Rates

US Rates Sell Off At The Front End, Yield Curve Flattens As Inflation Breakevens Rise

Macro headlines were dominated by the situation in Ukraine, although weak sanctions from the US and Europe indicate that peak fear may be behind us; market impact was mixed with a positive tilt: Russia's sovereign US$ CDS spreads were significantly wider (at 6-year high), but the Rouble was up 1.8%, while commodities like platinum and palladium were down

Published ET

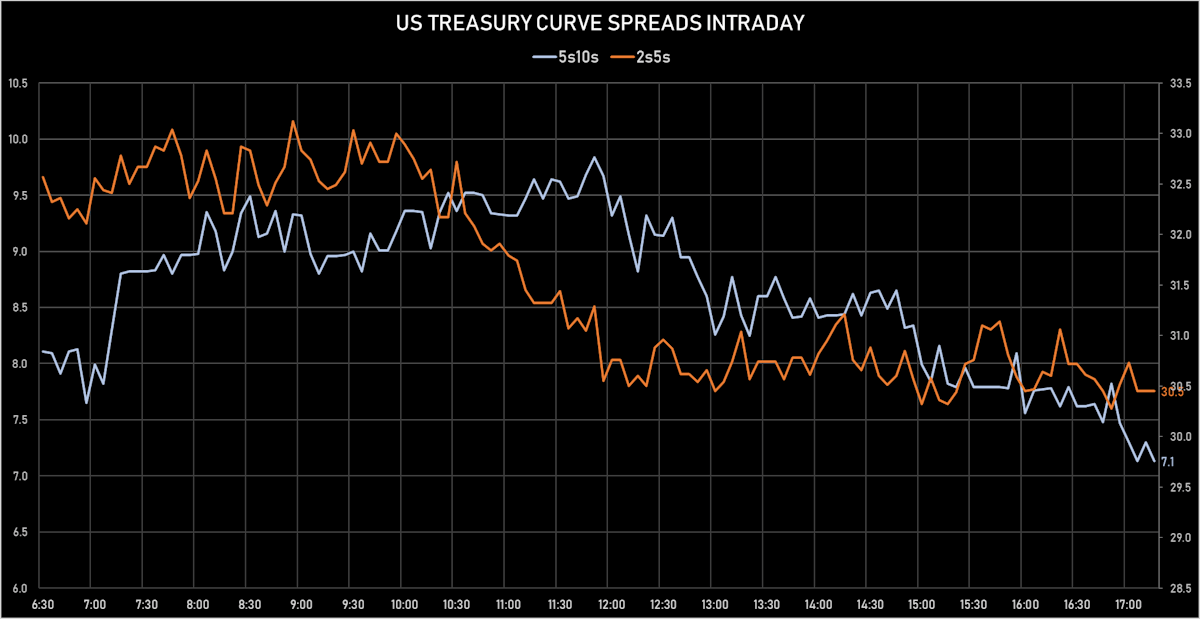

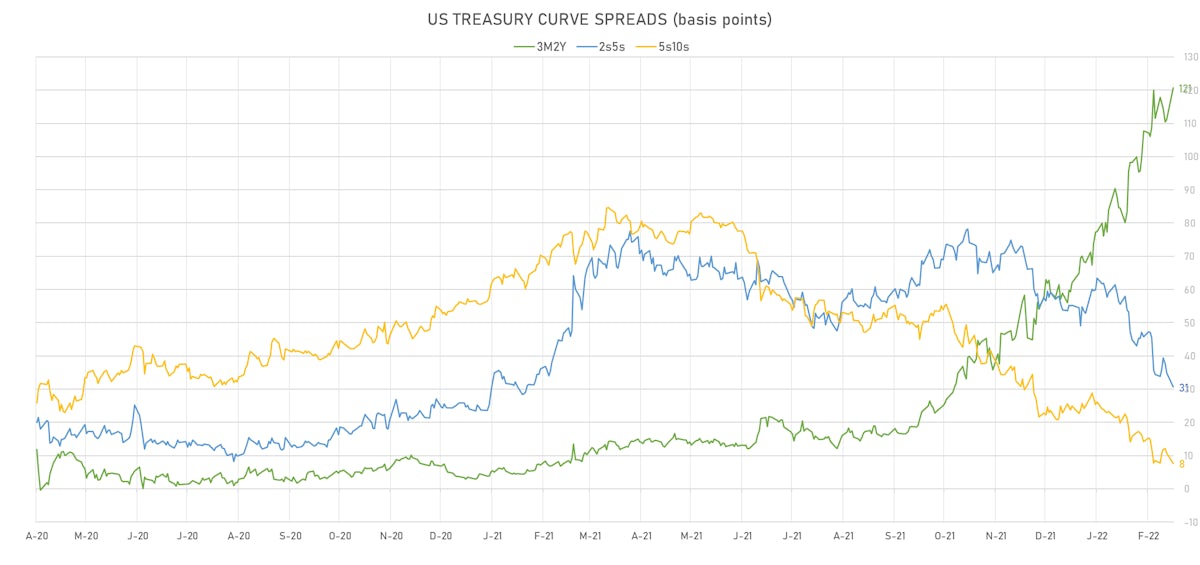

US Treasury Curve Spreads (basis points) | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +1.0bp today, now at 0.4900%; 3-Month OIS +2.5bp at 0.4205%

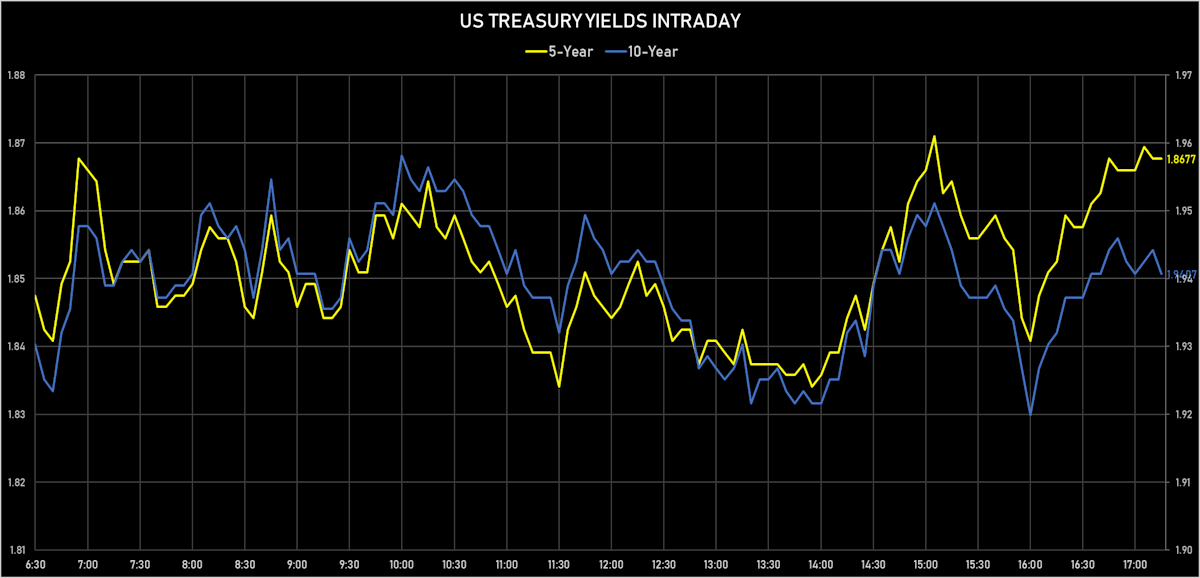

- The treasury yield curve flattened, with the 1s10s spread tightening -6.7 bp, now at 95.1 bp (YTD change: -17.7bp)

- 1Y: 0.9930% (up 8.5 bp)

- 2Y: 1.5615% (up 9.2 bp)

- 5Y: 1.8677% (up 4.9 bp)

- 7Y: 1.9410% (up 2.9 bp)

- 10Y: 1.9442% (up 1.7 bp)

- 30Y: 2.2421% (unchanged)

- US treasury curve spreads: 3m2Y at 119.9bp (up 8.7bp today), 2s5s at 30.7bp (down -4.3bp), 5s10s at 7.5bp (down -3.3bp), 10s30s at 29.8bp (down -1.8bp)

- Treasuries butterfly spreads: 1s5s10s at -73.6bp (up 1.2bp today), 5s10s30s at 21.8bp (up 2.2bp)

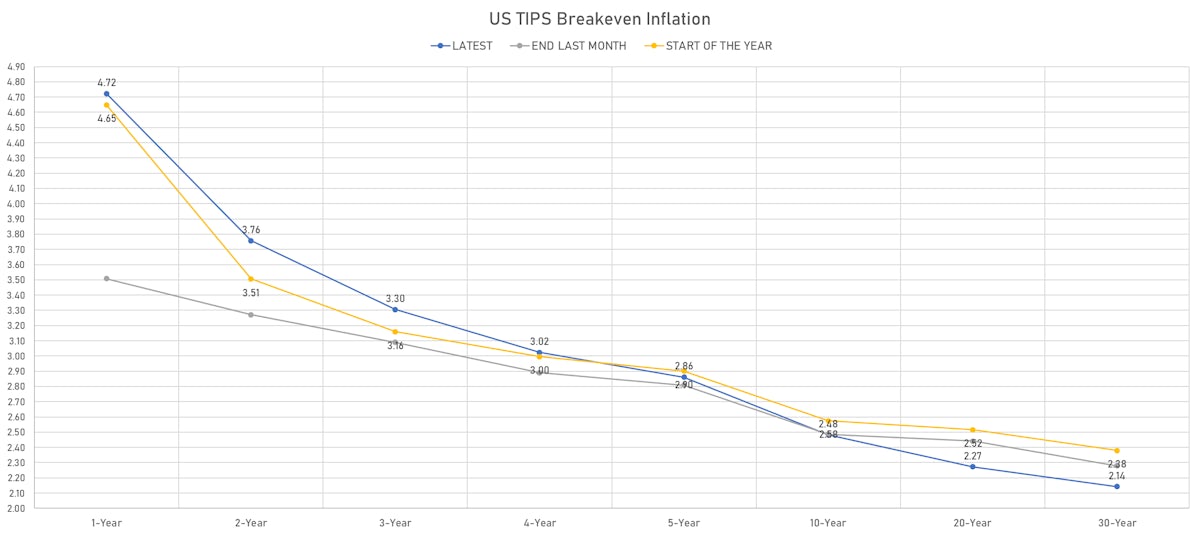

- TIPS 1Y breakeven inflation at 4.71% (up 10.8bp); 2Y at 3.75% (up 9.3bp); 5Y at 2.86% (up 4.1bp); 10Y at 2.48% (up 3.3bp); 30Y at 2.14% (up 2.2bp)

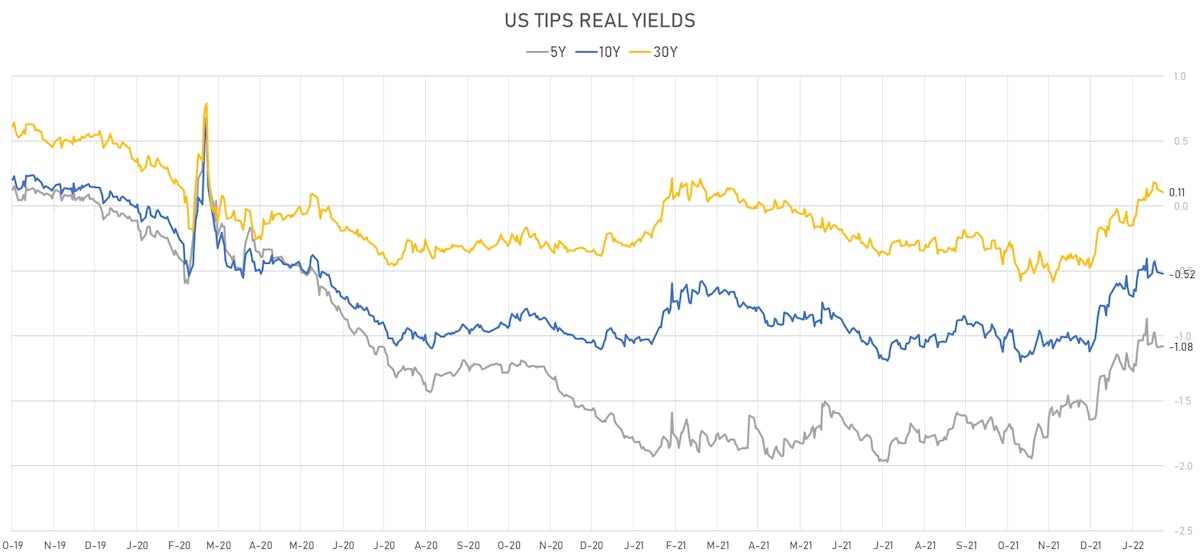

- US 5-Year TIPS Real Yield: +0.7 bp at -1.0800%; 10-Year TIPS Real Yield: -1.5 bp at -0.5230%; 30-Year TIPS Real Yield: -2.1 bp at 0.1070%

AUCTION RESULT: $51.7BN 2-YEAR 1.5% COUPON TREASURY NOTE (91282CEA5)

- Pretty good results, with decent pricing and record-high end-user demand (at 84.4%, vs 75.4% prior and 71.8% average)

- High yield: 1.553% (vs 0.990% prior), just 0.6bp through the when-issued at the bid deadline

- Direct bids: 18.8% (vs 9.4% prior)

- Indirect bids: 65.6% (vs 66.0% prior)

- Bid-to-cover: 2.64 (vs 2.81 prior)

GLOBAL MACRO RELEASES

- Argentina, Trade Balance, Current Prices for Jan 2022 (INDEC, Argentina) at 296.00 Mln USD (vs 371.00 Mln USD prior), below consensus estimate of 475.00 Mln USD

- Germany, Business Climate Germany (Incl. Services), Volume Index for Feb 2022 (Ifo, Univ. of Munich) at 98.90 (vs 95.70 prior), above consensus estimate of 96.50

- Germany, Ifo Business Climate Germany Expectation (Incl. Services), Volume Index for Feb 2022 (Ifo, Univ. of Munich) at 99.20 (vs 95.20 prior), above consensus estimate of 96.10

- Germany, Ifo Business Climate Germany Situation (Incl. services), Volume Index for Feb 2022 (Ifo, Univ. of Munich) at 98.60 (vs 96.10 prior), above consensus estimate of 96.60

- Hungary, Policy Rates, Base Rate for Feb 2022 (Cent. Bank, Hungary) at 3.40 % (a 50bp hike vs 2.90 % prior), in line with consensus

- Hungary, Policy Rates, Overnight Deposite Rate for Feb 2022 (Cent. Bank, Hungary) at 3.40 % (vs 2.90 % prior), in line with consensus

- Italy, CPI, Final, Change P/P, Price Index for Jan 2022 (ISTAT, Italy) at 1.60 % (vs 1.60 % prior), in line with consensus

- Italy, CPI, Final, Change Y/Y for Jan 2022 (ISTAT, Italy) at 4.80 % (vs 4.80 % prior), in line with consensus

- Italy, HICP, Final, Change P/P, Price Index for Jan 2022 (ISTAT, Italy) at 0.00 % (vs 0.20 % prior), below consensus estimate of 0.20 %

- Italy, HICP, Final, Change Y/Y, Price Index for Jan 2022 (ISTAT, Italy) at 5.10 % (vs 5.30 % prior), below consensus estimate of 5.30 %

- United Kingdom, CBI Industrial Trends, Level of total order books, current situation for Feb 2022 (CBI, UK) at 20.00 (vs 24.00 prior), below consensus estimate of 25.00

- United States, Conference Board, Consumer confidence for Feb 2022 (The Conference Board) at 110.50 (vs 113.80 prior), above consensus estimate of 110.00

- United States, House Prices, S&P Case-Shiller, Composite-20, Change P/P for Dec 2021 (Standard & Poor's) at 1.50 % (vs 1.20 % prior), above consensus estimate of 1.10 %

- United States, House Prices, S&P Case-Shiller, Composite-20, Change Y/Y, Price Index for Dec 2021 (Standard & Poor's) at 18.60 % (vs 18.30 % prior), above consensus estimate of 18.00 %

- United States, PMI, Composite, Output, Flash for Feb 2022 (Markit Economics) at 56.00 (vs 51.10 prior)

- United States, PMI, Manufacturing Sector, Total, Flash for Feb 2022 (Markit Economics) at 57.50 (vs 55.50 prior), above consensus estimate of 56.00

- United States, PMI, Services Sector, Business Activity, Flash for Feb 2022 (Markit Economics) at 56.70 (vs 51.20 prior), above consensus estimate of 53.00

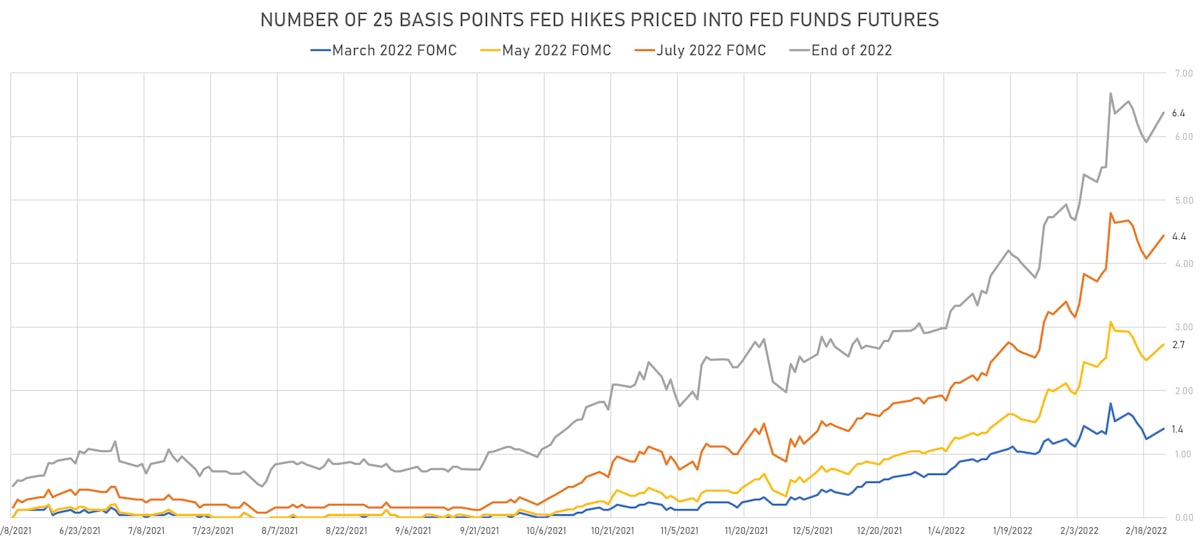

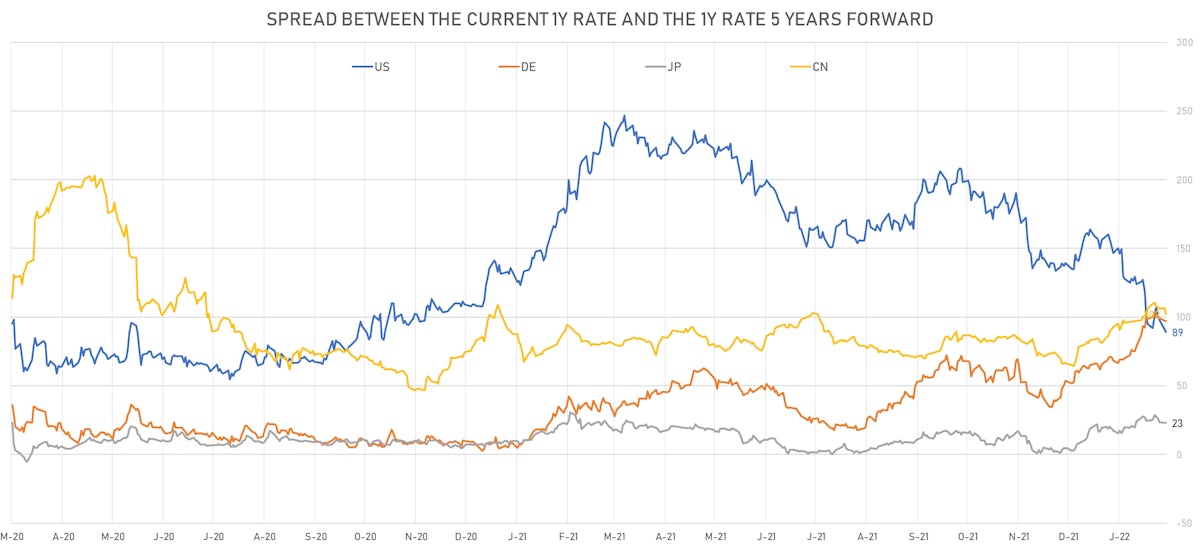

US FORWARD RATES

- Fed Funds futures now price in 34.6bp of Fed hikes by the end of March 2022, 68.5bp (2.74 x 25bp hikes) by the end of May 2022, and price in 6.35 hikes by the end of December 2022

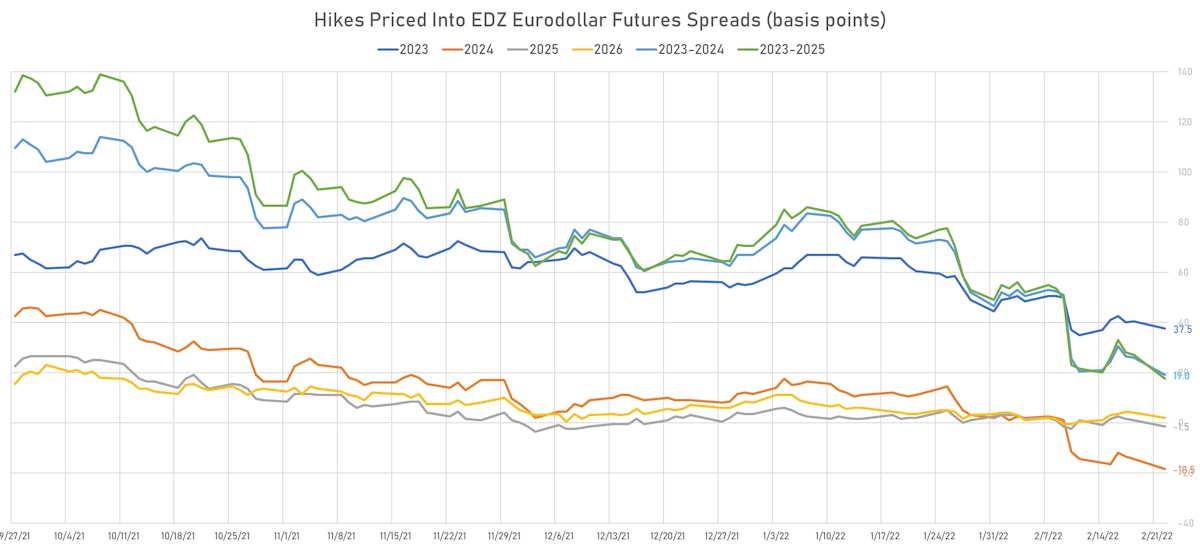

- 3-month Eurodollar futures (EDZ) spreads price in 37.5 bp of hikes in 2023 (equivalent to 1.5 x 25 bp hikes), down -3.0 bp today, and -18.5 bp of hikes in 2024 (equivalent to -0.7 x 25 bp hikes)

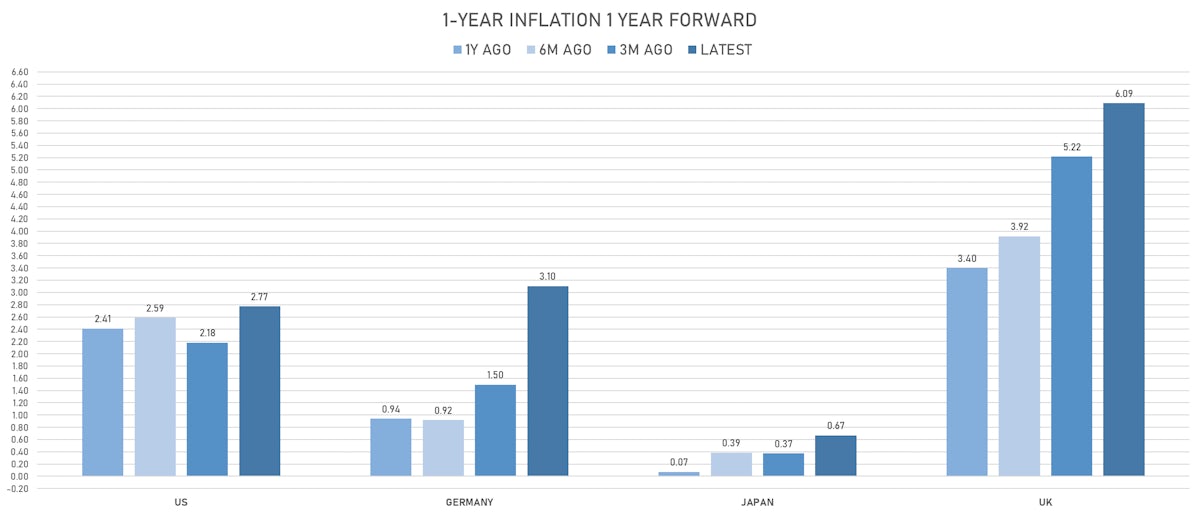

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 4.71% (up 10.8bp); 2Y at 3.75% (up 9.3bp); 5Y at 2.86% (up 4.1bp); 10Y at 2.48% (up 3.3bp); 30Y at 2.14% (up 2.2bp)

- 6-month spot US CPI swap up 5.4 bp to 4.579%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.0800%, +0.7 bp today; 10Y at -0.5230%, -1.5 bp today; 30Y at 0.1070%, -2.1 bp today

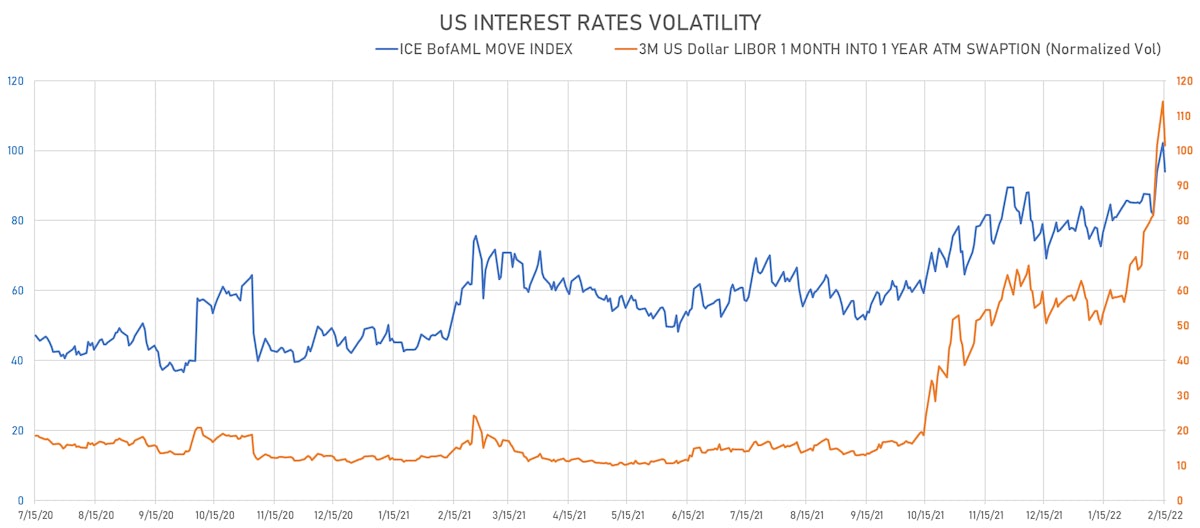

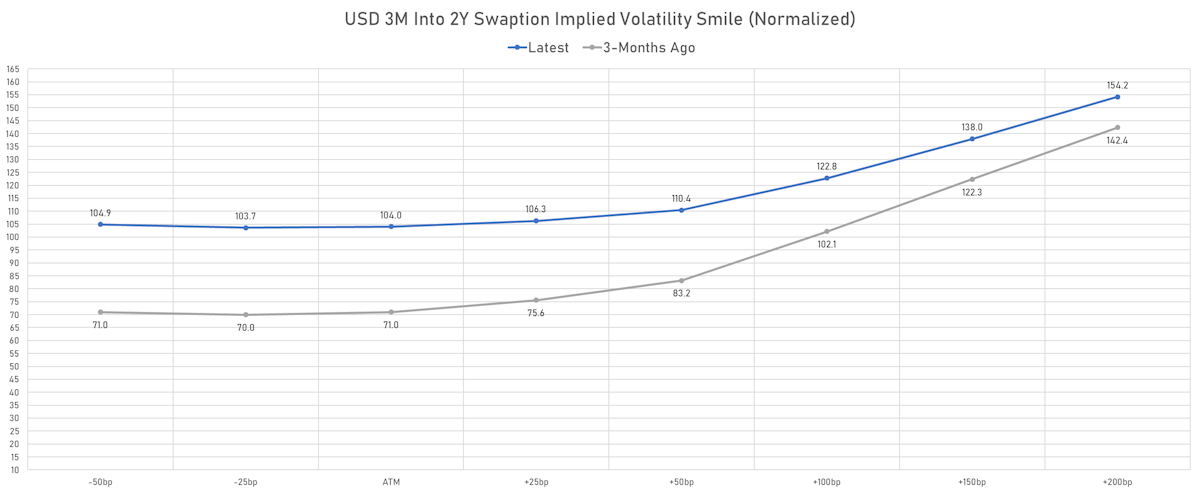

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 1.2% at 100.0%

- 3-Month LIBOR-OIS spread down -1.5 bp at 6.9 bp (12-months range: -5.5-13.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.014% (up 5.1 bp); the German 1Y-10Y curve is 2.3 bp steeper at 85.8bp (YTD change: +43.2 bp)

- Japan 5Y: 0.026% (down -1.9 bp); the Japanese 1Y-10Y curve is 0.6 bp flatter at 26.0bp (YTD change: +10.3 bp)

- China 5Y: 2.592% (up 4.0 bp); the Chinese 1Y-10Y curve is 4.9 bp flatter at 77.6bp (YTD change: +26.6 bp)

- Switzerland 5Y: 0.017% (up 3.6 bp); the Swiss 1Y-10Y curve is 1.0 bp flatter at 88.8bp (YTD change: +32.2 bp)