Rates

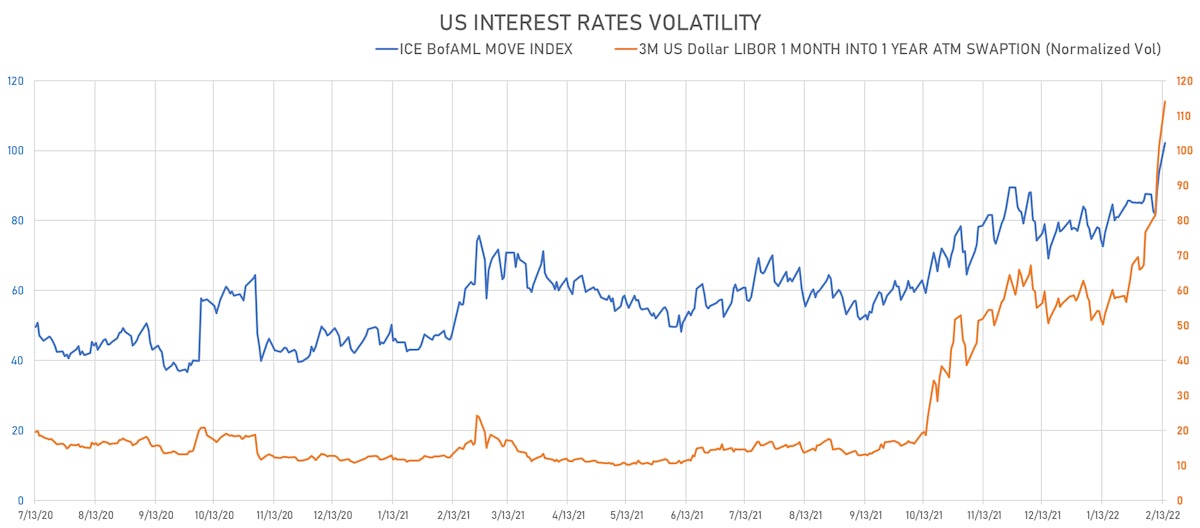

St. Louis Fed Bullard Spooks Markets Again, Brings Rates Volatility To Levels Not Seen Since March 2020

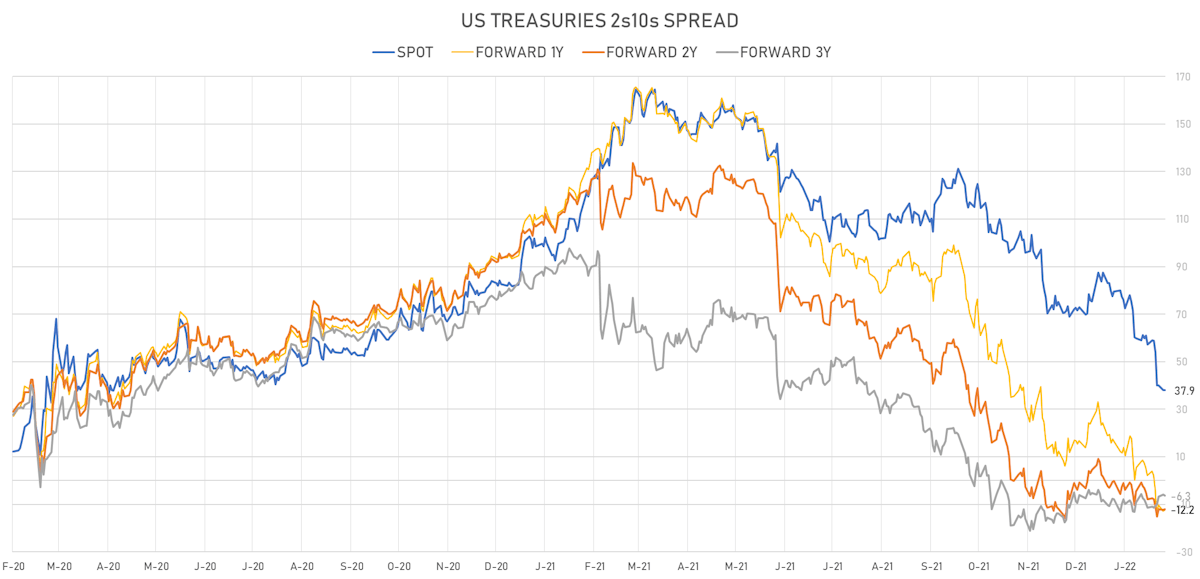

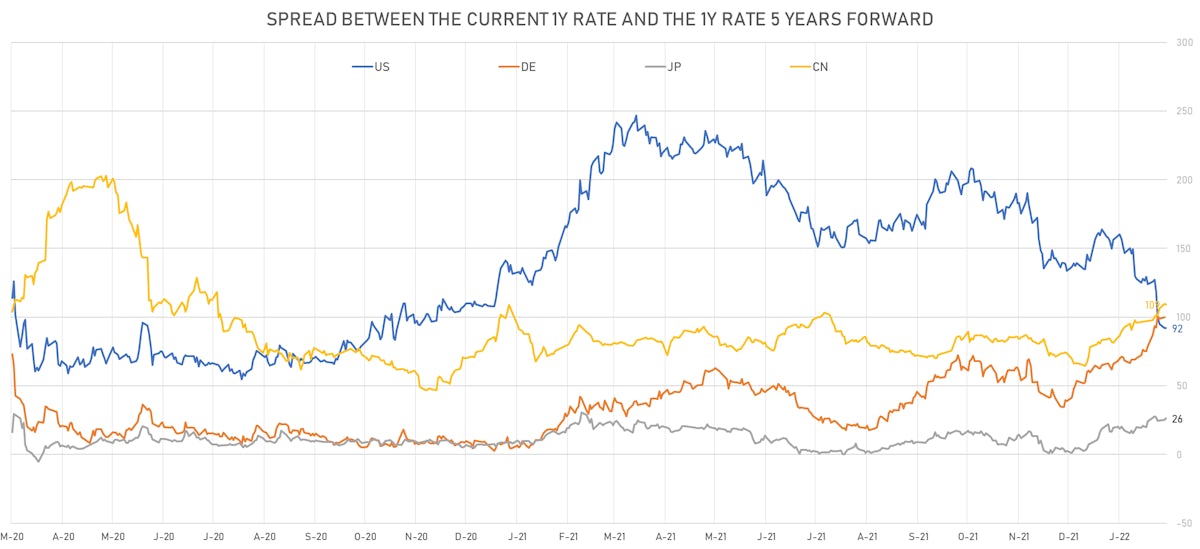

Over the past month, the market has come to expect 3 more hikes by the end of 2023, while the terminal rate in 5 years rose by less than one hike, with rates now pricing in almost 2/3 chance of a Fed cut in 2024 (reversal of policy mistake)

Published ET

US Rates Volatility | Sources: ϕpost, Refinitiv data

DAILY US SUMMARY

- The treasury yield curve steepened, with the 1s10s spread widening 0.1 bp, now at 88.2 bp (YTD change: -24.6bp)

- 1Y: 1.1040% (up 6.7 bp)

- 2Y: 1.5702% (up 8.3 bp)

- 5Y: 1.9080% (up 7.5 bp)

- 7Y: 1.9891% (up 6.8 bp)

- 10Y: 1.9858% (up 6.8 bp)

- 30Y: 2.2854% (up 5.1 bp)

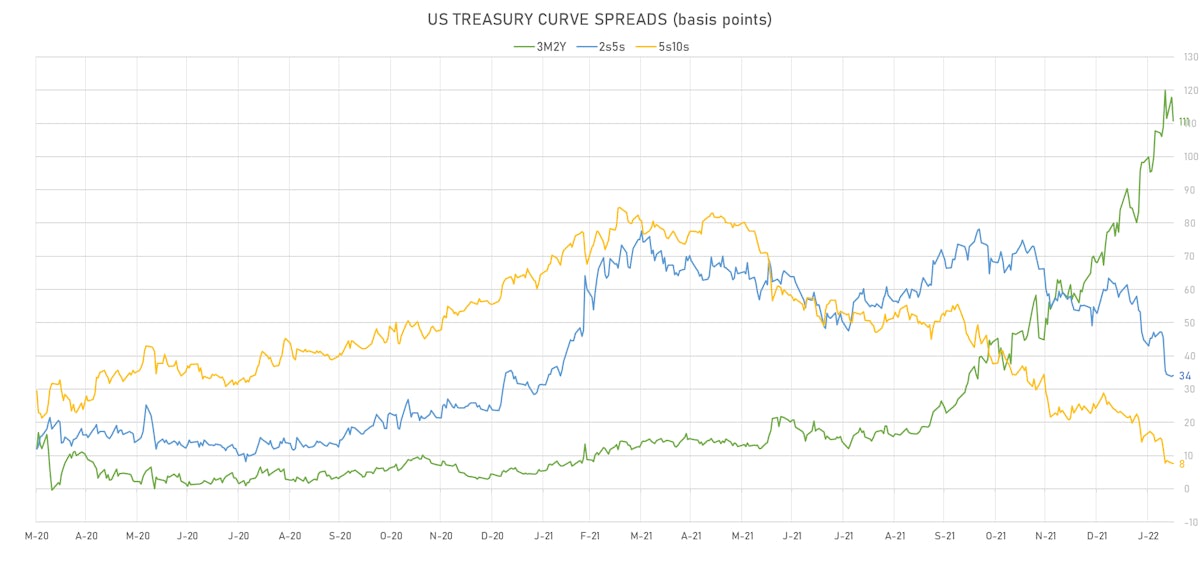

- US treasury curve spreads: 3m2Y at 110.7bp (down -7.2bp today), 2s5s at 34.1bp (up 0.6bp), 5s10s at 7.5bp (down -0.2bp), 10s30s at 29.8bp (down -0.4bp)

- Treasuries butterfly spreads: 1s5s10s at -79.3bp (down -2.8bp), 5s10s30s at 21.8bp (up 0.3bp)

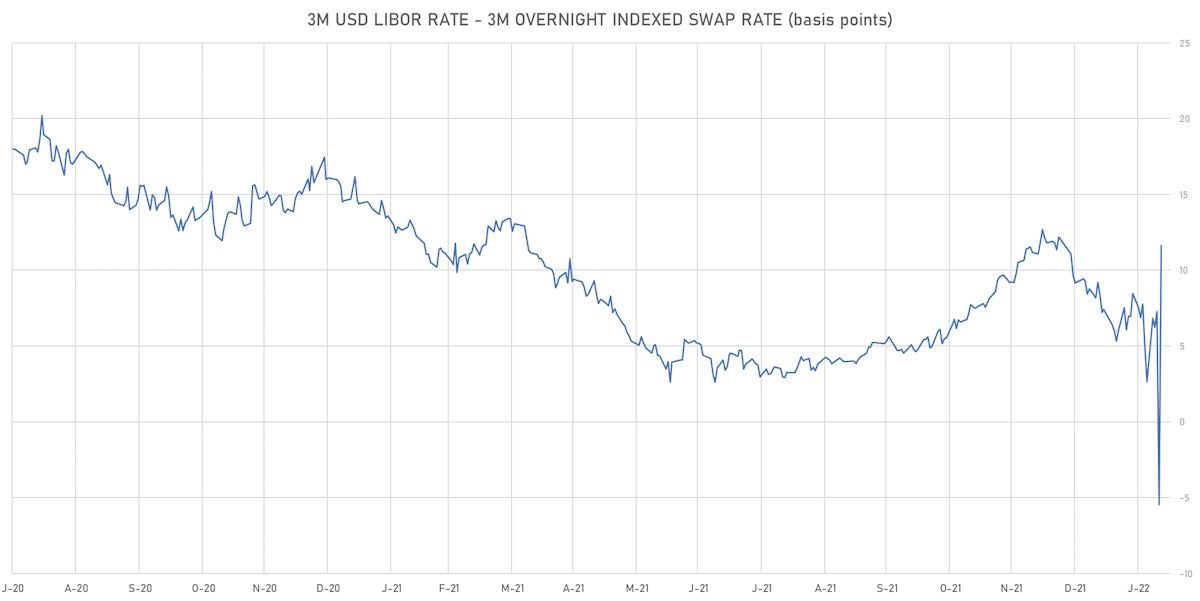

US FORWARD RATES

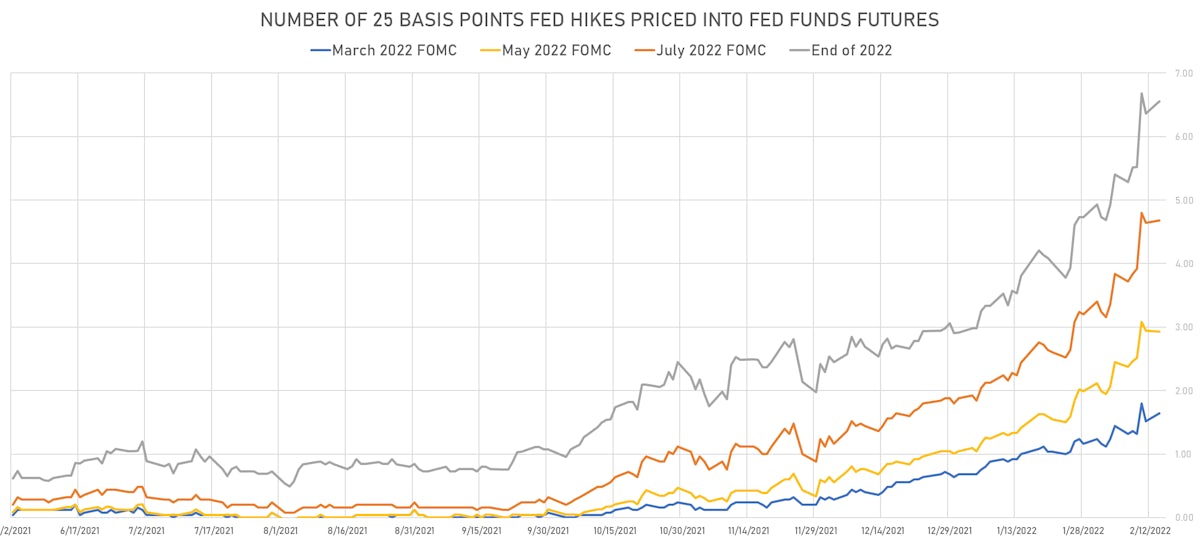

- Fed Funds futures now price in 39.6bp of Fed hikes by the end of March 2022, 72.3bp (2.89 x 25bp hikes) by the end of May 2022, and price in 6.55 hikes by the end of December 2022

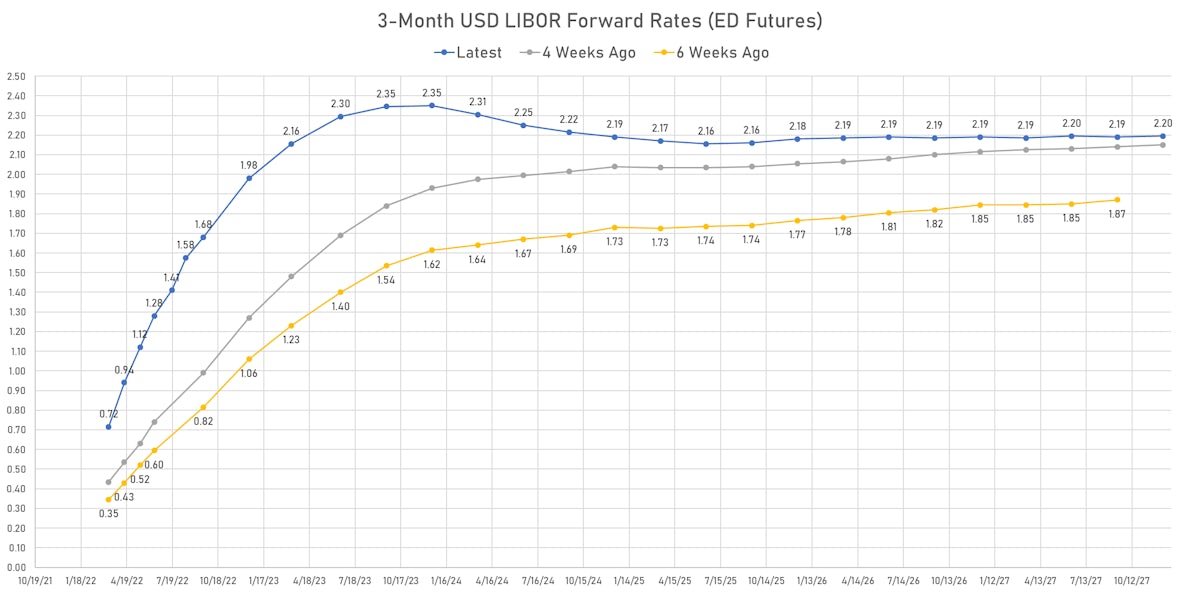

- 3-month Eurodollar futures (EDZ) spreads price in 37 bp of hikes in 2023 (equivalent to 1.5 x 25 bp hikes) and -16.0 bp of hikes in 2024 (equivalent to 64% chance of a 25 bp rate cut)

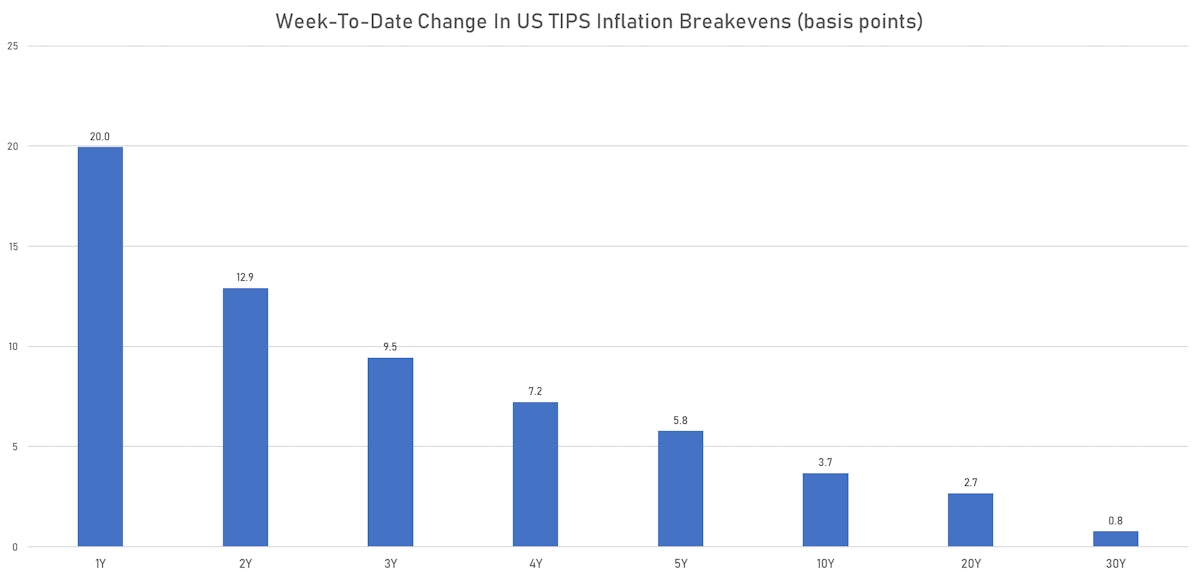

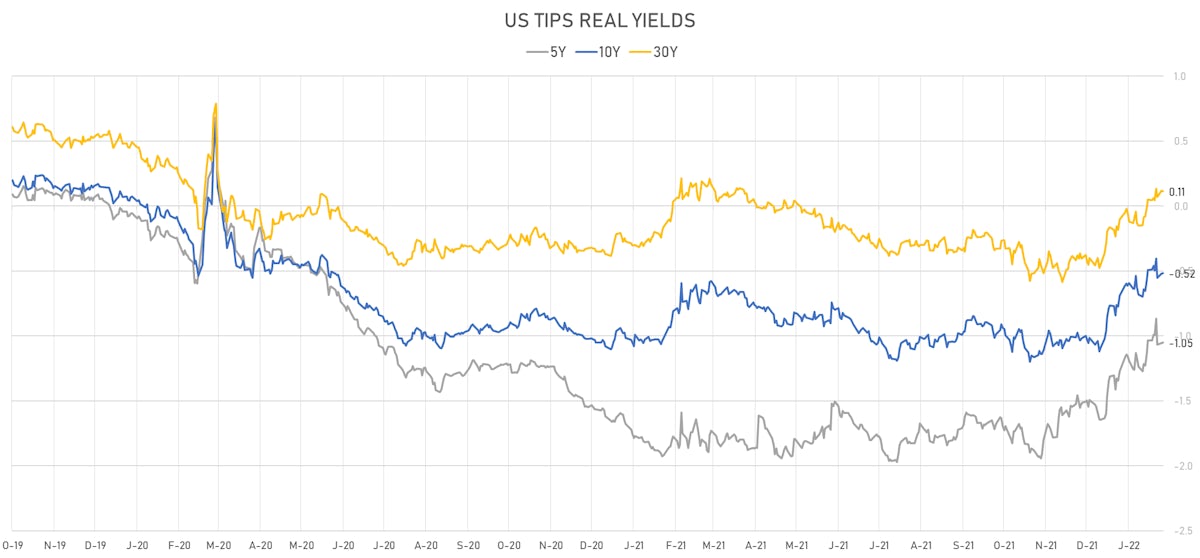

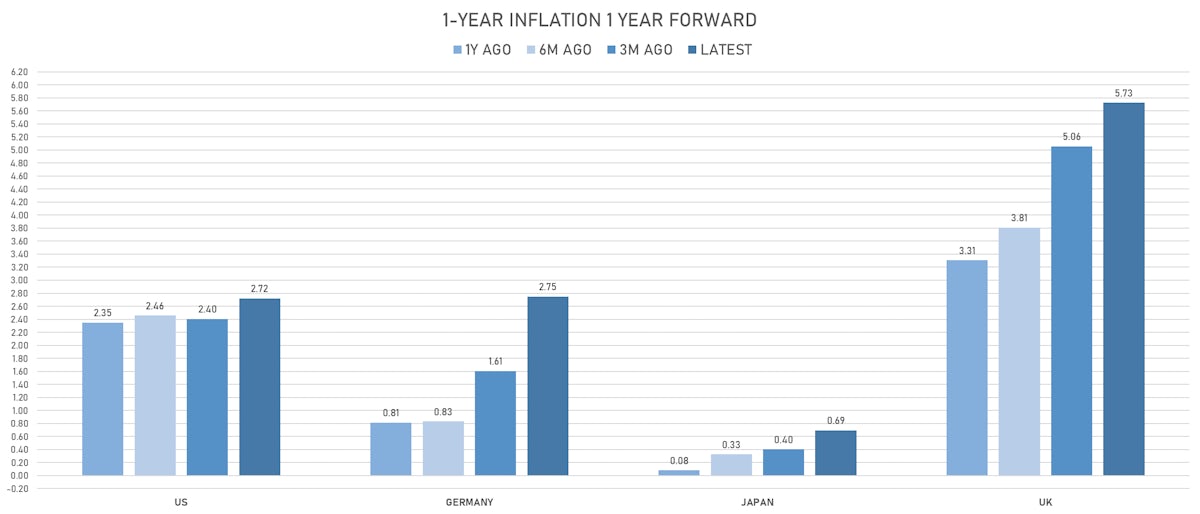

US INFLATION & REAL RATES

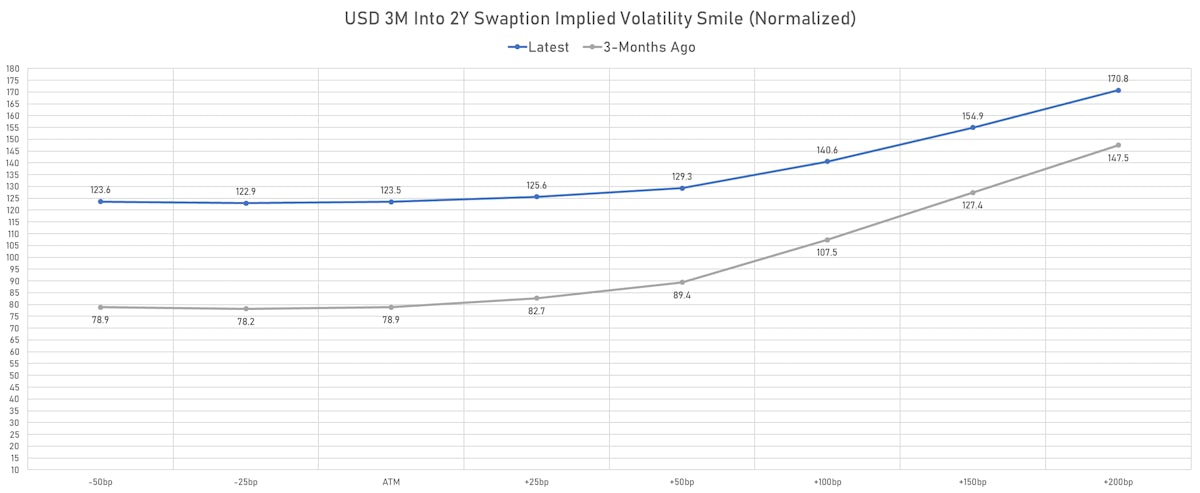

RATES VOLATILITY

- USD swap rate implied volatility (USD 1 Month into 1 Year ATM Swaption) up 12.5% at 114.0%

KEY INTERNATIONAL RATES

- Germany 5Y: 0.037% (up 2.4 bp); the German 1Y-10Y curve is 1.2 bp steeper at 91.2bp (YTD change: +47.3 bp)

- Japan 5Y: 0.044% (up 0.6 bp); the Japanese 1Y-10Y curve is 0.4 bp flatter at 28.4bp (YTD change: +12.3 bp)

- China 5Y: 2.508% (down -1.2 bp); the Chinese 1Y-10Y curve is 2.6 bp steeper at 89.0bp (YTD change: +38.0 bp)

- Switzerland 5Y: 0.026% (down -4.1 bp); the Swiss 1Y-10Y curve is 4.2 bp flatter at 88.4bp (YTD change: +31.9 bp)