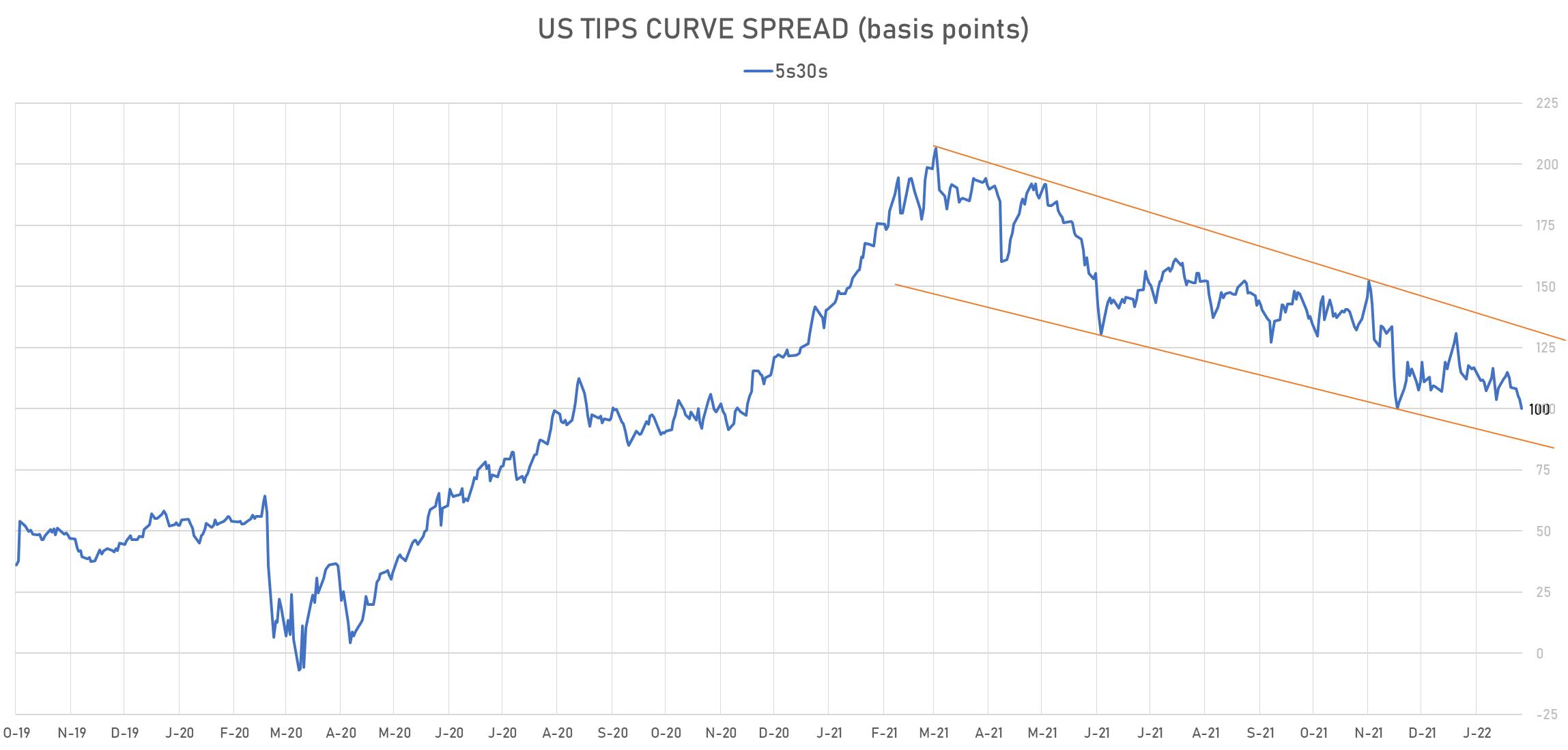

- An indicator we look at to gauge economic growth prospects is the US TIPS 5s30s spread, and it's falling as well, now down to 100bp (from 131bp on 1/4/22)

- Deutsche Bank's commentary after updating their forecast to 7 hikes in 2022: "This more aggressive policy response raises downside risks to growth. Engineering a soft landing for the economy is never easy. It is especially difficult with inflation well above target and accelerating at a time when the unemployment rate is already at the Fed’s view of maximum employment. We have highlighted how consumer indicators currently see nearly 50% risk of a recession over the next year. While that likely overstates the near-term potential for a downturn, a more aggressive Fed response aimed at taming inflation clearly raises recession risks in 2023 and 2024."

US FORWARD RATES

- Fed Funds futures now price in 45bp of Fed hikes by the end of March 2022, 77bp (3.1 x 25bp hikes) by the end of May 2022, and price in 6.7 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 37 bp of hikes in 2023 (equivalent to 1.5 x 25 bp hikes), down -13.0 bp today, and -11.5 bp of hikes in 2024 (equivalent to -0.5 x 25 bp hikes)

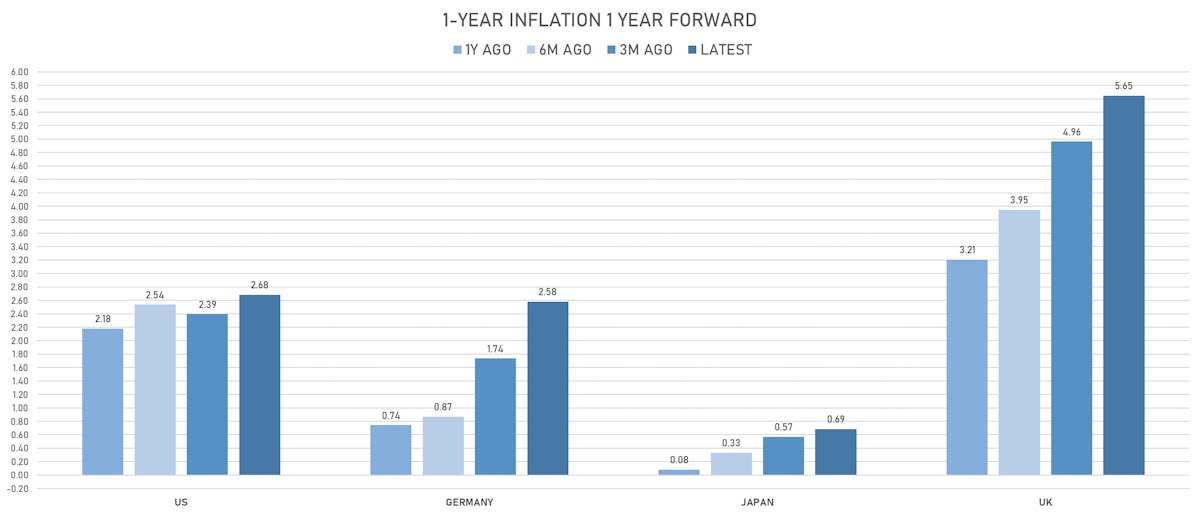

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 4.18% (up 43.9bp); 2Y at 3.44% (up 23.6bp); 5Y at 2.75% (up 2.7bp); 10Y at 2.45% (up 0.9bp); 30Y at 2.21% (down -1.5bp)

- US Real Rates: 5Y at -0.8660%, +12.8 bp today; 10Y at -0.4040%, +9.4 bp today; 30Y at 0.1340%, +8.8 bp today

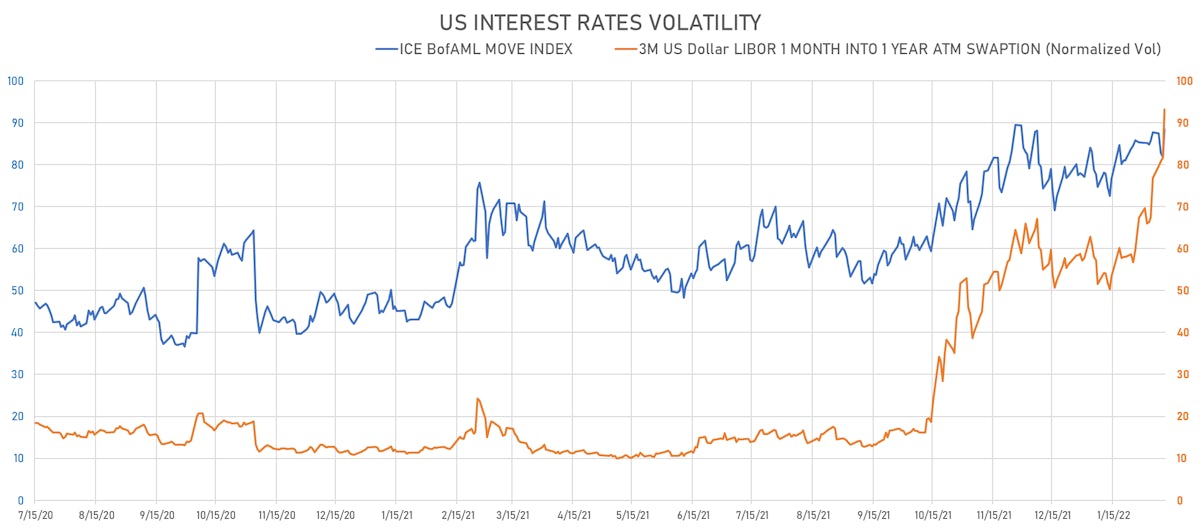

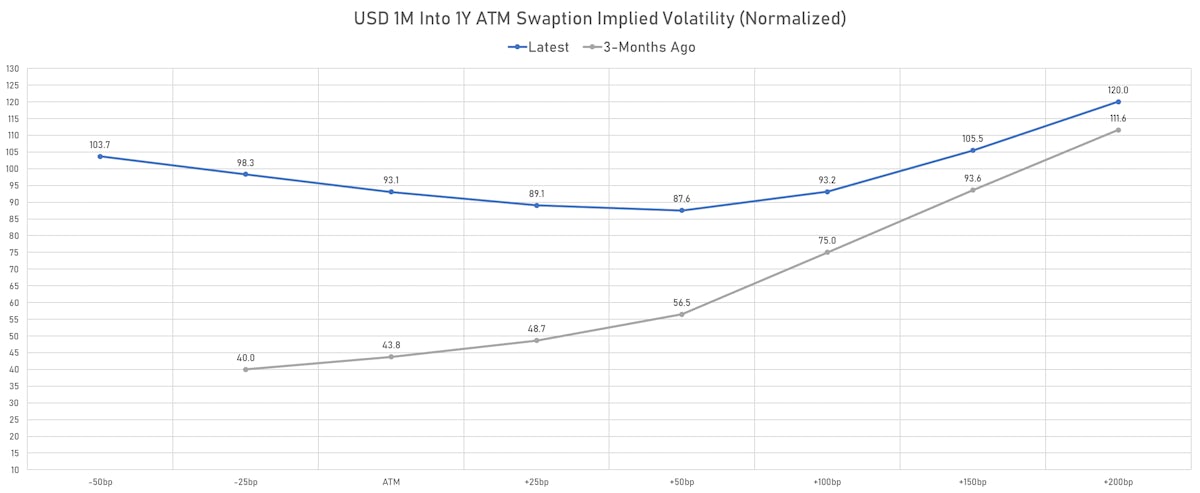

RATES VOLATILITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 11.5% at 93.1%

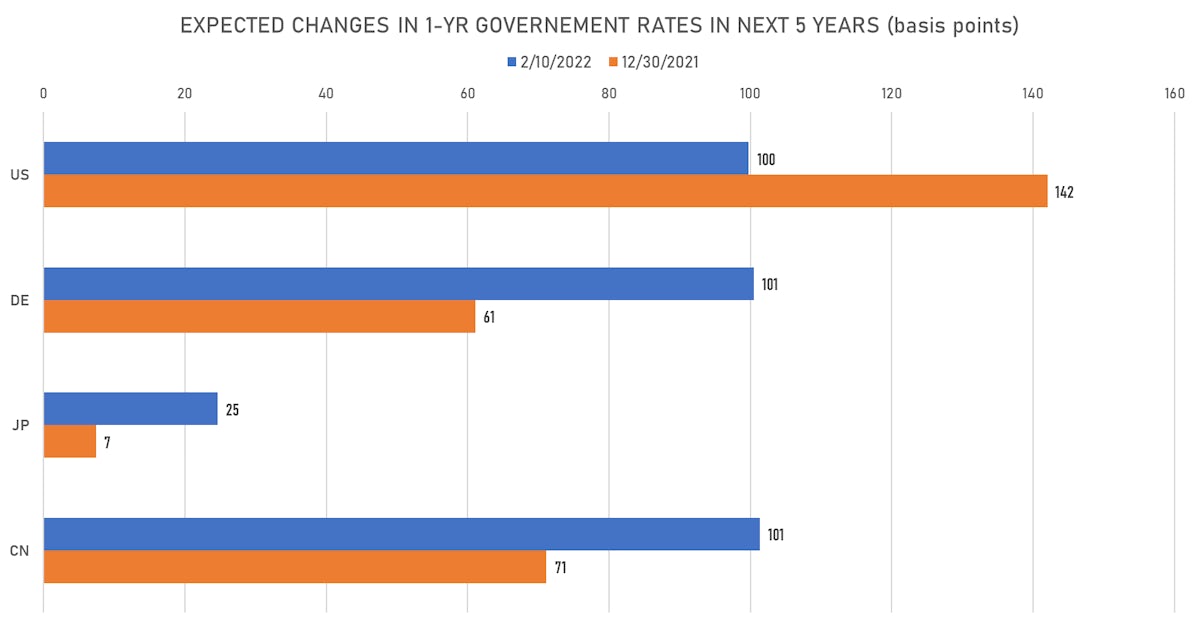

KEY INTERNATIONAL RATES

- Germany 5Y: 0.056% (up 6.6 bp); the German 1Y-10Y curve is 6.1 bp steeper at 92.1bp (YTD change: +46.7 bp)

- Japan 5Y: 0.028% (up 1.2 bp); the Japanese 1Y-10Y curve is 1.4 bp steeper at 32.4bp (YTD change: +13.3 bp)

- China 5Y: 2.442% (up 0.9 bp); the Chinese 1Y-10Y curve is 3.4 bp steeper at 88.5bp (YTD change: +37.5 bp)

- Switzerland 5Y: 0.018% (up 2.0 bp); the Swiss 1Y-10Y curve is 2.3 bp steeper at 92.2bp (YTD change: +30.7 bp)