Rates

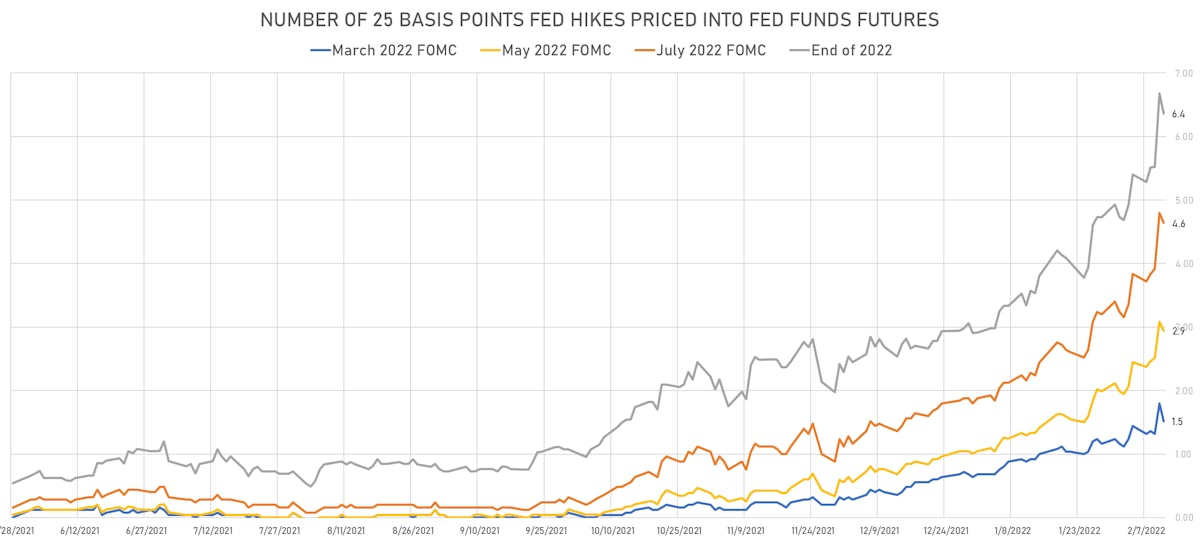

Wild Week In US Rates, With The Market Now Firmly Pricing In A Fed Policy Error

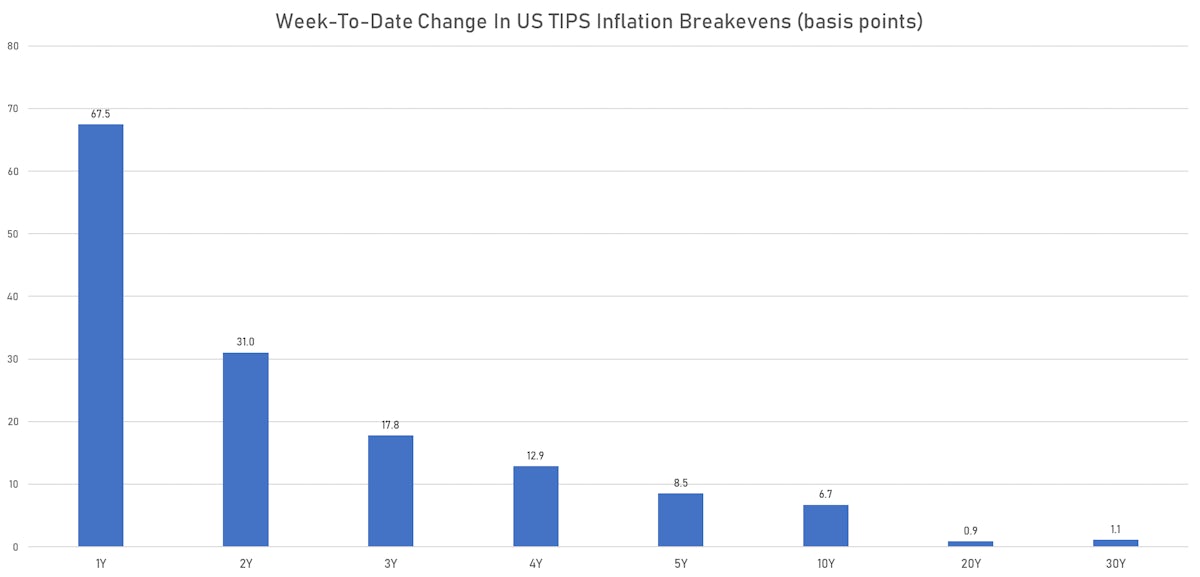

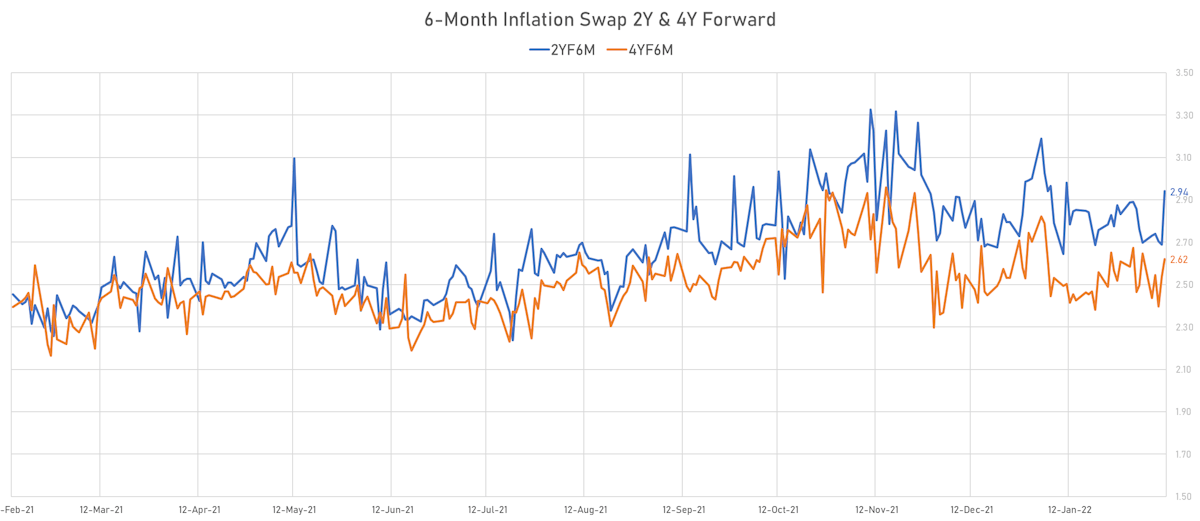

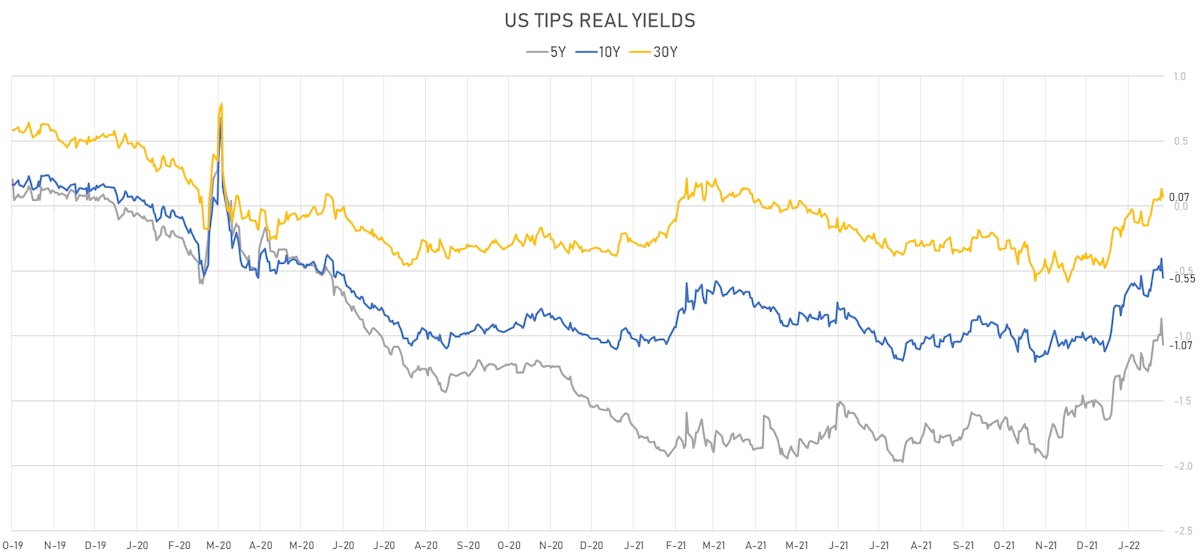

The moves in rates were led by breakevens, with inflation expectations revised markedly upward throughout the curve, while real yields were down modestly for the week except at the very long end

Published ET

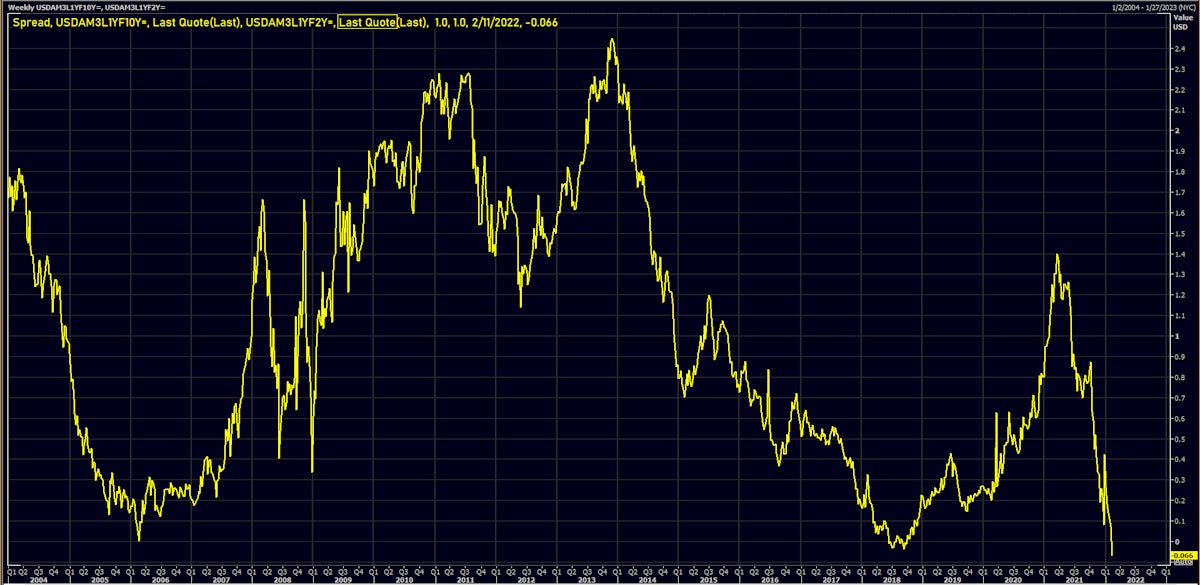

Inversion of the 1-Year Forward Starting Swap 2s10s Spread | Source: Refinitiv

QUICK US SUMMARY

- 3-Month USD LIBOR +11.1bp today, now at 0.5060%; 3-Month OIS -6.7bp at 0.3830%

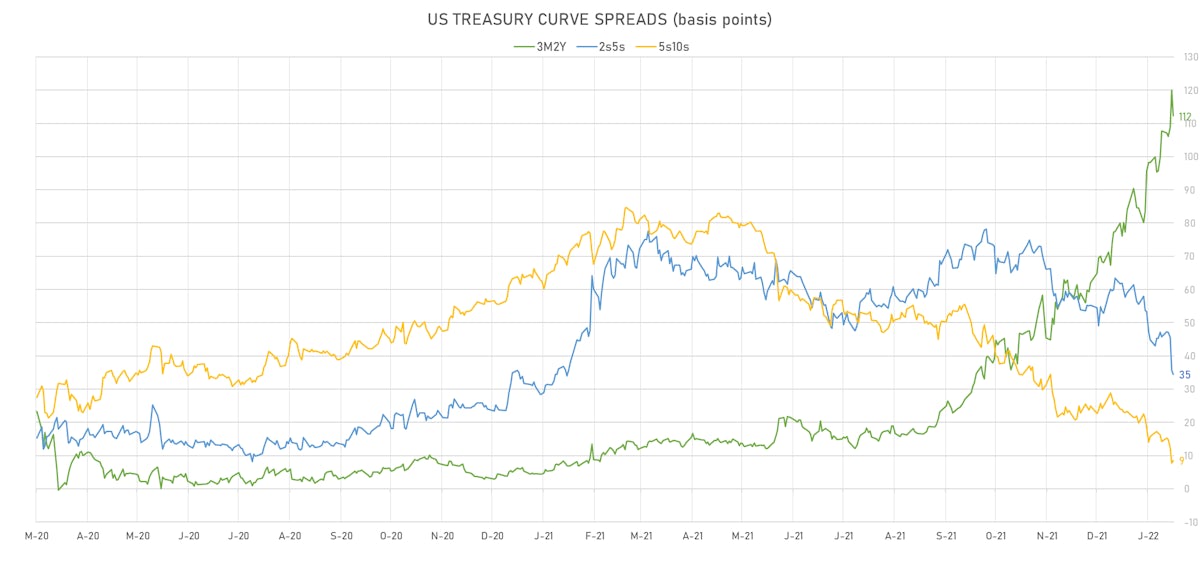

- The treasury yield curve flattened, with the 1s10s spread tightening -2.5 bp, now at 83.2 bp (YTD change: -29.6bp)

- 1Y: 1.0860% (down 10.1 bp today, up 20.3 bp for the week)

- 2Y: 1.4875% (down 12.2 bp today, up 17.2 bp this week)

- 5Y: 1.8325% (down 13.3 bp today, up 5.9 bp this week)

- 7Y: 1.9210% (down 12.5 bp today, up 2.9 bp this week)

- 10Y: 1.9181% (down 12.5 bp today, up 0.2 bp this week)

- 30Y: 2.2342% (down 8.9 bp today, up 2.1 bp this week)

- US treasury curve spreads: 3m2Y at 112.2bp (down -7.8bp today, up 4.4bp this week), 2s5s at 34.5bp (down -1.2bp today, down -11.1bp this week), 5s10s at 8.6bp (up 0.8bp today, down -5.7bp this week), 10s30s at 31.6bp (up 3.6bp today, up 1.7bp this week)

- Treasuries butterfly spreads: 1s5s10s at -73.8bp (up 6.7bp today), 5s10s30s at 20.6bp (up 0.7bp)

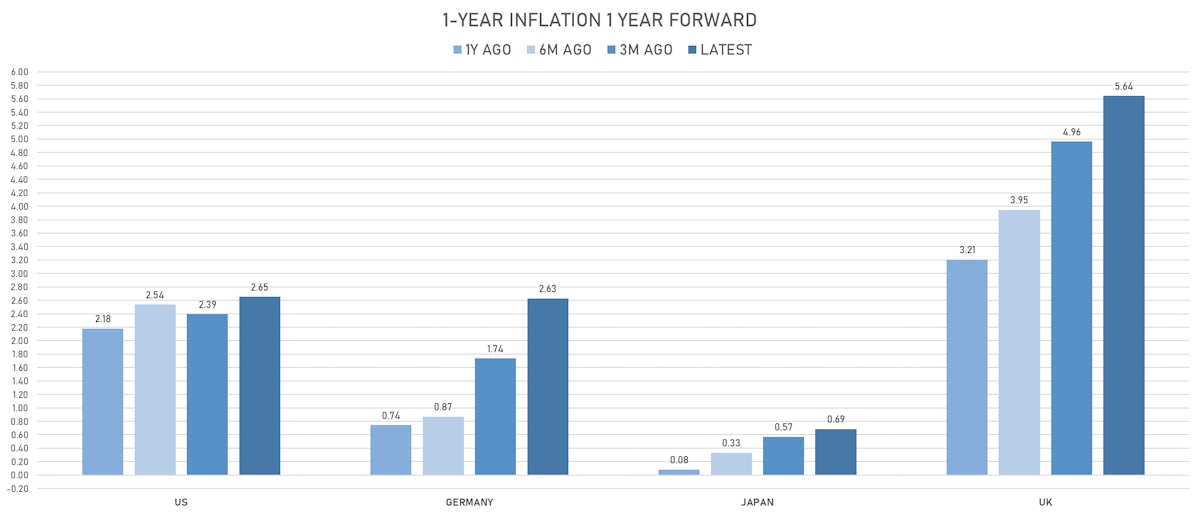

- TIPS 1Y breakeven inflation at 4.38% (up 19.4bp today, up 67.5bp this week); 2Y at 3.52% (up 8.2bp today, up 31.0bp this week); 5Y at 2.82% (up 6.6bp today, up 8.5bp this week); 10Y at 2.48% (up 2.5bp today, up 6.7bp this week); 30Y at 2.19% (down -1.4bp today, up 1.1bp this week)

- US 5-Year TIPS Real Yield: -20.0 bp today at -1.0660% (-2.9 bp this week); 10-Year TIPS Real Yield: -14.8 bp today at -0.5520% (-5.9 bp this week); 30-Year TIPS Real Yield: -6.3 bp at 0.0710% (+2.2 bp this week)

US MACRO RELEASES

- 1 Year Inflation Expectations (median), preliminary for Feb 2022 (UMICH, Survey) at 5.00 % (vs 4.90 % prior)

- University of Michigan, Current Conditions Index-prelim, Volume Index for Feb 2022 (UMICH, Survey) at 68.50 (vs 72.00 prior), below consensus estimate of 73.00

- University of Michigan, Total-prelim, Change Y/Y for Feb 2022 (UMICH, Survey) at 3.10 % (vs 3.10 % prior)

- University of Michigan, Total-prelim, Volume Index for Feb 2022 (UMICH, Survey) at 57.40 (vs 64.10 prior)

- University of Michigan, Total-prelim, Volume Index for Feb 2022 (UMICH, Survey) at 61.70 (vs 67.20 prior), below consensus estimate of 67.50

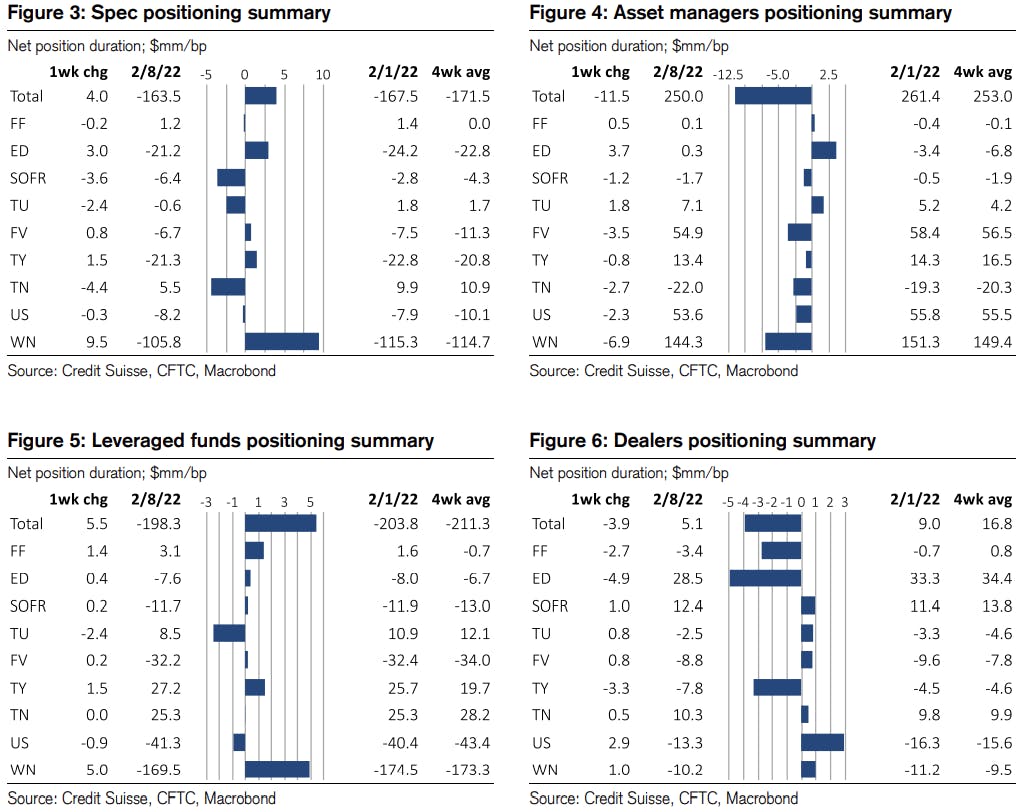

WEEKLY CFTC DURATION POSITIONING UPDATE

- both specs and leveraged funds covered some of their net short duration at the long end of the curve, but are stil massively short

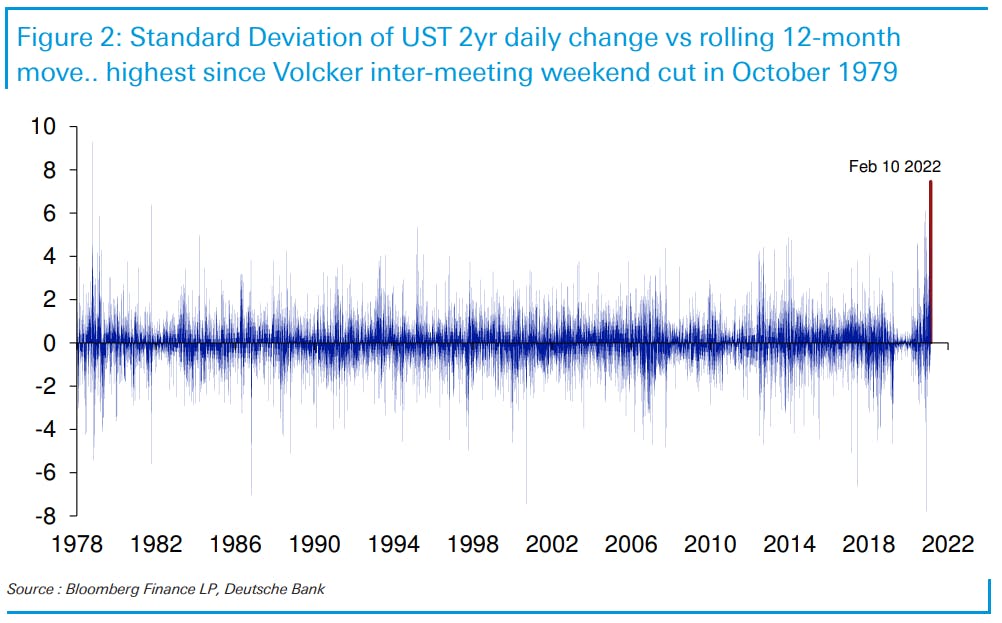

MAGNITUDE OF MOVE IN 2Y UST YIELD NOT SEEN SINCE 1979

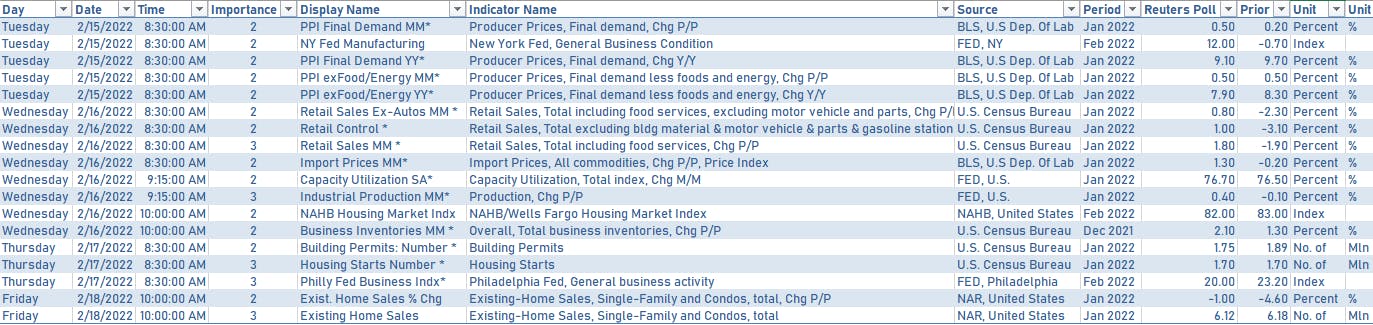

US MACRO RELEASES IN THE WEEK AHEAD

US FORWARD RATES

- Fed Funds futures now price in 36.9bp of Fed hikes by the end of March 2022, 74.2bp (2.97 x 25bp hikes) by the end of May 2022, and price in 6.29 hikes by the end of December 2022

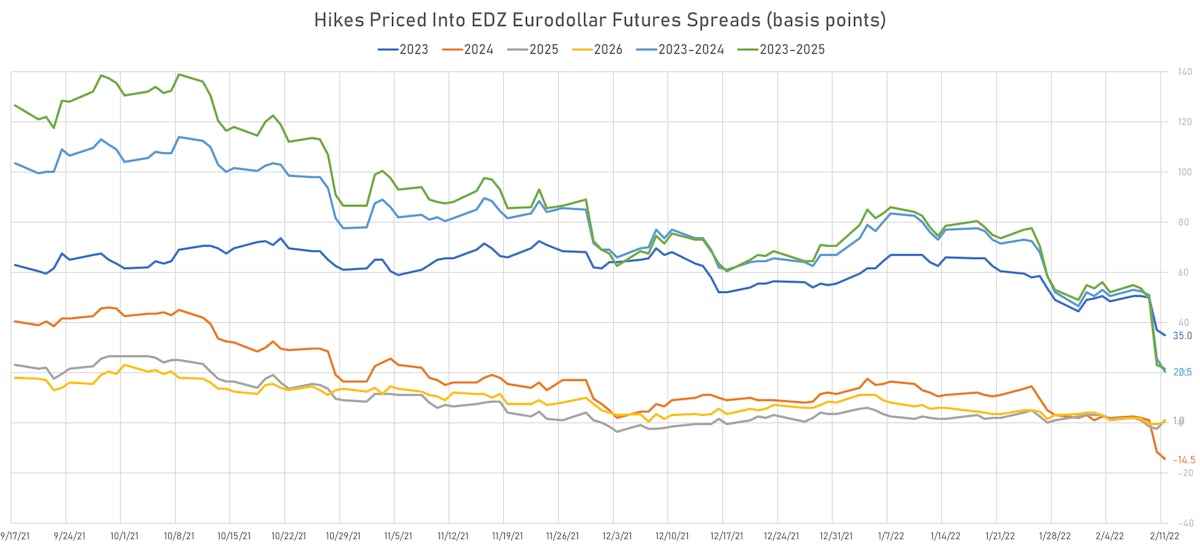

- 3-month Eurodollar futures (EDZ) spreads price in 35 bp of hikes in 2023 (equivalent to 1.4 x 25 bp hikes), down -2.0 bp today, and -14.5 bp of hikes in 2024 (equivalent to -0.6 x 25 bp hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 4.38% (up 19.4bp); 2Y at 3.52% (up 8.2bp); 5Y at 2.82% (up 6.6bp); 10Y at 2.48% (up 2.5bp); 30Y at 2.19% (down -1.4bp)

- 6-month spot US CPI swap up 55.4 bp to 4.412%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.0660%, -20.0 bp today; 10Y at -0.5520%, -14.8 bp today; 30Y at 0.0710%, -6.3 bp today

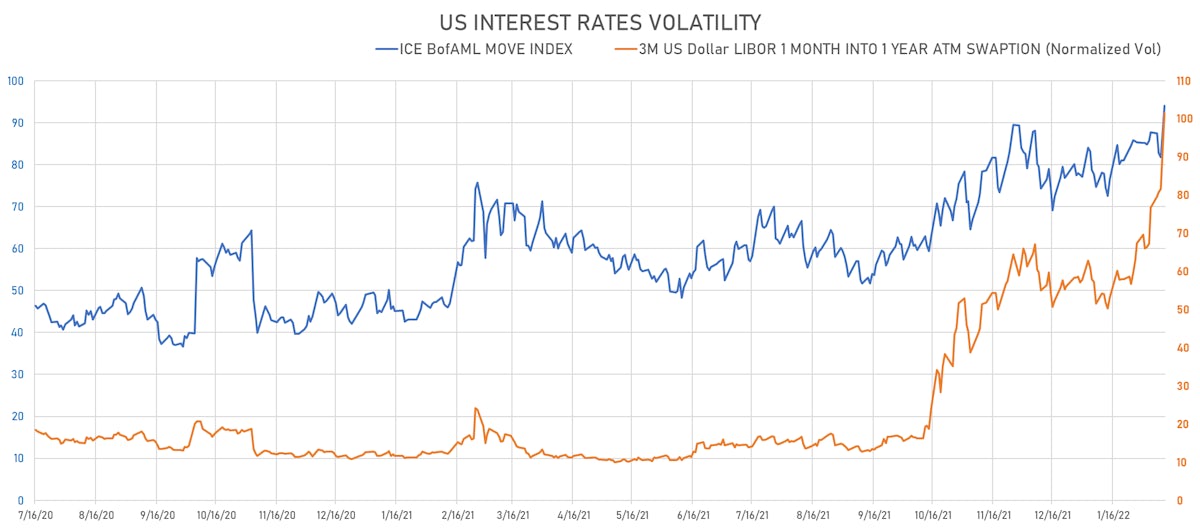

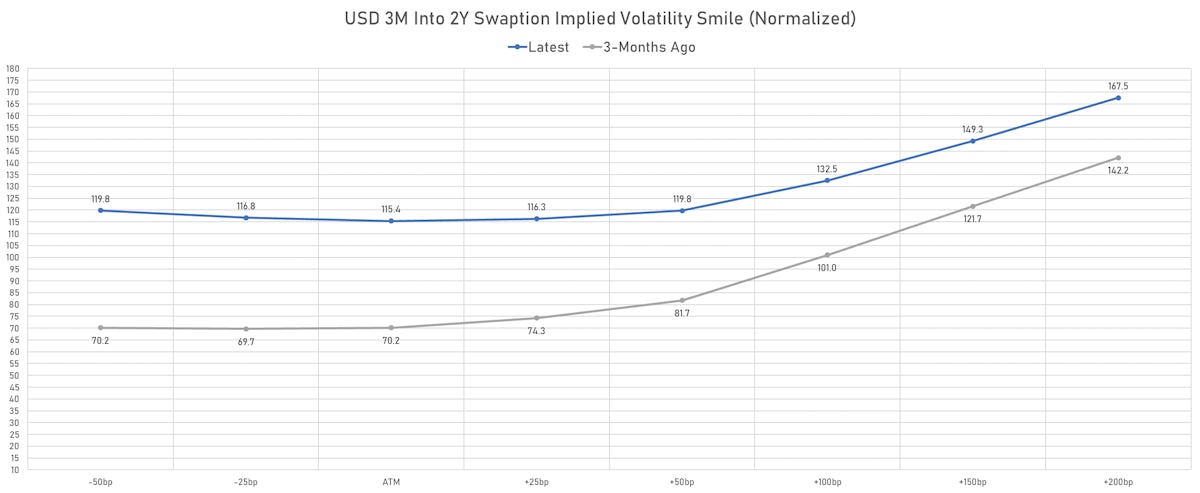

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 8.4% at 101.5%

- 3-Month LIBOR-OIS spread up 17.8 bp at 12.3 bp (12-months range: -5.5-13.4 bp)

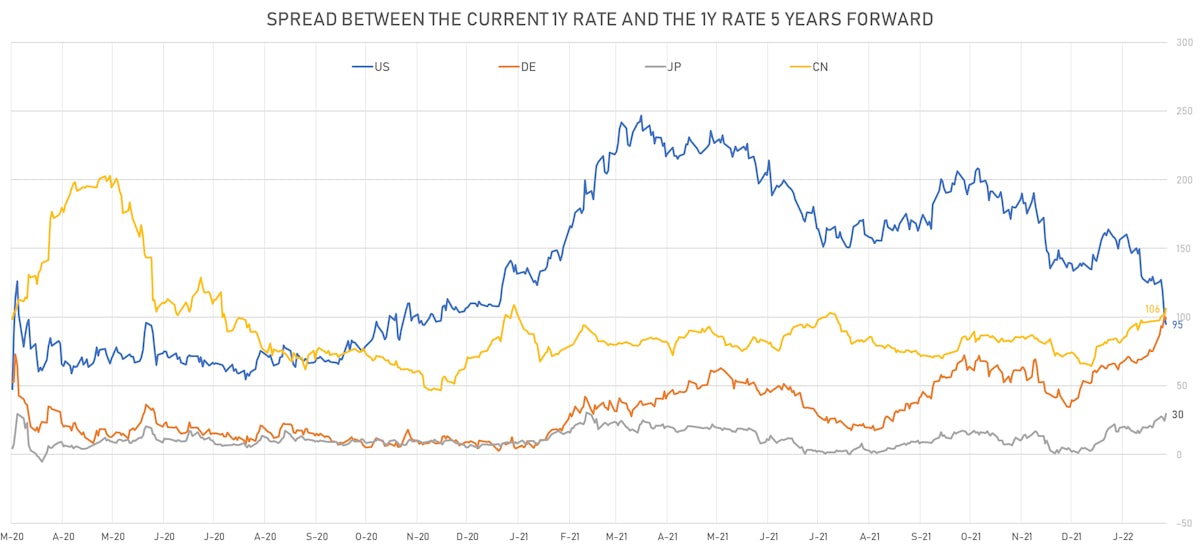

KEY INTERNATIONAL RATES

- Germany 5Y: 0.003% (down -1.7 bp); the German 1Y-10Y curve is 0.6 bp flatter at 89.6bp (YTD change: +46.1 bp)

- Japan 5Y: 0.028% (up 1.2 bp); the Japanese 1Y-10Y curve is 1.4 bp steeper at 32.4bp (YTD change: +13.3 bp)

- China 5Y: 2.506% (up 6.4 bp); the Chinese 1Y-10Y curve is 4.0 bp steeper at 92.5bp (YTD change: +41.5 bp)

- Switzerland 5Y: 0.067% (up 4.9 bp); the Swiss 1Y-10Y curve is 5.4 bp steeper at 96.6bp (YTD change: +36.1 bp)