Rates

US TIPS Breakevens Keep Rising Rapidly In Line With Commodities, While Money Market Stress Worsened In FRA-OIS And FRA-EONIA

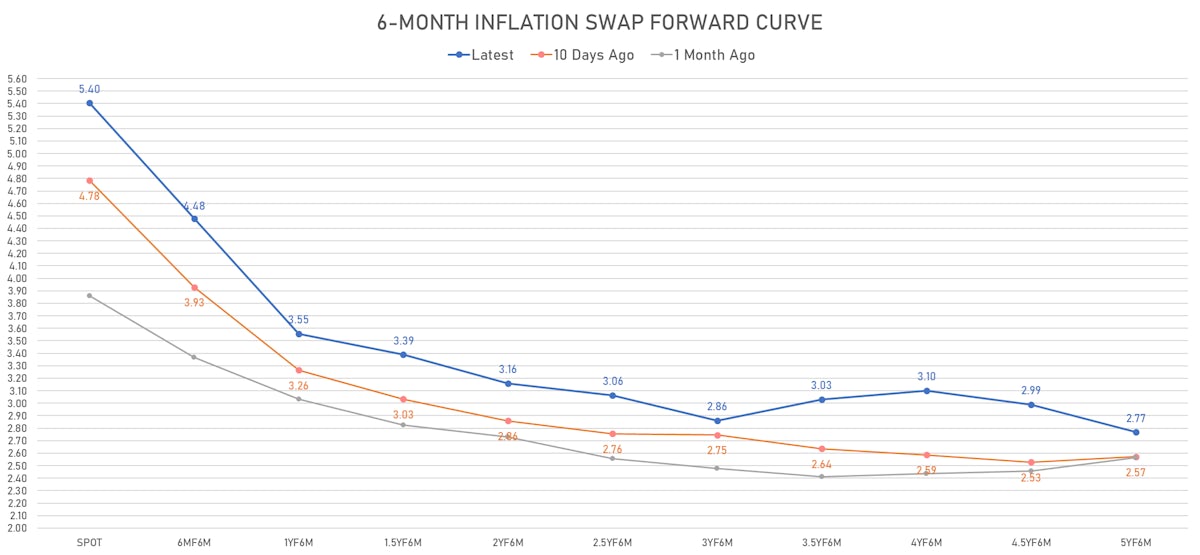

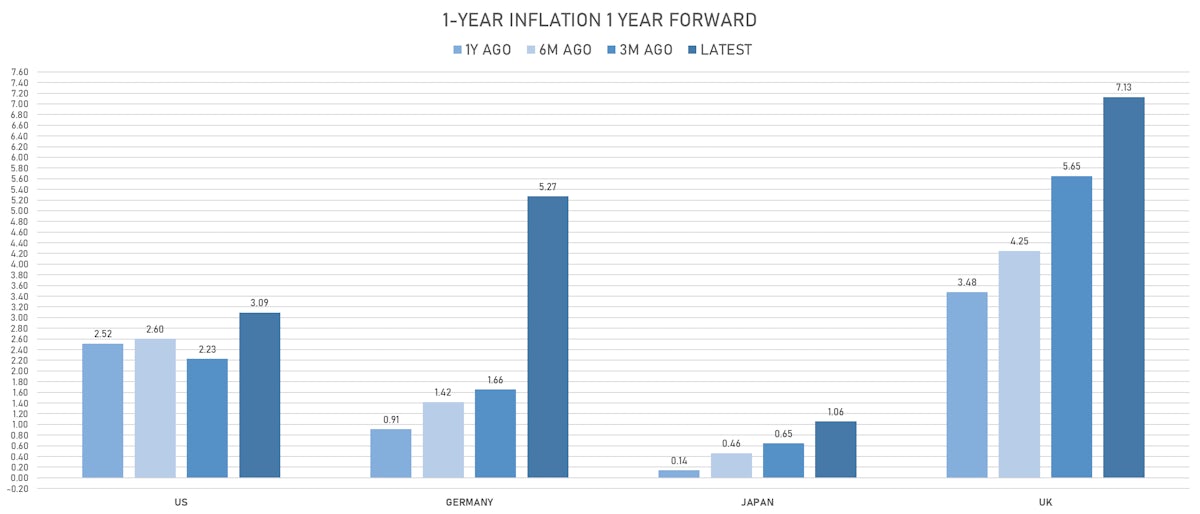

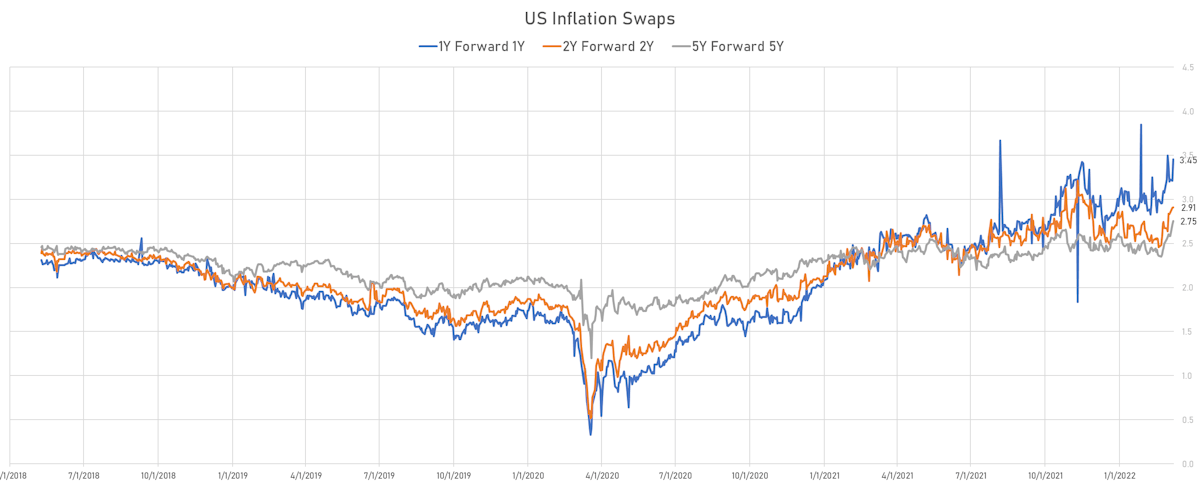

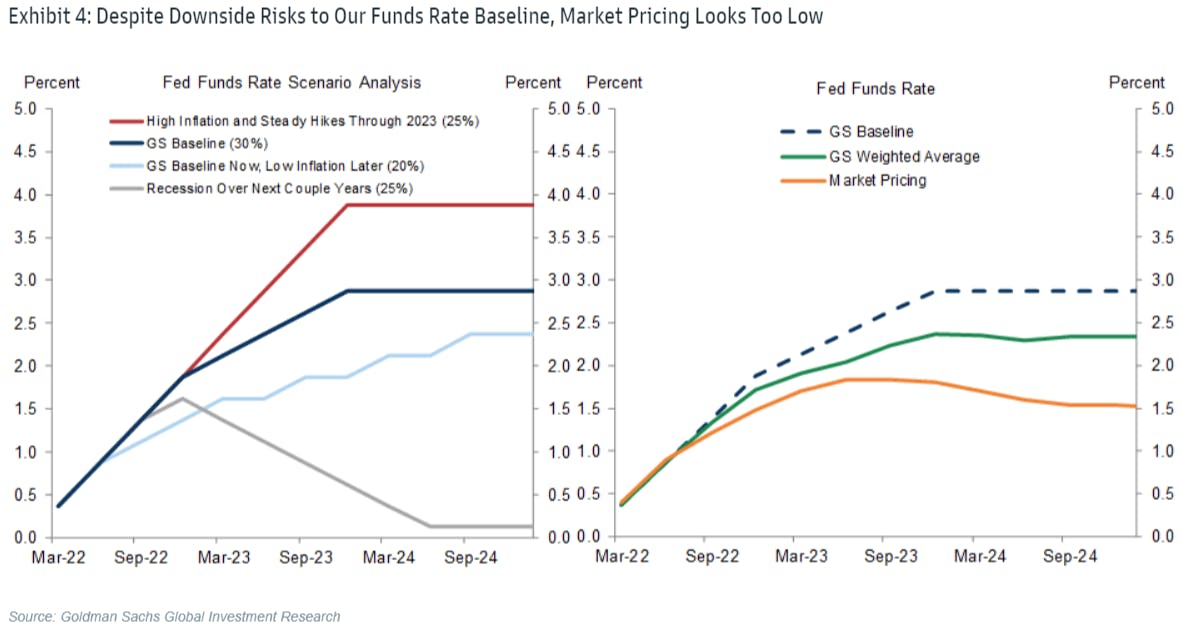

Looking at forward inflation swaps, it's clear that the market doesn't anticipate a quick reversal of inflationary pressures, meaning that if the Fed wants to reach a neutral rate (real rate at zero), it will have to hike a lot more and faster than what is currently priced into the term structure

Published ET

QUICK US SUMMARY

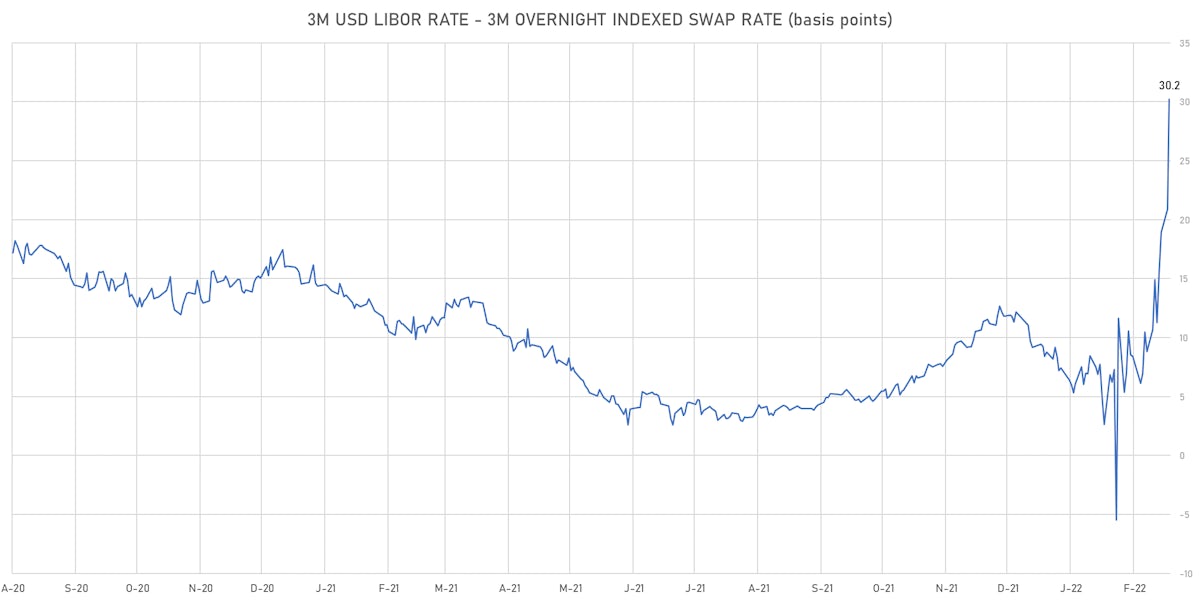

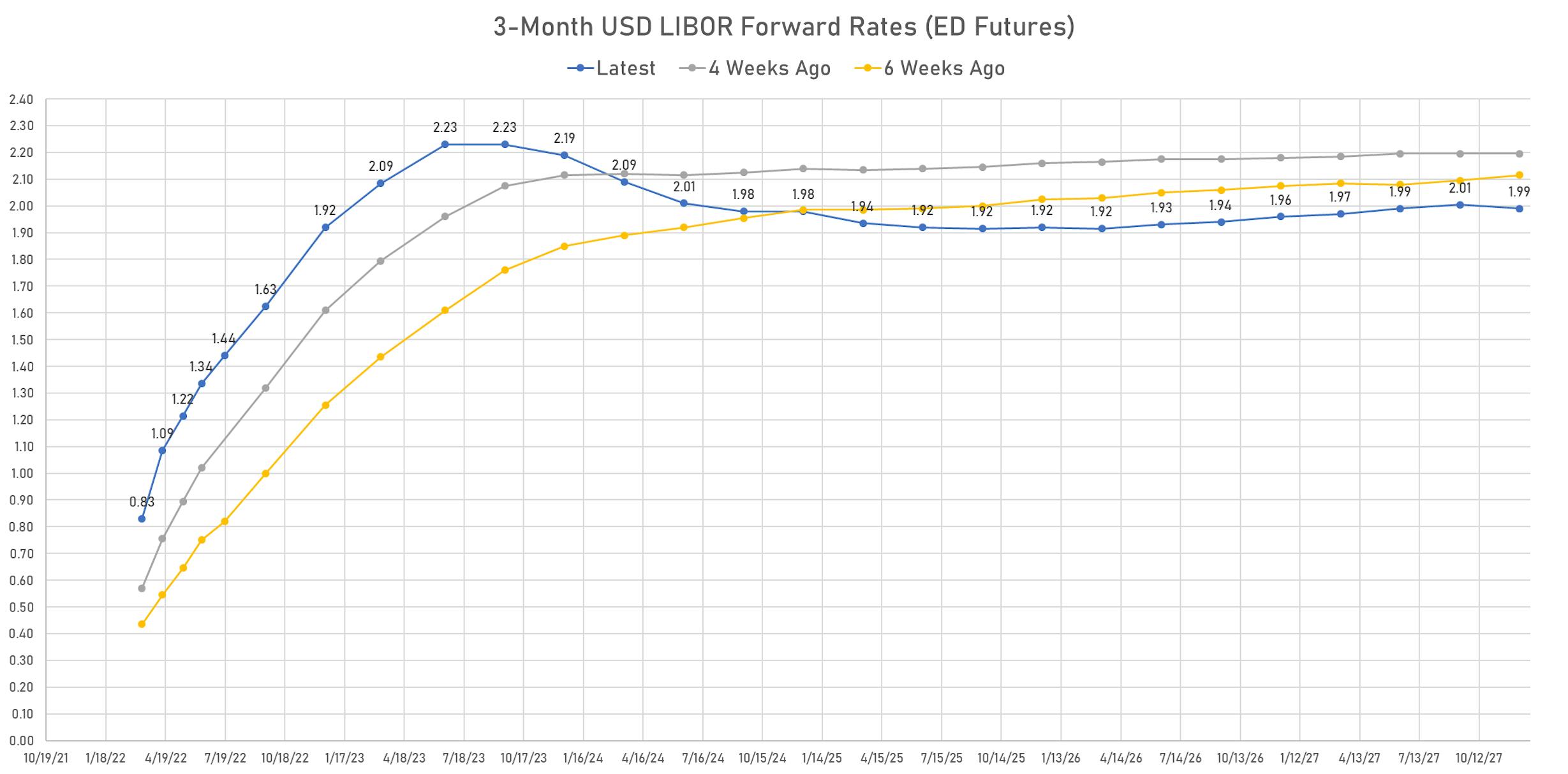

- 3-Month USD LIBOR +10.0bp today, now at 0.7430%; 3-Month OIS +0.7bp at 0.4410%

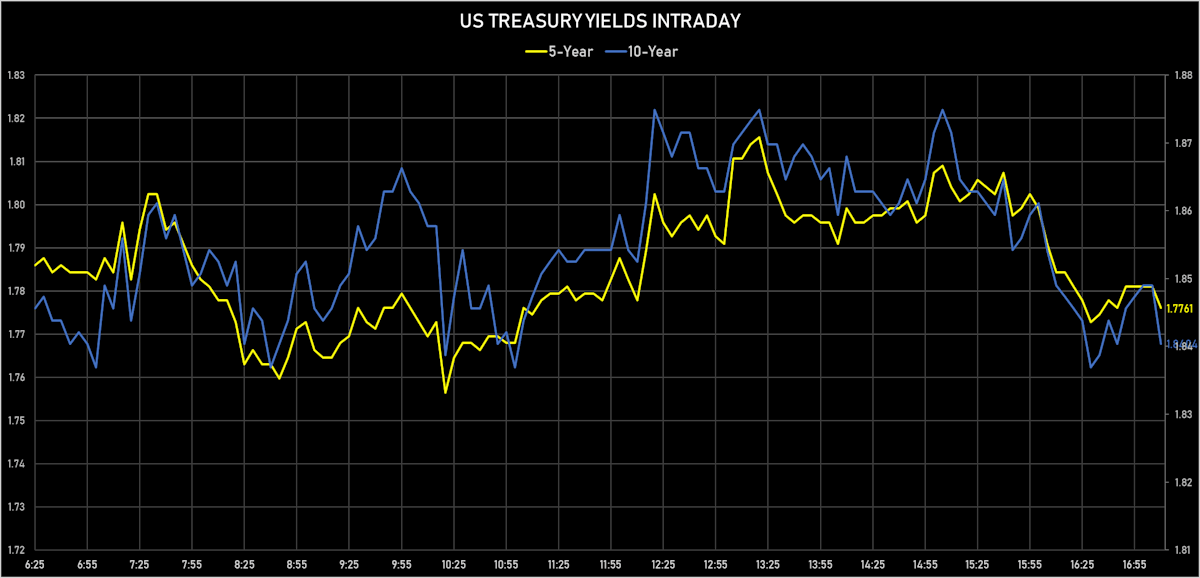

- The treasury yield curve steepened, with the 1s10s spread widening 2.8 bp, now at 76.9 bp (YTD change: -36.3bp)

- 1Y: 1.0703% (up 3.6 bp)

- 2Y: 1.5998% (up 4.5 bp)

- 5Y: 1.7753% (up 7.4 bp)

- 7Y: 1.8277% (up 7.2 bp)

- 10Y: 1.8396% (up 6.4 bp)

- 30Y: 2.2181% (up 3.5 bp)

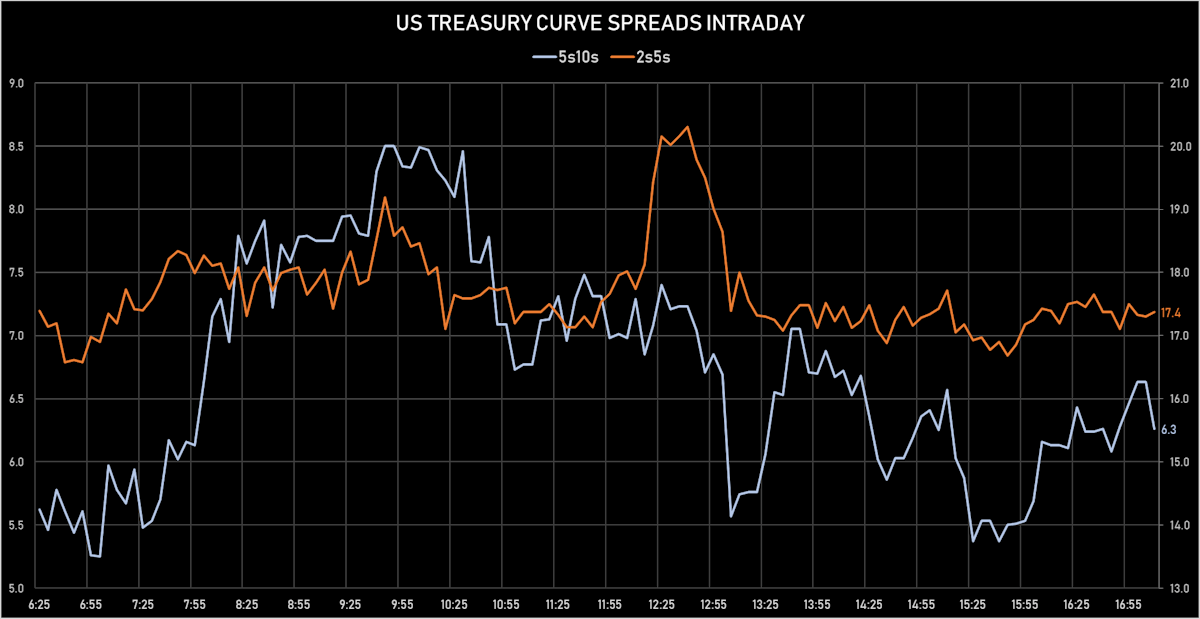

- US treasury curve spreads: 3m2Y at 123.0bp (up 1.4bp today), 2s5s at 17.6bp (up 3.3bp), 5s10s at 6.4bp (down -0.8bp), 10s30s at 37.9bp (down -2.7bp)

- Treasuries butterfly spreads: 1s5s10s at -65.4bp (down -5.1bp), 5s10s30s at 30.5bp (down -3.2bp)

- TIPS 1Y breakeven inflation at 5.86% (up 33.3bp); 2Y at 4.48% (up 15.0bp); 5Y at 3.40% (up 9.6bp); 10Y at 2.93% (up 7.9bp); 30Y at 2.55% (up 9.1bp)

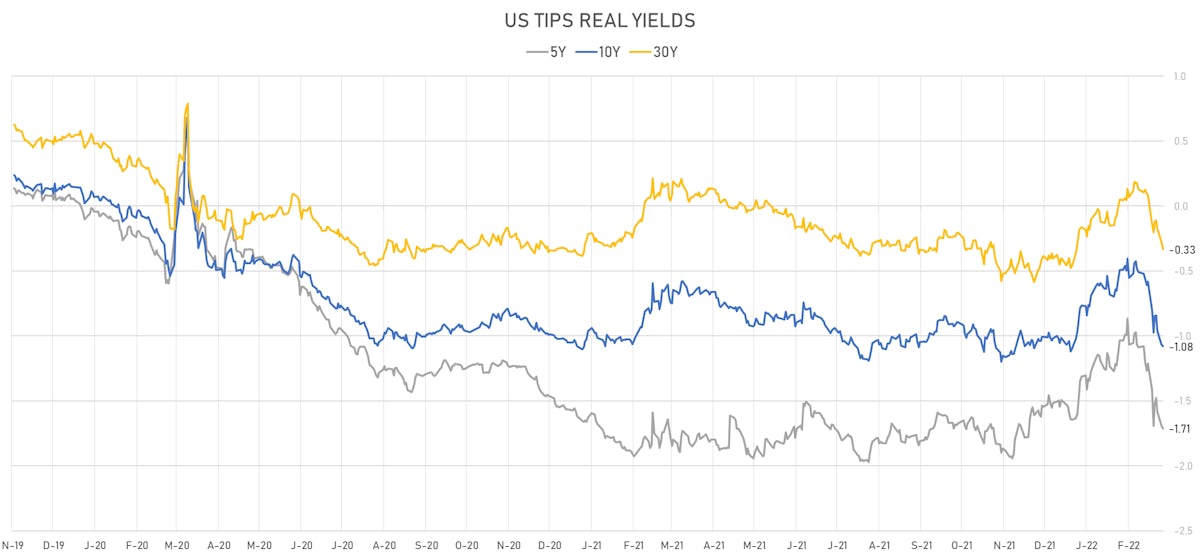

- US 5-Year TIPS Real Yield: -2.1 bp at -1.7120%; 10-Year TIPS Real Yield: -1.5 bp at -1.0810%; 30-Year TIPS Real Yield: -5.5 bp at -0.3310%

AUCTION RESULT: $47.8BN 3-YEAR 1.75% COUPON TREASURY NOTE (91282CED9)

- Not a terrible auction considering market conditions, with a small tail and reasonable end-user demand (at 73.7%, vs 79.7% prior and 71.6% average)

- High yield: 1.775% (vs 1.592% prior), a 1.2 bp tail vs the when-issued at the bid deadline

- Direct bids: 18.6% (vs 11.1% prior and 17.3% average)

- Indirect bids: 55.1% (vs 68.5% prior and 54.3% average)

- Bid-to-cover: 2.39 (vs 2.45 prior and 2.44 average)

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 05 Mar (Redbook Research) at 13.10 % (vs 13.40 % prior)

- NFIB, Index of Small Business Optimism for Feb 2022 (NFIB, United States) at 95.70 (vs 97.10 prior)

- Trade Balance, Total, Goods and services for Jan 2022 (U.S. Census Bureau) at -89.70 Bln USD (vs -80.70 Bln USD prior), below consensus estimate of -87.10 Bln USD

- Wholesale Inventories, Change P/P for Jan 2022 (U.S. Census Bureau) at 0.80 % (vs 0.80 % prior), in line with consensus

- Wholesale Trade, Change P/P for Jan 2022 (U.S. Census Bureau) at 4.00 % (vs 0.20 % prior)

US FORWARD RATES

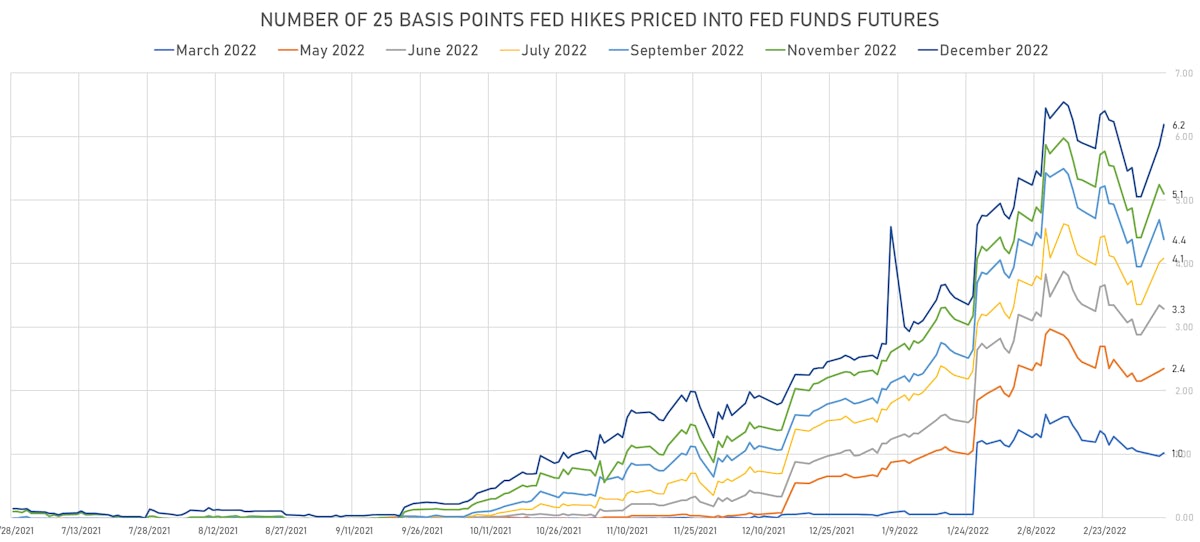

- Fed Funds futures now price in 25.5bp of Fed hikes by the end of March 2022, 58.8bp (2.35 x 25bp hikes) by the end of May 2022, and price in 6.19 hikes by the end of December 2022

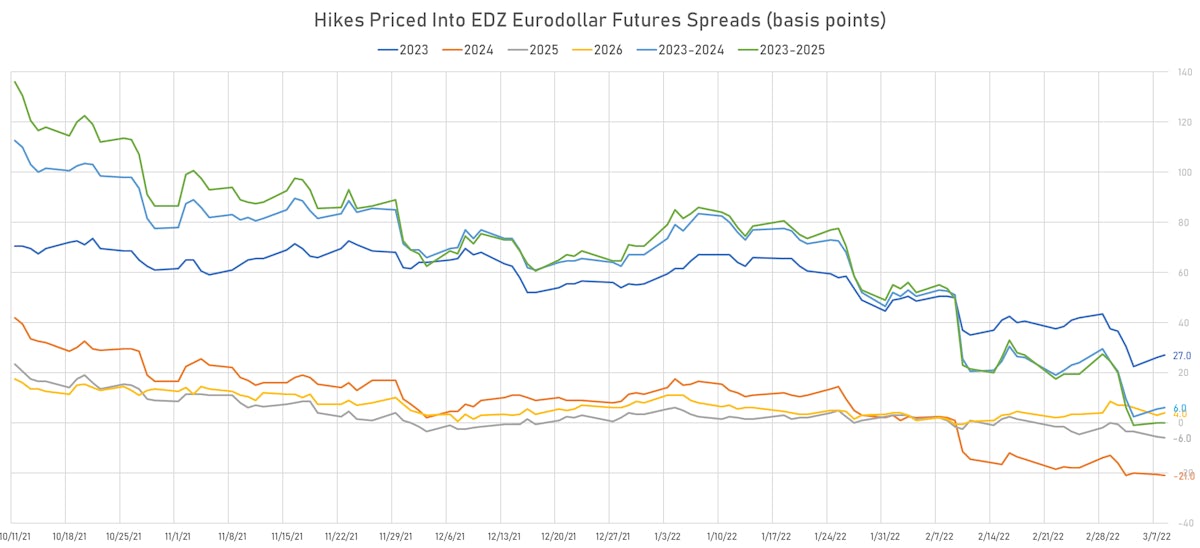

- 3-month Eurodollar futures (EDZ) spreads price in 27 bp of hikes in 2023 (equivalent to 1.1 x 25 bp hikes), up 1.0 bp today, and -21.0 bp of hikes in 2024 (equivalent to -0.8 x 25 bp hikes)

- Goldman Sachs sees current forward rates as too low compared to the level of inflation: their rationale is that if the Fed wants to tighten financial conditions, it needs to get to at least a zero real rate (i.e. a nominal rate close to 3%), which is 12 hikes away from where we stand

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.86% (up 33.3bp); 2Y at 4.48% (up 15.0bp); 5Y at 3.40% (up 9.6bp); 10Y at 2.93% (up 7.9bp); 30Y at 2.55% (up 9.1bp)

- 6-month spot US CPI swap up 15.2 bp to 5.404%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.7120%, -2.1 bp today; 10Y at -1.0810%, -1.5 bp today; 30Y at -0.3310%, -5.5 bp today

RATES VOLATILITY & LIQUIDITY

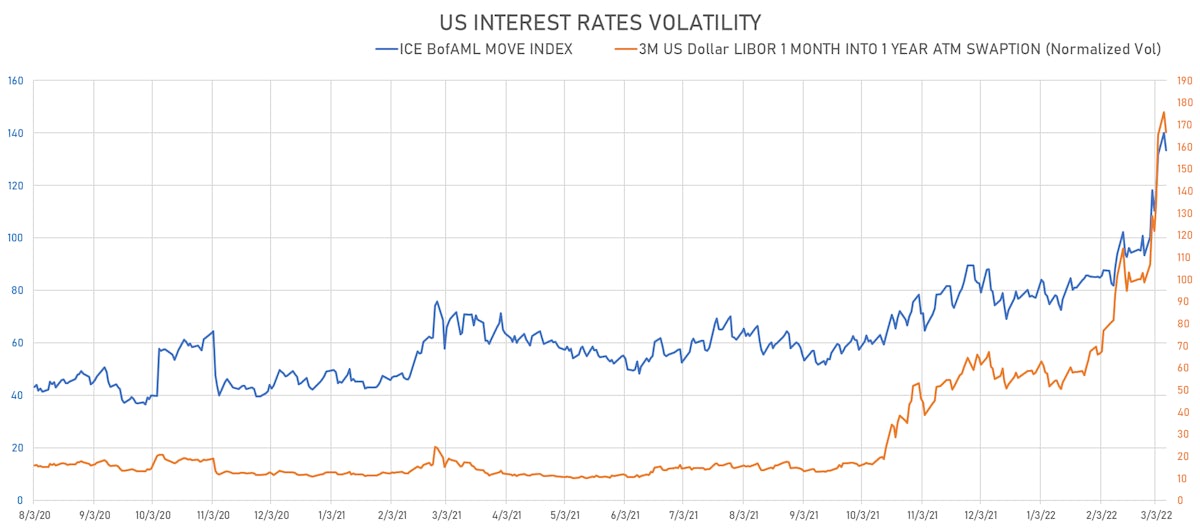

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -9.1 vols at 166.5 normal

- 3-Month LIBOR-OIS spread up 9.3 bp at 30.2 bp (12-months range: -5.5-30.2 bp)

KEY INTERNATIONAL RATES

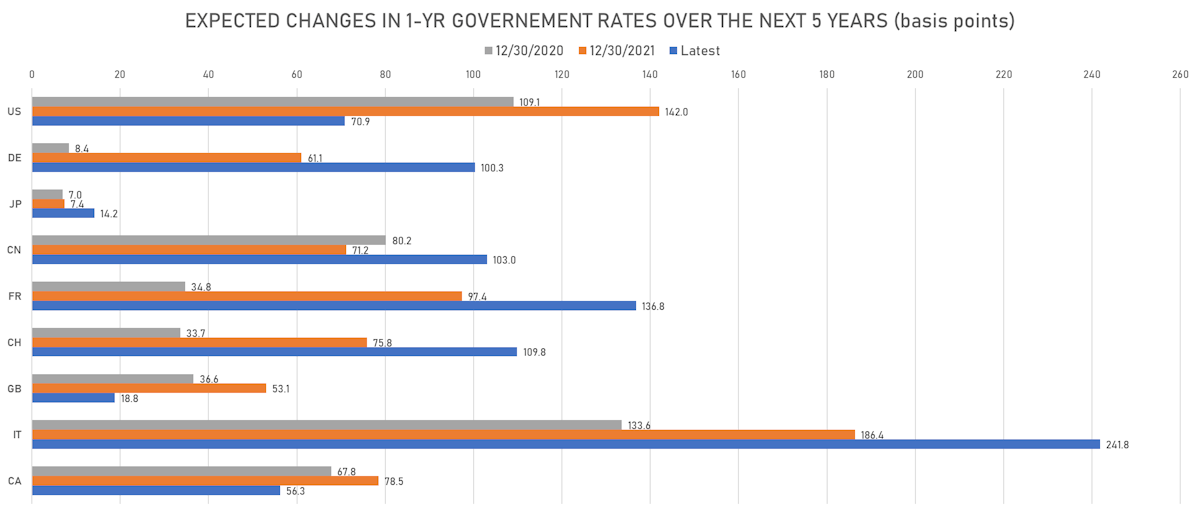

- Germany 5Y: -0.183% (up 9.4 bp); the German 1Y-10Y curve is 12.0 bp steeper at 81.8bp (YTD change: +35.6 bp)

- Japan 5Y: -0.001% (up 0.4 bp); the Japanese 1Y-10Y curve is 1.0 bp steeper at 23.8bp (YTD change: +6.9 bp)

- China 5Y: 2.526% (down -3.5 bp); the Chinese 1Y-10Y curve is 1.9 bp steeper at 78.4bp (YTD change: +27.4 bp)

- Switzerland 5Y: -0.103% (up 3.4 bp); the Swiss 1Y-10Y curve is 5.5 bp steeper at 84.3bp (YTD change: +26.6 bp)