Rates

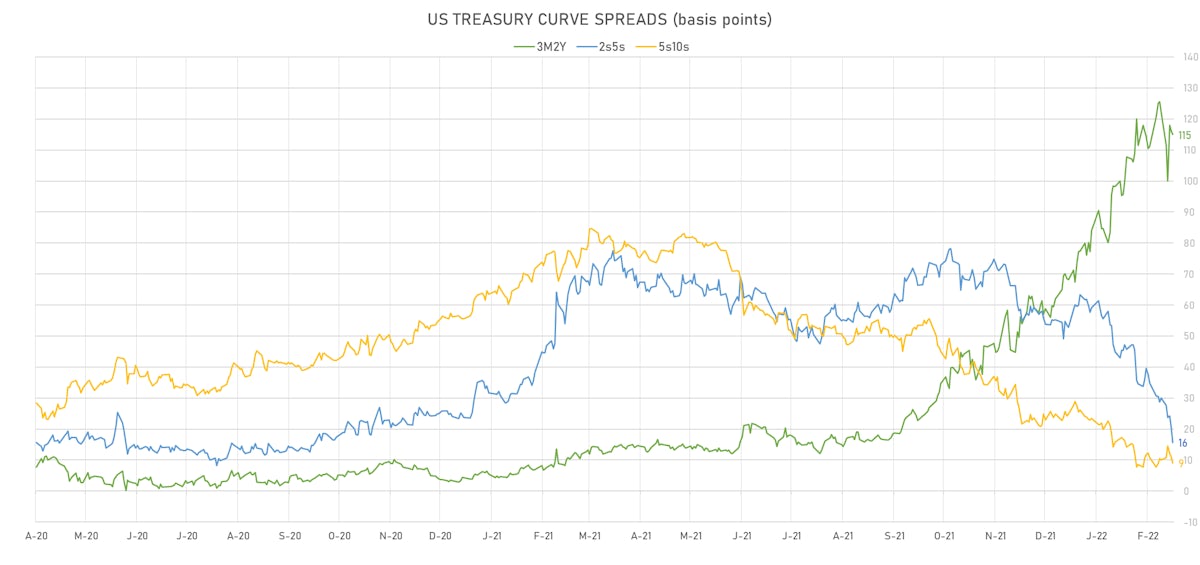

US Treasury Curve Continues To Bull Flatten, As Short-Term Rates Volatility Is Reaching Extraordinary Levels

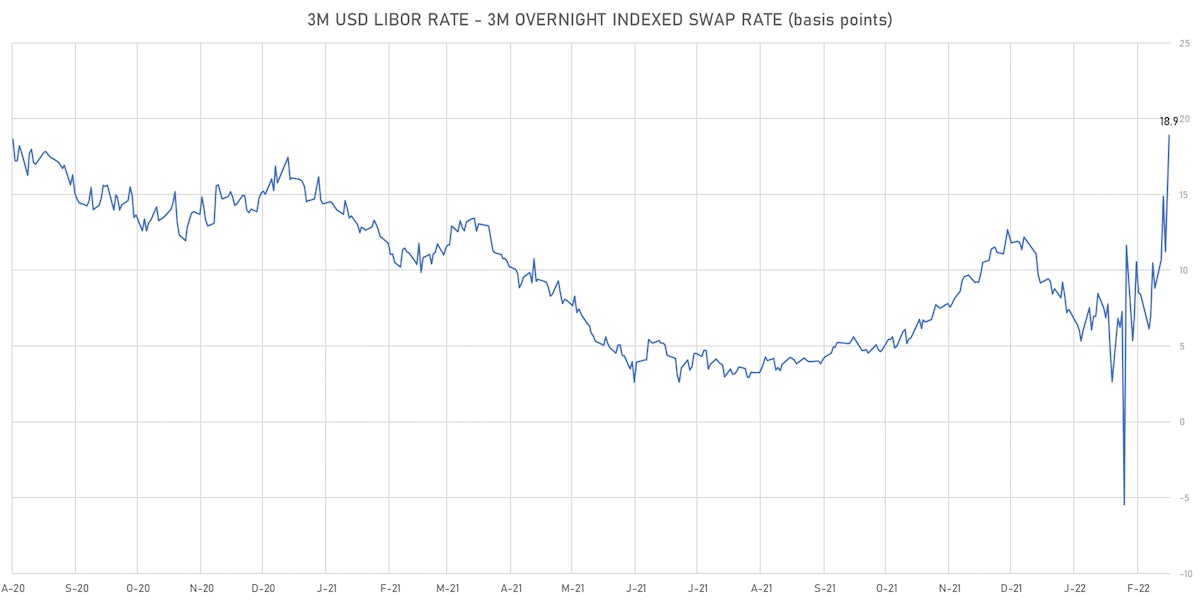

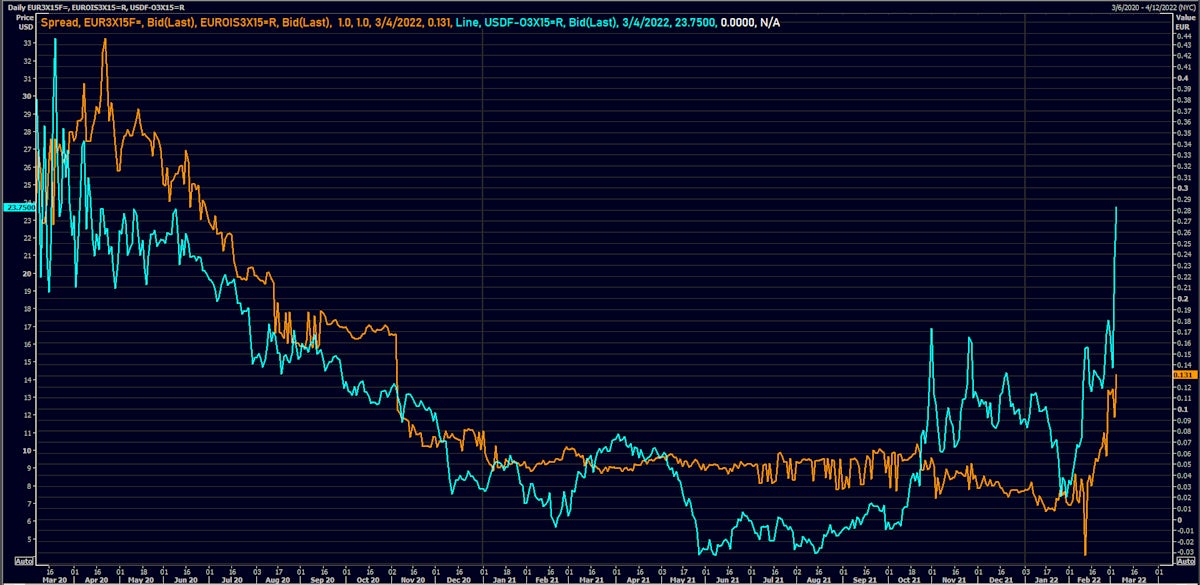

Funding markets have seen real tension since the last round of sanctions were announced: USD FRA-OIS and EUR FRA-EONIA spreads have risen significantly, with more pressure seen in dollar funding

Published ET

3x15 FRA-OIS Spreads in Euros and US Dollars | Source: Refinitiv

DAILY US SUMMARY

- 3-Month USD LIBOR +2.7bp today, now at 0.6100%; 3-Month OIS -0.7bp at 0.4210%

- The treasury yield curve flattened, with the 1s10s spread tightening -8.0 bp, now at 71.3 bp (YTD change: -42.0bp)

- 1Y: 1.0240% (down 2.3 bp)

- 2Y: 1.4879% (down 3.6 bp)

- 5Y: 1.6462% (down 8.4 bp)

- 7Y: 1.7064% (down 9.8 bp)

- 10Y: 1.7367% (down 10.3 bp)

- 30Y: 2.1603% (down 6.4 bp)

- US treasury curve spreads: 3m2Y at 115.0bp (down -1.1bp today), 2s5s at 15.8bp (down -4.6bp), 5s10s at 9.1bp (down -1.9bp), 10s30s at 42.4bp (up 3.8bp)

- Treasuries butterfly spreads: 1s5s10s at -53.9bp (up 4.9bp today), 5s10s30s at 32.5bp (up 5.4bp)

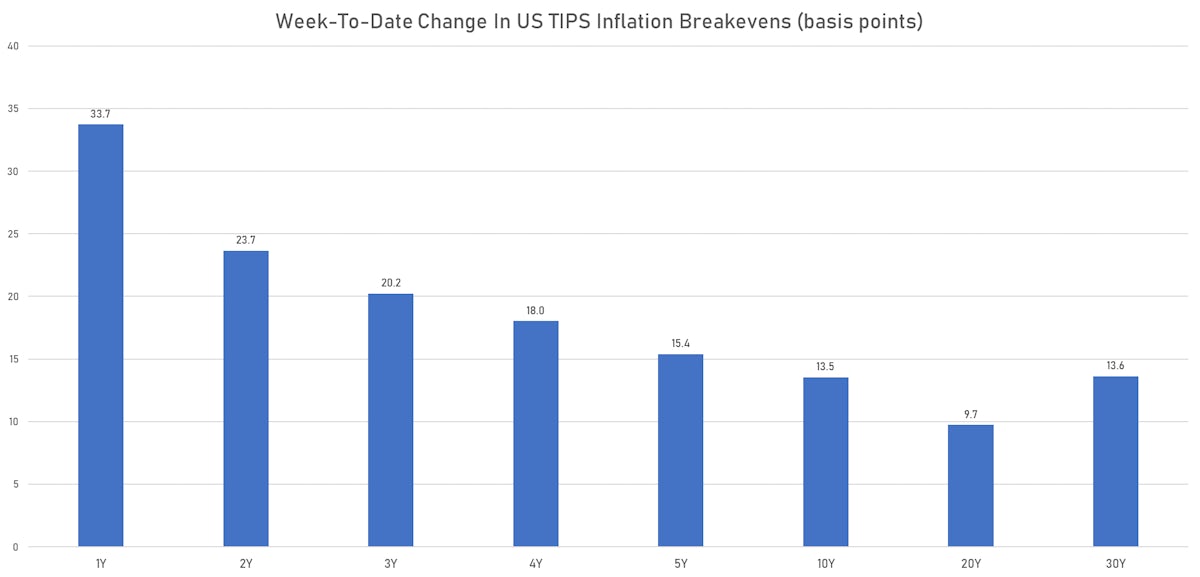

- TIPS 1Y breakeven inflation at 5.27% (up 6.1bp); 2Y at 4.16% (up 5.8bp); 5Y at 3.14% (up 2.4bp); 10Y at 2.70% (up 1.3bp); 30Y at 2.34% (down 0.0bp)

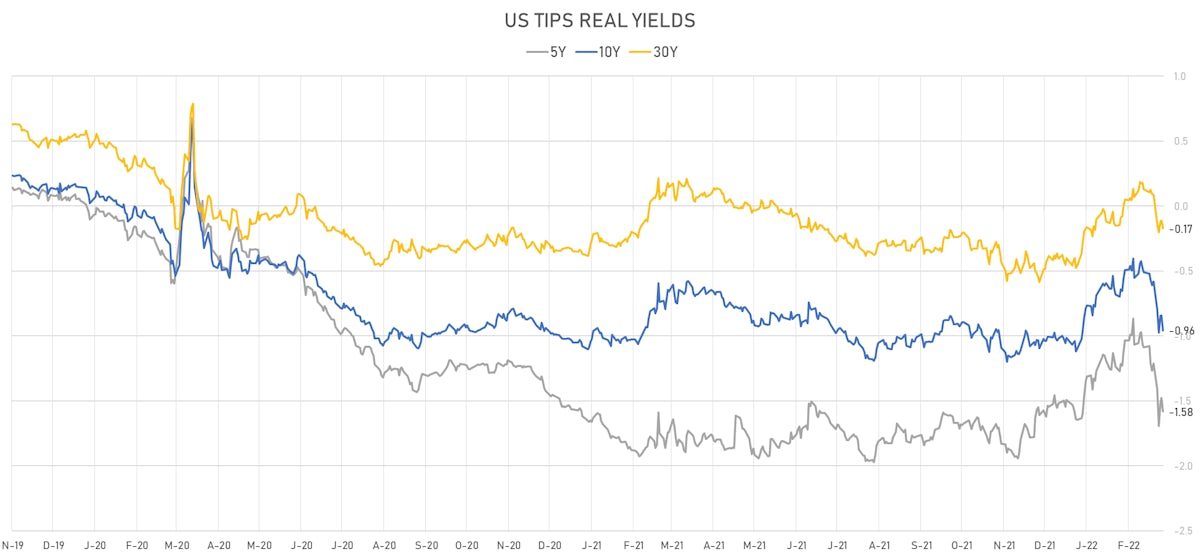

- US 5-Year TIPS Real Yield: -10.5 bp at -1.5800%; 10-Year TIPS Real Yield: -11.5 bp at -0.9570%; 30-Year TIPS Real Yield: -6.2 bp at -0.1730%

US MACRO RELEASES

- Average Earnings YY, Change Y/Y for Feb 2022 (BLS, U.S Dep. Of Lab) at 5.10 % (vs 5.70 % prior), below consensus estimate of 5.80 %

- Civilian participation, total for Feb 2022 (BLS, U.S Dep. Of Lab) at 62.30 % (vs 62.20 % prior)

- Earnings, Average Hourly, Nonfarm payrolls, all employees, total private, Change P/P for Feb 2022 (BLS, U.S Dep. Of Lab) at 0.00 % (vs 0.70 % prior), below consensus estimate of 0.50 %

- Employment, Nonfarm payroll, goods-producing, manufacturing, total, Absolute change for Feb 2022 (BLS, U.S Dep. Of Lab) at 36.00 k (vs 13.00 k prior), above consensus estimate of 23.00 k

- Employment, Nonfarm payroll, service-producing, government, Absolute change for Feb 2022 (BLS, U.S Dep. Of Lab) at 24.00 k (vs 23.00 k prior)

- Employment, Nonfarm payroll, total private, Absolute change for Feb 2022 (BLS, U.S Dep. Of Lab) at 654.00 k (vs 444.00 k prior), above consensus estimate of 378.00 k

- Employment, Nonfarm payroll, total, Absolute change for Feb 2022 (BLS, U.S Dep. Of Lab) at 678.00 k (vs 467.00 k prior), above consensus estimate of 400.00 k

- Hours Worked, Average Per Week, Nonfarm payrolls, all employees, total private for Feb 2022 (BLS, U.S Dep. Of Lab) at 34.70 hrs (vs 34.50 hrs prior), above consensus estimate of 34.60 hrs

- Unemployment, Rate for Feb 2022 (BLS, U.S Dep. Of Lab) at 3.80 % (vs 4.00 % prior), below consensus estimate of 3.90 %

- Unemployment, Rate, Special (U-6) for Feb 2022 (BLS, U.S Dep. Of Lab) at 7.20 % (vs 7.10 % prior)

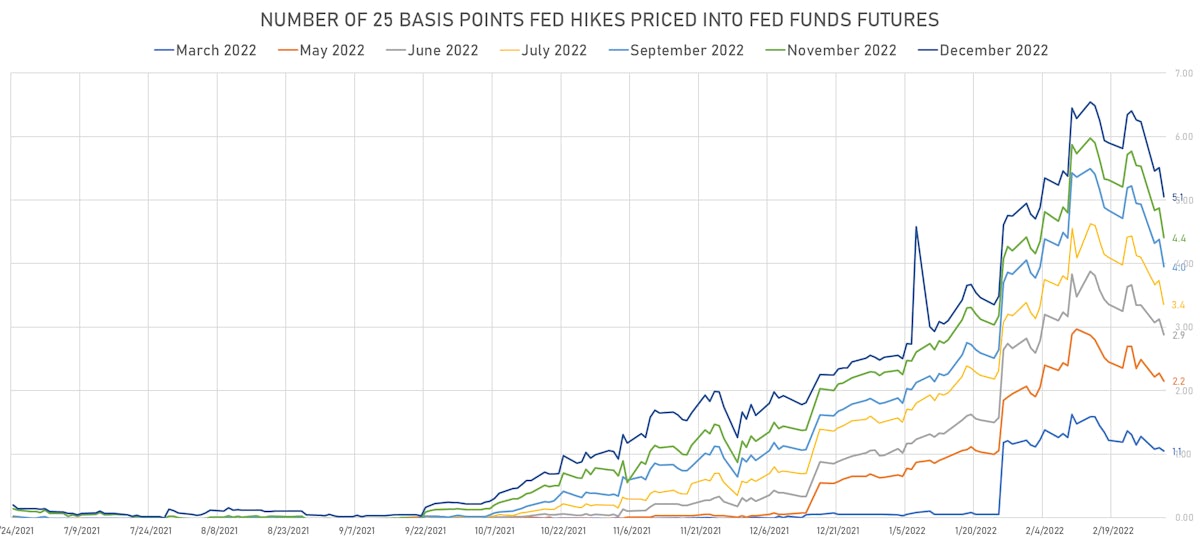

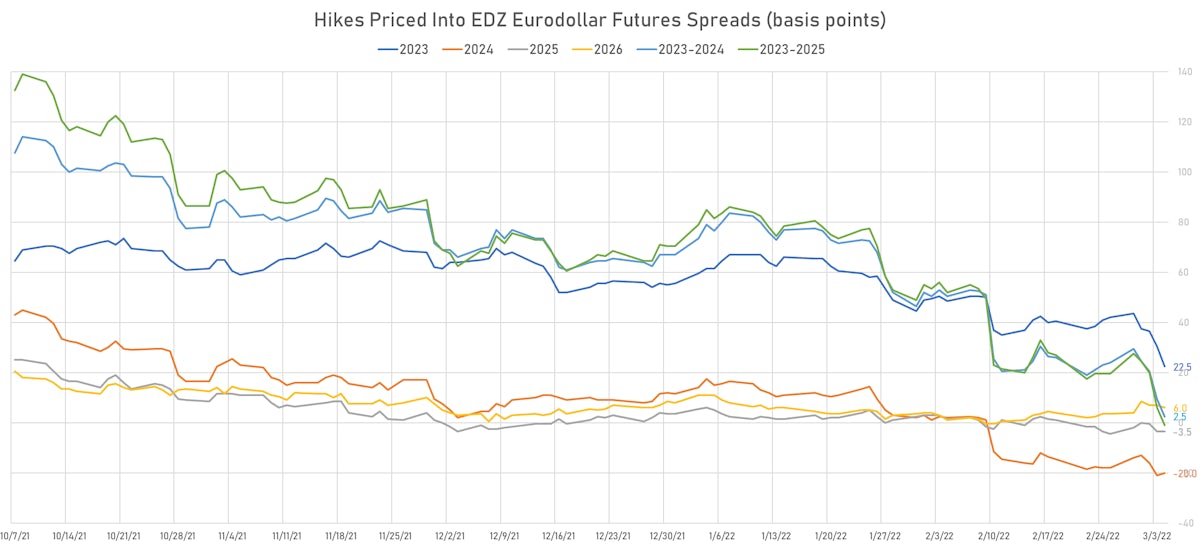

US FORWARD RATES

- Fed Funds futures now price in 26.3bp of Fed hikes by the end of March 2022, 53.8bp (2.15 x 25bp hikes) by the end of May 2022, and price in 5.05 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 22.5 bp of hikes in 2023 (equivalent to 0.9 x 25 bp hikes), down -8.0 bp today, and -20.0 bp of hikes in 2024 (equivalent to -0.8 x 25 bp hikes)

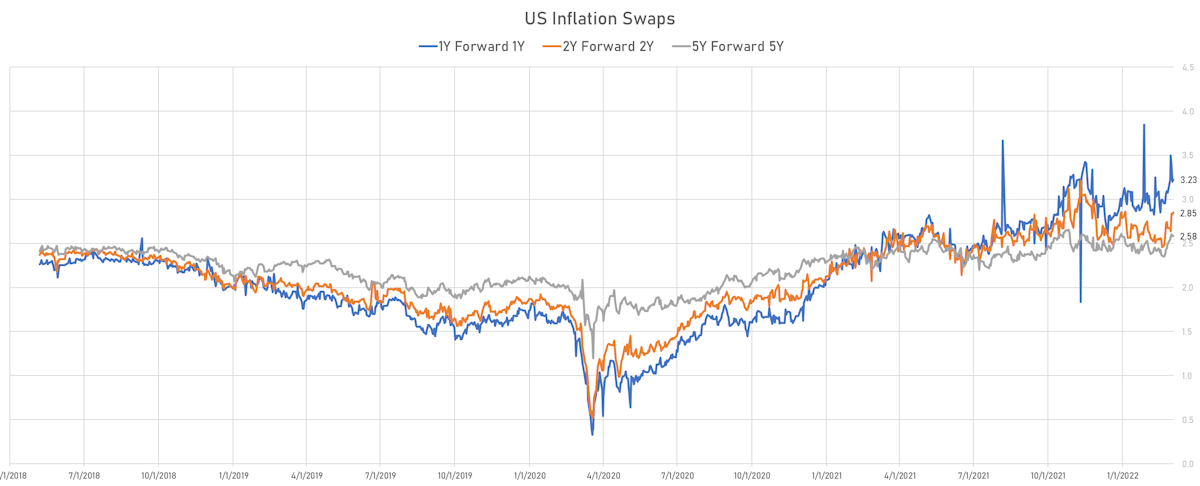

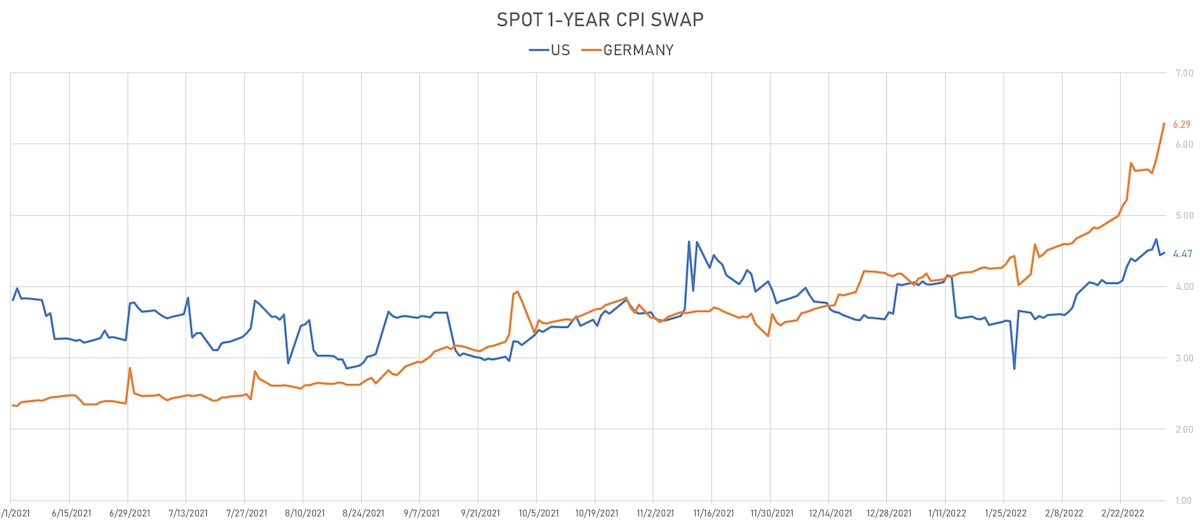

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.27% (up 6.1bp); 2Y at 4.16% (up 5.8bp); 5Y at 3.14% (up 2.4bp); 10Y at 2.70% (up 1.3bp); 30Y at 2.34% (down 0.0bp)

- 6-month spot US CPI swap down -2.3 bp to 4.855%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.5800%, -10.5 bp today; 10Y at -0.9570%, -11.5 bp today; 30Y at -0.1730%, -6.2 bp today

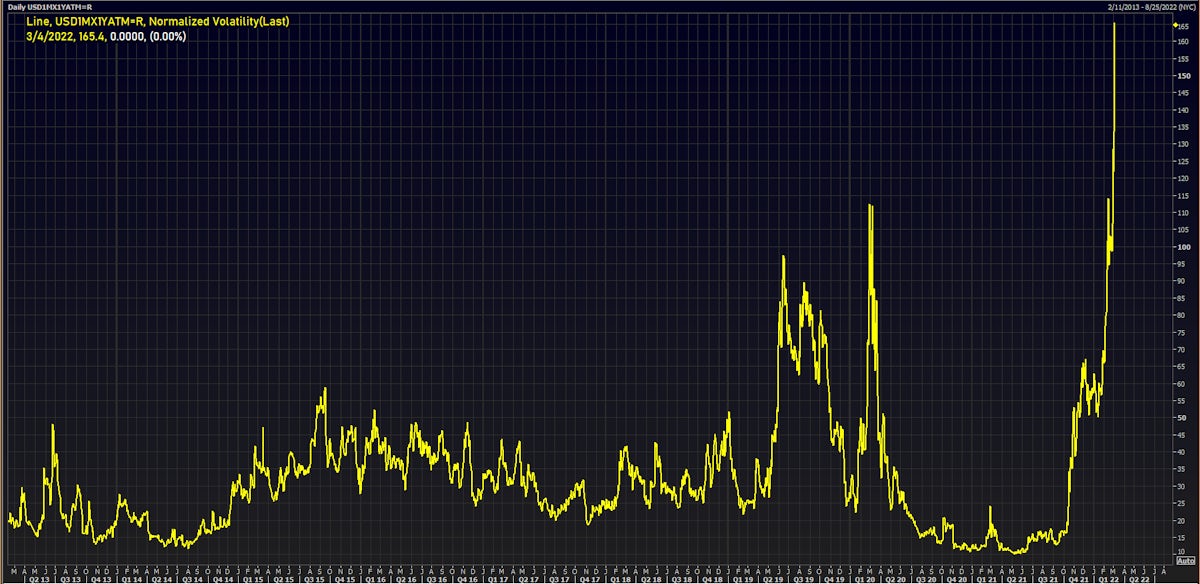

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 31.9 vols at 165.4 normals

- 3-Month LIBOR-OIS spread up 3.4 bp at 18.9 bp (12-months range: -5.5-18.9 bp)

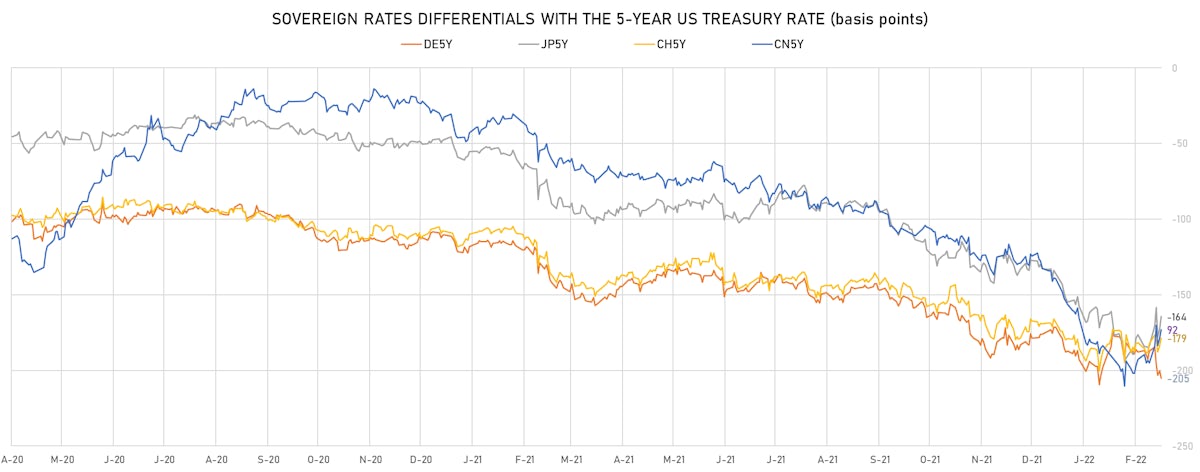

KEY INTERNATIONAL RATES

- Germany 5Y: -0.366% (down -13.2 bp); the German 1Y-10Y curve is 8.3 bp flatter at 63.3bp (YTD change: +16.8 bp)

- Japan 5Y: 0.007% (down -0.1 bp); the Japanese 1Y-10Y curve is 0.6 bp flatter at 24.1bp (YTD change: +7.0 bp)

- China 5Y: 2.569% (down -1.9 bp); the Chinese 1Y-10Y curve is 0.7 bp steeper at 75.5bp (YTD change: +24.5 bp)

- Switzerland 5Y: -0.139% (down -3.2 bp); the Swiss 1Y-10Y curve is 2.2 bp steeper at 88.2bp (YTD change: +29.7 bp)