Rates

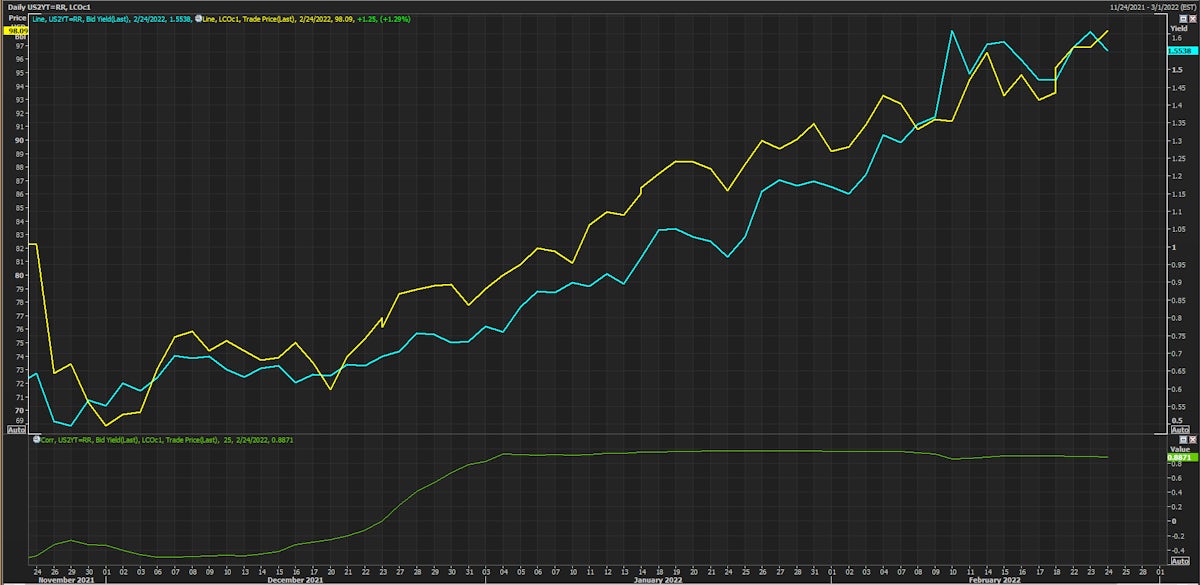

US Treasury Curve Continues To Bear Flatten, Driven By Higher Inflation Breakevens, As Oil Prices Near $100/BBL

Macro markets have increased the Ukrainian war risk premia over the past 24 hours: the Rouble is down close to 5% as we write, Russia's 5Y US$ CDS spread is up 80.1 basis points to 420 bp (1Y range: 75-420bp), nearly double where it was last week (215bp on 16 Feb.) and yields on local benchmarks are up 120bp across the curve (2Y now at 11.3%vs 10.1% last week)

Published ET

US 2Y Treasury Yield and Brent Crude Front Month Prices | Source: Refinitiv

QUICK US SUMMARY

- 3-Month USD LIBOR +0.2bp today, now at 0.4900%; 3-Month OIS +0.2bp at 0.4280%

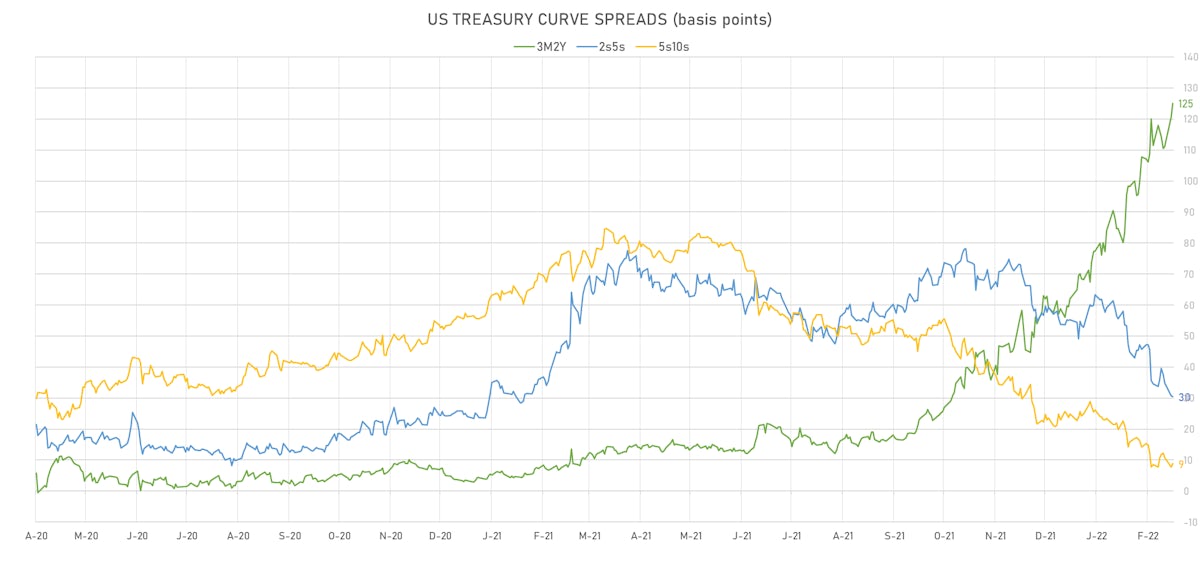

- The treasury yield curve flattened, with the 1s10s spread tightening -1.6 bp, now at 90.7 bp (YTD change: -22.1bp)

- 1Y: 1.0910% (up 7.0 bp)

- 2Y: 1.6056% (up 4.4 bp)

- 5Y: 1.9100% (up 4.2 bp)

- 7Y: 1.9899% (up 4.9 bp)

- 10Y: 1.9982% (up 5.4 bp)

- 30Y: 2.3022% (up 6.0 bp)

- US treasury curve spreads: 3m2Y at 125.1bp (up 4.4bp today), 2s5s at 29.3bp (down -0.3bp), 5s10s at 10.8bp (up 1.3bp), 10s30s at 31.2bp (up 0.5bp)

- Treasuries butterfly spreads: 1s5s10s at -69.1bp (up 4.5bp today), 5s10s30s at 21.2bp (down -0.6bp)

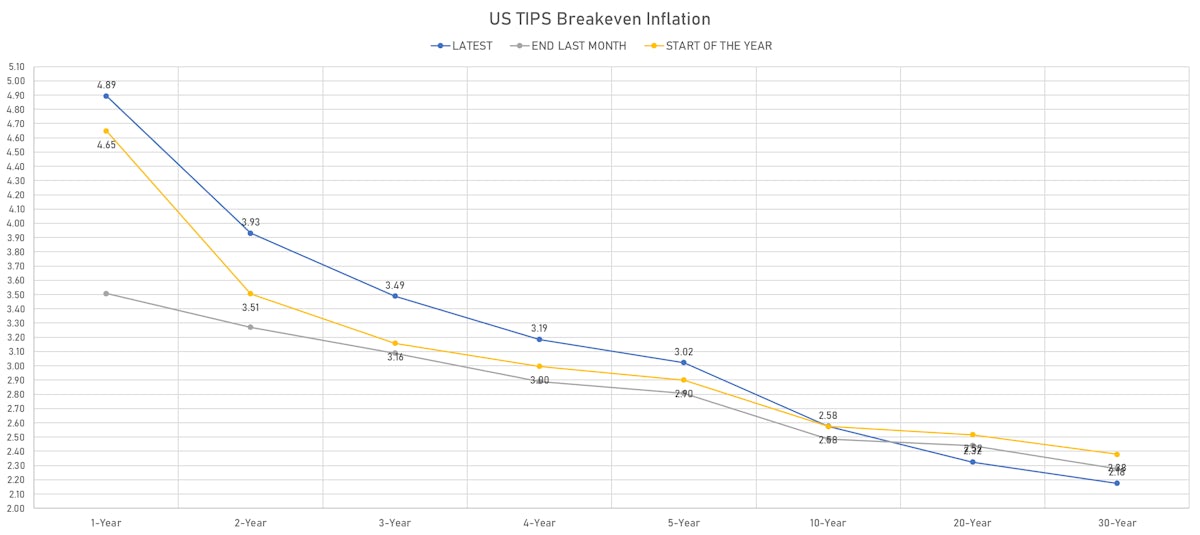

- TIPS 1Y breakeven inflation at 4.89% (up 18.3bp); 2Y at 3.93% (up 18.1bp); 5Y at 3.02% (up 16.0bp); 10Y at 2.58% (up 9.3bp); 30Y at 2.18% (up 3.6bp)

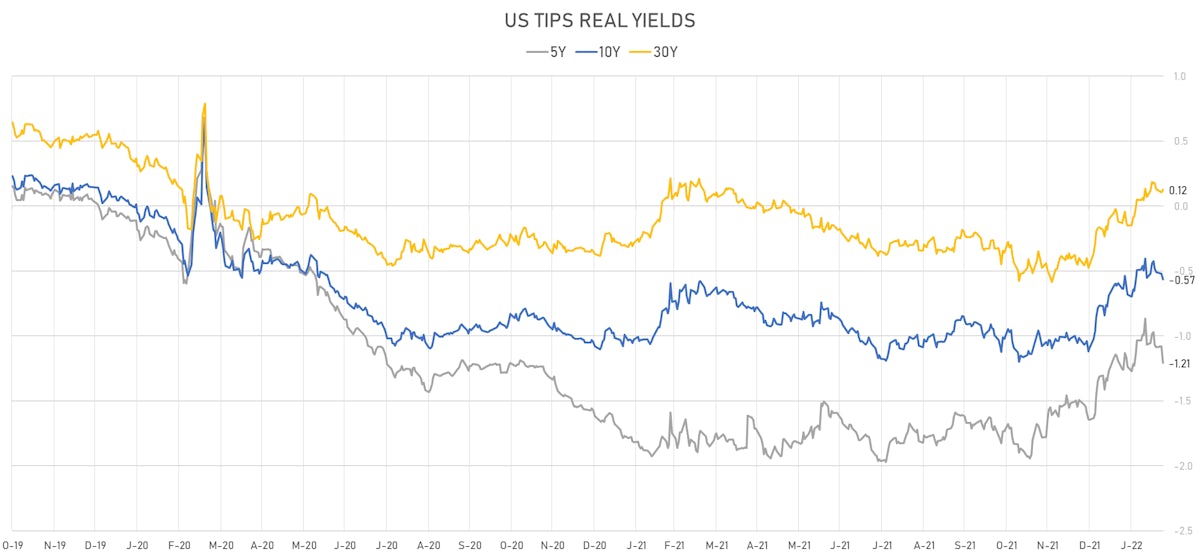

- US 5-Year TIPS Real Yield: -12.9 bp at -1.2090%; 10-Year TIPS Real Yield: -4.2 bp at -0.5650%; 30-Year TIPS Real Yield: +1.7 bp at 0.1240%

AUCTION RESULTS: $52.9BN 5-YEAR 1.875% COUPON TREASURY NOTE (91282CEC1)

- Good results, not dissimilar to yesterday's 2-year auction, with decent pricing and record-high end-user demand (86.2% vs 85.2% prior and 77.3% average)

- High yield: 1.880% (vs 1.533% prior), just 0.1bp through the when-issued at the bid deadline

- Direct bids: 18.4% (vs 16.5% prior and 16.8% average)

- Indirect bids: 67.8% (vs 68.7% prior and 60.5% average)

- Bid-to-cover: (2.49 vs 2.50 prior and 2.39 average)

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 19 Feb (Redbook Research) at 14.50 % (vs 15.40 % prior)

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 18 Feb (MBA, USA) at -13.10 % (vs -5.40 % prior)

- Mortgage applications, market composite index for W 18 Feb (MBA, USA) at 466.40 (vs 537.00 prior)

- Mortgage applications, market composite index, purchase for W 18 Feb (MBA, USA) at 250.70 (vs 279.00 prior)

- Mortgage applications, market composite index, refinancing for W 18 Feb (MBA, USA) at 1677.70 (vs 1988.80 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 18 Feb (MBA, USA) at 4.06 % (vs 4.05 % prior)

GLOBAL MACRO RELEASES

- Australia, Wage Prices, All Sectors, Total hourly rates of pay excluding bonuses, all industries, Change P/P for Q4 2021 (AU Bureau of Stat) at 0.70 % (vs 0.60 % prior), in line with consensus

- Australia, Wage Prices, All Sectors, Total hourly rates of pay excluding bonuses, all industries, Change Y/Y for Q4 2021 (AU Bureau of Stat) at 2.30 % (vs 2.20 % prior), below consensus estimate of 2.40 %

- Brazil, CPI, Broad national - 15 (IPCA-15), Change P/P for Feb 2022 (IBGE, Brazil) at 0.99 % (vs 0.58 % prior), above consensus estimate of 0.85 %

- Euro Zone, CPI, Change P/P, Price Index for Jan 2022 (Eurostat) at 0.30 % (vs 0.40 % prior), in line with consensus

- Euro Zone, CPI, Change Y/Y for Jan 2022 (Eurostat) at 5.10 % (vs 5.10 % prior), in line with consensus

- France, Business Sentiment, Composite business climate, manufacturing industry for Feb 2022 (INSEE, France) at 112.00 (vs 112.00 prior), in line with consensus

- New Zealand, Policy Rates, Official Cash Rate (OCR) for 23 Feb (RBNZ) at 1.00 % (a 25 bp hike), in line with consensus

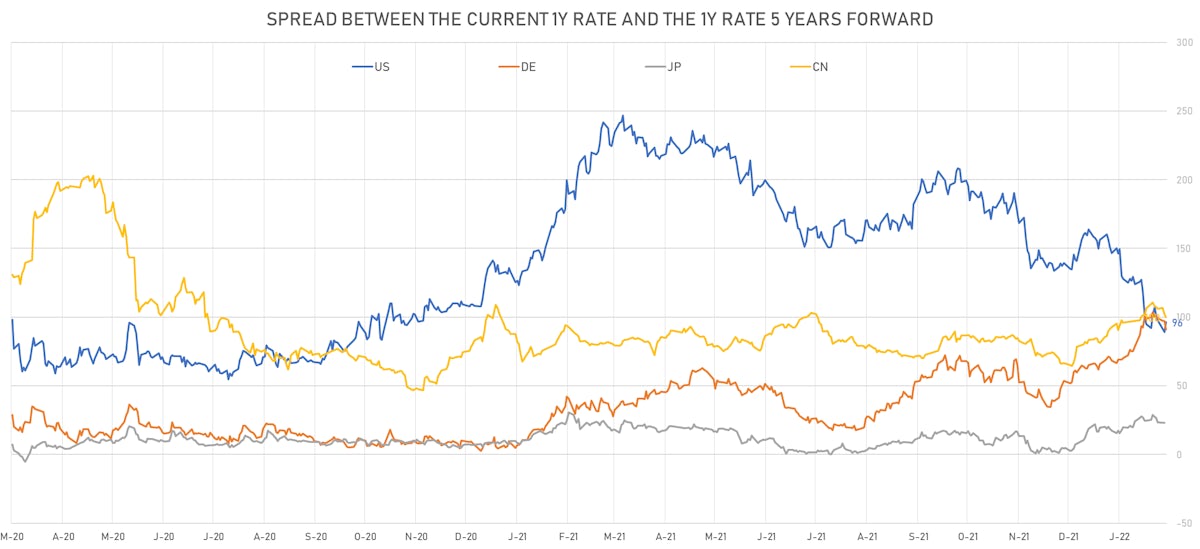

US FORWARD RATES

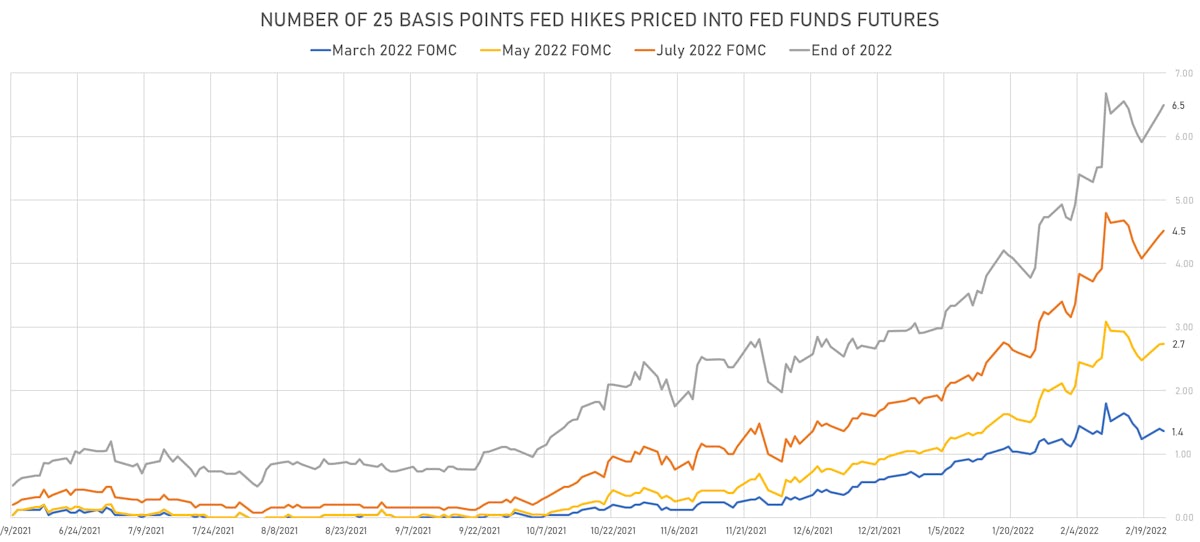

- Fed Funds futures now price in 33bp of Fed hikes by the end of March 2022, 647bp (2.7 x 25bp hikes) by the end of May 2022, and price in 6.4 hikes by the end of December 2022

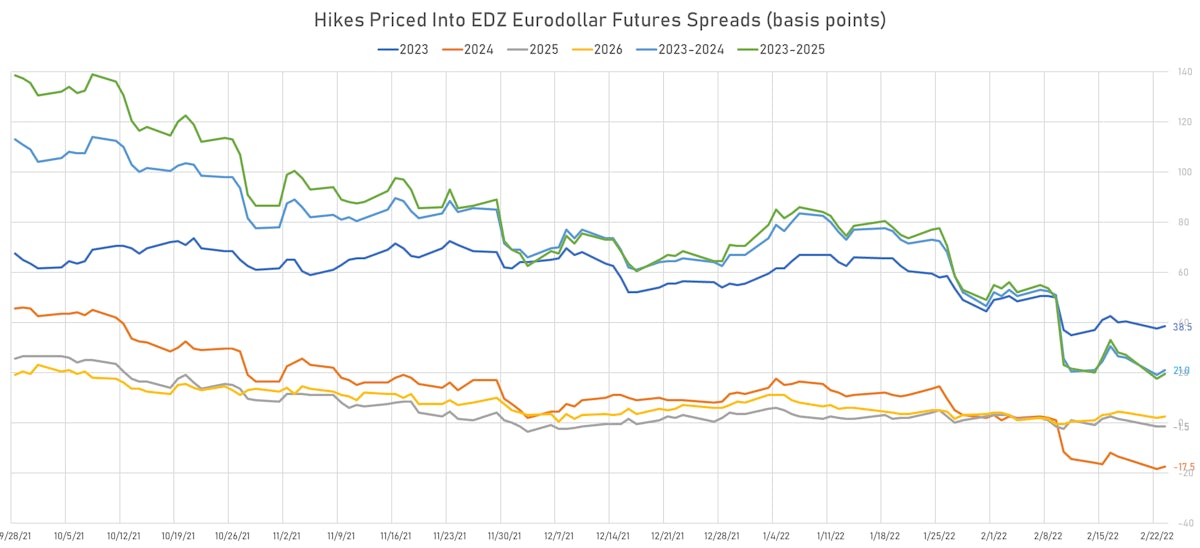

- 3-month Eurodollar futures (EDZ) spreads price in 38.5 bp of hikes in 2023 (equivalent to 1.5 x 25 bp hikes), up 1.0 bp today, and -17.5 bp of hikes in 2024 (equivalent to -0.7 x 25 bp hikes)

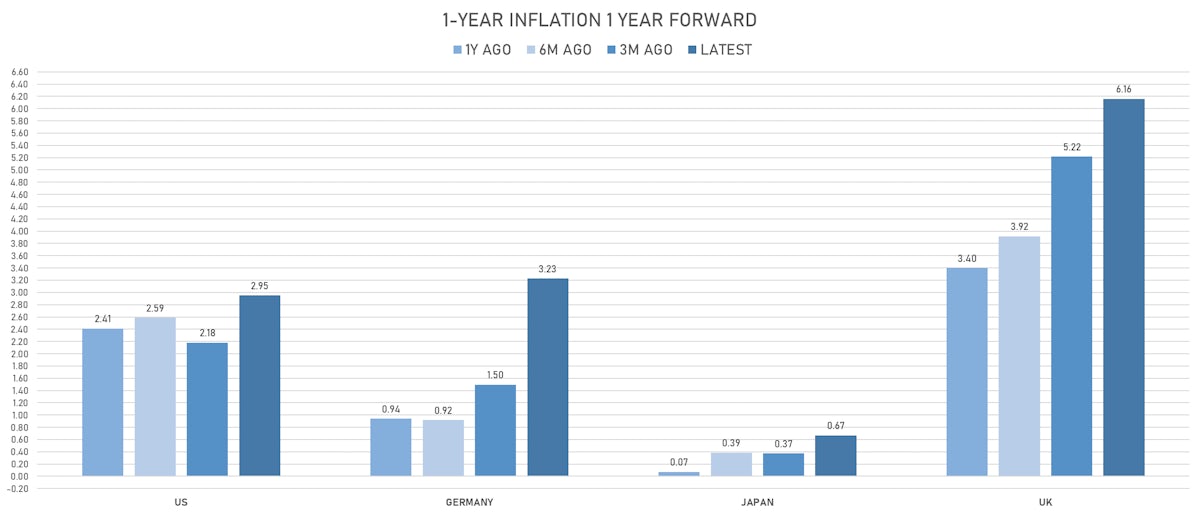

US INFLATION & REAL RATES

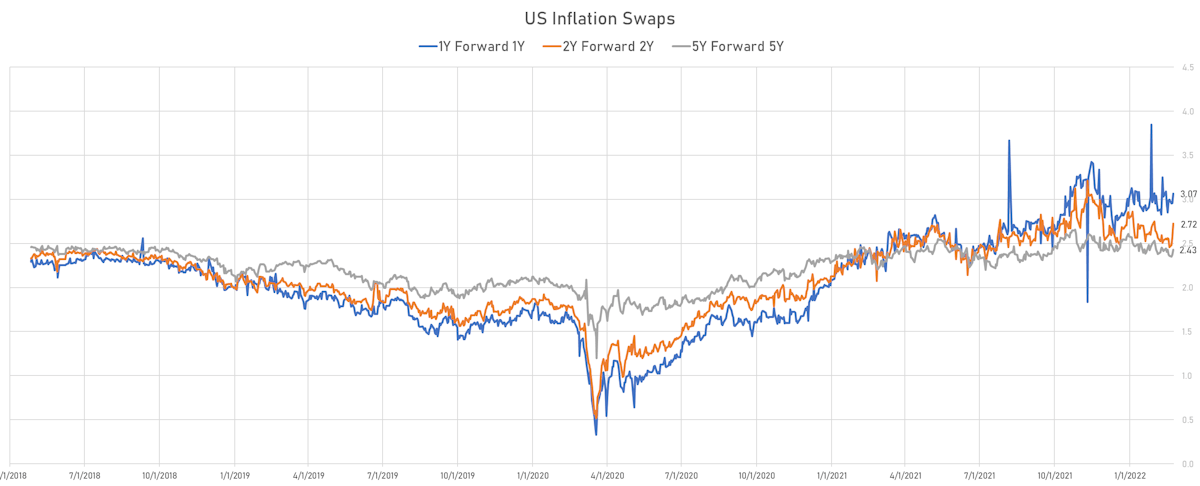

- TIPS 1Y breakeven inflation at 4.89% (up 18.3bp); 2Y at 3.93% (up 18.1bp); 5Y at 3.02% (up 16.0bp); 10Y at 2.58% (up 9.3bp); 30Y at 2.18% (up 3.6bp)

- 6-month spot US CPI swap up 18.7 bp to 4.766%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.2090%, -12.9 bp today; 10Y at -0.5650%, -4.2 bp today; 30Y at 0.1240%, +1.7 bp today

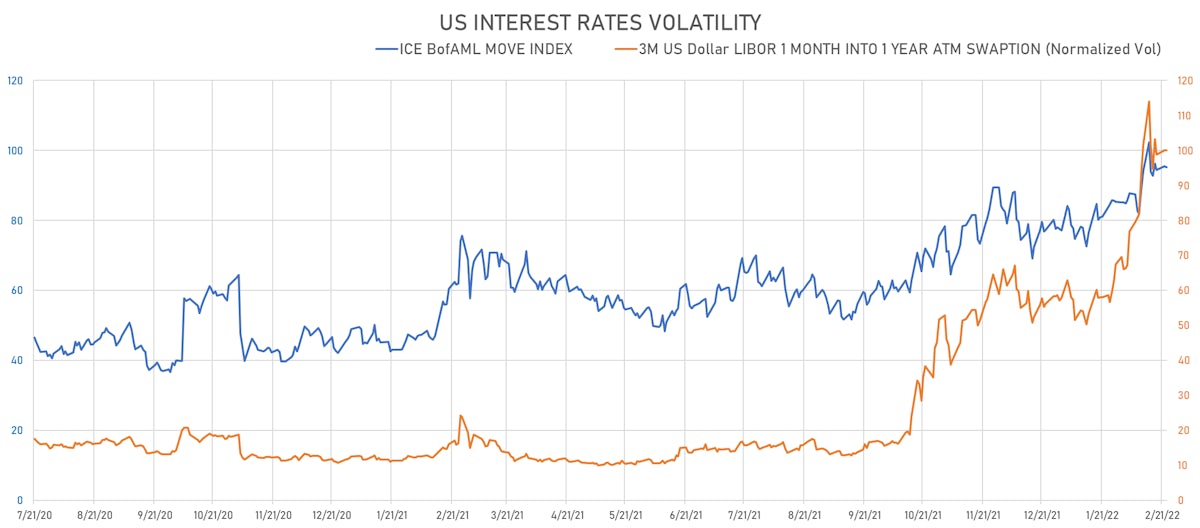

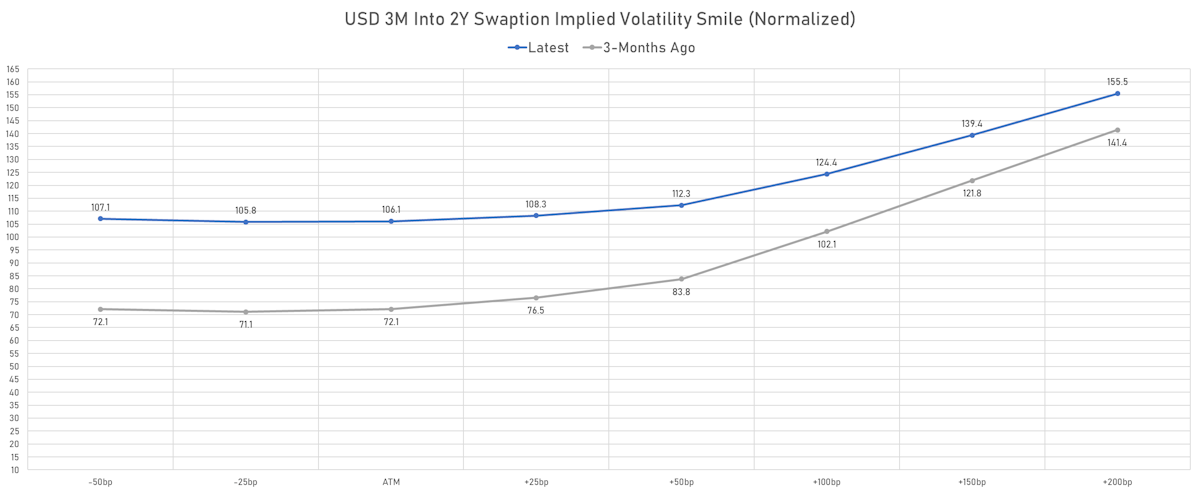

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) unchanged at 100.0

- 3-Month LIBOR-OIS spread up 0.1 bp at 6.2 bp (12-months range: -5.5-13.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: 0.002% (up 1.1 bp); the German 1Y-10Y curve is 3.8 bp flatter at 84.7bp (YTD change: +41.4 bp)

- Japan 5Y: 0.033% (down -1.9 bp); the Japanese 1Y-10Y curve is 0.6 bp flatter at 26.9bp (YTD change: +10.3 bp)

- China 5Y: 2.566% (down -2.4 bp); the Chinese 1Y-10Y curve is 3.1 bp flatter at 74.4bp (YTD change: +23.5 bp)

- Switzerland 5Y: 0.034% (up 1.4 bp); the Swiss 1Y-10Y curve is 0.6 bp steeper at 91.3bp (YTD change: +32.8 bp)