Rates

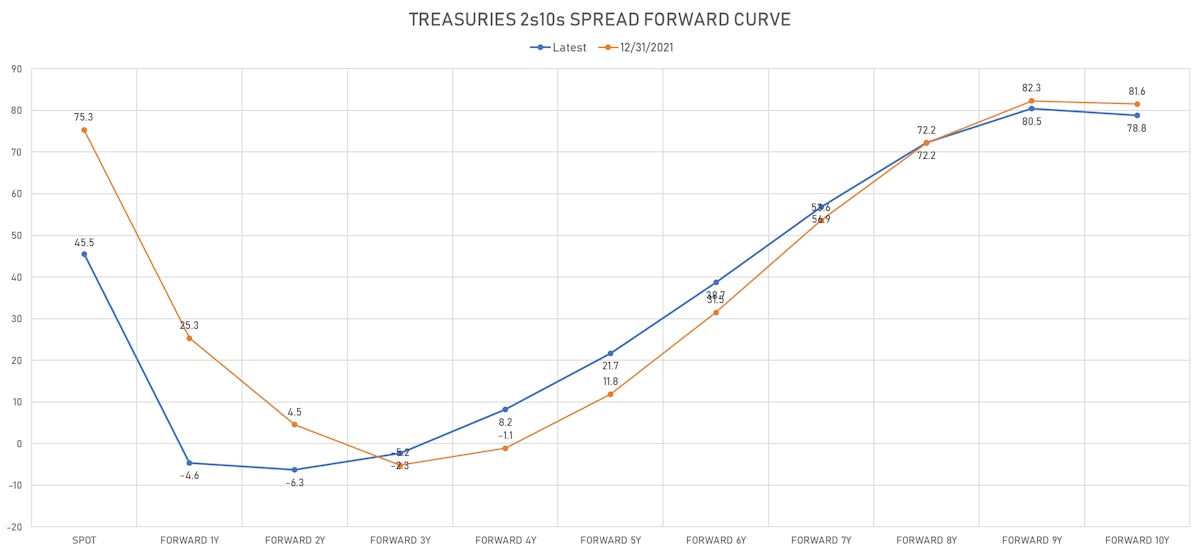

Macro Risk Aversion Leads To Modest Rebound Across The Rates Complex: Yields Down, Steeper Curve

Although the forward curve inversion is not a great development, the market seems to have some confidence that short-term rate hikes will allow inflation to drop back, with a high level of (negative) correlation between 5Y Treasury yields and 2Y forward 2Y inflation swaps

Published ET

US 5Y Treasury Yields vs 2Y Inflation Swap 2Y Forward (inverted vertical scales for 5Y Treasury yields and the correlation) | Source: Refinitiv

QUICK US SUMMARY

- 3-Month USD LIBOR -0.3bp today, now at 0.4850%; 3-Month OIS +1.3bp at 0.3955%

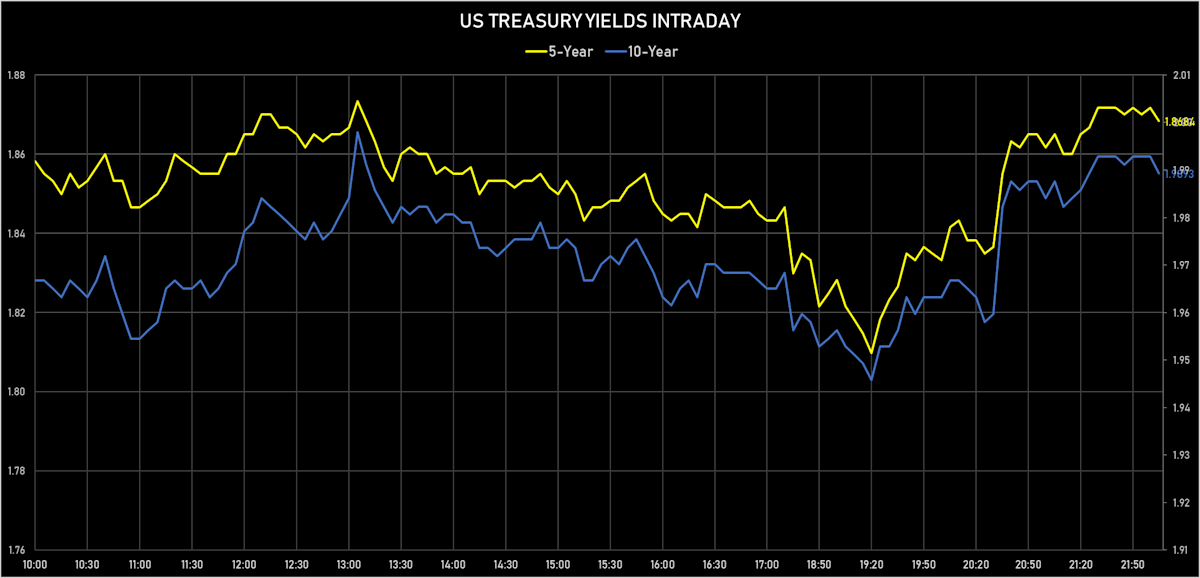

- The treasury yield curve steepened, with the 1s10s spread widening 3.5 bp, now at 91.9 bp (YTD change: -20.8bp)

- 1Y: 1.0490% (down 3.9 bp)

- 2Y: 1.4703% (down 5.0 bp)

- 5Y: 1.8466% (down 1.5 bp)

- 7Y: 1.9431% (down 1.0 bp)

- 10Y: 1.9684% (down 0.4 bp)

- 30Y: 2.2970% (down 1.9 bp)

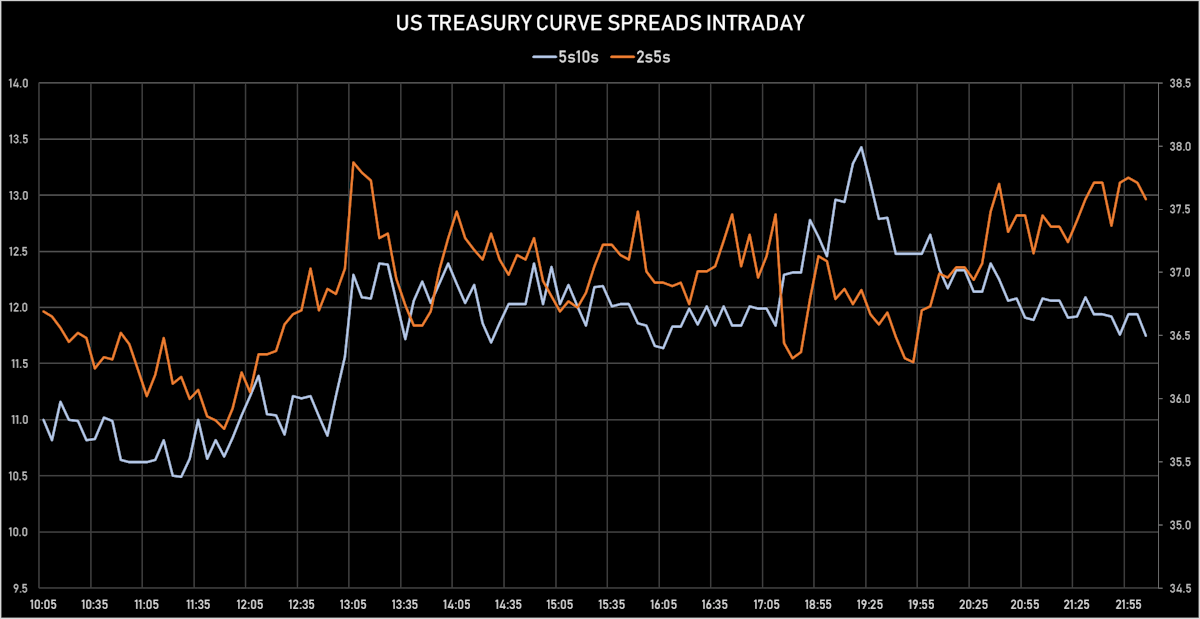

- US treasury curve spreads: 3m2Y at 108.7bp (down -5.7bp today), 2s5s at 37.3bp (down -2.2bp), 5s10s at 13.1bp (up 1.3bp), 10s30s at 33.6bp (up 3.2bp)

- Treasuries butterfly spreads: 1s5s10s at -70.5bp (up 4.8bp today), 5s10s30s at 20.5bp (up 2.4bp)

- TIPS 1Y breakeven inflation at 4.60% (up 8.2bp); 2Y at 3.63% (up 6.3bp); 5Y at 2.81% (up 0.2bp); 10Y at 2.45% (down -2.4bp); 30Y at 2.15% (down -5.1bp)

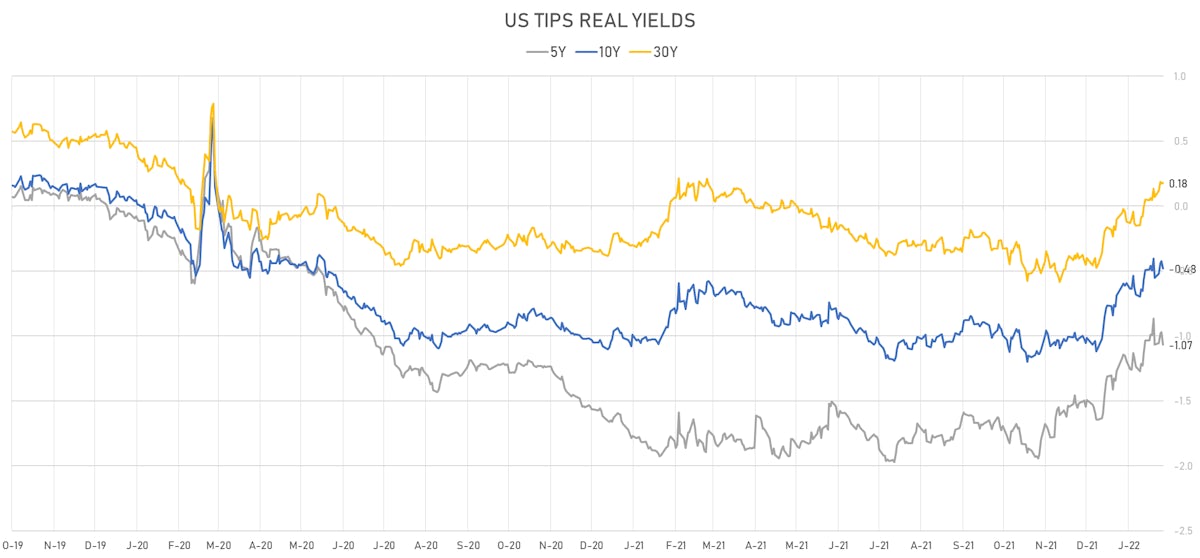

- US 5-Year TIPS Real Yield: -0.6 bp at -1.0750%; 10-Year TIPS Real Yield: -0.4 bp at -0.4850%; 30-Year TIPS Real Yield: -0.7 bp at 0.1720%

US MACRO RELEASES

- Building Permits for Jan 2022 (U.S. Census Bureau) at 1.90 Mln (vs 1.89 Mln prior), above consensus estimate of 1.76 Mln

- Building Permits, Change P/P for Jan 2022 (U.S. Census Bureau) at 0.70 % (vs 9.80 % prior)

- Housing Starts for Jan 2022 (U.S. Census Bureau) at 1.64 Mln (vs 1.70 Mln prior), below consensus estimate of 1.70 Mln

- Housing Starts, Change P/P for Jan 2022 (U.S. Census Bureau) at -4.10 % (vs 1.40 % prior)

- Jobless Claims, National, Continued for W 05 Feb (U.S. Dept. of Labor) at 1.59 Mln (vs 1.62 Mln prior), below consensus estimate of 1.61 Mln

- Jobless Claims, National, Initial for W 12 Feb (U.S. Dept. of Labor) at 248.00 k (vs 223.00 k prior), above consensus estimate of 219.00 k

- Jobless Claims, National, Initial, four week moving average for W 12 Feb (U.S. Dept. of Labor) at 243.25 k (vs 253.25 k prior)

- Philadelphia Fed, Future capital expenditures for Feb 2022 (FED, Philadelphia) at 21.50 (vs 26.20 prior)

- Philadelphia Fed, Future general business activity for Feb 2022 (FED, Philadelphia) at 28.10 (vs 28.70 prior)

- Philadelphia Fed, General business activity for Feb 2022 (FED, Philadelphia) at 16.00 (vs 23.20 prior), below consensus estimate of 20.00

- Philadelphia Fed, New orders for Feb 2022 (FED, Philadelphia) at 14.20 (vs 17.90 prior)

- Philadelphia Fed, Number of employees for Feb 2022 (FED, Philadelphia) at 32.30 (vs 26.10 prior)

- Philadelphia Fed, Prices paid for Feb 2022 (FED, Philadelphia) at 69.30 (vs 72.50 prior)

AUCTION RESULTS: $9BN 0.125% COUPON 30-YEAR TIPS (912810TE8)

- Bad stats all around, with poor pricing and much lower levels of end-user demand

- High yield: 0.195% (vs -0.292% prior), a chunky 5.5bp tail vs when-issued at the bid deadline

- Direct bids: 9.9% (vs 12.4% prior)

- Indirect bids: 69.9% (vs 74.9% prior)

- Bid-to-cover: 2.17 (vs 2.34 prior)

US FORWARD RATES

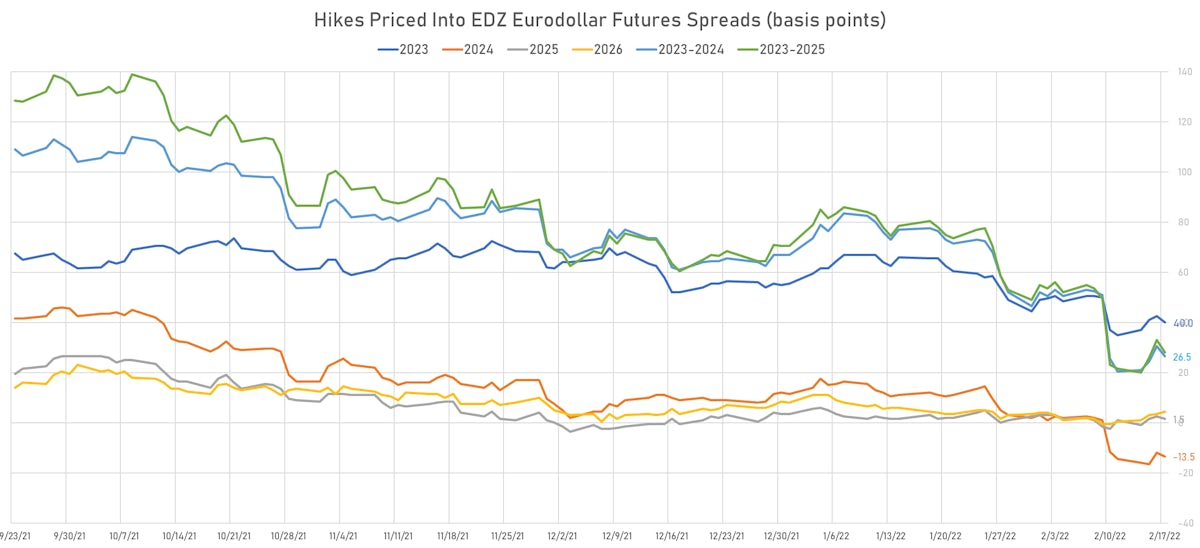

- Fed Funds futures now price in 33.9bp of Fed hikes by the end of March 2022, 63.2bp (2.53 x 25bp hikes) by the end of May 2022, and price in 5.89 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 40 bp of hikes in 2023 (equivalent to 1.6 x 25 bp hikes), down -2.5 bp today, and -13.5 bp of hikes in 2024 (equivalent to half a 25 bp cut)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 4.60% (up 8.2bp); 2Y at 3.63% (up 6.3bp); 5Y at 2.81% (up 0.2bp); 10Y at 2.45% (down -2.4bp); 30Y at 2.15% (down -5.1bp)

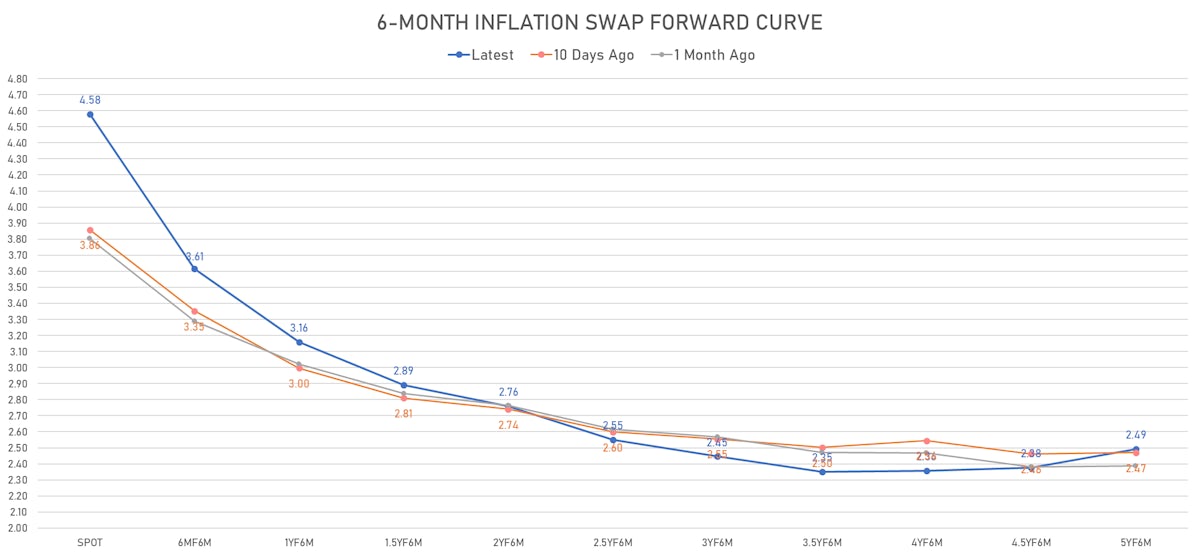

- 6-month spot US CPI swap up 7.6 bp to 4.580%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.0750%, -0.6 bp today; 10Y at -0.4850%, -0.4 bp today; 30Y at 0.1720%, -0.7 bp today

RATES VOLATILITY & LIQUIDITY

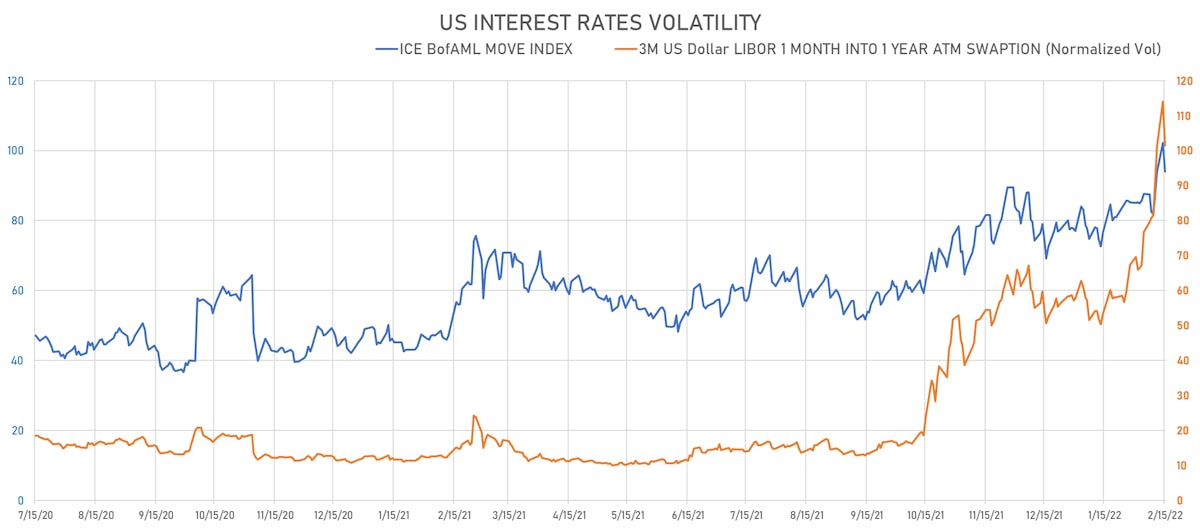

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 8.5% at 103.2%

- 3-Month LIBOR-OIS spread down -1.6 bp at 9.0 bp (12-months range: -5.5-13.4 bp)

KEY INTERNATIONAL RATES

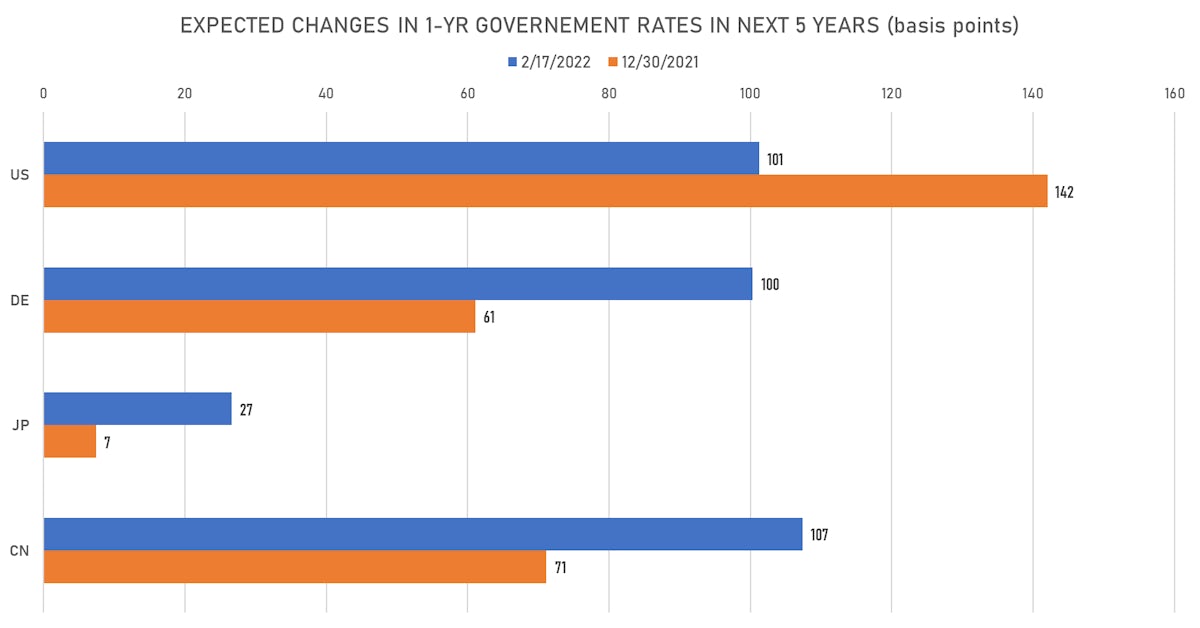

- Germany 5Y: -0.023% (down -4.5 bp); the German 1Y-10Y curve is 3.7 bp flatter at 88.2bp (YTD change: +45.0 bp)

- Japan 5Y: 0.053% (up 0.9 bp); the Japanese 1Y-10Y curve is 0.1 bp flatter at 27.8bp (YTD change: +12.1 bp)

- China 5Y: 2.482% (down -1.8 bp); the Chinese 1Y-10Y curve is 1.3 bp flatter at 86.8bp (YTD change: +35.8 bp)

- Switzerland 5Y: 0.023% (down -2.5 bp); the Swiss 1Y-10Y curve is 4.2 bp flatter at 91.1bp (YTD change: +32.6 bp)