Rates

Rates Sold At The Front End On Friday, With A Slightly Flatter Curve And Lower Breakevens

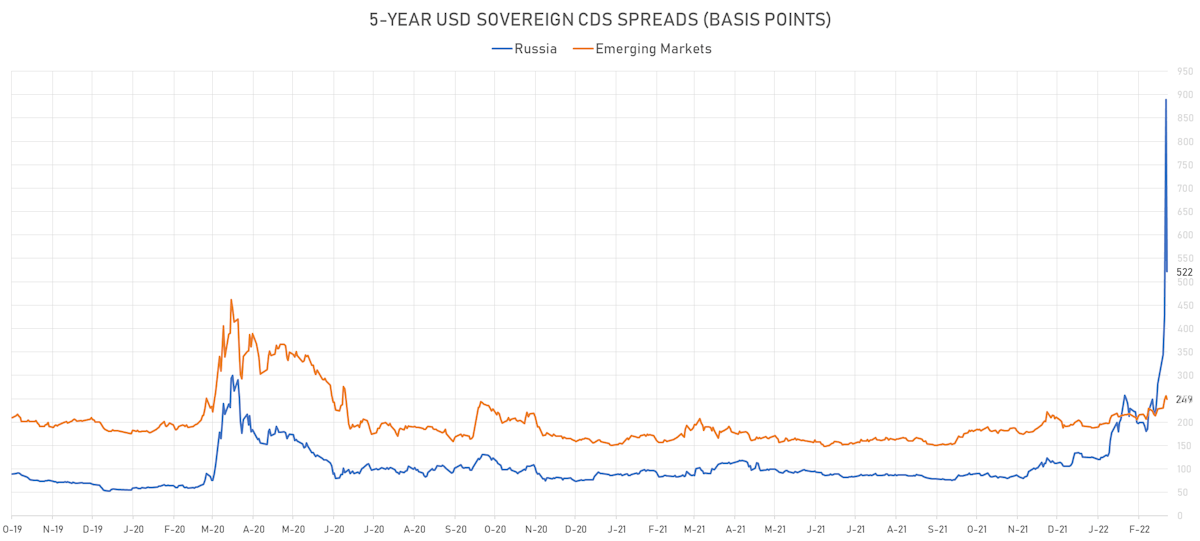

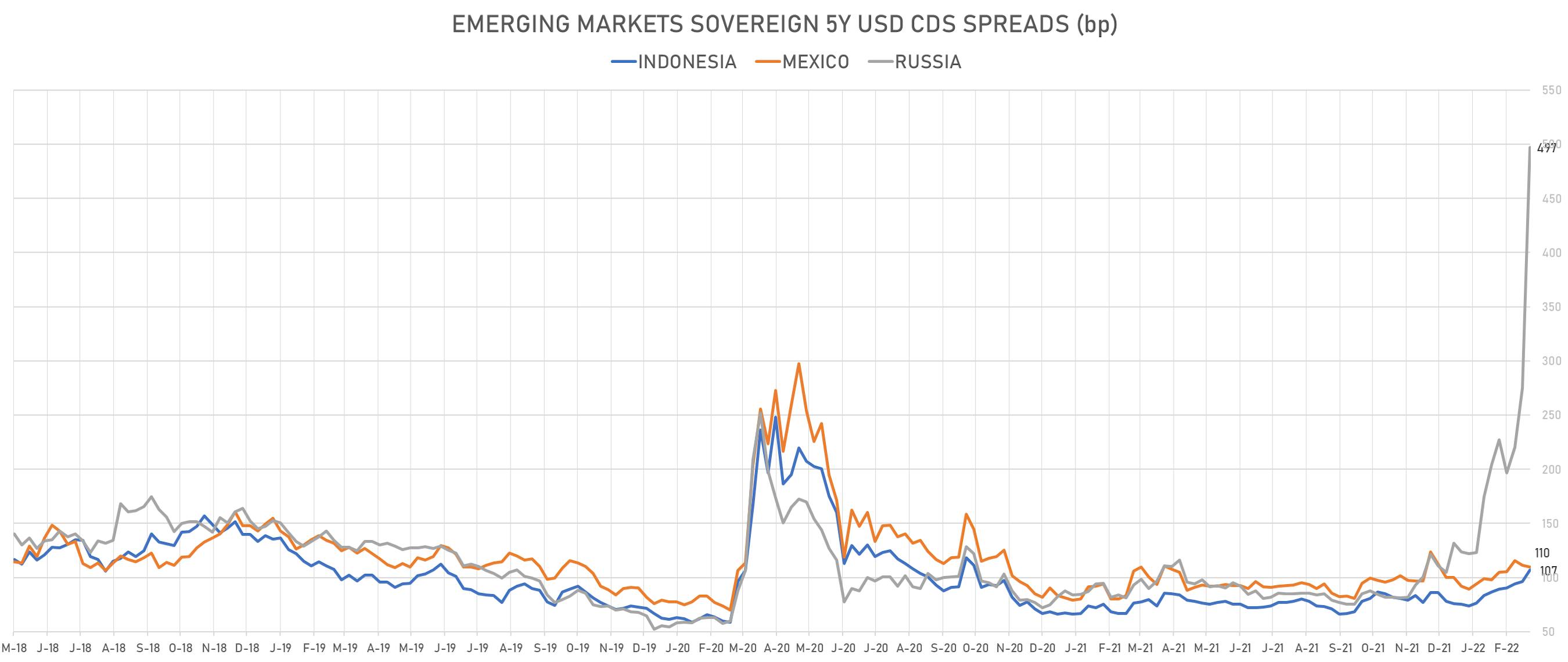

The risk sentiment shifted today as Putin seemed willing to negotiate with Ukrainians about their future leadership: Russia's 5Y US$ CDS spread was down 355 basis points to a still whopping 497 bp, and the Rouble was up 7.7% from Thursday's lows

Published ET

5Y US$ CDS Spreads For Russia vs Emerging Markets Sovereigns | Sources: ϕpost, Refinitiv data

DAILY US RATES SUMMARY

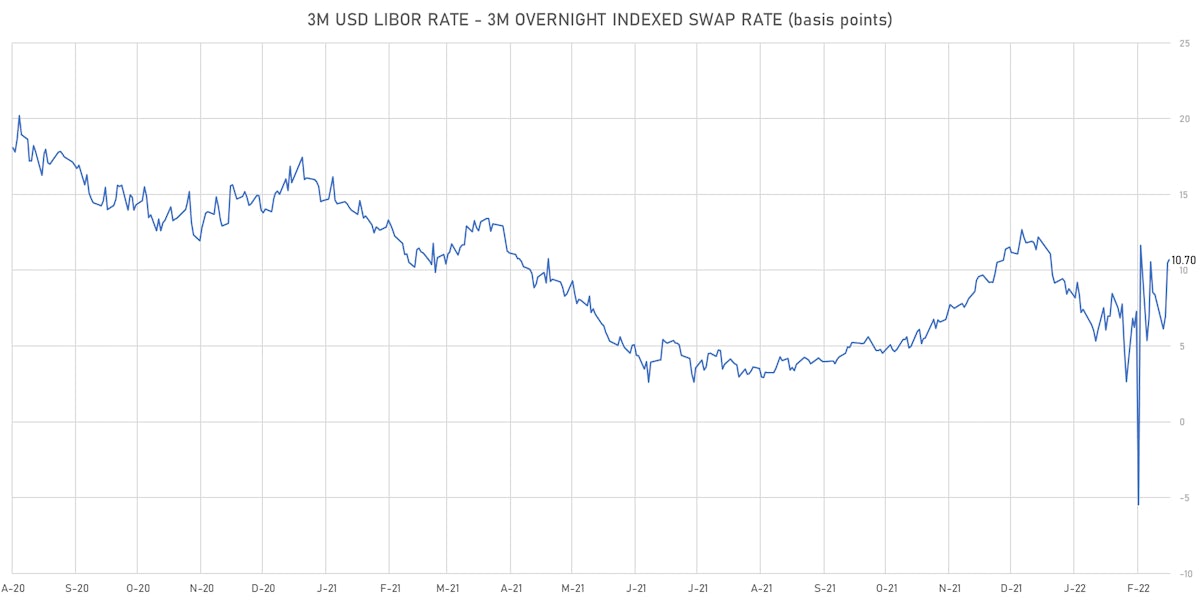

- 3-Month USD LIBOR +3.5bp today, now at 0.5430%; 3-Month OIS +3.3bp at 0.4360%

- The treasury yield curve flattened, with the 1s10s spread tightening -2.8 bp, now at 89.4 bp (YTD change: -23.3bp)

- 1Y: 1.0760% (up 2.8 bp)

- 2Y: 1.5697% (down 0.8 bp)

- 5Y: 1.8701% (up 0.5 bp)

- 7Y: 1.9590% (up 0.2 bp)

- 10Y: 1.9704% (up 0.0 bp)

- 30Y: 2.2847% (up 0.2 bp)

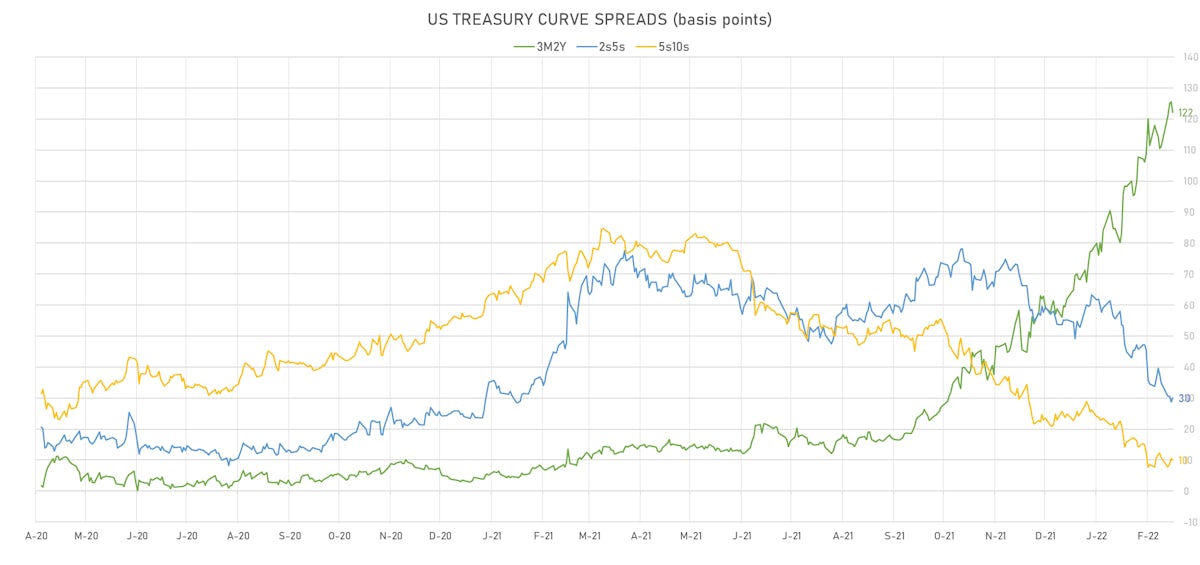

- US treasury curve spreads: 3m2Y at 122.2bp (down -3.4bp today), 2s5s at 30.1bp (up 1.3bp), 5s10s at 10.1bp (down -0.5bp), 10s30s at 31.3bp (up 0.1bp)

- Treasuries butterfly spreads: 1s5s10s at -67.8bp (up 2.8bp today), 5s10s30s at 21.2bp (up 0.5bp)

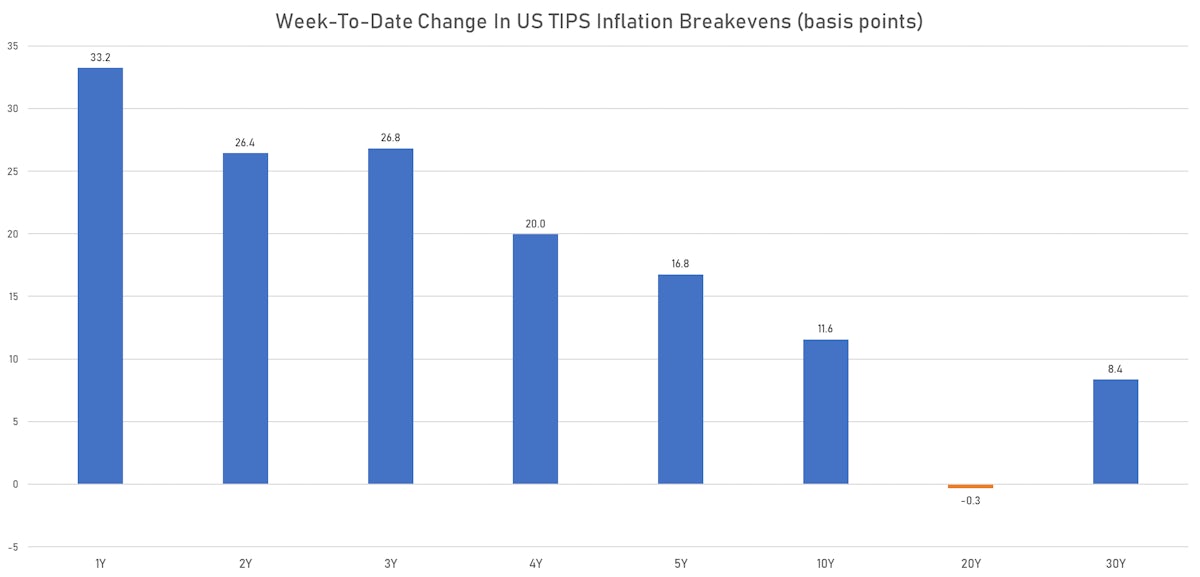

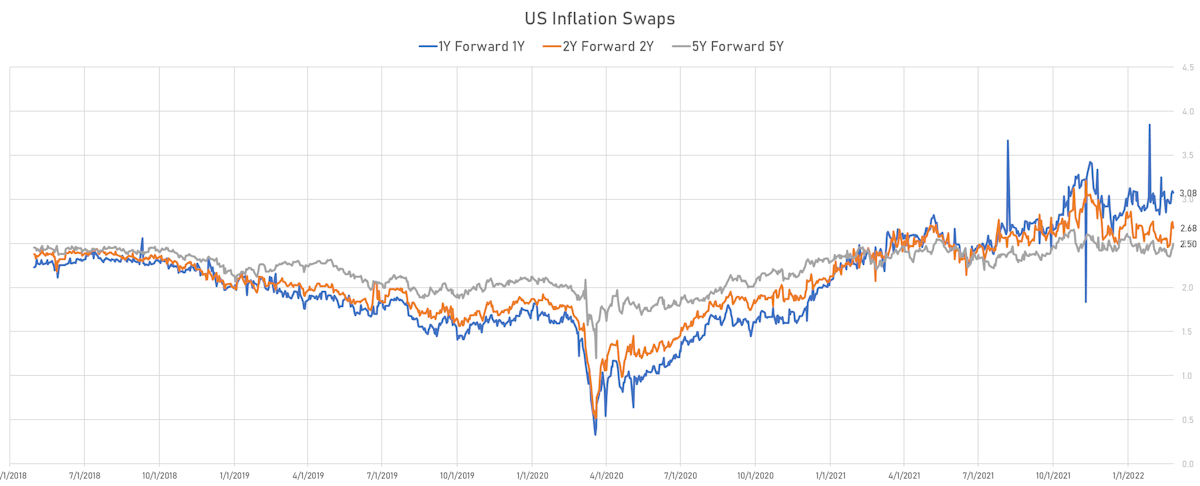

- TIPS 1Y breakeven inflation at 4.93% (down -7.7bp); 2Y at 3.92% (down -11.3bp); 5Y at 2.99% (down -4.9bp); 10Y at 2.57% (down -2.6bp); 30Y at 2.20% (up 1.0bp)

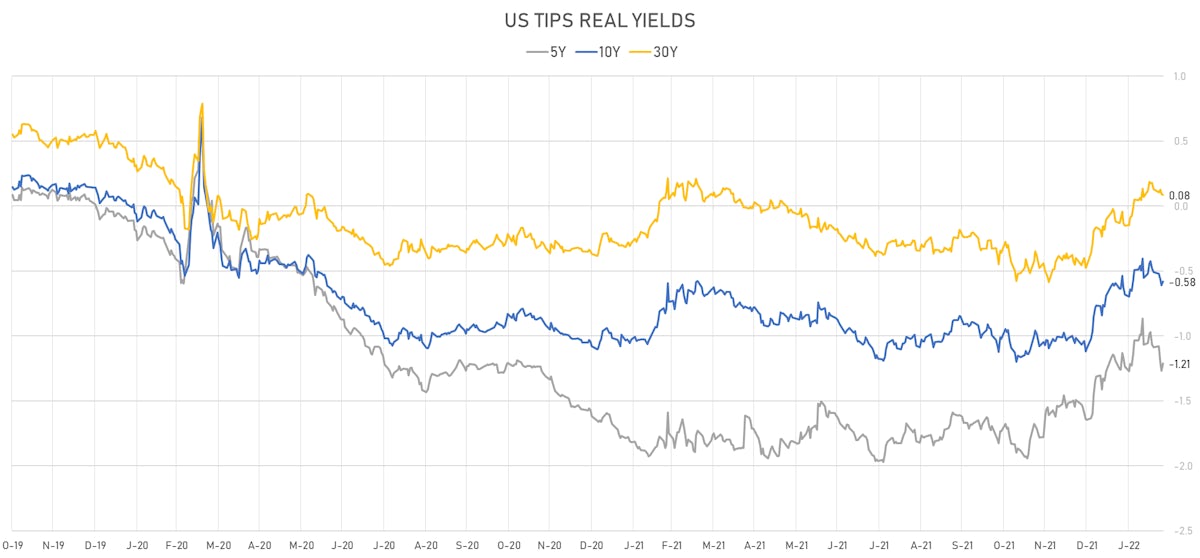

- US 5-Year TIPS Real Yield: +5.6 bp at -1.2110%; 10-Year TIPS Real Yield: +2.5 bp at -0.5830%; 30-Year TIPS Real Yield: -1.0 bp at 0.0840%

US MACRO DATA RELEASES

- Change P/P for Jan 2022 (BEA, US Dept. Of Com) at 0.00 % (vs 0.30 % prior), above consensus estimate of -0.30 %

- Manufacturers New Orders, Durable goods excluding defense, Change P/P for Jan 2022 (U.S. Census Bureau) at 1.60 % (vs 0.30 % prior), above consensus estimate of 0.10 %

- Manufacturers New Orders, Durable goods excluding transportation, Change P/P for Jan 2022 (U.S. Census Bureau) at 0.70 % (vs 0.60 % prior), above consensus estimate of 0.40 %

- Manufacturers New Orders, Durable goods total, Change P/P for Jan 2022 (U.S. Census Bureau) at 1.60 % (vs -0.70 % prior), above consensus estimate of 0.80 %

- Manufacturers New Orders, Nondefense capital goods excluding aircraft, Change P/P for Jan 2022 (U.S. Census Bureau) at 0.90 % (vs 0.30 % prior), above consensus estimate of 0.50 %

- Pending Home Sales, United States for Jan 2022 (NAR, United States) at 109.50 (vs 117.70 prior)

- Pending Home Sales, United States, Change P/P for Jan 2022 (NAR, United States) at -5.70 % (vs -3.80 % prior), below consensus estimate of 1.00 %

- Personal Consumption Expenditure, Change P/P for Jan 2022 (BEA, US Dept. Of Com) at 0.60 % (vs 0.40 % prior)

- Personal Consumption Expenditure, Change P/P for Jan 2022 (BEA, US Dept. Of Com) at 1.50 % (vs -1.00 % prior)

- Personal Consumption Expenditure, Change P/P for Jan 2022 (BEA, US Dept. Of Com) at 2.10 % (vs -0.60 % prior), above consensus estimate of 1.50 %

- Personal Consumption Expenditure, Change Y/Y for Jan 2022 (BEA, US Dept. Of Com) at 6.10 % (vs 5.80 % prior)

- Personal Consumption Expenditure, Personal consumption expenditures less food and energy, Change P/P for Jan 2022 (BEA, US Dept. Of Com) at 0.50 % (unchanged), in line with consensus

- Personal Consumption Expenditure, Personal consumption expenditures less food and energy, Change Y/Y for Jan 2022 (BEA, US Dept. Of Com) at 5.20 % (vs 4.90 % prior), above consensus estimate of 5.10 %

- Personal Consumption Expenditure, Total, trimmed mean inflation rate (1-month annualized), Change M/M for Jan 2022 (Fed Resrv, Dallas) at 6.70 % (vs 3.90 % prior)

- University of Michigan, 5 Year Inflation Expectations (median), Change Y/Y for Feb 2022 (UMICH, Survey) at 3.00 % (vs 3.10 % prior)

- 1 Year Inflation Expectations (median) for Feb 2022 (UMICH, Survey) at 4.90 % (vs 5.00 % prior)

- University of Michigan, Consumer Expectations Index, Volume Index for Feb 2022 (UMICH, Survey) at 59.40 (vs 57.40 prior)

- University of Michigan, Consumer Sentiment Index, Volume Index for Feb 2022 (UMICH, Survey) at 62.80 (vs 61.70 prior), above consensus estimate of 61.70

- University of Michigan, Current Conditions Index, Volume Index for Feb 2022 (UMICH, Survey) at 68.20 (vs 68.50 prior)

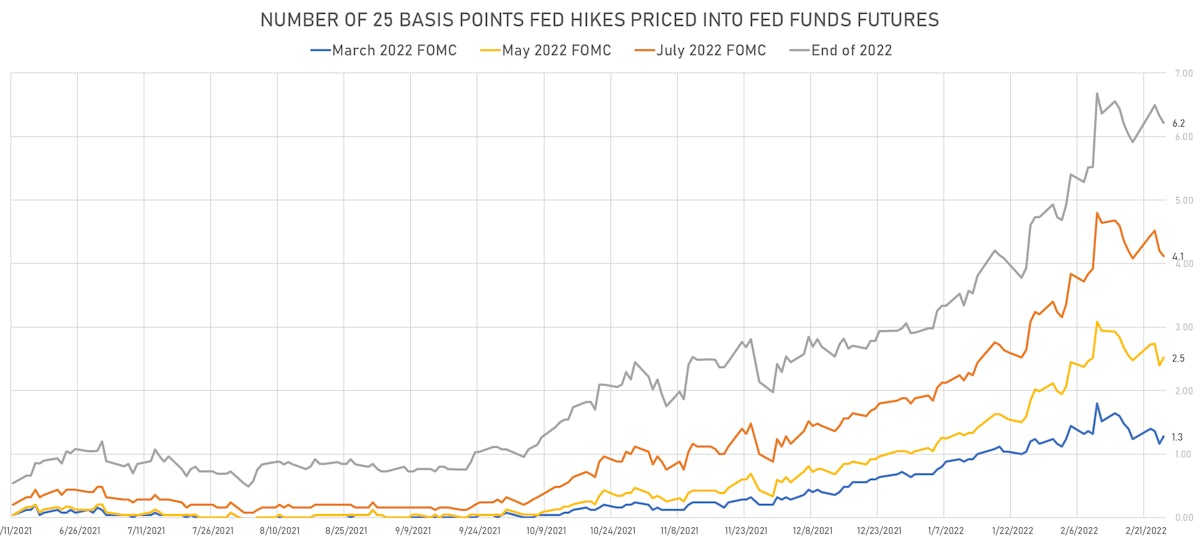

US FORWARD RATES

- Fed Funds futures now price in 31.9bp of Fed hikes by the end of March 2022, 62.3bp (2.5 x 25bp hikes) by the end of May 2022, and price in 6.2 hikes by the end of December 2022

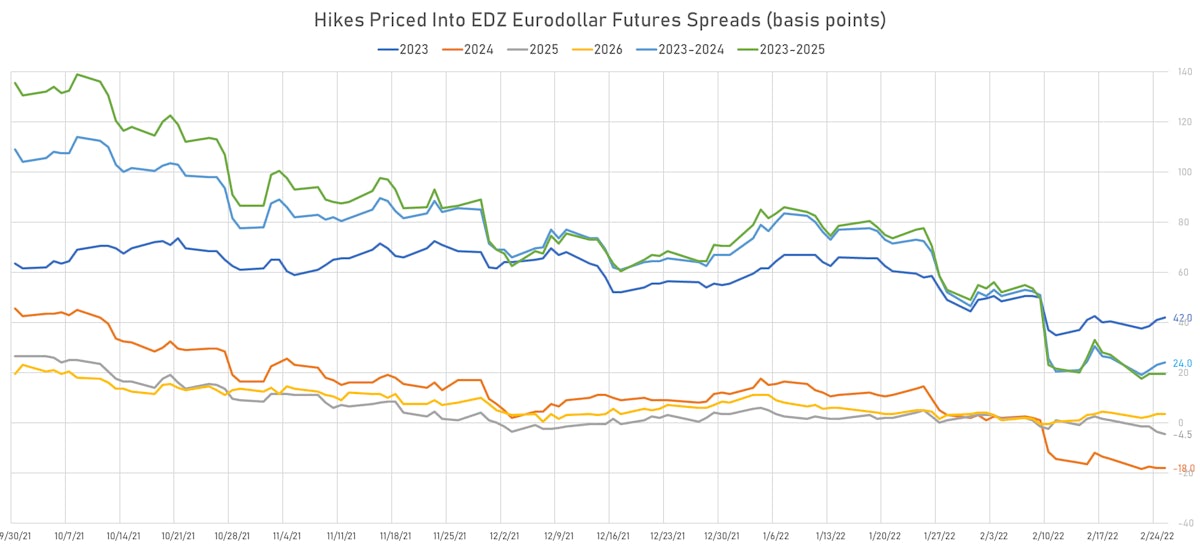

- 3-month Eurodollar futures (EDZ) spreads price in 42 bp of hikes in 2023 (equivalent to 1.7 x 25 bp hikes), up 1.0 bp today, and -18.0 bp of hikes in 2024 (equivalent to -0.7 x 25 bp hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 4.93% (down -7.7bp); 2Y at 3.92% (down -11.3bp); 5Y at 2.99% (down -4.9bp); 10Y at 2.57% (down -2.6bp); 30Y at 2.20% (up 1.0bp)

- 6-month spot US CPI swap down -11.3 bp to 4.783%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.2110%, +5.6 bp today; 10Y at -0.5830%, +2.5 bp today; 30Y at 0.0840%, -1.0 bp today

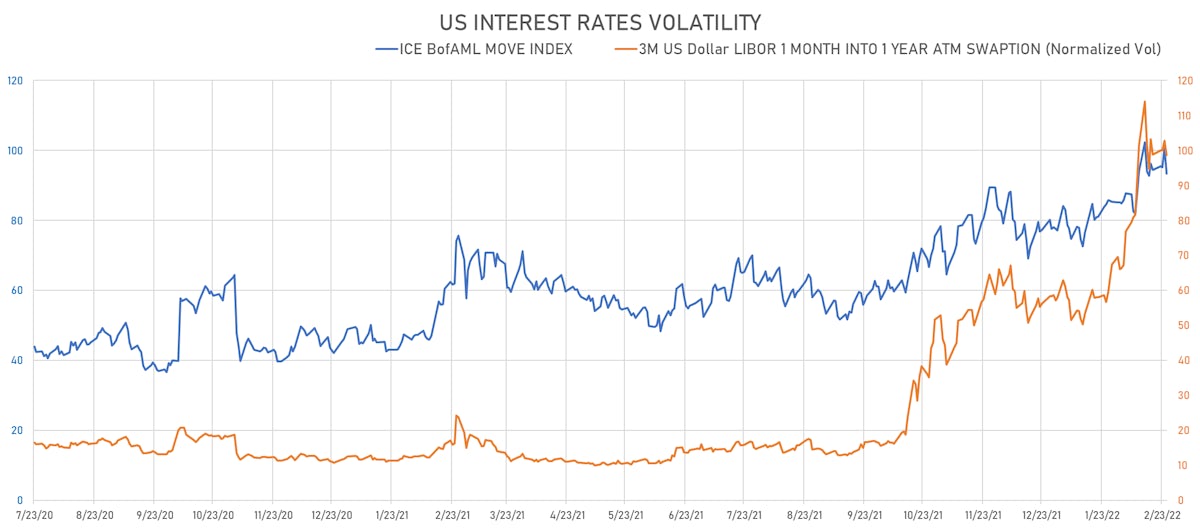

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -4.2% at 98.6 normals

- 3-Month LIBOR-OIS spread up 0.2 bp at 10.7 bp (12-months range: -5.5-13.4 bp)

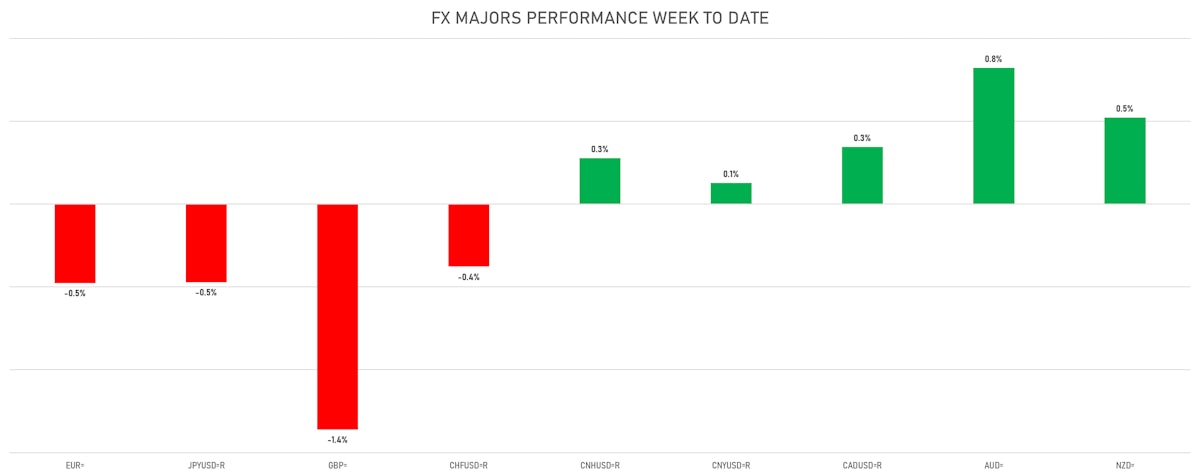

DAILY FX SUMMARY

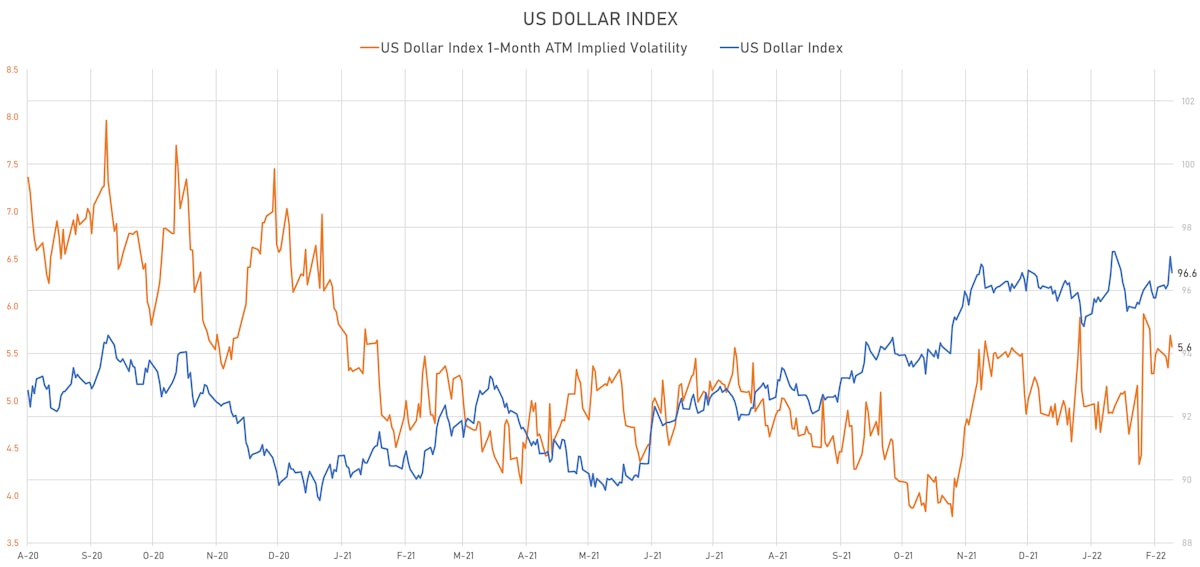

- The US Dollar Index is down -0.51% at 96.57 (YTD: +0.95%)

- Euro up 0.68% at 1.1267 (YTD: -0.9%)

- Yen down 0.03% at 115.56 (YTD: -0.4%)

- Onshore Yuan up 0.19% at 6.3169 (YTD: +0.7%)

- Swiss franc up 0.10% at 0.9250 (YTD: -1.4%)

- Sterling up 0.22% at 1.3405 (YTD: -0.9%)

- Canadian dollar up 0.82% at 1.2705 (YTD: -0.6%)

- Australian dollar up 0.98% at 0.7232 (YTD: -0.4%)

- NZ dollar up 0.64% at 0.6734 (YTD: -1.3%)

GLOBAL MACRO RELEASES

- Brazil, Composite Index, IGP-M inflation, Change P/P, Price Index for Feb 2022 (FGV, Brazil) at 1.83 % (vs 1.82 % prior), below consensus estimate of 1.86 %

- Euro Zone, All Respondents, Total, Consumer Confidence Indicator, Balance for Feb 2022 (DG ECFIN, France) at -8.80 (unchanged), in line with consensus

- France, GDP, Total growth, Change P/P for Q4 2021 (INSEE, France) at 0.70 % (unchanged), in line with consensus

- France, HICP, Flash, Change Y/Y, Price Index for Feb 2022 (INSEE, France) at 4.10 % (vs 3.30 % prior), above consensus estimate of 3.60 %

- Germany, GDP, Detailed, Change P/P for Q4 2021 (Destatis) at -0.30 % (vs -0.70 % prior), above consensus estimate of -0.70 %

- Germany, GDP, Detailed, Change Y/Y for Q4 2021 (Destatis) at 1.80 % (vs 1.40 % prior), above consensus estimate of 1.40 %

- Russia, Production, IP Total , Change Y/Y for Jan 2022 (RosStat, Russia) at 8.60 % (vs 6.10 % prior), above consensus estimate of 3.50 %

- United States, Manufacturers New Orders, Durable goods total, Change P/P for Jan 2022 (U.S. Census Bureau) at 1.60 % (vs -0.70 % prior), above consensus estimate of 0.80 %

- United States, Personal Consumption Expenditure, Change P/P for Jan 2022 (BEA, US Dept. Of Com) at 2.10 % (vs -0.60 % prior), above consensus estimate of 1.50 %

- United States, University of Michigan, Consumer Sentiment Index, Volume Index for Feb 2022 (UMICH, Survey) at 62.80 (vs 61.70 prior), above consensus estimate of 61.70

KEY INTERNATIONAL RATES

- Germany 5Y: -0.004% (up 6.2 bp); the German 1Y-10Y curve is 5.3 bp steeper at 86.1bp (YTD change: +42.8 bp)

- Japan 5Y: 0.032% (up 1.0 bp); the Japanese 1Y-10Y curve is 1.3 bp steeper at 28.1bp (YTD change: +10.9 bp)

- China 5Y: 2.528% (down -1.6 bp); the Chinese 1Y-10Y curve is 3.8 bp steeper at 77.0bp (YTD change: +26.0 bp)

- Switzerland 5Y: 0.046% (up 5.9 bp); the Swiss 1Y-10Y curve is 9.9 bp steeper at 94.9bp (YTD change: +38.4 bp)

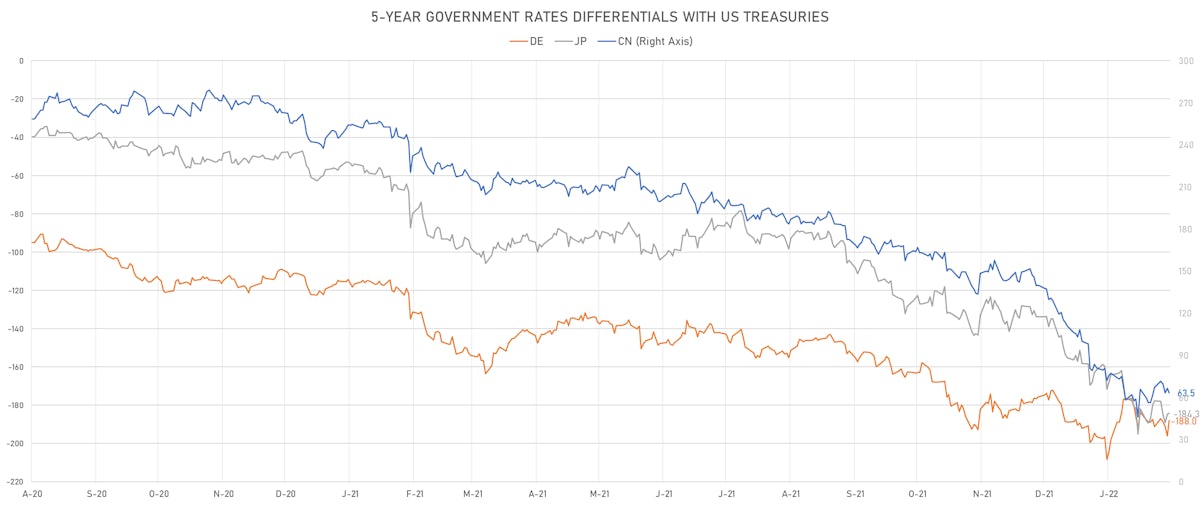

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -8.0 bp at 188.0 bp (YTD change: +15.9 bp)

- US-JAPAN: -0.4 bp at 184.3 bp (YTD change: +49.6 bp)

- US-CHINA: +3.1 bp at -63.5 bp (YTD change: +65.7 bp)

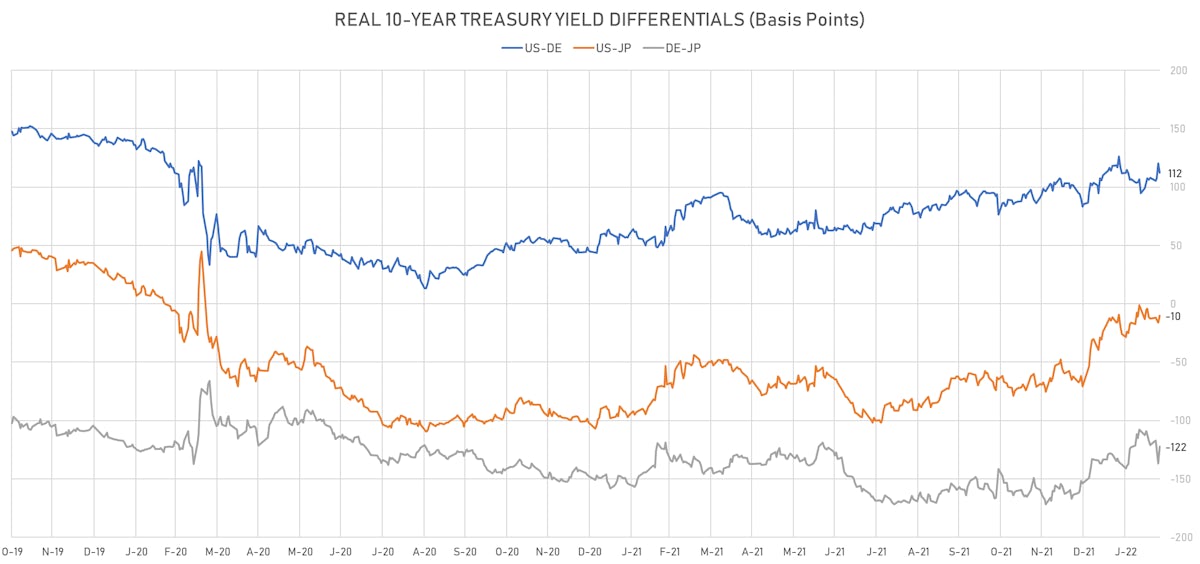

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -8.2 bp at 112.2 bp (YTD change: +29.0bp)

- US-JAPAN: +6.1 bp at -10.1 bp (YTD change: +60.7bp)

- JAPAN-GERMANY: -14.3 bp at 122.3 bp (YTD change: -31.7bp)

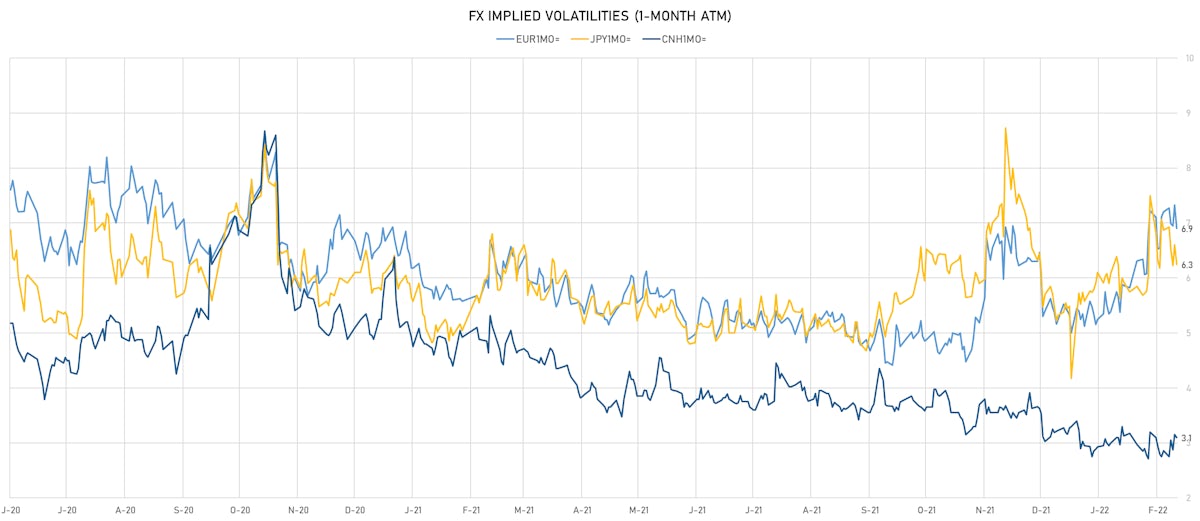

FX VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 7.32, down -0.21 (YTD: +1.21)

- Euro 1-Month At-The-Money Implied Volatility currently at 6.90, down -0.4 (YTD: +1.9)

- Japanese Yen 1M ATM IV currently at 6.25, down -0.4 (YTD: +2.1)

- Offshore Yuan 1M ATM IV unchanged at 3.10 (YTD: -0.2)

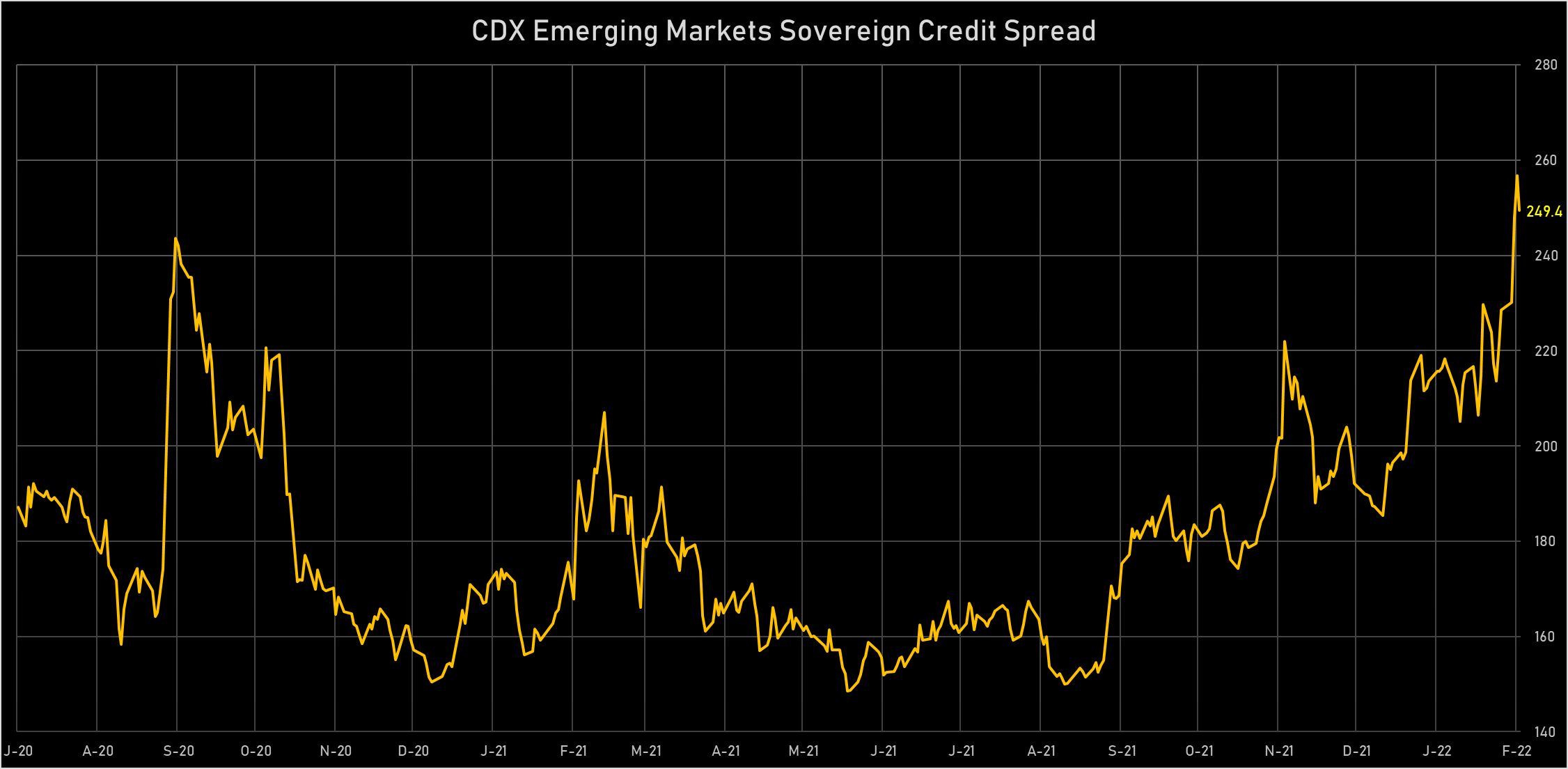

NOTABLE MOVES IN SOVEREIGN CDS TODAY

- Russia (rated BBB): down 355.2 basis points to 497 bp (1Y range: 75-852bp)

- Egypt (rated B+): down 53.8 basis points to 520 bp (1Y range: 283-574bp)

- Turkey (rated B+): down 31.5 basis points to 559 bp (1Y range: 293-614bp)

- South Africa (rated BB-): down 7.7 basis points to 217 bp (1Y range: 178-246bp)

- Mexico (rated BBB-): down 6.8 basis points to 110 bp (1Y range: 81-124bp)

- Chile (rated A-): down 6.3 basis points to 79 bp (1Y range: 48-95bp)

- Peru (rated BBB): down 4.2 basis points to 88 bp (1Y range: 65-105bp)

- Saudi Arabia (rated A): down 3.0 basis points to 53 bp (1Y range: 43-71bp)

- Qatar (rated AA-): down 2.5 basis points to 52 bp (1Y range: 37-55bp)

- China (rated A+): up 3.5 basis points to 60 bp (1Y range: 29-58bp)

NOTABLE MOVES IN SOVEREIGN CDS THIS WEEK

- China (rated A+): up 15.7 % to 60 bp (1Y range: 29-58bp)

- Argentina (rated CCC): up 6.0 % to 3,203 bp (1Y range: 1,362-3,883bp)

- Malaysia (rated BBB+): up 11.6 % to 72 bp (1Y range: 37-71bp)

- Philippines (rated BBB): up 11.6 % to 90 bp (1Y range: 37-89bp)

- Indonesia (rated BBB): up 10.6 % to 107 bp (1Y range: 66-107bp)

- Vietnam (rated BB): up 7.3 % to 124 bp (1Y range: 89-125bp)

- Qatar (rated AA-): up 4.9 % to 52 bp (1Y range: 37-55bp)

- Oman (rated BB-): up 5.9 % to 247 bp (1Y range: 223-312bp)

- Turkey (rated B+): up 5.6 % to 559 bp (1Y range: 293-614bp)

- Russia (rated BBB): up 85.6 % to 497 bp (1Y range: 75-852bp)

LARGEST FX MOVES TODAY

- Dominican Peso up 2.6% (YTD: +5.9%)

- CFA Franc BEAC up 2.4% (YTD: +3.2%)

- Kazakhstan Tenge up 1.8% (YTD: -5.8%)

- Chilean Peso up 1.8% (YTD: +6.2%)

- Samoa Tala up 1.8% (YTD: +0.8%)

- Turkish Lira up 1.7% (YTD: -3.6%)

- Fiji Dollar up 1.7% (YTD: +0.7%)

- South Africa Rand up 1.4% (YTD: +5.6%)

- Sierraleone Leon down 1.7% (YTD: -2.8%)

- Solomon Is Dollar down 2.4% (YTD: -2.1%)

LARGEST FX MOVES THIS WEEK

- Angolan Kwanza up 4.5% (YTD: +12.1%)

- Dominican Peso up 3.9% (YTD: +5.9%)

- Rwanda Franc up 2.7% (YTD: +2.7%)

- Hungarian Forint down 2.7% (YTD: +0.1%)

- Russian Rouble down 4.1% (YTD: -10.6%)

- Georgian Lari down 4.3% (YTD: -0.2%)

- Ukraine Hryvnia down 5.4% (YTD: -10.1%)

- Belarusian ruble down 5.7% (YTD: -7.2%)

- Kazakhstan Tenge down 7.4% (YTD: -5.8%)

YTD BIGGEST WINNERS & LOSERS

- Afghani up 13.0%

- Angolan Kwanza up 12.1%

- Brazilian Real up 7.9%

- Chilean Peso up 6.2%

- Liberian Dollar down 6.1%

- Belarusian ruble down 7.2%

- Ghanaian Cedi down 8.9%

- Ukraine Hryvnia down 10.1%

- Russian Rouble down 10.6%