Rates

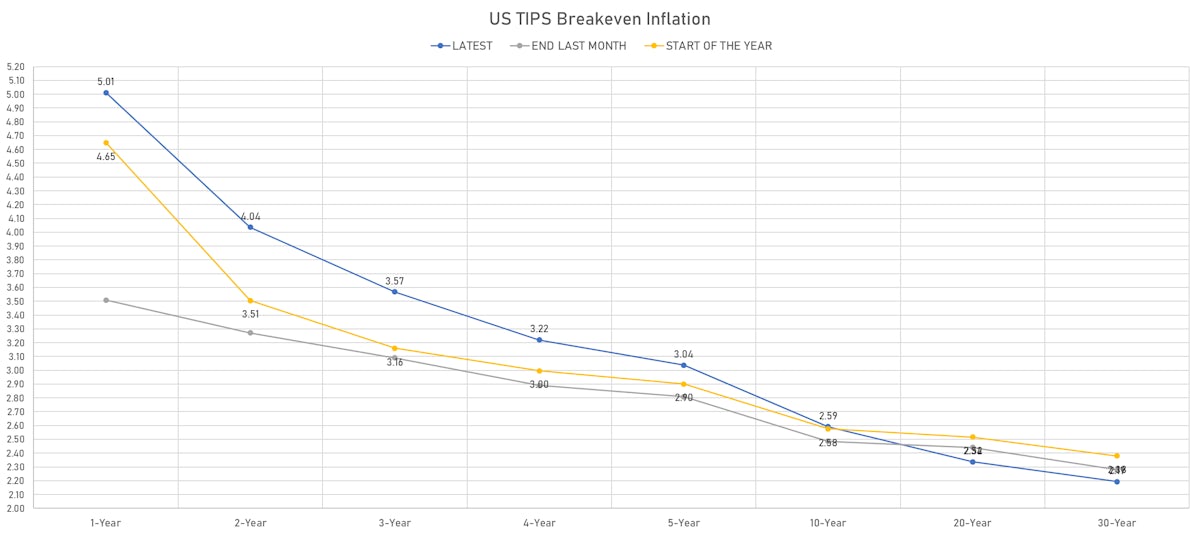

US GDP Data Showed Upward Revision To Price Deflator (+7.1% vs 6.9% est.), Leading To Further Rise In Inflation Breakevens

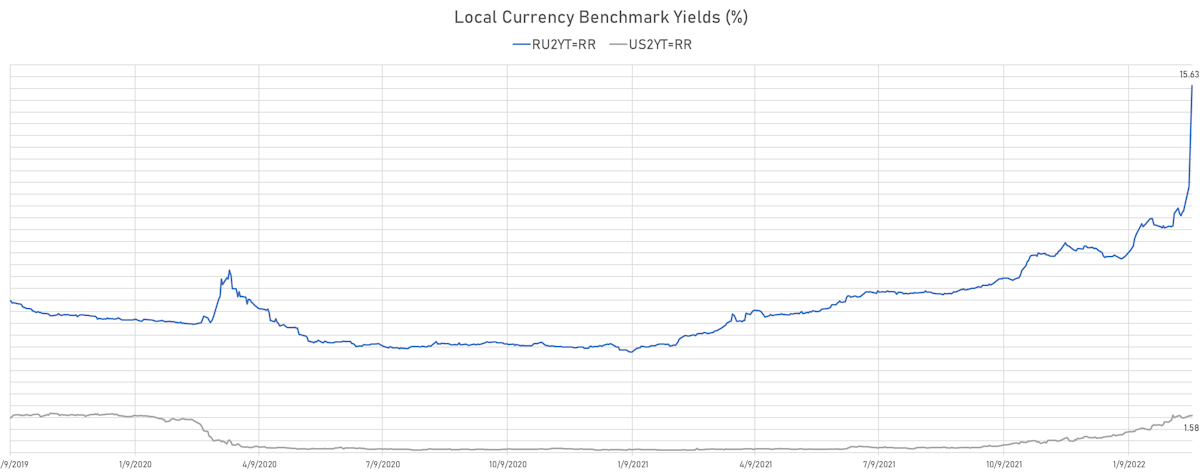

All eyes were obviously on Ukraine today and the monstrous volatility in Russian-related assets, with the 2-year Rouble benchmark yield jumping to nearly 16% and the Russian government's 5-year US$ CDS bid spread doubling to a new wide of 852 bp

Published ET

Russia vs US 2Y Treasury Yields | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

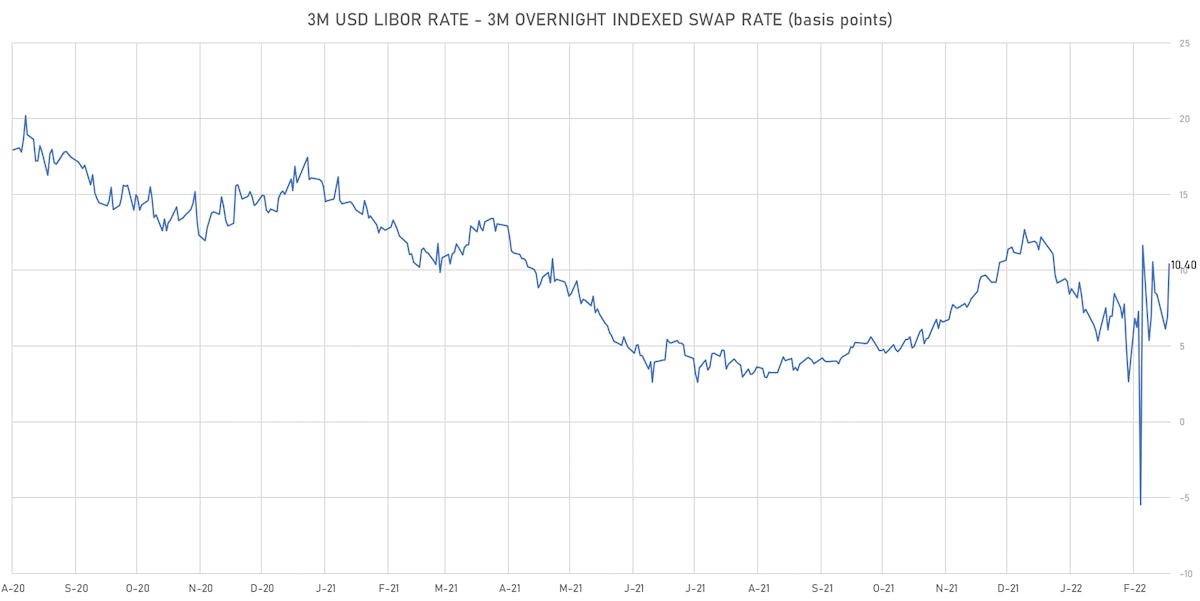

- 3-Month USD LIBOR +0.9bp today, now at 0.5070%; 3-Month OIS -2.5bp at 0.4030%

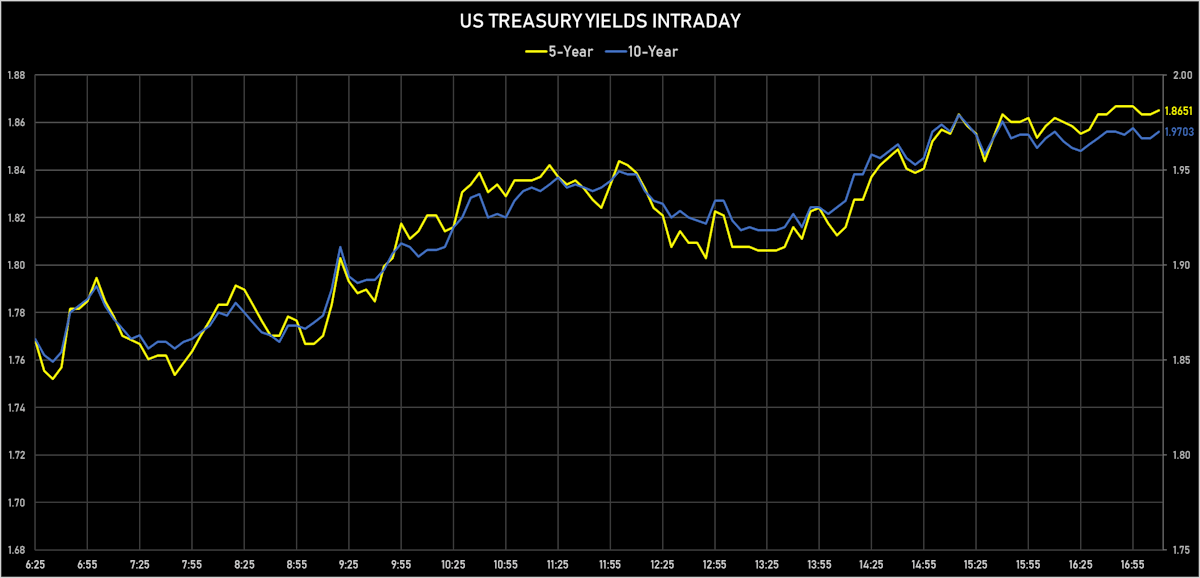

- The treasury yield curve steepened, with the 1s10s spread widening 3.4 bp, now at 89.4 bp (YTD change: -23.4bp)

- 1Y: 1.0760% (down 6.2 bp)

- 2Y: 1.5777% (down 2.8 bp)

- 5Y: 1.8651% (down 4.5 bp)

- 7Y: 1.9570% (down 3.3 bp)

- 10Y: 1.9703% (down 2.8 bp)

- 30Y: 2.2825% (down 2.0 bp)

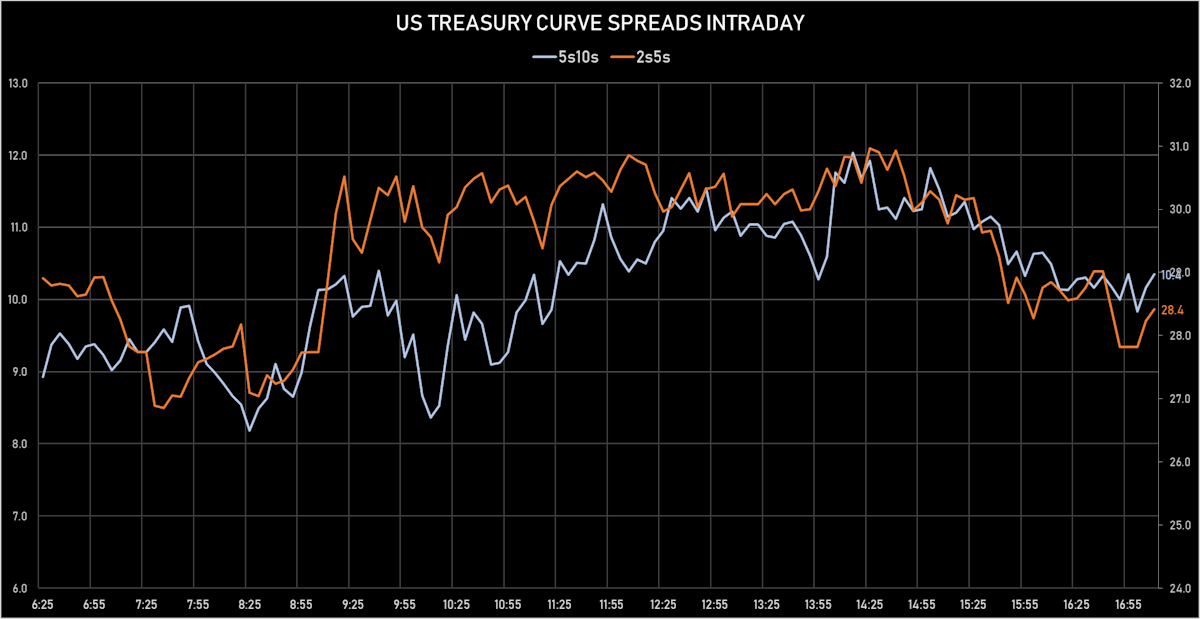

- US treasury curve spreads: 3m2Y at 125.6bp (up 0.5bp today), 2s5s at 28.9bp (down -1.7bp), 5s10s at 10.6bp (up 1.7bp), 10s30s at 31.1bp (up 0.7bp)

- Treasuries butterfly spreads: 1s5s10s at -70.7bp (down -1.5bp), 5s10s30s at 20.7bp (down -0.5bp)

- TIPS 1Y breakeven inflation at 5.01% (up 12.9bp); 2Y at 4.04% (up 8.7bp); 5Y at 3.04% (up 1.7bp); 10Y at 2.59% (up 1.4bp); 30Y at 2.19% (up 1.1bp)

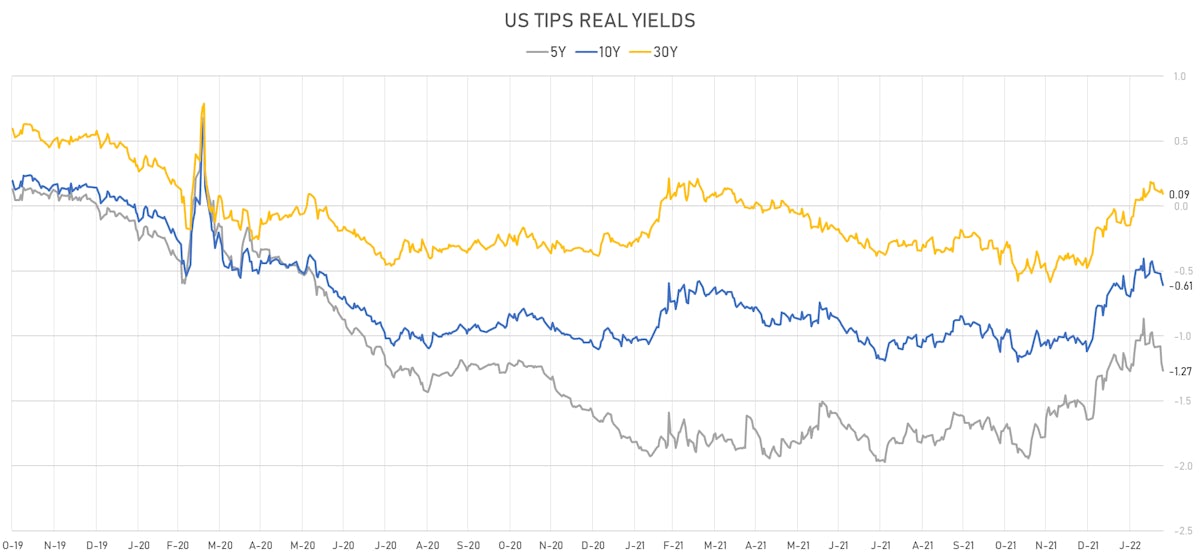

- US 5-Year TIPS Real Yield: -5.8 bp at -1.2670%; 10-Year TIPS Real Yield: -4.3 bp at -0.6080%; 30-Year TIPS Real Yield: -3.0 bp at 0.0940%

AUCTION RESULT: $50BN 7-YEAR 1.875% COUPON TREASURY NOTE (91282CEB3)

- Solid results, with good pricing helped risk aversion, and record-high end-user demand (at 87.7% vs 85.5% prior and 78.6% average)

- High yield: 1.905% (vs 1.769% prior), 1bp through the when-issued at the bid deadline

- Direct bids: 23.8% (vs 22.9% prior and 20.6% average)

- Indirect bids: 63.9% (vs 62.6% prior and 58.0% average)

- Bid-to-cover: 2.36 (vs 2.36 prior and 2.28 average)

US MACRO RELEASES

- Building Permits for Jan 2022 (U.S. Census Bureau) at 1.90 Mln (vs 1.90 Mln prior)

- Building Permits, Change P/P for Jan 2022 (U.S. Census Bureau) at 0.50 % (vs 0.70 % prior)

- Chicago Fed CFMMI, National Activity Index for Jan 2022 (Fed Res, Chicago) at 0.69 (vs -0.15 prior)

- GDP, Total-2nd Estimate, Change P/P for Q4 2021 (BEA, US Dept. Of Com) at 7.00 % (vs 6.90 % prior), in line with consensus

- Implicit Price Deflator, GDP, Total-prelim, Change P/P for Q4 2021 (BEA, US Dept. Of Com) at 7.20 % (vs 7.00 % prior), above consensus estimate of 6.90 %

- Jobless Claims, National, Continued for W 12 Feb (U.S. Dept. of Labor) at 1.48 Mln (vs 1.59 Mln prior), below consensus estimate of 1.58 Mln

- Jobless Claims, National, Initial for W 19 Feb (U.S. Dept. of Labor) at 232.00 k (vs 248.00 k prior), below consensus estimate of 235.00 k

- Jobless Claims, National, Initial, four week moving average for W 19 Feb (U.S. Dept. of Labor) at 236.25 k (vs 243.25 k prior)

- Kansas Fed, Current composite index for Feb 2022 (FED, Kansas) at 29.00 (vs 24.00 prior)

- Kansas Fed, Current production index for Feb 2022 (FED, Kansas) at 31.00 (vs 20.00 prior)

- New Home Sales for Jan 2022 (U.S. Census Bureau) at 0.80 Mln (vs 0.81 Mln prior), below consensus estimate of 0.81 Mln

- New Home Sales, Change P/P for Jan 2022 (U.S. Census Bureau) at -4.50 % (vs 11.90 % prior)

- Personal Consumption Expenditure, Profits after tax total-prelim, Change P/P for Q4 2021 (BEA, US Dept. Of Com) at 3.10 % (vs 3.30 % prior)

- Personal Consumption Expenditure, Total-prelim, Change P/P for Q4 2021 (BEA, US Dept. Of Com) at 5.00 % (vs 4.90 % prior), above consensus estimate of 4.90 %

- Personal Consumption Expenditure, Total-prelim, Change P/P for Q4 2021 (BEA, US Dept. Of Com) at 6.30 % (vs 6.50 % prior), below consensus estimate of 6.40 %

- Total-prelim, Change P/P for Q4 2021 (BEA, US Dept. Of Com) at 2.00 % (vs 1.90 % prior)

GLOBAL MACRO RELEASES

- Australia, Private New Capital Expenditure, All industries, Change P/P for Q4 2021 (AU Bureau of Stat) at 1.10 % (vs -2.20 % prior), below consensus estimate of 2.60 %

- Botswana, Policy Rates, Bank Rate for Feb 2022 (Bank of Botswana) at 3.75 % (unchanged)

- Japan, CPI, Tokyo, All Items, General, Change Y/Y for Feb 2022 (MIC, Japan) at 1.00 % (vs 0.50 % prior)

- Japan, CPI, Tokyo, All Items, Less fresh food, Change Y/Y for Feb 2022 (MIC, Japan) at 0.50 % (vs 0.20 % prior), above consensus estimate of 0.40 %

- South Korea, Policy Rates, Base Rate for Feb 2022 (The Bank of Korea) at 1.25 % (unchanged), in line with consensus

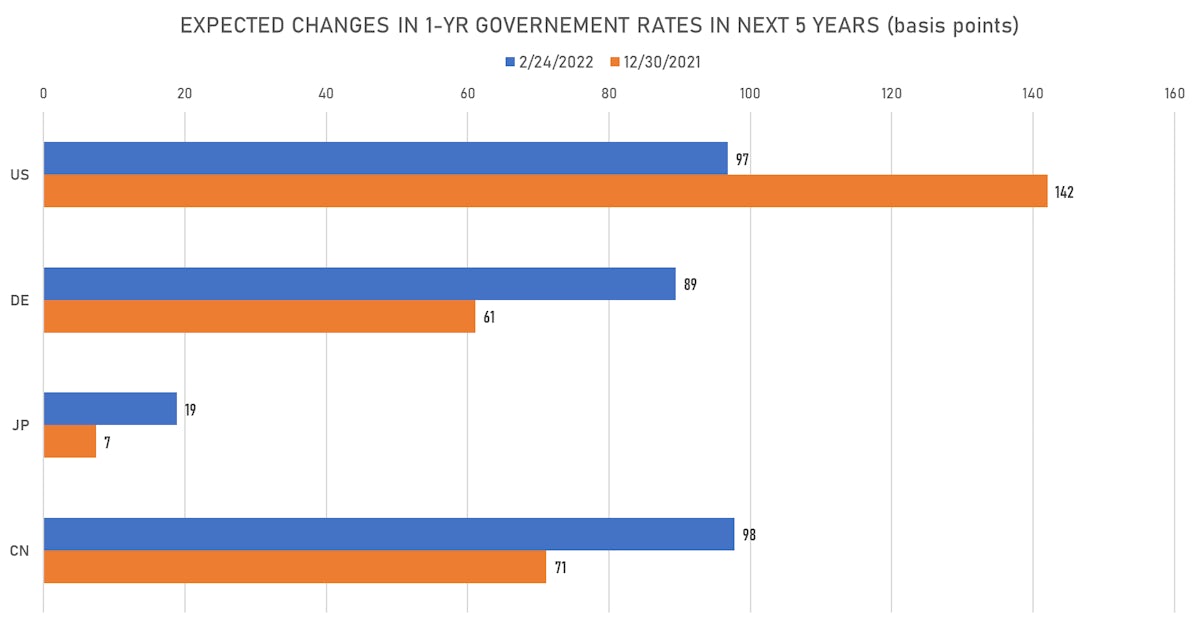

US FORWARD RATES

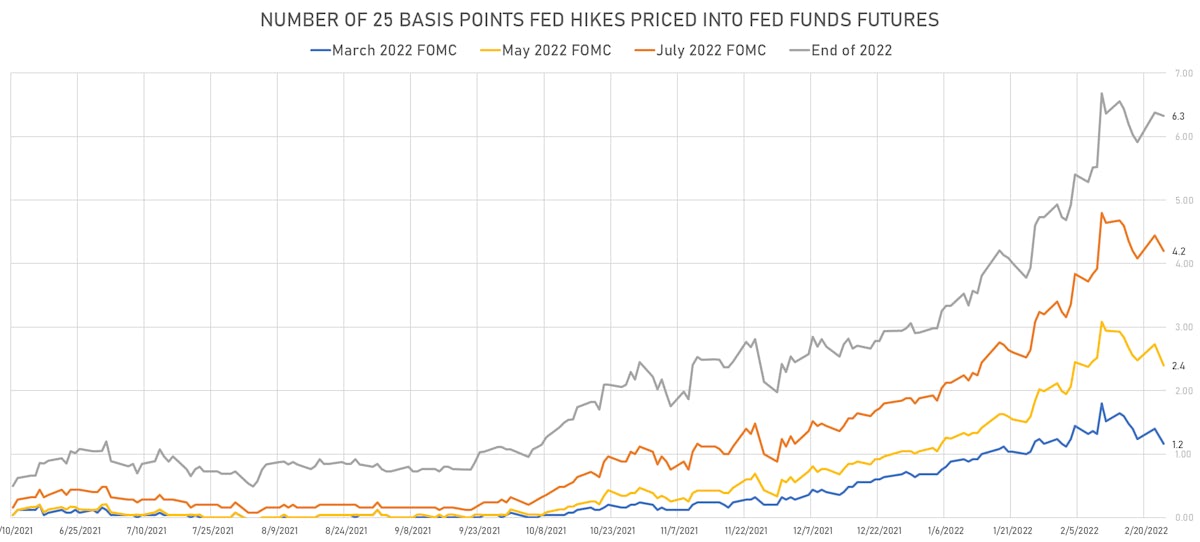

- Fed Funds futures now price in 29.1bp of Fed hikes by the end of March 2022, 59.6bp (2.4 x 25bp hikes) by the end of May 2022, and price in 6.3 hikes by the end of December 2022

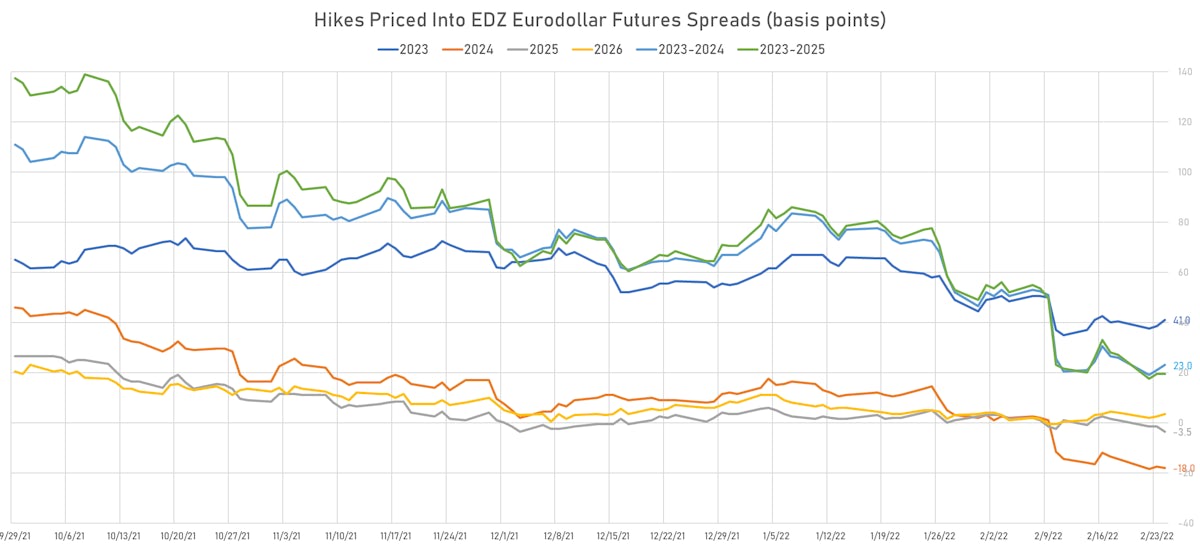

- 3-month Eurodollar futures (EDZ) spreads price in 41 bp of hikes in 2023 (equivalent to 1.6 x 25 bp hikes), up 2.5 bp today, and -18.0 bp of hikes in 2024 (equivalent to -0.7 x 25 bp hikes)

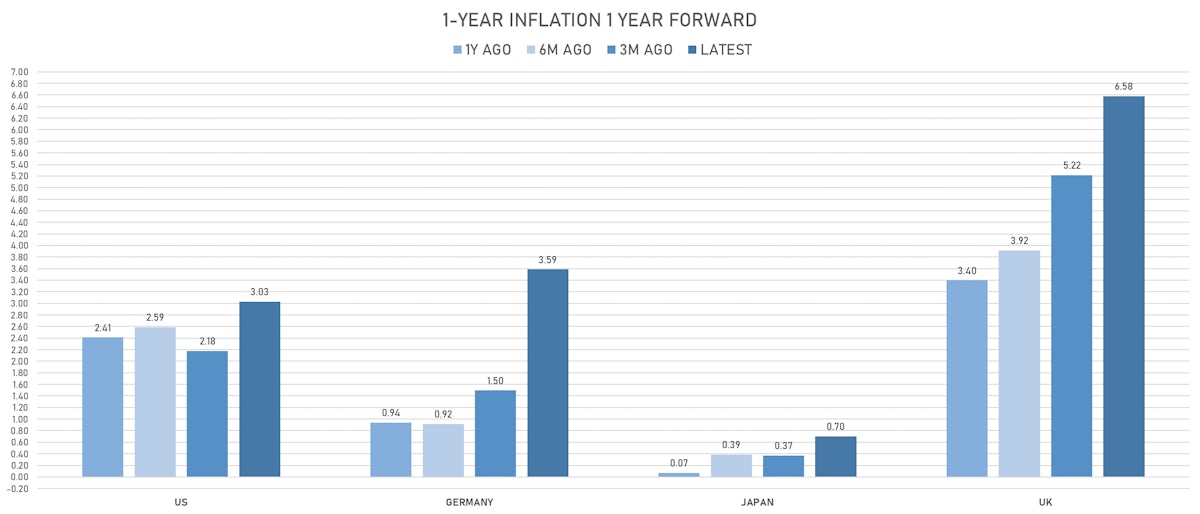

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.01% (up 12.9bp); 2Y at 4.04% (up 8.7bp); 5Y at 3.04% (up 1.7bp); 10Y at 2.59% (up 1.4bp); 30Y at 2.19% (up 1.1bp)

- 6-month spot US CPI swap up 13.0 bp to 4.896%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.2670%, -5.8 bp today; 10Y at -0.6080%, -4.3 bp today; 30Y at 0.0940%, -3.0 bp today

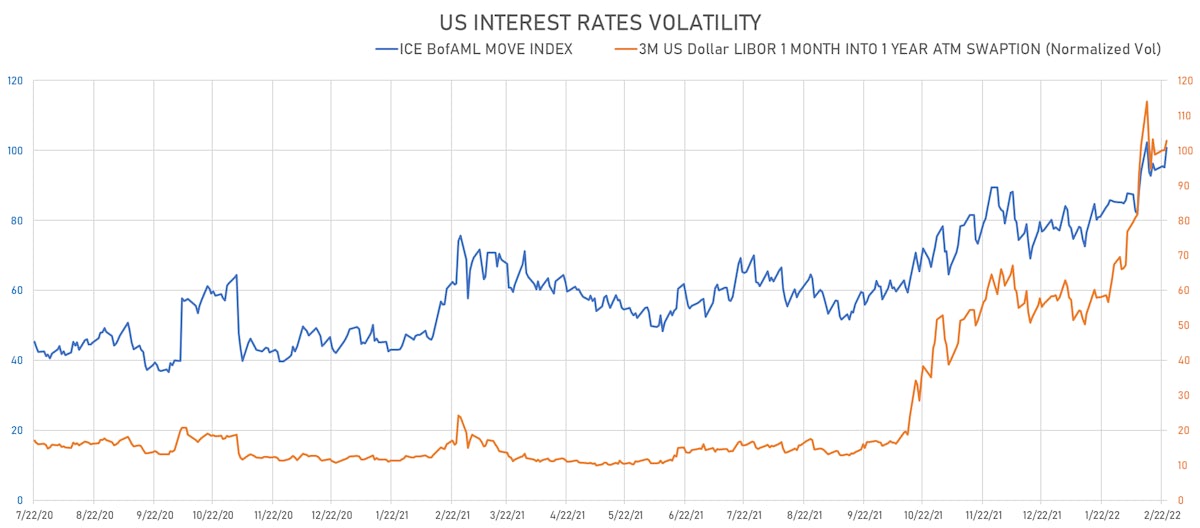

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 2.8% at 102.8 normals

- 3-Month LIBOR-OIS spread up 3.4 bp at 10.4 bp (12-months range: -5.5-13.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.089% (down -7.5 bp); the German 1Y-10Y curve is 2.4 bp flatter at 79.3bp (YTD change: +37.5 bp)

- Japan 5Y: 0.030% (down -0.4 bp); the Japanese 1Y-10Y curve is 0.7 bp flatter at 26.2bp (YTD change: +9.6 bp)

- China 5Y: 2.544% (down -2.4 bp); the Chinese 1Y-10Y curve is 1.3 bp flatter at 73.2bp (YTD change: +22.2 bp)

- Switzerland 5Y: -0.013% (down -3.9 bp); the Swiss 1Y-10Y curve is 4.3 bp flatter at 85.2bp (YTD change: +28.5 bp)